Key Insights

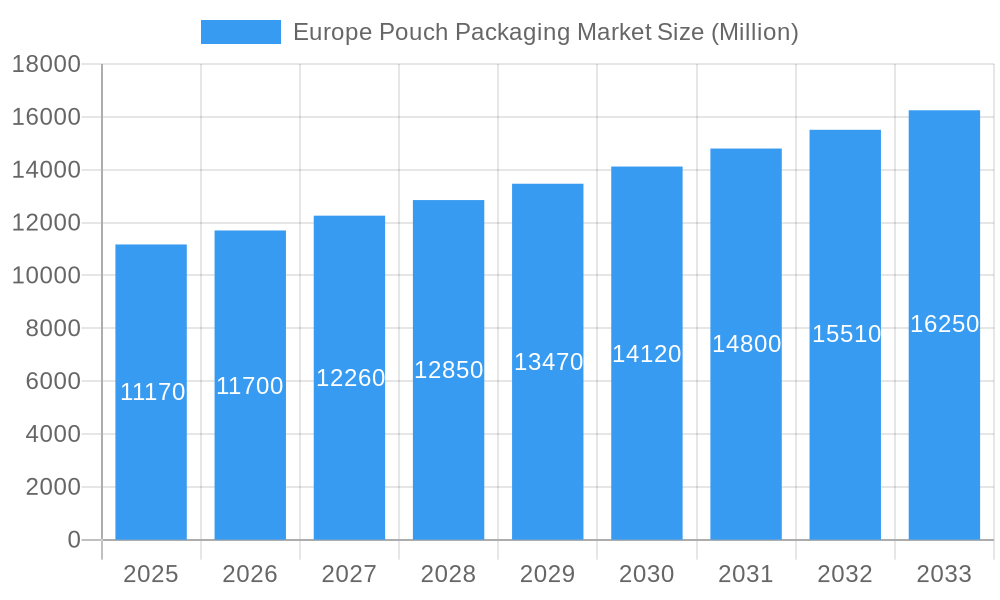

The Europe pouch packaging market, valued at approximately €11.17 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.68% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for convenient and portable food and beverage products fuels the adoption of pouches, particularly stand-up pouches and flexible packaging solutions. Furthermore, the rising consumer preference for sustainable and eco-friendly packaging options is pushing manufacturers to adopt recyclable and biodegradable pouch materials. E-commerce growth also significantly contributes to market expansion, as pouches offer superior protection and are ideally suited for online deliveries. Key players like Amcor, Bischof+Klein, AluFlexpack, Mondi, Constantia Flexibles, Coveris, Scholle IPN, Gualapack, Sealed Air, and Sonoco are actively shaping the market landscape through innovation in materials, designs, and production processes. Competition is fierce, with both established and emerging players vying for market share. However, challenges remain, including fluctuating raw material prices and the need for consistent advancements in sustainable packaging technologies to meet evolving consumer expectations and regulatory requirements.

Europe Pouch Packaging Market Market Size (In Billion)

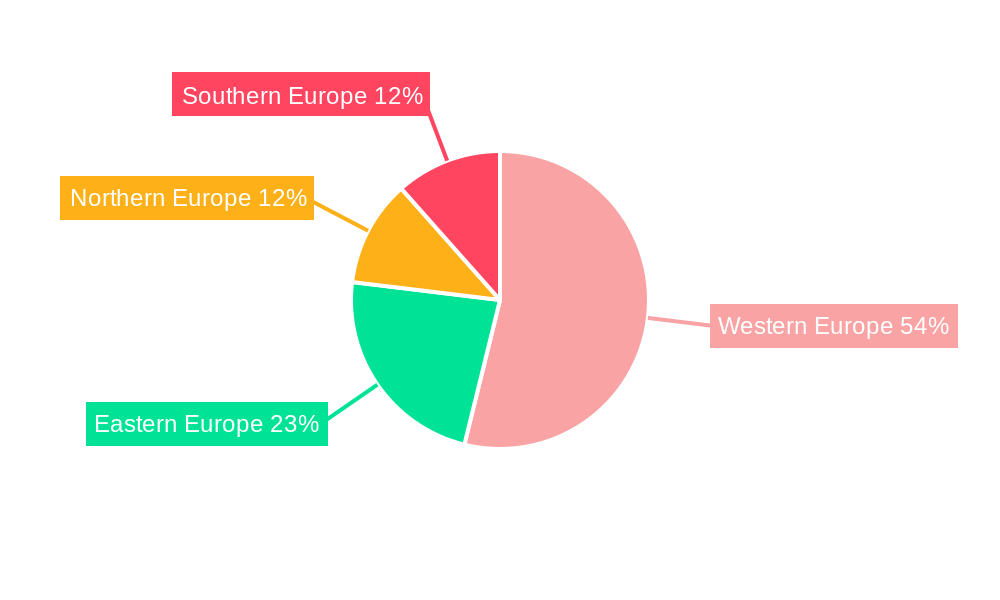

The market segmentation within Europe is diverse, encompassing various pouch types catering to different product categories. This includes food pouches (for snacks, sauces, etc.), beverage pouches (for juices, water, etc.), and non-food pouches (for personal care items, industrial products, etc.). Regional variations in consumption patterns and regulatory frameworks also influence market growth. Western European countries generally demonstrate higher adoption rates of advanced pouch packaging solutions compared to Eastern European markets, presenting opportunities for expansion and growth in the latter. Continuous advancements in barrier properties, improved functionality, and enhanced printing technologies are vital for maintaining market competitiveness and meeting evolving customer demands. The forecast period, 2025-2033, is expected to witness significant innovations in material science, leading to further growth in this dynamic market segment.

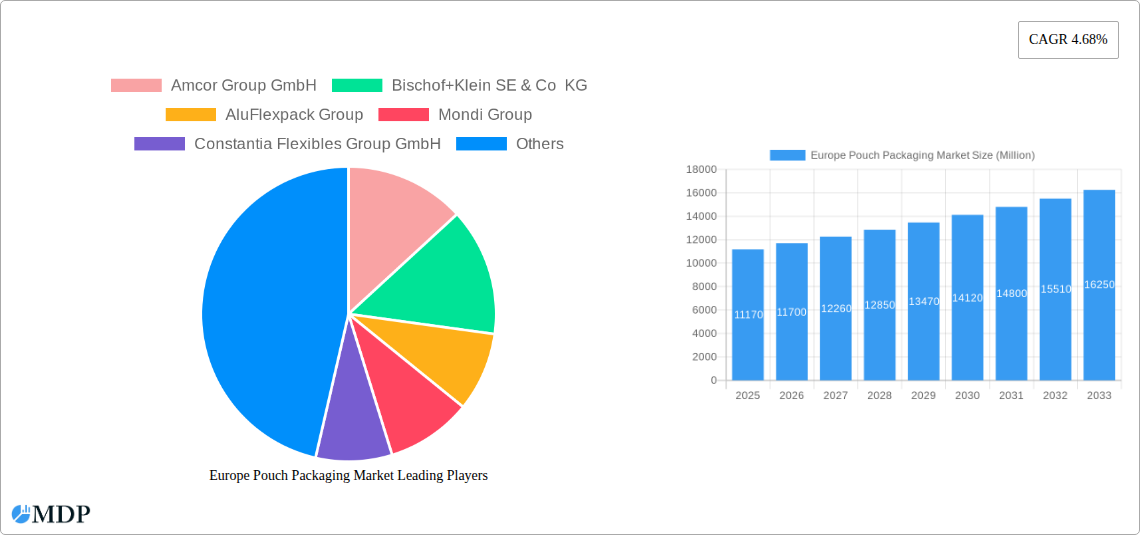

Europe Pouch Packaging Market Company Market Share

Europe Pouch Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Pouch Packaging Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report delves into market dynamics, competitive landscapes, and future growth potential. The market is expected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Europe Pouch Packaging Market Market Dynamics & Concentration

The Europe Pouch Packaging Market is characterized by a moderately concentrated landscape, with key players holding significant market share. However, the emergence of innovative startups and increased M&A activity are reshaping the competitive dynamics. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory compliance. The market witnessed xx M&A deals in the historical period (2019-2024), indicating a growing trend of consolidation. Several factors are driving market innovation:

- Sustainability Concerns: Growing consumer demand for eco-friendly packaging is pushing innovation towards recyclable and biodegradable materials.

- Technological Advancements: Advancements in flexible packaging technologies are leading to improved barrier properties, enhanced shelf life, and lightweight designs.

- Stringent Regulations: EU regulations on food safety and environmental protection are shaping packaging material choices and manufacturing processes.

- Product Substitution: The market is witnessing a gradual shift from rigid packaging to flexible pouches, driven by cost-effectiveness and convenience.

- End-User Trends: The increasing popularity of convenient ready-to-eat meals and on-the-go consumption patterns are fueling demand for pouch packaging across various sectors.

Market share analysis reveals that the top 5 players collectively hold approximately xx% of the market. The remaining market share is distributed amongst numerous smaller players and regional manufacturers.

Europe Pouch Packaging Market Industry Trends & Analysis

The Europe Pouch Packaging Market exhibits strong growth potential, driven by several key factors. The market registered a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a healthy growth trajectory during the forecast period. Key factors driving market growth include:

- Rising Demand for Convenient Food & Beverages: The growing preference for ready-to-eat meals and on-the-go consumption is significantly boosting demand.

- Technological Advancements in Packaging Materials: The development of sustainable and high-performance materials is expanding market opportunities.

- E-commerce Growth: The rapid expansion of e-commerce is driving demand for robust and protective packaging solutions.

- Increased Consumer Awareness of Sustainability: Growing environmental consciousness is pushing manufacturers to adopt sustainable packaging practices.

- Stringent Regulations & Compliance Requirements: This aspect influences the adoption of compliant materials and technologies.

Market penetration of sustainable packaging is growing steadily, with a projected xx% penetration rate by 2033. However, challenges like fluctuating raw material prices and stringent environmental regulations remain.

Leading Markets & Segments in Europe Pouch Packaging Market

The report identifies Germany, France, and the UK as leading markets within Europe, driven by factors such as high disposable incomes, strong demand for packaged food and beverages, and well-established retail infrastructure.

- Germany: Strong industrial base, high consumer spending, and a focus on sustainable packaging.

- France: Significant demand from food and beverage sectors, growing e-commerce, and robust logistics networks.

- UK: Large consumer base, high consumption of packaged goods, and a dynamic retail environment.

Other regions are exhibiting strong growth potential, albeit at varying rates, propelled by factors such as:

- Expanding Middle Class: This fuels demand for packaged goods in emerging economies.

- Improving Retail Infrastructure: This enhances product distribution and availability.

- Government Initiatives: Support for sustainable packaging through incentives and regulations.

Within segments, flexible packaging dominates, accounting for xx% of market value, driven by advantages such as cost-effectiveness, lightweight nature, and improved shelf life. Rigid packaging retains a niche market.

Europe Pouch Packaging Market Product Developments

Recent product innovations include the development of recyclable mono-polypropylene pouches, offering reduced environmental impact, improved barrier properties, and increased shelf life. These advancements cater to the growing consumer demand for sustainable packaging solutions and align with evolving regulatory standards. The integration of smart packaging technologies, such as sensors and RFID tags, is enhancing traceability and preventing counterfeiting.

Key Drivers of Europe Pouch Packaging Market Growth

Several key factors are driving the growth of the European pouch packaging market:

- Technological advancements: Innovations in materials science and packaging technology are leading to improved barrier properties, enhanced shelf life, and sustainable options.

- Economic growth: Rising disposable incomes in several European countries are fueling demand for convenient packaged foods and beverages.

- Favorable regulatory environment: Regulatory support for sustainable packaging is creating opportunities for eco-friendly solutions. Examples include the EU's Single-Use Plastics Directive and various national-level regulations.

Challenges in the Europe Pouch Packaging Market Market

The Europe Pouch Packaging Market faces challenges such as:

- Fluctuating raw material prices: This impacts production costs and profitability.

- Stringent environmental regulations: Compliance with regulations regarding recyclability and compostability can increase manufacturing costs.

- Intense competition: The market is characterized by several large and small players, leading to price wars and reduced profit margins. This also necessitates continuous innovation to maintain competitiveness.

Emerging Opportunities in Europe Pouch Packaging Market

Long-term growth is driven by several emerging opportunities:

- Growing demand for sustainable packaging: Consumers are increasingly choosing eco-friendly options, creating market demand for recyclable and biodegradable pouches.

- Advancements in smart packaging: Integrating technology into pouches to enhance traceability and improve supply chain efficiency will unlock new revenue streams.

- Expansion into new applications: Pouches are finding new applications in various sectors, including cosmetics, pharmaceuticals, and personal care.

Leading Players in the Europe Pouch Packaging Market Sector

- Amcor Group GmbH

- Bischof+Klein SE & Co KG

- AluFlexpack Group

- Mondi Group

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- Scholle IPN Corporation (SIG)

- Gualapack SpA

- Sealed Air Corporation (SEE)

- Sonoco Products Company

- *List Not Exhaustive

Key Milestones in Europe Pouch Packaging Market Industry

- March 2024: Capri Sun Group launched a recyclable mono-polypropylene drinks pouch, reducing CO2 emissions by 25%. This signifies a significant move towards sustainable packaging within the beverage sector.

- March 2024: PepsiCo introduced premium snack packaging with 50% recycled plastic content, demonstrating a commitment to sustainability in the food industry. This sets a precedent for higher recycled content in flexible packaging.

Strategic Outlook for Europe Pouch Packaging Market Market

The Europe Pouch Packaging Market presents significant growth opportunities driven by the increasing demand for sustainable and innovative packaging solutions. Companies can leverage technological advancements, strategic partnerships, and focus on sustainability to capitalize on future market potential. Focusing on eco-friendly materials, smart packaging technologies, and expanding into new applications will be key to securing a competitive edge in this dynamic market.

Europe Pouch Packaging Market Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Europe Pouch Packaging Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Pouch Packaging Market Regional Market Share

Geographic Coverage of Europe Pouch Packaging Market

Europe Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Consumption of Ready-to-Eat Food Across the Region; Increasing Demand for Light Weight Packaging Solution

- 3.3. Market Restrains

- 3.3.1. High Consumption of Ready-to-Eat Food Across the Region; Increasing Demand for Light Weight Packaging Solution

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of On-The-Go Food is Set to Drive the Market Forward

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor Group GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bischof+Klein SE & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AluFlexpack Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mondi Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Constantia Flexibles Group GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coveris Management GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Scholle IPN Corporation (SIG)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gualapack SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sealed Air Corporation (SEE)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sonoco Products Company*List Not Exhaustive 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amcor Group GmbH

List of Figures

- Figure 1: Europe Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pouch Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Europe Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Europe Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Europe Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 5: Europe Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Europe Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: Europe Pouch Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Pouch Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Europe Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Europe Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Europe Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Europe Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 13: Europe Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Europe Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 15: Europe Pouch Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Pouch Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Europe Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Pouch Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pouch Packaging Market?

The projected CAGR is approximately 4.68%.

2. Which companies are prominent players in the Europe Pouch Packaging Market?

Key companies in the market include Amcor Group GmbH, Bischof+Klein SE & Co KG, AluFlexpack Group, Mondi Group, Constantia Flexibles Group GmbH, Coveris Management GmbH, Scholle IPN Corporation (SIG), Gualapack SpA, Sealed Air Corporation (SEE), Sonoco Products Company*List Not Exhaustive 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Europe Pouch Packaging Market?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.17 Million as of 2022.

5. What are some drivers contributing to market growth?

High Consumption of Ready-to-Eat Food Across the Region; Increasing Demand for Light Weight Packaging Solution.

6. What are the notable trends driving market growth?

Increasing Consumption of On-The-Go Food is Set to Drive the Market Forward.

7. Are there any restraints impacting market growth?

High Consumption of Ready-to-Eat Food Across the Region; Increasing Demand for Light Weight Packaging Solution.

8. Can you provide examples of recent developments in the market?

March 2024: Capri Sun Group, a German-based juice brand, launched a recyclable, mono-polypropylene drinks pouch with an aim to reduce CO2 emissions by 25% compared to its previous design and support the brand’s mission to adopt fully recyclable packaging.March 2024: PepsiCo, in collaboration with its partners in the flexible food packaging supply chain, introduced a novel premium snack packaging. This innovative packaging, which boasts 50% recycled plastic content, not only meets rigorous food-contact standards but also marks a significant step toward sustainability. Initially rolled out for PepsiCo's Sunbites brand, the packaging made its debut in the United Kingdom and Ireland in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the Europe Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence