Key Insights

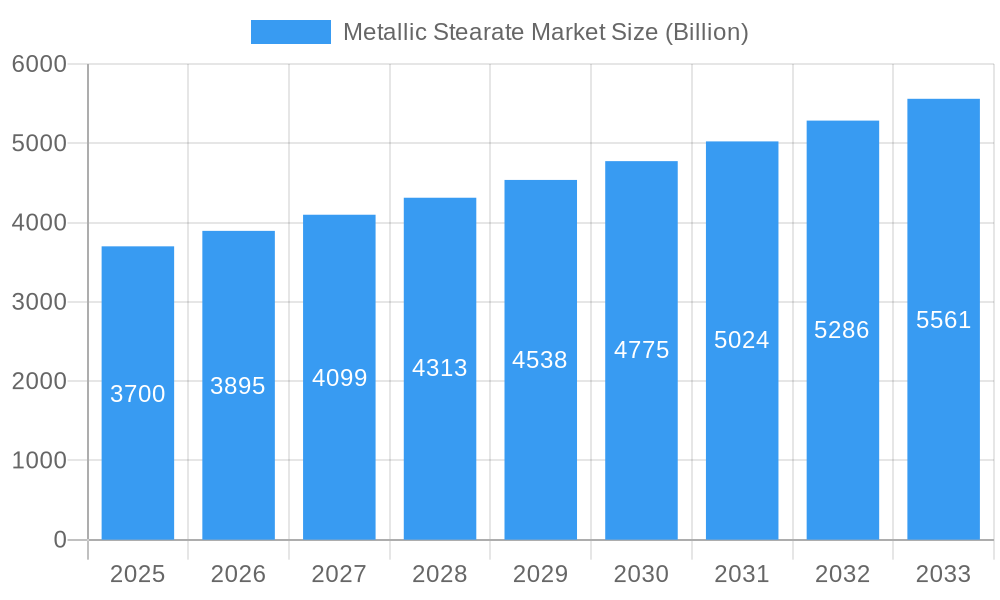

The global Metallic Stearate Market is poised for significant expansion, projected to reach USD 3.7 Billion by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 5.4% through 2033. This steady growth is underpinned by several critical drivers, primarily the burgeoning demand from the plastics industry, where metallic stearates serve as indispensable lubricants, mold release agents, and stabilizers. The pharmaceutical sector also contributes substantially, leveraging their properties as excipients and flow aids. Furthermore, the increasing adoption of metallic stearates in personal care products and construction materials, driven by their enhancing functionalities, further fuels market momentum. Emerging economies, particularly in the Asia Pacific region, are showcasing accelerated growth due to rapid industrialization and a rising middle class, leading to increased consumption across various end-use industries.

Metallic Stearate Market Market Size (In Billion)

The market segmentation reveals a diverse landscape, with Zinc Stearate, Calcium Stearate, and Magnesium Stearate holding prominent positions due to their widespread applications. While the overall outlook is positive, certain restraints, such as fluctuating raw material prices and the availability of alternative additives, could present minor challenges. However, continuous innovation in product development and the exploration of new applications are expected to mitigate these concerns. Key players are actively investing in research and development, expanding their production capacities, and forging strategic partnerships to solidify their market presence. The competitive landscape is characterized by a mix of established global manufacturers and emerging regional players, all vying for a larger share of this expanding market. The market is anticipated to witness strategic collaborations and mergers & acquisitions as companies seek to enhance their product portfolios and geographical reach.

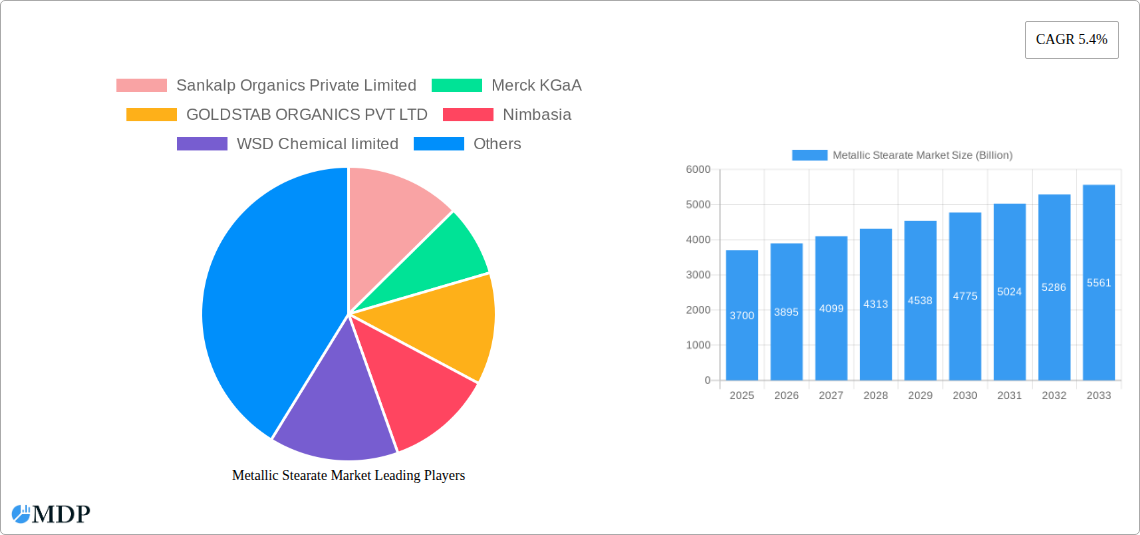

Metallic Stearate Market Company Market Share

Metallic Stearate Market: Comprehensive Analysis, Trends, and Forecast (2019–2033)

Unlock critical insights into the global Metallic Stearate Market with our in-depth report. This comprehensive study delves into market dynamics, industry trends, leading segments, product developments, key growth drivers, challenges, and emerging opportunities. Covering the period from 2019 to 2033, with a base year of 2025, our report provides actionable intelligence for stakeholders seeking to capitalize on this rapidly evolving sector. With an estimated market size of XX Billion USD in 2025, the metallic stearates market is projected to reach XX Billion USD by 2033, exhibiting a robust CAGR of XX% during the forecast period. This report is essential for manufacturers, suppliers, distributors, and investors in the plastics, rubber, pharmaceuticals, personal care, construction materials, and paints & coatings industries.

Metallic Stearate Market Dynamics & Concentration

The metallic stearate market exhibits a moderate to high concentration, with a significant presence of key global players alongside regional manufacturers. Innovation drivers are primarily focused on developing stearates with enhanced performance characteristics, such as improved thermal stability, reduced dusting, and tailored rheological properties for specific applications. Regulatory frameworks, particularly concerning food contact materials and environmental sustainability, are increasingly influencing product development and manufacturing processes. Product substitutes, though present, often struggle to match the cost-effectiveness and diverse functional benefits of metallic stearates in their primary applications. End-user trends are leaning towards eco-friendly formulations and materials with a lower environmental footprint. Mergers and acquisitions (M&A) activities, while not exceptionally high, have played a role in market consolidation and expansion of product portfolios. For instance, the acquisition of smaller, specialized players by larger chemical conglomerates allows for enhanced market reach and synergistic product offerings. The market share distribution is characterized by several leading companies holding substantial portions, while a considerable number of smaller entities cater to niche markets. M&A deal counts have averaged around X per year during the historical period, indicating strategic moves for market penetration and technological integration.

- Market Concentration: Moderate to High, with a few key global players.

- Innovation Drivers: Enhanced performance, sustainability, reduced dusting.

- Regulatory Influence: Food contact, environmental compliance, REACH.

- Product Substitutes: Limited in core applications, cost and performance trade-offs.

- End-User Trends: Demand for sustainable and high-performance solutions.

- M&A Activities: Strategic for consolidation, market expansion, and portfolio enhancement.

Metallic Stearate Market Industry Trends & Analysis

The metallic stearate market is poised for significant expansion driven by several overarching industry trends and robust growth drivers. The increasing demand from the plastics industry for effective lubricants, release agents, and stabilizers is a primary catalyst. As polymer consumption continues to rise globally, particularly in packaging, automotive, and construction sectors, so too does the need for metallic stearates like zinc stearate and calcium stearate to improve processing efficiency and final product quality. The rubber industry also presents a substantial market, where these compounds act as processing aids, anti-tack agents, and activators, crucial for tire manufacturing and other rubber product applications.

Technological disruptions are shaping the market through the development of advanced manufacturing techniques that improve stearate purity and consistency, leading to higher-performing products. Innovations in particle size control and surface modification are enabling customized stearates for specialized applications, such as high-temperature plastics or sensitive pharmaceutical formulations. Consumer preferences are increasingly shifting towards healthier and safer products, boosting the demand for metallic stearates in personal care applications like cosmetics and toiletries, where they function as emulsifiers, thickeners, and opacifiers. Similarly, the pharmaceutical sector utilizes them as glidants and anti-adherents in tablet manufacturing.

The construction materials industry benefits from metallic stearates as waterproofing agents and cement additives, contributing to the durability and performance of building products. Paints and coatings also leverage these additives for improved pigment dispersion and matting effects. Competitive dynamics are characterized by fierce competition among established players and emerging manufacturers, necessitating continuous innovation and strategic partnerships. The market penetration of metallic stearates is high across their primary applications, reflecting their indispensable role in numerous industrial processes. The projected CAGR of XX% underscores the sustained growth trajectory, fueled by both existing applications and the development of new use cases. The global market size is estimated to be XX Billion USD in 2025, with a projected growth to XX Billion USD by 2033.

Leading Markets & Segments in Metallic Stearate Market

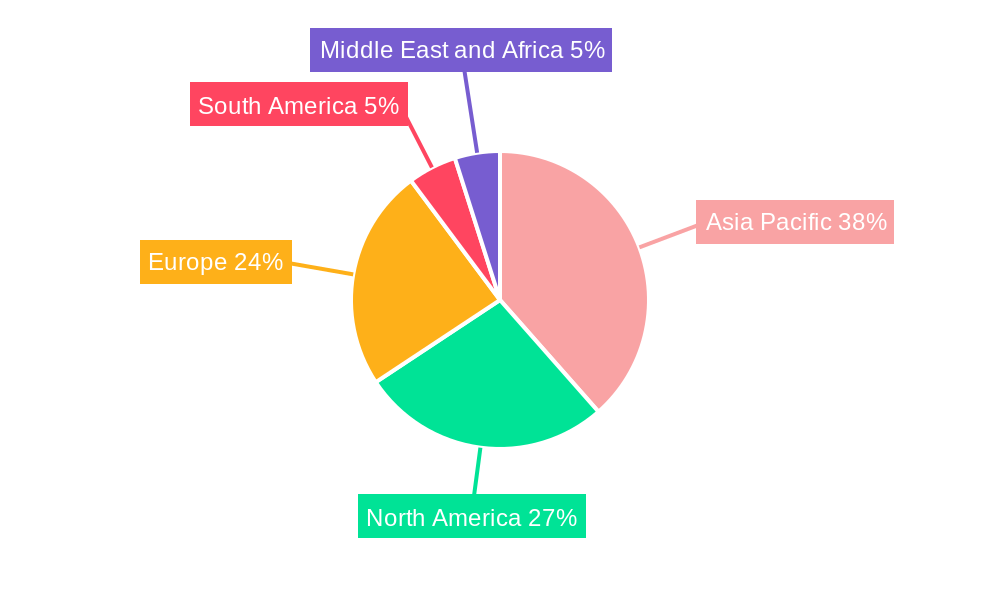

The metallic stearate market is characterized by the dominance of specific regions and product/application segments. Asia Pacific has emerged as the leading region, propelled by rapid industrialization, a burgeoning manufacturing base, and substantial investments in infrastructure and construction. Countries like China and India are significant consumers due to their large-scale plastic production, automotive manufacturing, and expanding construction activities. Economic policies favoring manufacturing growth and infrastructure development have further solidified Asia Pacific's position.

Within product segments, Zinc Stearate holds a prominent market share. Its widespread use as a lubricant, release agent, and stabilizer in the plastics and rubber industries, coupled with its effectiveness and cost-efficiency, makes it a high-demand product. Its application extends to paints and coatings for matting effects and to personal care products as an anti-caking agent.

In terms of applications, the Plastic segment is the largest contributor to the metallic stearate market. The sheer volume of plastic production and its diverse applications across packaging, automotive components, consumer goods, and construction materials drives the demand for stearates as processing aids and performance enhancers. Calcium stearate, zinc stearate, and aluminum stearate are extensively used in this sector.

- Dominant Region: Asia Pacific, driven by industrialization and manufacturing growth.

- Key Economic Drivers: Government incentives for manufacturing, infrastructure development projects, and a large consumer base.

- Infrastructure Impact: Growth in construction and automotive sectors directly fuels demand.

- Leading Product Segment: Zinc Stearate, due to its versatility and cost-effectiveness.

- Key Application Drivers: Lubrication in plastics, release agent in rubber, matting agent in coatings.

- Dominant Application Segment: Plastic, representing the largest consumption volume.

- Key Drivers: Expansion of polymer applications in packaging, automotive, and consumer goods.

- Material Usage: Widespread adoption of zinc, calcium, and aluminum stearates.

- Other Significant Segments:

- Rubber: Crucial for tire manufacturing and other rubber goods.

- Personal Care: Growing demand for safe and effective cosmetic ingredients.

- Pharmaceuticals: Essential for tablet manufacturing as glidants and anti-adherents.

- Construction Materials: Used as waterproofing agents and cement additives.

- Paints and Coatings: Utilized for pigment dispersion and surface finishing.

Metallic Stearate Market Product Developments

Product development in the metallic stearate market is actively focused on enhancing their functionality and sustainability. Innovations are geared towards creating highly pure, low-dusting stearates that offer superior lubrication and release properties in demanding polymer processing. For instance, advancements in production techniques have led to micronized stearates with controlled particle sizes, improving dispersion and preventing agglomeration in sensitive formulations. Furthermore, there is a growing emphasis on developing stearates from renewable or recycled sources, aligning with the global push for greener chemical solutions. These developments aim to provide a competitive edge by offering tailored solutions that meet stringent industry standards and evolving consumer preferences for eco-friendly materials.

Key Drivers of Metallic Stearate Market Growth

The metallic stearate market is propelled by several significant growth drivers. The burgeoning plastics industry, fueled by demand from packaging, automotive, and construction sectors, is a primary engine. Increased consumption of rubber in tire manufacturing and other industrial applications also boosts demand. Technological advancements in manufacturing processes are leading to higher purity and better-performing stearates. Furthermore, the growing personal care and pharmaceutical industries, which utilize stearates for their emollient, emulsifying, and anti-caking properties, contribute significantly. Supportive government regulations in some regions, promoting domestic manufacturing and industrial growth, indirectly benefit the market.

Challenges in the Metallic Stearate Market Market

Despite robust growth, the metallic stearate market faces certain challenges. Fluctuations in the prices of raw materials, such as fatty acids and metal oxides, can impact manufacturing costs and profit margins. Stringent environmental regulations and concerns regarding the disposal of certain metallic stearates can pose compliance hurdles. Intense competition among numerous global and regional players leads to price pressures. Additionally, the development of advanced alternative additives could potentially substitute metallic stearates in specific niche applications, although their widespread adoption is limited by cost and performance trade-offs.

Emerging Opportunities in Metallic Stearate Market

Emerging opportunities in the metallic stearate market are driven by increasing demand for specialized, high-performance stearates in advanced applications. The growing trend towards sustainable and bio-based materials is creating opportunities for stearates derived from renewable sources. Strategic partnerships and collaborations between raw material suppliers, manufacturers, and end-users are fostering innovation and market expansion. Furthermore, the untapped potential in developing economies, coupled with increasing industrialization, presents a significant avenue for market growth. The continuous exploration of new applications in sectors like advanced composites and specialty coatings will also shape future market dynamics.

Leading Players in the Metallic Stearate Market Sector

- Sankalp Organics Private Limited

- Merck KGaA

- GOLDSTAB ORGANICS PVT LTD

- Nimbasia

- WSD Chemical limited

- Peter Greven GmbH & Co KG

- Kemipex

- PMC Biogenix Inc

- Synergy Poly Additives Pvt Ltd

- MITTAL Dhatu (MITTAL GROUP OF INDUSTRIES)

- James M Brown

- Allbright Industries

- AVANSCHEM

- PROMAX Industries ApS

- Valtris Specialty Chemicals

- Baerlocher GmbH

Key Milestones in Metallic Stearate Market Industry

- September 2020: Kigo Chemical entered into an agreement with Valtris Specialty Chemicals to distribute Synpro Metallic Stearates across Mexico, expanding market reach in Latin America.

- October 2020: Ravago Chemicals North America (RCNA) announced a partnership with Valtris Specialty Chemicals. RCNA will distribute Valtris materials for the Food, Nutraceutical & Pharmaceutical (FNP), and Personal Care segments, indicating a focus on life science applications.

Strategic Outlook for Metallic Stearate Market Market

The strategic outlook for the metallic stearate market remains exceptionally positive, characterized by sustained growth and evolving opportunities. Key growth accelerators include the continued expansion of the plastics and rubber industries, driven by global economic development and increasing demand for consumer goods and infrastructure. The rising emphasis on sustainable manufacturing practices will foster innovation in bio-based and eco-friendly stearates, offering a distinct competitive advantage. Strategic alliances and mergers are anticipated to further consolidate the market, allowing for greater economies of scale and enhanced product portfolios. Furthermore, emerging applications in specialized sectors and the increasing penetration in developing economies present significant long-term growth potential for market participants who can adapt to these dynamic shifts.

Metallic Stearate Market Segmentation

-

1. Product

- 1.1. Zinc Stearate

- 1.2. Calcium Stearate

- 1.3. Magnesium Stearate

- 1.4. Aluminium Stearate

- 1.5. Others

-

2. Application

- 2.1. Plastic

- 2.2. Rubber

- 2.3. Pharmaceuticals

- 2.4. Personal Care

- 2.5. Construction Materials

- 2.6. Paints and Coatings

- 2.7. Others

Metallic Stearate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Metallic Stearate Market Regional Market Share

Geographic Coverage of Metallic Stearate Market

Metallic Stearate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Plastic Industry; Rising Demand from Rubber Segment

- 3.3. Market Restrains

- 3.3.1. Health Hazard related to Metallic Stearate; Impact of COVID-19 Pandemic

- 3.4. Market Trends

- 3.4.1. Plastic Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metallic Stearate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Zinc Stearate

- 5.1.2. Calcium Stearate

- 5.1.3. Magnesium Stearate

- 5.1.4. Aluminium Stearate

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Plastic

- 5.2.2. Rubber

- 5.2.3. Pharmaceuticals

- 5.2.4. Personal Care

- 5.2.5. Construction Materials

- 5.2.6. Paints and Coatings

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Asia Pacific Metallic Stearate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Zinc Stearate

- 6.1.2. Calcium Stearate

- 6.1.3. Magnesium Stearate

- 6.1.4. Aluminium Stearate

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Plastic

- 6.2.2. Rubber

- 6.2.3. Pharmaceuticals

- 6.2.4. Personal Care

- 6.2.5. Construction Materials

- 6.2.6. Paints and Coatings

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. North America Metallic Stearate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Zinc Stearate

- 7.1.2. Calcium Stearate

- 7.1.3. Magnesium Stearate

- 7.1.4. Aluminium Stearate

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Plastic

- 7.2.2. Rubber

- 7.2.3. Pharmaceuticals

- 7.2.4. Personal Care

- 7.2.5. Construction Materials

- 7.2.6. Paints and Coatings

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Metallic Stearate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Zinc Stearate

- 8.1.2. Calcium Stearate

- 8.1.3. Magnesium Stearate

- 8.1.4. Aluminium Stearate

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Plastic

- 8.2.2. Rubber

- 8.2.3. Pharmaceuticals

- 8.2.4. Personal Care

- 8.2.5. Construction Materials

- 8.2.6. Paints and Coatings

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South America Metallic Stearate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Zinc Stearate

- 9.1.2. Calcium Stearate

- 9.1.3. Magnesium Stearate

- 9.1.4. Aluminium Stearate

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Plastic

- 9.2.2. Rubber

- 9.2.3. Pharmaceuticals

- 9.2.4. Personal Care

- 9.2.5. Construction Materials

- 9.2.6. Paints and Coatings

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Metallic Stearate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Zinc Stearate

- 10.1.2. Calcium Stearate

- 10.1.3. Magnesium Stearate

- 10.1.4. Aluminium Stearate

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Plastic

- 10.2.2. Rubber

- 10.2.3. Pharmaceuticals

- 10.2.4. Personal Care

- 10.2.5. Construction Materials

- 10.2.6. Paints and Coatings

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sankalp Organics Private Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck KGaA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GOLDSTAB ORGANICS PVT LTD

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nimbasia

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 WSD Chemical limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Peter Greven GmbH & Co KG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kemipex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PMC Biogenix Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Synergy Poly Additives Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MITTAL Dhatu (MITTAL GROUP OF INDUSTRIES)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 James M Brown

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Allbright Industries

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AVANSCHEM

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 PROMAX Industries ApS

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Valtris Specialty Chemicals

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Baerlocher GmbH

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Sankalp Organics Private Limited

List of Figures

- Figure 1: Global Metallic Stearate Market Revenue Breakdown (Billion, %) by Region 2025 & 2033

- Figure 2: Global Metallic Stearate Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Metallic Stearate Market Revenue (Billion), by Product 2025 & 2033

- Figure 4: Asia Pacific Metallic Stearate Market Volume (K Tons), by Product 2025 & 2033

- Figure 5: Asia Pacific Metallic Stearate Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: Asia Pacific Metallic Stearate Market Volume Share (%), by Product 2025 & 2033

- Figure 7: Asia Pacific Metallic Stearate Market Revenue (Billion), by Application 2025 & 2033

- Figure 8: Asia Pacific Metallic Stearate Market Volume (K Tons), by Application 2025 & 2033

- Figure 9: Asia Pacific Metallic Stearate Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Metallic Stearate Market Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Metallic Stearate Market Revenue (Billion), by Country 2025 & 2033

- Figure 12: Asia Pacific Metallic Stearate Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Metallic Stearate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Metallic Stearate Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Metallic Stearate Market Revenue (Billion), by Product 2025 & 2033

- Figure 16: North America Metallic Stearate Market Volume (K Tons), by Product 2025 & 2033

- Figure 17: North America Metallic Stearate Market Revenue Share (%), by Product 2025 & 2033

- Figure 18: North America Metallic Stearate Market Volume Share (%), by Product 2025 & 2033

- Figure 19: North America Metallic Stearate Market Revenue (Billion), by Application 2025 & 2033

- Figure 20: North America Metallic Stearate Market Volume (K Tons), by Application 2025 & 2033

- Figure 21: North America Metallic Stearate Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Metallic Stearate Market Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Metallic Stearate Market Revenue (Billion), by Country 2025 & 2033

- Figure 24: North America Metallic Stearate Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Metallic Stearate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Metallic Stearate Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Metallic Stearate Market Revenue (Billion), by Product 2025 & 2033

- Figure 28: Europe Metallic Stearate Market Volume (K Tons), by Product 2025 & 2033

- Figure 29: Europe Metallic Stearate Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Europe Metallic Stearate Market Volume Share (%), by Product 2025 & 2033

- Figure 31: Europe Metallic Stearate Market Revenue (Billion), by Application 2025 & 2033

- Figure 32: Europe Metallic Stearate Market Volume (K Tons), by Application 2025 & 2033

- Figure 33: Europe Metallic Stearate Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Metallic Stearate Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Metallic Stearate Market Revenue (Billion), by Country 2025 & 2033

- Figure 36: Europe Metallic Stearate Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Metallic Stearate Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Metallic Stearate Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Metallic Stearate Market Revenue (Billion), by Product 2025 & 2033

- Figure 40: South America Metallic Stearate Market Volume (K Tons), by Product 2025 & 2033

- Figure 41: South America Metallic Stearate Market Revenue Share (%), by Product 2025 & 2033

- Figure 42: South America Metallic Stearate Market Volume Share (%), by Product 2025 & 2033

- Figure 43: South America Metallic Stearate Market Revenue (Billion), by Application 2025 & 2033

- Figure 44: South America Metallic Stearate Market Volume (K Tons), by Application 2025 & 2033

- Figure 45: South America Metallic Stearate Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Metallic Stearate Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Metallic Stearate Market Revenue (Billion), by Country 2025 & 2033

- Figure 48: South America Metallic Stearate Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Metallic Stearate Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Metallic Stearate Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Metallic Stearate Market Revenue (Billion), by Product 2025 & 2033

- Figure 52: Middle East and Africa Metallic Stearate Market Volume (K Tons), by Product 2025 & 2033

- Figure 53: Middle East and Africa Metallic Stearate Market Revenue Share (%), by Product 2025 & 2033

- Figure 54: Middle East and Africa Metallic Stearate Market Volume Share (%), by Product 2025 & 2033

- Figure 55: Middle East and Africa Metallic Stearate Market Revenue (Billion), by Application 2025 & 2033

- Figure 56: Middle East and Africa Metallic Stearate Market Volume (K Tons), by Application 2025 & 2033

- Figure 57: Middle East and Africa Metallic Stearate Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Metallic Stearate Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Metallic Stearate Market Revenue (Billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Metallic Stearate Market Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East and Africa Metallic Stearate Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Metallic Stearate Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Metallic Stearate Market Revenue Billion Forecast, by Product 2020 & 2033

- Table 2: Global Metallic Stearate Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 3: Global Metallic Stearate Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 4: Global Metallic Stearate Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Global Metallic Stearate Market Revenue Billion Forecast, by Region 2020 & 2033

- Table 6: Global Metallic Stearate Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Metallic Stearate Market Revenue Billion Forecast, by Product 2020 & 2033

- Table 8: Global Metallic Stearate Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 9: Global Metallic Stearate Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 10: Global Metallic Stearate Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Global Metallic Stearate Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 12: Global Metallic Stearate Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 14: China Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 16: India Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 18: Japan Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 20: South Korea Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global Metallic Stearate Market Revenue Billion Forecast, by Product 2020 & 2033

- Table 24: Global Metallic Stearate Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 25: Global Metallic Stearate Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 26: Global Metallic Stearate Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 27: Global Metallic Stearate Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 28: Global Metallic Stearate Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 30: United States Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 32: Canada Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 34: Mexico Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Metallic Stearate Market Revenue Billion Forecast, by Product 2020 & 2033

- Table 36: Global Metallic Stearate Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 37: Global Metallic Stearate Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 38: Global Metallic Stearate Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 39: Global Metallic Stearate Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 40: Global Metallic Stearate Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 42: Germany Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: France Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 46: France Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Italy Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 48: Italy Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Global Metallic Stearate Market Revenue Billion Forecast, by Product 2020 & 2033

- Table 52: Global Metallic Stearate Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 53: Global Metallic Stearate Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 54: Global Metallic Stearate Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 55: Global Metallic Stearate Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 56: Global Metallic Stearate Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Brazil Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 58: Brazil Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Argentina Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 60: Argentina Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Global Metallic Stearate Market Revenue Billion Forecast, by Product 2020 & 2033

- Table 64: Global Metallic Stearate Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 65: Global Metallic Stearate Market Revenue Billion Forecast, by Application 2020 & 2033

- Table 66: Global Metallic Stearate Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 67: Global Metallic Stearate Market Revenue Billion Forecast, by Country 2020 & 2033

- Table 68: Global Metallic Stearate Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: South Africa Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 72: South Africa Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Metallic Stearate Market Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Metallic Stearate Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metallic Stearate Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Metallic Stearate Market?

Key companies in the market include Sankalp Organics Private Limited, Merck KGaA, GOLDSTAB ORGANICS PVT LTD, Nimbasia, WSD Chemical limited, Peter Greven GmbH & Co KG, Kemipex, PMC Biogenix Inc, Synergy Poly Additives Pvt Ltd, MITTAL Dhatu (MITTAL GROUP OF INDUSTRIES), James M Brown, Allbright Industries, AVANSCHEM, PROMAX Industries ApS, Valtris Specialty Chemicals, Baerlocher GmbH.

3. What are the main segments of the Metallic Stearate Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.7 Billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Plastic Industry; Rising Demand from Rubber Segment.

6. What are the notable trends driving market growth?

Plastic Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Health Hazard related to Metallic Stearate; Impact of COVID-19 Pandemic.

8. Can you provide examples of recent developments in the market?

In September 2020, Kigo Chemical, entered into an agreement with Valtris Specialty Chemicals, to distribute Synpro Metallic Stearates across Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metallic Stearate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metallic Stearate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metallic Stearate Market?

To stay informed about further developments, trends, and reports in the Metallic Stearate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence