Key Insights

The North American contract packaging market is experiencing robust growth, driven by increasing demand for outsourced packaging solutions across various industries. The market's expansion is fueled by several key factors. Firstly, the rising prevalence of e-commerce and the associated need for efficient and cost-effective packaging solutions are significantly boosting demand. Secondly, the pharmaceutical and food sectors, with their stringent regulatory requirements and focus on maintaining product quality and safety, heavily rely on specialized contract packaging services. This trend is further amplified by the growth of personalized and customized products, requiring flexible and adaptable packaging solutions that are best provided through contract packaging. Finally, the increasing focus on sustainability and eco-friendly packaging materials is creating new opportunities for contract packaging companies that can offer innovative and sustainable packaging options.

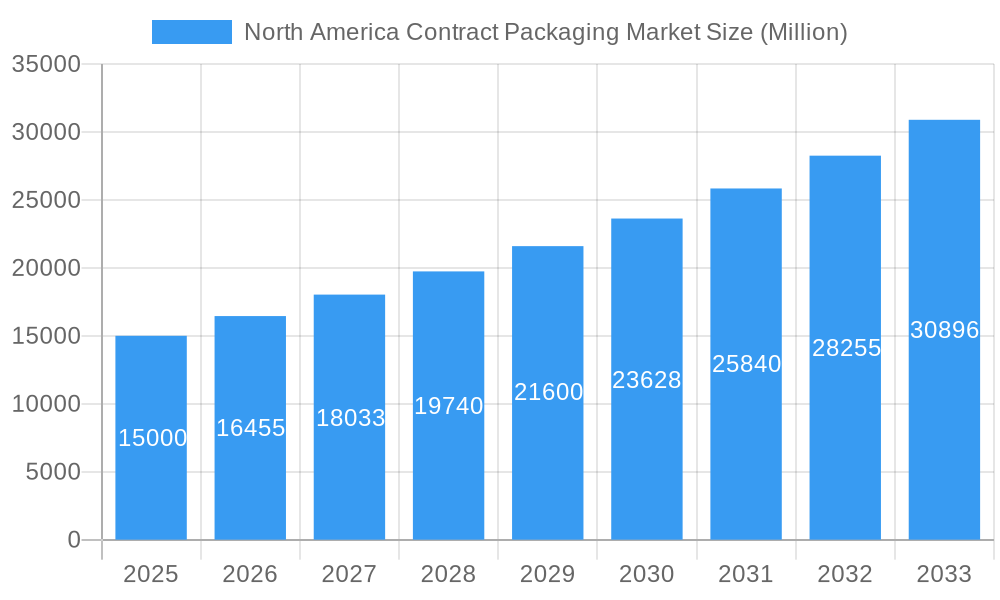

North America Contract Packaging Market Market Size (In Billion)

While the overall market shows strong potential, certain challenges exist. Increased competition among contract packaging providers necessitates continuous innovation and adaptation to maintain a competitive edge. Fluctuations in raw material costs and labor expenses can impact profitability. Moreover, maintaining consistent quality and regulatory compliance across diverse industries and product types requires significant investment in technology and skilled personnel. Despite these challenges, the market's positive trajectory, driven by the underlying growth in e-commerce and the increasing complexities of packaging requirements across key sectors like pharmaceuticals and food, is expected to continue for the forecast period. Considering a base year market size of approximately $XX million (the provided value is missing, but based on the provided CAGR and the existence of numerous listed companies, a reasonable estimate would be in the billions), a 9.70% CAGR suggests a considerable market expansion over the next decade. The market segmentation by packaging type (primary, secondary, tertiary) and end-user vertical (beverages, pharmaceuticals, food, others) provides further insight into the diverse opportunities within this dynamic landscape.

North America Contract Packaging Market Company Market Share

North America Contract Packaging Market Report: 2019-2033

Uncover lucrative opportunities and navigate challenges in the dynamic North American contract packaging market with this comprehensive report. This in-depth analysis provides a granular view of market dynamics, trends, leading players, and future prospects from 2019-2033, encompassing historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). The report is essential for industry stakeholders, investors, and strategic decision-makers seeking to capitalize on the growth trajectory of this multi-billion-dollar market.

North America Contract Packaging Market Market Dynamics & Concentration

The North American contract packaging market, valued at xx Million in 2025, is characterized by a moderately consolidated landscape with several large players and numerous smaller niche operators. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory compliance requirements. Innovation in packaging materials (sustainable and eco-friendly options), automation technologies (robotics and AI), and supply chain optimization are key drivers. Stringent regulatory frameworks, particularly within the pharmaceutical and food sectors, significantly impact market dynamics. Product substitutes, such as in-house packaging solutions, exert competitive pressure. Growing consumer preferences for convenient and sustainable packaging are shaping market trends. M&A activity within the sector contributes to market consolidation, with xx M&A deals recorded between 2019 and 2024, resulting in an average annual market share shift of approximately xx%.

- Market Share: The top 5 players hold approximately xx% of the market share.

- M&A Activity: The frequency of mergers and acquisitions reflects strategic consolidation efforts and expansion strategies.

- Innovation Drivers: Sustainability, automation, and enhanced traceability are key drivers shaping innovation within the sector.

- Regulatory Framework: Stringent regulations in sectors like pharmaceuticals and food products influence packaging choices and manufacturing processes.

- End-User Trends: The increasing demand for customized and sustainable packaging solutions drives market growth.

North America Contract Packaging Market Industry Trends & Analysis

The North American contract packaging market exhibits a robust CAGR of xx% during the forecast period (2025-2033), driven by the burgeoning e-commerce sector, rising demand for convenient packaging across various industries, and increasing outsourcing of packaging operations by companies to focus on core competencies. Technological disruptions, particularly the integration of automation and AI, are reshaping operational efficiency and cost structures. Consumer preferences are shifting towards sustainable and eco-friendly packaging options, prompting companies to adopt innovative materials and processes. Competitive dynamics are intense, with companies focusing on differentiation strategies such as specialized services, advanced technologies, and strong supply chain management to maintain market share. Market penetration for sustainable packaging is increasing at a rate of xx% annually.

Leading Markets & Segments in North America Contract Packaging Market

The pharmaceutical segment dominates the North American contract packaging market, driven by stringent regulatory compliance, specialized handling requirements, and the need for robust supply chain management. Within packaging types, secondary packaging holds the largest market share, followed by primary and tertiary packaging. The US remains the leading market, attributed to a robust manufacturing base, advanced infrastructure, and high consumer spending.

- Pharmaceutical Segment Drivers: Stringent regulations, specialized handling needs, and complex supply chain demands.

- Secondary Packaging Dominance: High demand for secondary packaging for product protection, branding, and distribution efficiency.

- US Market Leadership: Established manufacturing base, advanced infrastructure, and substantial consumer spending.

- Regional Variations: Growth rates vary across regions due to differences in economic development and consumer preferences.

North America Contract Packaging Market Product Developments

Recent product innovations center around sustainable materials (bioplastics, recycled content), advanced automation technologies (robotics, AI-powered systems), and improved traceability solutions (RFID, blockchain). These advancements enhance efficiency, reduce costs, and improve product safety and sustainability. The market is witnessing a shift towards specialized packaging solutions tailored to specific industry requirements and consumer preferences. These innovative offerings provide companies with significant competitive advantages.

Key Drivers of North America Contract Packaging Market Growth

Key growth drivers include the burgeoning e-commerce sector's demand for efficient packaging, the increasing adoption of automation and AI in packaging operations, and the growing focus on sustainable packaging solutions. Government regulations promoting sustainability also encourage investment in eco-friendly packaging materials. Rising consumer demand for convenient and attractive packaging across various industries, such as food and beverages, further contributes to market growth.

Challenges in the North America Contract Packaging Market Market

Major challenges include fluctuations in raw material prices, supply chain disruptions, and intense competition. Stringent regulatory compliance requirements across industries pose significant operational hurdles and increase compliance costs. Maintaining quality control across diverse packaging solutions and managing a skilled workforce remain operational concerns. These challenges can impact profit margins and slow down growth by approximately xx% annually.

Emerging Opportunities in North America Contract Packaging Market

Emerging opportunities arise from the growing demand for personalized and customized packaging, the expansion of e-commerce in rural areas, and the increasing adoption of advanced technologies like blockchain for improved traceability. Strategic partnerships and mergers and acquisitions will consolidate the industry and allow for greater efficiency and access to new markets. The development of sustainable and innovative packaging materials represents a significant growth catalyst.

Leading Players in the North America Contract Packaging Market Sector

- AmeriPac

- Genco (FedEx Supply Chain)

- Jones Healthcare Group

- UNICEP Packaging LLC

- Aaron Thomas Company

- Complete Co-Packing Services Ltd

- Pharma Tech Industries Inc

- Co-Pak Packaging Group

- Reed Lane Inc

- WG-Pro Manufacturing Inc

- Multipack Solutions LLC

- Anderson Packaging LLC

- Stamar Packaging Inc

- Green Packaging Asia

- MJS Packaging

- Sharp Corporation (UDG)

Key Milestones in North America Contract Packaging Market Industry

- May 2021: Sharp Corporation (UDG) invested USD 17 Million in its Conshohocken, PA facility, expanding its pharmaceutical packaging capacity.

- December 2020: Complete Co-Packing Services Limited partnered with Brewdog to package its craft beer advent calendars and gins, showcasing the demand for contract packaging in the beverage sector.

Strategic Outlook for North America Contract Packaging Market Market

The North American contract packaging market presents substantial growth opportunities over the forecast period. Strategic investments in automation, sustainable materials, and specialized services will drive market expansion. Companies that successfully navigate regulatory compliance and adapt to evolving consumer preferences will gain a competitive edge. Focus on supply chain resilience and strategic partnerships will be critical for long-term success.

North America Contract Packaging Market Segmentation

-

1. Packaging

- 1.1. Primary Packaging

- 1.2. Secondary Packaging

- 1.3. Tertiary Packaging

-

2. End-User Vertical

- 2.1. Beverages

- 2.2. Pharmaceuticals

- 2.3. Food

North America Contract Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Contract Packaging Market Regional Market Share

Geographic Coverage of North America Contract Packaging Market

North America Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Steady rise in demand from the food industry; Recent trend of outsourcing non-core operations; Ongoing efforts towards serialization in the pharmaceutical sector

- 3.3. Market Restrains

- 3.3.1. In-house Packaging; Increasing Lead Time and Logistics Cost

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is one of the Significant Factor for Growth of Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging

- 5.1.1. Primary Packaging

- 5.1.2. Secondary Packaging

- 5.1.3. Tertiary Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.2.1. Beverages

- 5.2.2. Pharmaceuticals

- 5.2.3. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Packaging

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AmeriPac

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Genco (FedEx Supply Chain)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jones Healthcare Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UNICEP Packaging LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aaron Thomas Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Complete Co-Packing Services Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pharma Tech Industries Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Co-Pak Packaging Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Reed Lane Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WG-Pro Manufacturing Inc*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Multipack Solutions LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Anderson Packaging LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Stamar Packaging Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Green Packaging Asia

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 MJS Packaging

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Sharp Corporation (UDG)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 AmeriPac

List of Figures

- Figure 1: North America Contract Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 2: North America Contract Packaging Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 3: North America Contract Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 5: North America Contract Packaging Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 6: North America Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Contract Packaging Market?

The projected CAGR is approximately 9.70%.

2. Which companies are prominent players in the North America Contract Packaging Market?

Key companies in the market include AmeriPac, Genco (FedEx Supply Chain), Jones Healthcare Group, UNICEP Packaging LLC, Aaron Thomas Company, Complete Co-Packing Services Ltd, Pharma Tech Industries Inc, Co-Pak Packaging Group, Reed Lane Inc, WG-Pro Manufacturing Inc*List Not Exhaustive, Multipack Solutions LLC, Anderson Packaging LLC, Stamar Packaging Inc, Green Packaging Asia, MJS Packaging, Sharp Corporation (UDG).

3. What are the main segments of the North America Contract Packaging Market?

The market segments include Packaging, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Steady rise in demand from the food industry; Recent trend of outsourcing non-core operations; Ongoing efforts towards serialization in the pharmaceutical sector.

6. What are the notable trends driving market growth?

Food and Beverage Industry is one of the Significant Factor for Growth of Market.

7. Are there any restraints impacting market growth?

In-house Packaging; Increasing Lead Time and Logistics Cost.

8. Can you provide examples of recent developments in the market?

May 2021 - Sharp, a subsidiary of UDG Healthcare plc, a global leader in contract packaging and clinical supply services, has invested USD17 million in its Conshohocken, PA location. The new 4-acre plot is directly adjacent to Sharp's two enduring commercial pharmaceutical packaging buildings, which collectively form the organization's Blistering Centre of Excellence and is the most developed addition to an ongoing capacity development project at the Conshohocken campus.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Contract Packaging Market?

To stay informed about further developments, trends, and reports in the North America Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence