Key Insights

The United Kingdom timber cladding market is projected for significant expansion, anticipated to grow at a Compound Annual Growth Rate (CAGR) of 12.79%. With an estimated market size of 9.82 billion in the base year 2025, this sector exhibits strong economic momentum. This growth is primarily attributed to increasing consumer demand for natural, sustainable building materials, spurred by heightened environmental consciousness and a preference for aesthetically pleasing building exteriors in residential and non-residential developments. The inherent versatility of timber cladding, enabling diverse design possibilities for structures, further enhances its adoption. Key market participants such as Timbmet, BSW Timber Ltd, Howarth Timber Group, and Vastern Timber Limited are actively engaged in innovation and meeting this growing demand. The market is segmented by product type, featuring popular options like Cedar, Larch, and Oak, alongside other species such as Spruce and Chestnut, each offering distinct aesthetic and functional advantages.

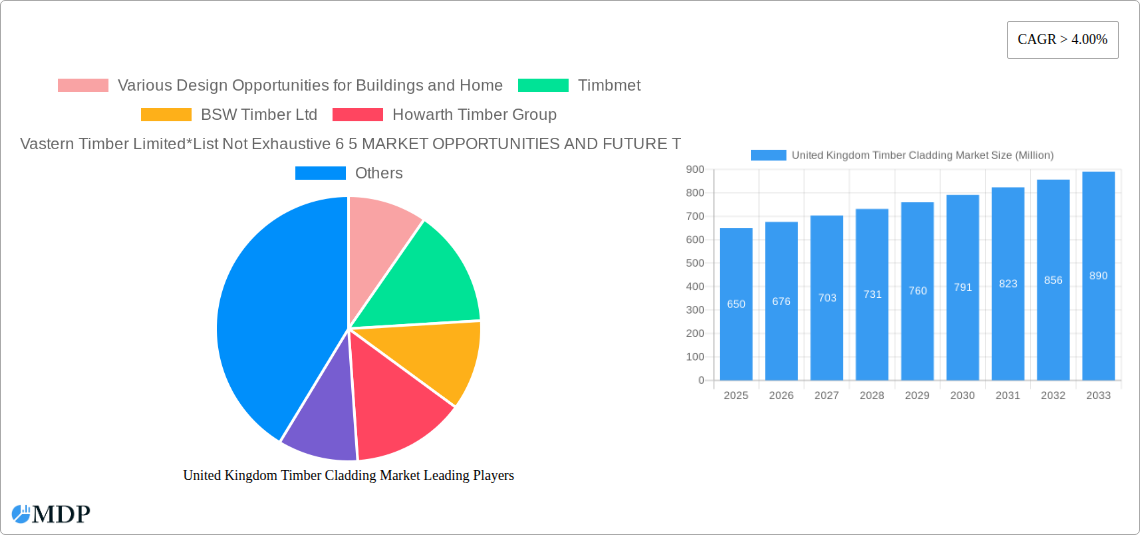

United Kingdom Timber Cladding Market Market Size (In Billion)

Timber cladding is predominantly utilized for both roof and wall applications, serving protective and decorative purposes for buildings. The residential sector, driven by homeowners enhancing property appeal, and the non-residential sector, including commercial, public, and leisure facilities appreciating timber's sustainability and visual qualities, are the primary end-user industries. While opportunities abound, potential market challenges include fluctuating timber prices, supply chain interruptions, and the emergence of alternative cladding materials. Nevertheless, robust demand for sustainable construction solutions and timber's inherent design flexibility position the UK market for sustained and substantial growth through 2033. The emphasis on eco-friendly building practices and the natural aesthetic appeal of timber will remain crucial growth catalysts.

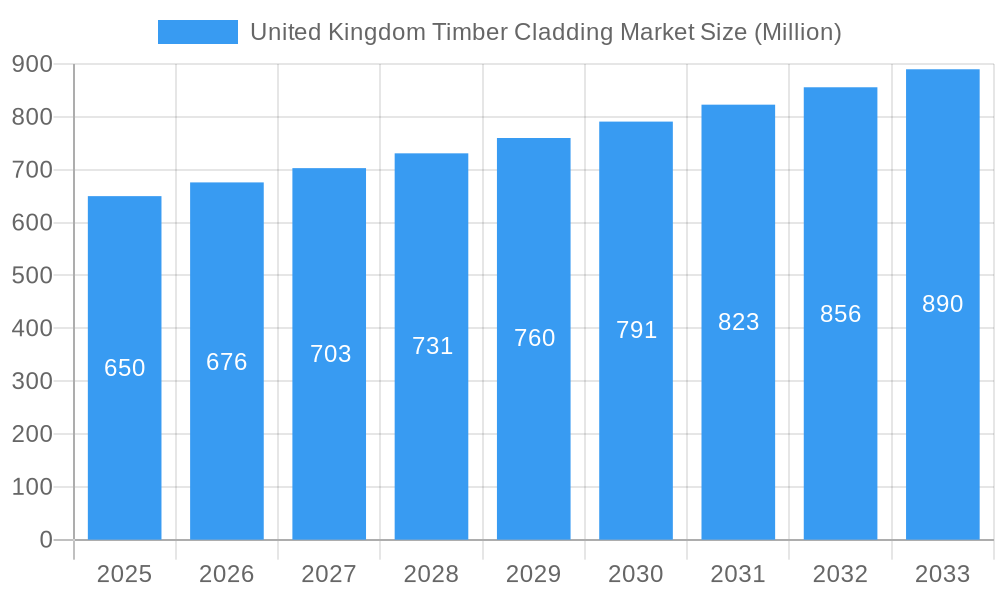

United Kingdom Timber Cladding Market Company Market Share

United Kingdom Timber Cladding Market: Comprehensive Report & Strategic Insights (2019-2033)

Unlock the potential of the UK timber cladding market with this in-depth report. Delve into market dynamics, emerging trends, and strategic opportunities shaping the future of building facades. This report provides actionable insights for manufacturers, suppliers, architects, and developers navigating the evolving landscape of sustainable and aesthetically pleasing construction materials.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

United Kingdom Timber Cladding Market Market Dynamics & Concentration

The United Kingdom timber cladding market is characterized by a moderate concentration, with a mix of established large-scale suppliers and a growing number of niche manufacturers catering to specific design requirements. Innovation drivers are primarily focused on enhancing durability, sustainability, and aesthetic versatility. Regulatory frameworks, particularly concerning fire safety and environmental standards, play a pivotal role in shaping product development and market entry. Product substitutes, such as composite materials and brick slips, present competition, but the inherent aesthetic and eco-friendly appeal of timber continues to drive demand. End-user trends reveal a growing preference for natural materials, energy efficiency, and a desire for unique architectural designs. Mergers and acquisitions (M&A) activities, while not yet at peak levels, are strategically consolidating market players and expanding product portfolios. We observed approximately 3 significant M&A deals within the historical period, with leading companies like BSW Timber Ltd. and Taylor Maxwell Group Limited being acquired, signifying a trend towards consolidation. Market share is distributed, with the top 5 players estimated to hold around 35% of the market.

United Kingdom Timber Cladding Market Industry Trends & Analysis

The United Kingdom timber cladding market is experiencing robust growth, propelled by a confluence of factors including increasing construction activity, a heightened demand for sustainable building materials, and evolving architectural aesthetics. The market is projected to grow at a substantial Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025-2033). This upward trajectory is significantly influenced by government initiatives promoting green building practices and the growing awareness among consumers regarding the environmental benefits of timber as a renewable resource. Technological disruptions are manifesting in advanced wood treatment techniques, enhancing durability, weather resistance, and fire retardancy, thereby broadening the applicability of timber cladding in diverse architectural projects. Consumer preferences are shifting towards natural, warm, and textured finishes that contribute to the aesthetic appeal of both residential and commercial buildings. The inherent versatility of timber allows for a wide array of design opportunities, from traditional rustic looks to sleek modern facades, catering to a broad spectrum of architectural styles. Competitive dynamics are characterized by an increasing emphasis on product innovation, sustainable sourcing, and value-added services such as pre-finished cladding systems and technical support. Market penetration is steadily increasing, particularly in new-build projects and extensive renovation schemes, as specifiers and homeowners recognize the long-term value and aesthetic advantages of timber cladding.

Leading Markets & Segments in United Kingdom Timber Cladding Market

The Wall Cladding segment is the dominant application within the UK timber cladding market, driven by its extensive use in both new construction and retrofitting projects for residential and non-residential buildings. This segment is further bolstered by the demand for aesthetic enhancement and improved thermal insulation in building envelopes.

Product Segment Dominance:

- Cedar: Stands out as a highly sought-after product due to its natural durability, aesthetic appeal, and inherent resistance to rot and insect infestation. Its rich color and grain patterns make it a premium choice for architects and homeowners alike.

- Larch: Another strong contender, Larch offers excellent durability and stability, making it suitable for exposed locations. Its naturally beautiful warm tones age gracefully, contributing to its popularity.

- Oak: While a premium and often more expensive option, Oak is chosen for its exceptional hardness, durability, and classic aesthetic, particularly for high-end projects and historical restorations.

- Other Products (Spruce, Chestnut, etc.): These segments cater to specific budget requirements and design briefs, offering a cost-effective yet viable alternative for various cladding applications. Spruce, for instance, is often used when a painted finish is desired, while Chestnut offers a unique aesthetic.

End-User Industry Dominance:

- Residential: This segment is a primary driver, fueled by the growing trend towards eco-friendly home renovations and new builds that emphasize natural materials and enhanced curb appeal. The desire for attractive and sustainable housing solutions directly translates to higher demand for timber cladding.

- Non-Residential: This segment, encompassing commercial, educational, and healthcare facilities, is also witnessing significant growth. The pursuit of sustainable building certifications, improved aesthetics, and cost-effective long-term solutions makes timber cladding an attractive option for a wide range of non-residential projects.

Key drivers for dominance within these segments include evolving building regulations prioritizing sustainability and aesthetics, government incentives for green construction, and the increasing popularity of biophilic design principles that integrate natural elements into built environments.

United Kingdom Timber Cladding Market Product Developments

Product development in the UK timber cladding market is heavily focused on enhancing performance and aesthetic appeal. Innovations include advanced acetylation and thermal modification processes that significantly improve wood's durability, dimensional stability, and resistance to decay and insect attack, expanding its use in challenging environments. The introduction of pre-finished and pre-fabricated cladding systems is streamlining installation and offering consistent quality. Furthermore, the development of a wider range of timber species and profiles allows for greater design flexibility, catering to diverse architectural styles and client preferences, from rustic charm to contemporary elegance.

Key Drivers of United Kingdom Timber Cladding Market Growth

The United Kingdom timber cladding market is propelled by several key drivers. Firstly, the growing demand for sustainable and environmentally friendly building materials aligns with global and national green building initiatives. Secondly, increasing construction and renovation activities, particularly in the residential sector, create a consistent demand for facade solutions. Thirdly, evolving architectural trends favoring natural aesthetics and biophilic design are significantly boosting the appeal of timber cladding. Lastly, technological advancements in wood treatment and manufacturing are enhancing the durability, performance, and aesthetic versatility of timber products, making them more competitive and suitable for a wider range of applications.

Challenges in the United Kingdom Timber Cladding Market Market

Despite its growth, the United Kingdom timber cladding market faces several challenges. Fluctuations in timber prices and supply chain disruptions can impact cost-effectiveness and project timelines. Stringent regulatory requirements, particularly concerning fire safety standards, necessitate ongoing product development and compliance testing, adding to manufacturing costs. Competition from alternative cladding materials, such as composites and metal panels, presents a continuous challenge, requiring timber suppliers to emphasize their unique advantages. Furthermore, perceived maintenance requirements and durability concerns among some consumers can act as a restraint, although advancements in treatments are mitigating these issues.

Emerging Opportunities in United Kingdom Timber Cladding Market

Emerging opportunities within the UK timber cladding market are abundant. The increasing focus on circular economy principles and the demand for responsibly sourced materials present a significant advantage for certified timber products. The growth of the modular construction sector offers opportunities for pre-fabricated timber cladding systems. Furthermore, urban regeneration projects and the retrofitting of older buildings create substantial demand for aesthetic and sustainable facade solutions. Strategic partnerships with architectural firms and developers to promote innovative design applications and the development of new, enhanced timber treatments will further unlock market potential.

Leading Players in the United Kingdom Timber Cladding Market Sector

- Timbmet

- BSW Timber Ltd.

- Howarth Timber Group

- Vastern Timber Limited

- The Brookridge Group (Brookridge Timber)

- NORclad

- Accsys

- Glenalmond Timber Company Ltd

- Dura Composites Ltd

- Russwood ltd

- James Hardie Group

Key Milestones in United Kingdom Timber Cladding Market Industry

- January 2022: Binderholz Group acquired BSW Timber Ltd. This acquisition will strengthen Binderholz Group's market position in the European solid wood processing industry.

- June 2021: Brickability Group acquired Taylor Maxwell Group Limited, the UK's leading timber and non-combustible cladding supplier to the construction industry, for GBP 63 million (USD 89.57 million). This acquisition will strengthen Brickability Group's market position.

Strategic Outlook for United Kingdom Timber Cladding Market Market

The strategic outlook for the UK timber cladding market is highly positive, driven by a strong alignment with sustainability mandates and evolving consumer preferences. Growth accelerators will stem from continued innovation in product durability and fire resistance, further solidifying timber's position as a safe and desirable cladding material. Expanding the range of timber species and finishes to cater to diverse design opportunities for buildings and homes will be crucial. Strategic collaborations with specifiers and the development of educational resources to highlight the long-term benefits and aesthetic versatility of timber cladding will further enhance market penetration. The increasing adoption of timber in larger commercial and public sector projects signifies a significant growth avenue.

United Kingdom Timber Cladding Market Segmentation

-

1. Product

- 1.1. Cedar

- 1.2. Larch

- 1.3. Oak

- 1.4. Other Products (Spruce, Chestnut, etc.)

-

2. Application

- 2.1. Roof Cladding

- 2.2. Wall Cladding

-

3. End-User Industry

- 3.1. Residential

- 3.2. Non-Residential

United Kingdom Timber Cladding Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Timber Cladding Market Regional Market Share

Geographic Coverage of United Kingdom Timber Cladding Market

United Kingdom Timber Cladding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand in Residential and Non-Residential for Construction Activities; Increasing Demand for Strong and Lightweight Materials in Construction

- 3.3. Market Restrains

- 3.3.1. Timber Shortage; Combustibles Legislation

- 3.4. Market Trends

- 3.4.1. Rising Demand from the Residential Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Timber Cladding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Cedar

- 5.1.2. Larch

- 5.1.3. Oak

- 5.1.4. Other Products (Spruce, Chestnut, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Roof Cladding

- 5.2.2. Wall Cladding

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Residential

- 5.3.2. Non-Residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Various Design Opportunities for Buildings and Home

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Timbmet

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BSW Timber Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Howarth Timber Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vastern Timber Limited*List Not Exhaustive 6 5 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Brookridge Group (Brookridge Timber)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NORclad

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Accsys

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Glenalmond Timber Company Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dura Composites Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Russwood ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 James Hardie Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Various Design Opportunities for Buildings and Home

List of Figures

- Figure 1: United Kingdom Timber Cladding Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Timber Cladding Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Timber Cladding Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United Kingdom Timber Cladding Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: United Kingdom Timber Cladding Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: United Kingdom Timber Cladding Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Timber Cladding Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United Kingdom Timber Cladding Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: United Kingdom Timber Cladding Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 8: United Kingdom Timber Cladding Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Timber Cladding Market?

The projected CAGR is approximately 12.79%.

2. Which companies are prominent players in the United Kingdom Timber Cladding Market?

Key companies in the market include Various Design Opportunities for Buildings and Home, Timbmet, BSW Timber Ltd, Howarth Timber Group, Vastern Timber Limited*List Not Exhaustive 6 5 MARKET OPPORTUNITIES AND FUTURE TRENDS, The Brookridge Group (Brookridge Timber), NORclad, Accsys, Glenalmond Timber Company Ltd, Dura Composites Ltd, Russwood ltd, James Hardie Group.

3. What are the main segments of the United Kingdom Timber Cladding Market?

The market segments include Product, Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.82 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand in Residential and Non-Residential for Construction Activities; Increasing Demand for Strong and Lightweight Materials in Construction.

6. What are the notable trends driving market growth?

Rising Demand from the Residential Segment.

7. Are there any restraints impacting market growth?

Timber Shortage; Combustibles Legislation.

8. Can you provide examples of recent developments in the market?

January 2022: Binderholz Group acquired BSW Timber Ltd. This acquisition will strengthen Binderholz Group's market position in the European solid wood processing industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Timber Cladding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Timber Cladding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Timber Cladding Market?

To stay informed about further developments, trends, and reports in the United Kingdom Timber Cladding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence