Key Insights

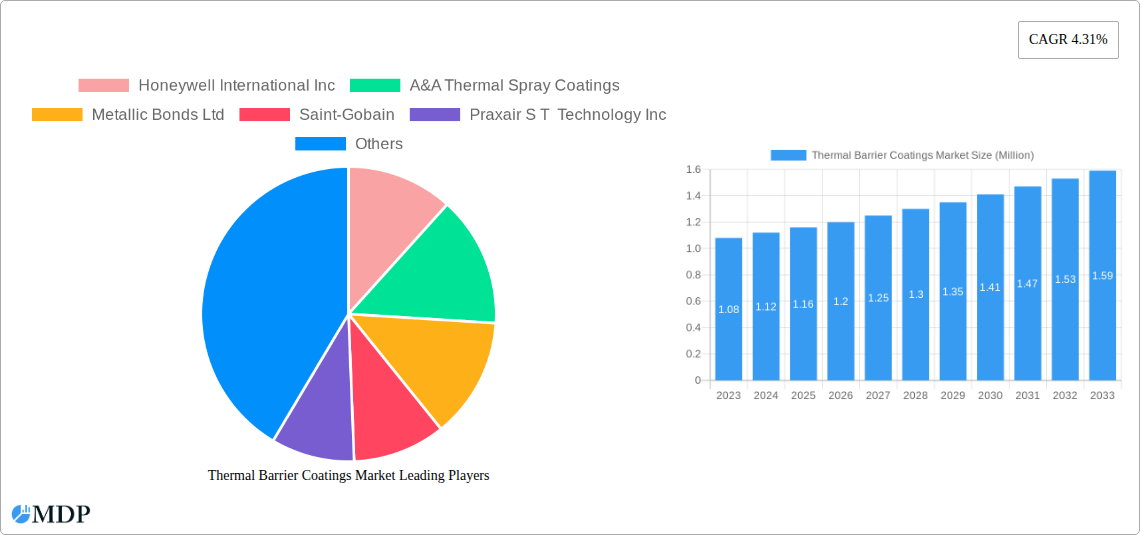

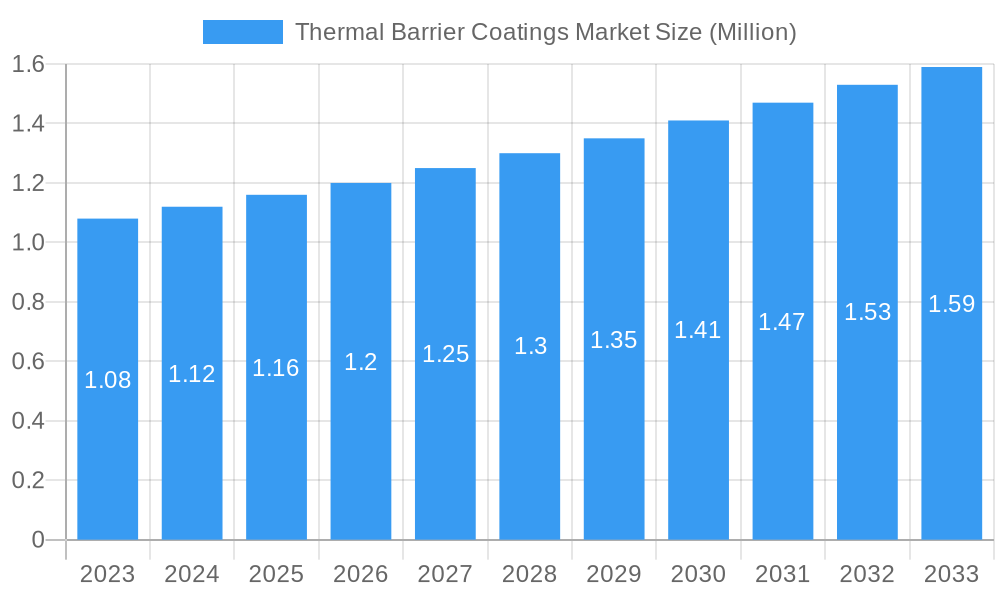

The global Thermal Barrier Coatings (TBCs) market is poised for substantial growth, estimated to reach $1.16 billion by 2025, driven by a CAGR of 4.31% through 2033. This expansion is fueled by critical industry drivers such as increasing demand for high-performance materials in aerospace and automotive sectors to enhance fuel efficiency and reduce emissions. Advanced TBCs play a vital role in protecting critical engine components from extreme temperatures, thereby extending their lifespan and improving operational reliability. The power generation industry also contributes significantly to market growth, as TBCs are integral to the efficiency and longevity of turbines operating under harsh conditions. Furthermore, ongoing research and development in ceramic and intermetallic coating technologies are unlocking new applications and performance capabilities, further propelling market expansion.

Thermal Barrier Coatings Market Market Size (In Million)

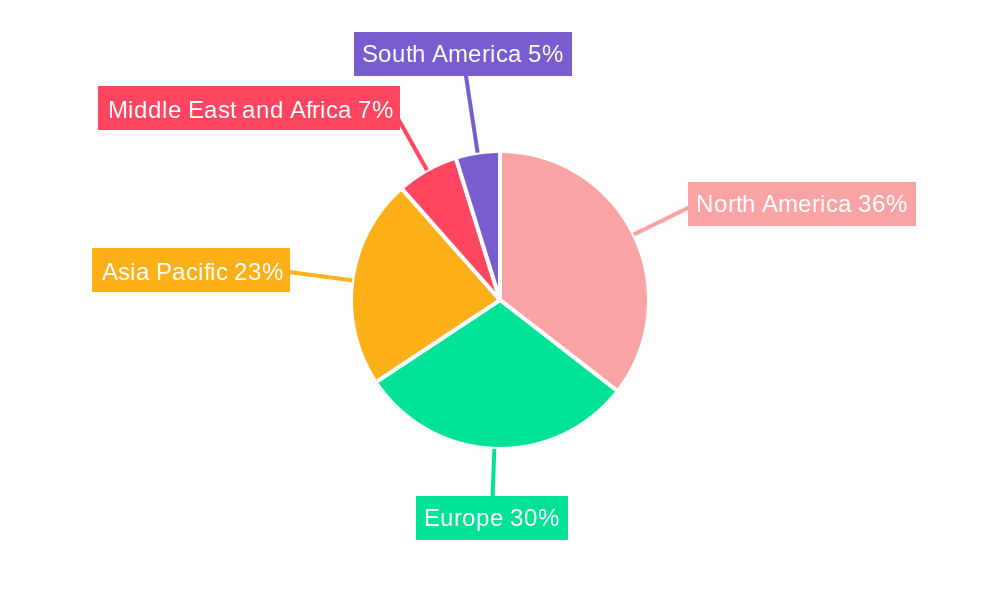

The TBC market is segmented by product type, with Metal bond coats, Ceramic top coats, and Intermetallic coatings being key categories, each offering distinct protective properties. Ceramic coatings, in particular, are witnessing robust demand due to their superior thermal insulation capabilities. The market is further defined by its diverse end-user industries, including automotive, aerospace, power plants, and oil and gas, with emerging applications in marine and railway sectors. Geographically, North America and Europe have historically dominated the market, supported by established industries and significant R&D investments. However, the Asia Pacific region, led by China and India, is emerging as a rapidly growing market, propelled by expanding manufacturing capabilities, increasing infrastructure development, and a burgeoning automotive and aerospace sector. Restraints such as the high cost of advanced TBCs and complex application processes are being mitigated by technological advancements and a growing emphasis on lifecycle cost reduction.

Thermal Barrier Coatings Market Company Market Share

Dive deep into the dynamic Thermal Barrier Coatings (TBC) market, a rapidly expanding sector crucial for enhancing the performance and longevity of critical components across industries. This comprehensive report offers an in-depth analysis of the global thermal barrier coatings market size, market share, and market forecast from 2019 to 2033, with a base year of 2025. Explore key drivers, prevailing trends, and emerging opportunities shaping the thermal spray coatings market, aerospace coatings, and automotive coatings. Discover market insights for high-temperature coatings, ceramic coatings, and their applications in power generation, oil and gas, and beyond.

Thermal Barrier Coatings Market Market Dynamics & Concentration

The thermal barrier coatings market exhibits a moderately concentrated landscape, with key players like Honeywell International Inc, Saint-Gobain, and OC Oerlikon Management AG holding significant market share. Innovation is a primary driver, fueled by the relentless pursuit of higher operating temperatures, improved fuel efficiency, and extended component life in demanding environments. Robust regulatory frameworks governing emissions and safety standards further propel the adoption of advanced TBC solutions. Product substitution remains a minor threat, as the unique protective properties of TBCs are difficult to replicate. End-user trends are heavily influenced by the aerospace sector's demand for lightweight, high-performance materials and the automotive industry's focus on emission reduction and engine efficiency. The oil and gas sector's need for corrosion and erosion resistance in harsh environments also contributes significantly. Merger and acquisition (M&A) activities, while not dominant, are strategic, aimed at expanding product portfolios, geographical reach, and technological capabilities. The number of notable M&A deals in the TBC sector is estimated to be between 5-10 annually, signaling consolidation and strategic growth.

Thermal Barrier Coatings Market Industry Trends & Analysis

The thermal barrier coatings market is poised for substantial growth, driven by escalating demand for high-performance materials that can withstand extreme temperatures and corrosive environments. The global thermal barrier coatings market size is projected to reach an estimated $XX Million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. Key growth drivers include the increasing stringency of emission regulations worldwide, compelling industries to adopt more efficient and durable engine technologies that rely heavily on advanced coatings. The aerospace sector, a cornerstone of the TBC market, continues to invest heavily in next-generation aircraft, demanding lighter, more fuel-efficient engines that necessitate superior thermal management solutions. Similarly, the automotive industry is witnessing a surge in the adoption of TBCs to enhance engine performance, reduce emissions, and meet evolving fuel economy standards, particularly with the rise of hybrid and electric vehicle components operating at higher thermal loads.

Technological disruptions are continuously redefining the TBC landscape. Advancements in plasma spray, electron beam physical vapor deposition (EB-PVD), and air plasma spray (APS) techniques are enabling the development of more sophisticated coatings with enhanced adhesion, reduced porosity, and superior thermal insulation properties. The increasing use of advanced ceramic materials, such as yttria-stabilized zirconia (YSZ) and gadolinium zirconate (GZO), is expanding the application range and performance capabilities of TBCs. Consumer preferences are increasingly aligning with sustainable and energy-efficient solutions, directly benefiting the TBC market as these coatings contribute to improved operational efficiency and reduced environmental impact. Competitive dynamics are characterized by fierce innovation and strategic alliances, as companies strive to differentiate themselves through superior product offerings and technological leadership. The market penetration of TBCs is expected to rise across all major end-user industries, signifying a broad-based demand for these critical protective layers.

Leading Markets & Segments in Thermal Barrier Coatings Market

The thermal barrier coatings market is dominated by the Ceramic (Top Coat) segment, which accounts for a significant market share due to its exceptional thermal insulation properties and widespread application in high-temperature components. This dominance is further propelled by the robust demand from the Aerospace end-user industry, where TBCs are indispensable for jet engine turbines, combustors, and exhaust systems to withstand extreme heat and extend component lifespan, thereby reducing maintenance costs and improving fuel efficiency.

Dominant Product Segment:

- Ceramic (Top Coat): The superior thermal insulation capabilities of ceramic top coats, primarily based on yttria-stabilized zirconia (YSZ), make them the preferred choice for high-temperature applications. Key drivers for this segment include:

- Technological Advancements: Continuous research and development in ceramic formulations and application techniques are enhancing performance and durability.

- Aerospace Demand: Critical components in jet engines require the extreme heat resistance offered by ceramic TBCs.

- Power Generation Efficiency: Ceramic coatings in gas turbines contribute to higher operating temperatures, leading to improved energy conversion efficiency.

- Ceramic (Top Coat): The superior thermal insulation capabilities of ceramic top coats, primarily based on yttria-stabilized zirconia (YSZ), make them the preferred choice for high-temperature applications. Key drivers for this segment include:

Dominant End-user Industry:

- Aerospace: This sector represents the largest consumer of thermal barrier coatings. The stringent performance requirements and the significant economic impact of component failure in aircraft engines drive substantial investment in TBC technology. Key drivers for aerospace dominance include:

- Performance Requirements: Unparalleled need for heat resistance, wear resistance, and oxidation resistance in jet engines.

- Safety Standards: Strict safety regulations necessitate reliable and long-lasting components.

- Economic Benefits: Extended component life and improved fuel efficiency translate to significant cost savings.

- Aerospace: This sector represents the largest consumer of thermal barrier coatings. The stringent performance requirements and the significant economic impact of component failure in aircraft engines drive substantial investment in TBC technology. Key drivers for aerospace dominance include:

Leading Geographic Regions:

- North America: This region exhibits strong leadership driven by its advanced aerospace and defense industries, coupled with a significant presence of oil and gas exploration and power generation facilities. Government investments in research and development further bolster the TBC market.

- Europe: A mature market with a strong automotive manufacturing base and a growing focus on renewable energy and advanced power generation solutions. Stringent environmental regulations also push for adoption of efficient technologies.

Other Key Segments:

- Metal (Bond Coat): Crucial for adhesion and providing a transition layer, metal bond coats (often Ni-based alloys) are vital for the overall performance of TBC systems.

- Automotive: Growing adoption in internal combustion engines, turbochargers, and exhaust systems for improved efficiency and reduced emissions.

- Power Plants: Essential for gas turbines and other high-temperature components in conventional and nuclear power generation.

- Oil and Gas: Critical for protecting components in exploration, extraction, and refining processes from corrosion and erosion.

Thermal Barrier Coatings Market Product Developments

The thermal barrier coatings market is witnessing continuous product innovations focused on enhancing thermal insulation, durability, and environmental resistance. ZIRCOTEC's launch of Thermohold, a versatile ceramic TBC applicable to a wide range of substrates including metals, composites, and high-temperature plastics, signifies a trend towards broader applicability and material compatibility. This development addresses the growing need for advanced protective solutions in diverse industrial settings. These product advancements are driven by ongoing research into novel ceramic compositions, advanced application techniques like electron beam physical vapor deposition (EB-PVD) for denser and more uniform coatings, and the development of multi-layered TBC systems that offer superior performance under extreme conditions. The competitive advantage lies in companies that can offer bespoke TBC solutions with enhanced adhesion, reduced thermal conductivity, and improved resistance to thermal cycling, thereby extending component life and optimizing operational efficiency across industries.

Key Drivers of Thermal Barrier Coatings Market Growth

The thermal barrier coatings market is primarily driven by the relentless pursuit of enhanced operational efficiency and component longevity in high-temperature environments. Key growth drivers include:

- Increasing Demand for Fuel Efficiency: In aerospace and automotive sectors, TBCs enable higher operating temperatures in engines, leading to improved combustion efficiency and reduced fuel consumption.

- Stringent Emission Regulations: Global environmental mandates necessitate advanced engine technologies that rely on thermal management solutions like TBCs to reduce harmful emissions.

- Extended Component Lifespan: TBCs protect critical engine parts from extreme heat, oxidation, and corrosion, significantly extending their service life and reducing maintenance costs.

- Growth in Power Generation: The expansion of gas turbine technology in power plants for efficient energy production directly fuels the demand for high-performance TBCs.

- Advancements in Material Science and Application Techniques: Ongoing innovation in ceramic materials and thermal spray technologies enables the development of more effective and durable TBCs.

Challenges in the Thermal Barrier Coatings Market Market

Despite robust growth, the thermal barrier coatings market faces several challenges that could temper its expansion. The high cost of advanced TBC materials and application processes remains a significant barrier for smaller enterprises and certain applications. Developing and adhering to stringent quality control standards and certifications, particularly in the aerospace industry, requires substantial investment and expertise. The availability of skilled labor for applying and inspecting these complex coatings can also be a constraint. Furthermore, while TBCs offer significant benefits, the initial capital expenditure for their implementation can be a deterrent for some industries.

Emerging Opportunities in Thermal Barrier Coatings Market

Emerging opportunities within the thermal barrier coatings market are driven by innovation and expanding application frontiers. The growing interest in advanced manufacturing techniques like additive manufacturing (3D printing) for creating intricate TBC structures presents a significant avenue for growth. The development of self-healing TBCs that can repair micro-cracks autonomously will further enhance component reliability. Expansion into newer end-user industries, such as advanced industrial furnaces, renewable energy systems (e.g., concentrated solar power), and even high-performance electronics operating under thermal stress, offers substantial untapped potential. Strategic partnerships between TBC manufacturers and original equipment manufacturers (OEMs) will also foster the integration of TBC solutions into new product designs from the outset.

Leading Players in the Thermal Barrier Coatings Market Sector

- Honeywell International Inc

- A&A Thermal Spray Coatings

- Metallic Bonds Ltd

- Saint-Gobain

- Praxair S T Technology Inc

- CTS Inc

- KECO Coatings

- OC Oerlikon Management AG

- Chromalloy Gas Turbine LLC

- ZIRCOTEC

- Northwest Mettech Corp

- Tech Line Coatings LLC

- Hayden Corp

Key Milestones in Thermal Barrier Coatings Market Industry

- March 2023: Zircotec company launched a ceramic thermal barrier coating called Thermohold. This technology can be applied to various substrate materials, including metallic surfaces like cast iron, steel alloys, aluminum, and titanium, composite materials like carbon-fiber-reinforced polymers (CFRPs), and high-temperature plastics.

- December 2022: OC Oerlikon Management AG announced its plans to construct a new state-of-the-art assembly and production site for its surface solutions and equipment businesses in Switzerland to provide customers with Oerlikon Metco solutions, including thermal barrier coatings. This facility will also include equipment assembling and production services and is expected to be operational in 2025.

Strategic Outlook for Thermal Barrier Coatings Market Market

The thermal barrier coatings market is on a trajectory of sustained growth, propelled by continuous innovation and expanding applications. Strategic opportunities lie in developing TBC solutions for emerging technologies like advanced combustion engines, hypersonic vehicles, and next-generation energy systems. Collaboration with research institutions and end-users will be crucial for tailoring coatings to specific performance requirements. Companies that can offer integrated solutions, encompassing material development, application expertise, and comprehensive lifecycle support, will be well-positioned for future success. The increasing focus on sustainability and energy efficiency will continue to be a major growth accelerator, driving the adoption of advanced TBCs across a wider spectrum of industries.

Thermal Barrier Coatings Market Segmentation

-

1. Product

- 1.1. Metal (Bond Coat)

- 1.2. Ceramic (Top Coat)

- 1.3. Intermetallic

- 1.4. Other Products (Metal Glass Composites)

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Aerospace

- 2.3. Power Plants

- 2.4. Oil and Gas

- 2.5. Other End-user Industries (Marine and Railways)

Thermal Barrier Coatings Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Thermal Barrier Coatings Market Regional Market Share

Geographic Coverage of Thermal Barrier Coatings Market

Thermal Barrier Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Aerospace Sector; Growing Dependence on Gas-Fired Turbines for Power Generation; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices; Other Restraints

- 3.4. Market Trends

- 3.4.1. Aerospace Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermal Barrier Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Metal (Bond Coat)

- 5.1.2. Ceramic (Top Coat)

- 5.1.3. Intermetallic

- 5.1.4. Other Products (Metal Glass Composites)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace

- 5.2.3. Power Plants

- 5.2.4. Oil and Gas

- 5.2.5. Other End-user Industries (Marine and Railways)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Asia Pacific Thermal Barrier Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Metal (Bond Coat)

- 6.1.2. Ceramic (Top Coat)

- 6.1.3. Intermetallic

- 6.1.4. Other Products (Metal Glass Composites)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Aerospace

- 6.2.3. Power Plants

- 6.2.4. Oil and Gas

- 6.2.5. Other End-user Industries (Marine and Railways)

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. North America Thermal Barrier Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Metal (Bond Coat)

- 7.1.2. Ceramic (Top Coat)

- 7.1.3. Intermetallic

- 7.1.4. Other Products (Metal Glass Composites)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Aerospace

- 7.2.3. Power Plants

- 7.2.4. Oil and Gas

- 7.2.5. Other End-user Industries (Marine and Railways)

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Thermal Barrier Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Metal (Bond Coat)

- 8.1.2. Ceramic (Top Coat)

- 8.1.3. Intermetallic

- 8.1.4. Other Products (Metal Glass Composites)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Aerospace

- 8.2.3. Power Plants

- 8.2.4. Oil and Gas

- 8.2.5. Other End-user Industries (Marine and Railways)

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South America Thermal Barrier Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Metal (Bond Coat)

- 9.1.2. Ceramic (Top Coat)

- 9.1.3. Intermetallic

- 9.1.4. Other Products (Metal Glass Composites)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Aerospace

- 9.2.3. Power Plants

- 9.2.4. Oil and Gas

- 9.2.5. Other End-user Industries (Marine and Railways)

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Thermal Barrier Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Metal (Bond Coat)

- 10.1.2. Ceramic (Top Coat)

- 10.1.3. Intermetallic

- 10.1.4. Other Products (Metal Glass Composites)

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Aerospace

- 10.2.3. Power Plants

- 10.2.4. Oil and Gas

- 10.2.5. Other End-user Industries (Marine and Railways)

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 A&A Thermal Spray Coatings

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Metallic Bonds Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Saint-Gobain

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Praxair S T Technology Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CTS Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KECO Coatings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 OC Oerlikon Management AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Chromalloy Gas Turbine LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ZIRCOTEC*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northwest Mettech Corp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Tech Line Coatings LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hayden Corp

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Thermal Barrier Coatings Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Thermal Barrier Coatings Market Revenue (Million), by Product 2025 & 2033

- Figure 3: Asia Pacific Thermal Barrier Coatings Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: Asia Pacific Thermal Barrier Coatings Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Thermal Barrier Coatings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Thermal Barrier Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Thermal Barrier Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Thermal Barrier Coatings Market Revenue (Million), by Product 2025 & 2033

- Figure 9: North America Thermal Barrier Coatings Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: North America Thermal Barrier Coatings Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Thermal Barrier Coatings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Thermal Barrier Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Thermal Barrier Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Thermal Barrier Coatings Market Revenue (Million), by Product 2025 & 2033

- Figure 15: Europe Thermal Barrier Coatings Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Thermal Barrier Coatings Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Thermal Barrier Coatings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Thermal Barrier Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Thermal Barrier Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Thermal Barrier Coatings Market Revenue (Million), by Product 2025 & 2033

- Figure 21: South America Thermal Barrier Coatings Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: South America Thermal Barrier Coatings Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Thermal Barrier Coatings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Thermal Barrier Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Thermal Barrier Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Thermal Barrier Coatings Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East and Africa Thermal Barrier Coatings Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Thermal Barrier Coatings Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Thermal Barrier Coatings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Thermal Barrier Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Thermal Barrier Coatings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Thermal Barrier Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Thermal Barrier Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Thermal Barrier Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 19: Global Thermal Barrier Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Russia Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 28: Global Thermal Barrier Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Product 2020 & 2033

- Table 34: Global Thermal Barrier Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Thermal Barrier Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Thermal Barrier Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermal Barrier Coatings Market?

The projected CAGR is approximately 4.31%.

2. Which companies are prominent players in the Thermal Barrier Coatings Market?

Key companies in the market include Honeywell International Inc, A&A Thermal Spray Coatings, Metallic Bonds Ltd, Saint-Gobain, Praxair S T Technology Inc, CTS Inc, KECO Coatings, OC Oerlikon Management AG, Chromalloy Gas Turbine LLC, ZIRCOTEC*List Not Exhaustive, Northwest Mettech Corp, Tech Line Coatings LLC, Hayden Corp.

3. What are the main segments of the Thermal Barrier Coatings Market?

The market segments include Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Aerospace Sector; Growing Dependence on Gas-Fired Turbines for Power Generation; Other Drivers.

6. What are the notable trends driving market growth?

Aerospace Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices; Other Restraints.

8. Can you provide examples of recent developments in the market?

March 2023: Zircotec company launched a ceramic thermal barrier coating called Thermohold. This technology can be applied to various substrate materials, including metallic surfaces like cast iron, steel alloys, aluminum, and titanium, composite materials like carbon-fiber-reinforced polymers (CFRPs), and high-temperature plastics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermal Barrier Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermal Barrier Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermal Barrier Coatings Market?

To stay informed about further developments, trends, and reports in the Thermal Barrier Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence