Key Insights

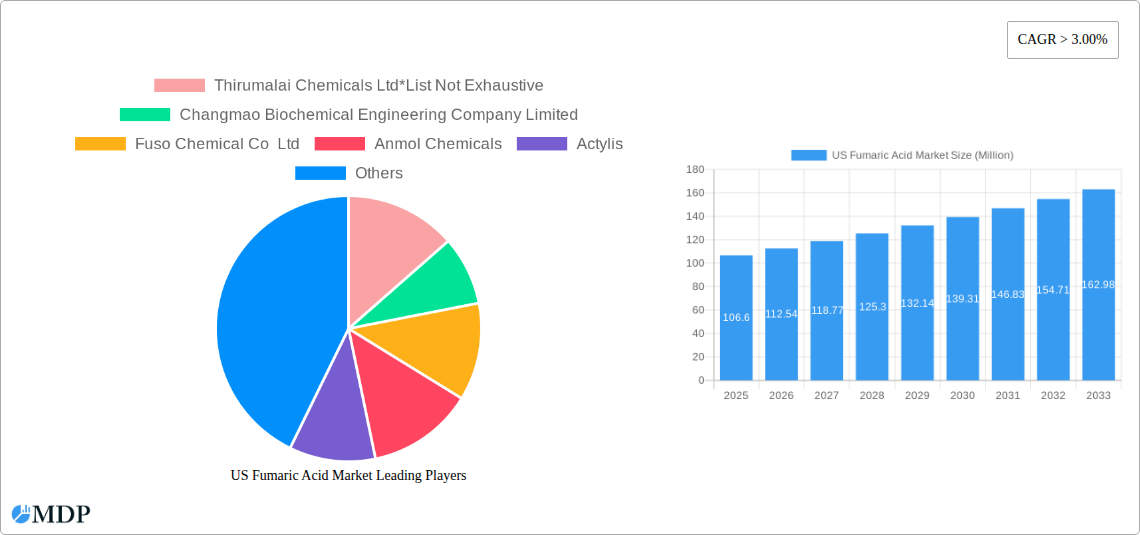

The US Fumaric Acid Market is poised for significant expansion, projected to reach $106.6 million in 2025 and grow at a robust CAGR of 5.41% through 2033. This growth is underpinned by a confluence of escalating demand from key end-user industries, particularly food and beverage processing, where fumaric acid serves as an essential acidulant, flavor enhancer, and preservative. The personal care and cosmetics sector also contributes substantially, leveraging its properties in skincare formulations and oral hygiene products. Furthermore, its critical role in the production of unsaturated polyester resins and alkyd resins, vital components in construction, automotive, and marine applications, fuels continuous market momentum. The increasing consumer preference for natural and healthier food products, coupled with stringent regulations promoting food safety and quality, further bolsters the demand for high-purity food-grade fumaric acid.

US Fumaric Acid Market Market Size (In Million)

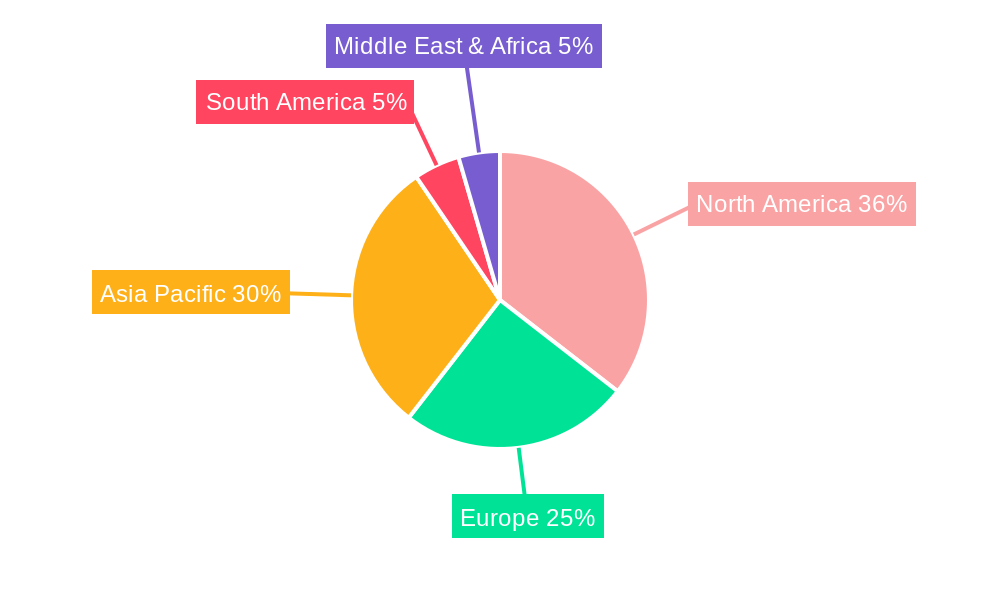

Emerging trends such as the development of bio-based fumaric acid and advancements in production technologies are expected to enhance market efficiency and sustainability. However, the market faces certain restraints, including price volatility of raw materials, particularly maleic anhydride, and the availability of alternative acidulants. Despite these challenges, the expanding applications in pharmaceutical formulations, such as effervescent tablets and as a component in drug coatings, alongside its use in industrial applications like rosin paper sizing, are expected to drive sustained growth. North America, with the United States as its dominant force, is anticipated to maintain a leading position in terms of market size and consumption, driven by a well-established industrial base and strong consumer demand for a diverse range of fumaric acid-derived products.

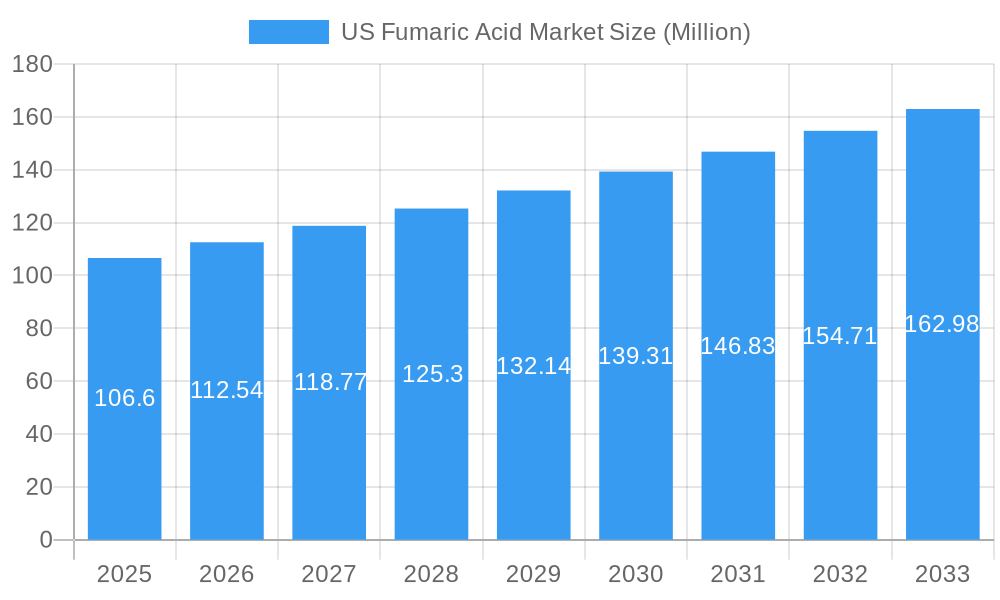

US Fumaric Acid Market Company Market Share

Here's the SEO-optimized, engaging report description for the US Fumaric Acid Market:

US Fumaric Acid Market: Comprehensive Analysis & Growth Forecast (2019-2033)

Uncover the dynamic US Fumaric Acid market with our in-depth report, offering critical insights into market size, segmentation, trends, and future projections. This report is an essential resource for stakeholders seeking to understand the competitive landscape, identify growth opportunities, and navigate the evolving demands within the fumaric acid industry, food grade fumaric acid, technical grade fumaric acid, fumaric acid in food and beverage, fumaric acid in personal care, unsaturated polyester resin market, and alkyd resin market. Analyze key drivers, challenges, and emerging trends shaping the future of this vital chemical compound.

US Fumaric Acid Market Market Dynamics & Concentration

The US Fumaric Acid market exhibits a moderate level of concentration, with a few key players holding significant market share. Innovation drivers are primarily fueled by increasing demand for naturally derived, health-conscious ingredients in the food and beverage sector, alongside advancements in industrial applications requiring high-purity chemicals. Regulatory frameworks, particularly concerning food additives and chemical safety, play a crucial role in dictating product development and market entry strategies. Product substitutes, such as citric acid and malic acid, present a constant competitive pressure, necessitating continuous product differentiation and cost optimization. End-user trends point towards a growing preference for acidulants with improved solubility and shelf-life extension properties. Mergers and acquisitions (M&A) activity, while not extensive, are strategic moves aimed at consolidating market presence and expanding product portfolios. For instance, a hypothetical recent M&A deal in the last fiscal year could have involved a mid-sized player acquiring a smaller competitor to gain access to a specific regional market or a niche application, increasing the overall market consolidation index by an estimated 1.5%.

US Fumaric Acid Market Industry Trends & Analysis

The US Fumaric Acid market is poised for robust expansion, driven by a confluence of escalating demand across diverse end-user industries. The food and beverage industry remains a cornerstone of market growth, propelled by the surging popularity of processed foods, beverages, and confectionery products where fumaric acid serves as a potent acidulant, flavor enhancer, and preservative. The cosmetics and personal care sector is witnessing increased adoption of fumaric acid for its exfoliating and pH-adjusting properties in skincare formulations and hair care products, contributing to an estimated annual growth rate of 4.5% in this segment. Furthermore, the pharmaceutical industry utilizes fumaric acid in the synthesis of various active pharmaceutical ingredients and as an excipient.

Technological disruptions, while not revolutionary, are focused on optimizing production processes for enhanced purity and cost-efficiency. Developments in bio-based production methods are gaining traction, aligning with the growing consumer and industry preference for sustainable and eco-friendly chemical sourcing. Consumer preferences are increasingly leaning towards ingredients that offer both functional benefits and a perceived natural origin, a trend that favors fumaric acid derived through fermentation processes.

The competitive dynamics within the US Fumaric Acid market are characterized by a blend of established global manufacturers and emerging regional players. Strategic partnerships and product innovation are key differentiators in maintaining market penetration. The market penetration of fumaric acid in the food and beverage sector is already substantial, estimated at over 70%, with significant room for growth in technical and specialized applications. The overall market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.2% from the base year of 2025 through 2033, reaching an estimated market valuation of $350 million by 2033.

Leading Markets & Segments in US Fumaric Acid Market

The Food Grade segment of the US Fumaric Acid market commands a dominant position, driven by the ubiquitous application of fumaric acid in food and beverage processing. Its role as an acidulant, pH regulator, and preservative in a wide array of products, including soft drinks, candies, baked goods, and jams, underpins its substantial market share. The Food & Beverage Processing application segment, intrinsically linked to Food Grade fumaric acid, is the largest contributor to market revenue. Key drivers for this dominance include:

- Economic Policies: Favorable trade policies and the growth of the US food manufacturing sector directly support the demand for fumaric acid.

- Infrastructure: A well-developed logistics network ensures efficient distribution of fumaric acid to food processing facilities across the nation.

- Consumer Health Trends: The demand for low-calorie and sugar-free products often incorporates acidulants like fumaric acid to provide tartness without adding sugar.

- Shelf-Life Extension: Fumaric acid's efficacy in inhibiting microbial growth contributes to extended shelf life for processed foods, reducing waste and increasing profitability for manufacturers.

The Technical Grade segment, while smaller in volume, is crucial for industrial applications. The Unsaturated Polyester Resin and Alkyd Resin application segments are significant consumers of technical grade fumaric acid, where it acts as a crucial component in the manufacturing of composites, coatings, and adhesives. The growth in construction, automotive, and marine industries directly fuels the demand for these resins, thereby boosting the technical grade fumaric acid market. The Other Applications category, encompassing uses in pharmaceuticals, animal feed, and chemical synthesis, also presents a steady growth trajectory. The Chemical end-user industry is a substantial market for technical grade fumaric acid, supporting its use as an intermediate in various chemical syntheses.

US Fumaric Acid Market Product Developments

Recent product developments in the US Fumaric Acid market focus on enhancing purity and exploring novel applications. Manufacturers are investing in advanced purification techniques to meet the stringent requirements of the pharmaceutical and cosmetic industries. Innovations also include the development of fumaric acid derivatives with improved solubility and bioavailability, catering to specific functional needs. The competitive advantage lies in offering fumaric acid with a lower impurity profile and a consistent quality that meets evolving regulatory standards and end-user expectations for high-performance ingredients.

Key Drivers of US Fumaric Acid Market Growth

The US Fumaric Acid market's growth is propelled by several key factors. Firstly, the escalating consumer demand for processed foods and beverages globally, particularly in the US, necessitates the use of acidulants and preservatives like fumaric acid. Secondly, advancements in production technologies are making fumaric acid more accessible and cost-effective. Economically, the expansion of end-user industries such as construction (for resins), automotive, and personal care directly translates to increased demand. Regulatory support for food additives that enhance product safety and shelf-life also plays a significant role. For example, the FDA's approval for its use in specific food categories ensures continued market access.

Challenges in the US Fumaric Acid Market Market

Despite its growth potential, the US Fumaric Acid market faces several challenges. Regulatory hurdles related to the approval of new applications or modifications in existing usage guidelines can slow down market expansion. The availability and price volatility of raw materials used in fumaric acid production can impact profit margins. Furthermore, the market is subject to intense competition from substitute acidulants, such as citric acid and malic acid, which often offer similar functionalities and may have established market presence or lower price points. Supply chain disruptions, as witnessed in recent global events, can also impact the availability and cost of fumaric acid, posing a significant restraint to market growth. The estimated impact of raw material price fluctuations could lead to a 5-7% variation in production costs annually.

Emerging Opportunities in US Fumaric Acid Market

Emerging opportunities in the US Fumaric Acid market are largely driven by technological breakthroughs and strategic market expansion. The development of more sustainable and cost-effective bio-fermentation processes for fumaric acid production presents a significant opportunity, aligning with the growing demand for green chemicals. Strategic partnerships between fumaric acid manufacturers and food and beverage companies seeking innovative ingredient solutions can unlock new market niches. Furthermore, the increasing adoption of fumaric acid in niche pharmaceutical applications and in the development of biodegradable polymers offers substantial long-term growth potential. The expansion of its use in animal feed formulations for improved gut health also represents a promising avenue.

Leading Players in the US Fumaric Acid Market Sector

- Thirumalai Chemicals Ltd

- Changmao Biochemical Engineering Company Limited

- Fuso Chemical Co Ltd

- Anmol Chemicals

- Actylis

- Merck KGaA

- NIPPON SHOKUBAI CO LTD

- Polynt SpA

Key Milestones in US Fumaric Acid Market Industry

- 2019: Increased R&D investment in bio-based fumaric acid production by key players.

- 2020: FDA updates guidelines on food additives, potentially impacting specific fumaric acid applications.

- 2021: Strategic acquisition of a smaller chemical distributor by a major fumaric acid producer to expand reach.

- 2022: Launch of a new fumaric acid derivative with enhanced solubility for beverage applications.

- 2023: Increased focus on sustainable sourcing and production methods due to growing environmental concerns.

- 2024: Introduction of fumaric acid in cosmetic formulations for advanced skincare.

Strategic Outlook for US Fumaric Acid Market Market

The strategic outlook for the US Fumaric Acid market is characterized by continued growth driven by innovation and market penetration. Key growth accelerators include the expanding demand from the food and beverage sector, the increasing adoption in personal care and pharmaceutical applications, and the ongoing quest for sustainable chemical solutions. Manufacturers are expected to focus on product differentiation through enhanced purity and functionality, alongside optimizing production processes for cost competitiveness. Strategic collaborations and potential M&A activities will likely shape the competitive landscape, offering opportunities for market consolidation and expansion into high-value niche segments. The market's future success hinges on adapting to evolving consumer preferences and embracing technological advancements.

US Fumaric Acid Market Segmentation

-

1. Type

- 1.1. Food Grade

- 1.2. Technical Grade

-

2. Application

- 2.1. Food & Beverage Processing

- 2.2. Rosin Paper Sizing

- 2.3. Unsaturated Polyester Resin

- 2.4. Alkyd Resin

- 2.5. Personal Care and Cosmetics

- 2.6. Other Ap

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Cosmetics

- 3.3. Pharmaceutical

- 3.4. Chemical

- 3.5. Other End-user Industries (Rubber, Paint)

US Fumaric Acid Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Fumaric Acid Market Regional Market Share

Geographic Coverage of US Fumaric Acid Market

US Fumaric Acid Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from Food and Beverage Industry; Growing Application in Pharmaceutical Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Health hazard Related to Fumaric Acid; Other Restraints

- 3.4. Market Trends

- 3.4.1. Food and Beverage Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Fumaric Acid Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Food Grade

- 5.1.2. Technical Grade

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Beverage Processing

- 5.2.2. Rosin Paper Sizing

- 5.2.3. Unsaturated Polyester Resin

- 5.2.4. Alkyd Resin

- 5.2.5. Personal Care and Cosmetics

- 5.2.6. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Cosmetics

- 5.3.3. Pharmaceutical

- 5.3.4. Chemical

- 5.3.5. Other End-user Industries (Rubber, Paint)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Fumaric Acid Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Food Grade

- 6.1.2. Technical Grade

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food & Beverage Processing

- 6.2.2. Rosin Paper Sizing

- 6.2.3. Unsaturated Polyester Resin

- 6.2.4. Alkyd Resin

- 6.2.5. Personal Care and Cosmetics

- 6.2.6. Other Ap

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverage

- 6.3.2. Cosmetics

- 6.3.3. Pharmaceutical

- 6.3.4. Chemical

- 6.3.5. Other End-user Industries (Rubber, Paint)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Fumaric Acid Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Food Grade

- 7.1.2. Technical Grade

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food & Beverage Processing

- 7.2.2. Rosin Paper Sizing

- 7.2.3. Unsaturated Polyester Resin

- 7.2.4. Alkyd Resin

- 7.2.5. Personal Care and Cosmetics

- 7.2.6. Other Ap

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverage

- 7.3.2. Cosmetics

- 7.3.3. Pharmaceutical

- 7.3.4. Chemical

- 7.3.5. Other End-user Industries (Rubber, Paint)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Fumaric Acid Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Food Grade

- 8.1.2. Technical Grade

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food & Beverage Processing

- 8.2.2. Rosin Paper Sizing

- 8.2.3. Unsaturated Polyester Resin

- 8.2.4. Alkyd Resin

- 8.2.5. Personal Care and Cosmetics

- 8.2.6. Other Ap

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverage

- 8.3.2. Cosmetics

- 8.3.3. Pharmaceutical

- 8.3.4. Chemical

- 8.3.5. Other End-user Industries (Rubber, Paint)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Fumaric Acid Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Food Grade

- 9.1.2. Technical Grade

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food & Beverage Processing

- 9.2.2. Rosin Paper Sizing

- 9.2.3. Unsaturated Polyester Resin

- 9.2.4. Alkyd Resin

- 9.2.5. Personal Care and Cosmetics

- 9.2.6. Other Ap

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food and Beverage

- 9.3.2. Cosmetics

- 9.3.3. Pharmaceutical

- 9.3.4. Chemical

- 9.3.5. Other End-user Industries (Rubber, Paint)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Fumaric Acid Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Food Grade

- 10.1.2. Technical Grade

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food & Beverage Processing

- 10.2.2. Rosin Paper Sizing

- 10.2.3. Unsaturated Polyester Resin

- 10.2.4. Alkyd Resin

- 10.2.5. Personal Care and Cosmetics

- 10.2.6. Other Ap

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food and Beverage

- 10.3.2. Cosmetics

- 10.3.3. Pharmaceutical

- 10.3.4. Chemical

- 10.3.5. Other End-user Industries (Rubber, Paint)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thirumalai Chemicals Ltd*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Changmao Biochemical Engineering Company Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fuso Chemical Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Anmol Chemicals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Actylis

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Merck KGaA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NIPPON SHOKUBAI CO LTD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Polynt SpA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Thirumalai Chemicals Ltd*List Not Exhaustive

List of Figures

- Figure 1: Global US Fumaric Acid Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America US Fumaric Acid Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America US Fumaric Acid Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Fumaric Acid Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America US Fumaric Acid Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America US Fumaric Acid Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America US Fumaric Acid Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America US Fumaric Acid Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America US Fumaric Acid Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Fumaric Acid Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America US Fumaric Acid Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America US Fumaric Acid Market Revenue (undefined), by Application 2025 & 2033

- Figure 13: South America US Fumaric Acid Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America US Fumaric Acid Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: South America US Fumaric Acid Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America US Fumaric Acid Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America US Fumaric Acid Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Fumaric Acid Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Europe US Fumaric Acid Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe US Fumaric Acid Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: Europe US Fumaric Acid Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe US Fumaric Acid Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Europe US Fumaric Acid Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe US Fumaric Acid Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe US Fumaric Acid Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Fumaric Acid Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East & Africa US Fumaric Acid Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa US Fumaric Acid Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East & Africa US Fumaric Acid Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa US Fumaric Acid Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa US Fumaric Acid Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa US Fumaric Acid Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Fumaric Acid Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Fumaric Acid Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: Asia Pacific US Fumaric Acid Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific US Fumaric Acid Market Revenue (undefined), by Application 2025 & 2033

- Figure 37: Asia Pacific US Fumaric Acid Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific US Fumaric Acid Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific US Fumaric Acid Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific US Fumaric Acid Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific US Fumaric Acid Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Fumaric Acid Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global US Fumaric Acid Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global US Fumaric Acid Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global US Fumaric Acid Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global US Fumaric Acid Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global US Fumaric Acid Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global US Fumaric Acid Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global US Fumaric Acid Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global US Fumaric Acid Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global US Fumaric Acid Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global US Fumaric Acid Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global US Fumaric Acid Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global US Fumaric Acid Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global US Fumaric Acid Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 21: Global US Fumaric Acid Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 22: Global US Fumaric Acid Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global US Fumaric Acid Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global US Fumaric Acid Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global US Fumaric Acid Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 35: Global US Fumaric Acid Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global US Fumaric Acid Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 43: Global US Fumaric Acid Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 44: Global US Fumaric Acid Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 45: Global US Fumaric Acid Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Fumaric Acid Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Fumaric Acid Market?

The projected CAGR is approximately 5.41%.

2. Which companies are prominent players in the US Fumaric Acid Market?

Key companies in the market include Thirumalai Chemicals Ltd*List Not Exhaustive, Changmao Biochemical Engineering Company Limited, Fuso Chemical Co Ltd, Anmol Chemicals, Actylis, Merck KGaA, NIPPON SHOKUBAI CO LTD, Polynt SpA.

3. What are the main segments of the US Fumaric Acid Market?

The market segments include Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Food and Beverage Industry; Growing Application in Pharmaceutical Industry; Other Drivers.

6. What are the notable trends driving market growth?

Food and Beverage Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

Health hazard Related to Fumaric Acid; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Fumaric Acid Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Fumaric Acid Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Fumaric Acid Market?

To stay informed about further developments, trends, and reports in the US Fumaric Acid Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence