Key Insights

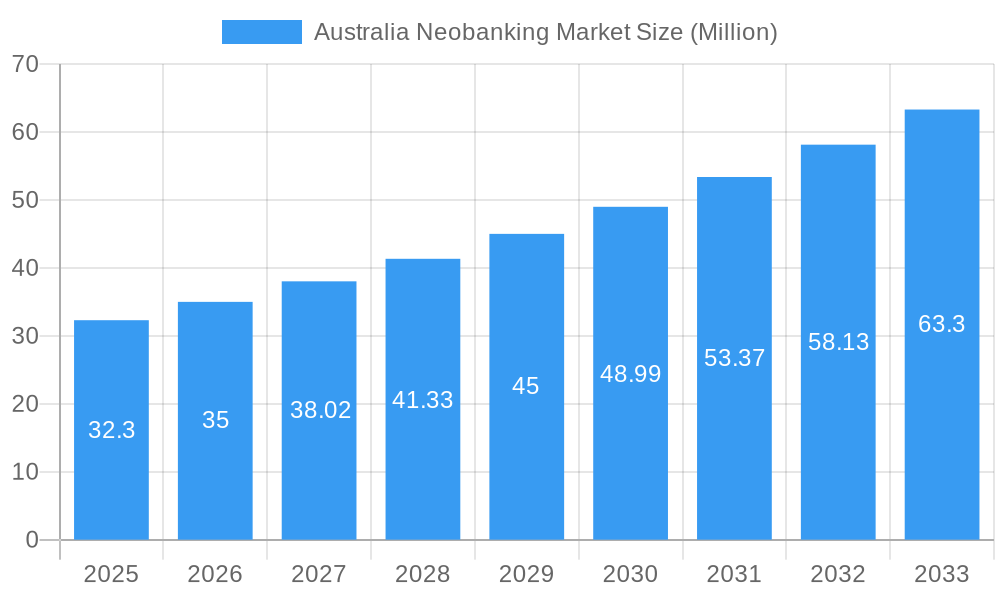

The Australian neobanking market, valued at $32.30 million in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.36% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of digital technologies and smartphones among Australian consumers fuels demand for convenient and accessible financial services. Neobanks offer streamlined user interfaces, superior customer service, and innovative features like personalized budgeting tools and instant transaction capabilities, appealing to tech-savvy individuals and businesses. Secondly, regulatory changes fostering competition in the financial sector and a growing preference for fee-transparent, customer-centric banking solutions contribute to neobank market penetration. The competitive landscape includes established players like UP Neo Bank, Revolut, and Judo Bank, alongside emerging fintech companies vying for market share through aggressive marketing and product innovation. While challenges such as security concerns and regulatory hurdles remain, the overall market trajectory suggests robust growth over the forecast period.

Australia Neobanking Market Market Size (In Million)

The anticipated growth trajectory projects substantial market expansion in the coming years. The presence of both established international neobanks and homegrown Australian players creates a dynamic competitive landscape fostering further innovation. Market segmentation, while not explicitly detailed, likely includes individual consumers and small-to-medium-sized businesses (SMBs) as key target demographics. Future growth will hinge on the ability of neobanks to address evolving customer needs, enhance security features, and navigate the regulatory framework effectively. Expansion into niche market segments and strategic partnerships with established financial institutions are likely to be key strategies for success in this burgeoning market. Maintaining customer trust and demonstrating robust financial stability will be crucial factors shaping market dynamics throughout the forecast period.

Australia Neobanking Market Company Market Share

This comprehensive report provides an in-depth analysis of the dynamic Australian neobanking market, covering the period 2019-2033. With a focus on market dynamics, industry trends, leading players, and future opportunities, this report is an essential resource for investors, industry stakeholders, and anyone seeking to understand this rapidly evolving sector. We delve into key segments, examine significant milestones, and forecast market growth, offering actionable insights for strategic decision-making. The report utilizes data from the base year 2025 and offers projections until 2033, providing a robust understanding of the historical period (2019-2024) and future trajectory.

Australia Neobanking Market Market Dynamics & Concentration

The Australian neobanking market is characterized by intense competition, fueled by technological innovation and evolving consumer preferences. Market concentration is currently moderate, with a few dominant players and a large number of emerging competitors. The market share of the top 5 players is estimated at xx% in 2025, indicating a fragmented landscape with potential for further consolidation through mergers and acquisitions (M&A).

- Innovation Drivers: Open banking APIs, AI-powered personalization, and embedded finance are key drivers of innovation.

- Regulatory Framework: The Australian Prudential Regulation Authority (APRA) plays a crucial role in shaping the regulatory landscape, influencing the entry of new players and the operational practices of existing ones.

- Product Substitutes: Traditional banking services and other fintech solutions pose a competitive threat to neobanks.

- End-User Trends: Consumers increasingly demand seamless digital experiences, personalized financial management tools, and transparent fee structures.

- M&A Activities: The number of M&A deals in the Australian neobanking market has increased in recent years (xx deals in 2024), reflecting the market's dynamic nature and the strategic importance of consolidation.

Australia Neobanking Market Industry Trends & Analysis

The Australian neobanking market is experiencing robust growth, driven by several factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration is currently at xx% and expected to reach xx% by 2033. Key market growth drivers include:

- Increasing Smartphone Penetration: High smartphone adoption fuels the demand for mobile-first banking solutions.

- Rising Financial Literacy: Greater awareness of financial products and services among consumers drives adoption.

- Technological Disruptions: Advancements in technology, such as AI and blockchain, continuously reshape the competitive landscape.

- Changing Consumer Preferences: Customers prioritize convenience, personalization, and superior customer service.

- Competitive Dynamics: Intense competition among established neobanks and the continuous influx of new players fosters innovation and enhances consumer choice.

Leading Markets & Segments in Australia Neobanking Market

The Australian neobanking market shows strong growth across various segments with a particular focus on major metropolitan areas like Sydney and Melbourne. This dominance is driven by factors including:

- High Population Density: Concentrated populations in these areas create a larger potential customer base.

- Advanced Digital Infrastructure: Robust digital infrastructure enables seamless access to neobanking services.

- High Average Income: A higher disposable income facilitates greater adoption of premium financial services.

- Pro-Innovation Regulatory Environment: Supportive regulations promote the growth of fintech and neobanking in these regions.

The detailed dominance analysis reveals that the metropolitan areas of Sydney and Melbourne collectively contribute to xx% of the overall market revenue in 2025.

Australia Neobanking Market Product Developments

Neobanks in Australia are continuously innovating their product offerings. Key developments include the integration of AI-powered features for personalized financial advice, advanced security measures leveraging blockchain technology, and the development of tailored financial products catering to specific customer segments. These innovations aim to enhance customer experience, improve operational efficiency, and strengthen competitive positioning within the market.

Key Drivers of Australia Neobanking Market Growth

Several factors are driving the growth of the Australian neobanking market. Technological advancements such as AI and machine learning are enabling personalized financial management tools. Favorable government policies and regulations promoting financial inclusion are also contributing to the market's expansion. Additionally, the increasing adoption of mobile devices and digital channels among consumers further accelerates the market's growth.

Challenges in the Australia Neobanking Market Market

The Australian neobanking market faces challenges, including stringent regulatory compliance requirements that increase operational costs. Competition from established banks and other fintech players creates pressure on pricing and profitability. Furthermore, security concerns surrounding data breaches and fraud remain a significant concern, demanding robust security measures. These challenges can impact market expansion and profitability for neobanks.

Emerging Opportunities in Australia Neobanking Market

The Australian neobanking market presents significant long-term growth opportunities. Strategic partnerships with established financial institutions can provide access to a wider customer base and enhance product offerings. Technological advancements like embedded finance and open banking will unlock new revenue streams. Expansion into underserved market segments and geographical areas also presents a significant opportunity for market growth.

Leading Players in the Australia Neobanking Market Sector

- UP Neo Bank

- Alex

- Volt Bank

- BNK

- Revolut

- Hay

- Judo Bank

- Tyro

- Douugh

- DayTek

- List Not Exhaustive

Key Milestones in Australia Neobanking Market Industry

- May 2022: UBank, Australia's first digital bank, unveiled a new brand identity following its merger with 86400, combining a strong customer base with advanced technology.

- December 2023: UBank partnered with designer Jordan Gogos to launch a fashion initiative, demonstrating a unique approach to brand building and customer engagement.

Strategic Outlook for Australia Neobanking Market Market

The Australian neobanking market exhibits substantial future potential. Strategic partnerships, technological innovation, and expansion into underserved markets will drive long-term growth. By focusing on customer-centric solutions and adapting to evolving regulatory frameworks, neobanks can secure a strong position in this dynamic and competitive landscape. The market is poised for continued expansion, driven by technological advancements and evolving consumer preferences.

Australia Neobanking Market Segmentation

-

1. Account

- 1.1. Business Account

- 1.2. Saving Account

-

2. Service

- 2.1. Mobile Banking

- 2.2. Payments & Money transfer

- 2.3. Savings account

- 2.4. Loans

- 2.5. Others

-

3. Application

- 3.1. Enterprise

- 3.2. Personal

- 3.3. Others

Australia Neobanking Market Segmentation By Geography

- 1. Australia

Australia Neobanking Market Regional Market Share

Geographic Coverage of Australia Neobanking Market

Australia Neobanking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Next Generation Technologies.

- 3.3. Market Restrains

- 3.3.1. Next Generation Technologies.

- 3.4. Market Trends

- 3.4.1. Rising Investment in Fintech in Australia Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account

- 5.1.1. Business Account

- 5.1.2. Saving Account

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Mobile Banking

- 5.2.2. Payments & Money transfer

- 5.2.3. Savings account

- 5.2.4. Loans

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Enterprise

- 5.3.2. Personal

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Account

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UP Neo Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volt Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BNK

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Revolut

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Judo Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tyro

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Douugh

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DayTek**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UP Neo Bank

List of Figures

- Figure 1: Australia Neobanking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Neobanking Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Neobanking Market Revenue Million Forecast, by Account 2020 & 2033

- Table 2: Australia Neobanking Market Volume Billion Forecast, by Account 2020 & 2033

- Table 3: Australia Neobanking Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Australia Neobanking Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: Australia Neobanking Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Australia Neobanking Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: Australia Neobanking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Australia Neobanking Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Australia Neobanking Market Revenue Million Forecast, by Account 2020 & 2033

- Table 10: Australia Neobanking Market Volume Billion Forecast, by Account 2020 & 2033

- Table 11: Australia Neobanking Market Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Australia Neobanking Market Volume Billion Forecast, by Service 2020 & 2033

- Table 13: Australia Neobanking Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Australia Neobanking Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Australia Neobanking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Australia Neobanking Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Neobanking Market?

The projected CAGR is approximately 8.36%.

2. Which companies are prominent players in the Australia Neobanking Market?

Key companies in the market include UP Neo Bank, Alex, Volt Bank, BNK, Revolut, Hay, Judo Bank, Tyro, Douugh, DayTek**List Not Exhaustive.

3. What are the main segments of the Australia Neobanking Market?

The market segments include Account, Service, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Next Generation Technologies..

6. What are the notable trends driving market growth?

Rising Investment in Fintech in Australia Driving the Market.

7. Are there any restraints impacting market growth?

Next Generation Technologies..

8. Can you provide examples of recent developments in the market?

December 2023: Ubank and designer Jordan Gogos collaborated to launch custom fashion pieces and introduce the Feel-Good Fashion Fund initiative for emerging designers. Jordan Gogos is known for his innovative and boundary-pushing work.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Neobanking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Neobanking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Neobanking Market?

To stay informed about further developments, trends, and reports in the Australia Neobanking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence