Key Insights

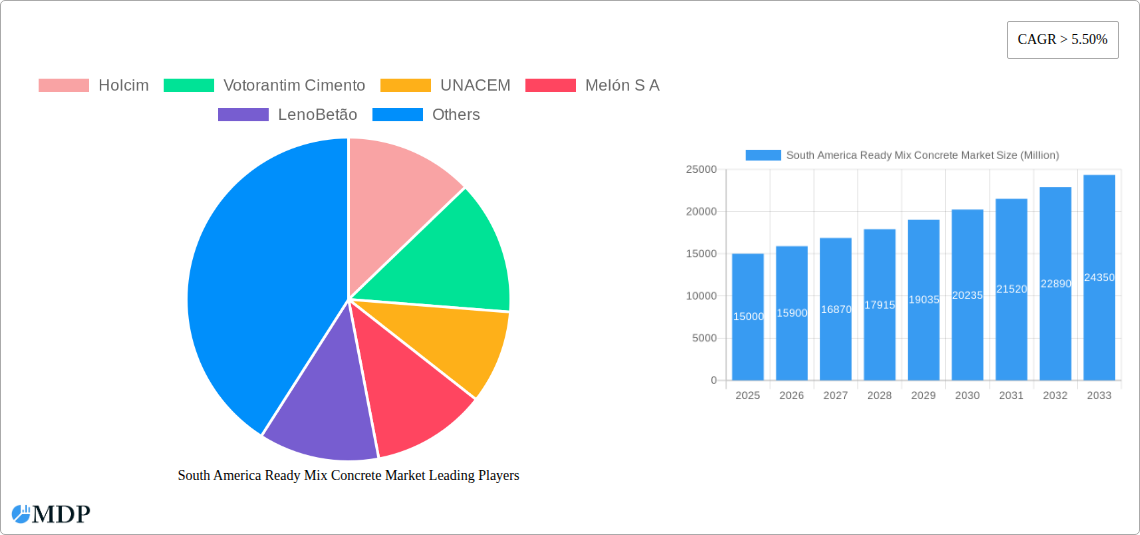

The South American ready-mix concrete market is experiencing robust growth, driven by significant infrastructure development projects across Brazil and Argentina, as well as increasing residential and commercial construction activities in the region. The market's Compound Annual Growth Rate (CAGR) exceeding 5.50% from 2019 to 2024 indicates a consistently expanding demand for ready-mix concrete. This growth is fueled by government initiatives promoting infrastructure modernization, urbanization trends leading to increased housing demands, and a steady rise in industrial and commercial projects. Key segments within this market include central mixed, shrink mixed, and transit mixed concrete, catering to diverse construction needs. Major players like Holcim, Votorantim Cimento, and CEMEX are actively shaping the market landscape through strategic investments and expansion plans. While challenges such as fluctuating raw material prices and economic volatility exist, the long-term outlook for the South American ready-mix concrete market remains positive, with continued growth projected throughout the forecast period (2025-2033). The market size in 2025 is estimated to be substantial, reflecting the cumulative effect of these factors. Further growth will be influenced by the successful execution of large-scale infrastructure projects and the sustained growth of the construction industry in the region. The competition among major players is intense, resulting in continuous product innovation and improvements in efficiency.

South America Ready Mix Concrete Market Market Size (In Billion)

The diverse end-use sectors—commercial, industrial and institutional, infrastructure, and residential—contribute significantly to the overall market size and demand. Brazil and Argentina are the leading contributors, but growth potential also exists in the Rest of South America. The preference for ready-mix concrete over on-site mixing is primarily due to enhanced quality control, time efficiency, and reduced labor costs, driving market penetration. Future growth will depend upon consistent government investment in infrastructure, the stability of the regional economies, and the ability of industry players to effectively manage challenges related to resource availability and logistics. Continuous innovation in concrete technology, incorporating sustainable and high-performance materials, is expected to further stimulate market growth.

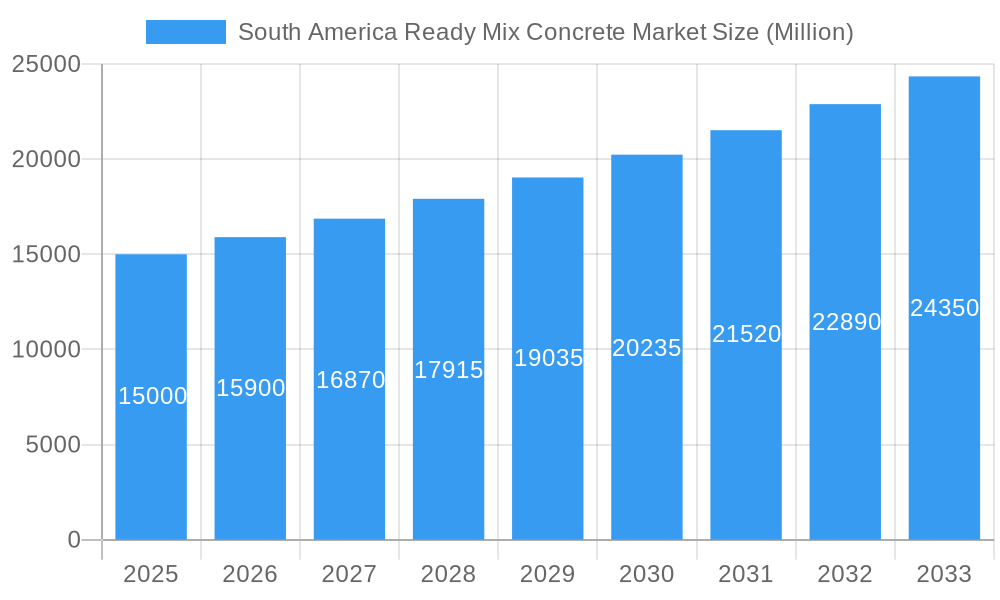

South America Ready Mix Concrete Market Company Market Share

South America Ready Mix Concrete Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Ready Mix Concrete market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, trends, leading players, and future growth prospects. The report leverages extensive market research, incorporating key industry developments and offering actionable intelligence for informed decision-making.

South America Ready Mix Concrete Market Dynamics & Concentration

The South American ready-mix concrete market exhibits a moderately consolidated structure, with a handful of major players controlling a significant market share. The market share held by the top five players is estimated to be approximately xx%. This concentration is influenced by factors such as economies of scale, extensive distribution networks, and strong brand recognition. However, smaller regional players also contribute significantly, especially in niche segments.

Innovation Drivers: Technological advancements in concrete formulations, including high-performance concrete and sustainable mixes, are driving market innovation. Automation in production and delivery processes is further optimizing efficiency and cost-effectiveness.

Regulatory Frameworks: Varying regulations across South American countries concerning construction standards, environmental impact, and safety protocols significantly influence market dynamics. Compliance costs and the complexity of navigating different regulatory landscapes impact profitability and expansion strategies.

Product Substitutes: Alternative construction materials, such as prefabricated components and other building materials, pose a degree of competition. However, the versatility, strength, and widespread acceptance of ready-mix concrete maintain its dominant position.

End-User Trends: The increasing urbanization and infrastructure development across South America are driving demand for ready-mix concrete across residential, commercial, and industrial sectors. Government initiatives focusing on infrastructure projects fuel further market growth.

M&A Activities: The past five years have seen xx mergers and acquisitions in the South American ready-mix concrete sector. This activity reflects the strategic consolidation efforts of major players seeking to expand their market presence and optimize operational efficiency. For example, Holcim's divestment in 2022 resulted in a significant shift in market share.

South America Ready Mix Concrete Market Industry Trends & Analysis

The South American ready-mix concrete market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by a surge in construction activity fueled by economic expansion, urbanization, and government investments in infrastructure development. Market penetration in emerging economies within South America remains high and continues to grow as infrastructure projects expand. Technological advancements such as the use of 3D printing for concrete structures and the adoption of sustainable concrete formulations are adding value and driving market diversification. Growing environmental awareness is boosting the demand for environmentally friendly concrete solutions, creating a new segment of market competition and growth. Consumer preference is shifting toward high-performance, durable, and sustainable concrete products which is spurring innovation and new product development.

Leading Markets & Segments in South America Ready Mix Concrete Market

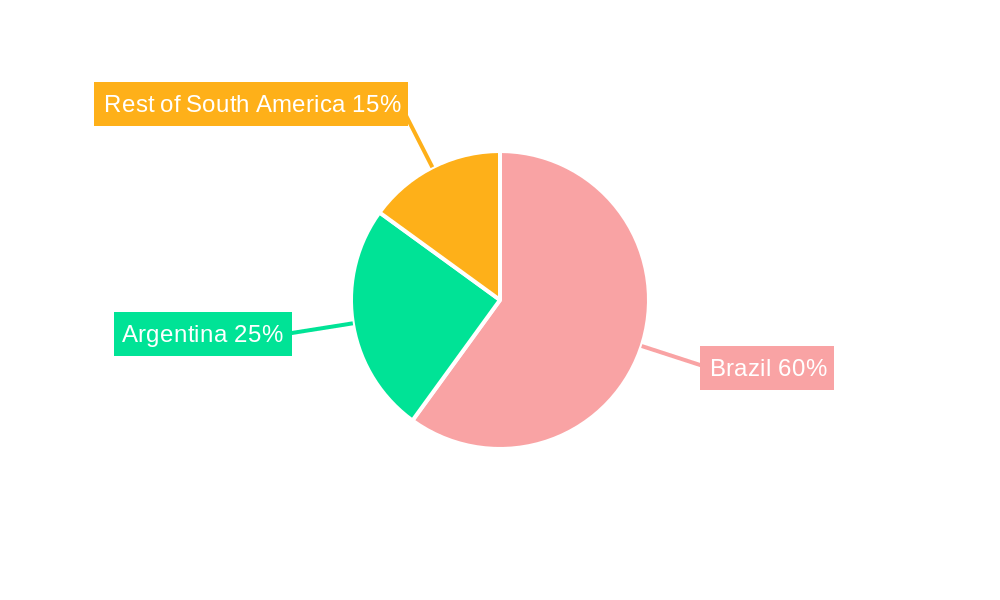

Brazil remains the dominant market in South America for ready-mix concrete, accounting for approximately xx% of the regional market. This is largely attributed to its robust construction sector, extensive infrastructure projects, and considerable economic activity. Other significant markets include Colombia, Argentina, and Chile.

Key Drivers by Segment:

End-Use Sector:

- Infrastructure: Government investments in transportation, energy, and water infrastructure projects are significantly boosting demand.

- Residential: Rapid urbanization and population growth contribute to a large and growing residential construction sector.

- Commercial & Industrial: Expansion of commercial and industrial activities leads to heightened demand for high-quality concrete solutions.

Product Type:

- Central Mixed: This segment holds the largest market share due to its cost-effectiveness and widespread availability.

- Transit Mixed: Demand is growing for projects requiring quick delivery and placement of concrete.

- Shrink Mixed: While a smaller segment, shrink-mixed concrete finds application in specialized construction projects.

South America Ready Mix Concrete Market Product Developments

Recent product developments focus on high-performance concrete with enhanced strength, durability, and sustainability attributes. This includes incorporating recycled materials and utilizing innovative additives to reduce environmental impact. The industry also emphasizes ready-mix concrete solutions tailored to specific construction needs, including high-strength concrete for skyscrapers, lightweight concrete for residential buildings, and self-consolidating concrete for complex projects. These advancements provide competitive advantages by meeting diverse customer requirements and improving construction efficiency.

Key Drivers of South America Ready Mix Concrete Market Growth

The South American ready-mix concrete market is propelled by several key factors. Robust economic growth in several key countries fosters construction activity. Government investments in infrastructure projects, particularly transportation networks and energy infrastructure, are significant drivers. Urbanization and population growth fuel increased demand for housing and commercial spaces. Technological advancements in concrete formulation and production processes continue to enhance efficiency and product quality.

Challenges in the South America Ready Mix Concrete Market

Challenges include fluctuations in raw material prices (cement, aggregates), affecting production costs. The infrastructure for efficient transportation and logistics in some regions can also pose challenges. Competition among established players and the emergence of new entrants can impact market share and profitability. Regulatory changes and environmental compliance requirements present additional hurdles for companies operating in the sector.

Emerging Opportunities in South America Ready Mix Concrete Market

The market presents significant long-term growth opportunities. Government-led investments in green building and infrastructure projects are driving demand for eco-friendly concrete. Strategic partnerships between ready-mix concrete producers and construction companies enable better supply chain management and project coordination. Technological innovations, like 3D concrete printing and advanced materials, offer considerable potential for market expansion and increased efficiency.

Leading Players in the South America Ready Mix Concrete Market Sector

- Holcim

- Votorantim Cimento

- UNACEM

- Melón S A

- LenoBetão

- ULTRACEM S A S

- CEMEX S A B de C V

- Argos Group

- Polimix Concreto

- Supermix

Key Milestones in South America Ready Mix Concrete Market Industry

- September 2022: Holcim completed the divestment of its Brazilian business to Companhia Siderúrgica Nacional for USD 1.025 billion, impacting market share significantly.

- May 2023: Polimix Concreto commissioned a new manufacturing facility in Mooca, Sao Paulo, expanding its capacity and market reach in Brazil.

- August 2023: Polimix Concreto inaugurated a new ready-mix concrete production facility in Campinas, Sao Paulo, further strengthening its position in the Brazilian market.

Strategic Outlook for South America Ready Mix Concrete Market

The South American ready-mix concrete market is poised for sustained growth, driven by long-term economic expansion, infrastructure development, and urbanization. Companies focusing on innovation, sustainable practices, and efficient supply chain management will be best positioned to capitalize on future opportunities. Strategic partnerships and investments in new technologies, like 3D concrete printing, will be crucial for achieving competitive advantage and driving long-term success.

South America Ready Mix Concrete Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

- 2.1. Central Mixed

- 2.2. Shrink Mixed

- 2.3. Transit Mixed

South America Ready Mix Concrete Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Ready Mix Concrete Market Regional Market Share

Geographic Coverage of South America Ready Mix Concrete Market

South America Ready Mix Concrete Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific

- 3.3. Market Restrains

- 3.3.1. Toxic Effects of Terephthalic Acid

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Ready Mix Concrete Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Central Mixed

- 5.2.2. Shrink Mixed

- 5.2.3. Transit Mixed

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Holcim

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Votorantim Cimento

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UNACEM

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Melón S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LenoBetão

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ULTRACEM S A S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEMEX S A B de C V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Argos Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Polimix Concreto

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Supermix

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Holcim

List of Figures

- Figure 1: South America Ready Mix Concrete Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Ready Mix Concrete Market Share (%) by Company 2025

List of Tables

- Table 1: South America Ready Mix Concrete Market Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 2: South America Ready Mix Concrete Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: South America Ready Mix Concrete Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: South America Ready Mix Concrete Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 5: South America Ready Mix Concrete Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South America Ready Mix Concrete Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: South America Ready Mix Concrete Market Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 8: South America Ready Mix Concrete Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: South America Ready Mix Concrete Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: South America Ready Mix Concrete Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 11: South America Ready Mix Concrete Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South America Ready Mix Concrete Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Argentina South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Chile South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Colombia South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Peru South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Peru South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Venezuela South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Venezuela South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Ecuador South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ecuador South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Bolivia South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Bolivia South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Paraguay South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Paraguay South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Uruguay South America Ready Mix Concrete Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Uruguay South America Ready Mix Concrete Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Ready Mix Concrete Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the South America Ready Mix Concrete Market?

Key companies in the market include Holcim, Votorantim Cimento, UNACEM, Melón S A, LenoBetão, ULTRACEM S A S, CEMEX S A B de C V, Argos Group, Polimix Concreto, Supermix.

3. What are the main segments of the South America Ready Mix Concrete Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Toxic Effects of Terephthalic Acid.

8. Can you provide examples of recent developments in the market?

August 2023: Polimix Concreto augmented its presence in Brazil's concrete market by inaugurating a new production facility for ready-mix concrete in Campinas, Sao Paulo.May 2023: Polimix Concreto expanded its presence in Brazil's concrete market by commissioning a new manufacturing facility in Mooca, Sao Paulo. Polimix Concreto aims to cater to more customers through this expansion.September 2022: Holcim completed divesting its business in Brazil to Companhia Siderúrgica Nacional for USD 1.025 billion. The divestment includes Holcim's 19 ready-mix concrete plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Ready Mix Concrete Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Ready Mix Concrete Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Ready Mix Concrete Market?

To stay informed about further developments, trends, and reports in the South America Ready Mix Concrete Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence