Key Insights

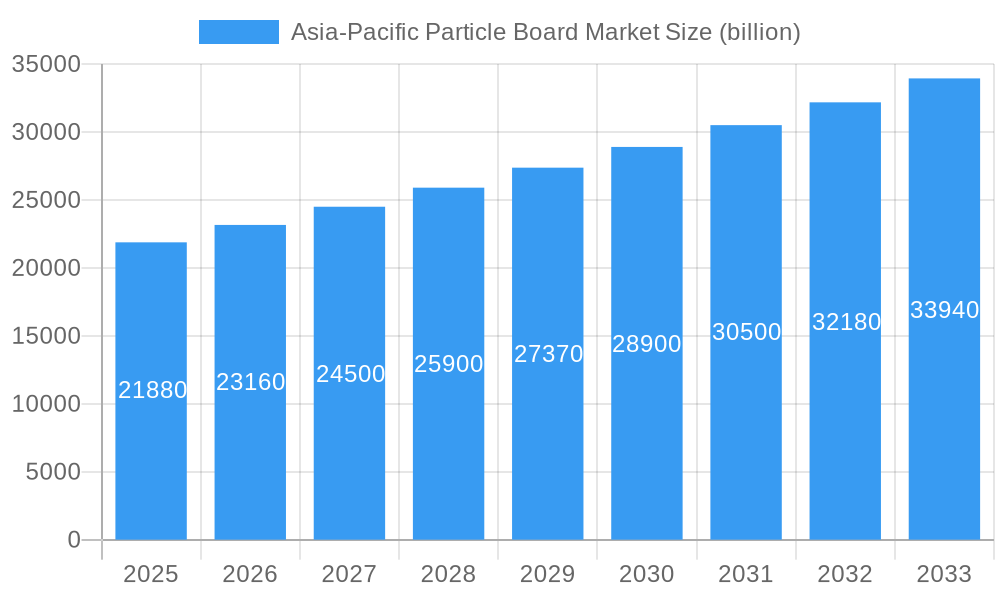

The Asia-Pacific particle board market is poised for robust growth, projected to reach an estimated USD 21.88 billion in 2025. This expansion is driven by a CAGR of 5.8% over the forecast period of 2025-2033. Key growth drivers include the burgeoning construction industry across the region, fueled by rapid urbanization and increasing disposable incomes, particularly in emerging economies like India and China. The demand for cost-effective and versatile building materials also underpins this growth. Furthermore, the furniture sector, a significant consumer of particle board due to its affordability and ease of fabrication, continues to expand, supporting market penetration. Advancements in manufacturing technologies are leading to improved product quality and performance, further stimulating demand.

Asia-Pacific Particle Board Market Market Size (In Billion)

The market is segmented by raw material, application, and geography, reflecting diverse consumption patterns. Wood-based materials, including sawdust, shavings, flakes, and chips, remain the dominant raw material source due to their widespread availability and sustainability initiatives. Applications in construction and furniture constitute the largest segments, with significant potential in infrastructure development and interior design. Geographically, China and India are anticipated to lead market expansion, owing to their large populations, extensive infrastructure projects, and growing manufacturing capabilities. While the market benefits from strong demand, potential restraints could emerge from fluctuations in raw material prices and increasing environmental regulations regarding wood sourcing and formaldehyde emissions in particle board production. Nonetheless, the overarching trend towards sustainable building practices and the development of low-emission particle boards are expected to mitigate these challenges and foster sustained market evolution.

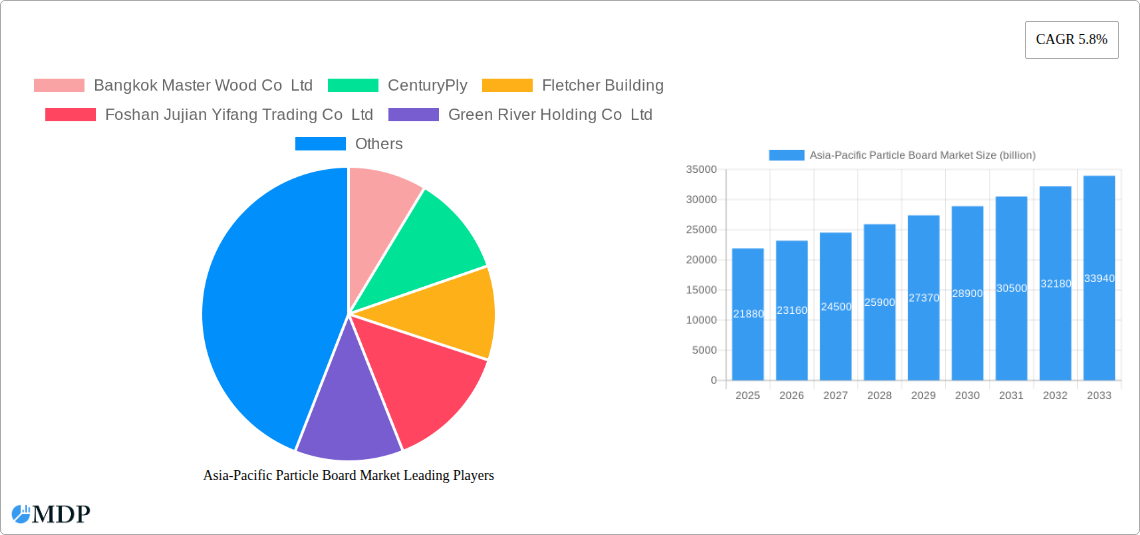

Asia-Pacific Particle Board Market Company Market Share

Unlock critical insights into the burgeoning Asia-Pacific particle board market with our in-depth report. Covering the historical period from 2019–2024 and projecting robust growth through 2033, this analysis delves into market dynamics, key trends, leading segments, and strategic outlook. With an estimated market size of over $50 billion by 2025, the Asia-Pacific particle board industry is a significant player in the global construction and furniture sectors, driven by increasing urbanization, infrastructure development, and a growing middle class. Our report provides actionable intelligence for manufacturers, suppliers, investors, and industry stakeholders seeking to navigate this dynamic landscape. Explore market share, CAGR projections, raw material trends (wood, bagasse, others), application insights (construction, furniture, infrastructure), and deep dives into key geographies like China, India, Japan, South Korea, and the Rest of Asia-Pacific.

Asia-Pacific Particle Board Market Market Dynamics & Concentration

The Asia-Pacific particle board market is characterized by moderate to high concentration, with a few dominant players holding significant market share. Innovation is largely driven by the development of eco-friendly and high-performance particle boards, alongside advancements in manufacturing efficiency. Regulatory frameworks, particularly concerning environmental standards and building codes, are increasingly influencing product development and market access. Product substitutes, such as MDF, plywood, and engineered wood panels, present a competitive challenge, necessitating continuous product differentiation and cost-effectiveness. End-user trends point towards a growing demand for sustainable and aesthetically pleasing particle board solutions for furniture and interior design. Merger and acquisition activities are observed, though relatively limited, indicating a focus on organic growth and capacity expansion by established companies. Key metrics reveal an average market share of approximately 15-20% for the top three players in specific sub-segments, while M&A deal counts remain below 5 major transactions annually, with deal values ranging from $50 million to $200 million.

Asia-Pacific Particle Board Market Industry Trends & Analysis

The Asia-Pacific particle board market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This growth is primarily fueled by robust economic development across the region, leading to increased disposable incomes and a subsequent surge in demand for housing and furniture. Urbanization remains a critical driver, necessitating the construction of new residential and commercial spaces, where particle boards are widely utilized for their cost-effectiveness and versatility. Infrastructure projects, including the development of public buildings, educational institutions, and healthcare facilities, further contribute to the escalating demand. Technological disruptions are transforming the industry, with a focus on developing particle boards with enhanced properties such as improved moisture resistance, fire retardancy, and acoustic insulation. This innovation is driven by the need to meet evolving building regulations and consumer preferences for safer and more functional materials. Consumer preferences are shifting towards sustainable and eco-friendly building materials, compelling manufacturers to adopt sustainable sourcing practices and develop low-emission particle boards. The competitive landscape is dynamic, with both global and regional players vying for market share. Strategies often involve product diversification, strategic partnerships, and capacity expansions to cater to the growing demand. Market penetration is steadily increasing, with particle boards becoming a preferred choice over traditional materials in various applications due to their cost-competitiveness and ease of manufacturing. The market is estimated to reach a value exceeding $80 billion by 2033, underscoring its substantial growth trajectory.

Leading Markets & Segments in Asia-Pacific Particle Board Market

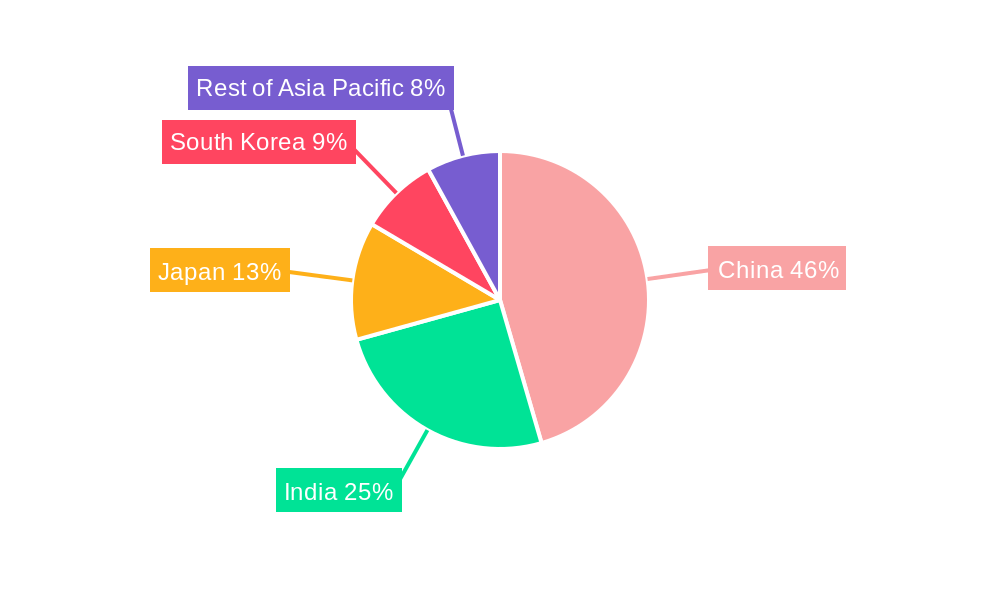

Dominant Geography: China China stands as the undisputed leader in the Asia-Pacific particle board market, accounting for over 40% of the regional market share. This dominance is attributed to its massive manufacturing capabilities, extensive domestic demand driven by rapid urbanization and infrastructure development, and favorable government policies supporting the construction sector.

- Key Drivers in China:

- Massive housing projects and urban expansion initiatives.

- Government incentives for green building materials.

- Strong domestic furniture manufacturing industry.

- Advanced production technologies and economies of scale.

Leading Raw Material: Wood The "Wood" segment, encompassing sawdust, shavings, flakes, and chips, overwhelmingly dominates the raw material landscape, contributing to over 85% of particle board production in the Asia-Pacific region. This is due to the widespread availability of wood residues from the lumber and furniture industries, making it the most cost-effective and readily accessible feedstock.

- Key Drivers for Wood Segment:

- Abundant availability of wood waste from forestry and woodworking industries.

- Cost-effectiveness compared to alternative raw materials.

- Established supply chains for wood-based raw materials.

- Growing demand for engineered wood products.

Leading Application: Furniture The "Furniture" application segment is the largest consumer of particle boards in Asia-Pacific, representing approximately 50% of the market demand. The region's burgeoning middle class and increasing disposable incomes are fueling a boom in home furnishing, with particle boards being a preferred material for affordable and versatile furniture designs.

- Key Drivers for Furniture Segment:

- Rising consumer spending on home décor and furnishings.

- Demand for flat-pack and modular furniture.

- Cost-effectiveness and ease of processing for furniture manufacturing.

- Aesthetic versatility and ability to be laminated with various finishes.

Significant Contributor: India India emerges as another high-growth market within the Asia-Pacific particle board sector. Its rapidly expanding construction industry, driven by government initiatives like "Housing for All," and a growing furniture market, are propelling significant demand. The country's large population and increasing urbanization are key factors contributing to its substantial market presence, with an estimated market share of around 15% and projected growth rates exceeding the regional average.

- Key Drivers in India:

- Intensified focus on affordable housing and infrastructure development.

- Growth of the organized furniture retail sector.

- Increasing adoption of engineered wood products in construction.

Emerging Market: Rest of Asia-Pacific The "Rest of Asia-Pacific" region, encompassing countries like Southeast Asian nations and Oceania, presents a growing opportunity. Increasing industrialization, infrastructure development, and rising consumerism in these economies are contributing to the expansion of the particle board market, albeit at a more nascent stage compared to China and India.

Asia-Pacific Particle Board Market Product Developments

Product development in the Asia-Pacific particle board market is increasingly focused on enhancing functionality and sustainability. Innovations include the development of moisture-resistant particle boards for use in humid environments and applications prone to water exposure, as well as fire-retardant particle boards to meet stringent safety regulations in construction. Furthermore, manufacturers are investing in research and development to produce low-VOC (Volatile Organic Compound) and formaldehyde-free particle boards, aligning with global trends towards healthier and environmentally conscious building materials. These advancements not only cater to regulatory demands but also offer competitive advantages by providing higher-value products with improved performance characteristics and enhanced market appeal.

Key Drivers of Asia-Pacific Particle Board Market Growth

The Asia-Pacific particle board market's robust growth is underpinned by several key drivers. Firstly, rapid urbanization and expanding infrastructure projects across the region necessitate vast quantities of affordable and versatile building materials, with particle board being a primary choice. Secondly, a burgeoning middle class with increasing disposable incomes is fueling demand for furniture and home décor, where particle boards offer a cost-effective solution. Thirdly, technological advancements in manufacturing processes are leading to improved product quality, enhanced performance characteristics, and greater production efficiency, thereby expanding the application range. Finally, growing environmental awareness and stricter regulations are encouraging the adoption of sustainable forestry practices and the development of eco-friendly particle board variants, which further bolsters market growth.

Challenges in the Asia-Pacific Particle Board Market Market

Despite its strong growth trajectory, the Asia-Pacific particle board market faces several challenges. Fluctuations in raw material prices, particularly for wood, can impact production costs and profitability. Stringent environmental regulations regarding formaldehyde emissions and waste disposal can necessitate significant investment in compliance and may limit production in certain areas. The presence of substitute materials like plywood and MDF, offering different aesthetic and performance attributes, also presents a competitive hurdle. Furthermore, supply chain disruptions, such as transportation issues and availability of skilled labor, can hinder production and market reach, particularly in less developed regions.

Emerging Opportunities in Asia-Pacific Particle Board Market

Several emerging opportunities are poised to catalyze long-term growth in the Asia-Pacific particle board market. The increasing demand for sustainable and certified wood products presents an opportunity for manufacturers adhering to responsible forestry practices. Technological breakthroughs in bio-based resins and binders could lead to the development of even more eco-friendly particle board alternatives. Strategic partnerships between raw material suppliers and particle board manufacturers can ensure stable supply and optimize costs. Furthermore, market expansion into developing economies within the Asia-Pacific region, where construction and furniture demand is on the rise, offers significant untapped potential.

Leading Players in the Asia-Pacific Particle Board Market Sector

- Bangkok Master Wood Co Ltd

- CenturyPly

- Fletcher Building

- Foshan Jujian Yifang Trading Co Ltd

- Green River Holding Co Ltd

- Greenlam Industries Ltd

- Jiangmen Changda Wood Products Co Ltd

- Metro Particle Co Ltd

- Panel Plus Co Ltd

- ONP-Vietnam LLC

- Shandong National Forest Products Co Ltd

- Shirdi Industries Limited

- Wisewoods Co Ltd

- Wanhua Ecoboard Co Ltd

Key Milestones in Asia-Pacific Particle Board Market Industry

- September 2022: Century Plyboards announced the opening of a new plant in Andhra Pradesh, India, with an annual capacity of 3.2 lakh cubic meters and an investment of USD 122 million. This expansion significantly boosts their production capabilities and market presence in India.

- December 2021: Greenlam Industries Limited stated that it would invest in cutting-edge machinery, tools, and technology to produce particle boards with a capacity of 231,000 CBM annually for an investment of USD 73.4 million. This strategic investment aims to enhance product quality and expand production capacity.

Strategic Outlook for Asia-Pacific Particle Board Market Market

The strategic outlook for the Asia-Pacific particle board market remains highly optimistic. Continued growth will be driven by sustained urbanization, infrastructure development, and the rising demand for affordable and versatile materials in construction and furniture. Companies are expected to focus on innovation in sustainable product development, including low-emission and high-performance particle boards, to meet evolving regulatory standards and consumer preferences. Capacity expansions, particularly in emerging markets like India and Southeast Asia, will be crucial for capturing market share. Strategic collaborations and potential mergers and acquisitions will likely play a role in consolidating the market and enhancing competitive advantages, ensuring long-term growth and profitability within this dynamic sector.

Asia-Pacific Particle Board Market Segmentation

-

1. Raw Material

-

1.1. Wood

- 1.1.1. Sawdust

- 1.1.2. Shavings

- 1.1.3. Flakes

- 1.1.4. Chips

- 1.2. Bagasse

- 1.3. Other Raw Materials

-

1.1. Wood

-

2. Application

- 2.1. Construction

- 2.2. Furniture

- 2.3. Infrastructure

- 2.4. Other Applications

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia-Pacific Particle Board Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Particle Board Market Regional Market Share

Geographic Coverage of Asia-Pacific Particle Board Market

Asia-Pacific Particle Board Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Furniture Industry; Easy Availability of Raw Materials

- 3.3. Market Restrains

- 3.3.1. Increasing Demand from the Furniture Industry; Easy Availability of Raw Materials

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Furniture Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Wood

- 5.1.1.1. Sawdust

- 5.1.1.2. Shavings

- 5.1.1.3. Flakes

- 5.1.1.4. Chips

- 5.1.2. Bagasse

- 5.1.3. Other Raw Materials

- 5.1.1. Wood

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Construction

- 5.2.2. Furniture

- 5.2.3. Infrastructure

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. China Asia-Pacific Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. Wood

- 6.1.1.1. Sawdust

- 6.1.1.2. Shavings

- 6.1.1.3. Flakes

- 6.1.1.4. Chips

- 6.1.2. Bagasse

- 6.1.3. Other Raw Materials

- 6.1.1. Wood

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Construction

- 6.2.2. Furniture

- 6.2.3. Infrastructure

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. India Asia-Pacific Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. Wood

- 7.1.1.1. Sawdust

- 7.1.1.2. Shavings

- 7.1.1.3. Flakes

- 7.1.1.4. Chips

- 7.1.2. Bagasse

- 7.1.3. Other Raw Materials

- 7.1.1. Wood

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Construction

- 7.2.2. Furniture

- 7.2.3. Infrastructure

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Japan Asia-Pacific Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. Wood

- 8.1.1.1. Sawdust

- 8.1.1.2. Shavings

- 8.1.1.3. Flakes

- 8.1.1.4. Chips

- 8.1.2. Bagasse

- 8.1.3. Other Raw Materials

- 8.1.1. Wood

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Construction

- 8.2.2. Furniture

- 8.2.3. Infrastructure

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. South Korea Asia-Pacific Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. Wood

- 9.1.1.1. Sawdust

- 9.1.1.2. Shavings

- 9.1.1.3. Flakes

- 9.1.1.4. Chips

- 9.1.2. Bagasse

- 9.1.3. Other Raw Materials

- 9.1.1. Wood

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Construction

- 9.2.2. Furniture

- 9.2.3. Infrastructure

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. Rest of Asia Pacific Asia-Pacific Particle Board Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. Wood

- 10.1.1.1. Sawdust

- 10.1.1.2. Shavings

- 10.1.1.3. Flakes

- 10.1.1.4. Chips

- 10.1.2. Bagasse

- 10.1.3. Other Raw Materials

- 10.1.1. Wood

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Construction

- 10.2.2. Furniture

- 10.2.3. Infrastructure

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bangkok Master Wood Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CenturyPly

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fletcher Building

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Foshan Jujian Yifang Trading Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Green River Holding Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Greenlam Industries Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jiangmen Changda Wood Products Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Metro Particle Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Panel Plus Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ONP-Vietnam LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shandong National Forest Products Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shirdi Industries Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Wisewoods Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Wanhua Ecoboard Co Ltd*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Bangkok Master Wood Co Ltd

List of Figures

- Figure 1: Global Asia-Pacific Particle Board Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Particle Board Market Revenue (billion), by Raw Material 2025 & 2033

- Figure 3: China Asia-Pacific Particle Board Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 4: China Asia-Pacific Particle Board Market Revenue (billion), by Application 2025 & 2033

- Figure 5: China Asia-Pacific Particle Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: China Asia-Pacific Particle Board Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: China Asia-Pacific Particle Board Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China Asia-Pacific Particle Board Market Revenue (billion), by Country 2025 & 2033

- Figure 9: China Asia-Pacific Particle Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India Asia-Pacific Particle Board Market Revenue (billion), by Raw Material 2025 & 2033

- Figure 11: India Asia-Pacific Particle Board Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 12: India Asia-Pacific Particle Board Market Revenue (billion), by Application 2025 & 2033

- Figure 13: India Asia-Pacific Particle Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: India Asia-Pacific Particle Board Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: India Asia-Pacific Particle Board Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India Asia-Pacific Particle Board Market Revenue (billion), by Country 2025 & 2033

- Figure 17: India Asia-Pacific Particle Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Japan Asia-Pacific Particle Board Market Revenue (billion), by Raw Material 2025 & 2033

- Figure 19: Japan Asia-Pacific Particle Board Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 20: Japan Asia-Pacific Particle Board Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Japan Asia-Pacific Particle Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Japan Asia-Pacific Particle Board Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Japan Asia-Pacific Particle Board Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Japan Asia-Pacific Particle Board Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Japan Asia-Pacific Particle Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Korea Asia-Pacific Particle Board Market Revenue (billion), by Raw Material 2025 & 2033

- Figure 27: South Korea Asia-Pacific Particle Board Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 28: South Korea Asia-Pacific Particle Board Market Revenue (billion), by Application 2025 & 2033

- Figure 29: South Korea Asia-Pacific Particle Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South Korea Asia-Pacific Particle Board Market Revenue (billion), by Geography 2025 & 2033

- Figure 31: South Korea Asia-Pacific Particle Board Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: South Korea Asia-Pacific Particle Board Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South Korea Asia-Pacific Particle Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Asia Pacific Asia-Pacific Particle Board Market Revenue (billion), by Raw Material 2025 & 2033

- Figure 35: Rest of Asia Pacific Asia-Pacific Particle Board Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 36: Rest of Asia Pacific Asia-Pacific Particle Board Market Revenue (billion), by Application 2025 & 2033

- Figure 37: Rest of Asia Pacific Asia-Pacific Particle Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Rest of Asia Pacific Asia-Pacific Particle Board Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: Rest of Asia Pacific Asia-Pacific Particle Board Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of Asia Pacific Asia-Pacific Particle Board Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of Asia Pacific Asia-Pacific Particle Board Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 2: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 6: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 10: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 14: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 18: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 22: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Asia-Pacific Particle Board Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Particle Board Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Asia-Pacific Particle Board Market?

Key companies in the market include Bangkok Master Wood Co Ltd, CenturyPly, Fletcher Building, Foshan Jujian Yifang Trading Co Ltd, Green River Holding Co Ltd, Greenlam Industries Ltd, Jiangmen Changda Wood Products Co Ltd, Metro Particle Co Ltd, Panel Plus Co Ltd, ONP-Vietnam LLC, Shandong National Forest Products Co Ltd, Shirdi Industries Limited, Wisewoods Co Ltd, Wanhua Ecoboard Co Ltd*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Particle Board Market?

The market segments include Raw Material, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Furniture Industry; Easy Availability of Raw Materials.

6. What are the notable trends driving market growth?

Growing Demand from the Furniture Industry.

7. Are there any restraints impacting market growth?

Increasing Demand from the Furniture Industry; Easy Availability of Raw Materials.

8. Can you provide examples of recent developments in the market?

September 2022: With an annual capacity of 3.2 lakh cubic meters, Century Plyboards announced the opening of a new plant in Andhra Pradesh, India, with an investment of USD 122 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Particle Board Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Particle Board Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Particle Board Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Particle Board Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence