Key Insights

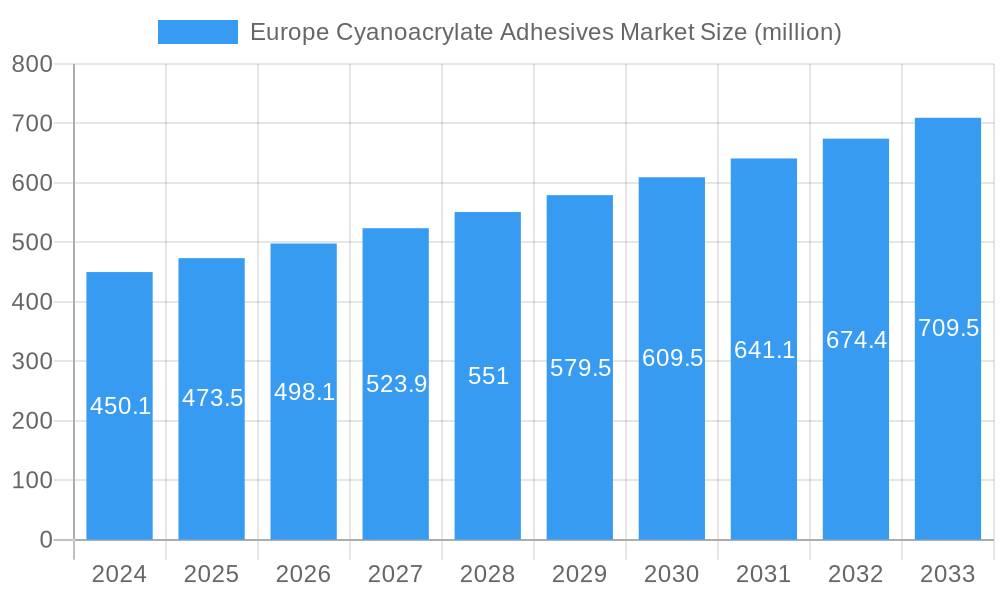

The Europe Cyanoacrylate Adhesives Market is poised for significant expansion, driven by robust demand across diverse end-user industries. In 2024, the market size stood at an estimated 450.1 million Euros, with a projected Compound Annual Growth Rate (CAGR) of 5.2% from 2025 through 2033. This upward trajectory is primarily fueled by the increasing adoption of cyanoacrylate adhesives in the automotive sector for lightweighting initiatives and enhanced assembly processes, alongside their growing application in aerospace for structural bonding and repair. Furthermore, the building and construction industry is witnessing a surge in demand for these fast-curing adhesives in specialized applications like panel bonding and furniture assembly, contributing to market growth. Innovations in adhesive technology, particularly advancements in UV-cured cyanoacrylates offering superior performance and faster curing times, are also acting as significant growth catalysts, enabling more efficient manufacturing and assembly operations. The market's expansion is further supported by evolving manufacturing techniques that prioritize speed and precision, where cyanoacrylate adhesives excel.

Europe Cyanoacrylate Adhesives Market Market Size (In Million)

Despite the strong growth outlook, certain factors could temper the market's full potential. While the inherent strengths of cyanoacrylate adhesives, such as rapid bonding and high tensile strength, continue to drive adoption, challenges related to their brittleness in certain applications and potential sensitivity to moisture can present limitations. However, ongoing research and development are actively addressing these constraints through formulations that offer increased flexibility and improved environmental resistance. The "Other End-user Industries" segment is expected to represent a substantial and growing portion of the market, encompassing areas like electronics, medical devices, and general manufacturing, where the precision and speed of cyanoacrylates are highly valued. Key players like Henkel AG & Co KGaA, 3M, and H.B. Fuller Company are at the forefront of innovation, investing in R&D to develop advanced cyanoacrylate solutions tailored to specific industry needs and to overcome existing market restraints, ensuring sustained market momentum.

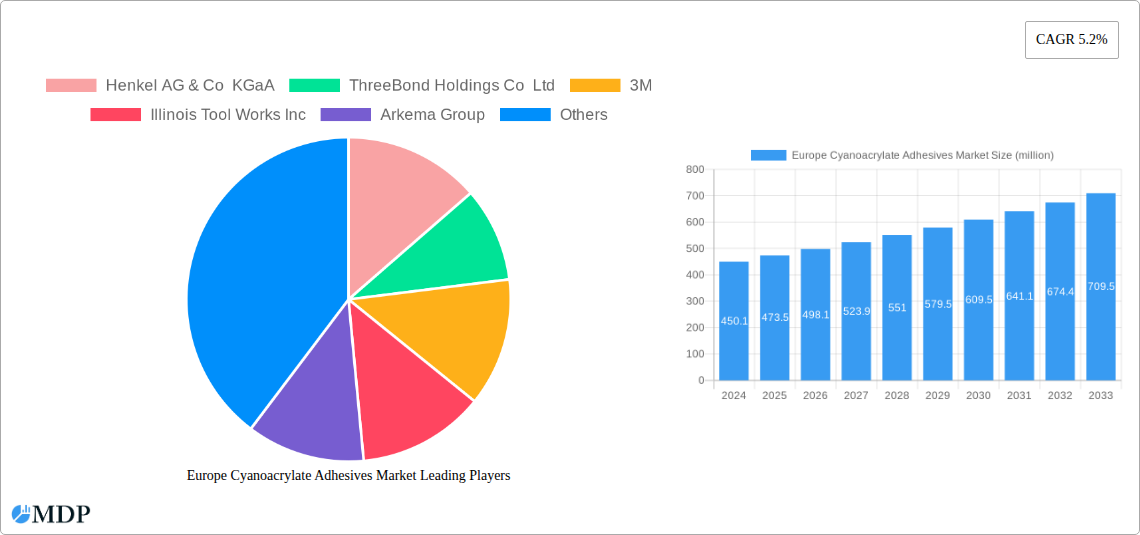

Europe Cyanoacrylate Adhesives Market Company Market Share

Europe Cyanoacrylate Adhesives Market: Comprehensive Analysis and Future Outlook (2019-2033)

Dive into the dynamic Europe cyanoacrylate adhesives market with this in-depth report. Exploring the study period of 2019–2033, with a base year and estimated year of 2025, this analysis provides unparalleled insights into reactive adhesives, UV cured adhesives, and their applications across key end-user industries such as aerospace, automotive, building and construction, footwear and leather, healthcare, and woodworking and joinery. Understand the competitive landscape shaped by industry leaders like Henkel AG & Co KGaA, ThreeBond Holdings Co Ltd, 3M, Illinois Tool Works Inc, Arkema Group, H B Fuller Company, Soudal Holding N V, Jowat SE, Permabond LLC, and DELO Industrie Klebstoffe GmbH & Co KGaA. This report offers critical data, future projections, and actionable strategies for stakeholders seeking to capitalize on the growing demand for high-performance bonding solutions in Europe.

Europe Cyanoacrylate Adhesives Market Market Dynamics & Concentration

The Europe cyanoacrylate adhesives market is characterized by a moderately concentrated competitive landscape, with a few key players holding significant market share. Innovation drivers are primarily fueled by the increasing demand for faster curing times, enhanced bond strength, and specialized formulations tailored to demanding applications. Regulatory frameworks, particularly concerning environmental impact and worker safety, are continuously evolving and influencing product development and adoption. Product substitutes, such as epoxies and polyurethanes, pose a competitive threat, but the unique rapid bonding capabilities of cyanoacrylates often provide a distinct advantage. End-user trends highlight a growing preference for lightweight, durable materials and efficient manufacturing processes, directly benefiting the automotive and aerospace sectors. Mergers and acquisitions (M&A) activity plays a crucial role in market consolidation and expansion. For instance, H.B. Fuller's acquisitions of Fourny NV and Apollo Chemicals underscore a strategic push to strengthen its European presence and construction adhesives portfolio. M&A deal counts are expected to remain steady as companies seek to acquire new technologies, expand market reach, and achieve economies of scale. The market anticipates a growing emphasis on sustainable adhesive solutions and bio-based cyanoacrylates.

Europe Cyanoacrylate Adhesives Market Industry Trends & Analysis

The Europe cyanoacrylate adhesives market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025–2033. This growth is intrinsically linked to the sustained industrial expansion across various European economies and the increasing adoption of advanced manufacturing techniques. Market penetration of cyanoacrylate adhesives is steadily rising, driven by their versatility and cost-effectiveness compared to traditional fastening methods. Key market growth drivers include the escalating demand from the automotive industry for lightweighting solutions, which reduces vehicle weight and improves fuel efficiency, and the stringent requirements of the aerospace sector for high-strength, reliable bonding in critical components. The building and construction industry is also a significant contributor, with cyanoacrylates finding applications in panel bonding, furniture assembly, and architectural elements where rapid setting and strong adhesion are paramount. Technological disruptions are largely centered on developing low-odor, low-blooming formulations that improve worker comfort and product aesthetics, particularly crucial for consumer-facing applications in footwear and leather and woodworking and joinery. Furthermore, advancements in UV cured adhesives are offering even faster curing speeds and enhanced performance characteristics, catering to high-volume manufacturing processes. Consumer preferences are shifting towards products that are durable, aesthetically pleasing, and assembled efficiently, directly influencing the demand for high-performance adhesives. The competitive dynamics are shaped by a blend of global giants and specialized regional players, each vying for market share through product innovation, strategic partnerships, and targeted marketing efforts. The increasing focus on sustainability is also driving the development of cyanoacrylate adhesives with reduced volatile organic compound (VOC) emissions and improved recyclability. The healthcare industry is also a growing segment, with cyanoacrylates being used in medical device assembly due to their biocompatibility and rapid bonding capabilities.

Leading Markets & Segments in Europe Cyanoacrylate Adhesives Market

The automotive segment is a dominant force within the Europe cyanoacrylate adhesives market, driven by the region's strong automotive manufacturing base and the continuous pursuit of vehicle lightweighting and improved assembly efficiency. The building and construction industry represents another significant growth area, propelled by ongoing infrastructure development projects and the increasing use of advanced bonding solutions in residential and commercial construction. Within the Technology segmentation, reactive adhesives currently hold a larger market share due to their established versatility and broad range of applications. However, UV cured adhesives are witnessing rapid growth, fueled by their extremely fast curing times and suitability for automated, high-volume production lines prevalent in sectors like electronics and medical device assembly.

- Dominant Regions/Countries: Germany, France, and the United Kingdom are the leading markets within Europe, owing to their robust industrial sectors, significant manufacturing output, and high adoption rates of advanced technologies. Economic policies supporting industrial innovation and infrastructure investments further bolster their market leadership.

- Automotive Industry Dominance: The automotive sector's insatiable demand for adhesives that facilitate the bonding of dissimilar materials, enhance structural integrity, and contribute to vehicle lightweighting makes it a cornerstone of the cyanoacrylate adhesives market. The increasing production of electric vehicles, with their unique assembly requirements, further amplifies this trend.

- Building and Construction Growth: Factors such as urban regeneration projects, demand for energy-efficient buildings, and the use of prefabricated construction elements are driving the adoption of cyanoacrylate adhesives in this sector. Their ability to provide rapid structural bonding in challenging environments is a key advantage.

- Aerospace Sector Requirements: The stringent safety and performance standards in the aerospace industry necessitate adhesives with exceptional bond strength, durability, and resistance to extreme conditions. Cyanoacrylates are increasingly being explored and utilized for interior cabin assembly and non-critical component bonding, contributing to market expansion.

- Healthcare Applications: The growing demand for precision in medical device manufacturing, where rapid, secure, and biocompatible bonding is crucial, is positioning the healthcare segment as a vital area for cyanoacrylate adhesive growth. This includes applications in surgical instruments, diagnostic equipment, and wearable health monitors.

- Footwear and Leather Industry: Cyanoacrylates' quick setting times and strong adhesion are highly valued in the footwear and leather industries for rapid assembly and repair applications, contributing to efficient production processes and product durability.

- Woodworking and Joinery: In woodworking, cyanoacrylates are employed for their ability to provide instant fixturing and strong bonds in furniture assembly, cabinetry, and custom joinery, enhancing production speed and the quality of finished products.

Europe Cyanoacrylate Adhesives Market Product Developments

Product developments in the Europe cyanoacrylate adhesives market are focused on enhancing performance and addressing specific application needs. Innovations include the development of low-odor, low-blooming formulations that improve user experience and product aesthetics, particularly in consumer goods and sensitive medical applications. High-performance cyanoacrylates are emerging with superior temperature resistance, chemical inertness, and impact strength, catering to demanding automotive and aerospace applications. Advancements in UV cured adhesives offer accelerated curing, precise application control, and improved bond line clarity. These developments aim to provide competitive advantages by enabling faster production cycles, creating more durable and aesthetically pleasing end products, and expanding the range of substrates that can be effectively bonded.

Key Drivers of Europe Cyanoacrylate Adhesives Market Growth

The Europe cyanoacrylate adhesives market is propelled by several key drivers. Technological advancements in adhesive formulations, such as improved temperature resistance and faster curing times, are critical. The burgeoning demand from the automotive industry for lightweighting solutions and efficient assembly processes is a significant economic factor. Furthermore, increasing investments in infrastructure and construction projects across Europe, coupled with the need for durable and fast-bonding solutions in these sectors, act as substantial growth catalysts. Regulatory support for advanced manufacturing techniques and the push for sustainable materials are also fostering innovation and adoption within the reactive adhesives and UV cured adhesives segments.

Challenges in the Europe Cyanoacrylate Adhesives Market Market

Despite its growth trajectory, the Europe cyanoacrylate adhesives market faces certain challenges. Stringent regulatory frameworks concerning chemical safety and environmental impact necessitate continuous product reformulation and compliance efforts, potentially increasing R&D costs. Supply chain disruptions and volatility in raw material prices can impact production costs and product availability. The availability of effective product substitutes from other adhesive chemistries, while often addressed by unique cyanoacrylate properties, remains a competitive pressure. Moreover, the need for specialized application equipment and training for certain high-performance cyanoacrylate formulations can present a barrier to widespread adoption in smaller enterprises.

Emerging Opportunities in Europe Cyanoacrylate Adhesives Market

Emerging opportunities in the Europe cyanoacrylate adhesives market lie in the increasing demand for sustainable and bio-based adhesive solutions, aligning with Europe's green initiatives. The growing healthcare sector, with its need for biocompatible and rapidly curing adhesives in medical device manufacturing, presents a significant untapped potential. Technological breakthroughs in developing cyanoacrylates with enhanced flexibility, toughness, and adhesion to a wider range of substrates will open new application avenues. Strategic partnerships between adhesive manufacturers and key end-users in the aerospace and automotive industries can foster co-development and accelerate the adoption of customized solutions, driving long-term growth. Expansion into niche markets and specialized applications within building and construction and woodworking and joinery also offers considerable scope.

Leading Players in the Europe Cyanoacrylate Adhesives Market Sector

- Henkel AG & Co KGaA

- ThreeBond Holdings Co Ltd

- 3M

- Illinois Tool Works Inc

- Arkema Group

- H B Fuller Company

- Soudal Holding N V

- Jowat SE

- Permabond LLC

- DELO Industrie Klebstoffe GmbH & Co KGaA

Key Milestones in Europe Cyanoacrylate Adhesives Market Industry

- May 2022: ITW Performance Polymers announced a distribution partnership with PREMA SA in Poland for its Devcon brand, expanding its market reach and distribution network for specialized adhesives.

- February 2022: H.B. Fuller announced the acquisition of Fourny NV, a significant move to strengthen its Construction Adhesives business in Europe and enhance its product portfolio in this key sector.

- January 2022: H.B. Fuller announced the acquisition of UK-based Apollo Chemicals, a strategic step to expand its footprint in the European market and bolster its offerings in various industrial adhesive segments.

Strategic Outlook for Europe Cyanoacrylate Adhesives Market Market

The strategic outlook for the Europe cyanoacrylate adhesives market is highly optimistic, driven by continued innovation and expanding application frontiers. Growth accelerators include the relentless pursuit of lightweighting in the automotive and aerospace industries, where cyanoacrylates offer critical bonding solutions. The increasing adoption of advanced manufacturing technologies, particularly automation and faster production lines, favors the rapid curing capabilities of UV cured adhesives. Furthermore, the focus on sustainability and the development of eco-friendly formulations will unlock new market segments and enhance brand loyalty. Strategic opportunities lie in forging deeper collaborations with end-users to develop bespoke adhesive solutions for emerging technological challenges and in exploring untapped potential within the healthcare and renewable energy sectors. The market is expected to witness continued consolidation and strategic partnerships aimed at enhancing market presence and technological leadership.

Europe Cyanoacrylate Adhesives Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Footwear and Leather

- 1.5. Healthcare

- 1.6. Woodworking and Joinery

- 1.7. Other End-user Industries

-

2. Technology

- 2.1. Reactive

- 2.2. UV Cured Adhesives

Europe Cyanoacrylate Adhesives Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

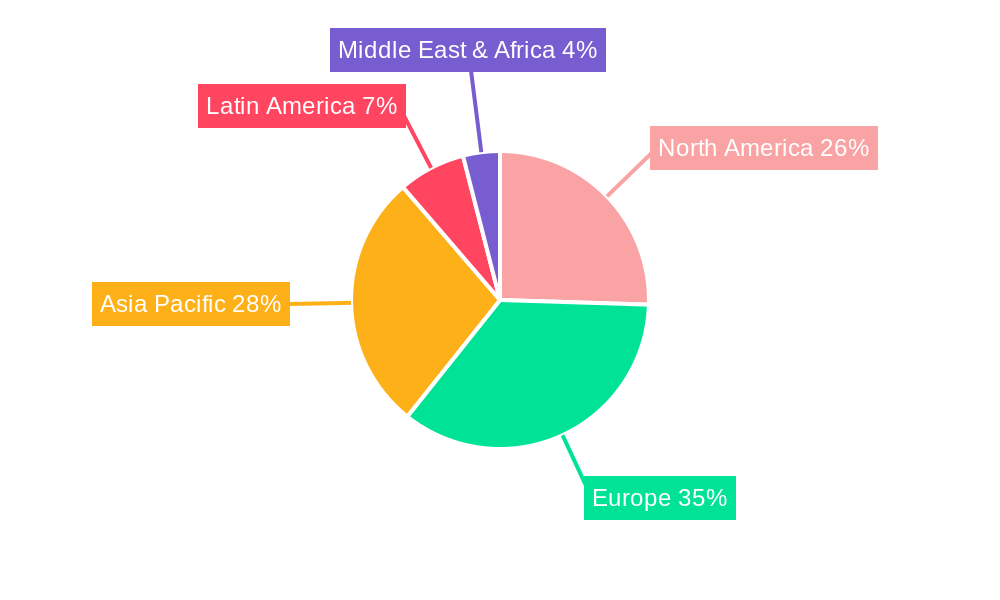

Europe Cyanoacrylate Adhesives Market Regional Market Share

Geographic Coverage of Europe Cyanoacrylate Adhesives Market

Europe Cyanoacrylate Adhesives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Rising Need for Refrigerators

- 3.2.2 Air Conditioners

- 3.2.3 and Chillers; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; HFCs as Potent Greenhouse Gases with High Global Warming Potential (GWP); Other Restraints

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Cyanoacrylate Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Footwear and Leather

- 5.1.5. Healthcare

- 5.1.6. Woodworking and Joinery

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Reactive

- 5.2.2. UV Cured Adhesives

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ThreeBond Holdings Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3M

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Illinois Tool Works Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arkema Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 H B Fuller Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Soudal Holding N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Jowat SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Permabond LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DELO Industrie Klebstoffe GmbH & Co KGaA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Europe Cyanoacrylate Adhesives Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Cyanoacrylate Adhesives Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Cyanoacrylate Adhesives Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 2: Europe Cyanoacrylate Adhesives Market Revenue million Forecast, by Technology 2020 & 2033

- Table 3: Europe Cyanoacrylate Adhesives Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Cyanoacrylate Adhesives Market Revenue million Forecast, by End User Industry 2020 & 2033

- Table 5: Europe Cyanoacrylate Adhesives Market Revenue million Forecast, by Technology 2020 & 2033

- Table 6: Europe Cyanoacrylate Adhesives Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Cyanoacrylate Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Cyanoacrylate Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Cyanoacrylate Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Cyanoacrylate Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Cyanoacrylate Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Cyanoacrylate Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Cyanoacrylate Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Cyanoacrylate Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Cyanoacrylate Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Cyanoacrylate Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Cyanoacrylate Adhesives Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Cyanoacrylate Adhesives Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Europe Cyanoacrylate Adhesives Market?

Key companies in the market include Henkel AG & Co KGaA, ThreeBond Holdings Co Ltd, 3M, Illinois Tool Works Inc, Arkema Group, H B Fuller Company, Soudal Holding N V, Jowat SE, Permabond LLC, DELO Industrie Klebstoffe GmbH & Co KGaA.

3. What are the main segments of the Europe Cyanoacrylate Adhesives Market?

The market segments include End User Industry, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 450.1 million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Need for Refrigerators. Air Conditioners. and Chillers; Other Drivers.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; HFCs as Potent Greenhouse Gases with High Global Warming Potential (GWP); Other Restraints.

8. Can you provide examples of recent developments in the market?

May 2022: ITW Performance Polymers announced a distribution partnership with PREMA SA in Poland for its Devcon brand.February 2022: H.B. Fuller announced the acquisition of Fourny NV to strengthen its Construction Adhesives business in Europe.January 2022: H.B. Fuller announced the acquisition of UK-based Apollo Chemicals to expand its foothold in the European market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Cyanoacrylate Adhesives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Cyanoacrylate Adhesives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Cyanoacrylate Adhesives Market?

To stay informed about further developments, trends, and reports in the Europe Cyanoacrylate Adhesives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence