Key Insights

The Russia sealants market is forecast to experience robust expansion, driven by significant demand from the construction and automotive sectors. Key growth factors include ongoing urban development, infrastructure modernization initiatives, and the increasing adoption of advanced building materials. Specialized sealant applications are also emerging in the aerospace and healthcare industries. The market is segmented by resin type, including acrylic, epoxy, polyurethane, and silicone, catering to diverse end-user requirements and pricing structures. Despite potential economic headwinds and import considerations, the overall market outlook remains favorable due to sustained construction activity and the need for high-performance sealing solutions. Leading international and regional manufacturers are actively engaged in this dynamic market.

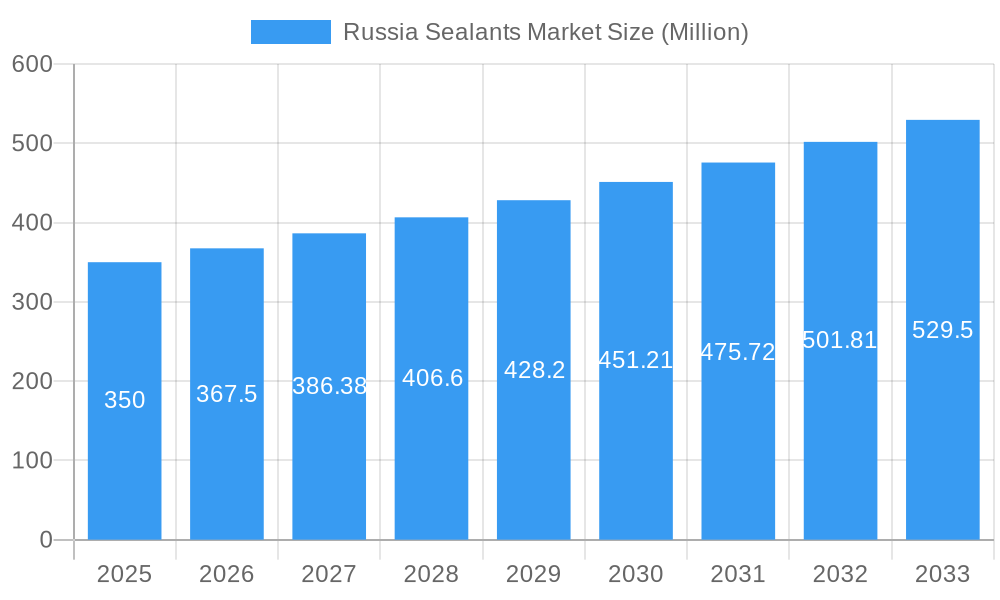

Russia Sealants Market Market Size (In Billion)

Government focus on infrastructure renewal and urban growth, alongside rising energy efficiency awareness in buildings and transportation, will continue to fuel sealant demand. Continued investment in R&D for innovative, sustainable, and high-performance sealant technologies is crucial for sustained market momentum. The market size is projected to reach 76.96 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.46% from the base year of 2025. Intense competition is anticipated as manufacturers aim to meet specific industry needs while navigating geopolitical influences and supply chain complexities.

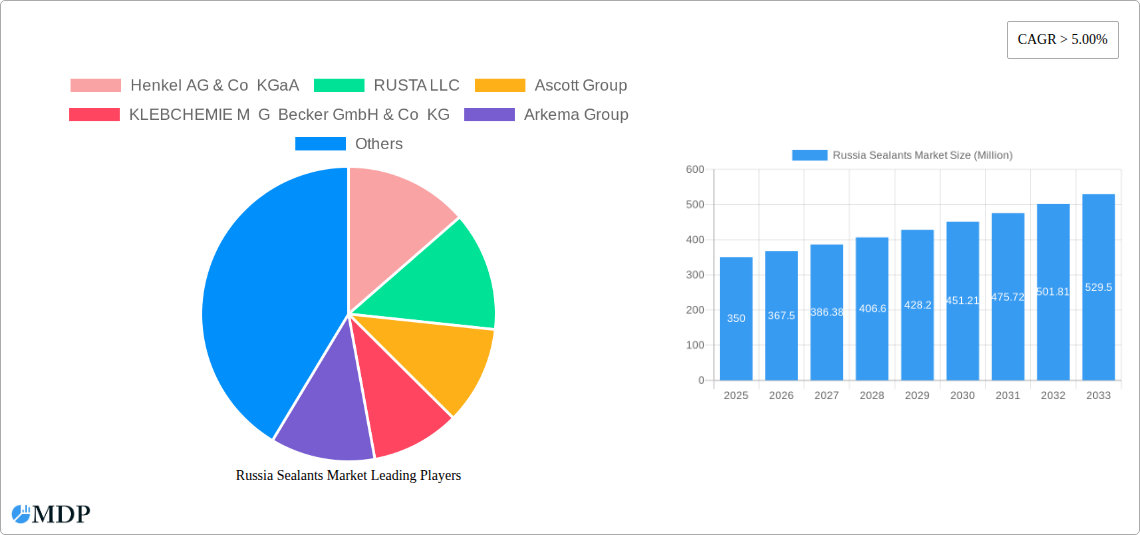

Russia Sealants Market Company Market Share

Russia Sealants Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Russia sealants market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, emerging trends, and future growth prospects. Benefit from actionable intelligence derived from rigorous market research, forecasting models, and expert analysis. This in-depth study is essential for navigating the complexities of the Russian sealant landscape and capitalizing on lucrative opportunities. Search keywords: Russia sealants market, Russia sealant market size, Russia sealant market share, Russia sealant industry, sealant market Russia, Russian sealant manufacturers, sealants market forecast Russia, Russia construction sealants.

Russia Sealants Market Market Dynamics & Concentration

The Russia sealants market exhibits a moderately consolidated structure, with several multinational corporations and domestic players vying for market share. The market's concentration is influenced by factors including the strength of established brands, technological advancements, and government regulations. The market share held by the top five players in 2025 is estimated to be xx%.

Market Dynamics:

- Innovation Drivers: Ongoing R&D efforts leading to the development of high-performance sealants with enhanced durability, sustainability, and specialized applications (e.g., fire-resistant sealants).

- Regulatory Frameworks: Compliance with building codes and environmental regulations significantly shapes product development and market access. Stricter environmental regulations are driving the adoption of eco-friendly sealant options.

- Product Substitutes: The availability of alternative materials, such as tapes and adhesives, poses a degree of competitive pressure. However, sealants’ unique properties (e.g., water resistance, flexibility) continue to maintain their demand.

- End-User Trends: Growth in the construction sector, particularly infrastructure projects, drives demand for sealants. Furthermore, increasing consumer awareness regarding energy efficiency contributes to higher demand for specialized sealants.

- M&A Activities: The market has witnessed several significant mergers and acquisitions, such as the acquisition of Profflex by Soudal in 2019. The number of M&A deals in the period 2019-2024 is estimated to be xx. Such activities consolidate market power and expand product portfolios.

Russia Sealants Market Industry Trends & Analysis

The Russia sealants market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is attributed to several key factors. The expanding construction industry, fuelled by both residential and commercial projects, is a major catalyst. Technological advancements in sealant formulations, leading to improved performance characteristics, also drive market expansion. Furthermore, increasing awareness of energy efficiency and sustainability is promoting the adoption of eco-friendly sealants. The market penetration of high-performance sealants is projected to reach xx% by 2033. Competitive dynamics are shaped by pricing strategies, product innovation, and brand recognition. Consumer preferences are shifting towards higher-quality, durable, and environmentally friendly sealants.

Leading Markets & Segments in Russia Sealants Market

The building and construction sector represents the largest end-user segment within the Russia sealants market, driven by extensive infrastructure development and urbanization. The Silicone resin segment holds a significant market share, owing to its versatile properties and suitability across diverse applications.

Key Drivers for Dominant Segments:

- Building and Construction: Government initiatives supporting infrastructure development, rising investments in real estate, and robust growth in the construction industry.

- Silicone Resins: Superior properties like flexibility, durability, and water resistance, making them suitable for a wide range of applications compared to other resins.

Dominance Analysis: The dominance of the building and construction sector is reinforced by consistent government investments in infrastructure projects, ongoing urbanization across Russia's major cities, and a growing residential construction market. Similarly, the popularity of silicone sealants is attributed to their superior performance and diverse applications, outperforming alternatives in numerous end-user segments.

Russia Sealants Market Product Developments

Recent product innovations focus on developing sealants with enhanced performance characteristics, such as improved weather resistance, UV stability, and fire resistance. These advancements cater to the growing demand for high-performance sealants in various industries. Manufacturers are emphasizing the development of eco-friendly and sustainable sealant options, utilizing recycled materials and minimizing environmental impact. These developments aim to improve market fit by fulfilling the needs of environmentally-conscious consumers and regulatory requirements.

Key Drivers of Russia Sealants Market Growth

The Russia sealants market’s growth is propelled by factors including the booming construction industry, sustained infrastructure investments by the government, and ongoing advancements in sealant technology resulting in improved product performance and durability. Increased consumer awareness of energy efficiency further fuels demand for high-performance sealants that enhance energy savings.

Challenges in the Russia Sealants Market Market

The Russia sealants market faces challenges such as fluctuating raw material prices, potential supply chain disruptions, and intense competition among domestic and international players. These factors could negatively impact pricing strategies and overall market growth. Economic volatility and geopolitical factors can also create uncertainties, affecting overall market expansion. Furthermore, regulatory compliance and environmental concerns present ongoing challenges for manufacturers.

Emerging Opportunities in Russia Sealants Market

The increasing focus on sustainable construction practices presents significant opportunities for manufacturers of eco-friendly sealants. Furthermore, strategic partnerships and collaborations among industry players could unlock new avenues for market expansion and technological advancements. Exploring niche applications within specialized industries (e.g., aerospace, healthcare) also presents growth potential.

Leading Players in the Russia Sealants Market Sector

- Henkel AG & Co KGaA

- RUSTA LLC

- Ascott Group

- KLEBCHEMIE M G Becker GmbH & Co KG

- Arkema Group

- Dow

- Soudal Holding N V

- MAPEI S p A

- Sika AG

- Kiilto

Key Milestones in Russia Sealants Market Industry

- June 2019: Soudal acquired Profflex, strengthening its presence in the Eastern European market and expanding its product portfolio. This significantly impacted market dynamics by increasing Soudal's market share and competitive advantage.

- April 2019: Dow's separation of its Material Science division through a spin-off of Dow Inc. resulted in a restructuring of the industry, impacting supply chains and potentially influencing product availability and pricing.

Strategic Outlook for Russia Sealants Market Market

The Russia sealants market presents a promising outlook, driven by the continued expansion of the construction sector and the growing demand for high-performance and sustainable sealants. Strategic investments in R&D, focusing on innovative product development and expansion into niche markets, will be crucial for capturing market share and achieving sustainable growth. Companies must proactively adapt to evolving regulatory landscapes and consumer preferences to maintain competitiveness in this dynamic market.

Russia Sealants Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Healthcare

- 1.5. Other End-user Industries

-

2. Resin

- 2.1. Acrylic

- 2.2. Epoxy

- 2.3. Polyurethane

- 2.4. Silicone

- 2.5. Other Resins

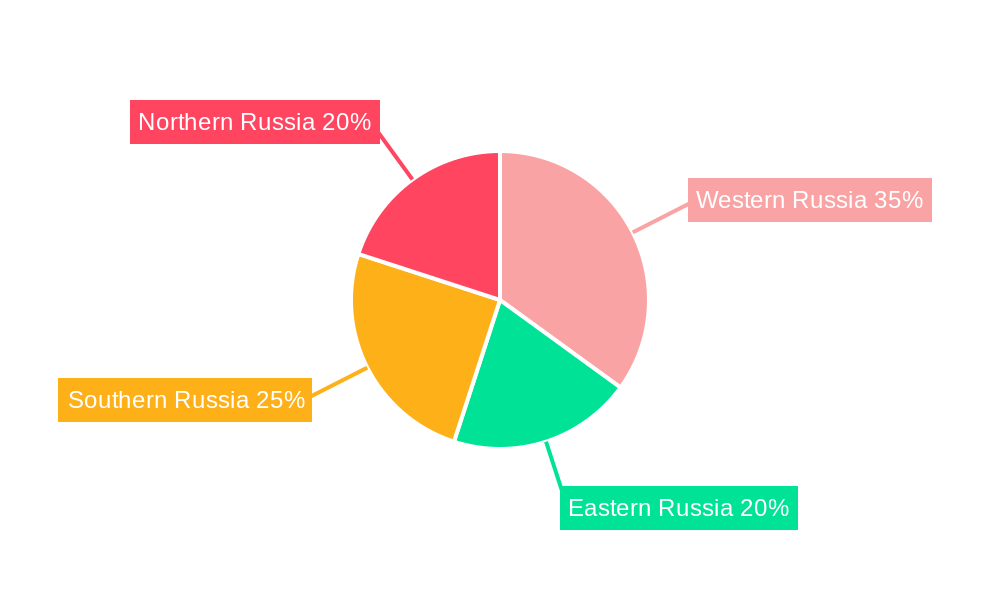

Russia Sealants Market Segmentation By Geography

- 1. Russia

Russia Sealants Market Regional Market Share

Geographic Coverage of Russia Sealants Market

Russia Sealants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Demand from Construction Industry; Adoption of Vacuum Insulation Panel for Automated Storage and Retrieval; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Cost of VIPs for Non-standard Sizes; Heavy Weight of Vacuum Insulation Panels

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Sealants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Healthcare

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin

- 5.2.1. Acrylic

- 5.2.2. Epoxy

- 5.2.3. Polyurethane

- 5.2.4. Silicone

- 5.2.5. Other Resins

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RUSTA LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ascott Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KLEBCHEMIE M G Becker GmbH & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arkema Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dow

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Soudal Holding N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MAPEI S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sika AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kiilto

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Russia Sealants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Sealants Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Sealants Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Russia Sealants Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 3: Russia Sealants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Russia Sealants Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Russia Sealants Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 6: Russia Sealants Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Sealants Market?

The projected CAGR is approximately 3.46%.

2. Which companies are prominent players in the Russia Sealants Market?

Key companies in the market include Henkel AG & Co KGaA, RUSTA LLC, Ascott Group, KLEBCHEMIE M G Becker GmbH & Co KG, Arkema Group, Dow, Soudal Holding N V, MAPEI S p A, Sika AG, Kiilto.

3. What are the main segments of the Russia Sealants Market?

The market segments include End User Industry, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.96 billion as of 2022.

5. What are some drivers contributing to market growth?

Robust Demand from Construction Industry; Adoption of Vacuum Insulation Panel for Automated Storage and Retrieval; Other Drivers.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Cost of VIPs for Non-standard Sizes; Heavy Weight of Vacuum Insulation Panels.

8. Can you provide examples of recent developments in the market?

June 2019: Soudal acquired Profflex, a Russia-based foam and sealant manufacturer, to strengthen its position in the Eastern European market.April 2019: Dow completed the separation of its Material Science division through a spin-off of Dow Inc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Sealants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Sealants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Sealants Market?

To stay informed about further developments, trends, and reports in the Russia Sealants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence