Key Insights

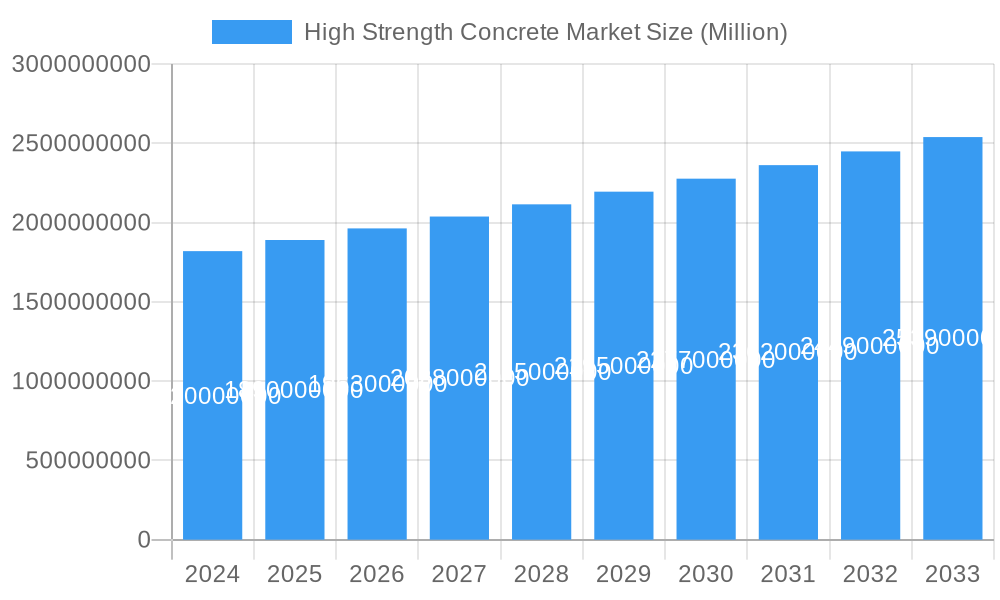

The global High Strength Concrete (HSC) market is poised for robust expansion, currently valued at approximately $1.82 billion in 2024. The market is projected to witness a healthy Compound Annual Growth Rate (CAGR) of 3.8% over the forecast period of 2025-2033. This sustained growth is primarily fueled by the increasing demand for durable, resilient, and structurally superior construction materials across various end-use sectors. Key drivers include the accelerating pace of infrastructure development globally, particularly in emerging economies, where projects like bridges, high-rise buildings, and tunnels necessitate the superior load-bearing capabilities offered by HSC. Furthermore, a growing emphasis on sustainable construction practices and the need for buildings with extended lifespans are also contributing significantly to the market's upward trajectory. The increasing adoption of advanced construction technologies and a greater understanding of HSC's performance benefits are encouraging wider application.

High Strength Concrete Market Market Size (In Billion)

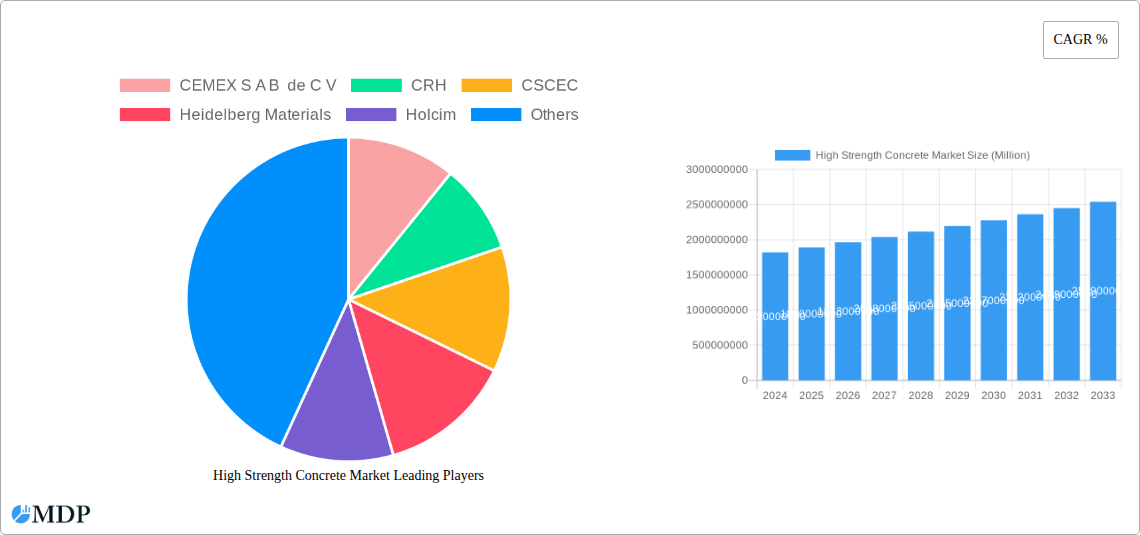

The market is segmented by product type into On-site Mix, Precast, and Ready-Mix, with Ready-Mix often dominating due to its convenience and consistent quality control. End-use sectors such as Infrastructure, Commercial, Industrial, and Residential are all significant contributors. Infrastructure projects, demanding extreme durability and load-bearing capacity, represent a substantial portion of demand. Growing urbanization and the subsequent need for taller buildings and more extensive transportation networks are key contributors to this segment. While the market benefits from strong demand drivers, it faces certain restraints. The initial cost of high-performance admixtures and specialized raw materials required for HSC production can be a barrier to entry for smaller contractors. Moreover, the technical expertise needed for proper mixing, placement, and curing of HSC can also pose challenges, particularly in regions with less developed construction expertise. However, these restraints are being gradually overcome through advancements in admixture technology and increased training initiatives. Major players like CEMEX, CRH, Heidelberg Materials, and Holcim are actively investing in research and development to enhance HSC properties and expand their market reach.

High Strength Concrete Market Company Market Share

This comprehensive report delves into the dynamic High Strength Concrete Market, a critical component of modern construction and infrastructure development. With a study period spanning 2019 to 2033, including a base year of 2025, estimated year of 2025, and forecast period of 2025–2033, this analysis provides unparalleled insights into market trends, growth drivers, and competitive landscapes. We explore the burgeoning demand for advanced building materials, driven by urbanization, infrastructure upgrades, and the increasing need for durable and sustainable construction solutions. This report is an essential resource for stakeholders seeking to navigate the complexities and capitalize on the immense opportunities within the global high strength concrete market.

High Strength Concrete Market Market Dynamics & Concentration

The High Strength Concrete Market is characterized by moderate to high concentration, with a few major global players holding significant market share, estimated to be over 70% in the base year of 2025. Innovation is a key differentiator, driven by the development of specialized admixtures and binders that enhance compressive strength, durability, and workability. Regulatory frameworks, particularly those focused on building codes, sustainability standards, and safety, play a crucial role in shaping market access and product development. Product substitutes, such as pre-stressed concrete or advanced composite materials, exist but often come with higher costs or specialized applications, leaving high strength concrete with a strong competitive edge for a wide array of uses. End-user trends indicate a rising preference for materials that offer longevity, reduced maintenance, and improved structural performance, directly benefiting the high strength concrete sector. Mergers and acquisitions (M&A) are a notable trend, with an estimated XX M&A deals annually between 2019 and 2024, indicating consolidation and strategic expansion by leading companies.

- Market Concentration: Dominated by a few key global players, fostering a competitive environment driven by innovation and cost-efficiency.

- Innovation Drivers: Focus on enhanced material properties, sustainable formulations, and cost-effective production methods.

- Regulatory Frameworks: Stringent building codes and environmental regulations influencing product development and market entry.

- Product Substitutes: Limited direct substitutes for core applications due to cost-performance advantages of high strength concrete.

- End-User Trends: Increasing demand for durable, low-maintenance, and sustainable construction materials.

- M&A Activities: Consistent activity for market consolidation and expansion of product portfolios.

High Strength Concrete Market Industry Trends & Analysis

The High Strength Concrete Market is poised for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is fueled by a confluence of factors, including accelerating global infrastructure development projects, the construction of taller and more complex buildings, and a growing emphasis on energy-efficient and sustainable building practices. Technological advancements are continuously pushing the boundaries of concrete performance, leading to the development of ultra-high performance concrete (UHPC) and self-healing concrete, which offer exceptional strength, durability, and reduced environmental impact. Consumer preferences are increasingly shifting towards materials that provide long-term value, lower lifecycle costs, and contribute to green building certifications. This demand is particularly evident in sectors like infrastructure and commercial construction, where the longevity and structural integrity of high strength concrete are paramount. Competitive dynamics are intensifying, with companies focusing on research and development to create differentiated products and expand their global footprint. Market penetration is steadily increasing across developed and developing economies, as construction projects increasingly specify high strength concrete for critical structural elements. The estimated market penetration for high strength concrete in major infrastructure projects is projected to reach XX% by 2033.

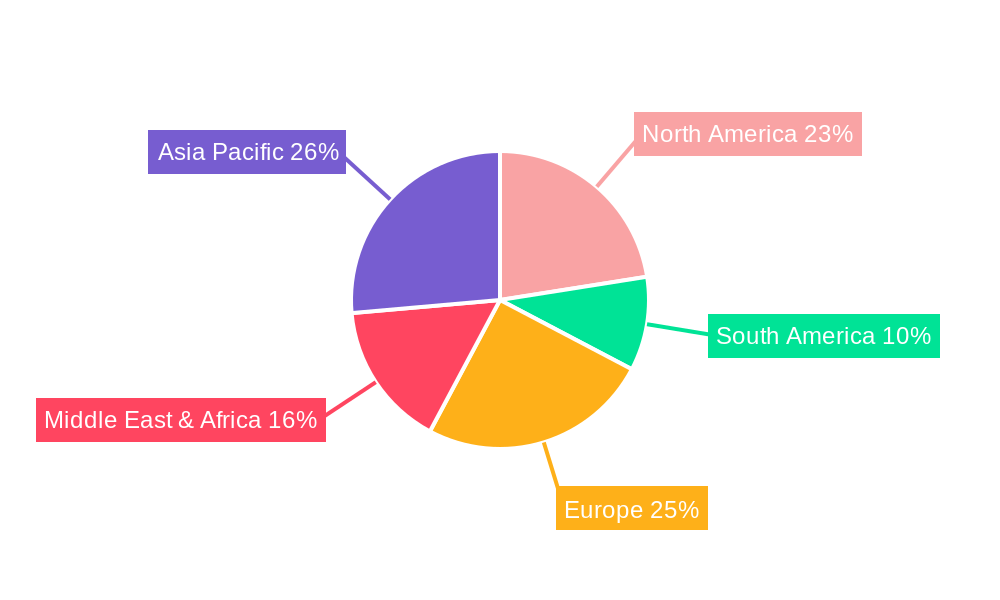

Leading Markets & Segments in High Strength Concrete Market

The High Strength Concrete Market exhibits distinct regional and sectoral dominance. Asia-Pacific, driven by rapid urbanization and massive infrastructure investments, particularly in countries like China and India, is the leading regional market, projected to hold over XX% of the global market share by 2033. Within the End Use Sectors, Infrastructure emerges as the most dominant segment, accounting for an estimated XX% of the market in 2025. This is largely attributed to government-led initiatives for developing transportation networks, utilities, and public facilities. The Industrial and Institutional sector also demonstrates significant growth, driven by the construction of large-scale manufacturing plants, data centers, and commercial complexes requiring robust structural integrity.

Product Segmentation reveals the preeminence of Ready-Mix concrete, representing over XX% of the market share in 2025. This is due to its convenience, consistent quality, and cost-effectiveness for large-scale projects.

- Dominant Region: Asia-Pacific, fueled by extensive infrastructure development and rapid urbanization.

- Key Drivers: Government stimulus packages for infrastructure, increasing disposable incomes, and a growing construction industry.

- Country Dominance: China and India are key contributors to regional growth.

- Dominant End Use Sector: Infrastructure.

- Key Drivers: Need for durable bridges, tunnels, highways, dams, and public transit systems.

- Economic Policies: Government spending on capital projects directly impacts demand.

- Strongly Performing Segment: Industrial and Institutional.

- Key Drivers: Construction of large-scale manufacturing facilities, data centers, and commercial complexes demanding high structural performance.

- Dominant Product: Ready-Mix Concrete.

- Key Drivers: Ease of use, consistent quality control, and cost-efficiency for large construction sites.

- Technological Integration: Advancements in delivery systems and quality assurance for ready-mix.

High Strength Concrete Market Product Developments

The High Strength Concrete Market is witnessing a surge in product innovations focused on enhancing performance and sustainability. Developments include the introduction of advanced admixtures, such as polycarboxylate ethers and silica fume, that significantly boost compressive strength and durability. The integration of nanomaterials like carbon nanotubes and graphene is also being explored to create ultra-high performance concrete (UHPC) with exceptional tensile strength and resistance to abrasion and chemical attack. Furthermore, a growing focus on sustainable concrete formulations involves the use of supplementary cementitious materials (SCMs) like fly ash and slag, reducing the carbon footprint of concrete production while maintaining or improving strength characteristics. These innovations are driven by the demand for lighter, stronger, and more resilient building materials for demanding applications.

Key Drivers of High Strength Concrete Market Growth

The High Strength Concrete Market is propelled by a multifaceted set of drivers. Technologically, advancements in admixture formulations and binder technologies are continuously enhancing the performance envelope of concrete, enabling higher compressive strengths and improved durability. Economically, significant global investments in infrastructure projects, including transportation networks, energy facilities, and urban development, are creating substantial demand. The increasing emphasis on sustainable construction practices and the need for materials that offer longevity and reduced maintenance are also critical economic drivers. Regulatory frameworks promoting stricter building codes for safety and seismic resistance further necessitate the use of high strength concrete. For instance, new seismic regulations in earthquake-prone regions are mandating higher strength concrete for critical structures.

Challenges in the High Strength Concrete Market Market

Despite its growth trajectory, the High Strength Concrete Market faces several challenges. The initial cost of high strength concrete, particularly formulations involving specialized admixtures, can be higher than conventional concrete, posing a barrier to adoption in price-sensitive markets. Regulatory hurdles and the need for specialized knowledge and equipment for proper mixing and placement can also impede widespread implementation. Supply chain disruptions for key raw materials, such as cement and aggregate, can impact production and lead to price volatility. Furthermore, the availability of skilled labor capable of handling and effectively utilizing high strength concrete mixes remains a concern in some regions. Competitive pressures from alternative construction materials, although often application-specific, also present an ongoing challenge.

Emerging Opportunities in High Strength Concrete Market

The High Strength Concrete Market is ripe with emerging opportunities driven by evolving construction needs and technological breakthroughs. The increasing global demand for resilient infrastructure capable of withstanding extreme weather events and seismic activity presents a significant growth catalyst for high strength concrete. The ongoing urbanization trend, particularly in developing economies, is creating a sustained demand for advanced building materials for both residential and commercial construction. Furthermore, the growing focus on green building and sustainability is driving innovation in low-carbon high strength concrete formulations, opening new market avenues. Strategic partnerships between concrete manufacturers, admixture suppliers, and research institutions are fostering the development of novel products and applications, further expanding the market's potential. The development of smart concrete, capable of self-monitoring and self-healing, also represents a significant long-term opportunity.

Leading Players in the High Strength Concrete Market Sector

- CEMEX S A B de C V

- CRH

- CSCEC

- Heidelberg Materials

- Holcim

- OYAK Cement

- Thomas Concrete Group

- UltraTech Cement Ltd

- Vicat

- Yunnan Construction Investment Holding Group Co Lt

Key Milestones in High Strength Concrete Market Industry

- June 2023: CRH finalized its acquisition of Buzzi Unicem's ready-mix concrete operations in Ukraine for USD 109 million, strengthening its presence and production capacity in Kyiv, Nikolajev, and Odesa.

- May 2023: Holcim successfully acquired BESBLOCK LTD, expanding its ready-mixed concrete business in the United Kingdom and bolstering its sustainable building solutions portfolio.

- January 2023: Holcim acquired five concrete plants of Ol-Trans in the Gdansk-Sopot-Gdynia area, Poland, solidifying its leadership in Northern Poland's ready-mix concrete market and enhancing its local network.

Strategic Outlook for High Strength Concrete Market Market

The strategic outlook for the High Strength Concrete Market is exceptionally promising, driven by accelerating infrastructure development and a global push towards more durable and sustainable construction. The market is expected to witness continued innovation in material science, leading to the development of ultra-high performance concrete (UHPC) and eco-friendly formulations. Key growth accelerators include government investments in resilient infrastructure, the increasing demand for tall buildings and complex structures, and the growing adoption of green building standards. Companies that focus on technological advancements, expand their geographic reach through strategic acquisitions and partnerships, and offer customized solutions for specific end-use applications will be well-positioned for sustained success. The increasing awareness of lifecycle costs and the long-term benefits of high strength concrete will continue to drive its adoption across diverse construction sectors.

High Strength Concrete Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

- 2.1. On-site Mix

- 2.2. Precast

- 2.3. Ready-Mix

High Strength Concrete Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High Strength Concrete Market Regional Market Share

Geographic Coverage of High Strength Concrete Market

High Strength Concrete Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Strength Concrete Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. On-site Mix

- 5.2.2. Precast

- 5.2.3. Ready-Mix

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. North America High Strength Concrete Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6.1.1. Commercial

- 6.1.2. Industrial and Institutional

- 6.1.3. Infrastructure

- 6.1.4. Residential

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. On-site Mix

- 6.2.2. Precast

- 6.2.3. Ready-Mix

- 6.1. Market Analysis, Insights and Forecast - by End Use Sector

- 7. South America High Strength Concrete Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End Use Sector

- 7.1.1. Commercial

- 7.1.2. Industrial and Institutional

- 7.1.3. Infrastructure

- 7.1.4. Residential

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. On-site Mix

- 7.2.2. Precast

- 7.2.3. Ready-Mix

- 7.1. Market Analysis, Insights and Forecast - by End Use Sector

- 8. Europe High Strength Concrete Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End Use Sector

- 8.1.1. Commercial

- 8.1.2. Industrial and Institutional

- 8.1.3. Infrastructure

- 8.1.4. Residential

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. On-site Mix

- 8.2.2. Precast

- 8.2.3. Ready-Mix

- 8.1. Market Analysis, Insights and Forecast - by End Use Sector

- 9. Middle East & Africa High Strength Concrete Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End Use Sector

- 9.1.1. Commercial

- 9.1.2. Industrial and Institutional

- 9.1.3. Infrastructure

- 9.1.4. Residential

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. On-site Mix

- 9.2.2. Precast

- 9.2.3. Ready-Mix

- 9.1. Market Analysis, Insights and Forecast - by End Use Sector

- 10. Asia Pacific High Strength Concrete Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End Use Sector

- 10.1.1. Commercial

- 10.1.2. Industrial and Institutional

- 10.1.3. Infrastructure

- 10.1.4. Residential

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. On-site Mix

- 10.2.2. Precast

- 10.2.3. Ready-Mix

- 10.1. Market Analysis, Insights and Forecast - by End Use Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CEMEX S A B de C V

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CRH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CSCEC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Heidelberg Materials

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Holcim

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OYAK Cement

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thomas Concrete Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 UltraTech Cement Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vicat

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yunnan Construction Investment Holding Group Co Lt

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CEMEX S A B de C V

List of Figures

- Figure 1: Global High Strength Concrete Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America High Strength Concrete Market Revenue (undefined), by End Use Sector 2025 & 2033

- Figure 3: North America High Strength Concrete Market Revenue Share (%), by End Use Sector 2025 & 2033

- Figure 4: North America High Strength Concrete Market Revenue (undefined), by Product 2025 & 2033

- Figure 5: North America High Strength Concrete Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America High Strength Concrete Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America High Strength Concrete Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America High Strength Concrete Market Revenue (undefined), by End Use Sector 2025 & 2033

- Figure 9: South America High Strength Concrete Market Revenue Share (%), by End Use Sector 2025 & 2033

- Figure 10: South America High Strength Concrete Market Revenue (undefined), by Product 2025 & 2033

- Figure 11: South America High Strength Concrete Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: South America High Strength Concrete Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America High Strength Concrete Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe High Strength Concrete Market Revenue (undefined), by End Use Sector 2025 & 2033

- Figure 15: Europe High Strength Concrete Market Revenue Share (%), by End Use Sector 2025 & 2033

- Figure 16: Europe High Strength Concrete Market Revenue (undefined), by Product 2025 & 2033

- Figure 17: Europe High Strength Concrete Market Revenue Share (%), by Product 2025 & 2033

- Figure 18: Europe High Strength Concrete Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe High Strength Concrete Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa High Strength Concrete Market Revenue (undefined), by End Use Sector 2025 & 2033

- Figure 21: Middle East & Africa High Strength Concrete Market Revenue Share (%), by End Use Sector 2025 & 2033

- Figure 22: Middle East & Africa High Strength Concrete Market Revenue (undefined), by Product 2025 & 2033

- Figure 23: Middle East & Africa High Strength Concrete Market Revenue Share (%), by Product 2025 & 2033

- Figure 24: Middle East & Africa High Strength Concrete Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa High Strength Concrete Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific High Strength Concrete Market Revenue (undefined), by End Use Sector 2025 & 2033

- Figure 27: Asia Pacific High Strength Concrete Market Revenue Share (%), by End Use Sector 2025 & 2033

- Figure 28: Asia Pacific High Strength Concrete Market Revenue (undefined), by Product 2025 & 2033

- Figure 29: Asia Pacific High Strength Concrete Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Asia Pacific High Strength Concrete Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific High Strength Concrete Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Strength Concrete Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 2: Global High Strength Concrete Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 3: Global High Strength Concrete Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global High Strength Concrete Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 5: Global High Strength Concrete Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 6: Global High Strength Concrete Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global High Strength Concrete Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 11: Global High Strength Concrete Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 12: Global High Strength Concrete Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global High Strength Concrete Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 17: Global High Strength Concrete Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 18: Global High Strength Concrete Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global High Strength Concrete Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 29: Global High Strength Concrete Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 30: Global High Strength Concrete Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global High Strength Concrete Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 38: Global High Strength Concrete Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 39: Global High Strength Concrete Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific High Strength Concrete Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Strength Concrete Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the High Strength Concrete Market?

Key companies in the market include CEMEX S A B de C V, CRH, CSCEC, Heidelberg Materials, Holcim, OYAK Cement, Thomas Concrete Group, UltraTech Cement Ltd, Vicat, Yunnan Construction Investment Holding Group Co Lt.

3. What are the main segments of the High Strength Concrete Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: CRH was set to acquire Buzzi Unicem's ready-mix concrete operations in Ukraine. The acquisition was finalized at USD 109 million and will include Buzzi's ready-mix concrete production units in Kyiv, Nikolajev, and Odesa.May 2023: Holcim successfully acquired BESBLOCK LTD to expand its ready-mixed concrete business in the United Kingdom and augment its presence in the sustainable building solutions market.January 2023: Holcim acquired five concrete plants of Ol-Trans, the leader in ready-mix concrete in the Gdansk-SopotGdynia area, Poland, to strengthen its local ready-mix concrete network and firmly establish it as the leader in Northern Poland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Strength Concrete Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Strength Concrete Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Strength Concrete Market?

To stay informed about further developments, trends, and reports in the High Strength Concrete Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence