Key Insights

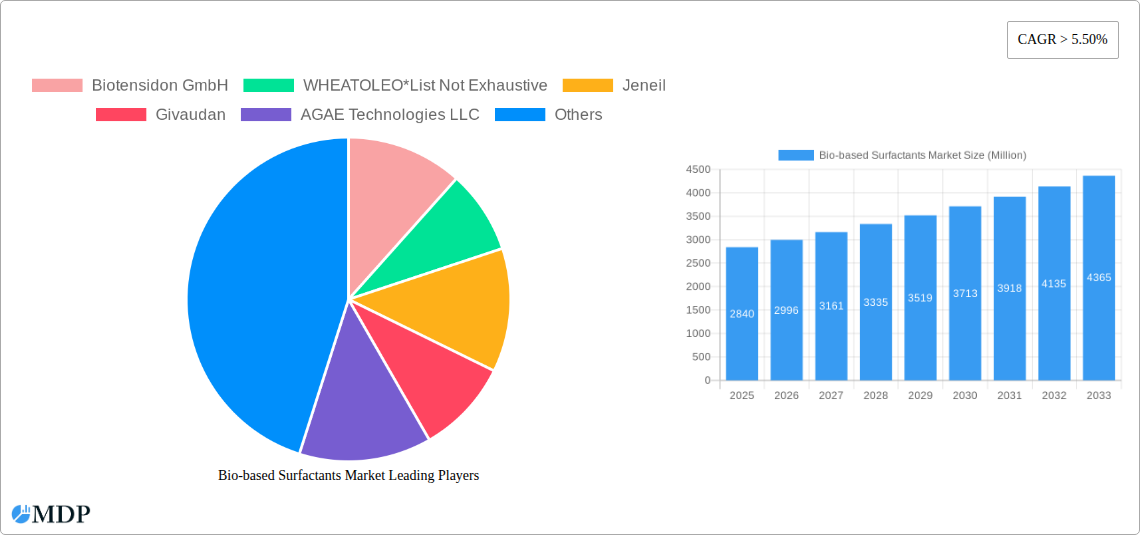

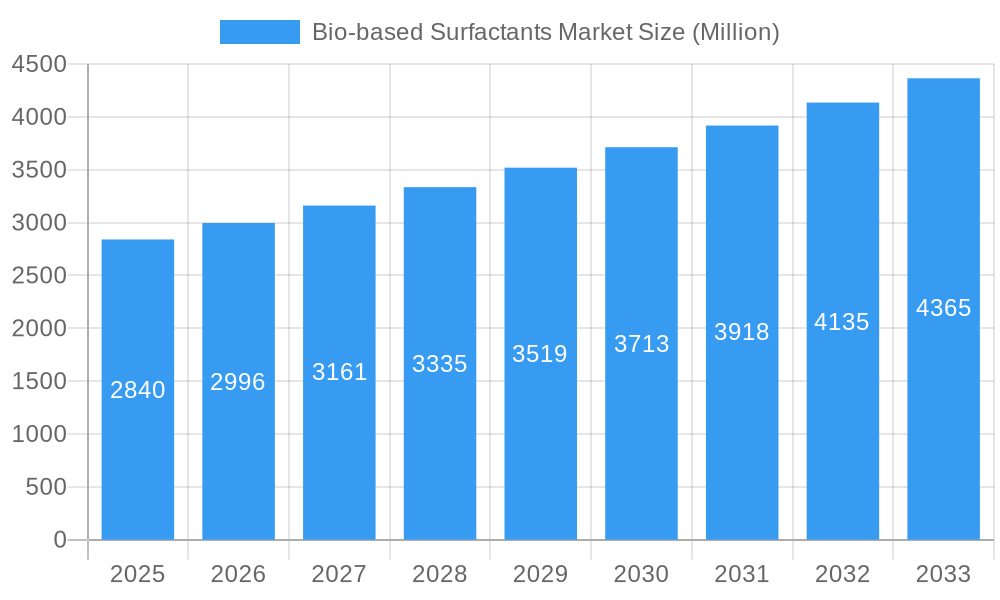

The global Bio-based Surfactants Market is projected for robust expansion, with a current market size estimated at USD 2.84 billion in 2025. The market is anticipated to grow at a significant Compound Annual Growth Rate (CAGR) of 5.47% from 2025 through 2033, indicating a sustained upward trajectory driven by increasing consumer preference for sustainable and eco-friendly products. This growth is further fueled by stringent government regulations promoting the use of biodegradable ingredients and a heightened awareness of the environmental impact of conventional petroleum-based surfactants. Key growth drivers include the escalating demand in the cosmetics and personal care sector, where consumers actively seek natural and plant-derived ingredients, as well as the burgeoning use in detergents and industrial cleaning applications due to their reduced toxicity and enhanced biodegradability. Emerging economies, particularly in the Asia Pacific region, are poised to contribute significantly to this growth, owing to rapid industrialization and increasing disposable incomes.

Bio-based Surfactants Market Market Size (In Billion)

The market's momentum is also shaped by several key trends. Innovations in biosurfactant production technologies, leading to improved efficiency and cost-effectiveness, are becoming increasingly prevalent. The development of novel biosurfactants with specialized functionalities, such as improved emulsification, foaming, and antimicrobial properties, is expanding their application spectrum. Furthermore, the food processing industry is witnessing a growing adoption of biosurfactants as emulsifiers and stabilizers, replacing synthetic alternatives. However, certain restraints, such as the relatively higher production cost compared to petrochemical-based surfactants and the need for further research and development to optimize performance in specific industrial applications, are present. Despite these challenges, the overarching commitment to sustainability and the inherent environmental benefits of bio-based surfactants position the market for significant value creation and widespread adoption across diverse industries in the coming years.

Bio-based Surfactants Market Company Market Share

Unlock the future of sustainable chemistry with our comprehensive report on the Bio-based Surfactants Market. This in-depth analysis, covering the period from 2019 to 2033 with a base and estimated year of 2025, dives deep into market dynamics, industry trends, leading segments, product developments, and key growth drivers. Explore the expanding landscape of environmentally friendly surfactants, projected to reach a market size of billions of dollars by 2033. This report is an indispensable resource for stakeholders seeking to capitalize on the burgeoning demand for bio-based alternatives across diverse applications, including detergents, personal care, food processing, and more. Understand the competitive landscape, identify emerging opportunities, and gain actionable insights to navigate this rapidly evolving market.

Bio-based Surfactants Market Market Dynamics & Concentration

The bio-based surfactants market is characterized by moderate concentration, with a growing number of players vying for market share. Innovation is a primary driver, fueled by increasing consumer demand for sustainable products and stringent environmental regulations. Leading companies are investing heavily in research and development to create novel biosurfactants with enhanced performance and broader applications. Regulatory frameworks, such as those promoting green chemistry and reducing reliance on petrochemicals, are further stimulating market growth. Product substitutes, primarily conventional surfactants, are facing increasing pressure from the superior environmental profile of bio-based alternatives. End-user trends are shifting towards eco-friendly ingredients, particularly in the cosmetics and personal care sectors. Merger and acquisition (M&A) activities are expected to intensify as larger corporations seek to integrate sustainable solutions into their portfolios. Key M&A deal counts have seen a steady increase, reflecting strategic consolidation and partnerships.

- Innovation Drivers:

- Consumer demand for natural and sustainable ingredients.

- Government initiatives and regulations promoting green chemistry.

- Advancements in biotechnology and fermentation processes.

- Corporate sustainability goals.

- Regulatory Frameworks:

- Support for biodegradable and renewable raw materials.

- Restrictions on hazardous chemical use.

- Certifications for eco-friendly products.

- End-User Trends:

- Growing preference for plant-derived and biodegradable ingredients.

- Demand for high-performance, eco-conscious cleaning solutions.

- Increased adoption in food and agricultural applications.

- M&A Activities:

- Acquisitions of specialized biosurfactant manufacturers.

- Joint ventures for R&D and market penetration.

- Strategic alliances for supply chain integration.

Bio-based Surfactants Market Industry Trends & Analysis

The bio-based surfactants market is experiencing robust growth, driven by a confluence of factors that are reshaping the chemical industry. The overarching trend is a global imperative towards sustainability, manifesting in heightened consumer awareness regarding environmental impact and the demand for eco-friendly products. This has directly translated into market growth drivers for bio-based surfactants, as they offer a compelling alternative to traditional petroleum-derived counterparts. Technological disruptions are continuously enhancing the efficiency and cost-effectiveness of biosurfactant production. Advances in microbial fermentation, enzymatic synthesis, and genetic engineering are leading to higher yields and a wider range of functional biosurfactants. Consumer preferences are a critical catalyst, with a significant shift towards natural, biodegradable, and ethically sourced ingredients across various industries. This is particularly evident in the personal care and cosmetics sectors, where consumers actively seek products aligned with their values. The projected Compound Annual Growth Rate (CAGR) for the bio-based surfactants market is strong, indicating sustained expansion throughout the forecast period. Market penetration is steadily increasing as performance parity is achieved and often surpassed by innovative bio-based solutions. Competitive dynamics are evolving, with established chemical giants increasingly investing in or acquiring biosurfactant capabilities to maintain market relevance and capture new revenue streams. Startups and niche players are also contributing significantly through specialized product development and innovative business models. The overall industry is moving towards a more circular economy, with bio-based surfactants playing a pivotal role in reducing the environmental footprint of numerous consumer and industrial products.

Leading Markets & Segments in Bio-based Surfactants Market

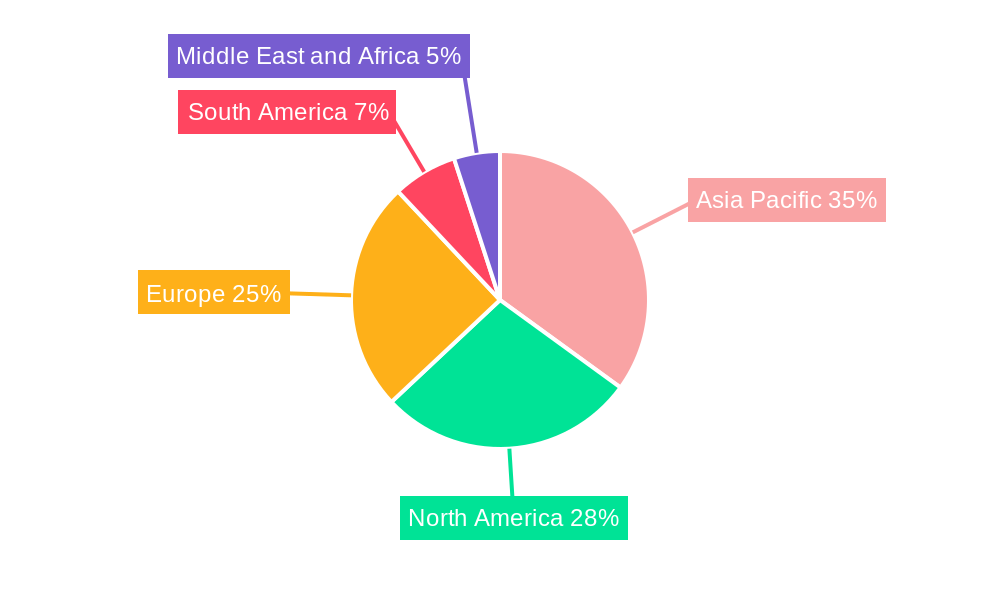

The bio-based surfactants market is witnessing significant traction across multiple regions and product segments, driven by distinct economic and environmental factors. North America and Europe currently lead in market dominance, owing to stringent environmental regulations, high consumer awareness, and well-established research and development infrastructure. Within these regions, countries like the United States, Germany, and France are at the forefront of adoption. The Cosmetics (Personal Care) application segment stands out as a primary growth engine. This is fueled by a strong consumer preference for natural ingredients, a desire for products with a lower environmental impact, and the perceived health benefits of plant-derived formulations. The demand for specialized, high-performance surfactants in skincare, haircare, and decorative cosmetics continues to rise.

- Dominant Region:

- North America: Driven by advanced R&D, supportive government policies, and strong consumer demand for sustainable products.

- Europe: Characterized by stringent REACH regulations and a high level of eco-consciousness among consumers.

- Dominant Country:

- United States: Significant investments in biotechnology and a large consumer market driving adoption across various applications.

- Germany: A hub for green chemistry innovation and a strong focus on sustainable manufacturing practices.

- Dominant Product Type:

- Glycolipids: Highly versatile, offering excellent emulsifying and foaming properties, making them ideal for personal care and detergents. Their biodegradability and low toxicity are key advantages.

- Dominant Application:

- Cosmetics (Personal Care): The consistent demand for natural and gentle ingredients in this sector positions it as the leading application.

- Detergents and Industrial Cleaners: Growing environmental concerns and regulations are pushing manufacturers to adopt bio-based alternatives for household and industrial cleaning products.

- Key Drivers for Segment Dominance:

- Economic Policies: Government incentives for green product development and manufacturing.

- Consumer Preferences: Increasing demand for natural, biodegradable, and ethically sourced products.

- Technological Advancements: Improved production efficiencies and performance characteristics of bio-based surfactants.

- Regulatory Landscape: Stricter environmental regulations favoring sustainable chemical alternatives.

Bio-based Surfactants Market Product Developments

Product development in the bio-based surfactants market is rapidly advancing, with a strong emphasis on improving performance, expanding application versatility, and enhancing sustainability profiles. Companies are innovating across various product types, including glycolipids, phospholipids, and polymeric biosurfactants, to meet specific industry needs. Key developments focus on creating surfactants with superior emulsifying, foaming, and wetting properties, often matching or exceeding the efficacy of conventional counterparts. The competitive advantage lies in offering a greener alternative without compromising on functionality. For instance, the development of novel fermentation techniques allows for the production of highly specific biosurfactants tailored for applications in food processing, pharmaceuticals, and enhanced oil recovery. These innovations are crucial for market penetration and capturing a larger share of the global surfactant market.

Key Drivers of Bio-based Surfactants Market Growth

The bio-based surfactants market is propelled by a multifaceted growth engine. Technological advancements in biotechnology and fermentation processes are making biosurfactant production more efficient and cost-effective, leading to wider adoption. Growing consumer demand for sustainable and natural products is a significant economic driver, pushing manufacturers across industries to seek eco-friendly alternatives. Furthermore, increasingly stringent environmental regulations worldwide, promoting green chemistry and reducing the reliance on petrochemicals, create a favorable regulatory environment for bio-based surfactants. The inherent biodegradability and lower toxicity of these surfactants also contribute to their market appeal, addressing growing concerns about environmental pollution and human health.

- Technological Innovation: Enhanced fermentation and enzymatic synthesis methods.

- Consumer Demand: Preference for natural, biodegradable, and sustainable products.

- Regulatory Support: Government mandates and incentives for green chemistry.

- Environmental Consciousness: Reduced ecological impact and improved safety profiles.

Challenges in the Bio-based Surfactants Market Market

Despite the robust growth, the bio-based surfactants market faces several challenges. Cost competitiveness with established petrochemical-based surfactants remains a significant barrier, although this gap is narrowing with technological advancements. Supply chain complexities for renewable feedstocks can also pose challenges, requiring reliable and sustainable sourcing strategies. Furthermore, performance parity in highly specialized industrial applications might still be a consideration for some biosurfactants, necessitating ongoing R&D. The market also contends with consumer education and awareness gaps, where a deeper understanding of biosurfactant benefits is required to fully drive adoption.

- Cost: Initial production costs can be higher than conventional surfactants.

- Supply Chain: Ensuring consistent and sustainable feedstock availability.

- Performance Perception: Overcoming any lingering perceptions of lower efficacy in niche applications.

- Market Education: Increasing consumer and industrial understanding of biosurfactant advantages.

Emerging Opportunities in Bio-based Surfactants Market

Emerging opportunities in the bio-based surfactants market are abundant and driven by innovation and a growing global commitment to sustainability. Technological breakthroughs in synthetic biology and metabolic engineering are enabling the production of novel biosurfactants with tailored functionalities and enhanced performance, opening doors to new application areas. Strategic partnerships between chemical manufacturers, research institutions, and feedstock providers are crucial for scaling up production and ensuring supply chain resilience. Market expansion into developing economies, where environmental awareness is rising and regulatory frameworks are evolving, presents a significant growth avenue. The increasing focus on circular economy principles further amplifies the demand for bio-based and biodegradable products, positioning biosurfactants as key enablers of a sustainable future.

Leading Players in the Bio-based Surfactants Market Sector

- Biotensidon GmbH

- WHEATOLEO

- Jeneil

- Givaudan

- AGAE Technologies LLC

- Kaneka Corporation

- TeeGene Biotech

- GlycoSurf LLC

- Evonik Industries AG

- Cognis Care Chemicals (BASF SE)

- Saraya Co Ltd

- Ecover

- Logos Technologies (Stepan Company)

- TensioGreen

- Synthezyme LLC

Key Milestones in Bio-based Surfactants Market Industry

- June 2022: Evonik Industries AG commenced construction of a commercial rhamnolipid production facility in Slovenská Ľupča, Slovakia, signaling its ambition to be a leader in sustainable biosurfactant production.

- March 2022: BASF SE's Care Creations division announced the development of Plantapon Soy, a bio-based anionic surfactant derived from soy protein, offering significant sustainability benefits to the personal care and cosmetics industry.

Strategic Outlook for Bio-based Surfactants Market Market

The strategic outlook for the bio-based surfactants market is exceptionally positive, driven by an accelerating global shift towards sustainability and circular economy principles. Growth will be significantly influenced by continued investment in research and development to enhance biosurfactant performance and cost-competitiveness. Strategic partnerships and collaborations will be crucial for optimizing supply chains, securing renewable feedstocks, and expanding market reach into diverse applications. The increasing regulatory pressure on conventional chemicals, coupled with evolving consumer preferences for eco-friendly products, will continue to fuel demand. Opportunities lie in innovation for high-value applications such as pharmaceuticals, food technology, and advanced materials, alongside further penetration into the already strong personal care and cleaning sectors. The market is poised for substantial growth, making it an attractive sector for investment and strategic development.

Bio-based Surfactants Market Segmentation

-

1. Product Type

- 1.1. Glycolip

- 1.2. Phospholipids

- 1.3. Surfactin

- 1.4. Lichenysin

- 1.5. Polymeric Biosurfactants

- 1.6. Other Product Types

-

2. Application

- 2.1. Detergents and Industrial Cleaners

- 2.2. Cosmetics (Personal Care)

- 2.3. Food Processing

- 2.4. Oilfield Chemicals

- 2.5. Agricultural Chemicals

- 2.6. Textiles

- 2.7. Other Applications

Bio-based Surfactants Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Bio-based Surfactants Market Regional Market Share

Geographic Coverage of Bio-based Surfactants Market

Bio-based Surfactants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Personal Care Industry in Asia-Pacific; Rising Consumer Inclination Toward the Use of Bioproducts

- 3.3. Market Restrains

- 3.3.1. High Production Cost; Other Restraints

- 3.4. Market Trends

- 3.4.1. Detergents and Industrial Cleaners Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bio-based Surfactants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Glycolip

- 5.1.2. Phospholipids

- 5.1.3. Surfactin

- 5.1.4. Lichenysin

- 5.1.5. Polymeric Biosurfactants

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Detergents and Industrial Cleaners

- 5.2.2. Cosmetics (Personal Care)

- 5.2.3. Food Processing

- 5.2.4. Oilfield Chemicals

- 5.2.5. Agricultural Chemicals

- 5.2.6. Textiles

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Bio-based Surfactants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Glycolip

- 6.1.2. Phospholipids

- 6.1.3. Surfactin

- 6.1.4. Lichenysin

- 6.1.5. Polymeric Biosurfactants

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Detergents and Industrial Cleaners

- 6.2.2. Cosmetics (Personal Care)

- 6.2.3. Food Processing

- 6.2.4. Oilfield Chemicals

- 6.2.5. Agricultural Chemicals

- 6.2.6. Textiles

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Bio-based Surfactants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Glycolip

- 7.1.2. Phospholipids

- 7.1.3. Surfactin

- 7.1.4. Lichenysin

- 7.1.5. Polymeric Biosurfactants

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Detergents and Industrial Cleaners

- 7.2.2. Cosmetics (Personal Care)

- 7.2.3. Food Processing

- 7.2.4. Oilfield Chemicals

- 7.2.5. Agricultural Chemicals

- 7.2.6. Textiles

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Bio-based Surfactants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Glycolip

- 8.1.2. Phospholipids

- 8.1.3. Surfactin

- 8.1.4. Lichenysin

- 8.1.5. Polymeric Biosurfactants

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Detergents and Industrial Cleaners

- 8.2.2. Cosmetics (Personal Care)

- 8.2.3. Food Processing

- 8.2.4. Oilfield Chemicals

- 8.2.5. Agricultural Chemicals

- 8.2.6. Textiles

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Bio-based Surfactants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Glycolip

- 9.1.2. Phospholipids

- 9.1.3. Surfactin

- 9.1.4. Lichenysin

- 9.1.5. Polymeric Biosurfactants

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Detergents and Industrial Cleaners

- 9.2.2. Cosmetics (Personal Care)

- 9.2.3. Food Processing

- 9.2.4. Oilfield Chemicals

- 9.2.5. Agricultural Chemicals

- 9.2.6. Textiles

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Bio-based Surfactants Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Glycolip

- 10.1.2. Phospholipids

- 10.1.3. Surfactin

- 10.1.4. Lichenysin

- 10.1.5. Polymeric Biosurfactants

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Detergents and Industrial Cleaners

- 10.2.2. Cosmetics (Personal Care)

- 10.2.3. Food Processing

- 10.2.4. Oilfield Chemicals

- 10.2.5. Agricultural Chemicals

- 10.2.6. Textiles

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Biotensidon GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WHEATOLEO*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jeneil

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Givaudan

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AGAE Technologies LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kaneka Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TeeGene Biotech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GlycoSurf LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Evonik Industries AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cognis Care Chemicals (BASF SE)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Saraya Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ecover

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Logos Technologies (Stepan Company)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TensioGreen

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Synthezyme LLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Biotensidon GmbH

List of Figures

- Figure 1: Global Bio-based Surfactants Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Bio-based Surfactants Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Bio-based Surfactants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Bio-based Surfactants Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific Bio-based Surfactants Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Bio-based Surfactants Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Bio-based Surfactants Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Bio-based Surfactants Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: North America Bio-based Surfactants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Bio-based Surfactants Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: North America Bio-based Surfactants Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Bio-based Surfactants Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Bio-based Surfactants Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Bio-based Surfactants Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe Bio-based Surfactants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Bio-based Surfactants Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Europe Bio-based Surfactants Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Bio-based Surfactants Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Bio-based Surfactants Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Bio-based Surfactants Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: South America Bio-based Surfactants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Bio-based Surfactants Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America Bio-based Surfactants Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Bio-based Surfactants Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Bio-based Surfactants Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Bio-based Surfactants Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Bio-based Surfactants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Bio-based Surfactants Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Bio-based Surfactants Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Bio-based Surfactants Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Bio-based Surfactants Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bio-based Surfactants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Bio-based Surfactants Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Bio-based Surfactants Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Bio-based Surfactants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Bio-based Surfactants Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Bio-based Surfactants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: ASEAN Countries Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Bio-based Surfactants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Global Bio-based Surfactants Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Bio-based Surfactants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: United States Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Canada Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Bio-based Surfactants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: Global Bio-based Surfactants Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 21: Global Bio-based Surfactants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Germany Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Italy Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Spain Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Bio-based Surfactants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global Bio-based Surfactants Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Bio-based Surfactants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Brazil Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Argentina Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Bio-based Surfactants Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 35: Global Bio-based Surfactants Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Global Bio-based Surfactants Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Saudi Arabia Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: South Africa Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Bio-based Surfactants Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bio-based Surfactants Market?

The projected CAGR is approximately 5.47%.

2. Which companies are prominent players in the Bio-based Surfactants Market?

Key companies in the market include Biotensidon GmbH, WHEATOLEO*List Not Exhaustive, Jeneil, Givaudan, AGAE Technologies LLC, Kaneka Corporation, TeeGene Biotech, GlycoSurf LLC, Evonik Industries AG, Cognis Care Chemicals (BASF SE), Saraya Co Ltd, Ecover, Logos Technologies (Stepan Company), TensioGreen, Synthezyme LLC.

3. What are the main segments of the Bio-based Surfactants Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Personal Care Industry in Asia-Pacific; Rising Consumer Inclination Toward the Use of Bioproducts.

6. What are the notable trends driving market growth?

Detergents and Industrial Cleaners Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

High Production Cost; Other Restraints.

8. Can you provide examples of recent developments in the market?

In June 2022, Evonik Industries AG started constructing a commercial rhamnolipid production facility in Slovenská Ľupča, Slovakia. With this new biosurfactant plant, the company has plans to become a pioneer of good quality, sustainable biosurfactants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bio-based Surfactants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bio-based Surfactants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bio-based Surfactants Market?

To stay informed about further developments, trends, and reports in the Bio-based Surfactants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence