Key Insights

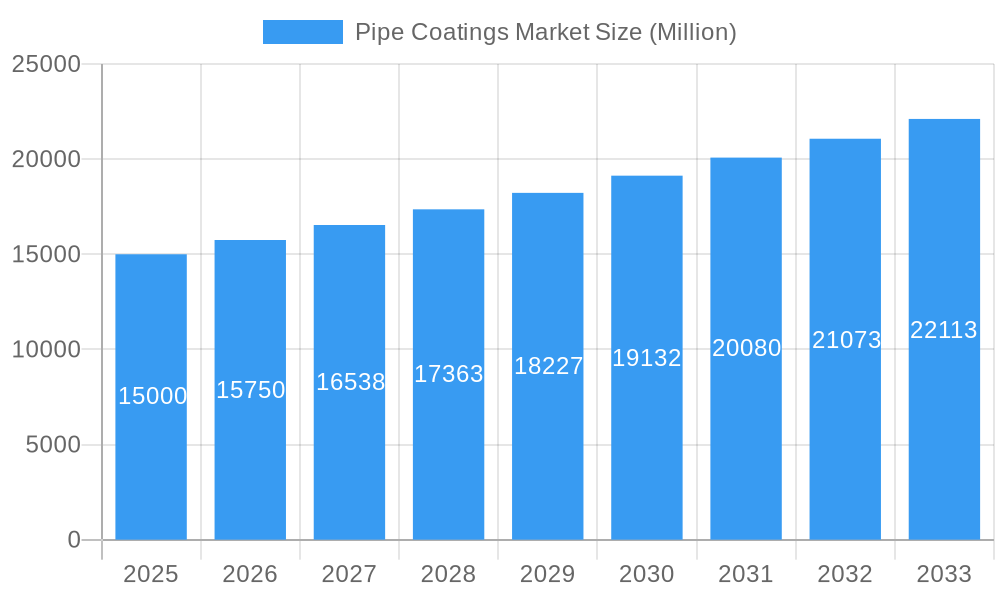

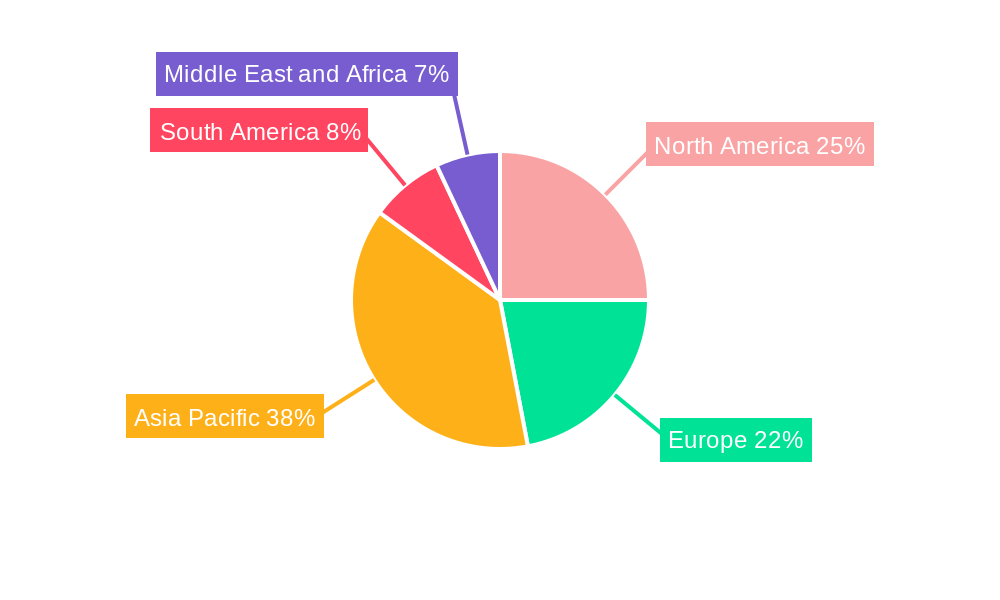

The global pipe coatings market is experiencing robust growth, driven by the increasing demand for infrastructure development, particularly in emerging economies, and the expanding oil and gas sector. The market's Compound Annual Growth Rate (CAGR) exceeding 5% signifies a significant expansion projected through 2033. Key drivers include stringent regulations aimed at preventing corrosion and leakage in pipelines transporting hazardous materials, alongside the rising adoption of sustainable and environmentally friendly coating solutions. The thermoplastic segment holds a substantial market share, favored for its ease of application and cost-effectiveness. However, the epoxy layered segment is witnessing notable growth due to its superior performance characteristics in harsh environments. Geographically, the Asia-Pacific region, fueled by significant infrastructure projects and industrial expansion in countries like China and India, is expected to dominate the market. North America and Europe also maintain considerable market shares due to established infrastructure and ongoing maintenance needs. Growth is being somewhat restrained by the volatility of raw material prices and fluctuations in global economic conditions. Nevertheless, ongoing investments in pipeline infrastructure, particularly for water and wastewater treatment and the energy sector, are expected to offset these restraints and fuel continued market expansion. The competitive landscape is characterized by both established players and regional manufacturers, with ongoing mergers, acquisitions, and technological advancements shaping the market dynamics.

Pipe Coatings Market Market Size (In Billion)

The market segmentation reveals a diverse range of material types, each catering to specific application requirements. Thermoplastics, while dominant, face competition from epoxy layered coatings which offer superior corrosion resistance and durability, making them especially valuable for harsh environments. Similarly, the end-user industries show considerable variation with oil and gas, water and wastewater treatment, and infrastructure being major consumers. The regional disparity highlights the significant growth potential in Asia-Pacific, driven by rapid industrialization and infrastructure spending. However, the mature markets of North America and Europe continue to contribute substantially due to existing infrastructure needing consistent maintenance and upgrades. Continuous innovation in coating materials and application techniques, focusing on enhanced durability, corrosion resistance, and environmentally friendly solutions, further shapes the competitive landscape and creates opportunities for both established players and new entrants. Long-term forecasts suggest sustained growth, driven by the enduring need for efficient and durable pipeline systems across various industries.

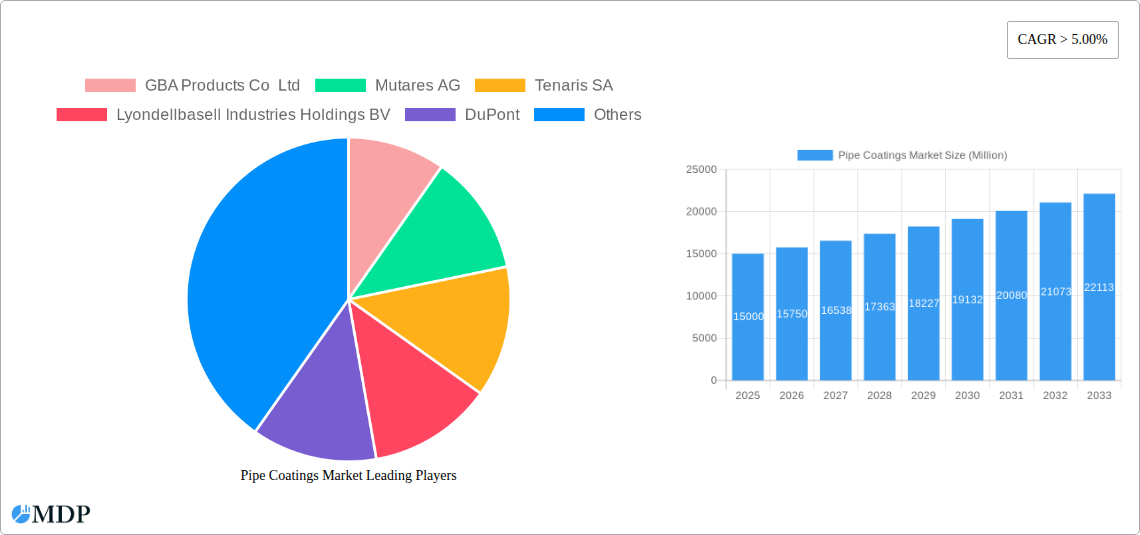

Pipe Coatings Market Company Market Share

Pipe Coatings Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Pipe Coatings Market, offering actionable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this report unravels market dynamics, trends, and future opportunities. The study incorporates meticulous analysis of key segments, leading players, and significant market developments, providing a crucial resource for strategic decision-making. Expected market size in 2025 is estimated at XX Million.

Pipe Coatings Market Dynamics & Concentration

The pipe coatings market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the presence of numerous regional and specialized companies indicates a competitive environment. Market concentration is influenced by factors such as economies of scale in manufacturing and distribution, technological advancements, and the ability to cater to diverse end-user needs. The market is witnessing increased M&A activity, primarily driven by a desire to expand product portfolios, geographic reach, and technological capabilities. For instance, the acquisition of Sika AG's European industrial coatings business by Sherwin-Williams in July 2022 illustrates this trend.

- Market Concentration: The top 5 players hold approximately XX% of the global market share in 2025 (estimated).

- Innovation Drivers: Demand for corrosion-resistant, high-performance coatings, coupled with stricter environmental regulations, are driving innovation in material science and application techniques.

- Regulatory Frameworks: Stringent environmental regulations governing volatile organic compound (VOC) emissions are shaping product development and influencing market dynamics.

- Product Substitutes: The availability of alternative pipe materials (e.g., plastic pipes) presents a challenge, though the performance characteristics of coated steel pipes often remain superior for certain applications.

- End-User Trends: Growth in infrastructure development, particularly in oil & gas and water treatment, is a key driver of market demand.

- M&A Activities: The number of M&A deals in the pipe coatings market has increased by approximately XX% between 2019 and 2024, indicating consolidation within the industry.

Pipe Coatings Market Industry Trends & Analysis

The pipe coatings market is experiencing robust growth, driven by the increasing demand for infrastructure development across various sectors, stringent environmental regulations mandating corrosion protection, and the continuous advancement of coating technologies. The market is projected to achieve a CAGR of XX% during the forecast period (2025-2033). This growth is fueled by factors such as rising investments in oil & gas pipelines, water infrastructure projects, and chemical processing plants. Technological advancements, including the development of high-performance, eco-friendly coatings, are enhancing market penetration. The competitive landscape is characterized by intense rivalry among established players, emphasizing innovation and strategic partnerships. Consumer preferences are shifting towards sustainable and high-performance coatings with extended lifespans, reducing maintenance costs.

Leading Markets & Segments in Pipe Coatings Market

The Oil and Gas sector represents the dominant end-user industry for pipe coatings, globally. Geographically, the Asia-Pacific region is projected to lead the market due to extensive infrastructure development and industrialization. North America and Europe also represent significant markets, driven by replacement and upgrading of existing infrastructure.

Key Drivers:

- Oil and Gas: Demand for corrosion protection in pipelines transporting oil and gas across diverse terrains and harsh environments is a primary driver.

- Water and Wastewater Treatment: Aging infrastructure necessitates rehabilitation and new installations, driving demand for coatings that enhance durability and prevent leaks.

- Infrastructure: Government investments in transportation and utility infrastructure are fueling growth in the pipe coatings market.

Dominance Analysis:

The Epoxy Layered segment holds the largest market share among material types due to its excellent corrosion resistance and versatility. However, Thermoplastics are gaining traction due to their ease of application and cost-effectiveness for certain applications. The high demand for durable and eco-friendly solutions will continue to shape future market trends.

Pipe Coatings Market Product Developments

Recent product developments focus on advanced materials providing superior corrosion resistance, enhanced durability, and improved application techniques. This includes the development of next-generation coatings like PPG HI-TEMP 1027 HD, which addresses challenging corrosion-under-insulation (CUI) conditions. The trend is towards eco-friendly, low-VOC coatings meeting increasingly stringent environmental regulations. This focus on sustainability, combined with performance enhancement, ensures market fit and competitive advantage.

Key Drivers of Pipe Coatings Market Growth

The global pipe coatings market is experiencing substantial growth, fueled by a confluence of technological advancements, economic factors, and regulatory pressures. Technological breakthroughs in material science have resulted in the development of superior coatings offering enhanced corrosion resistance, durability, and sustainability. Robust economic growth in various sectors, particularly infrastructure development, is driving increased demand for pipe coatings. Furthermore, stringent environmental regulations promoting the use of eco-friendly coatings are acting as a catalyst for market expansion.

Challenges in the Pipe Coatings Market

The pipe coatings market faces several challenges, including fluctuating raw material prices impacting production costs and profit margins. Supply chain disruptions can cause delays in project completion. Intense competition among established players requires continuous innovation to maintain a competitive edge. Stringent environmental regulations need compliance, adding to operational costs. These factors pose potential impediments to market growth.

Emerging Opportunities in Pipe Coatings Market

The pipe coatings market is poised for significant long-term growth, driven by several emerging opportunities. Advancements in nanotechnology and other advanced materials offer potential for developing even more durable and corrosion-resistant coatings. Strategic partnerships between coating manufacturers and pipeline operators can lead to innovative solutions tailored to specific needs. Expanding into new geographical regions, particularly developing economies with significant infrastructure investment, presents substantial growth potential.

Leading Players in the Pipe Coatings Market Sector

- GBA Products Co Ltd

- Mutares AG

- Tenaris SA

- Lyondellbasell Industries Holdings BV

- DuPont

- Aegion Coating Services (also operates through subsidiary Bayou Coating)

- Allan Edwards Inc

- Shawcor Ltd

- Shaic International Co

- Jotun

- Arabian Pipe Coating Co (APCO)

- Dura-Bond (DBB Acquisition LLC)

- AkzoNobel NV

- Bauhuis BV

- Bredero Shaw Ltd

- BSR Coatings

- Celanese Corporation

- Perma-Pipe Inc

- Wasco Energy Group of Companies

- Corinth Pipeworks (Cenergy Holdings SA)

- 3M

- PPG Industries Inc

- Borusan Mannesmann

- The Sherwin-Williams Company (Valspar)

- A W Chesterton Co

- Al Qahtani Pipe Coating Industries

- Hempel Coatings

- BASF SE

Key Milestones in Pipe Coatings Market Industry

- August 2021: PPG announced the introduction of PPG HI-TEMP 1027 HD coating, a next-generation ambient-cure coating designed for challenging corrosion-under-insulation (CUI) conditions. This signifies a significant advancement in corrosion protection technology.

- July 2022: The Sherwin-Williams Company completed its acquisition of Sika AG's European industrial coatings business. This acquisition strengthens Sherwin-Williams' position in the market, expanding its product portfolio and geographic reach.

Strategic Outlook for Pipe Coatings Market Market

The pipe coatings market presents substantial growth potential driven by sustained infrastructure investments, technological innovations, and the rising demand for sustainable solutions. Strategic partnerships and collaborations between manufacturers, pipeline operators, and research institutions are expected to foster innovation and drive market expansion. Companies focusing on developing advanced, eco-friendly coatings with enhanced performance characteristics are poised to capture significant market share in the years to come. The market is expected to continue to grow at a healthy pace driven by long-term infrastructure projects and advancements in coatings technology.

Pipe Coatings Market Segmentation

-

1. Material Type

- 1.1. Thermoplastics

- 1.2. Epoxy Layered

- 1.3. Coal Tar Enamel

- 1.4. Asphalt Enamel

- 1.5. Vinyl Ester-based

- 1.6. Other Material Types

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Water and Wastewater Treatment

- 2.3. Mining

- 2.4. Agriculture

- 2.5. Chemical Processing and Transport

- 2.6. Infrastructure

- 2.7. Other End-user Industries

Pipe Coatings Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Qatar

- 5.4. Rest of Middle East and Africa

Pipe Coatings Market Regional Market Share

Geographic Coverage of Pipe Coatings Market

Pipe Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Upsurge in Shale Oil and Gas Production in North America; Growing Infrastructure and Industrialization in the Asia-Pacific Region; Rise in Irrigation and Agricultural Activities in Southeast Asia; Rising Energy Demand in Europe

- 3.3. Market Restrains

- 3.3.1. Operational Challenges in Newly Discovered Energy Reserves; Competition from Renewable Energy Substitutes

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment to Dominate the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pipe Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Thermoplastics

- 5.1.2. Epoxy Layered

- 5.1.3. Coal Tar Enamel

- 5.1.4. Asphalt Enamel

- 5.1.5. Vinyl Ester-based

- 5.1.6. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Water and Wastewater Treatment

- 5.2.3. Mining

- 5.2.4. Agriculture

- 5.2.5. Chemical Processing and Transport

- 5.2.6. Infrastructure

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Asia Pacific Pipe Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Thermoplastics

- 6.1.2. Epoxy Layered

- 6.1.3. Coal Tar Enamel

- 6.1.4. Asphalt Enamel

- 6.1.5. Vinyl Ester-based

- 6.1.6. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Water and Wastewater Treatment

- 6.2.3. Mining

- 6.2.4. Agriculture

- 6.2.5. Chemical Processing and Transport

- 6.2.6. Infrastructure

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. North America Pipe Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Thermoplastics

- 7.1.2. Epoxy Layered

- 7.1.3. Coal Tar Enamel

- 7.1.4. Asphalt Enamel

- 7.1.5. Vinyl Ester-based

- 7.1.6. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Water and Wastewater Treatment

- 7.2.3. Mining

- 7.2.4. Agriculture

- 7.2.5. Chemical Processing and Transport

- 7.2.6. Infrastructure

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe Pipe Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Thermoplastics

- 8.1.2. Epoxy Layered

- 8.1.3. Coal Tar Enamel

- 8.1.4. Asphalt Enamel

- 8.1.5. Vinyl Ester-based

- 8.1.6. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Water and Wastewater Treatment

- 8.2.3. Mining

- 8.2.4. Agriculture

- 8.2.5. Chemical Processing and Transport

- 8.2.6. Infrastructure

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. South America Pipe Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Thermoplastics

- 9.1.2. Epoxy Layered

- 9.1.3. Coal Tar Enamel

- 9.1.4. Asphalt Enamel

- 9.1.5. Vinyl Ester-based

- 9.1.6. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Water and Wastewater Treatment

- 9.2.3. Mining

- 9.2.4. Agriculture

- 9.2.5. Chemical Processing and Transport

- 9.2.6. Infrastructure

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Pipe Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Thermoplastics

- 10.1.2. Epoxy Layered

- 10.1.3. Coal Tar Enamel

- 10.1.4. Asphalt Enamel

- 10.1.5. Vinyl Ester-based

- 10.1.6. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Water and Wastewater Treatment

- 10.2.3. Mining

- 10.2.4. Agriculture

- 10.2.5. Chemical Processing and Transport

- 10.2.6. Infrastructure

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GBA Products Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mutares AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tenaris SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lyondellbasell Industries Holdings BV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DuPont

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aegion Coating Services (also operates through subsidiary Bayou Coating)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Allan Edwards Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shawcor Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shaic International Co

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Jotun

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Arabian Pipe Coating Co (APCO)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dura-Bond (DBB Acquisition LLC)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AkzoNobel NV

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Bauhuis BV

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Bredero Shaw Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 BSR Coatings

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Celanese Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Perma-Pipe Inc

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Wasco Energy Group of Companies*List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Corinth Pipeworks (Cenergy Holdings SA)

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 3M

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 PPG Industries Inc

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Borusan Mannesmann

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 The Sherwin-Williams Company (Valspar)

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 A W Chesterton Co

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Al Qahtani Pipe Coating Industries

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Hempel Coatings

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 BASF SE

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.1 GBA Products Co Ltd

List of Figures

- Figure 1: Global Pipe Coatings Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Pipe Coatings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 3: Asia Pacific Pipe Coatings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: Asia Pacific Pipe Coatings Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Pipe Coatings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Pipe Coatings Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Pipe Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Pipe Coatings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 9: North America Pipe Coatings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: North America Pipe Coatings Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Pipe Coatings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Pipe Coatings Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Pipe Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Pipe Coatings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 15: Europe Pipe Coatings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Europe Pipe Coatings Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Pipe Coatings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Pipe Coatings Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Pipe Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Pipe Coatings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 21: South America Pipe Coatings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: South America Pipe Coatings Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: South America Pipe Coatings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Pipe Coatings Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Pipe Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Pipe Coatings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 27: Middle East and Africa Pipe Coatings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Middle East and Africa Pipe Coatings Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Pipe Coatings Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Pipe Coatings Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Pipe Coatings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pipe Coatings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 2: Global Pipe Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Pipe Coatings Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Pipe Coatings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 5: Global Pipe Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Pipe Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Pipe Coatings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 13: Global Pipe Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Pipe Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Pipe Coatings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 19: Global Pipe Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Pipe Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: France Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Italy Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Pipe Coatings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 27: Global Pipe Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Pipe Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Pipe Coatings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 33: Global Pipe Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Pipe Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Qatar Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Pipe Coatings Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pipe Coatings Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Pipe Coatings Market?

Key companies in the market include GBA Products Co Ltd, Mutares AG, Tenaris SA, Lyondellbasell Industries Holdings BV, DuPont, Aegion Coating Services (also operates through subsidiary Bayou Coating), Allan Edwards Inc, Shawcor Ltd, Shaic International Co, Jotun, Arabian Pipe Coating Co (APCO), Dura-Bond (DBB Acquisition LLC), AkzoNobel NV, Bauhuis BV, Bredero Shaw Ltd, BSR Coatings, Celanese Corporation, Perma-Pipe Inc, Wasco Energy Group of Companies*List Not Exhaustive, Corinth Pipeworks (Cenergy Holdings SA), 3M, PPG Industries Inc, Borusan Mannesmann, The Sherwin-Williams Company (Valspar), A W Chesterton Co, Al Qahtani Pipe Coating Industries, Hempel Coatings, BASF SE.

3. What are the main segments of the Pipe Coatings Market?

The market segments include Material Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Upsurge in Shale Oil and Gas Production in North America; Growing Infrastructure and Industrialization in the Asia-Pacific Region; Rise in Irrigation and Agricultural Activities in Southeast Asia; Rising Energy Demand in Europe.

6. What are the notable trends driving market growth?

Oil and Gas Segment to Dominate the Market Demand.

7. Are there any restraints impacting market growth?

Operational Challenges in Newly Discovered Energy Reserves; Competition from Renewable Energy Substitutes.

8. Can you provide examples of recent developments in the market?

July 2022: The Sherwin-Williams Company announced that it had completed its acquisition of the European industrial coatings business of Sika AG. The acquired business will become part of Sherwin-Williams' Performance Coatings Group operating segment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pipe Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pipe Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pipe Coatings Market?

To stay informed about further developments, trends, and reports in the Pipe Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence