Key Insights

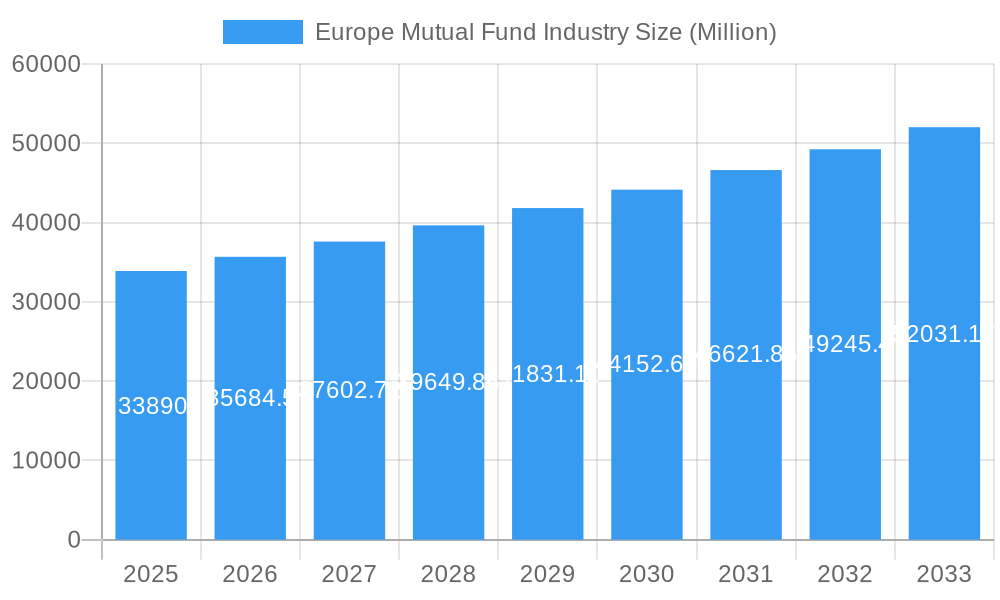

The European mutual fund industry, valued at €33.89 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing awareness of long-term investment strategies among European investors, coupled with favorable regulatory environments promoting diversification and wealth management, are significantly contributing to market growth. Furthermore, the rise of digital platforms and robo-advisors is democratizing access to mutual funds, attracting a wider range of investors, including younger demographics. However, the market faces certain headwinds. Economic uncertainty and fluctuating market conditions can impact investor sentiment and investment flows. Competition among established players like BlackRock, Amundi, BNP Paribas Asset Management, JP Morgan, Natixis, AXA, UBS, HSBC, DWS Group, PIMCO, and Invesco (though this list is not exhaustive) remains intense, placing pressure on margins. Despite these challenges, the long-term outlook for the European mutual fund industry remains positive, driven by sustained investor demand and ongoing innovation within the financial technology sector.

Europe Mutual Fund Industry Market Size (In Billion)

The segmentation of the European mutual fund market is crucial to understanding its dynamics. While specific segment data is unavailable, it's likely that equity funds, bond funds, and balanced funds constitute the major segments, with variations in performance influenced by macroeconomic factors and investor risk appetites. Regional variations within Europe are also expected, with potentially higher growth rates observed in regions with stronger economic performance and higher levels of financial literacy. Future growth hinges on the ability of fund managers to adapt to evolving investor preferences, incorporate sustainable investing strategies, and leverage technological advancements to enhance the overall investor experience. The industry's focus on transparency, regulatory compliance, and responsible investment practices will further shape its trajectory in the coming years.

Europe Mutual Fund Industry Company Market Share

Europe Mutual Fund Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe mutual fund industry, covering market dynamics, leading players, key trends, and future growth prospects from 2019 to 2033. This crucial study offers actionable insights for investors, industry stakeholders, and strategic decision-makers navigating the evolving landscape of European mutual funds. The report leverages rigorous data analysis and expert insights to unveil critical growth drivers and potential challenges shaping this dynamic sector.

Study Period: 2019-2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025-2033 | Historical Period: 2019-2024

Europe Mutual Fund Industry Market Dynamics & Concentration

The European mutual fund market is characterized by a dynamic and evolving competitive landscape. While a degree of market concentration persists, it is tempered by a constant influx of innovative players and a persistent drive for differentiation. Key aspects shaping this environment include:

- Market Share Concentration: In 2024, the top 5 players, including industry giants like BlackRock, Amundi, and BNP Paribas Asset Management, are estimated to command approximately [Insert Specific Percentage Here] of the market. Despite this concentration, numerous smaller, specialized firms and agile new entrants are actively challenging incumbents, fostering a competitive ecosystem and pushing the boundaries of investment solutions.

- Mergers and Acquisitions (M&A) Activity: The last five years have seen robust M&A activity, with approximately [Insert Specific Number Here] significant deals. These strategic acquisitions are primarily driven by a desire to enhance product suites, acquire cutting-edge technological capabilities, and achieve greater operational efficiencies in an increasingly complex market.

- Regulatory Framework: The industry operates within a constantly evolving regulatory landscape. Key regulations such as MiFID II continue to exert a profound influence, dictating operational strategies, product development cycles, and distribution channel management. Ongoing adjustments and new directives necessitate continuous adaptation from all market participants.

- Innovation Drivers: Technological advancements are a primary catalyst for innovation. The integration of Artificial Intelligence (AI) for sophisticated portfolio management, the proliferation of user-friendly robo-advisor platforms, and advancements in data analytics are fundamentally reshaping how investment products are created, managed, and delivered. This pursuit of efficiency and enhanced client experience is paramount.

- End-User Trends: A significant shift in investor preferences is evident. There is a burgeoning demand for low-cost, passively managed funds, particularly Exchange Traded Funds (ETFs), alongside a strong and growing commitment to sustainable and Environmental, Social, and Governance (ESG) investing. This trend is compelling fund managers to re-evaluate and reorient their product offerings to align with these evolving ethical and financial priorities.

Europe Mutual Fund Industry Industry Trends & Analysis

This section provides a detailed analysis of the key trends driving the growth of the European mutual fund industry. We explore the market's Compound Annual Growth Rate (CAGR), market penetration, and competitive dynamics.

The European mutual fund market is characterized by a moderate growth trajectory, driven by increasing investor participation, particularly among retail investors, and the introduction of innovative investment products. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033).

Market penetration remains relatively high in established markets like the UK and Germany. However, significant untapped potential exists in several Central and Eastern European countries, offering growth opportunities for expansion.

Technological disruptions are also impacting the industry. The rise of fintech platforms and digital investment solutions is driving competition and challenging traditional business models. Consumer preferences are shifting towards more personalized and transparent investment solutions, forcing mutual fund companies to adapt their strategies.

Leading Markets & Segments in Europe Mutual Fund Industry

This section identifies the dominant regions, countries, and segments within the European mutual fund industry.

- Key Drivers of Dominance:

- Strong Economic Growth: Countries with strong economic growth, such as Germany and the UK, exhibit higher demand for mutual fund investments.

- Developed Financial Infrastructure: Well-developed financial infrastructure fosters higher investor confidence and facilitates easier access to mutual fund products.

- Favorable Regulatory Environment: Supportive regulatory frameworks encourage investor participation and ensure industry stability.

- High Savings Rate: Countries with high savings rates naturally present a large pool of potential investors for mutual funds.

The UK and Germany consistently emerge as the leading markets, accounting for a substantial portion of the total market volume, driven by factors like robust economic growth, well-developed financial systems, and high investor awareness. However, other countries in Western Europe, alongside rapidly growing economies in Eastern Europe, present significant untapped potential.

Europe Mutual Fund Industry Product Developments

Product innovation in the European mutual fund industry is accelerating, with a clear emphasis on technologically advanced and investor-centric solutions. This encompasses a significant surge in the development of ESG-focused funds, reflecting a growing investor appetite for ethically aligned investments. Furthermore, actively managed strategies are increasingly leveraging AI and Machine Learning to enhance performance and offer sophisticated insights. The sustained expansion of passively managed ETFs and index funds continues to cater to the demand for transparency and cost-effectiveness. The seamless integration of robo-advisors into wealth management ecosystems highlights a broader trend towards personalization, enhanced accessibility, and intuitive digital client journeys. These developments collectively aim to provide diversified, transparent, and values-driven investment opportunities to a broad spectrum of investors.

Key Drivers of Europe Mutual Fund Industry Growth

The European mutual fund industry is propelled by a confluence of powerful growth drivers:

- Technological Advancements: The transformative power of AI in portfolio management, the accessibility offered by robo-advisors, and the potential of blockchain technology are fundamentally reshaping investment management. These innovations are not only boosting operational efficiency but also democratizing access to sophisticated investment strategies for a wider range of investors.

- Economic Growth: A backdrop of sustained economic expansion across many European nations bolsters investor confidence. This positive economic sentiment directly translates into increased disposable income and a greater propensity to invest, thereby driving demand for mutual fund products.

- Favorable Regulatory Environment: While evolving, the overall regulatory framework in Europe, when supportive, significantly enhances investor trust and market stability. Transparent and well-defined regulations foster a conducive environment for industry growth and product proliferation.

Challenges in the Europe Mutual Fund Industry Market

The European mutual fund industry faces several significant challenges:

- Regulatory Hurdles: Complex and evolving regulations increase compliance costs and can stifle innovation.

- Increased Competition: Intense competition from other investment products, including ETFs, and the emergence of fintech platforms present significant pressure.

- Economic Uncertainty: Geopolitical uncertainties and economic downturns can negatively impact investor sentiment and fund performance, reducing demand.

Emerging Opportunities in Europe Mutual Fund Industry

The European mutual fund industry presents exciting opportunities for growth, driven primarily by:

Technological breakthroughs, such as AI-powered risk management, will enhance efficiency and personalize investment experiences. Strategic partnerships between traditional fund managers and fintech companies will offer a wider reach and innovative products. Expanding into emerging markets in Central and Eastern Europe presents significant untapped potential for market expansion and growth.

Key Milestones in Europe Mutual Fund Industry Industry

- March 2022: J.P. Morgan's acquisition of Global Shares, a premier provider of cloud-based share plan management software, marked a significant enhancement of its technological capabilities and client reach. This strategic move underscores the indispensable role of advanced technology in navigating the modern mutual fund landscape.

- March 2022: Natixis CIB's implementation of nCino's AI-powered Automated Spreading technology revolutionized its credit processing. This adoption exemplifies the growing trend of integrating AI to optimize operational efficiency, refine decision-making, and streamline complex processes within financial institutions.

Strategic Outlook for Europe Mutual Fund Industry Market

The European mutual fund industry is positioned for a trajectory of sustained growth, fueled by ongoing technological innovation, evolving investor demands, and strategic expansion into emerging markets. Success in this dynamic environment will hinge on forging robust strategic partnerships, meticulously developing differentiated product offerings, and adeptly navigating the complexities of the regulatory landscape. The industry's future will be defined by a thoughtful equilibrium between established investment methodologies and the integration of nascent technologies, ensuring that a diverse array of investor needs and risk appetites are effectively addressed.

Europe Mutual Fund Industry Segmentation

-

1. Fund Type

- 1.1. Equity

- 1.2. Debt

- 1.3. Multi-Asset

- 1.4. Money Market

- 1.5. Other Fund Types

-

2. Investor Type

- 2.1. Households

- 2.2. Monetary Financial Institutions

- 2.3. General Government

- 2.4. Non-Financial Corporations

- 2.5. Insurers & Pension Funds

- 2.6. Other financial Intermediaries

Europe Mutual Fund Industry Segmentation By Geography

- 1. Luxembourg

- 2. Ireland

- 3. Germany

- 4. France

- 5. United Kingdom

- 6. Netherlands

- 7. Italy

- 8. Rest of Europe

Europe Mutual Fund Industry Regional Market Share

Geographic Coverage of Europe Mutual Fund Industry

Europe Mutual Fund Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth; Low Interest Rates

- 3.3. Market Restrains

- 3.3.1. Economic Growth; Low Interest Rates

- 3.4. Market Trends

- 3.4.1. Investment Funds Domiciled in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity

- 5.1.2. Debt

- 5.1.3. Multi-Asset

- 5.1.4. Money Market

- 5.1.5. Other Fund Types

- 5.2. Market Analysis, Insights and Forecast - by Investor Type

- 5.2.1. Households

- 5.2.2. Monetary Financial Institutions

- 5.2.3. General Government

- 5.2.4. Non-Financial Corporations

- 5.2.5. Insurers & Pension Funds

- 5.2.6. Other financial Intermediaries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Luxembourg

- 5.3.2. Ireland

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. United Kingdom

- 5.3.6. Netherlands

- 5.3.7. Italy

- 5.3.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. Luxembourg Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 6.1.1. Equity

- 6.1.2. Debt

- 6.1.3. Multi-Asset

- 6.1.4. Money Market

- 6.1.5. Other Fund Types

- 6.2. Market Analysis, Insights and Forecast - by Investor Type

- 6.2.1. Households

- 6.2.2. Monetary Financial Institutions

- 6.2.3. General Government

- 6.2.4. Non-Financial Corporations

- 6.2.5. Insurers & Pension Funds

- 6.2.6. Other financial Intermediaries

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 7. Ireland Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 7.1.1. Equity

- 7.1.2. Debt

- 7.1.3. Multi-Asset

- 7.1.4. Money Market

- 7.1.5. Other Fund Types

- 7.2. Market Analysis, Insights and Forecast - by Investor Type

- 7.2.1. Households

- 7.2.2. Monetary Financial Institutions

- 7.2.3. General Government

- 7.2.4. Non-Financial Corporations

- 7.2.5. Insurers & Pension Funds

- 7.2.6. Other financial Intermediaries

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 8. Germany Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 8.1.1. Equity

- 8.1.2. Debt

- 8.1.3. Multi-Asset

- 8.1.4. Money Market

- 8.1.5. Other Fund Types

- 8.2. Market Analysis, Insights and Forecast - by Investor Type

- 8.2.1. Households

- 8.2.2. Monetary Financial Institutions

- 8.2.3. General Government

- 8.2.4. Non-Financial Corporations

- 8.2.5. Insurers & Pension Funds

- 8.2.6. Other financial Intermediaries

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 9. France Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 9.1.1. Equity

- 9.1.2. Debt

- 9.1.3. Multi-Asset

- 9.1.4. Money Market

- 9.1.5. Other Fund Types

- 9.2. Market Analysis, Insights and Forecast - by Investor Type

- 9.2.1. Households

- 9.2.2. Monetary Financial Institutions

- 9.2.3. General Government

- 9.2.4. Non-Financial Corporations

- 9.2.5. Insurers & Pension Funds

- 9.2.6. Other financial Intermediaries

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 10. United Kingdom Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 10.1.1. Equity

- 10.1.2. Debt

- 10.1.3. Multi-Asset

- 10.1.4. Money Market

- 10.1.5. Other Fund Types

- 10.2. Market Analysis, Insights and Forecast - by Investor Type

- 10.2.1. Households

- 10.2.2. Monetary Financial Institutions

- 10.2.3. General Government

- 10.2.4. Non-Financial Corporations

- 10.2.5. Insurers & Pension Funds

- 10.2.6. Other financial Intermediaries

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 11. Netherlands Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Fund Type

- 11.1.1. Equity

- 11.1.2. Debt

- 11.1.3. Multi-Asset

- 11.1.4. Money Market

- 11.1.5. Other Fund Types

- 11.2. Market Analysis, Insights and Forecast - by Investor Type

- 11.2.1. Households

- 11.2.2. Monetary Financial Institutions

- 11.2.3. General Government

- 11.2.4. Non-Financial Corporations

- 11.2.5. Insurers & Pension Funds

- 11.2.6. Other financial Intermediaries

- 11.1. Market Analysis, Insights and Forecast - by Fund Type

- 12. Italy Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Fund Type

- 12.1.1. Equity

- 12.1.2. Debt

- 12.1.3. Multi-Asset

- 12.1.4. Money Market

- 12.1.5. Other Fund Types

- 12.2. Market Analysis, Insights and Forecast - by Investor Type

- 12.2.1. Households

- 12.2.2. Monetary Financial Institutions

- 12.2.3. General Government

- 12.2.4. Non-Financial Corporations

- 12.2.5. Insurers & Pension Funds

- 12.2.6. Other financial Intermediaries

- 12.1. Market Analysis, Insights and Forecast - by Fund Type

- 13. Rest of Europe Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Fund Type

- 13.1.1. Equity

- 13.1.2. Debt

- 13.1.3. Multi-Asset

- 13.1.4. Money Market

- 13.1.5. Other Fund Types

- 13.2. Market Analysis, Insights and Forecast - by Investor Type

- 13.2.1. Households

- 13.2.2. Monetary Financial Institutions

- 13.2.3. General Government

- 13.2.4. Non-Financial Corporations

- 13.2.5. Insurers & Pension Funds

- 13.2.6. Other financial Intermediaries

- 13.1. Market Analysis, Insights and Forecast - by Fund Type

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 BlackRock

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Amundi

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 BNP Paribas Asset Management

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 JP Morgan

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Natixis

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 AXA

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 UBS

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 HSBC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 DWS Group

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 PIMCO

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Invesco**List Not Exhaustive

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 BlackRock

List of Figures

- Figure 1: Global Europe Mutual Fund Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Europe Mutual Fund Industry Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: Luxembourg Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 4: Luxembourg Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 5: Luxembourg Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 6: Luxembourg Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 7: Luxembourg Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 8: Luxembourg Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 9: Luxembourg Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 10: Luxembourg Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 11: Luxembourg Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: Luxembourg Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 13: Luxembourg Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Luxembourg Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Ireland Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 16: Ireland Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 17: Ireland Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 18: Ireland Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 19: Ireland Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 20: Ireland Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 21: Ireland Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 22: Ireland Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 23: Ireland Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Ireland Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 25: Ireland Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Ireland Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Germany Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 28: Germany Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 29: Germany Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 30: Germany Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 31: Germany Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 32: Germany Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 33: Germany Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 34: Germany Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 35: Germany Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Germany Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 37: Germany Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Germany Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: France Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 40: France Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 41: France Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 42: France Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 43: France Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 44: France Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 45: France Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 46: France Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 47: France Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: France Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 49: France Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: France Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: United Kingdom Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 52: United Kingdom Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 53: United Kingdom Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 54: United Kingdom Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 55: United Kingdom Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 56: United Kingdom Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 57: United Kingdom Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 58: United Kingdom Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 59: United Kingdom Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: United Kingdom Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 61: United Kingdom Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: United Kingdom Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Netherlands Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 64: Netherlands Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 65: Netherlands Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 66: Netherlands Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 67: Netherlands Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 68: Netherlands Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 69: Netherlands Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 70: Netherlands Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 71: Netherlands Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 72: Netherlands Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 73: Netherlands Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Netherlands Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 75: Italy Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 76: Italy Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 77: Italy Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 78: Italy Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 79: Italy Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 80: Italy Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 81: Italy Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 82: Italy Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 83: Italy Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 84: Italy Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 85: Italy Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 86: Italy Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 87: Rest of Europe Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 88: Rest of Europe Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 89: Rest of Europe Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 90: Rest of Europe Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 91: Rest of Europe Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 92: Rest of Europe Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 93: Rest of Europe Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 94: Rest of Europe Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 95: Rest of Europe Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 96: Rest of Europe Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 97: Rest of Europe Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Rest of Europe Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 2: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 3: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 4: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 5: Global Europe Mutual Fund Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 8: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 9: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 10: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 11: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 14: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 15: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 16: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 17: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 20: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 21: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 22: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 23: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 26: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 27: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 28: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 29: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 32: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 33: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 34: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 35: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 38: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 39: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 40: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 41: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 43: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 44: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 45: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 46: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 47: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 49: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 50: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 51: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 52: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 53: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Mutual Fund Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Mutual Fund Industry?

Key companies in the market include BlackRock, Amundi, BNP Paribas Asset Management, JP Morgan, Natixis, AXA, UBS, HSBC, DWS Group, PIMCO, Invesco**List Not Exhaustive.

3. What are the main segments of the Europe Mutual Fund Industry?

The market segments include Fund Type, Investor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth; Low Interest Rates.

6. What are the notable trends driving market growth?

Investment Funds Domiciled in Europe.

7. Are there any restraints impacting market growth?

Economic Growth; Low Interest Rates.

8. Can you provide examples of recent developments in the market?

March 2022: J.P. Morgan announced that it had agreed to acquire Global Shares, a leading cloud-based share plan management software provider. Global Shares has an expansive client base of over 600 corporate clients that range from early-stage start-ups to mature multinational public corporations. The firm has nearly USD 200 billion assets under administration across 650,000 corporate employee participants. It operates with an experienced team of over 600 employees headquartered in Cork, Ireland, and 16 locations across Europe, the Middle East & Africa, North America, and Asia-Pacific.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Mutual Fund Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Mutual Fund Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Mutual Fund Industry?

To stay informed about further developments, trends, and reports in the Europe Mutual Fund Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence