Key Insights

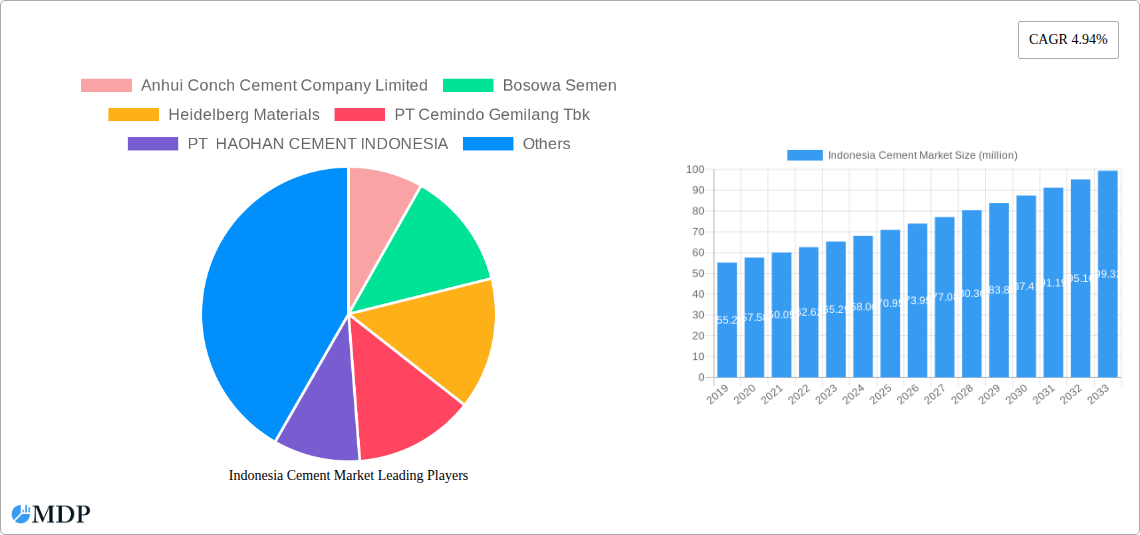

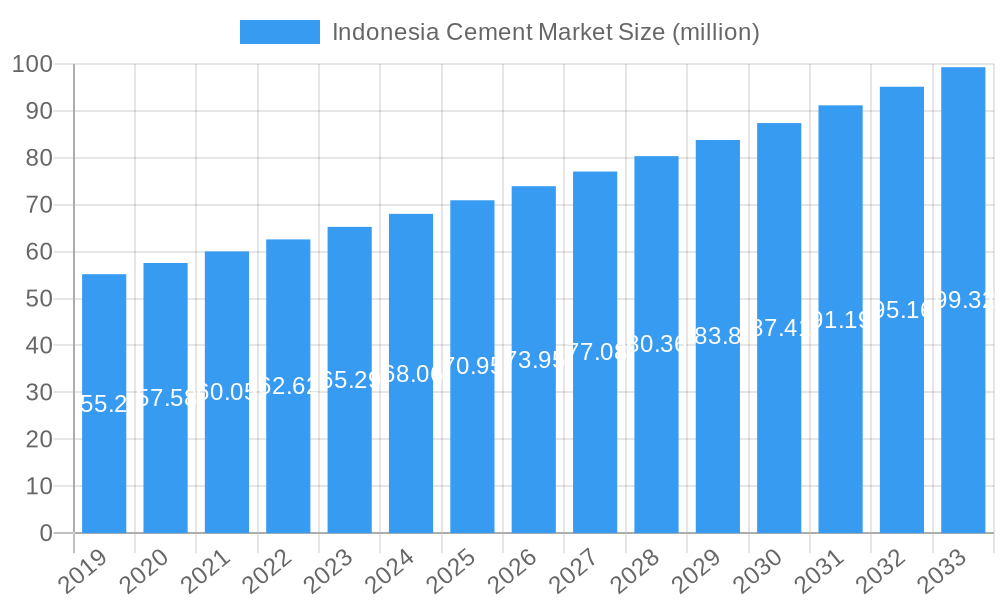

The Indonesian cement market is poised for robust growth, projected to reach an estimated USD 68.12 million in 2025, with a significant Compound Annual Growth Rate (CAGR) of 4.94% from 2019 to 2033. This expansion is primarily fueled by the escalating demand from the infrastructure sector, driven by substantial government investments in national development projects, including roads, bridges, public transportation, and housing initiatives. Furthermore, the residential construction segment continues to be a strong contributor, supported by urbanization trends and a growing middle class seeking improved housing. Industrial and commercial construction also plays a vital role, with ongoing development in manufacturing facilities, retail spaces, and office buildings reflecting the nation's economic dynamism. The rising popularity of blended cements, offering enhanced durability and sustainability, is also a key trend shaping product demand.

Indonesia Cement Market Market Size (In Million)

The market is characterized by diverse product offerings, including Ordinary Portland Cement (OPC), white cement, blended cements, and fiber cement, catering to a wide spectrum of construction needs. While the strong growth trajectory is evident, certain factors could present challenges. Fluctuations in raw material costs, particularly for clinker and energy, can impact profitability. Additionally, stringent environmental regulations and the increasing focus on sustainable construction practices necessitate continuous innovation and investment in eco-friendly production methods. Companies like Anhui Conch Cement Company Limited, Heidelberg Materials, and SCG are actively participating in this competitive landscape, focusing on expanding production capacity, optimizing supply chains, and developing differentiated products to meet evolving market demands and maintain their market share within Indonesia.

Indonesia Cement Market Company Market Share

Indonesia Cement Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock in-depth insights into the dynamic Indonesian cement market with this comprehensive report. Delve into market size, growth trajectories, and strategic landscapes shaping the future of cement production and consumption in Southeast Asia's largest economy. This report offers a critical analysis of market concentration, industry trends, leading segments, product innovations, growth drivers, challenges, and emerging opportunities, providing actionable intelligence for stakeholders in the construction and materials sector.

Indonesia Cement Market Market Dynamics & Concentration

The Indonesian cement market exhibits a moderate level of concentration, with a few dominant players controlling a significant share of production and sales. Key companies like Semen Indonesia (SIG), Heidelberg Materials (through PT Indocement Tunggal Prakarsa Tbk), and SCG significantly influence market dynamics. Anhui Conch Cement Company Limited and Bosowa Semen are also prominent contributors. The market is driven by innovation in product development, particularly in the area of sustainable and specialized cements, and is shaped by evolving regulatory frameworks aimed at promoting environmental responsibility and construction standards. Product substitutes, while present, generally do not offer the same performance characteristics as cement in core construction applications. End-user trends are heavily influenced by infrastructure development and the burgeoning residential sector, with commercial, industrial, and institutional segments also contributing to demand. Merger and acquisition (M&A) activities, such as Semen Indonesia's acquisition of an 83.52% stake in Solusi Bangun Indonesia in January 2023, illustrate ongoing consolidation and strategic expansion efforts aimed at enhancing market share and operational efficiency. The market is characterized by strategic partnerships and capacity expansions designed to meet growing domestic demand.

Indonesia Cement Market Industry Trends & Analysis

The Indonesian cement industry is poised for robust growth, fueled by consistent infrastructure development, a growing urban population, and a strong residential construction sector. The compound annual growth rate (CAGR) for the Indonesian cement market is projected to be approximately 6.5% over the forecast period. This growth is underpinned by government initiatives focused on developing transportation networks, housing, and industrial facilities, all of which are major consumers of cement. Technological disruptions are increasingly influencing production processes, with a growing emphasis on energy efficiency, digitalization, and the development of green cement alternatives to meet environmental regulations and sustainability demands. Consumer preferences are shifting towards higher-performance and eco-friendly cement products, encouraging manufacturers to invest in research and development. Competitive dynamics are characterized by intense price competition, strategic capacity expansions, and a focus on supply chain optimization to ensure timely delivery across the vast archipelago. Market penetration is high, with cement being a fundamental building material, but opportunities for growth lie in specialized products and untapped regional markets. The market is experiencing a steady increase in demand for blended cements and specialized formulations catering to diverse construction needs.

Leading Markets & Segments in Indonesia Cement Market

The Infrastructure end-use sector is a dominant force in the Indonesian cement market, driven by extensive government spending on national development projects. This includes the construction of toll roads, bridges, airports, ports, and public utilities across the country. Economic policies prioritizing infrastructure development directly translate into increased cement demand. The Residential sector also holds significant importance, fueled by a growing middle class and urbanization trends, leading to a constant need for new housing units and renovations. The Commercial, Industrial, and Institutional sectors contribute steadily to market growth, with the development of office buildings, factories, shopping malls, and educational facilities.

In terms of product segments, Ordinary Portland Cement (OPC) remains the workhorse of the industry, widely used in a majority of construction applications due to its versatility and cost-effectiveness. However, Blended Cement is witnessing substantial growth due to its enhanced properties such as improved durability, reduced heat of hydration, and lower environmental impact, aligning with sustainability trends and regulatory push for greener building materials. The Other Types segment, which may include specialized cements for specific applications like oil well cement or masonry cement, is also expected to see incremental growth as construction complexity increases. Fiber Cement, while a niche segment, is gaining traction in specific applications due to its fire resistance and durability.

Key drivers for the dominance of infrastructure and residential segments include:

- Government Infrastructure Spending: Ambitious projects under national strategic plans significantly boost cement consumption.

- Urbanization and Population Growth: Increasing populations in urban centers necessitate continuous housing and commercial development.

- Economic Policies: Government incentives for housing and infrastructure projects directly impact demand.

- Technological Advancements: Development of specialized cements caters to evolving construction needs within these sectors.

Indonesia Cement Market Product Developments

Product development in the Indonesian cement market is increasingly focused on sustainability and enhanced performance. Manufacturers are innovating with greener cement formulations, incorporating supplementary cementitious materials (SCMs) to reduce clinker content and lower carbon footprints. New products aim to offer improved durability, faster setting times, and specialized properties for challenging construction environments. For instance, Heidelburg Material's subsidiary, PT Indocement Tunggal Prakarsa Tbk, introduced "Semen Jempolan" in January 2023 to support the government's environmentally friendly cement production program, showcasing a direct response to market trends and regulatory drivers. These innovations cater to a growing demand for eco-conscious building materials and construction solutions that offer superior longevity and reduced maintenance.

Key Drivers of Indonesia Cement Market Growth

The Indonesian cement market's growth is propelled by several key factors:

- Massive Infrastructure Development: Government-led projects for roads, bridges, and public facilities are a primary demand driver.

- Robust Residential Construction: A growing population and rising disposable incomes fuel demand for housing.

- Urbanization: The shift towards urban living necessitates continuous construction of commercial and residential spaces.

- Government Support and Investment: Policies promoting construction and industrial growth create a favorable environment.

- Introduction of Sustainable and Specialized Cements: Innovation in product offerings caters to evolving market needs and environmental concerns.

Challenges in the Indonesia Cement Market Market

Despite strong growth prospects, the Indonesian cement market faces several challenges:

- Logistical Complexities: The archipelagic nature of Indonesia presents significant logistical hurdles for raw material sourcing and product distribution, increasing costs.

- Volatile Raw Material Prices: Fluctuations in the cost of key inputs like coal and limestone can impact profit margins.

- Intense Competition: A highly competitive market can lead to price wars and reduced profitability for some players.

- Regulatory Compliance: Adhering to evolving environmental regulations and construction standards requires ongoing investment and adaptation.

- Supply Chain Disruptions: Geopolitical events or natural disasters can disrupt the supply chain, affecting production and delivery.

Emerging Opportunities in Indonesia Cement Market

Emerging opportunities in the Indonesian cement market are ripe for exploration:

- Green Cement Technologies: Growing demand for sustainable building materials presents a significant opportunity for eco-friendly cement production.

- Specialty Cement Development: Tailoring cement products for specific applications like high-rise buildings, marine structures, and precast concrete can unlock niche markets.

- Digitalization of Operations: Implementing advanced technologies in manufacturing, supply chain management, and customer service can enhance efficiency and competitiveness.

- Regional Market Expansion: Exploring untapped demand in less developed regions within Indonesia can drive market penetration.

- Strategic Partnerships and Acquisitions: Collaborations can facilitate access to new technologies, markets, and resources, as exemplified by recent M&A activities.

Leading Players in the Indonesia Cement Market Sector

- Anhui Conch Cement Company Limited

- Bosowa Semen

- Heidelberg Materials

- PT Cemindo Gemilang Tbk

- PT HAOHAN CEMENT INDONESIA

- PT Jui Shin Indonesia

- PT SEMEN JAKARTA

- PT Sinar Tambang Arthalestari

- SCG

- SI

Key Milestones in Indonesia Cement Market Industry

- June 2023: SIG's subsidiary PT Semen Baturaja Tbk announced plans to expand its cement production capacity to 3.8 million tons of cement per year through three factories in Palembang, Baturaja City, Ogan Komering Ulu (OKU) Regency, South Sumatra, and Panjang, Bandar Lampung, Indonesia. This expansion aims to meet growing regional demand.

- January 2023: Heidelburg Material's subsidiary, PT Indocement Tunggal Prakarsa Tbk, launched a new cement product, Semen Jempolan, to support the government's environmentally friendly cement production program, highlighting a commitment to sustainability.

- January 2023: Semen Indonesia (SIG) acquired an 83.52% stake in Solusi Bangun Indonesia, which has a 14.8 Mt/yr cement production capacity, significantly strengthening its market position and operational footprint in Indonesia.

Strategic Outlook for Indonesia Cement Market Market

The strategic outlook for the Indonesian cement market remains highly positive, driven by sustained economic growth and ongoing infrastructure modernization. The market is expected to witness continuous expansion, with a significant emphasis on sustainable production practices and the development of high-performance cement products. Strategic investments in capacity enhancement, technological upgrades, and efficient logistics will be crucial for players to maintain a competitive edge. Companies that can successfully navigate regulatory landscapes and capitalize on the demand for eco-friendly solutions are well-positioned for long-term success. The ongoing consolidation and M&A activities suggest a trend towards greater market efficiency and stronger domestic players emerging.

Indonesia Cement Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

- 2.1. Blended Cement

- 2.2. Fiber Cement

- 2.3. Ordinary Portland Cement

- 2.4. White Cement

- 2.5. Other Types

Indonesia Cement Market Segmentation By Geography

- 1. Indonesia

Indonesia Cement Market Regional Market Share

Geographic Coverage of Indonesia Cement Market

Indonesia Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Cement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Blended Cement

- 5.2.2. Fiber Cement

- 5.2.3. Ordinary Portland Cement

- 5.2.4. White Cement

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Anhui Conch Cement Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosowa Semen

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Heidelberg Materials

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Cemindo Gemilang Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT HAOHAN CEMENT INDONESIA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Jui Shin Indonesia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT SEMEN JAKARTA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Sinar Tambang Arthalestari

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SCG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SI

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Anhui Conch Cement Company Limited

List of Figures

- Figure 1: Indonesia Cement Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Indonesia Cement Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Cement Market Revenue million Forecast, by End Use Sector 2020 & 2033

- Table 2: Indonesia Cement Market Revenue million Forecast, by Product 2020 & 2033

- Table 3: Indonesia Cement Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Indonesia Cement Market Revenue million Forecast, by End Use Sector 2020 & 2033

- Table 5: Indonesia Cement Market Revenue million Forecast, by Product 2020 & 2033

- Table 6: Indonesia Cement Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Cement Market?

The projected CAGR is approximately 4.94%.

2. Which companies are prominent players in the Indonesia Cement Market?

Key companies in the market include Anhui Conch Cement Company Limited, Bosowa Semen, Heidelberg Materials, PT Cemindo Gemilang Tbk, PT HAOHAN CEMENT INDONESIA, PT Jui Shin Indonesia, PT SEMEN JAKARTA, PT Sinar Tambang Arthalestari, SCG, SI.

3. What are the main segments of the Indonesia Cement Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 68.12 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: SIG's subsidiary PT Semen Baturaja Tbk announced to expand its cement production capacity to 3.8 million tons of cement per year through three factories in Palembang and Baturaja City, Ogan Komering Ulu (OKU) Regency, South Sumatra, Panjang, Bandar Lampung in Indonesia.January 2023: Heidelburg Material's subsidiary, PT Indocement Tunggal Prakarsa Tbk, introduced a new cement product, Semen Jempolan, to support the government's environmentally friendly cement production program.January 2023: Semen Indonesia (SIG) acquired an 83.52% stake in Solusi Bangun Indonesia, which has a 14.8 Mt/yr of cement production capacity, strengthening its cement business in Indonesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Cement Market?

To stay informed about further developments, trends, and reports in the Indonesia Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence