Key Insights

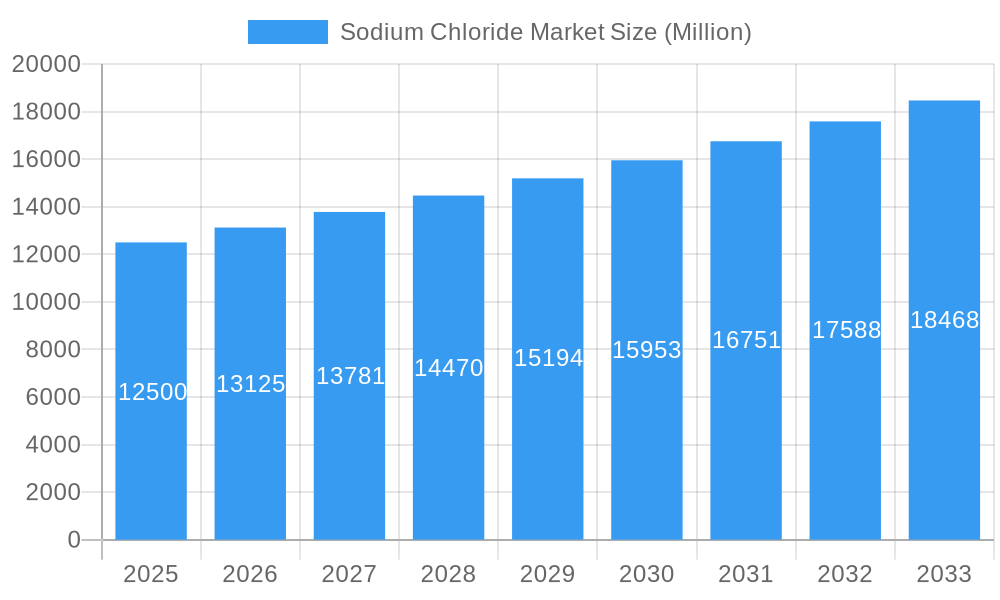

The global Sodium Chloride Market is projected for significant expansion, expected to reach 26.69 billion by 2025. Driven by a robust Compound Annual Growth Rate (CAGR) of 3%, this market exhibits consistent upward momentum. Key growth catalysts include increasing demand across essential sectors such as chemical production, deicing, water treatment, agriculture, food processing, and pharmaceuticals. Sodium chloride's fundamental necessity and versatility across industrial and consumer applications ensure sustained market strength. Furthermore, advancements in salt extraction, purification technologies, and a growing focus on sustainable sourcing positively influence market dynamics, supporting industry needs.

Sodium Chloride Market Market Size (In Billion)

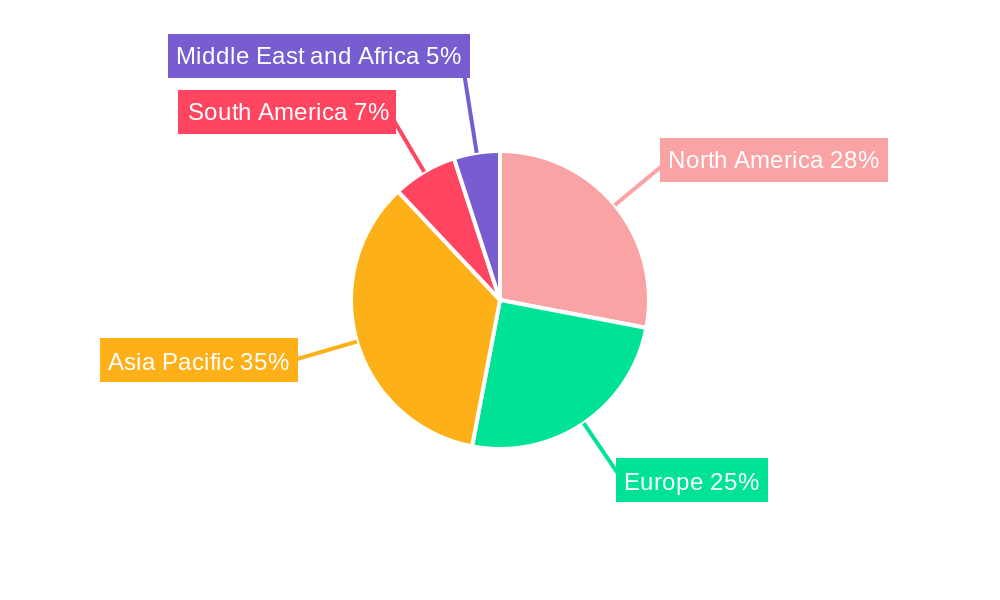

Primary growth drivers include accelerating industrialization in emerging economies, particularly in Asia Pacific, with significant expansion in chemical manufacturing and food processing. The global adoption of advanced water treatment solutions also presents a substantial growth opportunity, given sodium chloride's critical role in water conditioning. Market restraints may include raw material price volatility, stringent environmental regulations, and the emergence of alternative deicing agents in specific applications. Nevertheless, the indispensable nature of sodium chloride in core industries ensures enduring demand, with opportunities emerging from technological innovation and new application development.

Sodium Chloride Market Company Market Share

Sodium Chloride Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a thorough analysis of the global Sodium Chloride Market, offering actionable insights for industry stakeholders. Covering a study period from 2019 to 2033, with a base year of 2025, this research delves into market dynamics, segmentation, leading players, and future trends. Leveraging high-traffic keywords such as "sodium chloride market," "salt market," "industrial salt," "deicing salt," "chemical production," and "food grade salt," this report aims to maximize search visibility and attract a broad audience of industry professionals, investors, and decision-makers. Discover critical market drivers, emerging opportunities, and strategic imperatives shaping the future of this essential commodity.

Sodium Chloride Market Market Dynamics & Concentration

The Sodium Chloride Market is characterized by a moderate to high concentration, with a few key players dominating global production and supply. Innovation drivers include the development of purer grades for pharmaceutical and food applications, as well as advancements in extraction and purification technologies to enhance efficiency and sustainability. Regulatory frameworks, particularly concerning environmental impact and food safety standards, play a crucial role in shaping market access and product development. Product substitutes are limited for many core applications due to sodium chloride's unique chemical properties and cost-effectiveness, though in some niche areas, alternative chemicals might be considered. End-user trends indicate a consistent demand driven by essential industries like chemical production, food processing, and deicing, with growing emphasis on sustainable sourcing and high-purity products. Merger and acquisition (M&A) activities, while not extremely frequent, often involve strategic consolidation to gain market share or acquire specialized technologies. For instance, the Dampier Salt divestment by Rio Tinto signals strategic portfolio adjustments by major players. The market has witnessed a few significant M&A deals in recent years, contributing to the evolving competitive landscape. Understanding these dynamics is crucial for navigating the competitive terrain and identifying strategic growth avenues within the global sodium chloride industry.

Sodium Chloride Market Industry Trends & Analysis

The Sodium Chloride Market is poised for steady growth driven by multifaceted factors. A significant growth driver is the ever-increasing demand from the chemical industry, where sodium chloride serves as a fundamental feedstock for the production of chlorine, caustic soda, and numerous other essential chemicals. This fundamental demand underpins a substantial portion of the market's volume. Technological disruptions are emerging in the form of more efficient and environmentally friendly salt extraction and processing techniques. Innovations in solar evaporation and vacuum evaporation methods are improving yields and reducing energy consumption, thereby enhancing the sustainability profile of producers. Consumer preferences are evolving, particularly in the food processing sector, with a growing demand for high-purity, additive-free, and specifically graded salts for diverse culinary applications. This trend is pushing manufacturers to invest in advanced purification processes and stringent quality control measures. Competitive dynamics are shaped by global supply chain efficiencies, geographical resource availability, and the ability of companies to meet diverse end-user specifications. The market penetration of specialized salt grades for pharmaceutical and water conditioning applications is also on the rise, reflecting a growing awareness of the critical roles sodium chloride plays beyond its traditional uses. The projected Compound Annual Growth Rate (CAGR) for the Sodium Chloride Market is estimated to be in the range of 4-5% over the forecast period, indicating a robust and stable market trajectory. This growth is further bolstered by ongoing investments in infrastructure and industrial development in emerging economies, which naturally escalate the consumption of basic chemicals derived from sodium chloride.

Leading Markets & Segments in Sodium Chloride Market

The global Sodium Chloride Market exhibits distinct regional dominance and segment preferences. North America, particularly the United States and Canada, remains a leading market due to its substantial chemical manufacturing base and significant deicing requirements during winter months. Europe also represents a mature and significant market, driven by its robust chemical industry and established food processing sector. Asia Pacific is emerging as a high-growth region, fueled by rapid industrialization, expanding food consumption, and increasing infrastructure development, leading to higher demand across various applications.

Within the Grade segmentation, Vacuum Salt holds a dominant position due to its high purity and consistent quality, making it indispensable for pharmaceutical, food processing, and high-end chemical applications. Rock Salt remains crucial for deicing and certain industrial processes where purity is less critical, offering a cost-effective solution. Solar Salt, produced through natural evaporation, caters to a broad range of applications, including water conditioning and some chemical processes, especially in regions with favorable climatic conditions.

The Application segmentation reveals that Chemical Production constitutes the largest share, driven by the demand for chlorine and caustic soda. Deicing is another substantial application, particularly in colder climates, with demand fluctuating based on winter severity. Water Conditioning is experiencing steady growth as water quality concerns rise globally. Food Processing represents a high-value segment, with an increasing preference for specialized salt grades. The Pharmaceutical segment, though smaller in volume, commands higher prices due to stringent purity and quality requirements.

- Dominance Drivers in North America:

- Economic Policies: Favorable industrial policies and strong manufacturing sectors drive demand for chemical production.

- Infrastructure: Extensive road networks necessitate significant consumption of deicing salt.

- Consumer Demand: High per capita consumption in food and pharmaceutical sectors.

- Dominance Drivers in Chemical Production Application:

- Industrial Growth: Expansion of petrochemical and chemical manufacturing industries globally.

- Essential Feedstock: Inherent necessity of sodium chloride for producing fundamental chemicals like chlorine and caustic soda.

- Dominance Drivers in Vacuum Salt Grade:

- Purity Requirements: Critical for sensitive applications like pharmaceuticals and high-quality food products.

- Technological Advancements: Improved vacuum evaporation techniques ensure high purity and consistency.

- Dominance Drivers in Food Processing Application:

- Global Food Demand: Increasing population and evolving dietary habits worldwide.

- Product Innovation: Demand for flavored salts, mineral-enriched salts, and specialty culinary salts.

Sodium Chloride Market Product Developments

Product development in the Sodium Chloride Market focuses on enhancing purity, functionality, and sustainability. Innovations are geared towards producing ultra-pure sodium chloride for critical pharmaceutical applications, such as intravenous solutions and dialysis treatments, exemplified by B. Braun's FDA-approved manufacturing plant. In the food sector, advancements include the development of specialized salts with unique mineral profiles and enhanced solubility for specific food processing needs. Furthermore, companies are investing in sustainable production methods, such as utilizing renewable energy sources for evaporation processes, as seen in Nouryon's agreement with Suzano. These developments aim to not only meet stringent regulatory requirements but also cater to evolving consumer preferences for healthier and environmentally responsible products, thereby creating a competitive edge in niche and high-value market segments.

Key Drivers of Sodium Chloride Market Growth

The growth of the Sodium Chloride Market is propelled by several key drivers. Foremost is the essential nature of sodium chloride as a feedstock for the global chemical industry, underpinning the production of numerous vital chemicals. The increasing demand for purified water drives the growth of the water conditioning segment, as salt is a primary component in water softeners. In colder regions, seasonal deicing needs remain a significant and consistent driver of demand. Furthermore, the growing global population and expanding food processing industry ensure a continuous need for food-grade salt. Technological advancements in extraction and purification are also contributing by improving efficiency and enabling the production of higher-value specialty salts for pharmaceutical and other advanced applications, thereby expanding market reach and revenue potential.

Challenges in the Sodium Chloride Market Market

Despite its robust growth, the Sodium Chloride Market faces several challenges. Environmental regulations concerning brine disposal and land use can pose significant hurdles for extraction operations, potentially increasing operational costs and limiting expansion. Supply chain disruptions, as witnessed by the Dampier Salt divestment, can impact availability and pricing, particularly for geographically concentrated production sites. Fluctuating energy costs directly affect the profitability of energy-intensive evaporation processes. Moreover, the mature nature of some applications, like basic industrial salt, leads to intense price competition and lower profit margins, necessitating a strategic focus on higher-value specialty grades to maintain profitability and a strong market position.

Emerging Opportunities in Sodium Chloride Market

Emerging opportunities in the Sodium Chloride Market lie in the expansion of high-purity salt for the pharmaceutical sector, driven by increasing healthcare demands and the growing complexity of drug formulations. The development of specialty salts with unique mineral compositions and functional properties for health-conscious consumers and niche food applications presents another significant growth avenue. Furthermore, advancements in sustainable salt production, utilizing renewable energy and minimizing environmental impact, offer a competitive advantage and cater to the growing corporate responsibility demands. Strategic partnerships and geographical expansion into emerging economies with developing industrial and food processing sectors also present substantial long-term growth catalysts, opening new markets and customer bases.

Leading Players in the Sodium Chloride Market Sector

Cargill Incorporated CK Life Sciences Int'l (Holdings) Inc Compass Minerals INEOS K+S Aktiengesellschaft Nouryon Pon Pure Chemicals Group Rio Tinto Südwestdeutsche Salzwerke AG Swiss Salt Works AG Tata Chemicals Europe Wacker Chemie AG

Key Milestones in Sodium Chloride Market Industry

- January 2024: Dampier Salt, an Australian salt company whose 68% stakes are held by Rio Tinto, announced that it will be selling one of its three production sites, the Lake MacLeod site, to Leichhardt Industrials Group in Australia for USD 251 million. This strategic divestment by Rio Tinto indicates a reshuffling of assets within major global players, potentially impacting regional supply dynamics and ownership structures.

- January 2022: B. Braun received FDA permission for a pharmaceutical manufacturing plant in Florida. B. Braun Medical's Daytona Beach manufacturing plant is expected to produce 0.9% sodium chloride for injection, which will be offered in 1,000 ml and 500 ml Excel Plus IV bags from Bethlehem, Pennsylvania. This development highlights the increasing demand for high-purity pharmaceutical-grade sodium chloride and the expansion of specialized production facilities to meet this critical need.

- January 2022: Nouryon signed a 15-year agreement with Suzano, a eucalyptus pulp producing company. Nouryon is projected to commission its sustainable integrated manufacturing model for the new Suzano eucalyptus pulp mill in Ribas do Rio Pardo, Brazil. Nouryon will use renewable electricity from Suzano's new pulp mill to produce sodium chlorate. This agreement signifies a commitment towards sustainable manufacturing practices, leveraging renewable energy sources to produce essential industrial chemicals, and reflects Nouryon's strategic focus on environmentally conscious operations.

Strategic Outlook for Sodium Chloride Market Market

The strategic outlook for the Sodium Chloride Market is one of sustained growth and evolving specialization. Companies that focus on investing in advanced purification technologies will be well-positioned to capture higher-value segments like pharmaceuticals and premium food products. Embracing sustainable production practices, including the utilization of renewable energy and efficient resource management, will be crucial for long-term competitiveness and meeting growing environmental mandates. Strategic partnerships and collaborations, particularly in R&D for novel applications and geographical expansion into emerging markets, offer significant growth accelerators. The ability to adapt to fluctuating energy costs and navigate complex regulatory landscapes will also be key determinants of success. Overall, the market is expected to see continued demand driven by essential industrial and consumer needs, with opportunities for significant growth in specialized and sustainable offerings.

Sodium Chloride Market Segmentation

-

1. Grade

- 1.1. Rock Salt

- 1.2. Solar Salt

- 1.3. Vacuum Salt

-

2. Application

- 2.1. Chemical Production

- 2.2. Deicing

- 2.3. Water Conditioning

- 2.4. Agriculture

- 2.5. Food Processing

- 2.6. Pharmaceutical

- 2.7. Other Applications

Sodium Chloride Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Vietnam

- 1.6. Malaysia

- 1.7. Indonesia

- 1.8. Thailand

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Turkey

- 3.7. Italy

- 3.8. NORDIC

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Qatar

- 5.4. Nigeria

- 5.5. United Arab Emirates

- 5.6. Egypt

- 5.7. Rest of Middle East and Africa

Sodium Chloride Market Regional Market Share

Geographic Coverage of Sodium Chloride Market

Sodium Chloride Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Sodium Chloride from Food and Beverage Industry; Increasing Demand for Pharmaceutical-grade Sodium Chloride in North America and Europe

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Sodium Chloride from Food and Beverage Industry; Increasing Demand for Pharmaceutical-grade Sodium Chloride in North America and Europe

- 3.4. Market Trends

- 3.4.1. The Chemical Production Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sodium Chloride Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. Rock Salt

- 5.1.2. Solar Salt

- 5.1.3. Vacuum Salt

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Chemical Production

- 5.2.2. Deicing

- 5.2.3. Water Conditioning

- 5.2.4. Agriculture

- 5.2.5. Food Processing

- 5.2.6. Pharmaceutical

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. Asia Pacific Sodium Chloride Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. Rock Salt

- 6.1.2. Solar Salt

- 6.1.3. Vacuum Salt

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Chemical Production

- 6.2.2. Deicing

- 6.2.3. Water Conditioning

- 6.2.4. Agriculture

- 6.2.5. Food Processing

- 6.2.6. Pharmaceutical

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. North America Sodium Chloride Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. Rock Salt

- 7.1.2. Solar Salt

- 7.1.3. Vacuum Salt

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Chemical Production

- 7.2.2. Deicing

- 7.2.3. Water Conditioning

- 7.2.4. Agriculture

- 7.2.5. Food Processing

- 7.2.6. Pharmaceutical

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Europe Sodium Chloride Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. Rock Salt

- 8.1.2. Solar Salt

- 8.1.3. Vacuum Salt

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Chemical Production

- 8.2.2. Deicing

- 8.2.3. Water Conditioning

- 8.2.4. Agriculture

- 8.2.5. Food Processing

- 8.2.6. Pharmaceutical

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. South America Sodium Chloride Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 9.1.1. Rock Salt

- 9.1.2. Solar Salt

- 9.1.3. Vacuum Salt

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Chemical Production

- 9.2.2. Deicing

- 9.2.3. Water Conditioning

- 9.2.4. Agriculture

- 9.2.5. Food Processing

- 9.2.6. Pharmaceutical

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 10. Middle East and Africa Sodium Chloride Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 10.1.1. Rock Salt

- 10.1.2. Solar Salt

- 10.1.3. Vacuum Salt

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Chemical Production

- 10.2.2. Deicing

- 10.2.3. Water Conditioning

- 10.2.4. Agriculture

- 10.2.5. Food Processing

- 10.2.6. Pharmaceutical

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CK Life Sciences Int'l (Holdings) Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Compass Minerals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 INEOS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 K+S Aktiengesellschaft

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nouryon

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pon Pure Chemicals Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rio Tinto

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Südwestdeutsche Salzwerke AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Swiss Salt Works AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tata Chemicals Europe

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wacker Chemie AG*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Sodium Chloride Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Sodium Chloride Market Revenue (billion), by Grade 2025 & 2033

- Figure 3: Asia Pacific Sodium Chloride Market Revenue Share (%), by Grade 2025 & 2033

- Figure 4: Asia Pacific Sodium Chloride Market Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Sodium Chloride Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Sodium Chloride Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Sodium Chloride Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Sodium Chloride Market Revenue (billion), by Grade 2025 & 2033

- Figure 9: North America Sodium Chloride Market Revenue Share (%), by Grade 2025 & 2033

- Figure 10: North America Sodium Chloride Market Revenue (billion), by Application 2025 & 2033

- Figure 11: North America Sodium Chloride Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Sodium Chloride Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Sodium Chloride Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Sodium Chloride Market Revenue (billion), by Grade 2025 & 2033

- Figure 15: Europe Sodium Chloride Market Revenue Share (%), by Grade 2025 & 2033

- Figure 16: Europe Sodium Chloride Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Sodium Chloride Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Sodium Chloride Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Sodium Chloride Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Sodium Chloride Market Revenue (billion), by Grade 2025 & 2033

- Figure 21: South America Sodium Chloride Market Revenue Share (%), by Grade 2025 & 2033

- Figure 22: South America Sodium Chloride Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Sodium Chloride Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Sodium Chloride Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Sodium Chloride Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Sodium Chloride Market Revenue (billion), by Grade 2025 & 2033

- Figure 27: Middle East and Africa Sodium Chloride Market Revenue Share (%), by Grade 2025 & 2033

- Figure 28: Middle East and Africa Sodium Chloride Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Sodium Chloride Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Sodium Chloride Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Sodium Chloride Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sodium Chloride Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 2: Global Sodium Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Sodium Chloride Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Sodium Chloride Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 5: Global Sodium Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Sodium Chloride Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Vietnam Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Thailand Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Sodium Chloride Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 17: Global Sodium Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Sodium Chloride Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United States Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Sodium Chloride Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 23: Global Sodium Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Sodium Chloride Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Germany Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Italy Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: France Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Russia Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Turkey Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Italy Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: NORDIC Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Sodium Chloride Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 35: Global Sodium Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Sodium Chloride Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Colombia Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of South America Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Global Sodium Chloride Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 42: Global Sodium Chloride Market Revenue billion Forecast, by Application 2020 & 2033

- Table 43: Global Sodium Chloride Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Saudi Arabia Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Qatar Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Nigeria Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: United Arab Emirates Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: Egypt Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Rest of Middle East and Africa Sodium Chloride Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sodium Chloride Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Sodium Chloride Market?

Key companies in the market include Cargill Incorporated, CK Life Sciences Int'l (Holdings) Inc, Compass Minerals, INEOS, K+S Aktiengesellschaft, Nouryon, Pon Pure Chemicals Group, Rio Tinto, Südwestdeutsche Salzwerke AG, Swiss Salt Works AG, Tata Chemicals Europe, Wacker Chemie AG*List Not Exhaustive.

3. What are the main segments of the Sodium Chloride Market?

The market segments include Grade, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.69 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Sodium Chloride from Food and Beverage Industry; Increasing Demand for Pharmaceutical-grade Sodium Chloride in North America and Europe.

6. What are the notable trends driving market growth?

The Chemical Production Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Sodium Chloride from Food and Beverage Industry; Increasing Demand for Pharmaceutical-grade Sodium Chloride in North America and Europe.

8. Can you provide examples of recent developments in the market?

January 2024: Dampier Salt, an Australian salt company whose 68% stakes are held by Rio Tinto, announced that it will be selling one of its three production sites, the Lake MacLeod site, to Leichhardt Industrials Group in Australia for USD 251 million.January 2022: B. Braun received FDA permission for a pharmaceutical manufacturing plant in Florida. B. Braun Medical's Daytona Beach manufacturing plant is expected to produce 0.9% sodium chloride for injection, which will be offered in 1,000 ml and 500 ml Excel Plus IV bags from Bethlehem, Pennsylvania.January 2022: Nouryon signed a 15-year agreement with Suzano, a eucalyptus pulp producing company. Nouryon is projected to commission its sustainable integrated manufacturing model for the new Suzano eucalyptus pulp mill in Ribas do Rio Pardo, Brazil. Nouryon will use renewable electricity from Suzano's new pulp mill to produce sodium chlorate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sodium Chloride Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sodium Chloride Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sodium Chloride Market?

To stay informed about further developments, trends, and reports in the Sodium Chloride Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence