Key Insights

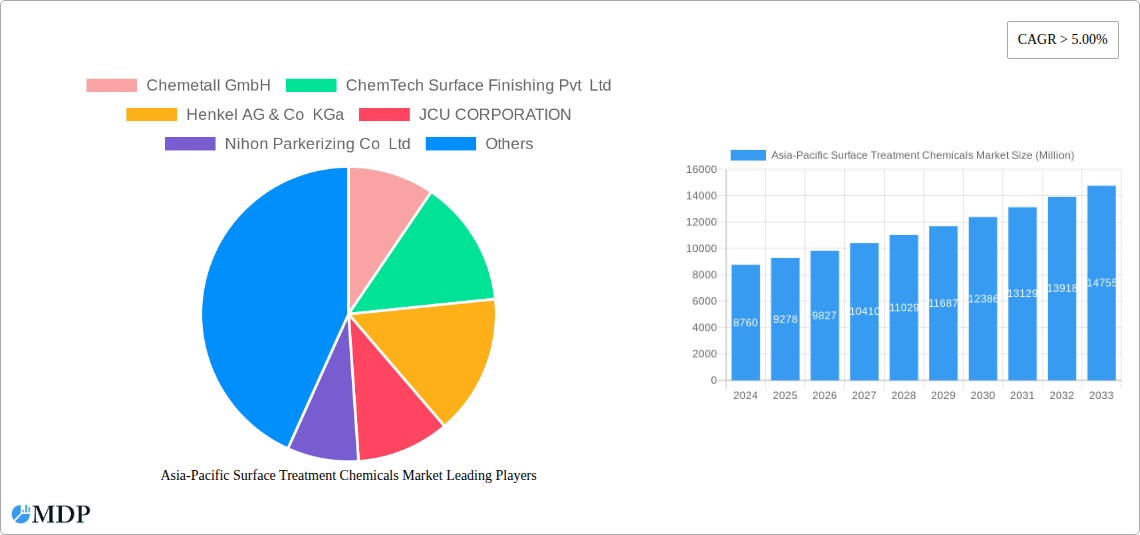

The Asia-Pacific surface treatment chemicals market is poised for significant expansion, reaching an estimated USD 8.76 billion in 2024. This robust growth is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 5.82% throughout the forecast period of 2019-2033. The region's burgeoning manufacturing sector, particularly in automotive, electronics, and aerospace, is a primary driver, demanding advanced surface finishing solutions for enhanced durability, corrosion resistance, and aesthetic appeal. Rapid industrialization and infrastructure development across emerging economies like India are further propelling the adoption of surface treatment chemicals. Furthermore, an increasing focus on eco-friendly and sustainable surface treatment processes, driven by stringent environmental regulations, is creating opportunities for innovative product development and market penetration. The demand for high-performance plating chemicals and advanced conversion coatings is expected to remain strong, supporting the market's upward trajectory.

Asia-Pacific Surface Treatment Chemicals Market Market Size (In Billion)

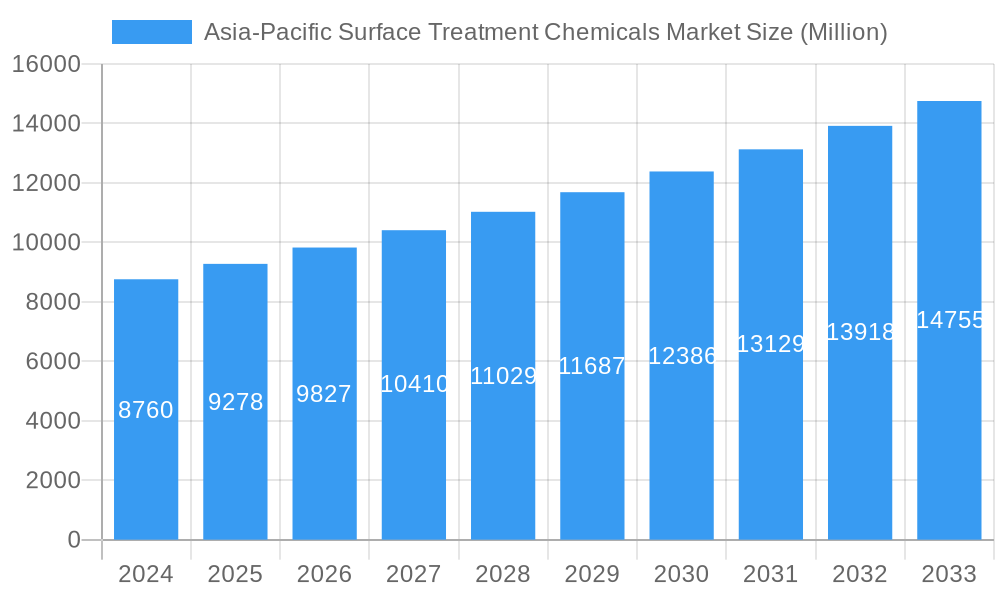

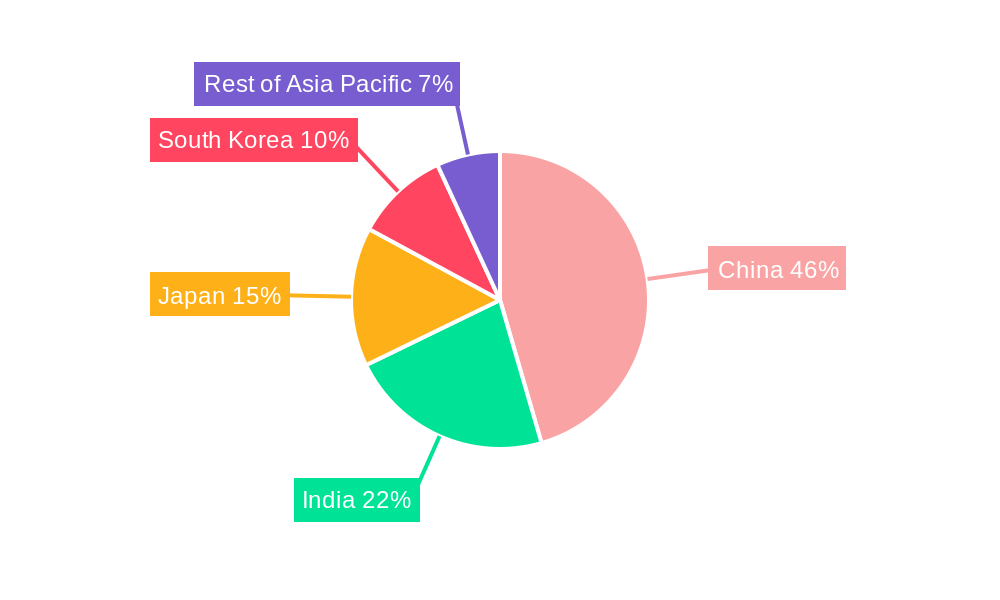

The market's growth is strategically segmented by chemical type, with plating chemicals and cleaners dominating current demand, while conversion coatings are gaining traction due to their environmental benefits and effectiveness on various substrates. The base material segment highlights a strong reliance on metals, followed by plastics, reflecting the dominant end-use industries. Geographically, China stands as the largest market, driven by its extensive manufacturing capabilities and export-oriented economy. However, India presents a substantial growth opportunity, with its rapidly expanding industrial base and increasing investment in advanced manufacturing technologies. South Korea and Japan, with their established advanced industries, also contribute significantly to regional demand. The presence of key global players like Henkel AG & Co KGa, PPG Industries Inc., and The Sherwin-Williams Company, alongside emerging regional leaders, signifies a competitive landscape characterized by continuous innovation and strategic collaborations to cater to evolving market needs.

Asia-Pacific Surface Treatment Chemicals Market Company Market Share

Dive deep into the burgeoning Asia-Pacific surface treatment chemicals market, a dynamic sector projected to reach US$ XXX billion by 2033, exhibiting a robust CAGR of XX% from 2025. This report offers an in-depth analysis of market dynamics, industry trends, leading segments, and strategic opportunities, crucial for stakeholders navigating this rapidly evolving landscape. The surface treatment chemicals market size in the Asia-Pacific region is driven by burgeoning manufacturing, automotive, aerospace, and electronics industries. This comprehensive report, covering the study period 2019–2033 with the base year 2025, provides actionable insights into plating chemicals, cleaners, conversion coatings, and other essential surface treatment chemicals. Explore the dominance of metals and plastics as base materials and gain insights into the China surface treatment chemicals market, India surface treatment chemicals market, and other key geographies.

Asia-Pacific Surface Treatment Chemicals Market Market Dynamics & Concentration

The Asia-Pacific surface treatment chemicals market is characterized by moderate to high concentration, with key players vying for market share through innovation and strategic expansions. The market concentration is influenced by the significant R&D investments and the proprietary technologies held by leading companies. Innovation drivers are primarily focused on developing eco-friendly and high-performance formulations, responding to stringent environmental regulations and the demand for enhanced material durability and aesthetics. Regulatory frameworks across the Asia-Pacific region, particularly concerning VOC emissions and hazardous substance content, are increasingly shaping product development and market entry strategies. Product substitutes, such as advanced material coatings and additive manufacturing techniques, present a growing challenge, necessitating continuous innovation in traditional surface treatment chemical offerings. End-user trends highlight a growing demand for specialized treatments that offer corrosion resistance, improved adhesion, and aesthetic appeal across diverse applications like automotive components, consumer electronics, and industrial machinery. M&A activities are also a significant factor, with companies actively acquiring smaller players or complementary technology providers to expand their product portfolios and geographical reach. For instance, the DIC Corporation's acquisition of Guangdong TOD New Materials Co. Ltd signifies a trend towards backward integration and strengthening market presence in key regions. The BASF inauguration of its largest surface treatment site under the Chemetall brand in China exemplifies the strategic focus on enhancing production capacity to meet surging regional demand.

Asia-Pacific Surface Treatment Chemicals Market Industry Trends & Analysis

The Asia-Pacific surface treatment chemicals market is experiencing significant growth, propelled by a confluence of factors including rapid industrialization, increasing demand for corrosion protection, and advancements in material science. Market growth drivers are deeply rooted in the expansion of key end-use industries such as automotive, aerospace, electronics, and construction. The burgeoning middle class in countries like China and India fuels the demand for consumer goods and vehicles, directly translating into higher consumption of surface treatment chemicals for enhanced aesthetics and durability. Technological advancements are playing a pivotal role, with a strong emphasis on developing sustainable and environmentally friendly formulations. This includes the shift towards water-based coatings, low-VOC (Volatile Organic Compound) alternatives, and chrome-free conversion coatings. Technological disruptions are also emerging from novel application methods and digital integration in process monitoring, leading to improved efficiency and reduced waste. Consumer preferences are increasingly leaning towards products with superior performance characteristics, such as enhanced scratch resistance, UV protection, and antimicrobial properties. This is pushing manufacturers to innovate and offer specialized solutions. The competitive dynamics are intense, with both established global players and emerging regional manufacturers actively competing on price, product quality, and service offerings. Strategic partnerships and collaborations are becoming common as companies aim to leverage each other's expertise and market access. The market penetration of advanced surface treatment technologies is steadily increasing, driven by the need for higher quality and more sustainable manufacturing processes across the entire Asia-Pacific region. The continuous drive for operational efficiency and cost optimization by manufacturers further fuels the adoption of efficient and effective surface treatment solutions, underpinning the overall expansion of the surface treatment chemicals market.

Leading Markets & Segments in Asia-Pacific Surface Treatment Chemicals Market

The Asia-Pacific surface treatment chemicals market is dominated by China, driven by its vast manufacturing base and significant investments in automotive, electronics, and infrastructure development. This dominance is further amplified by supportive government policies and a burgeoning domestic demand. Within the Chemical Type segment, Plating Chemicals hold a substantial market share, critical for providing corrosion resistance and enhancing the appearance of various metal components. The demand for electroplating and electroless plating solutions remains robust, particularly for applications in the automotive and electronics sectors. Cleaners are another vital segment, essential for preparing surfaces before subsequent treatment processes, ensuring optimal adhesion and performance. The increasing complexity of manufactured goods necessitates highly effective cleaning solutions across diverse materials. Conversion Coatings play a crucial role in enhancing paint adhesion and corrosion resistance, especially for aluminum and steel, making them indispensable in the automotive and aerospace industries. The segment of Other Chemical Types, encompassing coolants and paint strippers, also exhibits steady growth, catering to specialized industrial needs and maintenance requirements.

Regarding Base Material, Metals continue to be the dominant segment. The pervasive use of metals in construction, automotive manufacturing, and industrial machinery ensures a consistent demand for surface treatment chemicals. The increasing use of lightweight metals in automotive and aerospace applications further fuels this demand. Plastics represent a rapidly growing segment, as advancements in plastic manufacturing and the increasing substitution of metal parts with plastic components across various industries necessitate specialized surface treatments for improved aesthetics, durability, and functionality. The segment of Other Base Materials, including glass and alloys, while smaller, is projected to witness significant growth due to niche applications in specialized electronics, medical devices, and premium consumer goods.

Key drivers for the dominance of these segments include:

- Economic Policies: Government initiatives promoting manufacturing growth and export-oriented industries in countries like China and India directly stimulate the demand for surface treatment chemicals.

- Infrastructure Development: Large-scale infrastructure projects, from transportation networks to smart cities, require extensive use of treated metals, thereby boosting the market.

- Automotive Industry Expansion: The robust growth of the automotive sector across Asia-Pacific, including the burgeoning electric vehicle market, is a primary consumer of surface treatment chemicals for chassis, body parts, and components.

- Electronics Manufacturing Hub: The region's status as a global electronics manufacturing hub drives demand for specialized surface treatments for printed circuit boards, casings, and other electronic components.

- Technological Advancements: Continuous innovation in chemical formulations and application techniques caters to evolving industry requirements for performance, sustainability, and efficiency.

- Rising Disposable Incomes: Increased disposable incomes in emerging economies translate to higher demand for consumer goods and vehicles, indirectly boosting the surface treatment chemicals market.

Asia-Pacific Surface Treatment Chemicals Market Product Developments

Product development in the Asia-Pacific surface treatment chemicals market is characterized by a strong focus on sustainability, enhanced performance, and application-specific solutions. Manufacturers are introducing novel, low-VOC and chrome-free formulations to meet stringent environmental regulations and consumer demand for greener products. Innovations in nanocoatings offer superior scratch resistance and self-cleaning properties, while advancements in intelligent coatings provide real-time corrosion monitoring capabilities. Furthermore, there is a growing trend towards integrated solutions, where pre-treatment chemicals are optimized to work seamlessly with subsequent coating layers, leading to improved efficiency and overall finish quality. These developments cater to evolving industry needs for durability, aesthetics, and eco-friendliness across diverse applications, from automotive finishes to aerospace components and consumer electronics.

Key Drivers of Asia-Pacific Surface Treatment Chemicals Market Growth

The Asia-Pacific surface treatment chemicals market is propelled by several key drivers. The rapid industrialization and manufacturing expansion across the region, particularly in China and India, significantly increases the demand for surface treatment to protect and enhance manufactured goods. The automotive sector's robust growth, including the transition to electric vehicles, necessitates advanced surface treatments for corrosion resistance and aesthetic appeal. Furthermore, the burgeoning electronics industry requires specialized chemical treatments for components like printed circuit boards and semiconductors. Growing environmental consciousness and stricter regulations are driving the development and adoption of eco-friendly, low-VOC, and chrome-free alternatives. Finally, increasing investments in infrastructure development and aerospace manufacturing further contribute to the sustained demand for high-performance surface treatment chemicals.

Challenges in the Asia-Pacific Surface Treatment Chemicals Market Market

Despite robust growth, the Asia-Pacific surface treatment chemicals market faces several challenges. Stringent environmental regulations, particularly concerning hazardous substances and emissions, necessitate significant investment in R&D for compliance and can increase production costs. Volatile raw material prices, influenced by global supply chain disruptions and geopolitical factors, pose a risk to profit margins. Intense competition from both global and local players can lead to price pressures and impact market share. The need for specialized technical expertise and skilled labor for application and process optimization can be a bottleneck in certain regions. Additionally, counterfeit products entering the market can undermine the reputation of legitimate suppliers and compromise product quality.

Emerging Opportunities in Asia-Pacific Surface Treatment Chemicals Market

Emerging opportunities in the Asia-Pacific surface treatment chemicals market lie in several key areas. The rapid growth of the electric vehicle (EV) sector presents a significant opportunity for specialized coatings that enhance battery performance, thermal management, and lightweight component protection. The increasing adoption of advanced materials, such as composites and high-strength alloys, will drive demand for tailor-made surface treatments. Growing investments in renewable energy infrastructure, particularly solar and wind power, will create demand for corrosion-resistant coatings for turbines and panels. Furthermore, the trend towards smart manufacturing and Industry 4.0 opens avenues for intelligent surface treatment chemicals that integrate with digital monitoring and control systems, offering predictive maintenance and enhanced process efficiency. Strategic partnerships with end-users and a focus on developing sustainable, high-performance solutions will be crucial for capitalizing on these opportunities.

Leading Players in the Asia-Pacific Surface Treatment Chemicals Market Sector

- Chemetall GmbH

- ChemTech Surface Finishing Pvt Ltd

- Henkel AG & Co KGa

- JCU CORPORATION

- Nihon Parkerizing Co Ltd

- Nippon Paint Holdings Co Ltd

- NOF CORPORATION

- OC Oerlikon

- PPG Industries Inc

- The Sherwin-Williams Company

Key Milestones in Asia-Pacific Surface Treatment Chemicals Market Industry

- November 2022: BASF inaugurated its largest surface treatment site (under the Chemetall brand) in Pinghu City, Zhejiang Province, China. This 60,000 square meter facility significantly enhanced capacity to meet the regional demand for high-performance surface treatment chemicals.

- July 2022: DIC Corporation, a leading Japanese chemical company, announced the complete acquisition of Guangdong TOD New Materials Co. Ltd, a Chinese chemical coating resin manufacturer. This strategic acquisition aimed to strengthen backward integration and expand its market presence in China.

Strategic Outlook for Asia-Pacific Surface Treatment Chemicals Market Market

The strategic outlook for the Asia-Pacific surface treatment chemicals market is highly positive, fueled by sustained industrial growth and technological innovation. Key growth accelerators include the increasing demand for eco-friendly solutions, the expansion of electric vehicle production, and the growing application of advanced materials. Strategic opportunities lie in expanding product portfolios to include specialized treatments for niche applications, such as aerospace and medical devices, and in leveraging digital technologies for enhanced process efficiency and customer service. Companies that focus on sustainable product development, strategic acquisitions to enhance market reach, and strong R&D capabilities will be well-positioned to capture significant market share. The ongoing shift towards higher-value, performance-driven surface treatments will continue to shape the competitive landscape, offering substantial potential for growth and profitability.

Asia-Pacific Surface Treatment Chemicals Market Segmentation

-

1. Chemical Type

- 1.1. Plating Chemicals

- 1.2. Cleaners

- 1.3. Conversion Coatings

- 1.4. Other Chemical Types (Coolants, Paint Strippers)

-

2. Base Material

- 2.1. Metals

- 2.2. Plastics

- 2.3. Other Base Materials (Glass, Alloys, Wood)

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia-Pacific Surface Treatment Chemicals Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Surface Treatment Chemicals Market Regional Market Share

Geographic Coverage of Asia-Pacific Surface Treatment Chemicals Market

Asia-Pacific Surface Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Automotive and Transport Industry; Rapid industrialization in Asia-Pacific

- 3.3. Market Restrains

- 3.3.1. Increasing Demand from the Automotive and Transport Industry; Rapid industrialization in Asia-Pacific

- 3.4. Market Trends

- 3.4.1. Rising Demand for Surface Treatment Chemicals from the Automotive and Transportation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Plating Chemicals

- 5.1.2. Cleaners

- 5.1.3. Conversion Coatings

- 5.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 5.2. Market Analysis, Insights and Forecast - by Base Material

- 5.2.1. Metals

- 5.2.2. Plastics

- 5.2.3. Other Base Materials (Glass, Alloys, Wood)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. China Asia-Pacific Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Plating Chemicals

- 6.1.2. Cleaners

- 6.1.3. Conversion Coatings

- 6.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 6.2. Market Analysis, Insights and Forecast - by Base Material

- 6.2.1. Metals

- 6.2.2. Plastics

- 6.2.3. Other Base Materials (Glass, Alloys, Wood)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. India Asia-Pacific Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Plating Chemicals

- 7.1.2. Cleaners

- 7.1.3. Conversion Coatings

- 7.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 7.2. Market Analysis, Insights and Forecast - by Base Material

- 7.2.1. Metals

- 7.2.2. Plastics

- 7.2.3. Other Base Materials (Glass, Alloys, Wood)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. Japan Asia-Pacific Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Plating Chemicals

- 8.1.2. Cleaners

- 8.1.3. Conversion Coatings

- 8.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 8.2. Market Analysis, Insights and Forecast - by Base Material

- 8.2.1. Metals

- 8.2.2. Plastics

- 8.2.3. Other Base Materials (Glass, Alloys, Wood)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. South Korea Asia-Pacific Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Plating Chemicals

- 9.1.2. Cleaners

- 9.1.3. Conversion Coatings

- 9.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 9.2. Market Analysis, Insights and Forecast - by Base Material

- 9.2.1. Metals

- 9.2.2. Plastics

- 9.2.3. Other Base Materials (Glass, Alloys, Wood)

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. Rest of Asia Pacific Asia-Pacific Surface Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Plating Chemicals

- 10.1.2. Cleaners

- 10.1.3. Conversion Coatings

- 10.1.4. Other Chemical Types (Coolants, Paint Strippers)

- 10.2. Market Analysis, Insights and Forecast - by Base Material

- 10.2.1. Metals

- 10.2.2. Plastics

- 10.2.3. Other Base Materials (Glass, Alloys, Wood)

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Chemetall GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ChemTech Surface Finishing Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Henkel AG & Co KGa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JCU CORPORATION

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nihon Parkerizing Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nippon Paint Holdings Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NOF CORPORATION

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 OC Oerlikon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PPG Industries Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Sherwin-Williams Company*List Not Exhaustive 6 5 MARKET OPPORTUNITIES AND FUTURE TREND

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Chemetall GmbH

List of Figures

- Figure 1: Global Asia-Pacific Surface Treatment Chemicals Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 3: China Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 4: China Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Base Material 2025 & 2033

- Figure 5: China Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 6: China Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: China Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: China Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 11: India Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 12: India Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Base Material 2025 & 2033

- Figure 13: India Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 14: India Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: India Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: India Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Japan Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 19: Japan Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 20: Japan Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Base Material 2025 & 2033

- Figure 21: Japan Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 22: Japan Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Japan Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Japan Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Japan Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Korea Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 27: South Korea Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 28: South Korea Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Base Material 2025 & 2033

- Figure 29: South Korea Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 30: South Korea Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 31: South Korea Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: South Korea Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South Korea Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Asia Pacific Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 35: Rest of Asia Pacific Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 36: Rest of Asia Pacific Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Base Material 2025 & 2033

- Figure 37: Rest of Asia Pacific Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Base Material 2025 & 2033

- Figure 38: Rest of Asia Pacific Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Rest of Asia Pacific Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of Asia Pacific Asia-Pacific Surface Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Rest of Asia Pacific Asia-Pacific Surface Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 2: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 3: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 6: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 7: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 10: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 11: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 14: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 15: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 18: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 19: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 22: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Base Material 2020 & 2033

- Table 23: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global Asia-Pacific Surface Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Surface Treatment Chemicals Market?

The projected CAGR is approximately 5.82%.

2. Which companies are prominent players in the Asia-Pacific Surface Treatment Chemicals Market?

Key companies in the market include Chemetall GmbH, ChemTech Surface Finishing Pvt Ltd, Henkel AG & Co KGa, JCU CORPORATION, Nihon Parkerizing Co Ltd, Nippon Paint Holdings Co Ltd, NOF CORPORATION, OC Oerlikon, PPG Industries Inc, The Sherwin-Williams Company*List Not Exhaustive 6 5 MARKET OPPORTUNITIES AND FUTURE TREND.

3. What are the main segments of the Asia-Pacific Surface Treatment Chemicals Market?

The market segments include Chemical Type, Base Material, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Automotive and Transport Industry; Rapid industrialization in Asia-Pacific.

6. What are the notable trends driving market growth?

Rising Demand for Surface Treatment Chemicals from the Automotive and Transportation Industry.

7. Are there any restraints impacting market growth?

Increasing Demand from the Automotive and Transport Industry; Rapid industrialization in Asia-Pacific.

8. Can you provide examples of recent developments in the market?

In November 2022, BASF inaugurated its largest surface treatment site (under the Chemetall brand) in Pinghu City, Zhejiang Province, China. This location is 60,000 square meters in size and has enhanced capacity to meet the regional demand for high-performance surface treatment chemicals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Surface Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Surface Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Surface Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Surface Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence