Key Insights

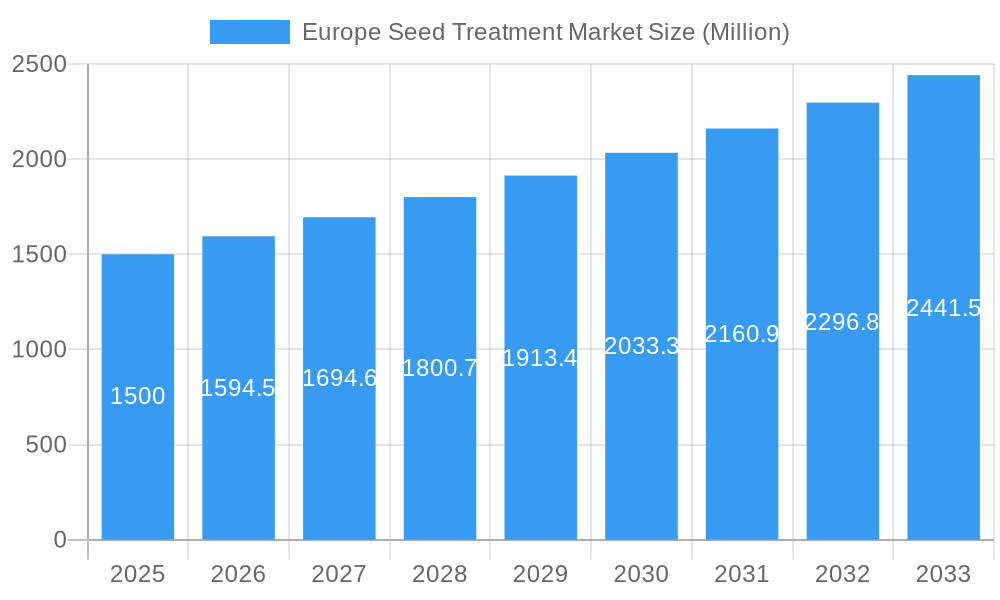

The European seed treatment market, valued at approximately €1.5 billion in 2025, is projected to experience robust growth, driven by increasing demand for high-yielding crops and the rising adoption of sustainable agricultural practices. A Compound Annual Growth Rate (CAGR) of 6.30% from 2025 to 2033 suggests a market value exceeding €2.5 billion by 2033. Key drivers include the growing prevalence of plant diseases and insect pests, necessitating effective seed treatments for crop protection. Furthermore, the increasing awareness of the benefits of seed treatments in improving germination rates, seedling vigor, and overall crop yield is fueling market expansion. The fungicide segment currently holds the largest market share, followed by insecticides and nematicides, reflecting the prevalent concerns regarding fungal, insect, and nematode infestations. Geographically, Germany, France, and the United Kingdom represent major markets, characterized by intensive agriculture and high adoption rates of advanced farming technologies. However, the market's growth is also influenced by regulatory constraints concerning pesticide usage and the ongoing research and development efforts focused on bio-based and environmentally friendly seed treatment solutions. Future growth will be significantly impacted by the introduction of innovative formulations, the expansion of organic farming practices, and the evolving regulatory landscape. The segment focusing on commercial crops and fruits and vegetables is expected to dominate due to higher value crops and the associated need for enhanced protection.

Europe Seed Treatment Market Market Size (In Billion)

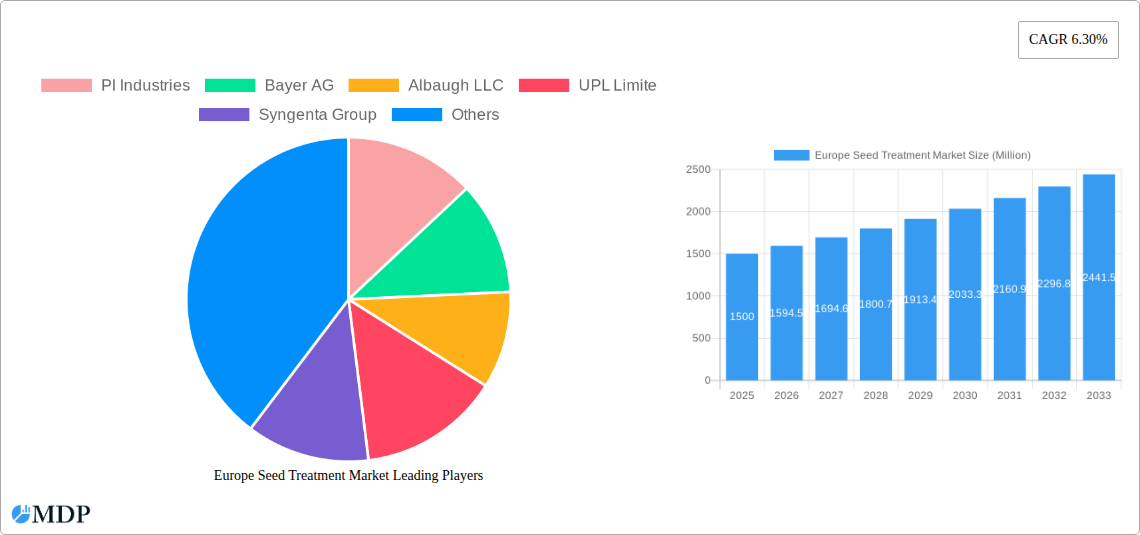

The competitive landscape is characterized by the presence of both multinational corporations and regional players. Major players like Bayer AG, Syngenta Group, and Corteva Agriscience are investing significantly in research and development to offer advanced seed treatment solutions catering to the specific needs of various crops and regions. Strategic partnerships, mergers and acquisitions, and the development of novel product portfolios are prominent strategies being employed to gain a competitive edge. The market's future trajectory will hinge on successfully balancing the need for effective crop protection with sustainable practices, driving the innovation and adoption of environmentally responsible seed treatment technologies across Europe.

Europe Seed Treatment Market Company Market Share

Europe Seed Treatment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Seed Treatment Market, offering invaluable insights for stakeholders across the agricultural sector. Covering the period from 2019 to 2033, with a base year of 2025, this study meticulously examines market dynamics, leading players, and future growth prospects. The report leverages extensive data analysis to project a robust forecast (2025-2033), providing actionable intelligence for strategic decision-making. Key segments analyzed include fungicides, insecticides, nematicides, and various crop types (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, and turf & ornamental) across major European countries: France, Germany, Italy, Netherlands, Russia, Spain, Ukraine, United Kingdom, and the Rest of Europe.

Europe Seed Treatment Market Market Dynamics & Concentration

The Europe seed treatment market is characterized by a moderately concentrated landscape, with several multinational corporations holding significant market share. The market's dynamics are shaped by a complex interplay of factors, including continuous innovation in seed treatment technologies, stringent regulatory frameworks, the emergence of bio-based alternatives, evolving end-user preferences towards sustainable agriculture, and a surge in mergers and acquisitions (M&A) activity.

Market concentration is estimated at xx%, with the top 5 players controlling approximately xx% of the market in 2025. M&A activity has been significant, with an estimated xx deals recorded between 2019 and 2024. This consolidation trend reflects the increasing importance of economies of scale and the need for companies to expand their product portfolios and geographic reach.

- Innovation Drivers: The development of novel seed treatment technologies, particularly those focusing on biopesticides and enhanced efficacy, are key drivers.

- Regulatory Frameworks: EU regulations concerning pesticide use and environmental protection heavily influence market dynamics.

- Product Substitutes: The rise of bio-based seed treatments offers a compelling alternative, increasing competitive pressure.

- End-User Trends: Growing demand for high-yielding crops and sustainable agricultural practices is driving market growth.

- M&A Activities: Recent mergers and acquisitions are reshaping the competitive landscape and driving market consolidation.

Europe Seed Treatment Market Industry Trends & Analysis

The Europe seed treatment market is experiencing robust growth, driven by several key factors. The rising global population, increasing demand for food, and the need to enhance crop yields are major contributors. Technological advancements, such as the development of advanced seed treatment formulations and the integration of precision agriculture techniques, are further fueling market expansion. The market exhibits a CAGR of xx% during the forecast period (2025-2033), with market penetration reaching approximately xx% by 2033. Consumer preferences are shifting towards sustainable and environmentally friendly seed treatment options, creating new opportunities for biopesticides and other eco-friendly alternatives. Intense competition among major players is driving innovation and price optimization.

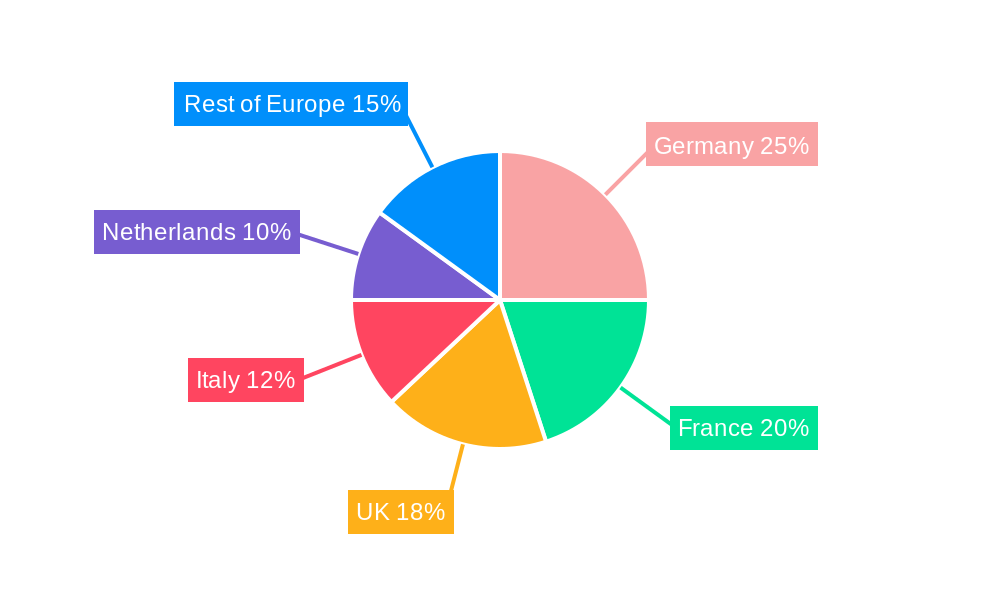

Leading Markets & Segments in Europe Seed Treatment Market

Germany and France are the leading markets in Europe, representing a combined xx% market share in 2025. This dominance is attributed to several factors.

- Germany: Strong agricultural sector, advanced farming practices, and high adoption of modern seed treatment technologies.

- France: Large agricultural land area, significant production of grains & cereals, and favorable government policies supporting agricultural innovation.

Within the segments, fungicides dominate, accounting for xx% of the market, followed by insecticides (xx%) and nematicides (xx%). Grains & Cereals and Commercial Crops are the leading crop types driving demand.

- Key Drivers for Germany: Strong agricultural R&D, supportive government policies, and well-developed distribution networks.

- Key Drivers for France: Extensive agricultural land, high crop yields, and a focus on sustainable agricultural practices.

Europe Seed Treatment Market Product Developments

Recent product innovations have focused on the development of seed treatments with enhanced efficacy, broader spectrum activity, and improved environmental compatibility. This includes the introduction of biopesticides and formulations with lower environmental impact. These advancements provide competitive advantages by offering superior crop protection while addressing growing environmental concerns. Technological trends such as nanotechnology and advanced formulations are playing a crucial role in improving product efficacy and delivery systems.

Key Drivers of Europe Seed Treatment Market Growth

Several factors are driving the growth of the Europe seed treatment market. These include rising global food demand, increasing adoption of advanced farming techniques, stringent regulations promoting crop protection, and the development of innovative, sustainable seed treatment technologies. The growing awareness of the benefits of seed treatment in enhancing crop yields and quality is another significant factor.

Challenges in the Europe Seed Treatment Market Market

The market faces challenges such as stringent regulatory approvals, potential supply chain disruptions, and intense competition from established and emerging players. These factors can impact product development timelines and profitability. Fluctuations in raw material prices also represent a considerable challenge.

Emerging Opportunities in Europe Seed Treatment Market

The development and adoption of biopesticides and other eco-friendly seed treatment solutions present significant growth opportunities. Strategic partnerships and collaborations between seed companies and chemical manufacturers are another potential avenue for growth. Expansion into new geographic markets within Europe and exploring new applications for seed treatment technologies, such as those targeting specific diseases or pests, also offer promising avenues.

Leading Players in the Europe Seed Treatment Market Sector

- PI Industries

- Bayer AG

- Albaugh LLC

- UPL Limited

- Syngenta Group

- Mitsui & Co Ltd (Certis Belchim)

- Corteva Agriscience

Key Milestones in Europe Seed Treatment Market Industry

- March 2022: Formation of Certis Belchim BV through the merger of Belchim Crop Protection and Certis Europe by Mitsui & Co. Ltd.

- May 2022: Corteva Agriscience expands its seed treatment capabilities with a new laboratory in Rosslyn, South Africa.

- January 2023: Bayer partners with Oerth Bio to develop eco-friendly crop protection solutions.

Strategic Outlook for Europe Seed Treatment Market Market

The Europe seed treatment market is poised for continued growth, driven by increasing food demand and technological advancements. Strategic partnerships, investments in R&D, and the development of sustainable seed treatment solutions will be crucial for achieving long-term success. Focusing on emerging markets and addressing regulatory challenges will also be key to unlocking the full potential of this market.

Europe Seed Treatment Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Seed Treatment Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Seed Treatment Market Regional Market Share

Geographic Coverage of Europe Seed Treatment Market

Europe Seed Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Schemes like the European Seed Treatment Assurance Scheme drive the seed treatment market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Seed Treatment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PI Industries

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Albaugh LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UPL Limite

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Syngenta Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsui & Co Ltd (Certis Belchim)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Corteva Agriscience

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 PI Industries

List of Figures

- Figure 1: Europe Seed Treatment Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Seed Treatment Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Seed Treatment Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Seed Treatment Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Seed Treatment Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Seed Treatment Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Seed Treatment Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Seed Treatment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Europe Seed Treatment Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Seed Treatment Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Seed Treatment Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Seed Treatment Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Seed Treatment Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Seed Treatment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Seed Treatment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Seed Treatment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Europe Seed Treatment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Seed Treatment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Seed Treatment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Seed Treatment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Seed Treatment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Seed Treatment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Seed Treatment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Seed Treatment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Seed Treatment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Seed Treatment Market?

The projected CAGR is approximately 14.54%.

2. Which companies are prominent players in the Europe Seed Treatment Market?

Key companies in the market include PI Industries, Bayer AG, Albaugh LLC, UPL Limite, Syngenta Group, Mitsui & Co Ltd (Certis Belchim), Corteva Agriscience.

3. What are the main segments of the Europe Seed Treatment Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Schemes like the European Seed Treatment Assurance Scheme drive the seed treatment market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.May 2022: Corteva Agriscience expanded its product development capabilities by opening a seed treatment laboratory in Rosslyn, South Africa. The site is well-positioned to fulfill the ongoing needs of grain producers throughout Africa and the Middle East (AME) and is connected to Corteva's worldwide CSAT network.March 2022: A new company called Certis Belchim BV was formed by Mitsui & Co. Ltd by merging its recently acquired Belchim Crop Protection and its European subsidiary Certis Europe. This was done in accordance with the terms of a definitive agreement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Seed Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Seed Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Seed Treatment Market?

To stay informed about further developments, trends, and reports in the Europe Seed Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence