Key Insights

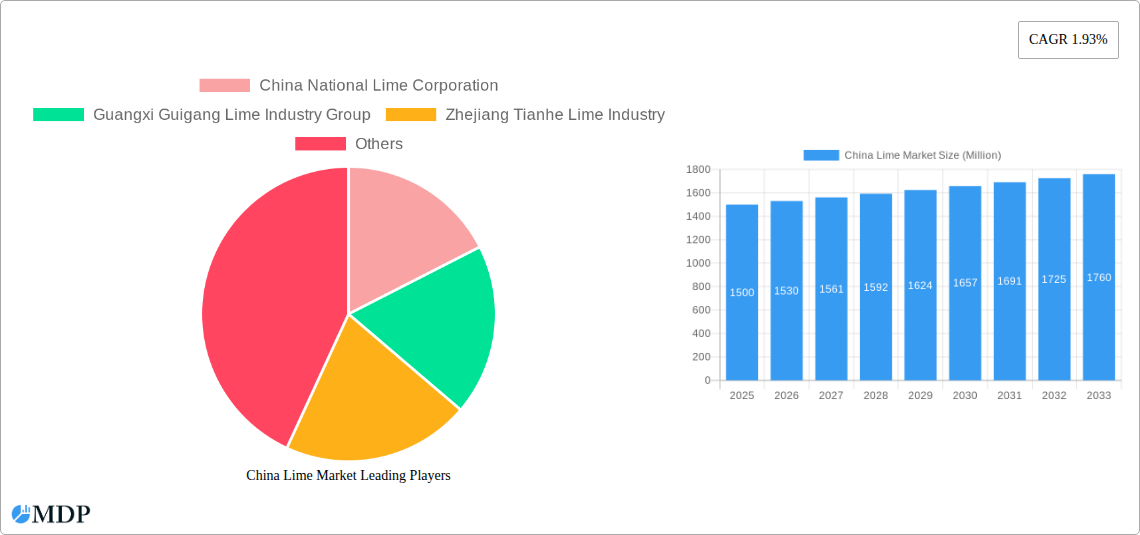

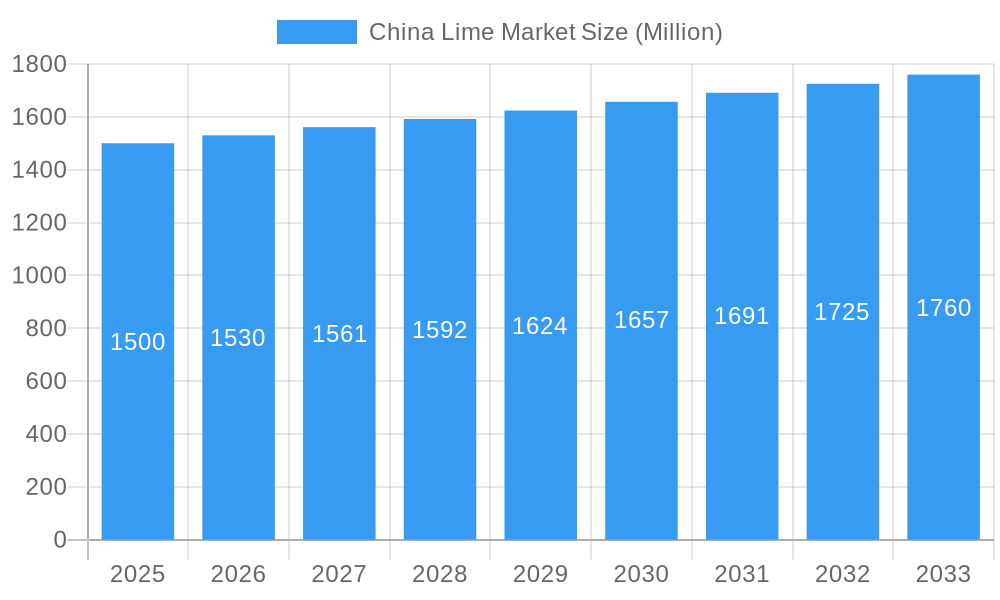

The China lime market, exhibiting a Compound Annual Growth Rate (CAGR) of 1.93% from 2019 to 2024, is poised for continued expansion through 2033. Driven by robust growth in construction, particularly infrastructure development and urbanization within China, the demand for lime in cement production and other building materials remains significant. The increasing adoption of lime in agricultural applications, as a soil amendment to improve crop yields and neutralize acidity, further fuels market growth. While the industrial lime segment currently holds a larger market share due to its extensive use in steelmaking and other industrial processes, the agricultural lime segment is expected to witness steady growth propelled by government initiatives promoting sustainable agricultural practices. The Asia-Pacific region, particularly China, dominates the global lime market owing to its large population, burgeoning industrial sector, and significant agricultural output. However, stringent environmental regulations regarding emissions from lime production facilities represent a key restraint on market expansion, prompting companies to adopt cleaner production technologies.

China Lime Market Market Size (In Billion)

The competitive landscape is moderately concentrated, with major players such as China National Lime Corporation and Guangxi Guigang Lime Industry Group dominating the market. These companies are increasingly focusing on strategic partnerships, acquisitions, and capacity expansions to enhance their market position. Future market growth hinges on the continued expansion of the construction and industrial sectors, government support for sustainable agriculture, and the successful implementation of environmentally friendly production processes. Given the projected CAGR and considering the substantial market size in 2024, we can reasonably anticipate a sustained growth trajectory, with potential for variations based on economic fluctuations and governmental policy changes. The market segmentation by product type (agricultural and industrial lime) and application (food and beverage, chemical, agriculture, others) provides valuable insights into specific growth drivers and potential investment opportunities within the diverse China lime market.

China Lime Market Company Market Share

Unlock Growth in China's Thriving Lime Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China lime market, offering invaluable insights for industry stakeholders seeking to capitalize on its significant growth potential. Spanning the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and emerging opportunities. The report leverages extensive data and analysis to deliver actionable strategies for success in this dynamic market. Projected market value exceeding xx Million by 2033.

China Lime Market Market Dynamics & Concentration

The China lime market exhibits a moderately concentrated structure, with key players like China National Lime Corporation, Guangxi Guigang Lime Industry Group, and Zhejiang Tianhe Lime Industry holding significant market share. However, the market also accommodates smaller regional players, particularly in agricultural lime segments. Innovation in lime processing technologies, such as improved calcination methods and enhanced purity levels, is a crucial driver of growth. The regulatory landscape, including environmental regulations and food safety standards, significantly influences market dynamics. Product substitutes, such as other alkaline materials, pose a level of competition, while the increasing demand across key end-use sectors like food and beverage, and chemical industries fuels market expansion. M&A activities within the sector remain moderate; however, the potential for consolidation remains a possibility in the coming years. xx M&A deals were recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top three players holding approximately xx% market share.

- Innovation Drivers: Improved calcination techniques, enhanced purity, sustainable sourcing.

- Regulatory Framework: Stringent environmental regulations, food safety standards.

- Product Substitutes: Alternative alkaline materials (e.g., calcium carbonate).

- End-User Trends: Growing demand from food & beverage, chemical, and agricultural sectors.

- M&A Activity: Moderate, with potential for future consolidation.

China Lime Market Industry Trends & Analysis

The China lime market demonstrates robust growth, projected at a CAGR of xx% during the forecast period (2025-2033). This growth is driven by rising disposable incomes, changing consumer preferences towards healthier food and beverages, and the expansion of the chemical and construction industries. Technological advancements in lime processing and handling contribute significantly to increased efficiency and reduced costs. The market penetration of high-purity lime products is also increasing due to rising demand in specialized applications. Competitive dynamics are shaped by factors such as pricing strategies, product differentiation, and brand recognition. The market also witnesses ongoing efforts to improve sustainability and reduce the carbon footprint of lime production.

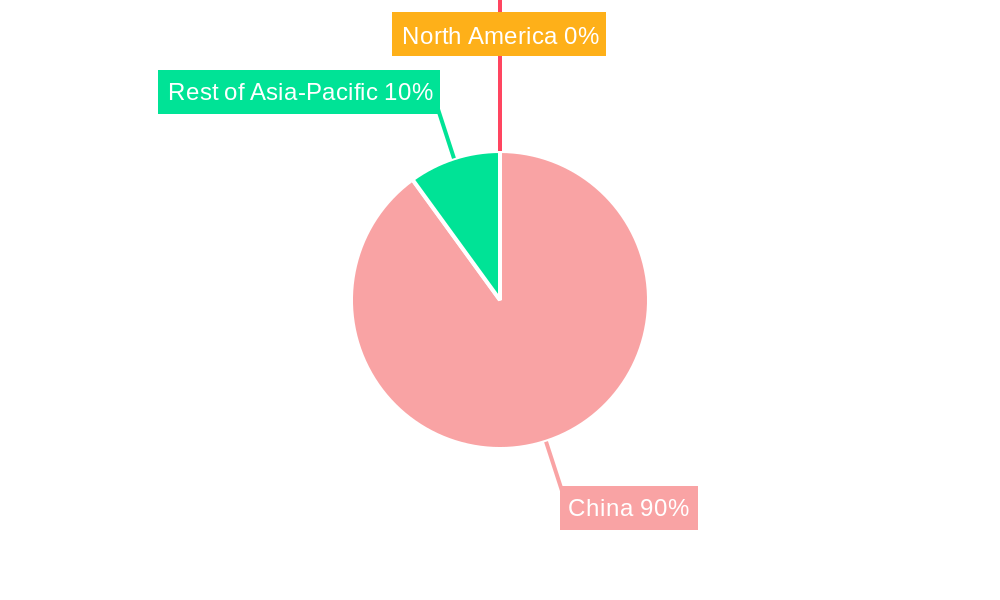

Leading Markets & Segments in China Lime Market

While precise regional data is limited, the southern provinces of China, known for their agricultural output and industrial activity, likely dominate the lime market. Industrial lime holds a larger market share compared to agricultural lime driven by substantial demand from chemical and construction industries.

By Product Type:

- Industrial Lime: Dominant segment, fueled by strong demand from chemical, construction and steel industries. Key driver: industrialization and infrastructure development.

- Agricultural Lime: Significant but smaller segment, driven by agricultural practices and soil amendment needs. Key driver: intensive farming and food security initiatives.

By Application:

- Chemical: Largest application segment, largely due to lime's use in various chemical processes. Key drivers: growth in chemical manufacturing and industrial production.

- Food and Beverage: Significant segment, driven by lime juice demand and use as a food additive. Key drivers: Increased consumer demand for lime-flavored products and beverages.

- Agriculture: Important segment, utilizing lime for soil pH adjustment. Key drivers: Growing agricultural sector and increasing focus on soil health.

- Others: Includes smaller applications in water treatment and construction. Key drivers: Urbanization, infrastructure development, and improving water quality standards.

China Lime Market Product Developments

Recent product developments focus on enhancing lime purity, consistency, and sustainability. Innovations in processing technologies aim to reduce energy consumption and environmental impact. New applications are emerging in specialized industries, driving demand for high-value lime products. The market is witnessing a gradual shift towards more sustainable and eco-friendly lime production methods.

Key Drivers of China Lime Market Growth

Several factors contribute to the growth of the China lime market. Strong economic growth fuels industrial expansion, boosting demand for industrial lime. The increasing adoption of agricultural practices that require lime for soil amendment drives agricultural lime demand. Moreover, rising consumer preferences for lime-flavored food and beverages also contribute to growth in the sector. Government initiatives promoting sustainable agriculture also create a positive impact.

Challenges in the China Lime Market Market

Challenges include fluctuations in raw material prices, stringent environmental regulations requiring compliance, and intense competition among lime producers. Supply chain disruptions can impact production and delivery, while the need to manage waste and emissions adds to operational costs. This translates into pricing pressures and margin constraints for businesses operating in the sector.

Emerging Opportunities in China Lime Market

Emerging opportunities include expanding into new applications, exploring strategic partnerships to secure raw materials and improve efficiency, and investing in sustainable technologies to reduce environmental impacts. Focusing on value-added lime products and expanding export markets will also unlock significant long-term growth.

Leading Players in the China Lime Market Sector

- China National Lime Corporation

- Guangxi Guigang Lime Industry Group

- Zhejiang Tianhe Lime Industry

Key Milestones in China Lime Market Industry

- June 2022: The Coca-Cola Company launched Topo Chico Hard Seltzer in China, featuring a Tangy Lemon Lime flavor, boosting lime demand in the beverage sector.

- July 2022: The General Administration of Customs of China approved the importation of fresh limes from Zimbabwe, potentially increasing lime supply and competition.

Strategic Outlook for China Lime Market Market

The China lime market presents a compelling growth opportunity driven by strong economic fundamentals and expanding industrial and agricultural sectors. Strategic initiatives including R&D investments in improved lime processing, sustainable sourcing practices, and exploring new market applications can further drive profitability and market share. Companies seeking to succeed should focus on enhancing value proposition through product differentiation, efficient supply chain management and compliance with stringent regulatory requirements.

China Lime Market Segmentation

- 1. Production Analysis (Volume)

- 2. Consumption Analysis (Value and Volume)

- 3. Import Analysis (Value and Volume)

- 4. Export Analysis (Value and Volume)

- 5. Price Trend Analysis

- 6. Production Analysis (Volume)

- 7. Consumption Analysis (Value and Volume)

- 8. Import Analysis (Value and Volume)

- 9. Export Analysis (Value and Volume)

- 10. Price Trend Analysis

China Lime Market Segmentation By Geography

- 1. China

China Lime Market Regional Market Share

Geographic Coverage of China Lime Market

China Lime Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Caters to various Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Lime Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis (Volume)

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis (Value and Volume)

- 5.3. Market Analysis, Insights and Forecast - by Import Analysis (Value and Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Analysis (Value and Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Production Analysis (Volume)

- 5.7. Market Analysis, Insights and Forecast - by Consumption Analysis (Value and Volume)

- 5.8. Market Analysis, Insights and Forecast - by Import Analysis (Value and Volume)

- 5.9. Market Analysis, Insights and Forecast - by Export Analysis (Value and Volume)

- 5.10. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis (Volume)

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China National Lime Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guangxi Guigang Lime Industry Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zhejiang Tianhe Lime Industry

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.1 China National Lime Corporation

List of Figures

- Figure 1: China Lime Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Lime Market Share (%) by Company 2025

List of Tables

- Table 1: China Lime Market Revenue Million Forecast, by Production Analysis (Volume) 2020 & 2033

- Table 2: China Lime Market Revenue Million Forecast, by Consumption Analysis (Value and Volume) 2020 & 2033

- Table 3: China Lime Market Revenue Million Forecast, by Import Analysis (Value and Volume) 2020 & 2033

- Table 4: China Lime Market Revenue Million Forecast, by Export Analysis (Value and Volume) 2020 & 2033

- Table 5: China Lime Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: China Lime Market Revenue Million Forecast, by Production Analysis (Volume) 2020 & 2033

- Table 7: China Lime Market Revenue Million Forecast, by Consumption Analysis (Value and Volume) 2020 & 2033

- Table 8: China Lime Market Revenue Million Forecast, by Import Analysis (Value and Volume) 2020 & 2033

- Table 9: China Lime Market Revenue Million Forecast, by Export Analysis (Value and Volume) 2020 & 2033

- Table 10: China Lime Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: China Lime Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: China Lime Market Revenue Million Forecast, by Production Analysis (Volume) 2020 & 2033

- Table 13: China Lime Market Revenue Million Forecast, by Consumption Analysis (Value and Volume) 2020 & 2033

- Table 14: China Lime Market Revenue Million Forecast, by Import Analysis (Value and Volume) 2020 & 2033

- Table 15: China Lime Market Revenue Million Forecast, by Export Analysis (Value and Volume) 2020 & 2033

- Table 16: China Lime Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 17: China Lime Market Revenue Million Forecast, by Production Analysis (Volume) 2020 & 2033

- Table 18: China Lime Market Revenue Million Forecast, by Consumption Analysis (Value and Volume) 2020 & 2033

- Table 19: China Lime Market Revenue Million Forecast, by Import Analysis (Value and Volume) 2020 & 2033

- Table 20: China Lime Market Revenue Million Forecast, by Export Analysis (Value and Volume) 2020 & 2033

- Table 21: China Lime Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: China Lime Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Lime Market?

The projected CAGR is approximately 1.93%.

2. Which companies are prominent players in the China Lime Market?

Key companies in the market include China National Lime Corporation, Guangxi Guigang Lime Industry Group, Zhejiang Tianhe Lime Industry.

3. What are the main segments of the China Lime Market?

The market segments include Production Analysis (Volume), Consumption Analysis (Value and Volume), Import Analysis (Value and Volume), Export Analysis (Value and Volume), Price Trend Analysis, Production Analysis (Volume), Consumption Analysis (Value and Volume), Import Analysis (Value and Volume), Export Analysis (Value and Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Caters to various Industries.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

July 2022: The General Administration of Customs of China issued an announcement, giving the green light to the importation of fresh citrus including limes from Zimbabwe that meets relevant phytosanitary protocols.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Lime Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Lime Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Lime Market?

To stay informed about further developments, trends, and reports in the China Lime Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence