Key Insights

The Sri Lanka lubricant market demonstrates a projected CAGR of 3.5% from 2024 to 2033, indicating a period of recovery and growth following a recent contraction. While the market faced challenges in the preceding period, potential drivers for this resurgence include economic stabilization, increased industrial activity, and a growing automotive sector. The current market size is estimated at $4 billion, with 2024 as the base year. Key market participants, including Bharat Petroleum, Indian Oil Corporation, and Shell, are actively competing through competitive pricing, product innovation, and robust distribution strategies.

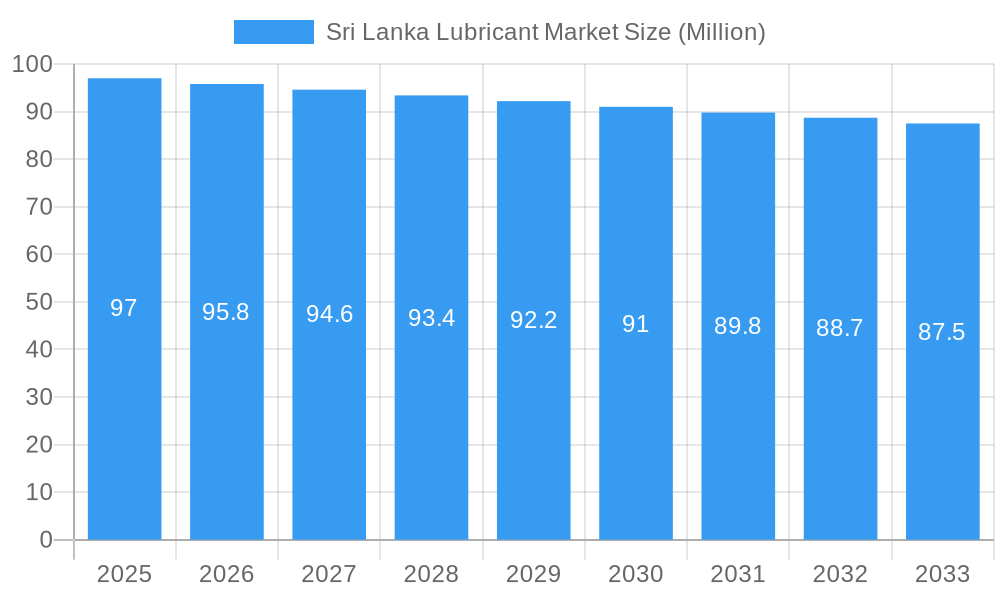

Sri Lanka Lubricant Market Market Size (In Billion)

Looking ahead, sustained economic development, infrastructure expansion, and supportive government policies will be critical for continued market expansion. Emerging trends such as the increasing adoption of fuel-efficient vehicles and the gradual integration of electric vehicles may influence traditional lubricant demand. However, significant opportunities lie within the growth of industrial sectors, the demand for specialized lubricants in manufacturing and construction, and strategic collaborations. A commitment to sustainable and eco-friendly lubricant solutions will also be vital for capturing environmentally conscious market segments. Enhancements in marketing and distribution are expected to drive market penetration and capitalize on emerging opportunities, fostering a dynamic market landscape throughout the forecast period.

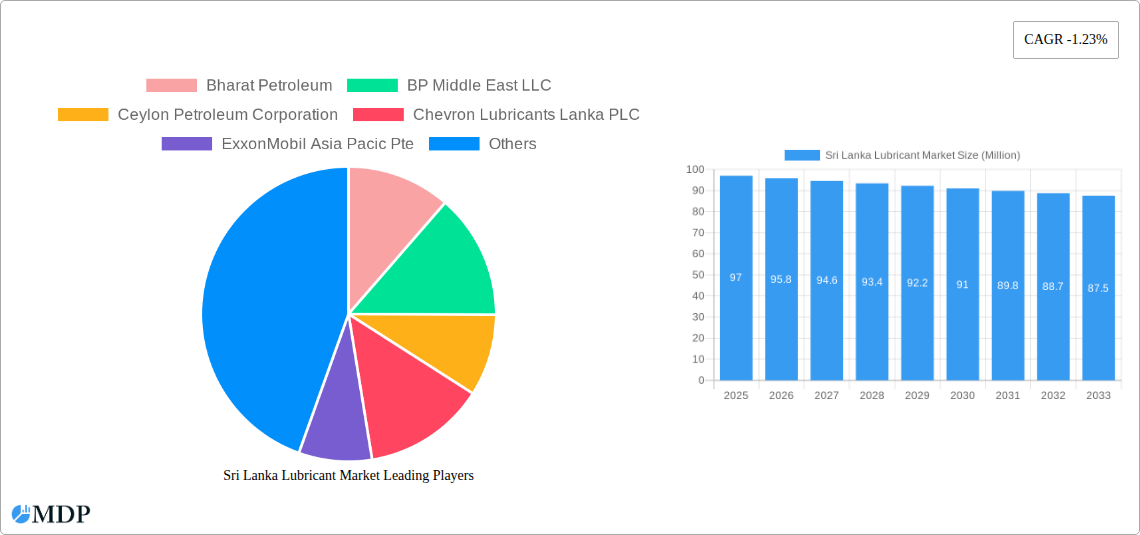

Sri Lanka Lubricant Market Company Market Share

Sri Lanka Lubricant Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Sri Lanka lubricant market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period covering 2019-2033, a base year of 2025, and a forecast period spanning 2025-2033, this report unveils the market's dynamics, trends, and future potential. The report leverages rigorous data analysis to provide actionable intelligence and strategic recommendations. Market size is presented in Millions.

Sri Lanka Lubricant Market Dynamics & Concentration

This section delves into the competitive landscape of Sri Lanka's lubricant market. We analyze market concentration, identifying key players and their respective market shares. The report examines innovation drivers, including technological advancements and product diversification, and assesses the impact of regulatory frameworks on market growth. Furthermore, we evaluate the influence of substitute products and evolving end-user trends, offering a comprehensive understanding of the market's competitive dynamics. Mergers and acquisitions (M&A) activities within the industry are also analyzed, detailing the number of deals and their impact on market consolidation. For example, the market share of Ceylon Petroleum Corporation is estimated at xx% in 2025, while the M&A activity in the period 2019-2024 resulted in approximately xx deals. Key aspects influencing market concentration include:

- Market Share Distribution: Examining the dominance of major players and the presence of smaller, niche players.

- Innovation and R&D Spending: Assessing the investment in new lubricant technologies and formulations.

- Regulatory Landscape: Analyzing the impact of government policies and environmental regulations.

- Substitute Products: Evaluating the threat posed by alternative lubrication solutions.

- End-User Trends: Analyzing shifts in demand across various sectors (automotive, industrial, etc.)

- M&A Activity: Tracking mergers, acquisitions, and joint ventures affecting market structure.

Sri Lanka Lubricant Market Industry Trends & Analysis

This section offers a detailed analysis of the Sri Lanka lubricant market's growth trajectory, focusing on key drivers, disruptive technologies, and evolving consumer preferences. We present a comprehensive overview of market dynamics, including:

- Market Size and Growth: Analyzing historical data (2019-2024) and projecting future growth (2025-2033) with CAGR estimations. The estimated market size in 2025 is xx Million, projected to reach xx Million by 2033.

- Technological Disruptions: Examining the impact of advancements in lubricant technology, such as synthetic oils and biolubricants.

- Consumer Preferences: Analyzing shifts in demand for different types of lubricants based on factors such as performance, price, and environmental concerns.

- Competitive Dynamics: Assessing the strategies employed by major players to gain market share and maintain competitiveness, including pricing strategies, branding, and distribution networks. The competitive intensity is assessed as (high/medium/low) based on factors like the number of players and market share concentration.

Leading Markets & Segments in Sri Lanka Lubricant Market

This section identifies the dominant regions, countries, or segments within the Sri Lanka lubricant market. We analyze the factors contributing to their dominance, including economic policies, infrastructure development, and industrial growth. A detailed analysis of the leading segment will be presented, with specific bullet points detailing reasons for its dominance:

- Dominant Segment: (e.g., Automotive lubricants) accounts for an estimated xx% of the market in 2025.

- Key Drivers of Dominance:

- Strong automotive sector growth.

- Rising vehicle ownership rates.

- Government initiatives promoting infrastructure development.

- Favorable economic conditions.

A thorough analysis will be included to explain the dominance of the identified segment. This will involve examining factors like market size, growth rate, and consumer preferences within the specific segment.

Sri Lanka Lubricant Market Product Developments

This section summarizes recent product innovations, applications, and their competitive advantages. The focus is on technological trends and market fit, with an emphasis on how new product introductions are shaping market competition. For instance, the increased adoption of synthetic lubricants is driven by improved performance and extended lifespan, leading to enhanced fuel efficiency and reduced maintenance costs. This trend is expected to continue, driving market growth in the forecast period.

Key Drivers of Sri Lanka Lubricant Market Growth

Several key factors are driving growth in the Sri Lanka lubricant market. These include:

- Economic Growth: Expanding industrial sectors and rising consumer spending are boosting demand for lubricants.

- Infrastructure Development: Investments in transportation and construction are fueling demand for industrial lubricants.

- Technological Advancements: The introduction of high-performance lubricants with improved efficiency is driving market growth.

Challenges in the Sri Lanka Lubricant Market

The Sri Lanka lubricant market faces several challenges, impacting growth and profitability:

- Price Volatility: Fluctuations in crude oil prices directly impact lubricant prices, affecting profitability and consumer demand. The impact of these fluctuations will be detailed.

- Import Dependence: Reliance on imports for raw materials exposes the market to global supply chain disruptions. The extent of import dependency and its impact on market stability will be quantified.

- Intense Competition: The presence of numerous domestic and international players leads to intense competition, impacting pricing and market share.

Emerging Opportunities in Sri Lanka Lubricant Market

Despite challenges, several opportunities exist for growth:

- Growing Industrialization: Expansion in sectors like manufacturing and construction presents significant opportunities for lubricant sales.

- Government Initiatives: Government support for infrastructure development and industrial growth creates a positive environment for market expansion.

- Technological Innovation: Developing and adopting eco-friendly and high-performance lubricants opens new avenues for growth.

Leading Players in the Sri Lanka Lubricant Market Sector

- Bharat Petroleum

- BP Middle East LLC

- Ceylon Petroleum Corporation

- Chevron Lubricants Lanka PLC

- ExxonMobil Asia Pacific Pte

- Indian Oil Corporation Limited

- Laugfs Holdings Limited

- Lubricant Company Sinopec

- Motul

- Shell Markets (Middle East) Limited

- Total Oil India Private Limited

- Toyota Tsusho Corporation

- Valvoline LLC *List Not Exhaustive

Key Milestones in Sri Lanka Lubricant Market Industry

- 2020: Launch of a new high-performance engine oil by a major player.

- 2022: Implementation of stricter environmental regulations impacting lubricant formulations.

- 2023: Acquisition of a local lubricant company by a multinational corporation. (Further milestones will be detailed in the full report)

Strategic Outlook for Sri Lanka Lubricant Market Market

The Sri Lanka lubricant market presents significant long-term growth potential driven by economic expansion, infrastructure development, and technological advancements. Strategic partnerships, investments in R&D, and product diversification will be key factors determining success in this competitive market. Companies focused on sustainability and eco-friendly products are poised for significant gains in market share.

Sri Lanka Lubricant Market Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Transmission and Gear Oils

- 1.3. Metalworking Fluid

- 1.4. Hydraulic Fluid

- 1.5. Grease

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Automotive and Other Transportation

- 2.3. Heavy Equipment

- 2.4. Metallurgy and Metalworking

- 2.5. Other End-user Industries

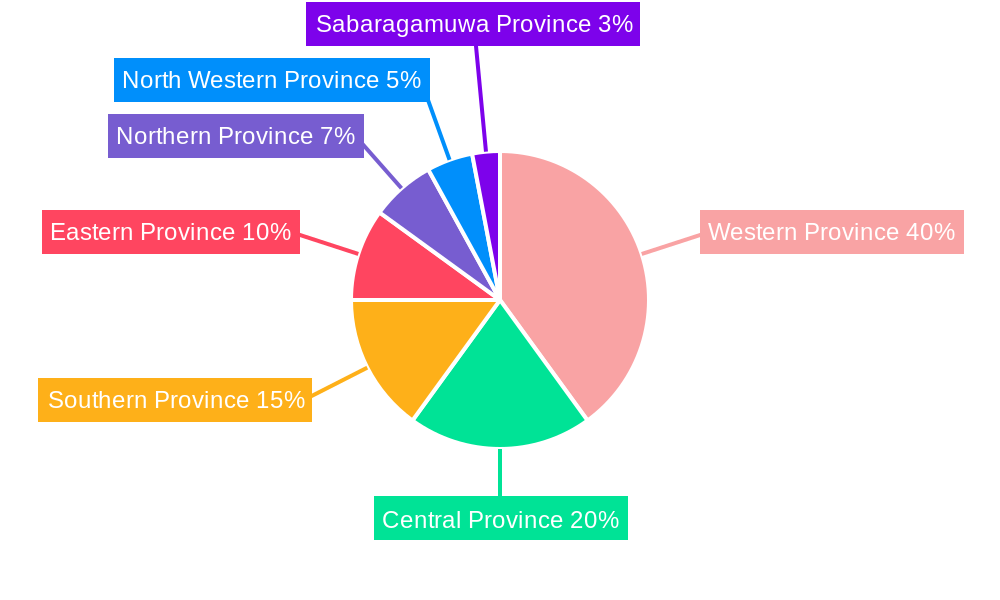

Sri Lanka Lubricant Market Segmentation By Geography

- 1. Sri Lanka

Sri Lanka Lubricant Market Regional Market Share

Geographic Coverage of Sri Lanka Lubricant Market

Sri Lanka Lubricant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Lubricants in Automobiles; Increasing Demand from Agricultural Machinery Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Lubricants in Automobiles; Increasing Demand from Agricultural Machinery Sector; Other Drivers

- 3.4. Market Trends

- 3.4.1. Growing Demand for Heavy Equipment from Agriculture Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sri Lanka Lubricant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Transmission and Gear Oils

- 5.1.3. Metalworking Fluid

- 5.1.4. Hydraulic Fluid

- 5.1.5. Grease

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Automotive and Other Transportation

- 5.2.3. Heavy Equipment

- 5.2.4. Metallurgy and Metalworking

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sri Lanka

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bharat Petroleum

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BP Middle East LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ceylon Petroleum Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chevron Lubricants Lanka PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ExxonMobil Asia Pacic Pte

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Indian Oil Corporation Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Laugfs Holdings Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lubricant Company Sinopec

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Motul

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shell Markets (Middle East) Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Total Oil India Private Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Toyota Tsusho Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Valvoline LLC*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Bharat Petroleum

List of Figures

- Figure 1: Sri Lanka Lubricant Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Sri Lanka Lubricant Market Share (%) by Company 2025

List of Tables

- Table 1: Sri Lanka Lubricant Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Sri Lanka Lubricant Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Sri Lanka Lubricant Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Sri Lanka Lubricant Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Sri Lanka Lubricant Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Sri Lanka Lubricant Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sri Lanka Lubricant Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Sri Lanka Lubricant Market?

Key companies in the market include Bharat Petroleum, BP Middle East LLC, Ceylon Petroleum Corporation, Chevron Lubricants Lanka PLC, ExxonMobil Asia Pacic Pte, Indian Oil Corporation Limited, Laugfs Holdings Limited, Lubricant Company Sinopec, Motul, Shell Markets (Middle East) Limited, Total Oil India Private Limited, Toyota Tsusho Corporation, Valvoline LLC*List Not Exhaustive.

3. What are the main segments of the Sri Lanka Lubricant Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Lubricants in Automobiles; Increasing Demand from Agricultural Machinery Sector; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand for Heavy Equipment from Agriculture Segment.

7. Are there any restraints impacting market growth?

Increasing Usage of Lubricants in Automobiles; Increasing Demand from Agricultural Machinery Sector; Other Drivers.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sri Lanka Lubricant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sri Lanka Lubricant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sri Lanka Lubricant Market?

To stay informed about further developments, trends, and reports in the Sri Lanka Lubricant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence