Key Insights

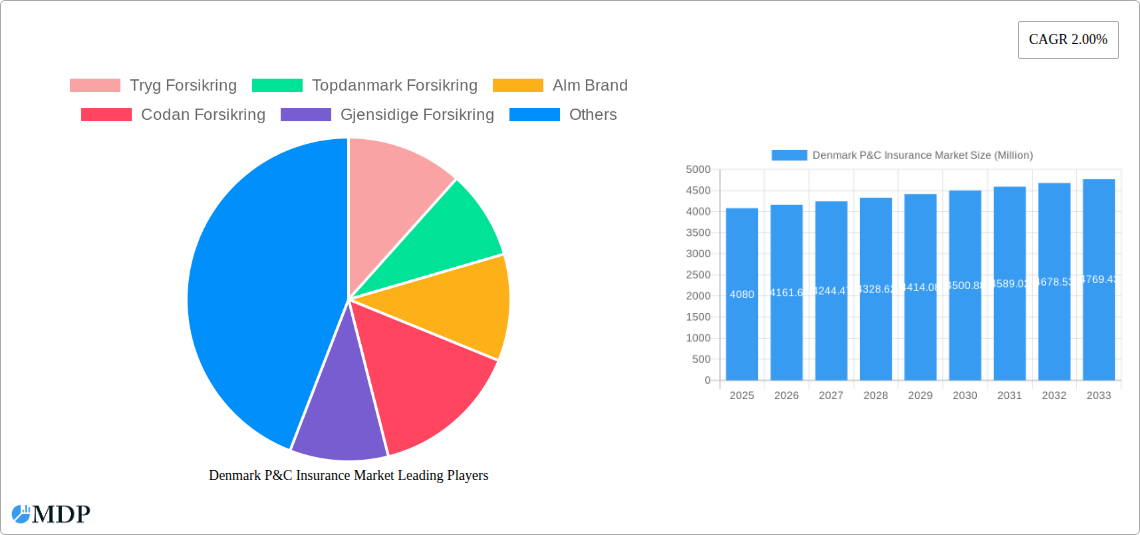

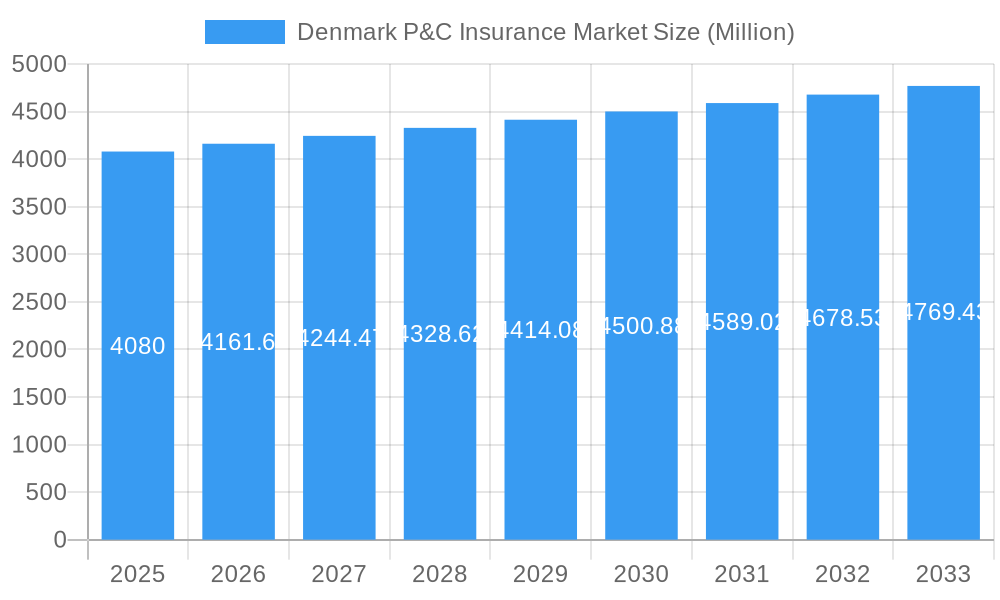

The Denmark Property & Casualty (P&C) insurance market, valued at €4.08 billion in 2025, exhibits a steady growth trajectory, projected to maintain a Compound Annual Growth Rate (CAGR) of 2.00% from 2025 to 2033. This growth is fueled by several key factors. Increasing awareness of the importance of risk mitigation among individuals and businesses is driving demand for various P&C insurance products, including home, auto, and liability insurance. Furthermore, the increasing frequency and severity of weather-related events in Denmark are contributing to a rise in demand for insurance coverage against natural disasters. Technological advancements, such as the adoption of Insurtech solutions for improved customer service and risk assessment, are also positively impacting market expansion. The presence of established and well-capitalized players such as Tryg Forsikring, Topdanmark Forsikring, and Alm Brand ensures market stability and competitive pricing, further driving market penetration.

Denmark P&C Insurance Market Market Size (In Billion)

However, the market faces certain challenges. Intense competition among established insurers and the emergence of new market entrants can pressure profit margins. Furthermore, regulatory changes and evolving consumer expectations necessitate continuous adaptation and innovation within the industry. Stricter regulations aimed at improving transparency and consumer protection might increase operational costs for insurance providers. Despite these restraints, the long-term outlook for the Denmark P&C insurance market remains positive, driven by robust economic growth and a growing awareness of insurance needs within the population. The market is expected to benefit from continued digital transformation and the increasing adoption of data-driven insights to better manage risks and serve customers more effectively. This creates opportunities for insurers to leverage innovative technology and tailor their offerings to meet the specific needs of the Danish market.

Denmark P&C Insurance Market Company Market Share

Denmark P&C Insurance Market: 2019-2033 Forecast & Analysis

This comprehensive report provides an in-depth analysis of the Denmark P&C insurance market, covering historical performance (2019-2024), current market dynamics (2025), and future projections (2025-2033). It offers actionable insights for industry stakeholders, including insurers, brokers, investors, and regulators. The report leverages extensive data analysis to present a clear picture of market trends, competitive landscapes, and growth opportunities. Key segments, leading players like Tryg Forsikring, Topdanmark Forsikring, and Alm Brand, and major industry developments are meticulously examined, providing a robust understanding of this dynamic market. Download now to gain a competitive edge.

Denmark P&C Insurance Market Market Dynamics & Concentration

The Danish P&C insurance market exhibits a moderately concentrated structure, with a few major players commanding significant market share. Tryg Forsikring and Topdanmark Forsikring hold the largest portions, exceeding xx% and xx% respectively in 2025 (estimated). Alm Brand, Codan Forsikring, and Gjensidige Forsikring also hold notable shares, contributing to the overall market consolidation. However, smaller players like Himmerland Forsikring and Protector Forsikring continue to compete, especially within niche segments.

- Market Concentration: High (xx%), driven by the dominance of a few major players.

- Innovation Drivers: Technological advancements in digital insurance, data analytics, and personalized offerings drive innovation.

- Regulatory Framework: The Danish Financial Supervisory Authority (FSA) sets the regulatory landscape, influencing pricing, solvency, and product offerings. Changes in regulations can significantly impact market dynamics.

- Product Substitutes: Limited direct substitutes exist, but increased competition from fintech companies offering alternative risk management solutions poses a threat.

- End-User Trends: Increasing demand for personalized insurance products and digital distribution channels shapes consumer preferences.

- M&A Activities: The acquisition of Assurance Partner by NORTH in March 2022 indicates a growing trend of consolidation and expansion within the market. The total number of M&A deals in the historical period (2019-2024) was xx. This is projected to increase to xx deals during the forecast period (2025-2033).

Denmark P&C Insurance Market Industry Trends & Analysis

The Denmark P&C insurance market is poised for steady growth, driven by a combination of factors. The Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period (2025-2033), fueled by increasing insurance penetration, rising disposable incomes, and government initiatives promoting financial inclusion. Technological disruptions, such as the adoption of Insurtech solutions and digitalization of processes, are streamlining operations and enhancing customer experience. Consumer preferences are shifting towards personalized, digitally-accessible policies. Competitive dynamics remain intense, with players focusing on product innovation, customer service, and strategic partnerships to gain a market advantage. Market penetration for home insurance is projected to be xx% by 2033.

Leading Markets & Segments in Denmark P&C Insurance Market

While data specifying regional variations within Denmark is limited, the market is primarily driven by urban areas with higher population density and economic activity. The most dominant segment is currently Motor Insurance, followed closely by Home Insurance. The growth in both segments is largely attributed to increased vehicle ownership and homeownership.

- Key Drivers:

- Strong Economy: Denmark's stable economy fosters consumer confidence and spending on insurance products.

- Favorable Regulatory Environment: Clear regulations provide a predictable and stable market for insurers.

- High Insurance Awareness: Danes demonstrate a high level of awareness and understanding of the importance of insurance coverage.

- Dominance Analysis: The market exhibits a dominance of motor insurance. This segment is characterized by high penetration, owing to mandatory insurance requirements, which leads to larger premiums and an increased overall market share. Home insurance, while experiencing considerable growth, remains the second largest market segment in the current period.

Denmark P&C Insurance Market Product Developments

The Danish P&C insurance market witnesses continuous product innovation, driven by technological advancements and evolving consumer preferences. Insurers are integrating Insurtech solutions to offer digital-first policies, personalized pricing, and seamless claims processes. Telematics-based motor insurance products are gaining popularity, using data from connected vehicles to personalize premiums based on driving behavior. Bundled products offering home and motor insurance together are also experiencing increased adoption.

Key Drivers of Denmark P&C Insurance Market Growth

Several factors are propelling growth in the Denmark P&C insurance market. Economic stability and rising disposable incomes lead to increased demand for insurance coverage. Technological advancements, particularly in digital insurance, enhance customer experience and operational efficiency. Furthermore, supportive government policies and regulations encourage market expansion.

Challenges in the Denmark P&C Insurance Market Market

The Denmark P&C insurance market faces challenges including intense competition, particularly from new market entrants and Insurtech companies. Cybersecurity threats and data privacy concerns represent significant risks to insurers. Fluctuating interest rates can also impact investment returns and profitability. Additionally, maintaining profitability amidst regulatory changes and stringent compliance requirements remains a key challenge. These factors collectively lead to a competitive landscape that challenges industry profitability. The estimated impact of these challenges on market growth is approximately a xx% reduction in CAGR.

Emerging Opportunities in Denmark P&C Insurance Market

Significant opportunities exist for growth in the Denmark P&C insurance market. The expansion of Insurtech solutions and strategic partnerships offers potential for enhanced product offerings and improved operational efficiency. The rising adoption of digital channels creates opportunities to reach wider customer segments and offer personalized insurance products. Moreover, the potential for expansion into new niche markets and product categories presents significant growth possibilities.

Leading Players in the Denmark P&C Insurance Market Sector

- Tryg Forsikring

- Topdanmark Forsikring

- Alm Brand

- Codan Forsikring

- Gjensidige Forsikring

- IF Insurance

- LB Forsikring

- GF Forsikring

- Himmerland Forsikring

- Protector Forsikring

Key Milestones in Denmark P&C Insurance Market Industry

- March 2022: Assurance Partner, a Danish insurance brokerage, was acquired by NORTH, a financial advisory firm. This acquisition signifies consolidation within the market and expansion of services offered.

- March 2022: Hemavi partnered with Hedvig to launch a home insurance platform in Denmark, increasing access to home insurance for tenants and landlords. This partnership demonstrates the growing role of Insurtech in the market.

Strategic Outlook for Denmark P&C Insurance Market Market

The Denmark P&C insurance market is projected to maintain a steady growth trajectory, driven by ongoing technological advancements, changing consumer preferences, and favorable regulatory conditions. The strategic focus for insurers lies in leveraging technology, building robust digital platforms, developing innovative products, and fostering strategic partnerships to cater to the evolving needs of a digitally-savvy customer base. This includes focusing on data analytics for better risk management and personalized offerings. The potential for market expansion into under-served sectors and leveraging international collaborations presents significant opportunities for growth and diversification.

Denmark P&C Insurance Market Segmentation

-

1. Product Type

- 1.1. Motor Vehicle Insurance

- 1.2. Fire and Other Damage Insurance

- 1.3. Marine, Aviation and Transport

- 1.4. General Liability

- 1.5. Others

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Banks

- 2.4. Others

Denmark P&C Insurance Market Segmentation By Geography

- 1. Denmark

Denmark P&C Insurance Market Regional Market Share

Geographic Coverage of Denmark P&C Insurance Market

Denmark P&C Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for Residential and Commercial Property Insurance

- 3.3. Market Restrains

- 3.3.1. Rising demand for Residential and Commercial Property Insurance

- 3.4. Market Trends

- 3.4.1. Rise in Residential Property Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark P&C Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Motor Vehicle Insurance

- 5.1.2. Fire and Other Damage Insurance

- 5.1.3. Marine, Aviation and Transport

- 5.1.4. General Liability

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Banks

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tryg Forsikring

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Topdanmark Forsikring

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alm Brand

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Codan Forsikring

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gjensidige Forsikring

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IF Insurance

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LB Forsikring

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GF Forsikring

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Himmerland Forsikring

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Protector Forsikring**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tryg Forsikring

List of Figures

- Figure 1: Denmark P&C Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Denmark P&C Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Denmark P&C Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Denmark P&C Insurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Denmark P&C Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Denmark P&C Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Denmark P&C Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Denmark P&C Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Denmark P&C Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Denmark P&C Insurance Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Denmark P&C Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Denmark P&C Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Denmark P&C Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Denmark P&C Insurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark P&C Insurance Market?

The projected CAGR is approximately 2.00%.

2. Which companies are prominent players in the Denmark P&C Insurance Market?

Key companies in the market include Tryg Forsikring, Topdanmark Forsikring, Alm Brand, Codan Forsikring, Gjensidige Forsikring, IF Insurance, LB Forsikring, GF Forsikring, Himmerland Forsikring, Protector Forsikring**List Not Exhaustive.

3. What are the main segments of the Denmark P&C Insurance Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for Residential and Commercial Property Insurance.

6. What are the notable trends driving market growth?

Rise in Residential Property Insurance.

7. Are there any restraints impacting market growth?

Rising demand for Residential and Commercial Property Insurance.

8. Can you provide examples of recent developments in the market?

In March 2022, Danish insurance brokerage Assurance Partner which has been offering its insurance for housing associations and real estate companies since 1992 was acquired by financial advisory firm NORTH which exists as an advisory house in Danmark offering advice within non-life insurance, pensions, financial agreements, and mortgage financing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark P&C Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark P&C Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark P&C Insurance Market?

To stay informed about further developments, trends, and reports in the Denmark P&C Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence