Key Insights

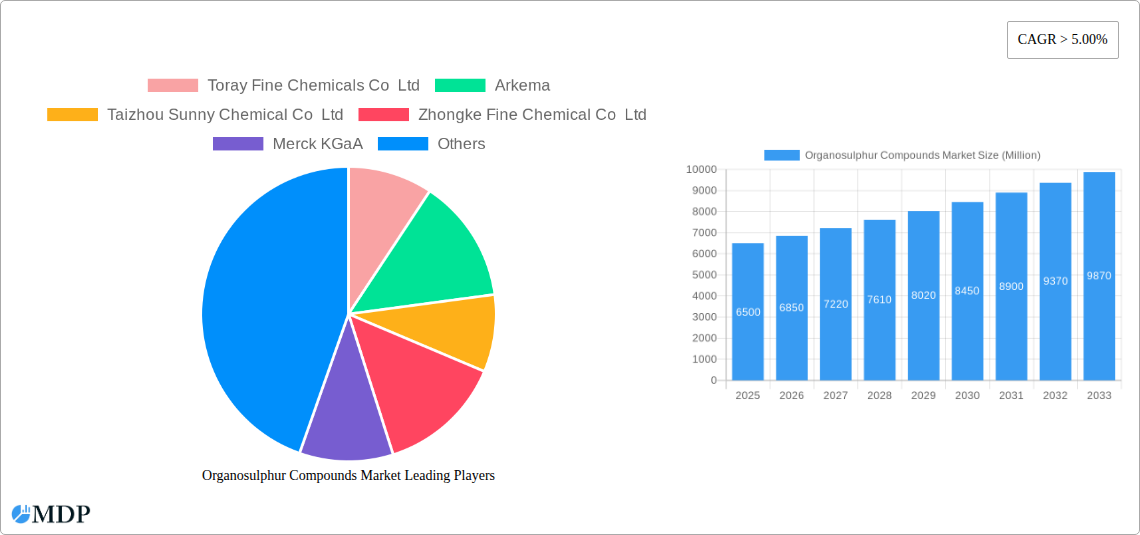

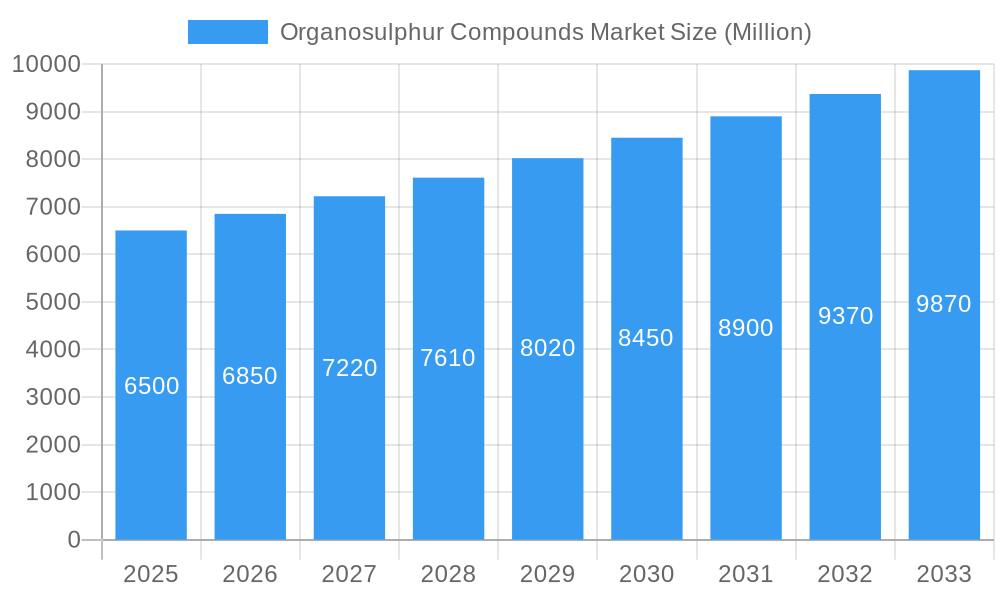

The global Organosulphur Compounds market is projected for significant expansion, with an estimated market size of $1450.75 million by 2024, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% through 2033. This growth is propelled by strong demand across key sectors, notably Polymers and Chemicals, where organosulphur compounds are vital for material synthesis and enhancement. The Oil and Gas industry also significantly contributes through refining processes and fuel additives. Emerging applications in Animal Nutrition, focusing on feed efficiency and animal well-being, are further stimulating market adoption. The competitive landscape features established players such as Arkema, Merck KGaA, and Chevron Phillips Chemical Company LLC, alongside prominent regional companies in Asia Pacific like Taizhou Sunny Chemical Co Ltd and Zhongke Fine Chemical Co Ltd.

Organosulphur Compounds Market Market Size (In Billion)

Key growth catalysts include rising industrialization, particularly in emerging economies, and advancements in chemical synthesis technologies that improve the performance and applicability of organosulphur compounds. Innovations within the Polymers and Chemicals sector, leading to the development of superior materials, are particularly influential. However, stringent environmental regulations concerning the production and disposal of sulphur-based chemicals present a challenge, driving the industry towards sustainable manufacturing and the development of eco-friendly alternatives. The market outlook remains robust, with segments like Mercaptans (including Dimethyl Disulfide (DMDS) and Dimethyl Sulfoxide (DMSO)) and Thioglycolic Acid and Ester anticipated to experience substantial growth, meeting diverse global industrial demands, with Asia Pacific leading in both production and consumption.

Organosulphur Compounds Market Company Market Share

Gain a comprehensive understanding of the global organosulphur compounds market through this in-depth report. Covering the forecast period from 2019 to 2033, with a base year of 2024, this analysis dissects market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, and emerging opportunities. Acquire actionable intelligence to effectively navigate the evolving organosulphur compounds market, crucial for sectors spanning animal nutrition, oil and gas, and polymers.

Organosulphur Compounds Market Market Dynamics & Concentration

The organosulphur compounds market exhibits a moderately concentrated landscape, with a few key players holding significant market share in specialized segments. Innovation remains a primary driver, fueled by increasing demand for high-performance materials and sustainable solutions across various end-user industries. Regulatory frameworks, particularly concerning environmental impact and safety standards, play a crucial role in shaping market entry and product development. The threat of product substitutes is generally low for highly specialized organosulphur compounds, but cost-competitiveness and performance parity can influence adoption in broader applications. End-user trends are leaning towards bio-based and eco-friendly alternatives, pushing manufacturers to invest in greener synthesis processes and applications. Mergers and acquisitions (M&A) activity, while not extensive, are strategic, aimed at consolidating market positions, acquiring new technologies, or expanding geographical reach. We anticipate XX M&A deals in the forecast period, with an estimated market share concentration of XX% held by the top 5 players.

Organosulphur Compounds Market Industry Trends & Analysis

The organosulphur compounds market is poised for robust growth, driven by a confluence of factors that underscore its indispensability across diverse industrial sectors. A primary growth catalyst is the escalating demand from the animal nutrition sector, where organosulphur compounds like methionines and cysteine play vital roles in animal feed formulations, promoting growth and health. The oil and gas industry continues to be a significant consumer, utilizing these compounds as corrosion inhibitors, catalysts, and in the refining processes. Furthermore, the burgeoning polymers and chemicals sector leverages organosulphur compounds for their unique properties, including their use as vulcanizing agents, stabilizers, and as intermediates in the synthesis of various specialty chemicals.

Technological disruptions are emerging, particularly in the development of novel synthesis routes that enhance efficiency and reduce environmental impact. This includes advancements in biocatalysis and flow chemistry for producing organosulphur compounds with greater purity and specificity. Consumer preferences are increasingly shifting towards products with enhanced performance and sustainability. This is prompting research and development into organosulphur compounds that offer improved efficacy, lower toxicity, and a reduced carbon footprint.

The competitive dynamics within the market are characterized by a blend of established chemical giants and specialized manufacturers. Strategic partnerships and collaborations are becoming more prevalent as companies seek to leverage each other's expertise and market reach. The market is also witnessing a gradual increase in market penetration for newer applications, driven by continuous innovation and a deeper understanding of the versatile properties of organosulphur compounds. The projected Compound Annual Growth Rate (CAGR) for the organosulphur compounds market is approximately XX% over the forecast period, indicating a strong upward trajectory.

Leading Markets & Segments in Organosulphur Compounds Market

The Polymers and Chemicals end-user industry is a dominant force in the global organosulphur compounds market, accounting for an estimated XX% of the total market share. This segment's prominence is propelled by the extensive use of organosulphur compounds as essential building blocks and additives in the manufacturing of a wide array of polymers, resins, and specialty chemicals. For instance, thiols and thioethers are critical in the production of synthetic rubbers, plastics, and coatings, where they act as vulcanizing agents, chain transfer agents, and stabilizers, enhancing the durability, flexibility, and overall performance of these materials. The inherent properties of organosulphur compounds, such as their ability to form strong sulfur-sulfur bonds, make them indispensable for cross-linking polymer chains, leading to enhanced mechanical strength and resistance to heat and chemicals.

Within the Type segment, Mercaptan (specifically Dimethyl Disulfide (DMDS)) is a leading sub-segment, driven by its widespread application in the petrochemical industry as a sulfiding agent and in the production of agricultural chemicals. Dimethyl Sulfoxide (DMSO), another key type, is highly valued for its exceptional solvent properties and its applications in pharmaceuticals, electronics, and as a chemical intermediate. The Oil and Gas end-user industry is another significant contributor to market growth, with organosulphur compounds being crucial for various refining processes, including hydrodesulfurization, and as additives in fuels and lubricants to improve performance and prevent corrosion.

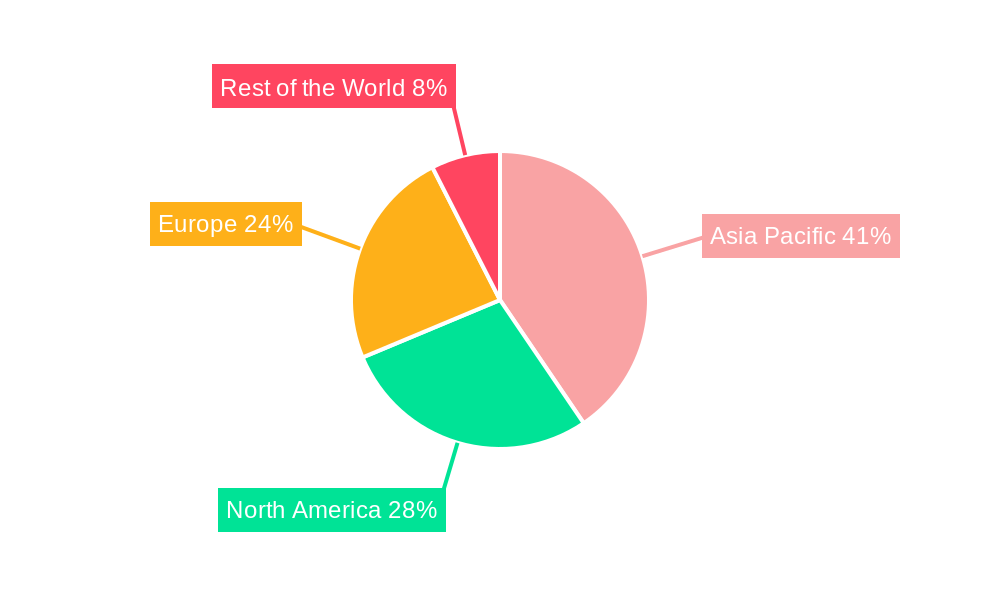

The geographical dominance lies with the Asia Pacific region, driven by rapid industrialization, a burgeoning manufacturing base, and increasing investments in chemical and petrochemical sectors. Countries like China and India are major consumers and producers, supported by favorable economic policies and robust infrastructure development. The growing demand for specialty chemicals, coupled with advancements in agricultural practices that boost the animal nutrition sector, further cements Asia Pacific's leading position.

Key drivers for this dominance include:

- Economic Policies: Government initiatives promoting industrial growth and foreign investment.

- Infrastructure Development: Expansion of manufacturing facilities and logistics networks.

- Technological Adoption: Increasing uptake of advanced chemical processes and applications.

- Growing End-User Industries: Sustained demand from polymers, agriculture, and oil & gas.

Organosulphur Compounds Market Product Developments

Product innovation in the organosulphur compounds market is focused on enhancing purity, improving synthesis efficiency, and developing novel applications. Key developments include greener synthesis routes for mercaptans and thiols, leading to reduced environmental impact. The expansion of DMSO applications in advanced pharmaceutical formulations and as a bio-solvent is a significant trend. Furthermore, research into sulfur-containing polymers is yielding materials with unique electrical, optical, and mechanical properties, offering competitive advantages in electronics and advanced materials sectors.

Key Drivers of Organosulphur Compounds Market Growth

Several interconnected factors are propelling the organosulphur compounds market forward. The increasing global demand for animal protein is directly fueling the animal nutrition sector's need for organosulphur compounds like methionine, which are essential amino acids for livestock health and growth. In the oil and gas industry, the stringent regulations regarding fuel sulfur content necessitate the use of organosulphur compounds in refining processes for desulfurization. The polymers and chemicals sector's continuous innovation in material science, leading to the development of new plastics, rubbers, and specialty chemicals with improved properties, relies heavily on the unique functionalities offered by these sulfur-containing compounds. Technological advancements in production methods, such as biocatalysis and more efficient chemical synthesis, are also reducing production costs and enhancing product quality, thereby stimulating market expansion.

Challenges in the Organosulphur Compounds Market Market

Despite its growth potential, the organosulphur compounds market faces several hurdles. Regulatory scrutiny concerning the environmental impact and potential toxicity of certain organosulphur compounds can lead to increased compliance costs and slow down market penetration in sensitive applications. Supply chain disruptions, exacerbated by geopolitical factors and fluctuations in raw material prices, can impact the availability and cost-effectiveness of production. The handling and safety requirements associated with some organosulphur compounds necessitate specialized infrastructure and training, adding to operational expenses. Furthermore, while direct substitutes are limited for many specialized applications, competition from alternative material solutions in broader applications can exert price pressure and limit market share expansion. The estimated impact of these challenges could lead to a XX% slower growth rate in specific sub-segments.

Emerging Opportunities in Organosulphur Compounds Market

The organosulphur compounds market is ripe with emerging opportunities, driven by ongoing innovation and evolving industry needs. The increasing focus on sustainable chemistry presents a significant avenue for growth, with opportunities in developing bio-based organosulphur compounds and more environmentally friendly production processes. Advancements in drug discovery and delivery systems are creating new applications for organosulphur compounds as therapeutic agents and excipients. The burgeoning field of advanced materials, including conductive polymers and novel catalysts, offers substantial potential for organosulphur compounds with unique electrochemical and catalytic properties. Strategic partnerships between chemical manufacturers and research institutions can accelerate the development and commercialization of these novel applications, unlocking new market segments.

Leading Players in the Organosulphur Compounds Market Sector

- Toray Fine Chemicals Co Ltd

- Arkema

- Taizhou Sunny Chemical Co Ltd

- Zhongke Fine Chemical Co Ltd

- Merck KGaA

- Chevron Phillips Chemical Company LLC

- Bruno Bock

- TCI Chemicals

- Daicel Corporation

- Dr Spiess Chemische Fabrik GmbH

- Hebei Yanuo Bioscience Co Ltd

Key Milestones in Organosulphur Compounds Market Industry

- 2023: Arkema announces expansion of its organosulphur production capacity to meet growing demand in specialty polymers.

- 2023: Toray Fine Chemicals Co Ltd develops a new, eco-friendly synthesis process for dimethyl disulfide (DMDS).

- 2024: Zhongke Fine Chemical Co Ltd introduces a novel thioglycolic acid derivative for the cosmetics industry.

- 2024: Merck KGaA expands its portfolio of organosulphur reagents for advanced research applications.

- 2024: Chevron Phillips Chemical Company LLC invests in R&D to explore new applications of organosulphur compounds in sustainable energy technologies.

Strategic Outlook for Organosulphur Compounds Market Market

The strategic outlook for the organosulphur compounds market is highly positive, characterized by sustained growth and diversification. Key growth accelerators include the continued expansion of the animal nutrition sector, driven by global food security demands, and the persistent need for high-performance chemicals in the polymers and oil & gas industries. Technological advancements in greener synthesis and novel applications, particularly in pharmaceuticals and advanced materials, will unlock new revenue streams. Companies that focus on sustainability, invest in research and development for innovative solutions, and forge strategic collaborations are best positioned to capitalize on the evolving market dynamics and achieve long-term success. The market's inherent versatility ensures its continued relevance and growth in the coming years.

Organosulphur Compounds Market Segmentation

-

1. Type

-

1.1. Mercaptan

- 1.1.1. Dimethyl Disulfide (DMDS)

- 1.2. Dimethyl Sulfoxide (DMSO)

- 1.3. Thioglycolic Acid and Ester

- 1.4. Other Types

-

1.1. Mercaptan

-

2. End-user Industry

- 2.1. Animal Nutrition

- 2.2. Oil and Gas

- 2.3. Polymers and Chemicals

- 2.4. Other End-user Industries

Organosulphur Compounds Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Rest of Europe

- 4. Rest of the World

Organosulphur Compounds Market Regional Market Share

Geographic Coverage of Organosulphur Compounds Market

Organosulphur Compounds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Use of Thiochemicals in Methionine Production; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Toxic Effects of Terephthalic Acid

- 3.4. Market Trends

- 3.4.1. Growing Usage in Animal Nutrition

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Organosulphur Compounds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mercaptan

- 5.1.1.1. Dimethyl Disulfide (DMDS)

- 5.1.2. Dimethyl Sulfoxide (DMSO)

- 5.1.3. Thioglycolic Acid and Ester

- 5.1.4. Other Types

- 5.1.1. Mercaptan

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Animal Nutrition

- 5.2.2. Oil and Gas

- 5.2.3. Polymers and Chemicals

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Organosulphur Compounds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mercaptan

- 6.1.1.1. Dimethyl Disulfide (DMDS)

- 6.1.2. Dimethyl Sulfoxide (DMSO)

- 6.1.3. Thioglycolic Acid and Ester

- 6.1.4. Other Types

- 6.1.1. Mercaptan

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Animal Nutrition

- 6.2.2. Oil and Gas

- 6.2.3. Polymers and Chemicals

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Organosulphur Compounds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mercaptan

- 7.1.1.1. Dimethyl Disulfide (DMDS)

- 7.1.2. Dimethyl Sulfoxide (DMSO)

- 7.1.3. Thioglycolic Acid and Ester

- 7.1.4. Other Types

- 7.1.1. Mercaptan

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Animal Nutrition

- 7.2.2. Oil and Gas

- 7.2.3. Polymers and Chemicals

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Organosulphur Compounds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mercaptan

- 8.1.1.1. Dimethyl Disulfide (DMDS)

- 8.1.2. Dimethyl Sulfoxide (DMSO)

- 8.1.3. Thioglycolic Acid and Ester

- 8.1.4. Other Types

- 8.1.1. Mercaptan

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Animal Nutrition

- 8.2.2. Oil and Gas

- 8.2.3. Polymers and Chemicals

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Organosulphur Compounds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mercaptan

- 9.1.1.1. Dimethyl Disulfide (DMDS)

- 9.1.2. Dimethyl Sulfoxide (DMSO)

- 9.1.3. Thioglycolic Acid and Ester

- 9.1.4. Other Types

- 9.1.1. Mercaptan

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Animal Nutrition

- 9.2.2. Oil and Gas

- 9.2.3. Polymers and Chemicals

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Toray Fine Chemicals Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Arkema

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Taizhou Sunny Chemical Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Zhongke Fine Chemical Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Merck KGaA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Chevron Phillips Chemical Company LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bruno Bock

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TCI Chemicals

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Daicel Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dr Spiess Chemische Fabrik GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hebei Yanuo Bioscience Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Toray Fine Chemicals Co Ltd

List of Figures

- Figure 1: Global Organosulphur Compounds Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Organosulphur Compounds Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Organosulphur Compounds Market Revenue (million), by Type 2025 & 2033

- Figure 4: Asia Pacific Organosulphur Compounds Market Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Organosulphur Compounds Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Organosulphur Compounds Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Organosulphur Compounds Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Organosulphur Compounds Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 9: Asia Pacific Organosulphur Compounds Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: Asia Pacific Organosulphur Compounds Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Organosulphur Compounds Market Revenue (million), by Country 2025 & 2033

- Figure 12: Asia Pacific Organosulphur Compounds Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Organosulphur Compounds Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Organosulphur Compounds Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Organosulphur Compounds Market Revenue (million), by Type 2025 & 2033

- Figure 16: North America Organosulphur Compounds Market Volume (K Tons), by Type 2025 & 2033

- Figure 17: North America Organosulphur Compounds Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Organosulphur Compounds Market Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Organosulphur Compounds Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 20: North America Organosulphur Compounds Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 21: North America Organosulphur Compounds Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: North America Organosulphur Compounds Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: North America Organosulphur Compounds Market Revenue (million), by Country 2025 & 2033

- Figure 24: North America Organosulphur Compounds Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Organosulphur Compounds Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Organosulphur Compounds Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Organosulphur Compounds Market Revenue (million), by Type 2025 & 2033

- Figure 28: Europe Organosulphur Compounds Market Volume (K Tons), by Type 2025 & 2033

- Figure 29: Europe Organosulphur Compounds Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Organosulphur Compounds Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Organosulphur Compounds Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 32: Europe Organosulphur Compounds Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 33: Europe Organosulphur Compounds Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Europe Organosulphur Compounds Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Europe Organosulphur Compounds Market Revenue (million), by Country 2025 & 2033

- Figure 36: Europe Organosulphur Compounds Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Organosulphur Compounds Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Organosulphur Compounds Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Organosulphur Compounds Market Revenue (million), by Type 2025 & 2033

- Figure 40: Rest of the World Organosulphur Compounds Market Volume (K Tons), by Type 2025 & 2033

- Figure 41: Rest of the World Organosulphur Compounds Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Rest of the World Organosulphur Compounds Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Rest of the World Organosulphur Compounds Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 44: Rest of the World Organosulphur Compounds Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: Rest of the World Organosulphur Compounds Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Rest of the World Organosulphur Compounds Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Rest of the World Organosulphur Compounds Market Revenue (million), by Country 2025 & 2033

- Figure 48: Rest of the World Organosulphur Compounds Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: Rest of the World Organosulphur Compounds Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Organosulphur Compounds Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Organosulphur Compounds Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Organosulphur Compounds Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Organosulphur Compounds Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Organosulphur Compounds Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Organosulphur Compounds Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Organosulphur Compounds Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Organosulphur Compounds Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Global Organosulphur Compounds Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Global Organosulphur Compounds Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Organosulphur Compounds Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Organosulphur Compounds Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Organosulphur Compounds Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: China Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: India Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Japan Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global Organosulphur Compounds Market Revenue million Forecast, by Type 2020 & 2033

- Table 24: Global Organosulphur Compounds Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 25: Global Organosulphur Compounds Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Organosulphur Compounds Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Organosulphur Compounds Market Revenue million Forecast, by Country 2020 & 2033

- Table 28: Global Organosulphur Compounds Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: United States Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Canada Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Organosulphur Compounds Market Revenue million Forecast, by Type 2020 & 2033

- Table 36: Global Organosulphur Compounds Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 37: Global Organosulphur Compounds Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Organosulphur Compounds Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Organosulphur Compounds Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: Global Organosulphur Compounds Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Germany Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Italy Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Italy Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: France Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: France Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Spain Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Spain Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Rest of Europe Organosulphur Compounds Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Europe Organosulphur Compounds Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Global Organosulphur Compounds Market Revenue million Forecast, by Type 2020 & 2033

- Table 54: Global Organosulphur Compounds Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 55: Global Organosulphur Compounds Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 56: Global Organosulphur Compounds Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 57: Global Organosulphur Compounds Market Revenue million Forecast, by Country 2020 & 2033

- Table 58: Global Organosulphur Compounds Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Organosulphur Compounds Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Organosulphur Compounds Market?

Key companies in the market include Toray Fine Chemicals Co Ltd, Arkema, Taizhou Sunny Chemical Co Ltd, Zhongke Fine Chemical Co Ltd , Merck KGaA, Chevron Phillips Chemical Company LLC, Bruno Bock, TCI Chemicals, Daicel Corporation, Dr Spiess Chemische Fabrik GmbH, Hebei Yanuo Bioscience Co Ltd.

3. What are the main segments of the Organosulphur Compounds Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1450.75 million as of 2022.

5. What are some drivers contributing to market growth?

Use of Thiochemicals in Methionine Production; Other Drivers.

6. What are the notable trends driving market growth?

Growing Usage in Animal Nutrition.

7. Are there any restraints impacting market growth?

Toxic Effects of Terephthalic Acid.

8. Can you provide examples of recent developments in the market?

Recent developments pertaining to the market studied will be covered in complete report.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Organosulphur Compounds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Organosulphur Compounds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Organosulphur Compounds Market?

To stay informed about further developments, trends, and reports in the Organosulphur Compounds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence