Key Insights

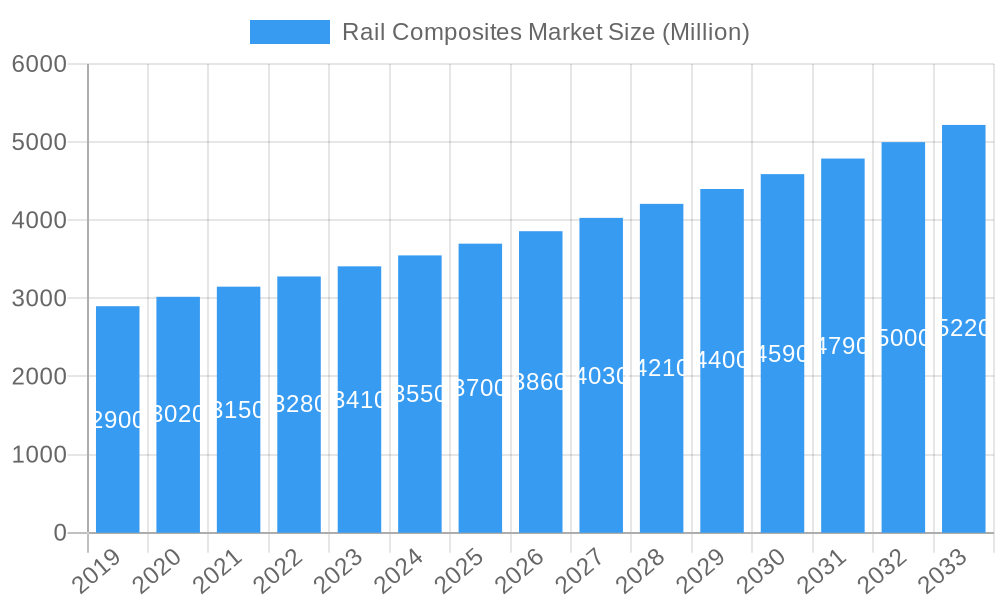

The Global Rail Composites Market is projected for substantial growth, expected to surpass $3.5 billion by 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 5.00% through 2033. This expansion is driven by the railway industry's demand for lightweight, durable, and high-performance materials, prioritizing enhanced fuel efficiency, reduced operational costs, and improved safety in rolling stock. The intrinsic advantages of composites, including superior strength-to-weight ratios, corrosion resistance, and design flexibility, are vital for modern rail infrastructure and vehicles. Growing sustainability initiatives and the imperative to minimize transportation's environmental impact further accelerate the adoption of advanced composite solutions.

Rail Composites Market Market Size (In Million)

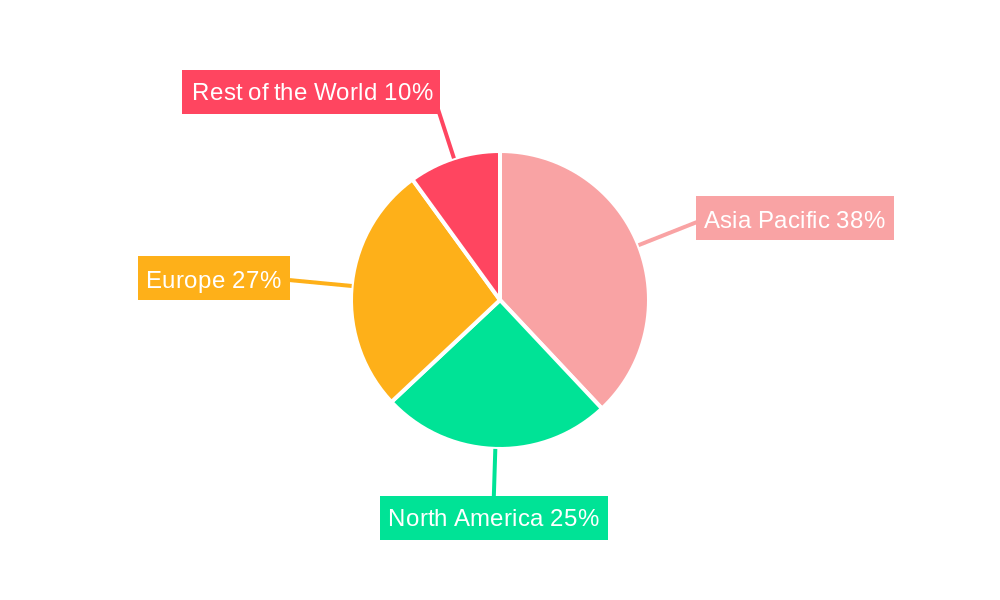

Market evolution is fueled by ongoing research and development in novel resin and fiber technologies. Epoxy and Vinyl Ester resins, alongside Glass Fiber and Carbon Fiber, are anticipated to lead material segments due to their proven performance. Both interior and exterior component applications show significant demand, indicating comprehensive composite integration across the rail ecosystem. Geographically, the Asia Pacific region, led by China and India, is a primary growth engine due to substantial railway modernization investments. North America and Europe also offer strong market potential, driven by stringent regulations, technological innovation, and infrastructure replacement needs. While material costs and specialized manufacturing expertise present challenges, the long-term benefits in lifecycle cost savings and performance ensure a positive outlook for the Rail Composites Market.

Rail Composites Market Company Market Share

This comprehensive market research report offers an exhaustive analysis of the Global Rail Composites Market, a vital sector fostering innovation and sustainability in transportation infrastructure. Covering the study period from 2019 to 2033, with a base year of 2024 and an estimated market size of $1.8 million, and a forecast period from 2025–2033, this report examines historical trends (2019–2024) and future projections. It provides actionable insights for manufacturers, suppliers, rail operators, and investors seeking to leverage the growing demand for lightweight, durable, and high-performance composite materials in the railway sector.

The Rail Composites Market is experiencing robust expansion, driven by the increasing need for energy efficiency, reduced maintenance costs, and enhanced passenger safety in rail transportation. This report provides a granular view of market dynamics, segmentation, key players, and future opportunities, serving as an essential tool for strategic decision-making. Explore the market's trajectory, primary growth drivers, emerging trends, and the competitive landscape shaping the future of rail transportation.

Rail Composites Market Dynamics & Concentration

The Global Rail Composites Market exhibits a moderately concentrated landscape, characterized by the presence of established global players alongside emerging regional manufacturers. Innovation in material science, particularly in developing advanced resins and high-strength fibers, is a primary driver, leading to the introduction of composites with superior mechanical properties, fire resistance, and weight reduction capabilities. Regulatory frameworks, focusing on passenger safety standards and environmental sustainability, are increasingly influencing product development and material selection, pushing the adoption of compliant composite solutions. Product substitutes, such as traditional metals, are facing stiff competition from composites due to their inherent advantages in weight and corrosion resistance. End-user trends are strongly leaning towards enhanced passenger comfort, operational efficiency, and reduced carbon footprints, all of which are directly addressed by the application of advanced composites. Mergers and Acquisitions (M&A) activities are present, albeit moderate, as companies seek to consolidate market share, acquire new technologies, and expand their geographical reach. For instance, the market saw an estimated xx M&A deals between 2019 and 2024. Key players like Solvay and Toray Industries Inc. hold significant market share, estimated at approximately xx% and xx% respectively in the base year 2025, reflecting their extensive product portfolios and strong R&D investments.

Rail Composites Market Industry Trends & Analysis

The Rail Composites Market is poised for significant expansion driven by a confluence of technological advancements, evolving consumer preferences, and a global push towards sustainable transportation solutions. The CAGR for the rail composites market is projected to be around xx% during the forecast period 2025–2033, indicating a robust growth trajectory. One of the paramount growth drivers is the relentless pursuit of lightweight materials to enhance energy efficiency and reduce operational costs for rail operators. Composites, offering a substantial weight reduction compared to traditional metallic components, directly contribute to lower fuel consumption and emissions, aligning with global environmental mandates. Technological disruptions, such as the development of novel resin formulations and advanced fiber architectures, are continuously improving the performance characteristics of rail composites. This includes enhanced fire, smoke, and toxicity (FST) ratings, crucial for passenger safety in enclosed environments, as well as superior mechanical strength and durability, leading to extended service life and reduced maintenance requirements. Consumer preferences are increasingly shaped by the demand for quieter, more comfortable, and safer train journeys. Composite materials contribute to noise and vibration dampening, thereby improving passenger experience. Furthermore, their resistance to corrosion and environmental degradation ensures the structural integrity of rolling stock and infrastructure over extended periods. The competitive dynamics within the market are intensifying, with companies focusing on vertical integration, strategic partnerships, and product differentiation to gain a competitive edge. Market penetration of composites in various rail applications, from interior fittings to structural components, is expected to rise from an estimated xx% in 2025 to xx% by 2033. The integration of smart composite technologies, embedding sensors for real-time structural monitoring, represents another significant trend, promising predictive maintenance and enhanced safety. The growing emphasis on circular economy principles is also prompting research into recyclable and bio-based composite materials for rail applications, further bolstering market prospects.

Leading Markets & Segments in Rail Composites Market

The Global Rail Composites Market is experiencing dynamic growth across various regions and segments, with specific areas demonstrating exceptional dominance. Asia Pacific, particularly China and India, is emerging as the leading market due to significant government investments in high-speed rail infrastructure and the expansion of existing rail networks. Economic policies promoting public transportation and sustainable development are key drivers in this region. The Resin Type segment is dominated by Epoxy resins, accounting for an estimated xx% market share in 2025. Epoxy resins are favored for their excellent mechanical properties, high strength-to-weight ratio, and superior adhesion, making them ideal for structural applications in rolling stock. Glass Fiber is the leading Fiber Type, holding approximately xx% of the market share in 2025. Its cost-effectiveness, combined with good mechanical performance and electrical insulation properties, makes it a widely adopted choice for various rail composite components. In terms of Application, the Interior segment is currently dominant, driven by the need for lightweight, aesthetically pleasing, and fire-retardant materials for cabin fittings, panels, and seating. This segment is expected to capture an estimated xx% of the market in 2025. However, the Exterior application segment is witnessing rapid growth, fueled by the demand for durable, weather-resistant, and impact-resistant materials for car bodies, aerodynamic fairings, and undercarriage components.

Key Drivers for Dominance in Asia Pacific:

- Massive government spending on railway infrastructure upgrades and new lines.

- Growth in high-speed rail networks requiring lightweight and durable materials.

- Increasing adoption of modern rolling stock with advanced composite components.

- Favorable manufacturing ecosystem and skilled labor availability.

Detailed Dominance Analysis: The prevalence of Epoxy resins and Glass Fiber in the market is attributed to their balanced performance-to-cost ratio, meeting the stringent requirements of the railway industry for safety, durability, and economic viability. The dominance of interior applications stems from the widespread retrofitting of existing trains and the ongoing construction of new passenger rolling stock where weight reduction and aesthetic appeal are paramount. As rail networks expand and evolve, the demand for exterior composite applications, offering enhanced aerodynamic efficiency and protection against harsh environmental conditions, is set to surge, driving significant growth in this segment.

Rail Composites Market Product Developments

Product developments in the Rail Composites Market are primarily focused on enhancing material performance, improving manufacturing efficiency, and ensuring compliance with stringent safety and environmental regulations. Innovations in resin technologies are leading to composites with improved fire resistance, reduced smoke emission, and enhanced thermal stability. Advanced fiber technologies, including hybrid fiber structures and novel carbon fiber architectures, are yielding materials with exceptional strength-to-weight ratios and impact resistance. These developments are crucial for exterior applications and critical structural components. Companies are also investing in sustainable composite solutions, exploring bio-based resins and recyclable materials to meet the growing demand for eco-friendly transportation. The competitive advantage derived from these product developments lies in offering lighter, stronger, safer, and more sustainable alternatives to traditional materials, directly addressing the evolving needs of the rail industry.

Key Drivers of Rail Composites Market Growth

The Rail Composites Market is propelled by several interconnected growth drivers. The overarching demand for lightweight materials to improve energy efficiency and reduce operational costs in rail transport is paramount. Technological advancements in advanced composite materials, including high-strength fibers and innovative resin systems, enable the creation of components that are both lighter and more durable. Stringent regulatory frameworks mandating improved safety standards, particularly concerning fire resistance and passenger evacuation, are also pushing the adoption of composites. Furthermore, the global push towards sustainable transportation and the reduction of carbon footprints directly favors the use of lightweight, energy-efficient composite solutions. Infrastructure development, especially in emerging economies, and the modernization of existing rail networks create substantial opportunities for the application of these advanced materials.

Challenges in the Rail Composites Market Market

Despite its strong growth potential, the Rail Composites Market faces several challenges. High initial material costs compared to traditional materials like steel can be a barrier to widespread adoption, particularly for smaller rail operators or in budget-constrained projects. The complex manufacturing processes and the need for specialized equipment and skilled labor can also increase overall project expenses. Regulatory hurdles and the need for extensive testing and certification for new composite materials in safety-critical applications can lead to prolonged development cycles and market entry delays. Supply chain complexities, including the availability and consistent quality of raw materials, can also pose challenges. Furthermore, the perceived risk and lack of established track record for certain novel composite applications among some stakeholders can slow down market acceptance.

Emerging Opportunities in Rail Composites Market

Emerging opportunities in the Rail Composites Market are significant and poised to shape its future trajectory. The growing focus on sustainable transportation is creating a demand for bio-based and recyclable composite materials, opening new avenues for material innovation and market expansion. Technological breakthroughs in areas like additive manufacturing and advanced resin curing techniques are enabling more efficient and cost-effective production of complex composite parts for rail applications. Strategic partnerships between composite manufacturers, rail operators, and technology providers are crucial for co-developing tailored solutions and accelerating market penetration. The increasing demand for enhanced passenger comfort and safety features, such as noise and vibration reduction, presents opportunities for specialized composite solutions. Finally, the expansion of urban rail networks and metro systems globally, particularly in densely populated areas, will continue to drive the demand for lightweight and durable rolling stock components.

Leading Players in the Rail Composites Market Sector

- Solvay

- Celanese Corporation

- Avient Corporation

- Reliance Industries Limited

- Exel Composites

- LANXESS

- BASF SE

- Kineco Limited

- Toray Industries Inc

- Hexcel Corporation

- Gurit

- TEIJIN LIMITED

- Mitsubishi Chemical Advanced Materials

Key Milestones in Rail Composites Market Industry

- May 2021: Celanese announced its plan to initiate a three-year plan to expand its LFT (long-fiber thermoplastics) capacity in Nanjing, China, with completion expected in the second half of 2023.

- 2022: Hexcel Corporation launched a new range of high-performance resin systems specifically designed for demanding aerospace and rail applications, offering enhanced FST properties.

- 2023: Toray Industries Inc. showcased its advanced carbon fiber composites for lightweight rail vehicle construction, demonstrating significant weight savings and improved fuel efficiency.

- 2024: Solvay introduced a novel bio-based epoxy resin for composite manufacturing, targeting the growing demand for sustainable solutions in the rail industry.

- 2025 (Estimated): LANXESS is anticipated to expand its portfolio of flame-retardant additives for rail composites, catering to evolving safety regulations.

Strategic Outlook for Rail Composites Market Market

The strategic outlook for the Rail Composites Market is exceptionally positive, driven by the sustained global commitment to modernizing and expanding railway networks. Growth accelerators include the increasing adoption of high-speed rail, urban transit systems, and freight transportation, all of which benefit from the lightweight and high-performance characteristics of composite materials. The market will witness a continued emphasis on innovation in sustainable composites, including bio-based and recyclable options, aligning with environmental mandates and corporate sustainability goals. Strategic collaborations between material manufacturers, rolling stock OEMs, and rail operators will be crucial for developing bespoke solutions that address specific performance and regulatory requirements. Furthermore, the integration of digital technologies, such as AI-driven material design and advanced simulation tools, will expedite product development and optimize material performance. The focus on lifecycle cost reduction, enhanced safety, and improved passenger experience will continue to position composites as the material of choice for the future of rail transportation.

Rail Composites Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Polyester

- 1.3. Phenolic

- 1.4. Vinyl Ester

- 1.5. Other Resin Types

-

2. Fiber Type

- 2.1. Glass Fiber

- 2.2. Carbon Fiber

- 2.3. Other Fiber Types

-

3. Application

- 3.1. Exterior

- 3.2. Interior

Rail Composites Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

- 4. Rest of the World

Rail Composites Market Regional Market Share

Geographic Coverage of Rail Composites Market

Rail Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Railway Projects in the Asia-Pacific Region; Rapidly Increasing Demand for High-speed Rail

- 3.3. Market Restrains

- 3.3.1 Lack of Railway Infrastructure in Vietnam

- 3.3.2 Indonesia

- 3.3.3 and Thailand; Restrictions on Composite Materials for Railway Application

- 3.4. Market Trends

- 3.4.1. Exterior Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rail Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Polyester

- 5.1.3. Phenolic

- 5.1.4. Vinyl Ester

- 5.1.5. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Fiber Type

- 5.2.1. Glass Fiber

- 5.2.2. Carbon Fiber

- 5.2.3. Other Fiber Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Exterior

- 5.3.2. Interior

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Asia Pacific Rail Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Epoxy

- 6.1.2. Polyester

- 6.1.3. Phenolic

- 6.1.4. Vinyl Ester

- 6.1.5. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Fiber Type

- 6.2.1. Glass Fiber

- 6.2.2. Carbon Fiber

- 6.2.3. Other Fiber Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Exterior

- 6.3.2. Interior

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. North America Rail Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Epoxy

- 7.1.2. Polyester

- 7.1.3. Phenolic

- 7.1.4. Vinyl Ester

- 7.1.5. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Fiber Type

- 7.2.1. Glass Fiber

- 7.2.2. Carbon Fiber

- 7.2.3. Other Fiber Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Exterior

- 7.3.2. Interior

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Europe Rail Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Epoxy

- 8.1.2. Polyester

- 8.1.3. Phenolic

- 8.1.4. Vinyl Ester

- 8.1.5. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Fiber Type

- 8.2.1. Glass Fiber

- 8.2.2. Carbon Fiber

- 8.2.3. Other Fiber Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Exterior

- 8.3.2. Interior

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Rest of the World Rail Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Epoxy

- 9.1.2. Polyester

- 9.1.3. Phenolic

- 9.1.4. Vinyl Ester

- 9.1.5. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Fiber Type

- 9.2.1. Glass Fiber

- 9.2.2. Carbon Fiber

- 9.2.3. Other Fiber Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Exterior

- 9.3.2. Interior

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Solvay

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Celanese Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Avient Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Reliance Industries Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Exel Composites

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 LANXESS

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BASF SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kineco Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Toray Industries Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Hexcel Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Gurit

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 TEIJIN LIMITED

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Mitsubishi Chemical Advanced Materials

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Solvay

List of Figures

- Figure 1: Global Rail Composites Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Rail Composites Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Rail Composites Market Revenue (million), by Resin Type 2025 & 2033

- Figure 4: Asia Pacific Rail Composites Market Volume (K Tons), by Resin Type 2025 & 2033

- Figure 5: Asia Pacific Rail Composites Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 6: Asia Pacific Rail Composites Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 7: Asia Pacific Rail Composites Market Revenue (million), by Fiber Type 2025 & 2033

- Figure 8: Asia Pacific Rail Composites Market Volume (K Tons), by Fiber Type 2025 & 2033

- Figure 9: Asia Pacific Rail Composites Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 10: Asia Pacific Rail Composites Market Volume Share (%), by Fiber Type 2025 & 2033

- Figure 11: Asia Pacific Rail Composites Market Revenue (million), by Application 2025 & 2033

- Figure 12: Asia Pacific Rail Composites Market Volume (K Tons), by Application 2025 & 2033

- Figure 13: Asia Pacific Rail Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Asia Pacific Rail Composites Market Volume Share (%), by Application 2025 & 2033

- Figure 15: Asia Pacific Rail Composites Market Revenue (million), by Country 2025 & 2033

- Figure 16: Asia Pacific Rail Composites Market Volume (K Tons), by Country 2025 & 2033

- Figure 17: Asia Pacific Rail Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Rail Composites Market Volume Share (%), by Country 2025 & 2033

- Figure 19: North America Rail Composites Market Revenue (million), by Resin Type 2025 & 2033

- Figure 20: North America Rail Composites Market Volume (K Tons), by Resin Type 2025 & 2033

- Figure 21: North America Rail Composites Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 22: North America Rail Composites Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 23: North America Rail Composites Market Revenue (million), by Fiber Type 2025 & 2033

- Figure 24: North America Rail Composites Market Volume (K Tons), by Fiber Type 2025 & 2033

- Figure 25: North America Rail Composites Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 26: North America Rail Composites Market Volume Share (%), by Fiber Type 2025 & 2033

- Figure 27: North America Rail Composites Market Revenue (million), by Application 2025 & 2033

- Figure 28: North America Rail Composites Market Volume (K Tons), by Application 2025 & 2033

- Figure 29: North America Rail Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: North America Rail Composites Market Volume Share (%), by Application 2025 & 2033

- Figure 31: North America Rail Composites Market Revenue (million), by Country 2025 & 2033

- Figure 32: North America Rail Composites Market Volume (K Tons), by Country 2025 & 2033

- Figure 33: North America Rail Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America Rail Composites Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Rail Composites Market Revenue (million), by Resin Type 2025 & 2033

- Figure 36: Europe Rail Composites Market Volume (K Tons), by Resin Type 2025 & 2033

- Figure 37: Europe Rail Composites Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 38: Europe Rail Composites Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 39: Europe Rail Composites Market Revenue (million), by Fiber Type 2025 & 2033

- Figure 40: Europe Rail Composites Market Volume (K Tons), by Fiber Type 2025 & 2033

- Figure 41: Europe Rail Composites Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 42: Europe Rail Composites Market Volume Share (%), by Fiber Type 2025 & 2033

- Figure 43: Europe Rail Composites Market Revenue (million), by Application 2025 & 2033

- Figure 44: Europe Rail Composites Market Volume (K Tons), by Application 2025 & 2033

- Figure 45: Europe Rail Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Europe Rail Composites Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Europe Rail Composites Market Revenue (million), by Country 2025 & 2033

- Figure 48: Europe Rail Composites Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: Europe Rail Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Rail Composites Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Rail Composites Market Revenue (million), by Resin Type 2025 & 2033

- Figure 52: Rest of the World Rail Composites Market Volume (K Tons), by Resin Type 2025 & 2033

- Figure 53: Rest of the World Rail Composites Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 54: Rest of the World Rail Composites Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 55: Rest of the World Rail Composites Market Revenue (million), by Fiber Type 2025 & 2033

- Figure 56: Rest of the World Rail Composites Market Volume (K Tons), by Fiber Type 2025 & 2033

- Figure 57: Rest of the World Rail Composites Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 58: Rest of the World Rail Composites Market Volume Share (%), by Fiber Type 2025 & 2033

- Figure 59: Rest of the World Rail Composites Market Revenue (million), by Application 2025 & 2033

- Figure 60: Rest of the World Rail Composites Market Volume (K Tons), by Application 2025 & 2033

- Figure 61: Rest of the World Rail Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 62: Rest of the World Rail Composites Market Volume Share (%), by Application 2025 & 2033

- Figure 63: Rest of the World Rail Composites Market Revenue (million), by Country 2025 & 2033

- Figure 64: Rest of the World Rail Composites Market Volume (K Tons), by Country 2025 & 2033

- Figure 65: Rest of the World Rail Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Rail Composites Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rail Composites Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 2: Global Rail Composites Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 3: Global Rail Composites Market Revenue million Forecast, by Fiber Type 2020 & 2033

- Table 4: Global Rail Composites Market Volume K Tons Forecast, by Fiber Type 2020 & 2033

- Table 5: Global Rail Composites Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Rail Composites Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 7: Global Rail Composites Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Global Rail Composites Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global Rail Composites Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 10: Global Rail Composites Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 11: Global Rail Composites Market Revenue million Forecast, by Fiber Type 2020 & 2033

- Table 12: Global Rail Composites Market Volume K Tons Forecast, by Fiber Type 2020 & 2033

- Table 13: Global Rail Composites Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global Rail Composites Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 15: Global Rail Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Rail Composites Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: China Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: China Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: India Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Japan Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Japan Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: South Korea Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Global Rail Composites Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 28: Global Rail Composites Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 29: Global Rail Composites Market Revenue million Forecast, by Fiber Type 2020 & 2033

- Table 30: Global Rail Composites Market Volume K Tons Forecast, by Fiber Type 2020 & 2033

- Table 31: Global Rail Composites Market Revenue million Forecast, by Application 2020 & 2033

- Table 32: Global Rail Composites Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 33: Global Rail Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: Global Rail Composites Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 35: United States Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: United States Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Canada Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Canada Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Mexico Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Mexico Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Global Rail Composites Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 42: Global Rail Composites Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 43: Global Rail Composites Market Revenue million Forecast, by Fiber Type 2020 & 2033

- Table 44: Global Rail Composites Market Volume K Tons Forecast, by Fiber Type 2020 & 2033

- Table 45: Global Rail Composites Market Revenue million Forecast, by Application 2020 & 2033

- Table 46: Global Rail Composites Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 47: Global Rail Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 48: Global Rail Composites Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Germany Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Germany Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Italy Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Italy Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: France Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 56: France Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 57: Rest of Europe Rail Composites Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Europe Rail Composites Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Global Rail Composites Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 60: Global Rail Composites Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 61: Global Rail Composites Market Revenue million Forecast, by Fiber Type 2020 & 2033

- Table 62: Global Rail Composites Market Volume K Tons Forecast, by Fiber Type 2020 & 2033

- Table 63: Global Rail Composites Market Revenue million Forecast, by Application 2020 & 2033

- Table 64: Global Rail Composites Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 65: Global Rail Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 66: Global Rail Composites Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rail Composites Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Rail Composites Market?

Key companies in the market include Solvay, Celanese Corporation, Avient Corporation, Reliance Industries Limited, Exel Composites, LANXESS, BASF SE, Kineco Limited, Toray Industries Inc , Hexcel Corporation, Gurit, TEIJIN LIMITED, Mitsubishi Chemical Advanced Materials.

3. What are the main segments of the Rail Composites Market?

The market segments include Resin Type, Fiber Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Railway Projects in the Asia-Pacific Region; Rapidly Increasing Demand for High-speed Rail.

6. What are the notable trends driving market growth?

Exterior Application to Dominate the Market.

7. Are there any restraints impacting market growth?

Lack of Railway Infrastructure in Vietnam. Indonesia. and Thailand; Restrictions on Composite Materials for Railway Application.

8. Can you provide examples of recent developments in the market?

In May 2021, Celanese announced its plan to initiate a three-year plan to expand its LFT (long-fiber thermoplastics ) capacity in Nanjing, China. This is expected to be completed by the second half of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rail Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rail Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rail Composites Market?

To stay informed about further developments, trends, and reports in the Rail Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence