Key Insights

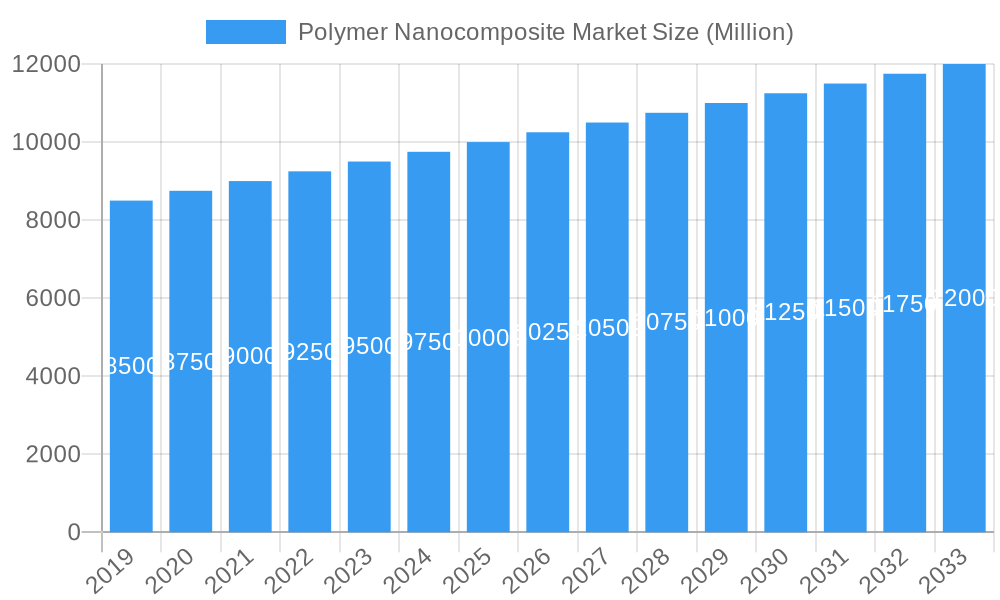

The global Polymer Nanocomposite Market is set for significant expansion, with a projected market size of $13.23 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 15.91% through 2033. This growth is propelled by the escalating demand for advanced materials offering superior mechanical, thermal, and electrical properties across various industries. Key drivers include the automotive sector's focus on lightweight, high-strength components for enhanced fuel efficiency and safety, and the aerospace and defense industry's requirement for high-performance materials in demanding environments. The electronics sector's increasing utilization of polymer nanocomposites for improved conductivity and miniaturization, alongside the packaging industry's pursuit of innovative solutions for superior barrier properties and sustainability, further fuels market expansion.

Polymer Nanocomposite Market Market Size (In Billion)

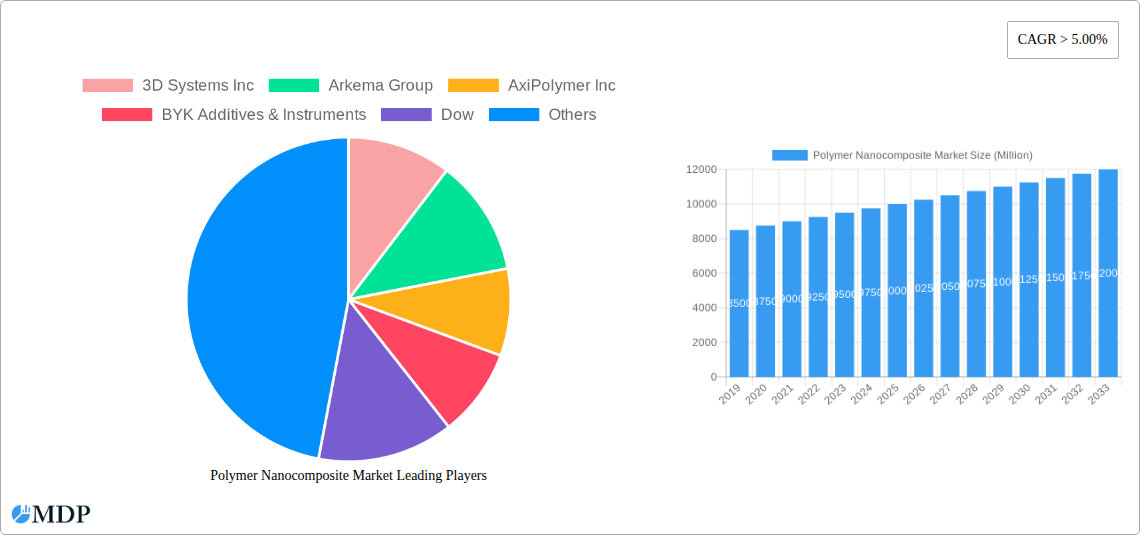

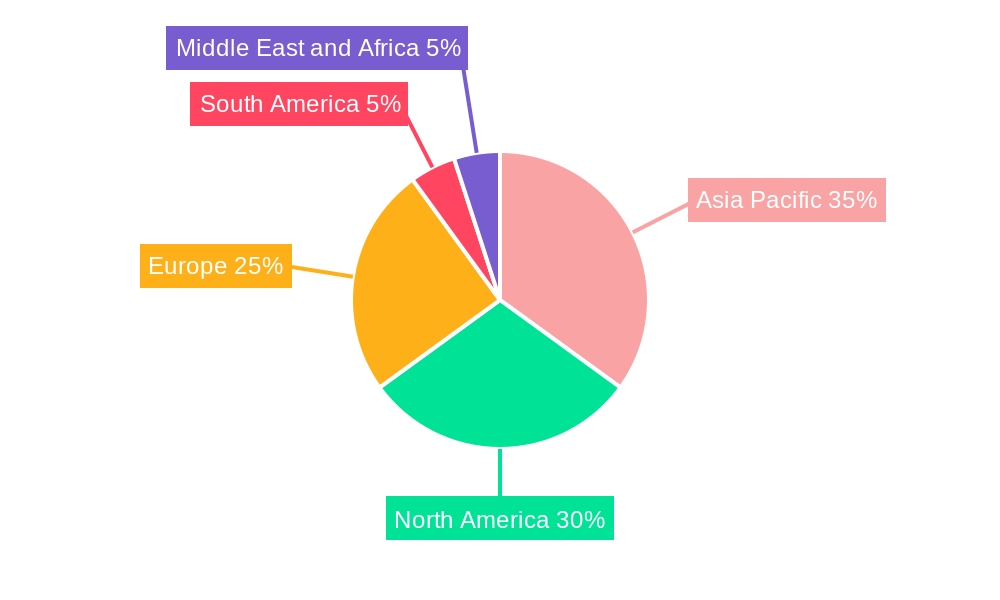

The market is shaped by technological advancements and strategic collaborations among leading players such as 3D Systems Inc, Arkema Group, Dow, and Evonik Industries AG. These companies are actively investing in R&D to introduce novel nanocomposite formulations and broaden their product offerings. The Carbon Nanotube and Nanofiber segment is anticipated to experience accelerated adoption owing to their exceptional strength and electrical conductivity. However, market growth may be constrained by the production costs of certain nanomaterials and the necessity for stringent regulatory frameworks for safe handling and environmental compliance. Geographically, Asia Pacific, particularly China and India, is emerging as a key growth region due to rapid industrialization and increasing adoption of advanced materials. North America and Europe remain mature yet expanding markets, emphasizing innovation and sustainable applications.

Polymer Nanocomposite Market Company Market Share

Unlocking the Future: Polymer Nanocomposite Market Growth and Innovation (2019-2033)

This comprehensive report delves into the dynamic Polymer Nanocomposite Market, forecasting significant growth and transformation from 2019 to 2033. With a base year of 2025 and an estimated value of $XX Million in 2025, the market is projected to expand at a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This analysis provides in-depth insights into market dynamics, industry trends, leading segments, product developments, key growth drivers, challenges, emerging opportunities, and a detailed competitive landscape. It is an indispensable resource for industry stakeholders, including manufacturers, suppliers, researchers, and investors seeking to capitalize on the burgeoning potential of these advanced materials. The report meticulously analyzes various fiber types, including Carbon Nanotube, Metal Oxide, Nanofiber, Nanoclay, and Other Fiber Types, alongside critical end-user industries such as Automotive, Packaging, Aerospace and Defense, Electronics, Energy, and Other End-user Industries.

Polymer Nanocomposite Market Market Dynamics & Concentration

The Polymer Nanocomposite Market is characterized by a moderate to high concentration, with a few key players holding significant market share. Innovation remains a primary driver, fueled by ongoing research and development into novel nanofillers and improved dispersion techniques. Regulatory frameworks, while evolving, are increasingly focused on safety and environmental impact, influencing product development and market entry. The availability of effective product substitutes, though present, often falls short of the enhanced properties offered by polymer nanocomposites. End-user trends highlight a growing demand for lightweight, high-strength, and functional materials across various applications. Mergers and acquisitions (M&A) activities are expected to continue as larger entities seek to acquire specialized technologies and expand their market reach. The report identifies approximately XX M&A deals within the historical period, indicating a consolidation trend. Market share analysis for key players reveals a dominant position held by approximately XX% of the top five companies.

Polymer Nanocomposite Market Industry Trends & Analysis

The Polymer Nanocomposite Market is experiencing rapid evolution, driven by a confluence of technological advancements, shifting consumer preferences, and increasing industrial demand for high-performance materials. A key growth driver is the relentless pursuit of lightweight yet robust materials, particularly within the automotive and aerospace sectors, to enhance fuel efficiency and structural integrity. Technological disruptions, such as advancements in nanoparticle synthesis and compounding technologies, are enabling the development of nanocomposites with tailored properties like improved thermal conductivity, electrical conductivity, and flame retardancy. Consumer preferences are increasingly favoring products that offer sustainability benefits, durability, and enhanced functionalities, directly impacting material selection in packaging and electronics. The competitive dynamics within the market are intensifying, with established chemical companies, specialized nanomaterial producers, and research institutions actively engaged in innovation and strategic collaborations. The market penetration of polymer nanocomposites is steadily increasing, projected to reach XX% by 2033, with a significant CAGR of XX% over the forecast period. This growth is underpinned by substantial investments in research and development, estimated to be in the billions of dollars annually.

Leading Markets & Segments in Polymer Nanocomposite Market

The Polymer Nanocomposite Market exhibits strong regional dominance, with Asia Pacific emerging as the leading market, driven by robust industrialization, significant investments in infrastructure, and a burgeoning automotive sector. Within this region, China stands out as a key country, benefiting from extensive manufacturing capabilities and supportive government policies aimed at promoting advanced materials.

Fiber Type Dominance:

- Carbon Nanotube (CNT): This segment is poised for substantial growth due to its exceptional strength-to-weight ratio and electrical conductivity, making it ideal for high-performance applications in aerospace, automotive, and electronics. Economic policies promoting lightweighting in transportation and increasing adoption in advanced electronics are key drivers.

- Nanoclay: Nanoclay-reinforced polymer nanocomposites are gaining traction in packaging and automotive applications, offering enhanced barrier properties, improved mechanical strength, and flame retardancy at a competitive cost. Supportive regulatory frameworks for sustainable packaging solutions are contributing to its growth.

- Metal Oxide: This segment is crucial for applications requiring enhanced thermal management, UV resistance, and antimicrobial properties, finding significant use in electronics and energy storage. Technological advancements in metal oxide nanoparticle synthesis are crucial for its continued expansion.

- Nanofiber: Nanofibers are witnessing increasing adoption in filtration, biomedical, and textile applications, owing to their high surface area and unique porous structures. Research and development into scalable production methods are critical for its market penetration.

End-user Industry Dominance:

- Automotive: This sector is a primary consumer, driven by the demand for lightweight components to improve fuel efficiency and reduce emissions, alongside enhanced safety features and integrated electronics. Government mandates for emission reduction and electric vehicle adoption are significant growth accelerators.

- Electronics: The miniaturization and increasing performance demands of electronic devices necessitate advanced materials with superior electrical, thermal, and mechanical properties, making polymer nanocomposites indispensable. The growth of 5G technology and wearable electronics further fuels this demand.

- Aerospace and Defense: The stringent requirements for lightweight, high-strength, and durable materials in aircraft and defense equipment make polymer nanocomposites a critical component. Innovations in composite manufacturing and the need for enhanced material performance in extreme conditions are key drivers.

- Packaging: Growing consumer demand for sustainable, durable, and functional packaging solutions, including enhanced barrier properties and active packaging technologies, is driving the adoption of polymer nanocomposites. Stringent regulations regarding food safety and waste reduction are also contributing.

Polymer Nanocomposite Market Product Developments

Recent product developments in the Polymer Nanocomposite Market showcase a strong emphasis on enhanced mechanical strength, improved thermal and electrical conductivity, and superior flame retardancy. Innovations are focused on achieving better dispersion of nanofillers within polymer matrices, leading to more consistent and predictable material properties. Applications are expanding into areas like advanced battery components, high-performance adhesives, and lightweight structural elements for consumer electronics and medical devices. These advancements provide manufacturers with a significant competitive advantage by enabling the creation of materials that meet specific, high-demand performance criteria.

Key Drivers of Polymer Nanocomposite Market Growth

The growth of the Polymer Nanocomposite Market is propelled by several key factors. Technologically, ongoing advancements in nanofiller synthesis and dispersion techniques are enabling the creation of materials with unprecedented properties. Economically, the increasing demand for lightweight and high-strength materials across industries like automotive and aerospace, driven by fuel efficiency mandates and performance requirements, is a significant catalyst. Regulatory frameworks that promote sustainable materials and advanced manufacturing also play a crucial role in driving adoption. Furthermore, the expanding range of applications, from advanced electronics to biomedical devices, is creating new market opportunities.

Challenges in the Polymer Nanocomposite Market Market

Despite robust growth, the Polymer Nanocomposite Market faces several challenges. Regulatory hurdles related to the long-term health and environmental impacts of nanomaterials can impede market entry and adoption. Supply chain issues, including the scalability and cost-effectiveness of producing high-quality nanofillers, present significant restraints. Furthermore, the complexity of processing and the need for specialized equipment can lead to higher manufacturing costs compared to conventional composites. Competitive pressures from existing material solutions and the ongoing development of alternative advanced materials also pose a threat to market expansion.

Emerging Opportunities in Polymer Nanocomposite Market

Emerging opportunities within the Polymer Nanocomposite Market are primarily driven by significant technological breakthroughs, strategic partnerships, and market expansion strategies. The development of bio-based and biodegradable polymer nanocomposites presents a substantial avenue for growth, catering to the increasing demand for sustainable materials. Furthermore, advancements in additive manufacturing (3D printing) are opening new frontiers for the application of polymer nanocomposites in creating complex, customized parts. Strategic collaborations between research institutions and industrial players are crucial for accelerating innovation and commercialization. Market expansion into emerging economies with growing manufacturing sectors also offers significant long-term growth potential.

Leading Players in the Polymer Nanocomposite Market Sector

- 3D Systems Inc

- Arkema Group

- AxiPolymer Inc

- BYK Additives & Instruments

- Dow

- Evonik Industries AG

- Foster Corporation

- Hybrid Plastics Inc

- Inframat Corporation

- InMat Inc

- Nanocor Inc

- Nanocyl SA

- Nanophase Technologies Corporation

- Powdermet Inc

- RTP Company

- Showa Denko KK

- ShayoNano Singapore Private Ltd

Key Milestones in Polymer Nanocomposite Market Industry

- 2019: Increased investment in research on carbon nanotube-polymer composites for automotive lightweighting.

- 2020: Launch of new nanoclay-based flame retardants for packaging applications.

- 2021: Significant advancements in the scalable production of graphene-enhanced polymer nanocomposites.

- 2022: Growing adoption of polymer nanocomposites in flexible electronics and wearable devices.

- 2023: Introduction of novel metal oxide nanocomposites for advanced thermal management solutions in electronics.

- 2024: Emerging focus on lifecycle assessment and end-of-life management for polymer nanocomposites.

Strategic Outlook for Polymer Nanocomposite Market Market

The strategic outlook for the Polymer Nanocomposite Market is exceptionally positive, driven by a sustained demand for high-performance, lightweight, and functional materials. Future growth will be accelerated by continued innovation in nanofiller technology, focusing on enhanced sustainability and cost-effectiveness. Strategic opportunities lie in forging deeper collaborations across the value chain, from raw material suppliers to end-users, to drive application-specific development. Expansion into emerging markets and niche applications, coupled with a proactive approach to regulatory compliance and safety, will be crucial for unlocking the full market potential and solidifying a leadership position in this transformative sector.

Polymer Nanocomposite Market Segmentation

-

1. Fiber Type

- 1.1. Carbon Nanotube

- 1.2. Metal Oxide

- 1.3. Nanofiber

- 1.4. Nanoclay

- 1.5. Other Fiber Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Packaging

- 2.3. Aerospace and Defense

- 2.4. Electronics

- 2.5. Energy

- 2.6. Other End-user Industries

Polymer Nanocomposite Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Polymer Nanocomposite Market Regional Market Share

Geographic Coverage of Polymer Nanocomposite Market

Polymer Nanocomposite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Polymer Nanocomposites from the Automotive Sector; Growing Applications in the Electronics and Semiconductor Industries

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand for Polymer Nanocomposites from the Automotive Sector; Growing Applications in the Electronics and Semiconductor Industries

- 3.4. Market Trends

- 3.4.1. Increasing Applications in the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Polymer Nanocomposite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fiber Type

- 5.1.1. Carbon Nanotube

- 5.1.2. Metal Oxide

- 5.1.3. Nanofiber

- 5.1.4. Nanoclay

- 5.1.5. Other Fiber Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Packaging

- 5.2.3. Aerospace and Defense

- 5.2.4. Electronics

- 5.2.5. Energy

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Fiber Type

- 6. Asia Pacific Polymer Nanocomposite Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fiber Type

- 6.1.1. Carbon Nanotube

- 6.1.2. Metal Oxide

- 6.1.3. Nanofiber

- 6.1.4. Nanoclay

- 6.1.5. Other Fiber Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Packaging

- 6.2.3. Aerospace and Defense

- 6.2.4. Electronics

- 6.2.5. Energy

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Fiber Type

- 7. North America Polymer Nanocomposite Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fiber Type

- 7.1.1. Carbon Nanotube

- 7.1.2. Metal Oxide

- 7.1.3. Nanofiber

- 7.1.4. Nanoclay

- 7.1.5. Other Fiber Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Packaging

- 7.2.3. Aerospace and Defense

- 7.2.4. Electronics

- 7.2.5. Energy

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Fiber Type

- 8. Europe Polymer Nanocomposite Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fiber Type

- 8.1.1. Carbon Nanotube

- 8.1.2. Metal Oxide

- 8.1.3. Nanofiber

- 8.1.4. Nanoclay

- 8.1.5. Other Fiber Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Packaging

- 8.2.3. Aerospace and Defense

- 8.2.4. Electronics

- 8.2.5. Energy

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Fiber Type

- 9. South America Polymer Nanocomposite Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fiber Type

- 9.1.1. Carbon Nanotube

- 9.1.2. Metal Oxide

- 9.1.3. Nanofiber

- 9.1.4. Nanoclay

- 9.1.5. Other Fiber Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Packaging

- 9.2.3. Aerospace and Defense

- 9.2.4. Electronics

- 9.2.5. Energy

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Fiber Type

- 10. Middle East and Africa Polymer Nanocomposite Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fiber Type

- 10.1.1. Carbon Nanotube

- 10.1.2. Metal Oxide

- 10.1.3. Nanofiber

- 10.1.4. Nanoclay

- 10.1.5. Other Fiber Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Packaging

- 10.2.3. Aerospace and Defense

- 10.2.4. Electronics

- 10.2.5. Energy

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Fiber Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 3D Systems Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arkema Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AxiPolymer Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BYK Additives & Instruments

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dow

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Evonik Industries AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Foster Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hybrid Plastics Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inframat Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 InMat Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nanocor Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nanocyl SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nanophase Technologies Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Powdermet Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 RTP Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Showa Denko KK

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ShayoNano Singapore Private Ltd *List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 3D Systems Inc

List of Figures

- Figure 1: Global Polymer Nanocomposite Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Polymer Nanocomposite Market Revenue (billion), by Fiber Type 2025 & 2033

- Figure 3: Asia Pacific Polymer Nanocomposite Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 4: Asia Pacific Polymer Nanocomposite Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Polymer Nanocomposite Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Polymer Nanocomposite Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Polymer Nanocomposite Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Polymer Nanocomposite Market Revenue (billion), by Fiber Type 2025 & 2033

- Figure 9: North America Polymer Nanocomposite Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 10: North America Polymer Nanocomposite Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Polymer Nanocomposite Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Polymer Nanocomposite Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Polymer Nanocomposite Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Polymer Nanocomposite Market Revenue (billion), by Fiber Type 2025 & 2033

- Figure 15: Europe Polymer Nanocomposite Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 16: Europe Polymer Nanocomposite Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Polymer Nanocomposite Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Polymer Nanocomposite Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Polymer Nanocomposite Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Polymer Nanocomposite Market Revenue (billion), by Fiber Type 2025 & 2033

- Figure 21: South America Polymer Nanocomposite Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 22: South America Polymer Nanocomposite Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Polymer Nanocomposite Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Polymer Nanocomposite Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Polymer Nanocomposite Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Polymer Nanocomposite Market Revenue (billion), by Fiber Type 2025 & 2033

- Figure 27: Middle East and Africa Polymer Nanocomposite Market Revenue Share (%), by Fiber Type 2025 & 2033

- Figure 28: Middle East and Africa Polymer Nanocomposite Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Polymer Nanocomposite Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Polymer Nanocomposite Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Polymer Nanocomposite Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Polymer Nanocomposite Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 2: Global Polymer Nanocomposite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Polymer Nanocomposite Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Polymer Nanocomposite Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 5: Global Polymer Nanocomposite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Polymer Nanocomposite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Polymer Nanocomposite Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 13: Global Polymer Nanocomposite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Polymer Nanocomposite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Polymer Nanocomposite Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 19: Global Polymer Nanocomposite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Polymer Nanocomposite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Polymer Nanocomposite Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 27: Global Polymer Nanocomposite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Polymer Nanocomposite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Polymer Nanocomposite Market Revenue billion Forecast, by Fiber Type 2020 & 2033

- Table 33: Global Polymer Nanocomposite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Polymer Nanocomposite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Polymer Nanocomposite Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Polymer Nanocomposite Market?

The projected CAGR is approximately 15.91%.

2. Which companies are prominent players in the Polymer Nanocomposite Market?

Key companies in the market include 3D Systems Inc, Arkema Group, AxiPolymer Inc, BYK Additives & Instruments, Dow, Evonik Industries AG, Foster Corporation, Hybrid Plastics Inc, Inframat Corporation, InMat Inc, Nanocor Inc, Nanocyl SA, Nanophase Technologies Corporation, Powdermet Inc, RTP Company, Showa Denko KK, ShayoNano Singapore Private Ltd *List Not Exhaustive.

3. What are the main segments of the Polymer Nanocomposite Market?

The market segments include Fiber Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.23 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Polymer Nanocomposites from the Automotive Sector; Growing Applications in the Electronics and Semiconductor Industries.

6. What are the notable trends driving market growth?

Increasing Applications in the Automotive Industry.

7. Are there any restraints impacting market growth?

; Increasing Demand for Polymer Nanocomposites from the Automotive Sector; Growing Applications in the Electronics and Semiconductor Industries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Polymer Nanocomposite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Polymer Nanocomposite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Polymer Nanocomposite Market?

To stay informed about further developments, trends, and reports in the Polymer Nanocomposite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence