Key Insights

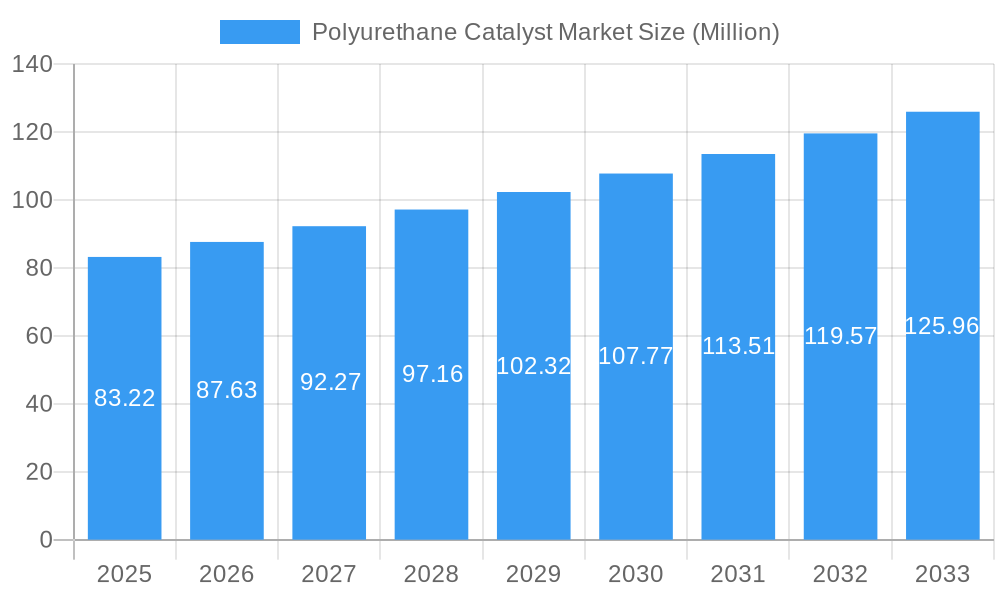

The global Polyurethane Catalyst Market is poised for robust growth, projected to reach approximately $83.22 million in market size by 2025, with a Compound Annual Growth Rate (CAGR) of 5.36% anticipated to extend through 2033. This expansion is fundamentally driven by the increasing demand for polyurethanes across a multitude of applications, most notably in the building and construction sector, where their insulating properties are paramount for energy efficiency, and in the automotive industry, for lightweight components and interior comfort. The furniture and footwear industries also represent significant consumption hubs, leveraging polyurethane's versatility in creating durable and comfortable products. Emerging trends include a growing preference for low-emission and sustainable polyurethane catalysts, spurred by stringent environmental regulations and increasing consumer awareness. Innovations in catalyst technology, focusing on enhanced performance and reduced environmental impact, are expected to further fuel market development.

Polyurethane Catalyst Market Market Size (In Million)

However, the market faces certain restraints, including the fluctuating prices of raw materials, which can impact overall production costs and profitability. Supply chain disruptions, as witnessed in recent years, can also pose challenges to consistent market performance. Despite these hurdles, the diverse range of applications for polyurethane, from rigid and flexible foams to coatings and thermoplastic polyurethanes, ensures a consistent demand. Key players like BASF SE, Covestro AG, and Dow are actively investing in research and development to address these challenges and capitalize on the market's upward trajectory. The Asia Pacific region, particularly China and India, is expected to lead growth due to rapid industrialization and expanding end-user industries, while North America and Europe remain significant markets with a strong focus on advanced and sustainable polyurethane solutions.

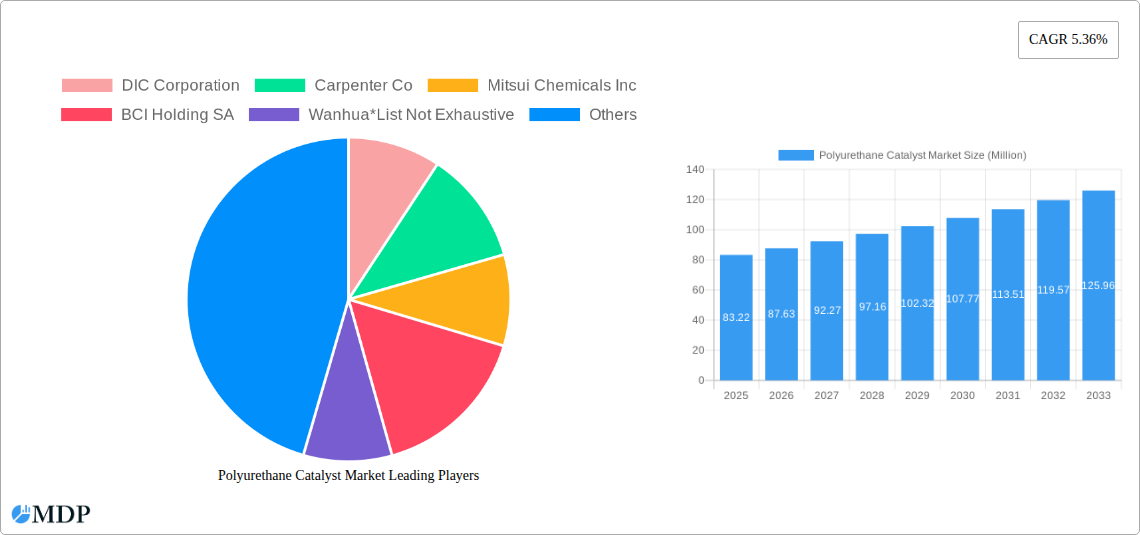

Polyurethane Catalyst Market Company Market Share

Gain unparalleled insights into the dynamic Polyurethane Catalyst Market with this comprehensive report, meticulously designed to empower industry stakeholders. Spanning a crucial Study Period from 2019 to 2033, with a sharp focus on the Base Year of 2025 and a robust Forecast Period of 2025–2033, this report delves deep into market dynamics, emerging trends, and the strategic landscape. Discover how advancements in catalysts are shaping the production of Rigid Foam, Flexible Foam, Coatings, Thermoplastic Polyurethane, and other critical segments, driving innovation across diverse End-user Industries including Furniture, Building and Construction, Electronics and Appliances, Automotive, Footwear, and Packaging.

This detailed analysis leverages high-traffic keywords such as "polyurethane catalyst," "PU foam catalyst," "catalyst market," "rigid PU foam," "flexible PU foam," "polyurethane coatings," "thermoplastic polyurethane," "automotive polyurethane," "construction polyurethane," and "furniture polyurethane" to ensure maximum search visibility. Understand the market's trajectory, identify key growth drivers, and capitalize on emerging opportunities within this multi-billion dollar industry. The report provides actionable intelligence for manufacturers, formulators, researchers, and investors navigating the complex world of polyurethane chemistry.

Polyurethane Catalyst Market Market Dynamics & Concentration

The Polyurethane Catalyst Market exhibits a moderate to high concentration, with leading players like BASF SE, Covestro AG, Huntsman International LLC, and Dow holding significant market share. Innovation is primarily driven by the demand for enhanced performance characteristics in polyurethane products, such as faster curing times, improved durability, and reduced VOC emissions. Regulatory frameworks, particularly those pertaining to environmental safety and material performance standards, are increasingly influencing catalyst development and adoption. Product substitutes, while present in niche applications, have yet to significantly disrupt the broad utility of polyurethane catalysts. End-user trends are heavily influenced by sustainability initiatives and the growing demand for lightweight yet robust materials across sectors like automotive and construction. Mergers and Acquisitions (M&A) activity is a key indicator of market consolidation and strategic expansion. For instance, in June 2023, Carpenter Co. acquired the Engineered Foams Division of Recticel NV, solidifying its position as a major player and hinting at further consolidation trends in the broader polyurethane ecosystem. The number of significant M&A deals in the catalyst and related upstream/downstream segments has seen a steady increase over the historical period.

Polyurethane Catalyst Market Industry Trends & Analysis

The Polyurethane Catalyst Market is poised for significant expansion, driven by a confluence of technological advancements and evolving consumer preferences. The projected Compound Annual Growth Rate (CAGR) for the forecast period is estimated to be approximately 5.8%, indicating robust market penetration and sustained demand. A key growth driver is the burgeoning Building and Construction sector, where the demand for energy-efficient insulation materials like rigid polyurethane foam continues to surge. This segment is expected to account for over 30% of the market by 2033. The automotive industry's push towards lightweighting for improved fuel efficiency and reduced emissions is another significant catalyst, fueling the demand for polyurethane components and consequently, the catalysts used in their production. Technological disruptions are emerging in the form of bio-based and low-VOC catalysts, aligning with global sustainability initiatives and increasing consumer preference for eco-friendly products. The development of novel catalyst formulations that enable precise control over reaction kinetics and polymer properties is also a critical trend, allowing for tailored solutions across various applications. Competitive dynamics are characterized by intense R&D efforts focused on product differentiation and cost optimization. Furthermore, the growing adoption of polyurethane in consumer goods, such as furniture and footwear, further solidifies the market's upward trajectory. The market penetration of advanced polyurethane systems, facilitated by innovative catalyst technologies, is expected to reach xx% by the end of the forecast period.

Leading Markets & Segments in Polyurethane Catalyst Market

The Building and Construction industry stands as the dominant end-user segment in the Polyurethane Catalyst Market, driven by escalating global infrastructure development and the inherent properties of rigid polyurethane foam. This dominance is underpinned by several key drivers, including stringent energy efficiency regulations in developed economies, a growing demand for sustainable building materials, and the versatility of PU insulation in both new constructions and retrofitting projects.

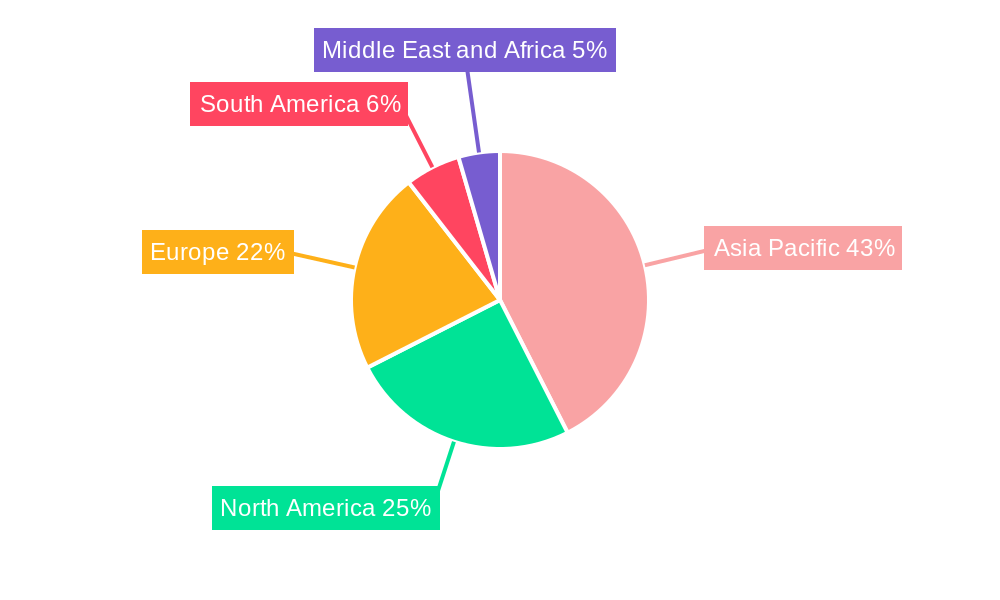

- Dominant Region: Asia Pacific, particularly China and India, leads in terms of market volume and growth, owing to rapid urbanization, substantial investments in infrastructure, and a burgeoning manufacturing base.

- Dominant Type: Rigid Foam accounts for the largest share, projected to exceed 40% of the market by 2033. Its exceptional insulating properties make it indispensable for refrigerators, freezers, and building insulation panels.

- Dominant End-user Industry: Building and Construction is the primary driver, fueled by policies encouraging energy conservation and the widespread adoption of PU insulation in residential, commercial, and industrial structures.

- Key Drivers in Building and Construction:

- Government initiatives promoting energy-efficient buildings and green construction practices.

- Increasing demand for thermal insulation to reduce energy consumption and carbon footprint.

- Growth in the housing sector and urban infrastructure development globally.

- Superior mechanical properties and durability of PU insulation compared to traditional materials.

- Automotive is the second-largest segment, with polyurethane catalysts essential for producing lightweight components, seating foams, and interior parts that enhance vehicle safety and fuel efficiency. Economic policies supporting automotive manufacturing and stringent emission standards are crucial growth catalysts here.

- Furniture and Footwear also represent significant segments, with flexible foam and thermoplastic polyurethane catalysts playing vital roles in comfort, durability, and design innovation. Consumer demand for comfortable and stylish furnishings, coupled with the athletic footwear market's continuous evolution, propels growth in these areas.

- Coatings represent a growing application, driven by the need for protective and aesthetically pleasing finishes in various industries, including automotive and industrial machinery. The demand for durable and chemical-resistant coatings enhances the market for specialized polyurethane catalysts.

Polyurethane Catalyst Market Product Developments

Product innovation in the Polyurethane Catalyst Market centers on developing catalysts that enhance process efficiency, reduce environmental impact, and enable the creation of advanced polyurethane materials. Leading companies are focusing on catalysts that facilitate lower processing temperatures, faster cure times, and reduced volatile organic compound (VOC) emissions, aligning with stringent environmental regulations and consumer demand for sustainable products. Developments include the creation of novel amine catalysts for flexible foams that offer improved resilience and reduced fogging, and tin-free catalysts for coatings that meet regulatory requirements without compromising performance. The competitive advantage lies in offering tailored catalyst systems that optimize the unique requirements of rigid, flexible, coating, and thermoplastic polyurethane applications, thereby enabling manufacturers to achieve desired material properties like enhanced durability, flexibility, and chemical resistance.

Key Drivers of Polyurethane Catalyst Market Growth

The Polyurethane Catalyst Market's growth is propelled by several interconnected factors. Technologically, advancements in catalyst chemistry are enabling the development of more efficient, sustainable, and high-performance polyurethane formulations. Economically, robust growth in key end-user industries such as building and construction, automotive, and furniture, particularly in emerging economies, creates a consistent demand for polyurethane materials. Regulatory drivers, including stricter environmental mandates and building codes emphasizing energy efficiency, further accelerate the adoption of polyurethane solutions and the specialized catalysts required for their production. For instance, increasing focus on reducing greenhouse gas emissions is driving demand for lightweight polyurethane components in vehicles.

Challenges in the Polyurethane Catalyst Market Market

Despite its robust growth, the Polyurethane Catalyst Market faces several challenges. Regulatory hurdles, particularly concerning the classification and handling of certain chemical substances used in catalyst formulations, can slow down product development and market entry. Supply chain disruptions and price volatility of raw materials, which are often petroleum-derived, can impact manufacturing costs and product availability. Furthermore, intense competition among established players and emerging manufacturers leads to price pressures and necessitates continuous innovation to maintain market share. The availability and adoption of viable, cost-effective alternative materials in specific applications also pose a challenge, requiring constant demonstration of polyurethane's superior performance and cost-effectiveness.

Emerging Opportunities in Polyurethane Catalyst Market

Emerging opportunities in the Polyurethane Catalyst Market are largely driven by sustainability and technological innovation. The burgeoning demand for bio-based and recycled polyols is creating a need for catalysts compatible with these greener feedstocks. The development of low-odor and low-emission catalysts is crucial for applications in sensitive environments like indoor furniture and automotive interiors. Strategic partnerships between catalyst manufacturers and polyurethane producers are fostering collaborative innovation, leading to bespoke solutions for niche applications. Furthermore, the expanding use of polyurethane in advanced composites, 3D printing, and medical devices presents significant untapped potential, requiring specialized catalysts to achieve precise material properties and processing control.

Leading Players in the Polyurethane Catalyst Market Sector

- BASF SE

- Covestro AG

- Huntsman International LLC

- Dow

- Carpenter Co.

- Mitsui Chemicals Inc.

- Wanhua Chemical Group Co., Ltd.

- LANXESS

- Sheela Foam Limited

- DIC Corporation

- Rogers Corporation

- Tosoh Corporation

- Kuwait Polyurethane Industries WLL

- INOAC Corporation

- BCI Holding SA

Key Milestones in Polyurethane Catalyst Market Industry

- June 2023: Carpenter Co. acquired the Engineered Foams Division of Recticel NV. This acquisition significantly strengthened Carpenter Co.'s position as a vertically integrated manufacturer of polyurethane foams and specialty polymer products, paving the way for innovations leveraging materials like Serene Foam and Hybrid TheraGel Memory Foam.

- July 2022: DIC Corporation acquired Guangdong TOD New Material Co. Ltd., a Chinese coating resin manufacturer. This strategic move bolstered DIC Corporation's capacity for various coating resins, including urethane, across the crucial Asian market, enhancing their offerings in polyurethane-based coatings.

Strategic Outlook for Polyurethane Catalyst Market Market

The strategic outlook for the Polyurethane Catalyst Market remains exceptionally positive, driven by continuous innovation and expanding applications. The increasing global focus on sustainability and circular economy principles will necessitate the development of eco-friendly catalysts and polyurethane formulations. Companies that invest in R&D for bio-based catalysts, recycling technologies, and low-VOC solutions will be well-positioned for future growth. Furthermore, the penetration of polyurethane into advanced sectors like renewable energy (e.g., wind turbine blades) and electric vehicles presents significant opportunities. Strategic collaborations, vertical integration, and a keen understanding of evolving regulatory landscapes will be crucial for sustained market leadership and capitalizing on the expanding global demand for high-performance polyurethane materials.

Polyurethane Catalyst Market Segmentation

-

1. Type

- 1.1. Rigid Foam

- 1.2. Flexible Foam

- 1.3. Coatings

- 1.4. Thermoplastic Polyurethane

- 1.5. Other Types

-

2. End-user Industry

- 2.1. Furniture

- 2.2. Building and Construction

- 2.3. Electronics and Appliances

- 2.4. Automotive

- 2.5. Footwear

- 2.6. Packaging

- 2.7. Other End-user Industries

Polyurethane Catalyst Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Polyurethane Catalyst Market Regional Market Share

Geographic Coverage of Polyurethane Catalyst Market

Polyurethane Catalyst Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Lightweight and High-performance Composites from the Automotive Industry; Increasing Demand from the Building and Construction Industry; Increasing Demand from the Bedding

- 3.2.2 Carpet

- 3.2.3 and Cushioning Industries

- 3.3. Market Restrains

- 3.3.1. Growing Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Building and Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polyurethane Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Rigid Foam

- 5.1.2. Flexible Foam

- 5.1.3. Coatings

- 5.1.4. Thermoplastic Polyurethane

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Furniture

- 5.2.2. Building and Construction

- 5.2.3. Electronics and Appliances

- 5.2.4. Automotive

- 5.2.5. Footwear

- 5.2.6. Packaging

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Polyurethane Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Rigid Foam

- 6.1.2. Flexible Foam

- 6.1.3. Coatings

- 6.1.4. Thermoplastic Polyurethane

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Furniture

- 6.2.2. Building and Construction

- 6.2.3. Electronics and Appliances

- 6.2.4. Automotive

- 6.2.5. Footwear

- 6.2.6. Packaging

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Polyurethane Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Rigid Foam

- 7.1.2. Flexible Foam

- 7.1.3. Coatings

- 7.1.4. Thermoplastic Polyurethane

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Furniture

- 7.2.2. Building and Construction

- 7.2.3. Electronics and Appliances

- 7.2.4. Automotive

- 7.2.5. Footwear

- 7.2.6. Packaging

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Polyurethane Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Rigid Foam

- 8.1.2. Flexible Foam

- 8.1.3. Coatings

- 8.1.4. Thermoplastic Polyurethane

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Furniture

- 8.2.2. Building and Construction

- 8.2.3. Electronics and Appliances

- 8.2.4. Automotive

- 8.2.5. Footwear

- 8.2.6. Packaging

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Polyurethane Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Rigid Foam

- 9.1.2. Flexible Foam

- 9.1.3. Coatings

- 9.1.4. Thermoplastic Polyurethane

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Furniture

- 9.2.2. Building and Construction

- 9.2.3. Electronics and Appliances

- 9.2.4. Automotive

- 9.2.5. Footwear

- 9.2.6. Packaging

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Polyurethane Catalyst Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Rigid Foam

- 10.1.2. Flexible Foam

- 10.1.3. Coatings

- 10.1.4. Thermoplastic Polyurethane

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Furniture

- 10.2.2. Building and Construction

- 10.2.3. Electronics and Appliances

- 10.2.4. Automotive

- 10.2.5. Footwear

- 10.2.6. Packaging

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DIC Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carpenter Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsui Chemicals Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BCI Holding SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wanhua*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rogers Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LANXESS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sheela Foam Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BASF SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huntsman International LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tosoh Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dow

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Kuwait Polyurethane Industries WLL

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Covestro AG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 INOAC Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 DIC Corporation

List of Figures

- Figure 1: Global Polyurethane Catalyst Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Polyurethane Catalyst Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Polyurethane Catalyst Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Polyurethane Catalyst Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Polyurethane Catalyst Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Polyurethane Catalyst Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Polyurethane Catalyst Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Polyurethane Catalyst Market Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Polyurethane Catalyst Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Polyurethane Catalyst Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Polyurethane Catalyst Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Polyurethane Catalyst Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Polyurethane Catalyst Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Polyurethane Catalyst Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Polyurethane Catalyst Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Polyurethane Catalyst Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Polyurethane Catalyst Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Polyurethane Catalyst Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Polyurethane Catalyst Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Polyurethane Catalyst Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Polyurethane Catalyst Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Polyurethane Catalyst Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Polyurethane Catalyst Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Polyurethane Catalyst Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Polyurethane Catalyst Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Polyurethane Catalyst Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Polyurethane Catalyst Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Polyurethane Catalyst Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Polyurethane Catalyst Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Polyurethane Catalyst Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Polyurethane Catalyst Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polyurethane Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Polyurethane Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Polyurethane Catalyst Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Polyurethane Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Polyurethane Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Polyurethane Catalyst Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Polyurethane Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Polyurethane Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Polyurethane Catalyst Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Polyurethane Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Polyurethane Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Polyurethane Catalyst Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Russia Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Polyurethane Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Polyurethane Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Polyurethane Catalyst Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Polyurethane Catalyst Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Polyurethane Catalyst Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Polyurethane Catalyst Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Polyurethane Catalyst Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polyurethane Catalyst Market?

The projected CAGR is approximately 5.36%.

2. Which companies are prominent players in the Polyurethane Catalyst Market?

Key companies in the market include DIC Corporation, Carpenter Co, Mitsui Chemicals Inc, BCI Holding SA, Wanhua*List Not Exhaustive, Rogers Corporation, LANXESS, Sheela Foam Limited, BASF SE, Huntsman International LLC, Tosoh Corporation, Dow, Kuwait Polyurethane Industries WLL, Covestro AG, INOAC Corporation.

3. What are the main segments of the Polyurethane Catalyst Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 83.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and High-performance Composites from the Automotive Industry; Increasing Demand from the Building and Construction Industry; Increasing Demand from the Bedding. Carpet. and Cushioning Industries.

6. What are the notable trends driving market growth?

Increasing Demand from the Building and Construction Industry.

7. Are there any restraints impacting market growth?

Growing Environmental Concerns.

8. Can you provide examples of recent developments in the market?

June 2023: Carpenter Co. acquired the Engineered Foams Division of Recticel NV. This acquisition helped produce the world’s largest vertically incorporated manufacturer of polyurethane foams and specialty polymer products. Moreover, this acquisition is expected to bring innovations in polyurethane foam through the industry’s leading materials, such as Serene Foam and Hybrid TheraGel Memory Foam.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polyurethane Catalyst Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polyurethane Catalyst Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polyurethane Catalyst Market?

To stay informed about further developments, trends, and reports in the Polyurethane Catalyst Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence