Key Insights

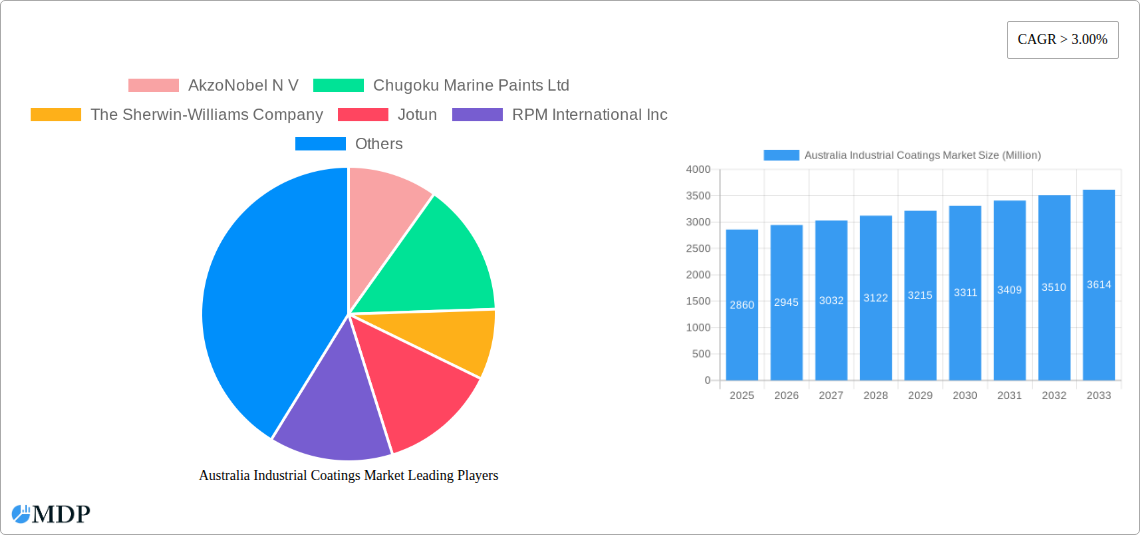

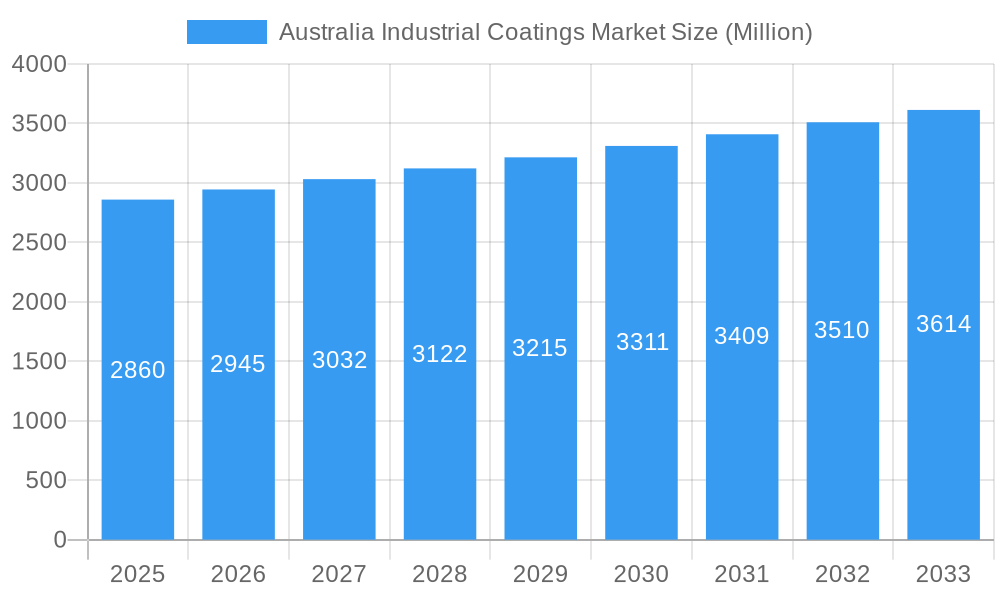

The Australian industrial coatings market is poised for steady expansion, projected to reach $2860 million by 2025. This growth is fueled by robust demand across key sectors, including infrastructure development, the oil and gas industry, and power generation, where protective and performance coatings are paramount. A significant driver is the increasing need for corrosion resistance and durability in harsh environmental conditions prevalent in Australia. Furthermore, advancements in coating technologies, such as the growing adoption of water-borne and powder coatings, are contributing to market uplift due to their environmental benefits and improved performance characteristics. The market is expected to witness a Compound Annual Growth Rate (CAGR) of over 3.00% during the study period, indicating a consistent upward trajectory. This expansion is further supported by ongoing investments in industrial facilities and a general trend towards enhancing the lifespan and aesthetic appeal of industrial assets.

Australia Industrial Coatings Market Market Size (In Billion)

The Australian industrial coatings market is characterized by a diverse range of resin types, with epoxy, polyurethane, and acrylic coatings holding substantial market share owing to their versatility and high-performance properties. While solvent-borne coatings have traditionally dominated, there's a discernible shift towards more environmentally friendly alternatives like water-borne and powder coatings, driven by stringent environmental regulations and increasing corporate sustainability initiatives. The oil and gas, power, and infrastructure sectors are anticipated to remain the primary end-user industries, demanding specialized coatings for asset protection and longevity. However, the general industrial segment is also expected to contribute significantly to market growth. Key players such as AkzoNobel N.V., The Sherwin-Williams Company, and PPG Industries are actively participating in this market, focusing on product innovation and strategic partnerships to capture market share and cater to evolving customer needs.

Australia Industrial Coatings Market Company Market Share

Gain unparalleled insights into the dynamic Australia industrial coatings market, a sector projected to reach $4,500.2 Million by 2033, exhibiting a robust CAGR of 6.2% from 2025. This in-depth report, covering the historical period of 2019-2024 and a detailed forecast from 2025-2033, offers critical analysis of market dynamics, industry trends, leading segments, and strategic opportunities. We dissect key segments including Epoxy, Polyurethane, Acrylic, Polyester, and Other Resin Types, alongside Water-borne Coatings, Solvent-borne Coatings, Powder, and Other Technologies. Furthermore, we explore the pivotal General Industrial and Protective Coatings (including Oil and Gas, Power, Infrastructure, and Other End-user Industries) sectors. This report is your definitive guide to navigating the Australian coatings industry, identifying lucrative avenues, and staying ahead of the competition.

Australia Industrial Coatings Market Market Dynamics & Concentration

The Australia industrial coatings market is characterized by a moderately concentrated landscape, with key players like AkzoNobel N.V., The Sherwin-Williams Company, PPG Industries, and Jotun holding significant market share. Innovation drivers are primarily focused on enhancing performance, sustainability, and application efficiency. The increasing demand for eco-friendly solutions is propelling the adoption of low-VOC (Volatile Organic Compound) coatings and water-borne technologies, influencing regulatory frameworks that are gradually tightening environmental standards. Product substitutes, while present, often struggle to match the specialized performance and durability offered by industrial coatings in demanding applications. End-user trends highlight a growing preference for coatings with extended lifecycles, improved corrosion resistance, and specialized functionalities like fire retardancy and anti-microbial properties. Mergers and acquisitions (M&A) activities, while not overwhelmingly frequent, play a crucial role in market consolidation and expansion of product portfolios. For instance, the acquisition of Wattyl by Hempel in February 2021 underscores the strategic importance of strengthening market presence and distribution networks. The market has witnessed a steady increase in M&A deal counts over the historical period, indicating a strategic push for market share acquisition and technological integration by major entities.

Australia Industrial Coatings Market Industry Trends & Analysis

The Australia industrial coatings market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive economic policies. The increasing focus on infrastructure development, coupled with the ongoing expansion of the oil and gas sector, is a primary growth engine, demanding high-performance protective coatings for asset integrity and longevity. Technological disruptions are significantly reshaping the market, with a notable shift towards sustainable and eco-friendly coating solutions. Water-borne coatings are gaining traction due to their lower VOC emissions and reduced environmental impact, aligning with stringent regulatory mandates. The development of advanced formulations, such as self-healing coatings and smart coatings with integrated sensor capabilities, is also on the rise, offering enhanced functionalities and predictive maintenance benefits. Consumer preferences are increasingly leaning towards coatings that offer superior durability, aesthetic appeal, and reduced application costs. The penetration of powder coatings, known for their durability and environmental benefits, is expected to witness a steady increase across various industrial applications. The competitive dynamics within the market are intense, with leading global players continuously investing in research and development to introduce innovative products and expand their market reach. The market is also experiencing a surge in demand for specialized coatings tailored to specific industry needs, such as those in the marine, automotive, and aerospace sectors. The projected CAGR of 6.2% for the forecast period of 2025–2033 reflects the robust growth trajectory anticipated for the Australian industrial coatings market, driven by these multifaceted trends and the industry's proactive response to evolving market demands.

Leading Markets & Segments in Australia Industrial Coatings Market

Within the Australia industrial coatings market, the Protective Coatings segment is poised for significant dominance, particularly driven by the Oil and Gas and Infrastructure sub-sectors. The vast geographical expanse of Australia, coupled with its rich natural resources, necessitates robust protective solutions for offshore platforms, pipelines, mining equipment, and critical infrastructure projects like bridges and ports.

Resin Type Dominance: Epoxy resins are expected to maintain their leadership position due to their exceptional adhesion, chemical resistance, and durability, making them ideal for demanding protective applications. Polyurethane coatings follow closely, offering excellent flexibility, UV resistance, and abrasion resistance, crucial for aesthetic and protective finishes in various industrial settings.

Technology Trends: The market is witnessing a significant shift towards Water-borne Coatings owing to increasing environmental regulations and a growing demand for sustainable solutions. While Solvent-borne Coatings will continue to hold a considerable share, especially in applications requiring high-solids content and rapid drying times, their market share is expected to gradually decline. Powder Coatings are also gaining momentum, particularly in the general industrial sector, for their eco-friendly profile and excellent finishing properties.

End-user Industry Performance:

- Protective Coatings (Oil and Gas): This sub-sector will remain a primary revenue generator, fueled by ongoing exploration, production, and maintenance activities. The harsh marine and corrosive environments necessitate advanced anti-corrosion coatings, driving demand for high-performance epoxy and polyurethane systems.

- Protective Coatings (Infrastructure): Significant government investment in infrastructure projects, including transportation networks, public buildings, and utilities, will propel the demand for durable and long-lasting protective coatings that can withstand environmental stressors and offer extended service life.

- General Industrial: This broad segment, encompassing machinery, equipment, and manufactured goods, will also contribute significantly, driven by the manufacturing sector's recovery and diversification. The demand for coatings that offer both aesthetic appeal and functional protection will be paramount.

The dominance of these segments is underpinned by strong economic policies supporting industrial growth, significant government expenditure on infrastructure, and an increasing awareness of the long-term economic benefits of investing in high-quality protective coatings to preserve valuable assets and reduce maintenance costs.

Australia Industrial Coatings Market Product Developments

Product innovation in the Australia industrial coatings market is increasingly focused on sustainability and advanced functionality. A prime example is PPG's introduction of the PPG ENVIROCRONTM LUM coating in June 2022, the industry's first commercial retroreflective powder coating. This patent-pending technology enhances visibility in low-light conditions, offering significant safety advantages for infrastructure and transportation applications. These advancements cater to a growing market demand for coatings that not only protect but also add value through enhanced safety features and improved operational efficiency. The focus on eco-friendly formulations, such as low-VOC and water-borne coatings, continues to drive research and development, ensuring market fit with evolving environmental regulations and consumer preferences for sustainable solutions.

Key Drivers of Australia Industrial Coatings Market Growth

The growth of the Australia industrial coatings market is propelled by several key factors. Foremost is the substantial investment in infrastructure development and maintenance across the nation, including transportation, utilities, and public facilities, which necessitates high-performance protective coatings. The robust oil and gas sector, with its ongoing exploration and production activities, further fuels demand for corrosion-resistant and durable coatings. Technological advancements, particularly the development of environmentally friendly, low-VOC, and water-borne coating systems, are crucial drivers, aligning with stricter environmental regulations and increasing consumer preference for sustainable solutions. Government initiatives supporting manufacturing and industrial diversification also play a vital role by stimulating demand for a wide range of industrial coatings.

Challenges in the Australia Industrial Coatings Market Market

Despite the positive growth trajectory, the Australia industrial coatings market faces certain challenges. Stringent environmental regulations, while driving innovation, can also increase production costs and necessitate significant investment in compliance. Fluctuations in raw material prices, particularly for key resins and pigments, can impact profitability and pricing strategies. The availability and cost of skilled labor for specialized coating applications can also pose a constraint. Furthermore, intense competition from both domestic and international players, coupled with the potential for product substitution from alternative protective materials, requires continuous innovation and cost-effectiveness to maintain market share. Supply chain disruptions, as evidenced in recent global events, can also lead to delays and increased costs.

Emerging Opportunities in Australia Industrial Coatings Market

Emerging opportunities within the Australia industrial coatings market are abundant, driven by technological breakthroughs and strategic market expansion. The growing emphasis on sustainability presents a significant opportunity for companies developing and marketing eco-friendly coatings, such as high-solids, water-borne, and powder coatings. The increasing demand for smart coatings with self-healing capabilities, corrosion monitoring sensors, and enhanced aesthetic properties opens new avenues for innovation and premium product offerings. The ongoing renewable energy transition, particularly in solar and wind power infrastructure, creates substantial demand for specialized protective coatings that can withstand harsh environmental conditions and extend asset lifespan. Furthermore, strategic partnerships and collaborations between coatings manufacturers and end-users can lead to the development of bespoke solutions, fostering loyalty and market penetration.

Leading Players in the Australia Industrial Coatings Market Sector

- AkzoNobel N V

- Chugoku Marine Paints Ltd

- The Sherwin-Williams Company

- Jotun

- RPM International Inc

- Beckers Group

- BASF SE

- Axalta Coating Systems

- Hempel A/S

- Sika AG

- PPG Industries

- Dulux Protective Coatings

- Wacker Chemie AG

Key Milestones in Australia Industrial Coatings Market Industry

- June 2022: PPG introduced the PPG ENVIROCRONTM LUM coating, the industry's first commercial retroreflective powder coating. The patent-pending layer is designed to aid vision at night and in low-light conditions.

- February 2021: Hempel announced a purchase agreement with Wattyl (Australia's leading manufacturer of decorative and protective coatings). The acquisition of Wattyl will strengthen the company's position as the leading digital platform in the Australian industrial coatings market.

Strategic Outlook for Australia Industrial Coatings Market Market

The strategic outlook for the Australia industrial coatings market is highly positive, characterized by sustained growth and increasing demand for advanced, sustainable solutions. Key growth accelerators include continued investment in major infrastructure projects and the mining sector, driving demand for high-performance protective coatings. The ongoing shift towards environmentally friendly technologies, such as water-borne and powder coatings, presents significant opportunities for companies at the forefront of sustainable innovation. Emerging applications in renewable energy infrastructure and the automotive sector will also contribute to market expansion. Strategic focus on product differentiation through advanced functionalities, coupled with robust R&D investments, will be crucial for market leaders. M&A activities are expected to continue, facilitating market consolidation and offering synergistic growth opportunities. The market is poised for a future where durability, environmental responsibility, and technological integration will define success.

Australia Industrial Coatings Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Polyurethane

- 1.3. Acrylic

- 1.4. Polyester

- 1.5. Other Resin Types

-

2. Technology

- 2.1. Water-borne Coatings

- 2.2. Solvent-borne Coatings

- 2.3. Powder

- 2.4. Other Technologies

-

3. End-user Industry

- 3.1. General Industrial

-

3.2. Protective Coatings

- 3.2.1. Oil and Gas

- 3.2.2. Power

- 3.2.3. Infrastructure

- 3.2.4. Other End-user Industries

Australia Industrial Coatings Market Segmentation By Geography

- 1. Australia

Australia Industrial Coatings Market Regional Market Share

Geographic Coverage of Australia Industrial Coatings Market

Australia Industrial Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protective Coatings; Increasing Usage of Corrosion Coatings

- 3.3. Market Restrains

- 3.3.1. Harmful Environmental Impact of Solvent-borne Coatings; Other Restraints

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Industrial Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Polyurethane

- 5.1.3. Acrylic

- 5.1.4. Polyester

- 5.1.5. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne Coatings

- 5.2.2. Solvent-borne Coatings

- 5.2.3. Powder

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. General Industrial

- 5.3.2. Protective Coatings

- 5.3.2.1. Oil and Gas

- 5.3.2.2. Power

- 5.3.2.3. Infrastructure

- 5.3.2.4. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AkzoNobel N V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chugoku Marine Paints Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Sherwin-Williams Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RPM International Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Beckers Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Axalta Coating Systems

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hempel A/S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sika AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PPG Industries

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dulux Protective Coatings

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Wacker Chemie AG*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 AkzoNobel N V

List of Figures

- Figure 1: Australia Industrial Coatings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Industrial Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Industrial Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Australia Industrial Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 3: Australia Industrial Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Australia Industrial Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 5: Australia Industrial Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Australia Industrial Coatings Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 7: Australia Industrial Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Australia Industrial Coatings Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: Australia Industrial Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 10: Australia Industrial Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 11: Australia Industrial Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Australia Industrial Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 13: Australia Industrial Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Australia Industrial Coatings Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 15: Australia Industrial Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Australia Industrial Coatings Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Industrial Coatings Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Australia Industrial Coatings Market?

Key companies in the market include AkzoNobel N V, Chugoku Marine Paints Ltd, The Sherwin-Williams Company, Jotun, RPM International Inc, Beckers Group, BASF SE, Axalta Coating Systems, Hempel A/S, Sika AG, PPG Industries, Dulux Protective Coatings, Wacker Chemie AG*List Not Exhaustive.

3. What are the main segments of the Australia Industrial Coatings Market?

The market segments include Resin Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2860 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protective Coatings; Increasing Usage of Corrosion Coatings.

6. What are the notable trends driving market growth?

Oil and Gas Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Harmful Environmental Impact of Solvent-borne Coatings; Other Restraints.

8. Can you provide examples of recent developments in the market?

June 2022: PPG introduced the PPG ENVIROCRONTM LUM coating, the industry's first commercial retroreflective powder coating. The patent-pending layer is designed to aid vision at night and in low-light conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Industrial Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Industrial Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Industrial Coatings Market?

To stay informed about further developments, trends, and reports in the Australia Industrial Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence