Key Insights

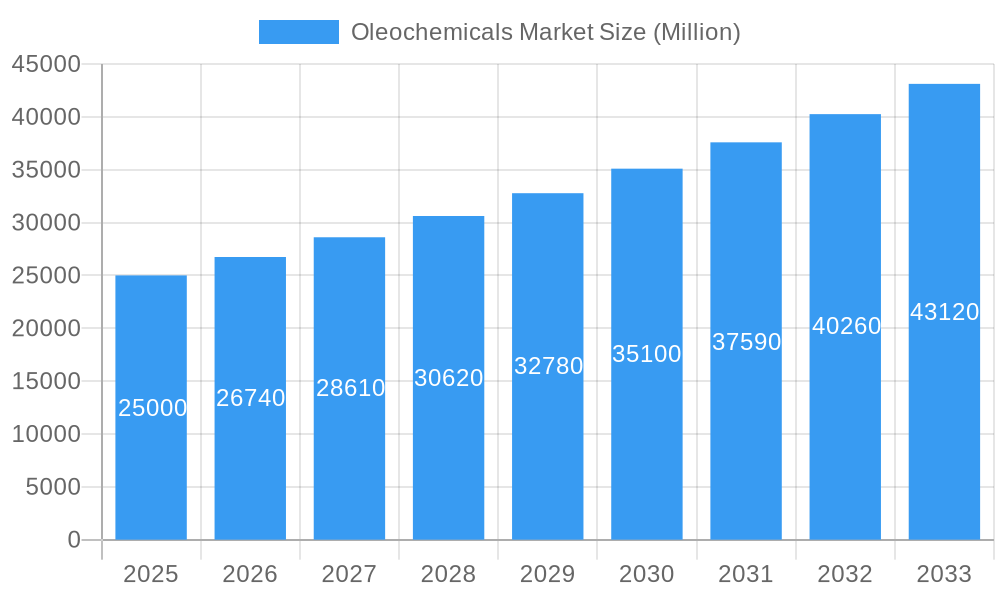

The global oleochemicals market is experiencing robust growth, driven by increasing demand from various sectors. A compound annual growth rate (CAGR) of 6.97% from 2019 to 2024 suggests a significant expansion, and this upward trajectory is projected to continue throughout the forecast period (2025-2033). Key drivers include the burgeoning bio-based materials sector, growing awareness of sustainability and the need for eco-friendly alternatives to petrochemicals, and rising consumption in diverse applications like personal care products, detergents, and biofuels. This market's expansion is also fueled by innovations in oleochemical production processes, leading to higher efficiency and cost-effectiveness. While supply chain disruptions and fluctuating raw material prices pose some challenges, the overall market outlook remains positive. The industry is segmented based on product type (e.g., fatty acids, fatty alcohols, glycerine), application (e.g., cosmetics, food, plastics), and geography. Major players like Baerlocher GmbH, Berg + Schmidt GmbH & Co KG, and Croda International Plc are actively shaping the market through strategic acquisitions, technological advancements, and geographical expansion. The increasing focus on sustainable and renewable resources further reinforces the long-term growth potential of the oleochemicals market.

Oleochemicals Market Market Size (In Billion)

The competitive landscape is characterized by both large multinational corporations and specialized regional players. While a comprehensive regional breakdown is not provided, it's reasonable to assume a distribution across key regions, with North America, Europe, and Asia-Pacific likely holding the largest market shares due to established manufacturing bases and strong demand. Furthermore, emerging economies are expected to contribute significantly to market growth as industrialization and consumer demand increase. The forecast period (2025-2033) anticipates continuous expansion, driven by factors such as increasing government support for renewable resources and the expanding applications of oleochemicals in emerging industries like green plastics and biodegradable packaging. Companies are strategically investing in research and development to create innovative products that meet the evolving demands of a more environmentally conscious consumer base.

Oleochemicals Market Company Market Share

Unlock Growth Opportunities in the Thriving Oleochemicals Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the global oleochemicals market, offering invaluable insights for industry stakeholders seeking to capitalize on emerging trends and opportunities. Covering the period 2019-2033, with a focus on 2025, this study examines market dynamics, leading players, and future growth projections. The report is essential for strategic decision-making and investment planning within this dynamic sector.

Oleochemicals Market Market Dynamics & Concentration

This section provides a comprehensive analysis of the competitive landscape of the oleochemicals market. We examine the degree of market concentration, identify key innovation drivers, assess the impact of regulatory influences and the threat of substitute products, understand evolving end-user trends, and track mergers and acquisitions (M&A) activity. Furthermore, we delve into market share distribution among leading players and analyze the frequency and strategic implications of M&A deals over the study period.

-

Market Concentration: The oleochemicals market exhibits a moderately concentrated structure, characterized by the significant market share held by several major global players. While precise market share data for individual companies is detailed in the full report, a thorough analysis of the competitive landscape reveals a dynamic interplay between established industry leaders and agile emerging entrants. Currently, the top 5 players collectively command approximately 55% of the market, with the remaining share distributed among a multitude of smaller, specialized participants. This dynamic ensures a competitive environment where innovation and strategic agility are paramount.

-

Innovation Drivers: A confluence of factors is propelling innovation in the oleochemicals sector. Key drivers include groundbreaking technological advancements in bio-based chemistry, a strong emphasis on sustainable sourcing of raw materials, and continuous process optimization for enhanced efficiency and reduced environmental impact. The development of novel oleochemical products meticulously tailored to meet the specific and evolving demands of various applications, from advanced polymers to high-performance lubricants, is creating substantial new opportunities for market expansion and differentiation.

-

Regulatory Frameworks: The global regulatory landscape plays a pivotal role in shaping the dynamics of the oleochemicals market. Stringent government regulations pertaining to sustainable sourcing practices, minimizing environmental impact, and ensuring product safety are significantly influencing production processes, product formulations, and overall market competitiveness. Compliance with these evolving regulations, including the adoption of eco-friendly standards and certifications, can present both opportunities for forward-thinking companies and challenges, particularly in terms of compliance costs and investment in new technologies, which often impact smaller players more significantly.

-

Product Substitutes: The oleochemicals market faces a competitive challenge from the availability of synthetic alternatives, particularly in certain niche and high-volume applications. These petrochemical-based substitutes often compete on price and established supply chains. This report provides a comprehensive analysis of the current and potential impact of these substitute materials, examining their market penetration, key differentiators, and the strategic responses of oleochemical manufacturers to maintain and grow their market share.

-

End-User Trends: A pronounced shift in consumer preferences towards sustainable, bio-based, and ethically sourced products is a significant tailwind for the oleochemicals market. This trend is demonstrably boosting demand across a wide spectrum of end-use segments, including personal care and cosmetics, food and beverages, pharmaceuticals, and various industrial applications such as detergents, lubricants, and biofuels. Of particular note is the increasing demand for oleochemical-derived ingredients in sustainable packaging solutions, driven by consumer awareness and corporate sustainability goals.

-

M&A Activities: The oleochemicals market has been a focal point for significant merger and acquisition (M&A) activity in recent years. Between 2019 and 2024, approximately 18 notable M&A deals were recorded. These strategic consolidations are primarily driven by the pursuit of enhanced market consolidation, the expansion of diverse product portfolios, the acquisition of innovative technologies, and the strategic securing of crucial raw material supply chains. Such activities are reshaping the competitive landscape and influencing market dynamics.

Oleochemicals Market Industry Trends & Analysis

This section delves into the pivotal factors propelling the growth of the oleochemicals market, highlights significant technological advancements, explores evolving consumer preferences, and dissects the intricate competitive dynamics within the sector. We offer a detailed analysis of historical and projected market growth rates, including Compound Annual Growth Rates (CAGR), market penetration rates of key product types, and the overall trajectory of the global oleochemicals market.

The oleochemicals market has demonstrated a consistent and robust growth trajectory throughout the historical period (2019-2024), primarily fueled by the escalating demand across a diverse range of end-use industries. This positive trend is projected to persist and accelerate into the forecast period (2025-2033), with an anticipated CAGR of approximately 5.2%. Several foundational factors underpin this sustained growth: the burgeoning demand for sustainable and bio-based alternatives to conventional petrochemical-based products, significant advancements in biotechnology and enzyme catalysis leading to more efficient and environmentally friendly production processes, and increasing supportive governmental policies and initiatives advocating for the adoption of bio-based materials. The competitive environment remains dynamic, with market players actively focusing on relentless innovation, cost optimization strategies, and forging strategic partnerships to fortify their market positions. Furthermore, evolving consumer preferences for natural, biodegradable, and environmentally benign products continue to be a major catalyst for market demand, evidenced by a notable increase in the market penetration of bio-based oleochemical derivatives within the personal care, food, and home care segments. The integration of circular economy principles into manufacturing processes is also gaining significant traction, focusing on waste reduction, resource efficiency, and enhanced product lifecycle sustainability.

Leading Markets & Segments in Oleochemicals Market

This section identifies the most prominent geographical regions, key countries, and influential market segments within the global oleochemicals market. We conduct an in-depth analysis of the factors driving regional and segmental growth, specifically highlighting the key market drivers and quantifying their contribution to overall market dominance and expansion.

-

Dominant Regions: The Asia-Pacific region is poised to maintain its leadership in the global oleochemicals market throughout the forecast period. This dominance is primarily attributed to rapid economic expansion, a burgeoning population driving increased consumption of consumer goods, and escalating demand for oleochemical-based products across various industries. For instance, China's vast manufacturing base and substantial domestic demand for surfactants and personal care ingredients, coupled with Southeast Asian countries' significant palm oil production and growing industrial sectors, solidify APAC's position. Europe and North America are also key regional markets, characterized by a strong focus on sustainability, high per capita consumption, and advanced R&D capabilities in bio-based chemicals. Europe's stringent environmental regulations and consumer preference for green products, alongside North America's innovative industrial applications and robust demand in the food and personal care sectors, contribute to their significant market share.

-

Dominant Segments: A detailed analysis and comparison of various oleochemical product segments, including fatty acids, fatty alcohols, glycerine, methyl esters, and amines, by both volume and value, highlights fatty acids and fatty alcohols as the dominant segments, collectively accounting for over 60% of the market share. The fastest-growing segments are observed in specialty esters and bio-based surfactants, driven by their increasing application in high-value industries like personal care and advanced materials. Fatty acids, derived from sources like palm oil and soybean oil, are extensively used in detergents, soaps, and lubricants. Fatty alcohols find widespread application in cosmetics, detergents, and plasticizers. Glycerine, a co-product of oleochemical production, is crucial in pharmaceuticals, food, and personal care. Further segmentation based on application, such as personal care, food & beverages, pharmaceuticals, industrial applications (detergents, lubricants, polymers), and biofuels, reveals that the personal care and food segments are experiencing robust growth due to the 'natural' and 'sustainable' product trends, while industrial applications remain significant in terms of volume.

Oleochemicals Market Product Developments

Recent product innovations in the oleochemicals market are characterized by a focus on sustainability, biodegradability, and enhanced functionality. The development of novel oleochemical derivatives with improved performance characteristics is attracting increased attention from diverse industries. This drive towards specialization caters to specific application needs, fostering competition and driving market growth. Technological advancements in enzymatic catalysis and green chemistry are also paving the way for the development of more efficient and environmentally benign production processes. This combination of improved performance and eco-friendliness is bolstering market adoption rates across multiple end-use sectors.

Key Drivers of Oleochemicals Market Growth

Several potent factors are actively fueling the growth and expansion of the oleochemicals market. These include:

- Growing Demand for Sustainable and Bio-Based Products: An increasing global consumer preference for eco-friendly, renewable, and biodegradable alternatives to petroleum-based products, coupled with mounting regulatory pressure on the use of unsustainable materials, is a primary catalyst for market expansion. Consumers and corporations are actively seeking greener solutions.

- Technological Advancements and Process Innovations: Continuous breakthroughs in bio-based chemistry, the utilization of enzymatic catalysis for milder and more selective reactions, and ongoing advancements in process optimization are significantly enhancing production efficiency, improving product quality, and reducing the environmental footprint of oleochemical manufacturing.

- Favorable Government Policies and Initiatives: Government initiatives worldwide are increasingly promoting bio-based industries through subsidies, tax incentives, and research grants. Policies supporting sustainable development, renewable energy, and circular economy principles further contribute to a more conducive environment for oleochemical market growth.

Challenges in the Oleochemicals Market Market

The oleochemicals market faces challenges, including:

- Fluctuating Raw Material Prices: Price volatility of palm oil and other feedstock influences production costs and market profitability.

- Stringent Regulatory Compliance: Meeting stringent environmental and safety standards necessitates significant investments and complex regulatory compliance procedures.

- Intense Competition: The market's competitive nature necessitates continuous innovation and cost optimization to maintain market share. This is particularly acute for smaller companies with less investment capacity.

Emerging Opportunities in Oleochemicals Market

Long-term growth catalysts include:

The emerging market for bio-based polymers and bioplastics presents a significant opportunity for oleochemical producers. The growing interest in circular economy models and the potential for using oleochemicals in various applications (e.g. biodegradable plastics) will fuel expansion. Strategic partnerships and collaborations between oleochemical producers and end-users will also accelerate growth by improving access to new markets and technologies. Geographical expansion into developing economies, where demand for sustainable products is rapidly growing, also presents a significant opportunity.

Leading Players in the Oleochemicals Market Sector

- Baerlocher GmbH

- Berg + Schmidt GmbH & Co KG

- Croda International Plc

- IOI Oleochemical

- Kao Corporation

- KLK OLEO

- KRATON CORPORATION

- Oleon NV

- PT Ecogreen Oleochemicals

- Vance Group Ltd

- VVF Limited

- List Not Exhaustive

Key Milestones in Oleochemicals Market Industry

- June 2023: Oleon NV made a significant investment of approximately USD 19.56 Million to inaugurate a new oleochemicals production plant that exclusively utilizes all-natural enzymes. This strategic move underscores the company's unwavering commitment to pioneering sustainable and innovative production methodologies within the industry.

- November 2022: Sinarmas Cepsa Pte. Ltd. formalized a Memorandum of Understanding (MoU) with Golden Agri-Resources. This pivotal agreement is geared towards expanding their joint bio-based chemicals production capabilities, signaling a strong ambition for global market expansion and an increased capacity to meet the growing worldwide demand for sustainable chemical solutions.

Strategic Outlook for Oleochemicals Market Market

The oleochemicals market is poised for significant growth, driven by the increasing demand for sustainable alternatives and technological advancements. Strategic opportunities include expanding into new applications, focusing on product differentiation, and leveraging collaborative partnerships to enhance market reach and innovation. Companies strategically investing in research and development, adopting sustainable practices, and expanding their global reach are well-positioned to capitalize on the market's long-term growth potential.

Oleochemicals Market Segmentation

-

1. Product Type

- 1.1. Fatty Acids

- 1.2. Fatty Alcohols

- 1.3. Methyl Esters

- 1.4. Glycerine

- 1.5. Other Product Types

-

2. End-user Industry

- 2.1. Cosmetics and Personal Care

- 2.2. Soap and Detergents

- 2.3. Pharmaceuticals

- 2.4. Food and Beverages

- 2.5. Polymers

- 2.6. Other End-user Industries

Oleochemicals Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Oleochemicals Market Regional Market Share

Geographic Coverage of Oleochemicals Market

Oleochemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Surfactants Industry in the Asia-Pacific Region; Growing Cosmetics Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Surfactants Industry in the Asia-Pacific Region; Growing Cosmetics Industry; Other Drivers

- 3.4. Market Trends

- 3.4.1. Soap and Detergents to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oleochemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fatty Acids

- 5.1.2. Fatty Alcohols

- 5.1.3. Methyl Esters

- 5.1.4. Glycerine

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Cosmetics and Personal Care

- 5.2.2. Soap and Detergents

- 5.2.3. Pharmaceuticals

- 5.2.4. Food and Beverages

- 5.2.5. Polymers

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Oleochemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fatty Acids

- 6.1.2. Fatty Alcohols

- 6.1.3. Methyl Esters

- 6.1.4. Glycerine

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Cosmetics and Personal Care

- 6.2.2. Soap and Detergents

- 6.2.3. Pharmaceuticals

- 6.2.4. Food and Beverages

- 6.2.5. Polymers

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Oleochemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fatty Acids

- 7.1.2. Fatty Alcohols

- 7.1.3. Methyl Esters

- 7.1.4. Glycerine

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Cosmetics and Personal Care

- 7.2.2. Soap and Detergents

- 7.2.3. Pharmaceuticals

- 7.2.4. Food and Beverages

- 7.2.5. Polymers

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Oleochemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fatty Acids

- 8.1.2. Fatty Alcohols

- 8.1.3. Methyl Esters

- 8.1.4. Glycerine

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Cosmetics and Personal Care

- 8.2.2. Soap and Detergents

- 8.2.3. Pharmaceuticals

- 8.2.4. Food and Beverages

- 8.2.5. Polymers

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Oleochemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Fatty Acids

- 9.1.2. Fatty Alcohols

- 9.1.3. Methyl Esters

- 9.1.4. Glycerine

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Cosmetics and Personal Care

- 9.2.2. Soap and Detergents

- 9.2.3. Pharmaceuticals

- 9.2.4. Food and Beverages

- 9.2.5. Polymers

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Oleochemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Fatty Acids

- 10.1.2. Fatty Alcohols

- 10.1.3. Methyl Esters

- 10.1.4. Glycerine

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Cosmetics and Personal Care

- 10.2.2. Soap and Detergents

- 10.2.3. Pharmaceuticals

- 10.2.4. Food and Beverages

- 10.2.5. Polymers

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Baerlocher GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Berg + Schmidt GmbH & Co KG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Croda International Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IOI Oleochemical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kao Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KLK OLEO

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KRATON CORPORATION

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oleon NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PT Ecogreen Oleochemicals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vance Group Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 VVF Limited*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Baerlocher GmbH

List of Figures

- Figure 1: Global Oleochemicals Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Oleochemicals Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Oleochemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Oleochemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Oleochemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Oleochemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Oleochemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Oleochemicals Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: North America Oleochemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Oleochemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Oleochemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Oleochemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Oleochemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Oleochemicals Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe Oleochemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Oleochemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Oleochemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Oleochemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Oleochemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Oleochemicals Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: South America Oleochemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Oleochemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: South America Oleochemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Oleochemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Oleochemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Oleochemicals Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Oleochemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Oleochemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Oleochemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Oleochemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Oleochemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oleochemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Oleochemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Oleochemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Oleochemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Oleochemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Oleochemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Oleochemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 13: Global Oleochemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Oleochemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Oleochemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 19: Global Oleochemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Oleochemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Oleochemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 27: Global Oleochemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Oleochemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Oleochemicals Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 33: Global Oleochemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Oleochemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Oleochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oleochemicals Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Oleochemicals Market?

Key companies in the market include Baerlocher GmbH, Berg + Schmidt GmbH & Co KG, Croda International Plc, IOI Oleochemical, Kao Corporation, KLK OLEO, KRATON CORPORATION, Oleon NV, PT Ecogreen Oleochemicals, Vance Group Ltd, VVF Limited*List Not Exhaustive.

3. What are the main segments of the Oleochemicals Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Surfactants Industry in the Asia-Pacific Region; Growing Cosmetics Industry; Other Drivers.

6. What are the notable trends driving market growth?

Soap and Detergents to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Surfactants Industry in the Asia-Pacific Region; Growing Cosmetics Industry; Other Drivers.

8. Can you provide examples of recent developments in the market?

In June 2023, Oleon NV opened an oleochemicals production plant that can operate purely based on proteins of all-natural origin (enzymes). A total of EUR 17.4 million (~USD 19.56 million) has been invested in the INCITE project, including EUR 13.3 million (~USD 14.95 million) in European subsidies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oleochemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oleochemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oleochemicals Market?

To stay informed about further developments, trends, and reports in the Oleochemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence