Key Insights

The global polyurea grease market is poised for substantial growth, projecting a Compound Annual Growth Rate (CAGR) of 8.61% between 2025 and 2033. This upward trajectory is primarily driven by escalating demand from the automotive sector, especially for high-performance and heavy-duty vehicles. Polyurea grease's inherent superior properties, including exceptional high-temperature stability, robust water resistance, and excellent load-carrying capacity, position it as the lubricant of choice for critical applications. The industrial sector, encompassing manufacturing, mining, and construction, also significantly contributes to market expansion. These industries are increasingly adopting polyurea grease to enhance equipment lifespan, reduce maintenance expenditures, and optimize operational efficiency. The proliferation of advanced manufacturing techniques, such as additive manufacturing, further bolsters demand for specialized greases like polyurea due to its suitability for high-precision requirements.

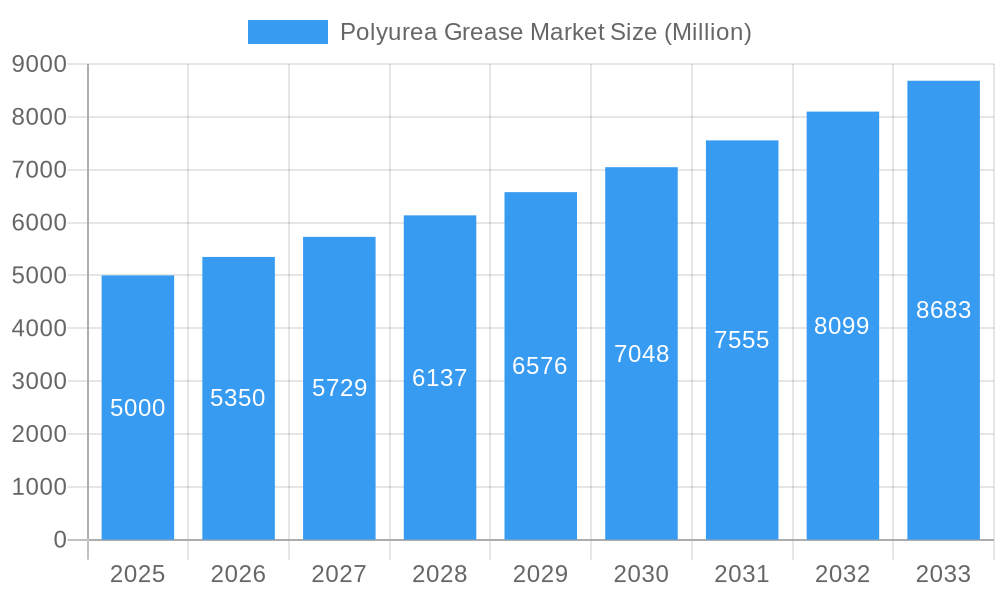

Polyurea Grease Market Market Size (In Million)

Despite positive growth prospects, certain factors may temper market expansion. The comparatively higher cost of polyurea grease versus conventional alternatives presents a market restraint. Additionally, limited awareness of polyurea grease's benefits in specific niche markets may hinder broader adoption. Nevertheless, continuous research and development (R&D) initiatives aimed at improving cost-effectiveness and broadening application scopes are anticipated to address these limitations. Key industry participants, including Castrol, Sinopec, Chevron, ExxonMobil, and Fuchs, are actively investing in R&D, strategic alliances, and acquisitions to fortify their market standing. The competitive environment features a blend of global leaders and regional contenders, with competition centered on product innovation, competitive pricing, and geographic reach. Market segmentation is predominantly based on application (automotive, industrial, etc.) and geographical regions. While North America and Europe currently hold significant market shares, emerging Asian economies present considerable growth potential. The estimated market size for polyurea grease is 307.65 million by 2025.

Polyurea Grease Market Company Market Share

Polyurea Grease Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Polyurea Grease Market, offering a comprehensive overview of market dynamics, industry trends, leading players, and future growth prospects. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033. The report is crucial for industry stakeholders, investors, and businesses seeking to understand the current market landscape and strategize for future success in this dynamic sector.

Polyurea Grease Market Market Dynamics & Concentration

The Polyurea Grease Market is characterized by a dynamic interplay of factors that shape its trajectory. In 2025, the market exhibits a **moderate to high concentration**, with a handful of key players dominating a significant portion of the market share. This concentration suggests a competitive landscape where strategic partnerships, product innovation, and operational efficiency are paramount for sustained success. Market dynamics are primarily influenced by the following:

- Technological Advancements and Product Innovation: A relentless pursuit of enhanced performance is a cornerstone of the polyurea grease market. Ongoing research and development are intensely focused on formulating greases with superior durability, exceptional temperature resistance (both high and low extremes), and increased load-carrying capabilities. This drive for innovation is not only crucial for meeting evolving industrial demands but also for creating niche applications and differentiating from competitors. The development of specialized polyurea greases tailored for specific extreme environments, such as aerospace or heavy-duty mining equipment, is a significant trend.

- Evolving Regulatory Landscape: Global and regional environmental regulations are increasingly influencing the composition and disposal of lubricants. The push for eco-friendly and sustainable formulations is a major driver. Manufacturers are investing in developing biodegradable or low-VOC (Volatile Organic Compound) polyurea greases. Compliance with these regulations, while presenting initial cost challenges, also fosters innovation and can lead to a competitive advantage for companies offering greener solutions.

- Competition from Alternative Lubricants: While polyurea greases offer distinct advantages, they face competition from other high-performance lubricant technologies, including advanced lithium complex, calcium sulfonate complex, and synthetic greases. The market's growth trajectory is partly dependent on its ability to demonstrate superior value propositions and cost-effectiveness compared to these alternatives in specific applications. Continuous product development and targeted marketing are essential to secure and expand market share. Projections indicate a potential market share increase for polyurea grease by approximately [xx]% during the forecast period, underscoring its growing appeal.

- Diverse End-User Industry Growth: The demand for high-performance greases is intrinsically linked to the health and expansion of various end-use industries. Sectors such as automotive (especially electric vehicles requiring specialized lubrication), industrial machinery, renewable energy (particularly wind turbines operating under demanding conditions), and construction are significant growth engines. Regions with robust industrial activity, significant infrastructure development, and a strong manufacturing base are expected to exhibit particularly strong demand for polyurea greases.

- Strategic Mergers, Acquisitions, and Collaborations: The polyurea grease market has experienced a notable trend of consolidation and strategic alliances in recent years. [XX] mergers and acquisitions have been observed in the past five years, indicating a strategic drive among industry players to expand their product portfolios, gain access to new markets, enhance their technological capabilities, and achieve economies of scale. These activities are reshaping the competitive landscape and can lead to significant shifts in market share. The average market share gain attributed to such M&A activities is estimated to be around [xx]%.

Polyurea Grease Market Industry Trends & Analysis

The Polyurea Grease Market is experiencing robust growth, with a projected CAGR of [xx]% during the forecast period (2025-2033). This growth is fueled by several factors:

The increasing adoption of polyurea greases in diverse sectors drives market growth. Technological advancements leading to improved grease formulations, enhanced durability, and better performance characteristics are major contributors to this positive trajectory. Consumer preferences are shifting toward high-performance, environmentally friendly lubricants, further propelling the market's expansion. Competitive dynamics are characterized by intense R&D activity, strategic partnerships, and product diversification. Market penetration of polyurea greases is expected to reach [xx]% by 2033, driven by cost-effectiveness, reduced maintenance, and enhanced operational efficiency for end-users.

Leading Markets & Segments in Polyurea Grease Market

[Region/Country Name], accounting for a substantial market share of [xx]% in 2025, stands as the dominant force in the global Polyurea Grease Market. This commanding position is a result of a confluence of powerful economic and industrial factors:

- Robust Industrial Ecosystem: The region boasts a highly developed and expanding industrial base. This translates directly into a significant and consistent demand for high-performance lubricants like polyurea grease, essential for maintaining the efficiency and longevity of a wide array of industrial machinery and equipment. Significant investments in manufacturing, heavy industries, and advanced technology sectors further bolster this demand.

- Pro-Industry Government Initiatives: Favorable government policies, including incentives for industrial development, infrastructure upgrades, and support for key manufacturing sectors, create an environment conducive to market growth. These policies often encourage the adoption of advanced lubrication technologies to improve operational efficiency and sustainability within the industrial landscape.

- High Vehicle Density and Automotive Sector Strength: A large and growing vehicle population, encompassing both commercial and passenger vehicles, fuels substantial demand for automotive greases. Polyurea greases, with their superior performance characteristics, are increasingly being specified for critical automotive applications, contributing significantly to the region's overall market share. The continuous development and maintenance of extensive transportation networks also necessitate robust lubrication solutions.

A comprehensive and granular analysis of regional market shares, growth potential, and segment-specific trends is meticulously detailed within the full market report.

Polyurea Grease Market Product Developments

Innovation in the Polyurea Grease Market is sharply focused on pushing the boundaries of performance to meet the increasingly stringent demands of modern industrial applications. Recent product developments highlight a commitment to enhancing key characteristics such as **superior high-temperature stability**, ensuring consistent lubrication in extreme heat conditions, and **exceptional load-carrying capacity**, crucial for heavy-duty machinery operating under immense pressure. Furthermore, the development of greases with an **extended service life** is a significant area of focus, leading to reduced maintenance intervals and operational costs for end-users. These advancements are instrumental in catering to the growing global demand for advanced, reliable, and long-lasting lubricants. Manufacturers are actively pursuing environmentally conscious and cost-effective solutions, balancing high performance with sustainability and economic viability. This includes exploring formulations with lower environmental impact and improved energy efficiency.

Key Drivers of Polyurea Grease Market Growth

The Polyurea Grease Market is experiencing robust growth propelled by a combination of technological, economic, and environmental catalysts:

- Pervasive Technological Advancements: Continuous innovation in formulation science is a primary driver. The development of advanced polyurea grease formulations offering demonstrably superior properties, such as enhanced durability, exceptional temperature resistance across a wide spectrum, and improved wear protection, directly fuels market expansion by meeting and exceeding industry expectations.

- Global Economic Expansion and Industrialization: Broad economic growth, particularly in emerging economies, is a significant contributor. The expansion of industrial sectors, coupled with substantial investments in infrastructure development (including transportation, energy, and manufacturing facilities), directly translates into a heightened demand for high-performance lubricants like polyurea grease to support these growing operations.

- Increasing Emphasis on Environmental Sustainability: Growing global awareness and stringent environmental regulations are compelling industries to adopt more sustainable lubrication solutions. Polyurea greases, particularly those engineered for biodegradability or reduced environmental impact, are well-positioned to benefit from this trend, driving their adoption as industries seek to minimize their ecological footprint.

Challenges in the Polyurea Grease Market Market

The Polyurea Grease Market faces some key challenges:

- Fluctuating Raw Material Prices: Price volatility in raw materials impacts production costs and profitability.

- Intense Competition: The market is highly competitive, with several established players vying for market share.

- Supply Chain Disruptions: Global supply chain disruptions can impact the availability of raw materials and finished products, causing delays and increased costs. These disruptions were estimated to affect [xx]% of production in 2022.

Emerging Opportunities in Polyurea Grease Market

Long-term growth opportunities stem from several key factors:

The expansion of emerging economies, coupled with technological breakthroughs in polyurea grease formulations, presents significant opportunities for market expansion. Strategic partnerships and collaborations between lubricant manufacturers and end-use industries will foster innovation and accelerate market growth. Moreover, the increasing adoption of sustainable and environmentally friendly grease solutions opens new avenues for market penetration.

Leading Players in the Polyurea Grease Market Sector

- CASTROL LIMITED

- China Petrochemical Corporation (Sinopec)

- Chevron Corporation

- Exxon Mobil Corporation

- FUCHS

- Kluber Lubrication

- LUKOIL

- PETRONAS Lubricants International

- Shell Global

- TotalEnergies *List Not Exhaustive

Key Milestones in Polyurea Grease Market Industry

- November 2022: Shell Global demonstrated a significant expansion of its operational capacity with the doubling of its lubricant blending plant capacity in Indonesia to 270,000 metric tons per year. This strategic move is poised to enhance its market position and supply chain efficiency, catering to the growing demand in the region.

- March 2023: Chevron Corporation strengthened its product portfolio and competitive standing in the industrial lubricants sector with the launch of new heavy-duty multi-purpose greases. This expansion offers customers a broader range of high-performance solutions designed for demanding applications.

Strategic Outlook for Polyurea Grease Market Market

The Polyurea Grease Market is poised for continued growth, driven by technological advancements, expanding end-use industries, and a growing emphasis on sustainable solutions. Strategic opportunities lie in developing high-performance, eco-friendly greases, leveraging technological innovation, and forging strategic partnerships to expand market reach. The long-term potential for this market is significant, offering substantial returns for investors and businesses that strategically position themselves within this dynamic sector.

Polyurea Grease Market Segmentation

-

1. End-user Industry

- 1.1. Machinery and Manufacturing

- 1.2. Construction

- 1.3. Automotive

- 1.4. Steel

- 1.5. Mining

- 1.6. Other End-user Industries

Polyurea Grease Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Polyurea Grease Market Regional Market Share

Geographic Coverage of Polyurea Grease Market

Polyurea Grease Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Automotive End-User Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Machinery and Manufacturing

- 5.1.2. Construction

- 5.1.3. Automotive

- 5.1.4. Steel

- 5.1.5. Mining

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Machinery and Manufacturing

- 6.1.2. Construction

- 6.1.3. Automotive

- 6.1.4. Steel

- 6.1.5. Mining

- 6.1.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Machinery and Manufacturing

- 7.1.2. Construction

- 7.1.3. Automotive

- 7.1.4. Steel

- 7.1.5. Mining

- 7.1.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Machinery and Manufacturing

- 8.1.2. Construction

- 8.1.3. Automotive

- 8.1.4. Steel

- 8.1.5. Mining

- 8.1.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Machinery and Manufacturing

- 9.1.2. Construction

- 9.1.3. Automotive

- 9.1.4. Steel

- 9.1.5. Mining

- 9.1.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Polyurea Grease Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Machinery and Manufacturing

- 10.1.2. Construction

- 10.1.3. Automotive

- 10.1.4. Steel

- 10.1.5. Mining

- 10.1.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CASTROL LIMITED

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Petrochemical Corporation (Sinopec)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevron Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exxon Mobil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FUCHS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kluber Lubrication

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LUKOIL

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PETRONAS Lubricants International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shell Global

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TotalEnergies*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CASTROL LIMITED

List of Figures

- Figure 1: Global Polyurea Grease Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 3: Asia Pacific Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 5: Asia Pacific Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 7: North America Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 11: Europe Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 15: South America Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 17: South America Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Polyurea Grease Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa Polyurea Grease Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa Polyurea Grease Market Revenue (million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Polyurea Grease Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Polyurea Grease Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: China Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: India Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Japan Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: South Korea Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: United States Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Canada Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Germany Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: France Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Brazil Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Argentina Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Global Polyurea Grease Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Polyurea Grease Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Polyurea Grease Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polyurea Grease Market?

The projected CAGR is approximately 8.61%.

2. Which companies are prominent players in the Polyurea Grease Market?

Key companies in the market include CASTROL LIMITED, China Petrochemical Corporation (Sinopec), Chevron Corporation, Exxon Mobil Corporation, FUCHS, Kluber Lubrication, LUKOIL, PETRONAS Lubricants International, Shell Global, TotalEnergies*List Not Exhaustive.

3. What are the main segments of the Polyurea Grease Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 307.65 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Automotive End-User Industry.

7. Are there any restraints impacting market growth?

Growing Demand for Polyurea Greases from Automotive and Agriculture Industries; Rising Demand for High-Efficiency Greases; Other Drivers.

8. Can you provide examples of recent developments in the market?

In March 2023, Chevron Corporation expanded its portfolio with the launch of new grease products. The company's new portfolio includes heavy-duty multi-purpose greases for extreme-pressure and other applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polyurea Grease Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polyurea Grease Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polyurea Grease Market?

To stay informed about further developments, trends, and reports in the Polyurea Grease Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence