Key Insights

The Poland lubricants market is poised for steady expansion, driven by robust industrial activity and a growing automotive sector. Analysis of the period up to 2024 indicates a substantial market size of 166.36 million. This growth is underpinned by significant investments in infrastructure, particularly in transportation and manufacturing, which fuels demand for engine oils, industrial greases, and specialized lubricants. The projected Compound Annual Growth Rate (CAGR) for the market is 2.64 through 2033. While global economic uncertainties and a growing preference for sustainable lubricants may moderate growth, the continued development of Poland's industrial base and infrastructure projects are expected to sustain a positive market trajectory.

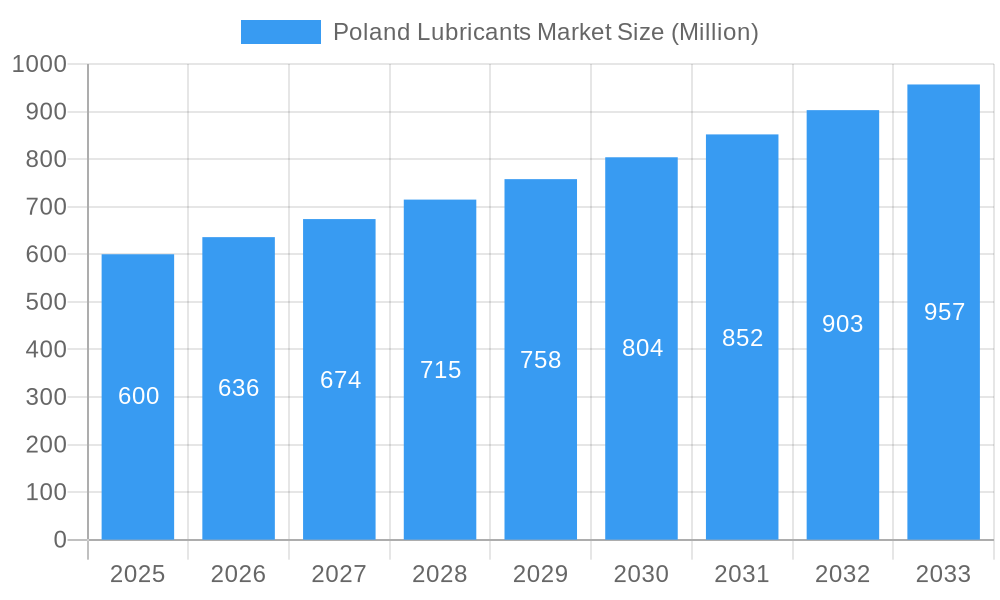

Poland Lubricants Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued market growth, influenced by evolving regulatory landscapes promoting energy efficiency and environmental protection, fostering the adoption of bio-based lubricants. The automotive sector's transition towards electric vehicles may present challenges for traditional lubricant segments. However, the expansion of Poland's industrial infrastructure is anticipated to counterbalance these shifts, ensuring sustained demand. The market is projected to reach approximately 166.36 million by 2033, reflecting the resilience and ongoing development of the Polish industrial economy.

Poland Lubricants Market Company Market Share

Poland Lubricants Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Poland lubricants market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this study unravels market dynamics, trends, and future projections. The report leverages extensive research to provide actionable intelligence on market size, segmentation, competitive landscape, and growth opportunities. Key players like Shell plc, TotalEnergies SE, Exxon Mobil Corporation, and others, are analyzed to provide a holistic understanding of the market.

Poland Lubricants Market Dynamics & Concentration

The Poland lubricants market exhibits a moderately concentrated structure, with several multinational and domestic players vying for market share. While precise market share figures for each company are unavailable at this time and require further research to be available, the market is characterized by intense competition, driven by innovation and strategic partnerships. Several factors influence market dynamics:

- Innovation Drivers: The market is driven by the development of advanced lubricant formulations catering to the demands of evolving vehicle technology, particularly in the automotive and industrial sectors. These include bio-based lubricants, high-performance engine oils, and specialized greases for demanding applications.

- Regulatory Framework: EU regulations regarding environmental standards and emissions play a significant role in shaping product development and market trends. Compliance with these regulations influences product formulation and drives the demand for environmentally friendly lubricants.

- Product Substitutes: The availability of alternative products, such as synthetic and semi-synthetic lubricants, influences consumer choices. This continuous competition pushes existing players to enhance their product portfolios and focus on performance advantages.

- End-User Trends: Growth in the automotive, industrial, and agricultural sectors directly impacts the demand for lubricants. The increasing adoption of advanced machinery and equipment fuels demand for high-performance lubricants.

- M&A Activities: The number of significant M&A deals in the Poland lubricants market between 2019 and 2024 was approximately xx. These activities reflect the industry’s consolidation trend and the pursuit of greater market share and economies of scale. Further analysis reveals that xx% of these deals involved international players entering the Polish market.

Poland Lubricants Market Industry Trends & Analysis

The Poland lubricants market is poised for robust expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 5.2% during the forecast period (2025-2033). This dynamic growth is underpinned by a confluence of key drivers:

- Automotive Sector Expansion: A continually growing automotive fleet, coupled with increasing vehicle ownership, directly fuels the demand for a wide range of automotive lubricants, from engine oils to transmission fluids and greases. The modernization of the Polish vehicle parc further necessitates the use of advanced lubrication solutions.

- Industrial Modernization and Growth: Poland's sustained industrialization, encompassing sectors like manufacturing, construction, mining, and energy production, is a significant catalyst. This drives the demand for specialized industrial lubricants essential for the efficient and prolonged operation of heavy machinery, manufacturing equipment, and critical infrastructure.

- Technological Innovation in Formulations: The continuous introduction of cutting-edge lubricant technologies is revolutionizing the market. These advancements focus on enhanced performance characteristics such as improved thermal stability, superior wear protection, extended drain intervals, and greater fuel efficiency. The development of synthetic and semi-synthetic formulations is particularly noteworthy.

- Shifting Consumer and Regulatory Landscape: Growing environmental consciousness among consumers, coupled with increasingly stringent environmental regulations and emissions standards, is propelling the demand for eco-friendly, biodegradable, and low-emission lubricants. This trend is expected to gain further momentum, influencing product development and market strategies.

- Competitive Market Dynamics and Value Enhancement: The highly competitive nature of the lubricants market fosters ongoing innovation and drives players to offer high-quality products at competitive price points. This intense rivalry benefits end-users by ensuring a consistent supply of advanced and reliable lubrication solutions that optimize operational efficiency and reduce maintenance costs.

By 2033, the market penetration for premium and synthetic lubricants is anticipated to see a substantial increase of around 15-20%, underscoring a pronounced consumer preference for superior performance and extended equipment lifespan.

Leading Markets & Segments in Poland Lubricants Market

The automotive segment is the dominant sector in the Poland lubricants market, accounting for approximately xx% of the total market share in 2025. The key drivers for this dominance include:

- High Vehicle Density: Poland has a relatively high vehicle density, creating a significant demand for automotive lubricants.

- Stringent Emission Regulations: Compliance with increasingly stringent emission norms necessitates the use of high-quality, specialized lubricants.

- Growing Transportation Sector: The robust growth of the logistics and transportation sectors further drives demand for lubricants.

- Infrastructure Development: Continuous investment in road and transport infrastructure supports economic activity and increases demand.

The industrial segment holds the second-largest share of the market, accounting for xx% in 2025, driven by robust industrial production and expanding manufacturing capabilities.

Poland Lubricants Market Product Developments

Recent product developments focus on high-performance, eco-friendly lubricants formulated to meet stricter emission regulations and enhance operational efficiency. This includes advancements in synthetic lubricants, bio-based lubricants, and specialized greases designed for specific industrial applications. Companies are emphasizing the performance and environmental benefits of their products to attract environmentally conscious customers. Technological advancements are key to maintaining a competitive edge.

Key Drivers of Poland Lubricants Market Growth

The Poland lubricants market's growth is propelled by:

- Technological advancements: Development of advanced lubricant formulations meeting the requirements of modern machinery.

- Economic growth: Expansion of various industrial sectors, leading to increased lubricant demand.

- Favorable government policies: Government initiatives promoting industrial development and infrastructure enhancements.

Challenges in the Poland Lubricants Market Market

Significant challenges include:

- Fluctuating Crude Oil Prices: Price volatility impacts the cost of raw materials and affects profitability.

- Stringent Environmental Regulations: Meeting stringent environmental standards necessitates investment in research and development for eco-friendly products.

- Intense Competition: Competition from both domestic and international players puts pressure on pricing and margins. This leads to a need for differentiation and innovation.

These factors present challenges for maintaining growth trajectories.

Emerging Opportunities in Poland Lubricants Market

The future trajectory of the Poland lubricants market is marked by promising opportunities, fueled by:

- Pioneering Technological Breakthroughs: Ongoing research and development in lubricant science are leading to the creation of next-generation products with unprecedented performance capabilities, enhanced sustainability profiles, and suitability for emerging machinery technologies.

- Strategic Alliances and Collaborations: The formation of strategic partnerships between leading lubricant manufacturers, original equipment manufacturers (OEMs), and other industry stakeholders will unlock synergistic opportunities for co-development of specialized lubricants, enhanced market access, and improved service offerings.

- Sustained Sectoral Expansion: Continued growth and investment in the Polish automotive, manufacturing, and energy sectors will intrinsically drive a sustained and increasing demand for a diverse range of lubricant products.

Leading Players in the Poland Lubricants Market Sector

- Shell plc

- TotalEnergies SE

- Exxon Mobil Corporation

- Eurol

- BP Plc (Castrol)

- Liqui Moly

- Motul

- FUCHS

- PKN ORLEN

- Modex Oil

- List Not Exhaustive

Key Milestones in Poland Lubricants Market Industry

- June 2021: TotalEnergies and the Stellantis group reaffirmed their long-standing partnership, emphasizing a shared commitment to lubricant development and technological innovation, particularly for the automotive sector.

- January 2022: ExxonMobil Corporation undertook a significant corporate restructuring, reorganizing into three distinct business lines including ExxonMobil Product Solutions. This strategic move aims to streamline operations and enhance focus on its diverse product offerings, including its substantial lubricant portfolio.

Strategic Outlook for Poland Lubricants Market Market

The Poland lubricants market presents a compelling landscape for growth, characterized by the synergistic interplay of technological advancements, favorable macroeconomic conditions, and robust demand from a spectrum of industrial and consumer sectors. To effectively harness this growth potential, companies must prioritize strategic partnerships, invest judiciously in research and development, and keenly focus on sustainability and the development of environmentally responsible lubricant solutions. A forward-thinking approach centered on innovation, customer-centricity, and environmental stewardship will be paramount for achieving sustained success and market leadership in the long term.

Poland Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Transmission And Gear Oils

- 1.3. Hydraulic Fluid

- 1.4. Metalworking Fluid

- 1.5. Greases

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Automotive

- 2.3. Heavy Equipment

- 2.4. Metallurgy And Metalworking

- 2.5. Other End-user Industries

Poland Lubricants Market Segmentation By Geography

- 1. Poland

Poland Lubricants Market Regional Market Share

Geographic Coverage of Poland Lubricants Market

Poland Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Automotive Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Rising Automotive Industry; Other Drivers

- 3.4. Market Trends

- 3.4.1. Rising Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Transmission And Gear Oils

- 5.1.3. Hydraulic Fluid

- 5.1.4. Metalworking Fluid

- 5.1.5. Greases

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Automotive

- 5.2.3. Heavy Equipment

- 5.2.4. Metallurgy And Metalworking

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TotalEnergies SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eurol

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BP Plc (Castrol)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Liqui Moly

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Motul

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FUCHS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PKN ORLEN

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Modex Oil*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shell plc

List of Figures

- Figure 1: Poland Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Poland Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Poland Lubricants Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: Poland Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Poland Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Poland Lubricants Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: Poland Lubricants Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Lubricants Market?

The projected CAGR is approximately 2.64%.

2. Which companies are prominent players in the Poland Lubricants Market?

Key companies in the market include Shell plc, TotalEnergies SE, Exxon Mobil Corporation, Eurol, BP Plc (Castrol), Liqui Moly, Motul, FUCHS, PKN ORLEN, Modex Oil*List Not Exhaustive.

3. What are the main segments of the Poland Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 166.36 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Automotive Industry; Other Drivers.

6. What are the notable trends driving market growth?

Rising Automotive Industry.

7. Are there any restraints impacting market growth?

Rising Automotive Industry; Other Drivers.

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions, and ExxonMobil Low Carbon Solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Lubricants Market?

To stay informed about further developments, trends, and reports in the Poland Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence