Key Insights

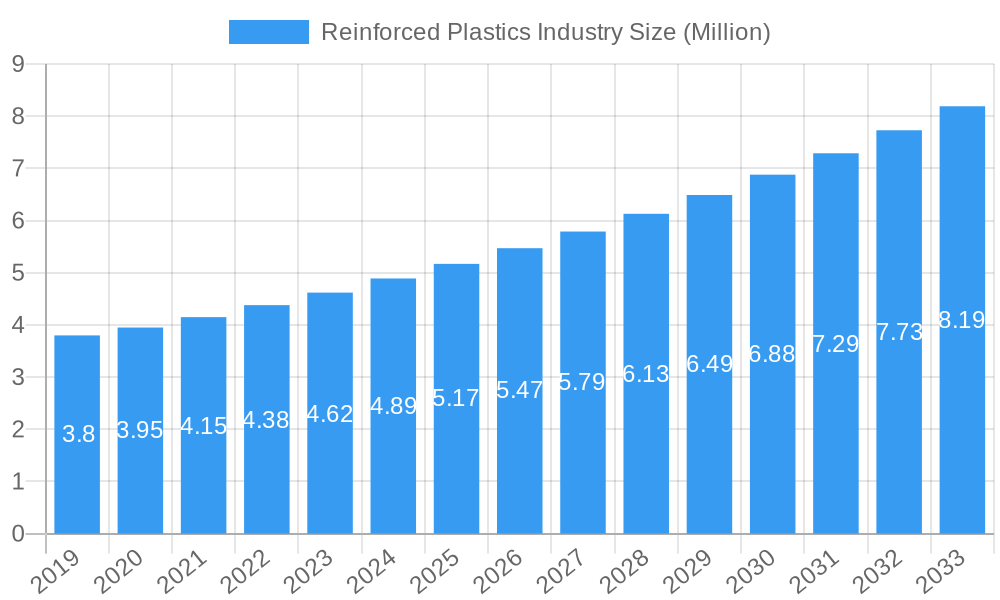

The global Reinforced Plastics market is poised for substantial growth, projected to reach an estimated market size of USD 5.36 billion in 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) study period extending from 2019 to 2033, indicating sustained momentum over the next decade. Historical data from 2019-2024 reveals a steady upward trajectory, setting a strong foundation for the forecast period of 2025-2033. Reinforced plastics, also known as fiber-reinforced polymers (FRPs), are increasingly favored across a diverse range of industries due to their exceptional strength-to-weight ratios, corrosion resistance, and design flexibility. Sectors such as automotive, aerospace, construction, and wind energy are key contributors to this demand, as manufacturers seek advanced materials to improve performance, fuel efficiency, and product longevity. The ongoing innovation in resin systems and reinforcement fibers, including advanced composites, further fuels market penetration and the development of novel applications.

Reinforced Plastics Industry Market Size (In Million)

Looking ahead, the forecast period from 2025 to 2033 anticipates continued robust expansion, building upon the established CAGR. The growing emphasis on sustainable building materials and lightweight components in transportation will be significant drivers. Furthermore, the increasing adoption of reinforced plastics in renewable energy infrastructure, particularly in wind turbine blades and solar panel components, is expected to contribute substantially to market volume. Emerging applications in marine, healthcare, and consumer goods will also play a vital role in diversifying the demand landscape. The market's trajectory is characterized by a persistent need for high-performance materials that can withstand challenging environments and offer cost-effective solutions, positioning reinforced plastics as a critical material for future industrial advancements.

Reinforced Plastics Industry Company Market Share

Unlock the future of advanced materials with our in-depth report on the global Reinforced Plastics Industry. This essential resource provides actionable insights, market-driving trends, and strategic intelligence for stakeholders navigating this dynamic sector. Covering the period from 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, our analysis delves into the intricacies of Glass Fiber, Carbon Fiber, and Aramid Fiber reinforced plastics, exploring their pivotal role across critical end-user industries like Automotive, Aerospace, Energy, and Construction.

Reinforced Plastics Industry Market Dynamics & Concentration

The global Reinforced Plastics Industry exhibits a moderate to high market concentration, with a significant share held by a few key players. Innovation serves as a primary driver, fueled by continuous research and development in material science and composite manufacturing. Regulatory frameworks, particularly those focused on sustainability, safety, and performance standards, are increasingly shaping market entry and product development. The threat of product substitutes, though present from traditional materials and emerging alternatives, is mitigated by the superior strength-to-weight ratio and design flexibility offered by reinforced plastics. End-user demand, driven by lightweighting initiatives in automotive and aerospace, and durability requirements in construction and energy, continues to be a potent growth catalyst. Merger and acquisition (M&A) activities, while not at extreme levels, play a role in consolidating market share and expanding technological capabilities. We have tracked xx M&A deal counts in the historical period, indicating strategic consolidation and expansion. Key companies like Teijin Limited, Solvay, and Toray Industries Inc. hold substantial market shares, contributing to the industry's concentrated nature.

- Innovation Drivers: Lightweighting, enhanced mechanical properties, corrosion resistance, and sustainable material development.

- Regulatory Frameworks: Environmental regulations (e.g., REACH, RoHS), safety standards (e.g., aerospace certification), and performance mandates.

- Product Substitutes: Advanced aluminum alloys, high-strength steels, and emerging bio-composites.

- End-User Trends: Electrification in automotive, renewable energy infrastructure, advanced composite structures in aerospace.

- M&A Activities: Strategic acquisitions for technology integration, market expansion, and vertical integration.

Reinforced Plastics Industry Industry Trends & Analysis

The Reinforced Plastics Industry is on a robust growth trajectory, characterized by a compelling Compound Annual Growth Rate (CAGR) of xx% projected over the forecast period. This expansion is propelled by a confluence of factors, including the relentless pursuit of lightweighting solutions across major industries, the escalating demand for materials offering superior strength and durability, and significant advancements in composite manufacturing technologies. The automotive sector, in particular, is a major beneficiary and driver, with reinforced plastics playing a crucial role in enhancing fuel efficiency and enabling the design of electric vehicle components. The aerospace industry continues to rely on these advanced materials for their critical performance attributes, contributing to significant market penetration in aircraft structures and interiors. Furthermore, the burgeoning renewable energy sector, with its demand for wind turbine blades and energy storage solutions, and the construction industry's need for durable, corrosion-resistant building materials, are further accelerating market adoption. Technological disruptions, such as the development of thermoplastic composites and advanced recycling techniques for composites, are reshaping the competitive landscape and opening new avenues for sustainable applications. Consumer preferences are increasingly leaning towards products that offer enhanced performance, safety, and environmental responsibility, aligning perfectly with the value proposition of reinforced plastics. The competitive dynamics are marked by intense innovation, strategic partnerships, and a growing emphasis on supply chain resilience. The overall market penetration of reinforced plastics is expected to rise to xx% by 2033, signifying their indispensable role in modern manufacturing.

Leading Markets & Segments in Reinforced Plastics Industry

The Glass Fiber Reinforced Plastics (GFRP) segment emerges as the dominant force within the Reinforced Plastics Industry, driven by its cost-effectiveness, versatile properties, and widespread applicability across various end-user industries. This dominance is particularly pronounced in the Building and Construction sector, where GFRP's excellent strength-to-weight ratio, corrosion resistance, and insulation properties make it an ideal choice for applications ranging from structural components to facade systems. Economic policies promoting sustainable and durable infrastructure development further bolster GFRP's market share in this segment.

The Automotive end-user industry represents another significant growth engine, with both GFRP and Carbon Fiber Reinforced Plastics (CFRP) experiencing substantial demand. The relentless drive for lightweighting in conventional vehicles and the increasing production of electric vehicles (EVs) necessitate materials that can reduce overall weight without compromising safety or performance. Government incentives and stringent fuel efficiency regulations are key economic drivers behind this trend.

Dominant Type Segment: Glass Fiber Reinforced Plastics (GFRP)

- Key Drivers: Cost-effectiveness, high tensile strength, electrical insulation properties, and excellent corrosion resistance.

- Dominance Analysis: GFRP's widespread use in construction for panels, pipes, and structural elements, as well as in automotive for body panels and under-the-hood components, solidifies its leading position. Its adaptability to various manufacturing processes further enhances its market appeal.

Dominant End-User Industry: Automotive

- Key Drivers: Lightweighting initiatives for improved fuel efficiency and EV range, enhanced safety through impact absorption, and design flexibility for complex geometries.

- Dominance Analysis: The automotive sector's continuous evolution towards more sustainable and performance-driven vehicles makes it a primary consumer of reinforced plastics. The growing adoption of CFRP in high-performance vehicles and GFRP in mass-produced vehicles highlights its critical role.

Emerging Strong Segments:

- Carbon Fiber Reinforced Plastics (CFRP) in Aerospace: Essential for aircraft weight reduction, leading to improved fuel efficiency and extended range. Stringent performance and safety requirements in this sector drive the demand for high-performance CFRP.

- Aramid Fiber Reinforced Plastics in Defense: Valued for their exceptional impact resistance and ballistic protection capabilities, crucial for military applications.

- Reinforced Plastics in Energy & Power: Driven by the demand for wind turbine blades (GFRP and CFRP) and components for renewable energy infrastructure, as well as corrosion-resistant materials for traditional energy extraction.

Reinforced Plastics Industry Product Developments

Recent product developments in the Reinforced Plastics Industry are heavily focused on enhancing sustainability and performance. The launch of EVOLVE sustainable solutions by Cabot Corporation in March 2023 exemplifies this trend, introducing a new technology platform for advanced reinforcing carbons that offer reliable industrial-level performance with a reduced environmental footprint. Simultaneously, the DowAksa joint venture's inauguration of an integrated carbon fiber composites production plant in Yalova, Turkey (April 2022) signifies a strategic move to boost carbon fiber composite production capacity, catering to the rising demand from sectors like automotive and aerospace. These innovations are geared towards meeting stringent performance requirements while addressing growing environmental concerns, providing manufacturers with advanced, eco-conscious material solutions.

Key Drivers of Reinforced Plastics Industry Growth

The Reinforced Plastics Industry's growth is propelled by a multifaceted set of drivers. Technologically, the ongoing advancements in composite material science, including the development of higher-strength fibers, advanced resin systems, and more efficient manufacturing processes, are crucial. Economically, the global emphasis on lightweighting across industries like automotive and aerospace to improve fuel efficiency and reduce emissions directly translates into increased demand for reinforced plastics. Regulatory tailwinds, such as stricter environmental standards and safety regulations that favor materials offering superior performance and durability, also play a significant role. Furthermore, the expansion of renewable energy infrastructure, particularly wind power, necessitates the use of large-scale composite structures, acting as a powerful growth accelerator.

Challenges in the Reinforced Plastics Industry Market

Despite its strong growth, the Reinforced Plastics Industry faces several challenges. High raw material costs, particularly for carbon fibers, can impact affordability for some applications. Complex and energy-intensive manufacturing processes present a barrier to entry and can increase production costs. End-of-life management and recycling remain significant environmental challenges, with established infrastructure for recycling composites still in its nascent stages. Stringent regulatory hurdles in certain sectors, such as aerospace, require extensive testing and certification, adding to development timelines and costs. The availability of skilled labor for advanced composite manufacturing is also a growing concern.

Emerging Opportunities in Reinforced Plastics Industry

The Reinforced Plastics Industry is ripe with emerging opportunities. The circular economy presents a significant avenue, with ongoing research and development in composite recycling technologies offering the potential to create a closed-loop system and reduce waste. The expansion of electric vehicles (EVs), with their inherent need for lightweighting and complex structural components, is a major growth catalyst. The increasing investment in renewable energy infrastructure, including wind turbines and solar panel components, will continue to drive demand. Strategic partnerships between material suppliers, manufacturers, and end-users can accelerate innovation and market penetration. Furthermore, the development of bio-based and recycled reinforced plastics offers a path towards more sustainable and environmentally friendly solutions, tapping into a growing market segment.

Leading Players in the Reinforced Plastics Industry Sector

- Ahlstrom

- RBJ Reinforced Plastics Ltd

- Teijin Limited

- Solvay

- Present Advanced Composites Inc

- Gulf Reinforced Plastics

- Celanese Corporation

- PPG Industries Inc

- Cabot Corporation

- Nikkiso Co Ltd

- Reliance Industries Ltd

- Toray Industries Inc

- BASF SE

- Dow

- Jiangsu QIYI Technology Co Ltd

- Hexcel Corporation

- Formosa Plastics Corporation

(List Not Exhaustive)

Key Milestones in Reinforced Plastics Industry Industry

- March 2023: Cabot Corporation announced the launch of EVOLVE sustainable solutions, a new technology platform for advancing sustainable reinforcing carbons. These sustainable reinforcing carbons will provide reliable performance at the industrial level.

- April 2022: DowAksa, a joint venture of Dow and Aska, announced the launch of a new integrated carbon fiber composites production plant in Yalova, Turkey. The new production facility will help to increase the production capacity of carbon fiber composites in the country.

Strategic Outlook for Reinforced Plastics Industry Market

The strategic outlook for the Reinforced Plastics Industry remains exceptionally positive, driven by the ongoing global megatrends of lightweighting, sustainability, and high-performance material demand. Future growth will be accelerated by continued innovation in material science, leading to lighter, stronger, and more cost-effective composites. The industry's ability to adapt to and embrace the principles of the circular economy through advanced recycling and the development of bio-composites will be crucial for long-term success. Strategic collaborations and vertical integration within the value chain will further enhance market competitiveness. Expansion into emerging markets and the development of specialized reinforced plastic solutions for sectors like medical devices and advanced electronics represent significant untapped potential, positioning the Reinforced Plastics Industry as a pivotal enabler of future technological advancements.

Reinforced Plastics Industry Segmentation

-

1. Type

- 1.1. Glass Fiber Reinforced Plastics

- 1.2. Carbon Fiber Reinforced Plastics

- 1.3. Aramid Fiber Reinforced Plastics

- 1.4. Other Ty

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Marine

- 2.3. Aerospace and Defence

- 2.4. Energy and Power

- 2.5. Building and Construction

- 2.6. Other En

Reinforced Plastics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

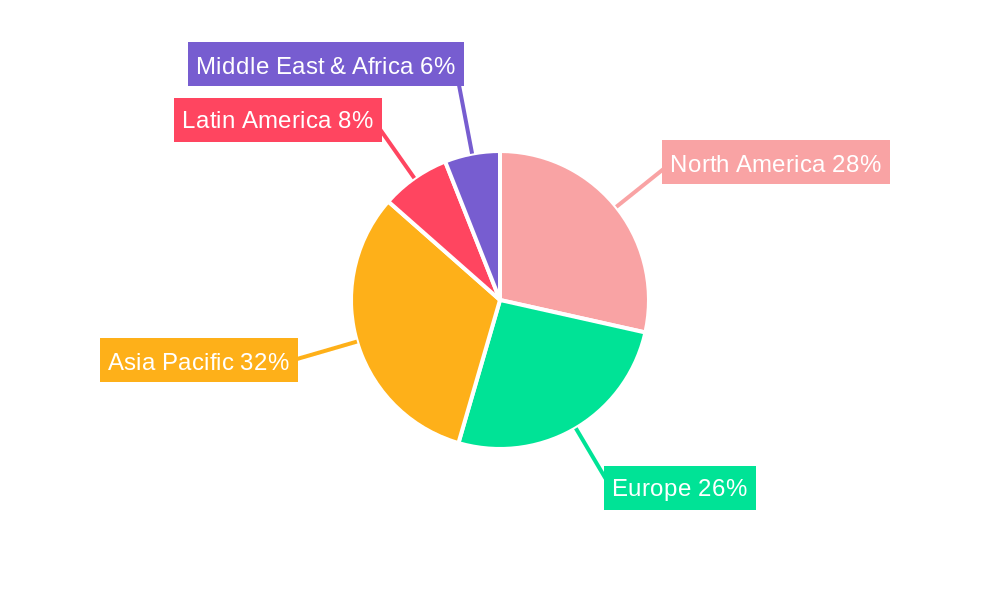

Reinforced Plastics Industry Regional Market Share

Geographic Coverage of Reinforced Plastics Industry

Reinforced Plastics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Aerospace Industry; Rising Demand for Fuel Efficient and Light-weight Vehicles; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Non-Degradable Nature of Reinforced Plastic; Other Restraints

- 3.4. Market Trends

- 3.4.1. Automotive Segment Dominated the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Reinforced Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Glass Fiber Reinforced Plastics

- 5.1.2. Carbon Fiber Reinforced Plastics

- 5.1.3. Aramid Fiber Reinforced Plastics

- 5.1.4. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Marine

- 5.2.3. Aerospace and Defence

- 5.2.4. Energy and Power

- 5.2.5. Building and Construction

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Reinforced Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Glass Fiber Reinforced Plastics

- 6.1.2. Carbon Fiber Reinforced Plastics

- 6.1.3. Aramid Fiber Reinforced Plastics

- 6.1.4. Other Ty

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Marine

- 6.2.3. Aerospace and Defence

- 6.2.4. Energy and Power

- 6.2.5. Building and Construction

- 6.2.6. Other En

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Reinforced Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Glass Fiber Reinforced Plastics

- 7.1.2. Carbon Fiber Reinforced Plastics

- 7.1.3. Aramid Fiber Reinforced Plastics

- 7.1.4. Other Ty

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Marine

- 7.2.3. Aerospace and Defence

- 7.2.4. Energy and Power

- 7.2.5. Building and Construction

- 7.2.6. Other En

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Reinforced Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Glass Fiber Reinforced Plastics

- 8.1.2. Carbon Fiber Reinforced Plastics

- 8.1.3. Aramid Fiber Reinforced Plastics

- 8.1.4. Other Ty

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Marine

- 8.2.3. Aerospace and Defence

- 8.2.4. Energy and Power

- 8.2.5. Building and Construction

- 8.2.6. Other En

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Reinforced Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Glass Fiber Reinforced Plastics

- 9.1.2. Carbon Fiber Reinforced Plastics

- 9.1.3. Aramid Fiber Reinforced Plastics

- 9.1.4. Other Ty

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Marine

- 9.2.3. Aerospace and Defence

- 9.2.4. Energy and Power

- 9.2.5. Building and Construction

- 9.2.6. Other En

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Reinforced Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Glass Fiber Reinforced Plastics

- 10.1.2. Carbon Fiber Reinforced Plastics

- 10.1.3. Aramid Fiber Reinforced Plastics

- 10.1.4. Other Ty

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Marine

- 10.2.3. Aerospace and Defence

- 10.2.4. Energy and Power

- 10.2.5. Building and Construction

- 10.2.6. Other En

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ahlstrom

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RBJ Reinforced Plastics Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Teijin Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Solvay

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Present Advanced Composites Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gulf Reinforced Plastics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Celanese Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PPG Industries Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cabot Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nikkiso Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Relaince Industries Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Toray Industries Inc*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BASF SE

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Dow

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Jiangsu QIYI Technology Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Hexcel Corporation

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Formosa Plastics Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Ahlstrom

List of Figures

- Figure 1: Global Reinforced Plastics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Reinforced Plastics Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Reinforced Plastics Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: Asia Pacific Reinforced Plastics Industry Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Reinforced Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Reinforced Plastics Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Reinforced Plastics Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Reinforced Plastics Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 9: Asia Pacific Reinforced Plastics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: Asia Pacific Reinforced Plastics Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Reinforced Plastics Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Reinforced Plastics Industry Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Reinforced Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Reinforced Plastics Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Reinforced Plastics Industry Revenue (Million), by Type 2025 & 2033

- Figure 16: North America Reinforced Plastics Industry Volume (K Tons), by Type 2025 & 2033

- Figure 17: North America Reinforced Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Reinforced Plastics Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Reinforced Plastics Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: North America Reinforced Plastics Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 21: North America Reinforced Plastics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: North America Reinforced Plastics Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: North America Reinforced Plastics Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Reinforced Plastics Industry Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Reinforced Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Reinforced Plastics Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Reinforced Plastics Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Reinforced Plastics Industry Volume (K Tons), by Type 2025 & 2033

- Figure 29: Europe Reinforced Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Reinforced Plastics Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Reinforced Plastics Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 32: Europe Reinforced Plastics Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 33: Europe Reinforced Plastics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Europe Reinforced Plastics Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Europe Reinforced Plastics Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Reinforced Plastics Industry Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Reinforced Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Reinforced Plastics Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Reinforced Plastics Industry Revenue (Million), by Type 2025 & 2033

- Figure 40: South America Reinforced Plastics Industry Volume (K Tons), by Type 2025 & 2033

- Figure 41: South America Reinforced Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Reinforced Plastics Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Reinforced Plastics Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: South America Reinforced Plastics Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: South America Reinforced Plastics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: South America Reinforced Plastics Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: South America Reinforced Plastics Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Reinforced Plastics Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Reinforced Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Reinforced Plastics Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Reinforced Plastics Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Reinforced Plastics Industry Volume (K Tons), by Type 2025 & 2033

- Figure 53: Middle East and Africa Reinforced Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Reinforced Plastics Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Reinforced Plastics Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 56: Middle East and Africa Reinforced Plastics Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 57: Middle East and Africa Reinforced Plastics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Middle East and Africa Reinforced Plastics Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Middle East and Africa Reinforced Plastics Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Reinforced Plastics Industry Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East and Africa Reinforced Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Reinforced Plastics Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Reinforced Plastics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Reinforced Plastics Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Reinforced Plastics Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Reinforced Plastics Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Reinforced Plastics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Reinforced Plastics Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Reinforced Plastics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Reinforced Plastics Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Global Reinforced Plastics Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Reinforced Plastics Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Reinforced Plastics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Reinforced Plastics Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global Reinforced Plastics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Reinforced Plastics Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 25: Global Reinforced Plastics Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Reinforced Plastics Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Reinforced Plastics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Reinforced Plastics Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United States Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Canada Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Reinforced Plastics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Reinforced Plastics Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 37: Global Reinforced Plastics Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Reinforced Plastics Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Reinforced Plastics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Reinforced Plastics Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Germany Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Italy Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Italy Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: France Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: France Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Global Reinforced Plastics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Reinforced Plastics Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 53: Global Reinforced Plastics Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Reinforced Plastics Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 55: Global Reinforced Plastics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Reinforced Plastics Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Brazil Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Brazil Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Argentina Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Argentina Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Global Reinforced Plastics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global Reinforced Plastics Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 65: Global Reinforced Plastics Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 66: Global Reinforced Plastics Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 67: Global Reinforced Plastics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Reinforced Plastics Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: South Africa Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: South Africa Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Reinforced Plastics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Reinforced Plastics Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Reinforced Plastics Industry?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the Reinforced Plastics Industry?

Key companies in the market include Ahlstrom, RBJ Reinforced Plastics Ltd, Teijin Limited, Solvay, Present Advanced Composites Inc, Gulf Reinforced Plastics, Celanese Corporation, PPG Industries Inc, Cabot Corporation, Nikkiso Co Ltd, Relaince Industries Ltd, Toray Industries Inc*List Not Exhaustive, BASF SE, Dow, Jiangsu QIYI Technology Co Ltd, Hexcel Corporation, Formosa Plastics Corporation.

3. What are the main segments of the Reinforced Plastics Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Aerospace Industry; Rising Demand for Fuel Efficient and Light-weight Vehicles; Other Drivers.

6. What are the notable trends driving market growth?

Automotive Segment Dominated the Market.

7. Are there any restraints impacting market growth?

Non-Degradable Nature of Reinforced Plastic; Other Restraints.

8. Can you provide examples of recent developments in the market?

March 2023: Cabot Corporation announced the launch of EVOLVE sustainable solutions, a new technology platform for advancing sustainable reinforcing carbons. These sustainable reinforcing carbons will provide reliable performance at the industrial level.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Reinforced Plastics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Reinforced Plastics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Reinforced Plastics Industry?

To stay informed about further developments, trends, and reports in the Reinforced Plastics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence