Key Insights

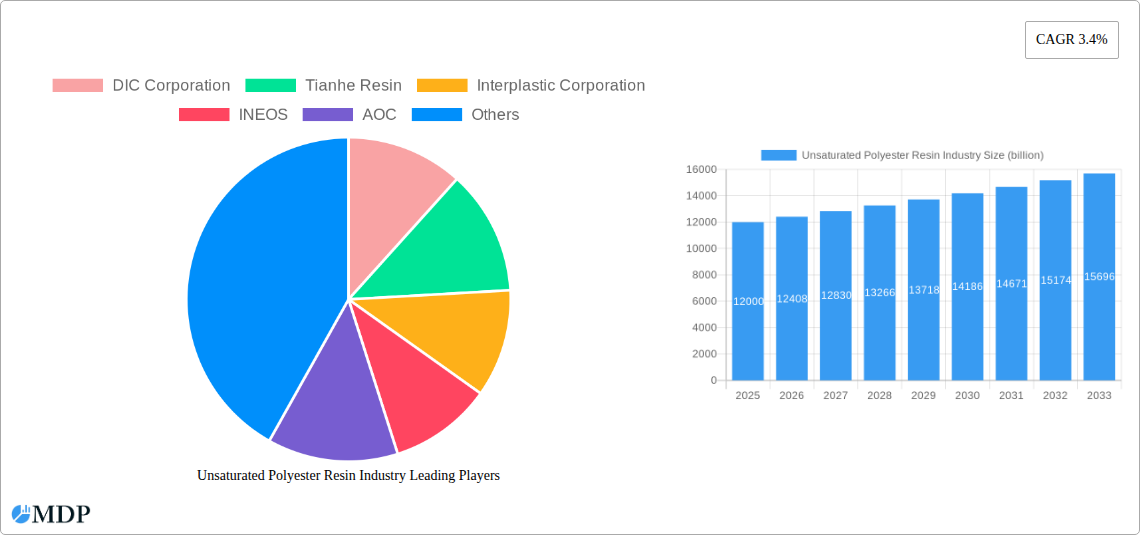

The global Unsaturated Polyester Resin (UPR) market is poised for steady expansion, projected to reach a significant $12 billion in 2025, with a compound annual growth rate (CAGR) of 3.4% during the forecast period of 2025-2033. This growth is primarily propelled by robust demand from the building and construction sector, driven by ongoing urbanization and infrastructure development initiatives worldwide. The versatility of UPRs in applications ranging from composite materials for structural components to decorative finishes, coupled with their cost-effectiveness and ease of processing, further bolsters market expansion. Furthermore, the increasing adoption of lightweight and durable materials in the transportation industry, as well as the growing use of UPRs in electrical and electronics for insulation and encapsulation, are significant contributors to this positive market trajectory. Emerging economies, particularly in the Asia Pacific region, are expected to be key growth engines due to rapid industrialization and a burgeoning manufacturing base.

Unsaturated Polyester Resin Industry Market Size (In Billion)

While the market demonstrates a healthy growth outlook, certain factors warrant attention. The increasing price volatility of raw materials, such as styrene and phthalic anhydride, can impact profit margins for manufacturers and influence pricing strategies. Additionally, stringent environmental regulations concerning volatile organic compound (VOC) emissions associated with certain UPR formulations necessitate continuous innovation and the development of eco-friendlier alternatives. However, ongoing research and development efforts focused on low-VOC and bio-based UPRs are expected to mitigate these challenges and unlock new market opportunities. The market is characterized by a competitive landscape with a mix of established global players and regional manufacturers, fostering innovation and driving product differentiation across various segments, including Ortho-resins, Isoresins, and Dicyclopentadiene (DCPD).

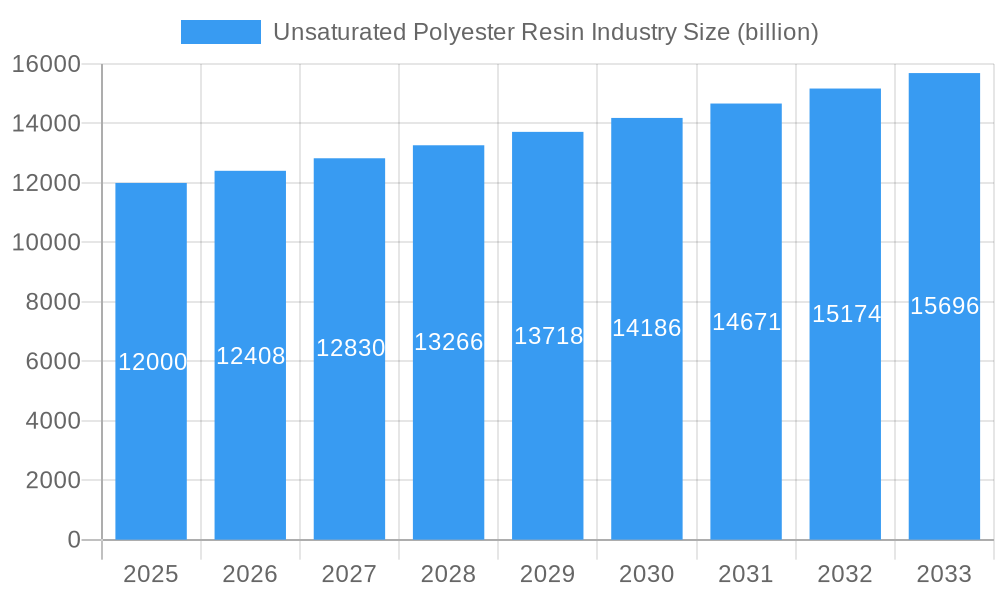

Unsaturated Polyester Resin Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Unsaturated Polyester Resin (UPR) market, providing critical insights for industry stakeholders. Spanning a study period of 2019–2033, with a base and estimated year of 2025, this report delves into market dynamics, technological advancements, competitive landscapes, and future growth trajectories. Explore the evolving UPR market, driven by robust demand from sectors such as building and construction, transportation, and paints and coatings. Our analysis covers key segments like ortho-resins, isoresins, and Dicyclopentadiene (DCPD) resins, offering actionable intelligence for strategic decision-making. The report examines the UPR industry's significant market size, projected to reach billions by 2025, with a compelling CAGR during the forecast period.

Unsaturated Polyester Resin Industry Market Dynamics & Concentration

The Unsaturated Polyester Resin industry exhibits a moderate to high market concentration, with a significant share held by a few key players. Innovation drivers, such as the development of high-performance resins with enhanced durability and reduced VOC emissions, are crucial for maintaining competitive advantage. Regulatory frameworks, particularly concerning environmental sustainability and safety standards, are increasingly shaping production processes and product formulations. Product substitutes, including vinyl ester resins and epoxy resins, present competitive pressures, necessitating continuous product differentiation and cost optimization. End-user trends, like the growing preference for lightweight materials in the transportation sector and sustainable building materials in building and construction, are significant growth catalysts. Mergers and Acquisitions (M&A) activities, exemplified by recent strategic consolidations, are reshaping the market landscape, with an estimated xx M&A deals recorded during the historical period. Companies like DIC Corporation and INEOS are actively participating in market consolidation, aiming to expand their product portfolios and geographical reach.

- Market Concentration: Moderate to High, with key players holding substantial market share.

- Innovation Drivers: High-performance resins, eco-friendly formulations, enhanced durability, reduced VOCs.

- Regulatory Frameworks: Environmental regulations, safety standards, REACH compliance.

- Product Substitutes: Vinyl ester resins, epoxy resins, thermoplastic composites.

- End-User Trends: Lightweighting in transportation, sustainable construction, demand for durable coatings.

- M&A Activities: Strategic acquisitions and mergers to enhance market presence and product offerings. Estimated xx M&A deals during the historical period.

Unsaturated Polyester Resin Industry Industry Trends & Analysis

The Unsaturated Polyester Resin market is experiencing robust growth, propelled by escalating demand across diverse end-user industries. The building and construction sector remains a dominant force, driven by global urbanization, infrastructure development, and the increasing use of UPR in composite materials for facades, pipes, and roofing. The transportation industry is a key growth area, with UPR composites offering lightweight alternatives to traditional materials, thereby improving fuel efficiency in automotive and aerospace applications. Furthermore, the paints and coatings segment is witnessing consistent expansion, owing to the use of UPR in gelcoats and protective coatings that provide excellent weather resistance and aesthetic appeal. Technological disruptions are playing a pivotal role, with advancements in resin formulations leading to improved mechanical properties, fire retardancy, and reduced styrene emissions. The market penetration of UPR is steadily increasing due to its cost-effectiveness and versatility. Consumer preferences are shifting towards sustainable and durable products, prompting manufacturers to invest in green UPR technologies and bio-based resins. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on customer-centric solutions. The chemical industry also contributes significantly to UPR consumption, utilizing it in various intermediate applications. The electrical and electronics sector leverages UPR for its insulating properties in components and housings. The projected Compound Annual Growth Rate (CAGR) for the UPR market during the forecast period is estimated at xx%, signifying substantial expansion.

Leading Markets & Segments in Unsaturated Polyester Resin Industry

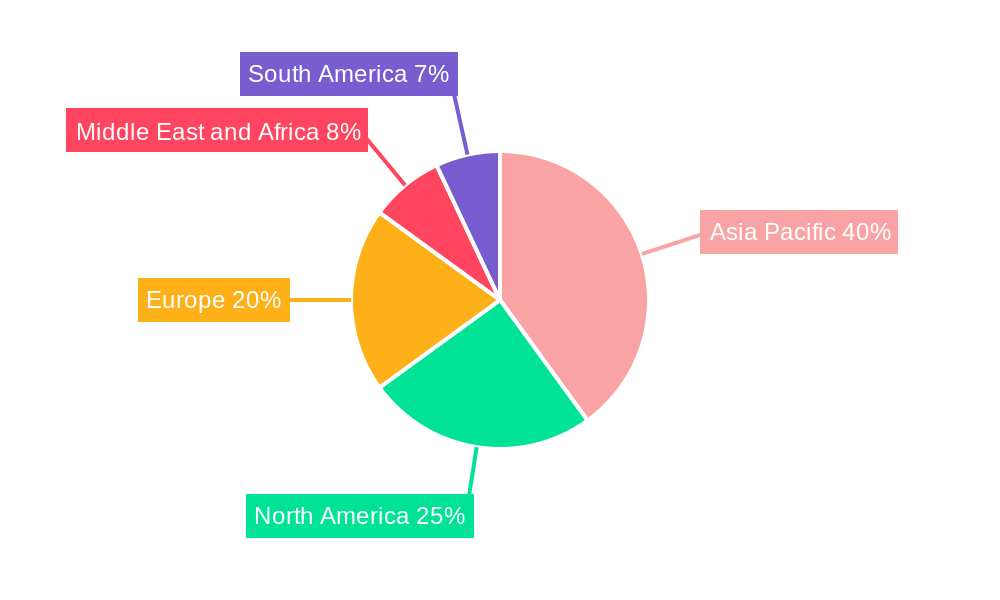

The Unsaturated Polyester Resin market is geographically diverse, with Asia Pacific emerging as the leading region, driven by rapid industrialization and infrastructure development in countries like China and India. The dominant country within this region, and globally, is China, owing to its massive manufacturing base and significant investments in construction and automotive sectors.

Dominant Segments by Type:

- Ortho-resins: This segment holds a significant market share due to its cost-effectiveness and widespread use in general-purpose applications, including boat hulls, tanks, and pipes.

- Key Drivers: Cost-effectiveness, wide range of applications, established manufacturing processes.

- Dominance Analysis: Ortho-resins benefit from their versatility and affordability, making them the go-to choice for many industrial and consumer products.

- Isoresins: These resins offer superior corrosion resistance and mechanical properties, making them ideal for demanding applications such as chemical storage tanks, industrial flooring, and marine components.

- Key Drivers: Enhanced corrosion resistance, improved mechanical strength, higher performance requirements.

- Dominance Analysis: The growing need for durable and resistant materials in harsh environments fuels the demand for isoresins.

- Dicyclopentadiene (DCPD): DCPD resins are known for their excellent toughness, impact resistance, and low shrinkage, finding applications in automotive parts, construction panels, and sporting goods.

- Key Drivers: Superior impact resistance, low shrinkage properties, lightweighting applications.

- Dominance Analysis: The increasing focus on lightweighting and durability in the automotive and construction sectors boosts the demand for DCPD resins.

- Other Types: This category includes specialized resins like terephthalic resins, which offer enhanced thermal and chemical resistance, catering to niche high-performance applications.

Dominant Segments by End-User Industry:

- Building and Construction: This segment is the largest consumer of UPR, utilizing it in a wide array of applications such as composite panels, pipes, sanitary ware, and decorative elements.

- Key Drivers: Urbanization, infrastructure projects, demand for durable and aesthetically pleasing building materials, fire-retardant properties.

- Dominance Analysis: The continuous global construction boom, coupled with the versatility and cost-effectiveness of UPR-based composites, solidifies its dominance in this sector.

- Transportation: UPR is increasingly used in automotive, marine, and aerospace industries for its lightweighting capabilities, contributing to fuel efficiency and performance. Applications include car body panels, boat hulls, and aircraft interiors.

- Key Drivers: Fuel efficiency mandates, lightweighting initiatives, demand for durable and impact-resistant components.

- Dominance Analysis: As industries strive for greater sustainability and performance, UPR's role in composite manufacturing is becoming indispensable.

- Paints and Coatings: UPR is extensively used in gelcoats for fiberglass reinforced plastics (FRP) and as a binder in various coating formulations, providing excellent gloss, weatherability, and chemical resistance.

- Key Drivers: Demand for protective and decorative coatings, aesthetic appeal, UV resistance.

- Dominance Analysis: The need for durable and visually appealing finishes across industries ensures a steady demand for UPR in coatings.

- Electrical and Electronics: UPR's excellent electrical insulating properties make it suitable for manufacturing components such as circuit boards, switchgears, and electrical casings.

- Key Drivers: Growth in electronics manufacturing, demand for insulating materials, miniaturization of electronic devices.

- Dominance Analysis: The expanding electronics industry and the need for reliable insulation materials contribute to consistent demand for UPR.

- Chemical: UPR is used in the production of tanks, pipes, and other equipment for chemical processing due to its resistance to corrosive substances.

- Key Drivers: Industrial chemical production, need for corrosion-resistant infrastructure.

- Dominance Analysis: The chemical industry's reliance on durable and resistant materials ensures a steady application for UPR.

Unsaturated Polyester Resin Industry Product Developments

Product development in the Unsaturated Polyester Resin industry is heavily focused on creating resins with enhanced performance characteristics and improved sustainability. Innovations include the development of fire-retardant UPRs for increased safety in construction and transportation, as well as low-VOC (Volatile Organic Compound) formulations to meet stringent environmental regulations. Advancements in bio-based UPRs, derived from renewable resources, are gaining traction, catering to the growing demand for eco-friendly materials. These developments aim to broaden the application spectrum of UPR, offering superior mechanical properties, chemical resistance, and aesthetic appeal, thereby providing a competitive edge to manufacturers and expanding market reach.

Key Drivers of Unsaturated Polyester Resin Industry Growth

The Unsaturated Polyester Resin industry is propelled by several key growth drivers. The escalating demand from the building and construction sector, fueled by global infrastructure development and urbanization, remains a primary catalyst. In the transportation industry, the push for lightweighting to improve fuel efficiency significantly boosts UPR consumption in composite materials. Technological advancements in resin formulations, leading to enhanced performance properties like fire retardancy and chemical resistance, are expanding application possibilities. Furthermore, favorable economic conditions and supportive government policies promoting industrial growth and manufacturing further stimulate market expansion. The cost-effectiveness of UPR compared to alternative materials also contributes to its widespread adoption across various sectors.

Challenges in the Unsaturated Polyester Resin Industry Market

Despite its robust growth, the Unsaturated Polyester Resin market faces several challenges. Fluctuations in raw material prices, particularly for styrene and maleic anhydride, can impact production costs and profitability. Stringent environmental regulations and increasing concerns over VOC emissions necessitate significant investments in cleaner production technologies and alternative formulations. The availability of viable product substitutes, such as epoxy resins and vinyl ester resins, poses competitive pressure, requiring continuous innovation and differentiation. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can also hinder production and timely delivery, impacting market stability.

Emerging Opportunities in Unsaturated Polyester Resin Industry

The Unsaturated Polyester Resin industry is poised for significant growth, driven by emerging opportunities. The increasing adoption of composite materials in renewable energy infrastructure, such as wind turbine blades, presents a substantial market expansion. Growing awareness and demand for sustainable and bio-based materials are opening avenues for the development and commercialization of eco-friendly UPR alternatives. Strategic partnerships and collaborations between resin manufacturers and end-users can foster tailored solutions and accelerate market penetration. Furthermore, the ongoing advancements in manufacturing technologies and the development of high-performance UPR grades catering to specialized applications are expected to catalyze long-term growth.

Leading Players in the Unsaturated Polyester Resin Industry Sector

- DIC Corporation

- Tianhe Resin

- Interplastic Corporation

- INEOS

- AOC

- BASF SE

- Xinyang Technology Group

- Crystic Resins India Pvt Ltd

- Showa Denko KK

- Scott Bader Company Ltd

- Reichhold LLC

- Zhangzhou Yabang Chemical Co Ltd

Key Milestones in Unsaturated Polyester Resin Industry Industry

- December 2022: INEOS Enterprises completed the acquisition of ASHTA Chemicals Inc from Bigshire Mexico S. de R.L. de C.V. The acquisition includes a 100 ktpa Potassium Hydroxide (KOH)/65 kte Chlorine plant. This strategic move by INEOS aims to strengthen its chemical portfolio and expand its production capabilities.

- July 2022: Scott Bader Pvt Ltd (India) acquired the commercial business of Satyen Polymers Pvt Ltd, which includes the marketing of all resin and gelcoat products. This strategic acquisition will expand the product range using Scott Bader technology to bring industry-leading adhesives and composites products to the Indian market, thereby enhancing its presence in the Indian subcontinent.

Strategic Outlook for Unsaturated Polyester Resin Industry Market

The strategic outlook for the Unsaturated Polyester Resin market is highly positive, characterized by sustained growth driven by innovation and expanding applications. The increasing demand for lightweight and durable materials in the transportation and building and construction sectors will continue to be a major growth accelerator. The industry's commitment to developing sustainable and eco-friendly resin solutions will unlock new market segments and attract environmentally conscious consumers. Strategic investments in research and development to enhance resin properties, such as fire retardancy and UV resistance, will further solidify UPR's competitive position. Exploring opportunities in emerging economies and forging strong partnerships with key end-users will be crucial for capturing market share and ensuring long-term profitability in this dynamic industry.

Unsaturated Polyester Resin Industry Segmentation

-

1. Type

- 1.1. Ortho-resins

- 1.2. Isoresins

- 1.3. Dicyclopentadiene (DCPD)

- 1.4. Other Types

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Chemical

- 2.3. Electrical and Electronics

- 2.4. Paints and Coatings

- 2.5. Transportation

- 2.6. Other End-user Industries

Unsaturated Polyester Resin Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Unsaturated Polyester Resin Industry Regional Market Share

Geographic Coverage of Unsaturated Polyester Resin Industry

Unsaturated Polyester Resin Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Manufacturing Glass Fiber-reinforced Plastics (GRP) in Europe; Desirable Properties of Unsaturated Polyester Resins

- 3.3. Market Restrains

- 3.3.1. Challenges in Automotive Industry; Other Restraints

- 3.4. Market Trends

- 3.4.1. Building and Construction Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Unsaturated Polyester Resin Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ortho-resins

- 5.1.2. Isoresins

- 5.1.3. Dicyclopentadiene (DCPD)

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Chemical

- 5.2.3. Electrical and Electronics

- 5.2.4. Paints and Coatings

- 5.2.5. Transportation

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Unsaturated Polyester Resin Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ortho-resins

- 6.1.2. Isoresins

- 6.1.3. Dicyclopentadiene (DCPD)

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Building and Construction

- 6.2.2. Chemical

- 6.2.3. Electrical and Electronics

- 6.2.4. Paints and Coatings

- 6.2.5. Transportation

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Unsaturated Polyester Resin Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ortho-resins

- 7.1.2. Isoresins

- 7.1.3. Dicyclopentadiene (DCPD)

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Building and Construction

- 7.2.2. Chemical

- 7.2.3. Electrical and Electronics

- 7.2.4. Paints and Coatings

- 7.2.5. Transportation

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Unsaturated Polyester Resin Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ortho-resins

- 8.1.2. Isoresins

- 8.1.3. Dicyclopentadiene (DCPD)

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Building and Construction

- 8.2.2. Chemical

- 8.2.3. Electrical and Electronics

- 8.2.4. Paints and Coatings

- 8.2.5. Transportation

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Unsaturated Polyester Resin Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ortho-resins

- 9.1.2. Isoresins

- 9.1.3. Dicyclopentadiene (DCPD)

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Building and Construction

- 9.2.2. Chemical

- 9.2.3. Electrical and Electronics

- 9.2.4. Paints and Coatings

- 9.2.5. Transportation

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Unsaturated Polyester Resin Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ortho-resins

- 10.1.2. Isoresins

- 10.1.3. Dicyclopentadiene (DCPD)

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Building and Construction

- 10.2.2. Chemical

- 10.2.3. Electrical and Electronics

- 10.2.4. Paints and Coatings

- 10.2.5. Transportation

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DIC Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tianhe Resin

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Interplastic Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 INEOS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AOC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Xinyang Technology Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crystic Resins India Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Showa Denko KK

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Scott Bader Company Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Reichhold LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Zhangzhou Yabang Chemical Co Ltd*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 DIC Corporation

List of Figures

- Figure 1: Global Unsaturated Polyester Resin Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Unsaturated Polyester Resin Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: Asia Pacific Unsaturated Polyester Resin Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Unsaturated Polyester Resin Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Unsaturated Polyester Resin Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Unsaturated Polyester Resin Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Unsaturated Polyester Resin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Unsaturated Polyester Resin Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: North America Unsaturated Polyester Resin Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Unsaturated Polyester Resin Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Unsaturated Polyester Resin Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Unsaturated Polyester Resin Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Unsaturated Polyester Resin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Unsaturated Polyester Resin Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Unsaturated Polyester Resin Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Unsaturated Polyester Resin Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Unsaturated Polyester Resin Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Unsaturated Polyester Resin Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Unsaturated Polyester Resin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Unsaturated Polyester Resin Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Unsaturated Polyester Resin Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Unsaturated Polyester Resin Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Unsaturated Polyester Resin Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Unsaturated Polyester Resin Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Unsaturated Polyester Resin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Unsaturated Polyester Resin Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Unsaturated Polyester Resin Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Unsaturated Polyester Resin Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Unsaturated Polyester Resin Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Unsaturated Polyester Resin Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Unsaturated Polyester Resin Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Unsaturated Polyester Resin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Unsaturated Polyester Resin Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Unsaturated Polyester Resin Industry?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Unsaturated Polyester Resin Industry?

Key companies in the market include DIC Corporation, Tianhe Resin, Interplastic Corporation, INEOS, AOC, BASF SE, Xinyang Technology Group, Crystic Resins India Pvt Ltd, Showa Denko KK, Scott Bader Company Ltd, Reichhold LLC, Zhangzhou Yabang Chemical Co Ltd*List Not Exhaustive.

3. What are the main segments of the Unsaturated Polyester Resin Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Manufacturing Glass Fiber-reinforced Plastics (GRP) in Europe; Desirable Properties of Unsaturated Polyester Resins.

6. What are the notable trends driving market growth?

Building and Construction Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Challenges in Automotive Industry; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: INEOS Enterprises completed the acquisition of ASHTA Chemicals Inc from Bigshire Mexico S. de R.L. de C.V. The acquisition includes a 100 ktpa Potassium Hydroxide (KOH)/65 kte Chlorine plant.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Unsaturated Polyester Resin Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Unsaturated Polyester Resin Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Unsaturated Polyester Resin Industry?

To stay informed about further developments, trends, and reports in the Unsaturated Polyester Resin Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence