Key Insights

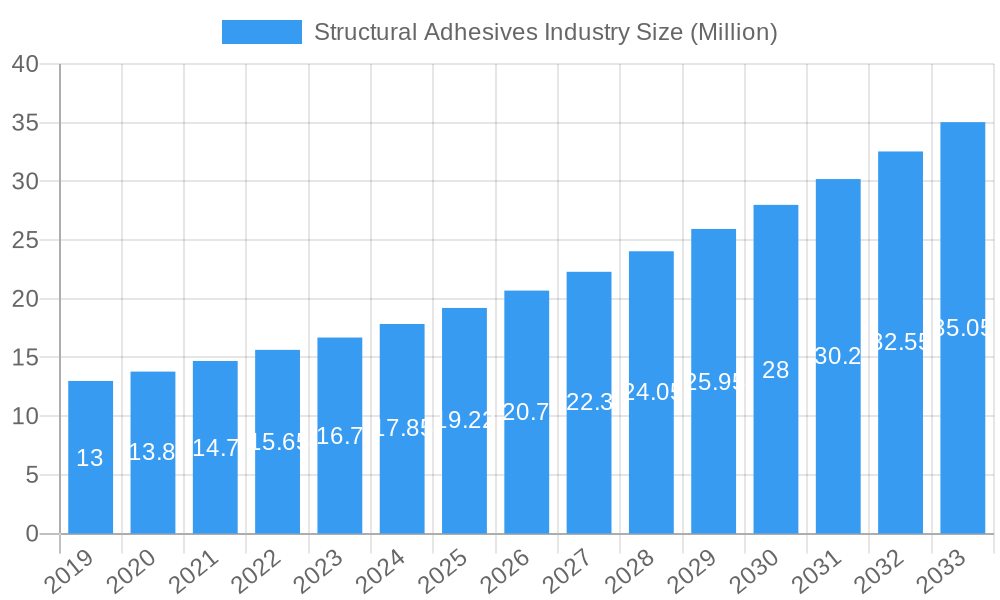

The global structural adhesives market is poised for robust expansion, projected to reach USD 19.22 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 7.64% through 2033. This significant growth is primarily driven by the increasing demand for lightweight and high-strength materials across various industries, particularly automotive, aerospace, and construction. The shift towards advanced manufacturing techniques and the need for sustainable bonding solutions are further fueling market adoption. Structural adhesives offer superior performance over traditional mechanical fasteners, including improved stress distribution, enhanced aesthetics, and resistance to vibration and fatigue. The automotive sector is a major contributor, with manufacturers increasingly relying on these adhesives for vehicle assembly to reduce weight, improve fuel efficiency, and enhance structural integrity. Similarly, the aerospace industry leverages structural adhesives for their ability to bond dissimilar materials and withstand extreme conditions.

Structural Adhesives Industry Market Size (In Million)

The market segmentation reveals a dynamic landscape. Epoxy resins dominate the market due to their excellent mechanical properties, chemical resistance, and versatility. Polyurethane and acrylic adhesives are also gaining traction, offering flexibility and faster curing times. In terms of end-user industries, construction is a significant segment, with structural adhesives being used in applications like façade bonding, flooring, and structural glazing, contributing to faster construction times and improved building performance. The wind energy sector is also a growing area, utilizing these adhesives for blade manufacturing and assembly. While the market exhibits strong growth potential, certain restraints such as the need for specialized application equipment and the potential for high initial costs can impact adoption in specific segments. However, ongoing innovation in adhesive formulations and application technologies is expected to mitigate these challenges. Key players like Huntsman International LLC, Henkel AG & Co KGaA, DuPont, and 3M are actively involved in research and development, introducing advanced products to cater to evolving industry demands.

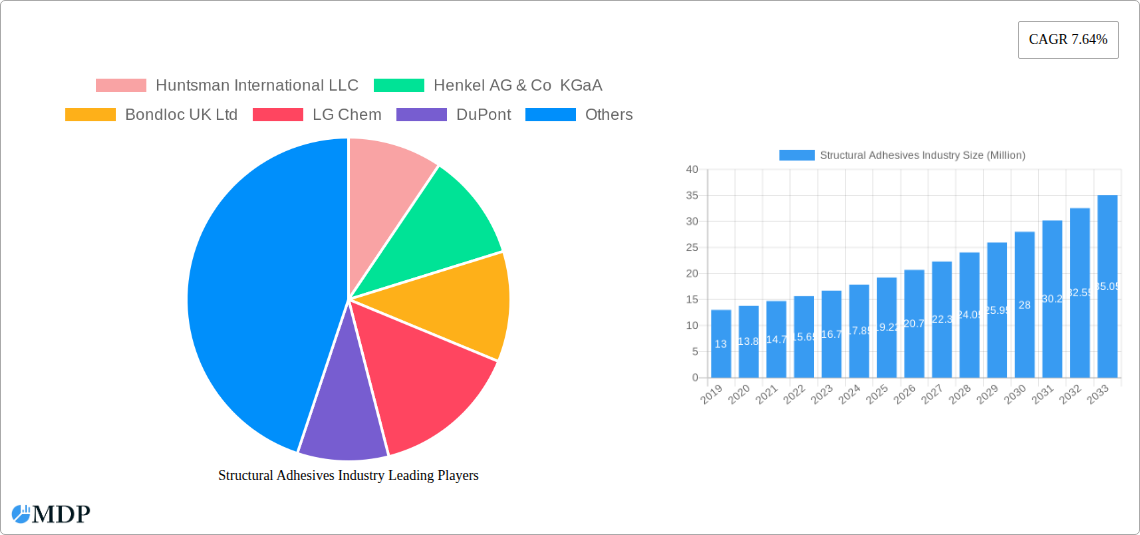

Structural Adhesives Industry Company Market Share

Gain comprehensive insights into the dynamic global Structural Adhesives Industry with our in-depth report. This essential resource offers a detailed examination of market segmentation, key growth drivers, competitive landscapes, and emerging opportunities, covering the historical period from 2019–2024 and projecting trends through 2033. Discover the pivotal role of structural adhesives in transforming industries like Automotive, Aerospace, Construction, and Wind Energy. This report leverages advanced analytical methods and real-time data to provide actionable intelligence for stakeholders seeking to capitalize on market evolution.

Structural Adhesives Industry Market Dynamics & Concentration

The Structural Adhesives Industry is characterized by a moderate to high market concentration, with a few major global players holding significant market share, estimated to be over 60% by the base year 2025. Innovation is a primary driver, fueled by the continuous demand for lighter, stronger, and more sustainable bonding solutions across diverse end-user industries. Regulatory frameworks, particularly concerning environmental impact and safety standards, are becoming increasingly stringent, influencing product development and material choices. Product substitutes, such as traditional mechanical fasteners, are gradually being displaced by the superior performance and design flexibility offered by advanced structural adhesives. End-user trends show a strong preference for adhesives that offer improved durability, reduced assembly time, and enhanced aesthetic appeal. Mergers and acquisitions (M&A) activities are a notable feature, with an average of 5-7 significant deals annually during the historical period. For instance, the acquisition of Ashland's Performance Adhesives business by Arkema for USD 1.65 billion in February 2022 underscores the strategic consolidation within the industry. M&A deal counts are expected to remain robust, reflecting a drive for market expansion and technological integration.

Structural Adhesives Industry Industry Trends & Analysis

The global Structural Adhesives Industry is poised for substantial growth, driven by an anticipated Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period 2025–2033. Market penetration is steadily increasing as industries recognize the intrinsic value proposition of structural adhesives in enhancing product performance and manufacturing efficiency. Key growth drivers include the escalating demand for lightweight materials in the automotive and aerospace sectors to improve fuel efficiency and reduce emissions, a trend projected to contribute an additional USD 10 billion in market value by 2030. Technological disruptions, such as the development of advanced epoxy and polyurethane formulations offering enhanced temperature resistance and chemical inertness, are reshaping product capabilities. Consumer preferences are increasingly leaning towards sustainable and eco-friendly bonding solutions, prompting manufacturers to invest in bio-based and low-VOC (Volatile Organic Compound) adhesives, a market segment expected to grow by 8% annually. Competitive dynamics are intensifying, with companies focusing on innovation, strategic partnerships, and regional expansion to capture market share. The emergence of smart adhesives with integrated sensor capabilities for structural health monitoring represents a significant technological frontier, offering enhanced safety and predictive maintenance opportunities in critical applications. Furthermore, the growing adoption of additive manufacturing (3D printing) technologies is creating new applications for specialized structural adhesives that can withstand the rigorous demands of 3D-printed components. The shift from traditional joining methods to adhesive bonding is a persistent trend, driven by improvements in adhesive strength, durability, and versatility. The industry is also witnessing a greater emphasis on customized solutions tailored to specific application requirements, fostering closer collaboration between adhesive manufacturers and end-users.

Leading Markets & Segments in Structural Adhesives Industry

The Epoxy resin type segment is projected to dominate the Structural Adhesives Industry, expected to account for over 35% of the market share by 2025. Its superior mechanical strength, chemical resistance, and thermal stability make it indispensable in demanding applications. The Automotive end-user industry is the leading market, driven by the industry's continuous pursuit of lightweighting strategies to meet stringent fuel efficiency standards and emission regulations. The automotive segment is anticipated to contribute approximately USD 25 billion to the global market by 2030.

- Key Drivers in Automotive:

- Lightweighting initiatives: Replacing traditional welding and mechanical fasteners with structural adhesives reduces vehicle weight, leading to improved fuel economy and reduced emissions.

- Electric Vehicle (EV) growth: The increasing production of EVs necessitates advanced bonding solutions for battery pack assembly, chassis integration, and lightweight body structures.

- Safety enhancements: Structural adhesives contribute to improved crashworthiness and occupant safety by distributing stress more effectively.

- Design flexibility: Adhesives allow for more complex and integrated designs, enabling manufacturers to create sleeker and more aerodynamic vehicle profiles.

- Dominance Analysis - Automotive: The automotive industry's sheer volume of production and its proactive adoption of new technologies make it a consistently strong performer. The integration of structural adhesives in unibody construction, panel bonding, and component assembly is a testament to their critical role. Regulatory pressures on emissions and fuel efficiency are relentless, directly fueling the demand for lighter materials and, consequently, advanced structural adhesives.

The Construction end-user industry represents another significant and rapidly growing market, fueled by global infrastructure development and urbanization trends. Factors such as the need for durable and weather-resistant building materials, as well as the increasing use of prefabricated construction elements, are driving demand. The construction segment is projected to witness a CAGR of around 7.2% during the forecast period.

- Key Drivers in Construction:

- Infrastructure development: Investments in bridges, tunnels, and high-rise buildings necessitate robust and long-lasting bonding solutions.

- Prefabricated and modular construction: Adhesives are crucial for assembling and connecting modular building components efficiently.

- Energy-efficient buildings: The use of adhesives in sealing and bonding for improved insulation contributes to energy efficiency.

- Renovation and repair: Structural adhesives offer effective solutions for reinforcing and repairing existing structures.

- Dominance Analysis - Construction: The construction sector's vast scale and ongoing global development projects ensure a sustained demand for reliable bonding. The trend towards sustainable building practices also favors adhesives that can contribute to improved insulation and durability, reducing the lifecycle impact of construction.

Structural Adhesives Industry Product Developments

Product innovation in the Structural Adhesives Industry is largely focused on developing formulations with enhanced performance characteristics and improved sustainability profiles. Advancements in epoxy, polyurethane, and acrylic chemistries are yielding adhesives with superior bond strength, faster curing times, and increased resistance to extreme temperatures and harsh environments. The development of solvent-free, low-VOC, and bio-based adhesives is a significant trend, aligning with global sustainability mandates and catering to growing environmental consciousness. Applications are expanding beyond traditional assembly to include sophisticated uses in electric vehicle battery encapsulation, aerospace composite bonding, and renewable energy infrastructure, such as wind turbine blade manufacturing. These innovations provide competitive advantages by enabling lighter, stronger, and more durable end products, while also streamlining manufacturing processes.

Key Drivers of Structural Adhesives Industry Growth

Several key factors are propelling the growth of the Structural Adhesives Industry. Technologically, the relentless pursuit of lightweighting in automotive and aerospace for improved fuel efficiency and performance is a primary driver, creating demand for adhesives that can effectively replace heavier mechanical fasteners. Economically, global infrastructure development and the expansion of the construction sector, particularly in emerging economies, are significantly boosting the adoption of structural adhesives for building and repair. Regulatory drivers, such as stricter environmental regulations mandating lower VOC emissions and the use of sustainable materials, are pushing manufacturers to innovate towards greener adhesive solutions. The growing demand for enhanced product durability and longevity across all end-user industries also plays a crucial role.

Challenges in the Structural Adhesives Industry Market

Despite robust growth, the Structural Adhesives Industry faces several challenges. Regulatory hurdles, particularly in ensuring compliance with evolving environmental and safety standards across different regions, can be complex and costly. Supply chain disruptions, as evidenced by recent global events, can impact the availability and pricing of raw materials, leading to production delays and increased costs. Competitive pressures from established players and the introduction of new, innovative products require continuous investment in research and development. Furthermore, the initial cost of some advanced structural adhesives can be higher than traditional fastening methods, posing a barrier to adoption in price-sensitive markets, though this is often offset by long-term cost savings in manufacturing and performance.

Emerging Opportunities in Structural Adhesives Industry

Emerging opportunities in the Structural Adhesives Industry are primarily driven by technological breakthroughs and evolving market demands. The burgeoning electric vehicle market presents a significant opportunity for specialized adhesives used in battery pack assembly, thermal management, and lightweight chassis construction. The increasing adoption of additive manufacturing (3D printing) is creating a demand for novel adhesives that can bond complex 3D-printed components effectively. Strategic partnerships between adhesive manufacturers and end-users are crucial for developing tailored solutions for niche applications. Furthermore, market expansion into developing regions with growing industrial bases offers substantial long-term growth potential. The growing emphasis on the circular economy is also fostering opportunities for adhesives that facilitate easier disassembly and recycling of products.

Leading Players in the Structural Adhesives Industry Sector

- Huntsman International LLC

- Henkel AG & Co KGaA

- Bondloc UK Ltd

- LG Chem

- DuPont

- Arkema

- RS Industrial

- H B Fuller Company

- Forgeway Ltd

- Engineered Bonding Solutions LLC

- Sika AG

- 3M

- Parker Hannifin Corp

- Illinois Tool Works Inc

Key Milestones in Structural Adhesives Industry Industry

- February 2022: Arkema finalized the acquisition of the Performance Adhesives business of Ashland. The products offered under this division include structural adhesives. The value of the transaction was USD 1.65 billion. The acquisition helped strengthen Arkema's Adhesive Solutions segment and aligned with the company's strategy to become a pure specialty material player by 2024. This strategic move significantly bolstered Arkema's market position and product portfolio in structural adhesives.

- February 2022: H.B. Fuller Company announced that it had finalized its purchase of Apollo, a manufacturer of liquid adhesives, coatings, and primers for the roofing, industrial and construction markets. It is expected that Apollo will strengthen H.B. Fuller's position in important high-value, high-margin areas in the United Kingdom and Europe. Apollo will operate inside H.B. Fuller's current Construction Adhesives and Engineering Adhesives business units. This acquisition aimed to enhance H.B. Fuller's presence and offerings in key geographical markets and product segments.

Strategic Outlook for Structural Adhesives Industry Market

The strategic outlook for the Structural Adhesives Industry is exceptionally positive, driven by a confluence of technological innovation and expanding market applications. Growth accelerators include the continuous development of high-performance, eco-friendly adhesive formulations, coupled with the increasing demand for lightweighting solutions across major industries. The burgeoning electric vehicle market and the expansion of renewable energy projects, particularly in wind energy, represent significant growth avenues. Strategic partnerships and collaborations between adhesive manufacturers, material suppliers, and end-users will be crucial for co-developing customized solutions and driving market penetration. Furthermore, the industry is poised to benefit from the increasing adoption of digital technologies, such as AI and IoT, for optimizing adhesive application processes and enabling predictive maintenance. The focus on sustainability will continue to shape product development, creating opportunities for bio-based and recyclable adhesive solutions.

Structural Adhesives Industry Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Polyurethane

- 1.3. Acrylic

- 1.4. Cyanoacrylate

- 1.5. Methyl Methacrylate

- 1.6. Other Resin Types

-

2. End-user Industry

- 2.1. Construction

- 2.2. Automotive

- 2.3. Aerospace

- 2.4. Wind Energy

- 2.5. Other End-user Industries

Structural Adhesives Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

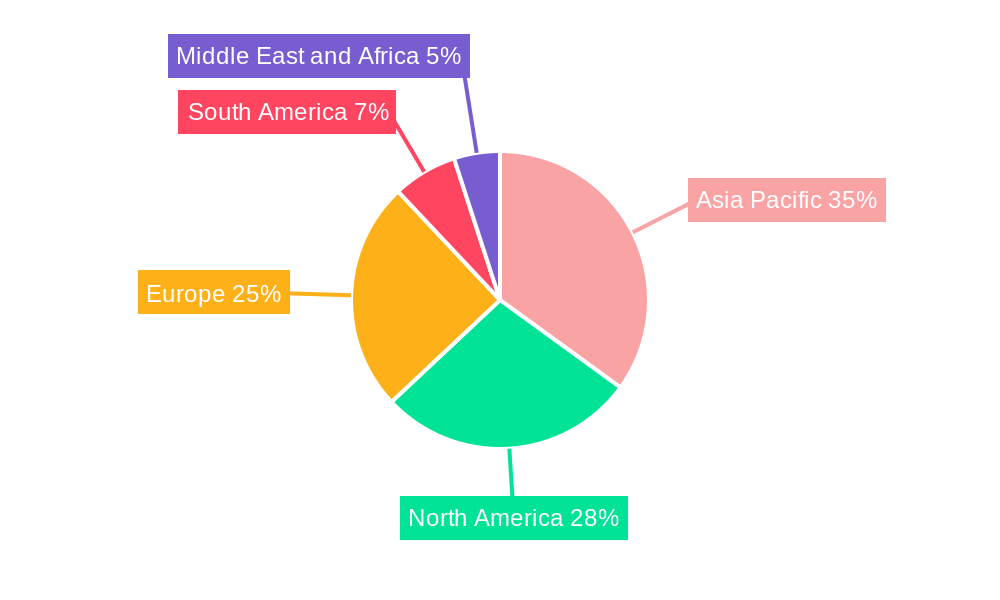

Structural Adhesives Industry Regional Market Share

Geographic Coverage of Structural Adhesives Industry

Structural Adhesives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Investments in Developing Economies in Asia-Pacific; Increasing Demand from the Global Construction and Automotive Sectors

- 3.3. Market Restrains

- 3.3.1. Growing Environmental and Health Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Structural Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Polyurethane

- 5.1.3. Acrylic

- 5.1.4. Cyanoacrylate

- 5.1.5. Methyl Methacrylate

- 5.1.6. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Construction

- 5.2.2. Automotive

- 5.2.3. Aerospace

- 5.2.4. Wind Energy

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Asia Pacific Structural Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Epoxy

- 6.1.2. Polyurethane

- 6.1.3. Acrylic

- 6.1.4. Cyanoacrylate

- 6.1.5. Methyl Methacrylate

- 6.1.6. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Construction

- 6.2.2. Automotive

- 6.2.3. Aerospace

- 6.2.4. Wind Energy

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. North America Structural Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Epoxy

- 7.1.2. Polyurethane

- 7.1.3. Acrylic

- 7.1.4. Cyanoacrylate

- 7.1.5. Methyl Methacrylate

- 7.1.6. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Construction

- 7.2.2. Automotive

- 7.2.3. Aerospace

- 7.2.4. Wind Energy

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Europe Structural Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Epoxy

- 8.1.2. Polyurethane

- 8.1.3. Acrylic

- 8.1.4. Cyanoacrylate

- 8.1.5. Methyl Methacrylate

- 8.1.6. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Construction

- 8.2.2. Automotive

- 8.2.3. Aerospace

- 8.2.4. Wind Energy

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. South America Structural Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Epoxy

- 9.1.2. Polyurethane

- 9.1.3. Acrylic

- 9.1.4. Cyanoacrylate

- 9.1.5. Methyl Methacrylate

- 9.1.6. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Construction

- 9.2.2. Automotive

- 9.2.3. Aerospace

- 9.2.4. Wind Energy

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Middle East and Africa Structural Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Epoxy

- 10.1.2. Polyurethane

- 10.1.3. Acrylic

- 10.1.4. Cyanoacrylate

- 10.1.5. Methyl Methacrylate

- 10.1.6. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Construction

- 10.2.2. Automotive

- 10.2.3. Aerospace

- 10.2.4. Wind Energy

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Huntsman International LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Henkel AG & Co KGaA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bondloc UK Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LG Chem

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DuPont

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arkema

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RS Industrial*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 H B Fuller Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Forgeway Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Engineered Bonding Solutions LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sika AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 3M

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Parker Hannifin Corp

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Illinois Tool Works Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Huntsman International LLC

List of Figures

- Figure 1: Global Structural Adhesives Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Structural Adhesives Industry Revenue (Million), by Resin Type 2025 & 2033

- Figure 3: Asia Pacific Structural Adhesives Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 4: Asia Pacific Structural Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Structural Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Structural Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Structural Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Structural Adhesives Industry Revenue (Million), by Resin Type 2025 & 2033

- Figure 9: North America Structural Adhesives Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 10: North America Structural Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Structural Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Structural Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Structural Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Structural Adhesives Industry Revenue (Million), by Resin Type 2025 & 2033

- Figure 15: Europe Structural Adhesives Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 16: Europe Structural Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Structural Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Structural Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Structural Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Structural Adhesives Industry Revenue (Million), by Resin Type 2025 & 2033

- Figure 21: South America Structural Adhesives Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 22: South America Structural Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Structural Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Structural Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Structural Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Structural Adhesives Industry Revenue (Million), by Resin Type 2025 & 2033

- Figure 27: Middle East and Africa Structural Adhesives Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 28: Middle East and Africa Structural Adhesives Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Structural Adhesives Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Structural Adhesives Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Structural Adhesives Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Structural Adhesives Industry Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Global Structural Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Structural Adhesives Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Structural Adhesives Industry Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 5: Global Structural Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Structural Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Structural Adhesives Industry Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 13: Global Structural Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Structural Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Structural Adhesives Industry Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 19: Global Structural Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Structural Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Structural Adhesives Industry Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 27: Global Structural Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Structural Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Structural Adhesives Industry Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 33: Global Structural Adhesives Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Structural Adhesives Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Structural Adhesives Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Structural Adhesives Industry?

The projected CAGR is approximately 7.64%.

2. Which companies are prominent players in the Structural Adhesives Industry?

Key companies in the market include Huntsman International LLC, Henkel AG & Co KGaA, Bondloc UK Ltd, LG Chem, DuPont, Arkema, RS Industrial*List Not Exhaustive, H B Fuller Company, Forgeway Ltd, Engineered Bonding Solutions LLC, Sika AG, 3M, Parker Hannifin Corp, Illinois Tool Works Inc.

3. What are the main segments of the Structural Adhesives Industry?

The market segments include Resin Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Investments in Developing Economies in Asia-Pacific; Increasing Demand from the Global Construction and Automotive Sectors.

6. What are the notable trends driving market growth?

Increasing Demand from the Construction Industry.

7. Are there any restraints impacting market growth?

Growing Environmental and Health Concerns.

8. Can you provide examples of recent developments in the market?

February 2022: Arkema finalized the acquisition of the Performance Adhesives business of Ashland. The products offered under this division include structural adhesives. The value of the transaction was USD 1.65 billion. The acquisition helped strengthen Arkema's Adhesive Solutions segment and aligned with the company's strategy to become a pure specialty material player by 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Structural Adhesives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Structural Adhesives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Structural Adhesives Industry?

To stay informed about further developments, trends, and reports in the Structural Adhesives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence