Key Insights

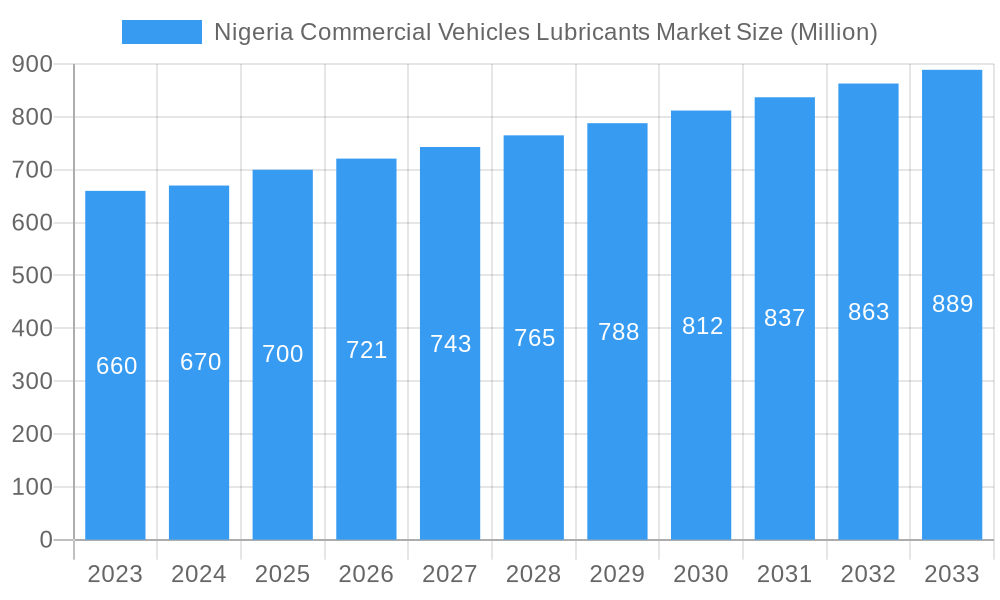

The Nigerian Commercial Vehicles Lubricants Market is projected for significant expansion, anticipating a market size of $574.93 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.89% from 2025 to 2033. Growth is fueled by rising demand for heavy-duty commercial vehicles supporting Nigeria's expanding logistics and transportation industries. Key drivers include e-commerce growth, infrastructure development, and increasing consumer spending. The market is segmented by product type, including Engine Oils, Greases, Hydraulic Fluids, and Transmission & Gear Oils, essential for commercial vehicle performance. Demand for high-performance synthetic lubricants is increasing as operators seek to reduce maintenance costs and improve fuel efficiency.

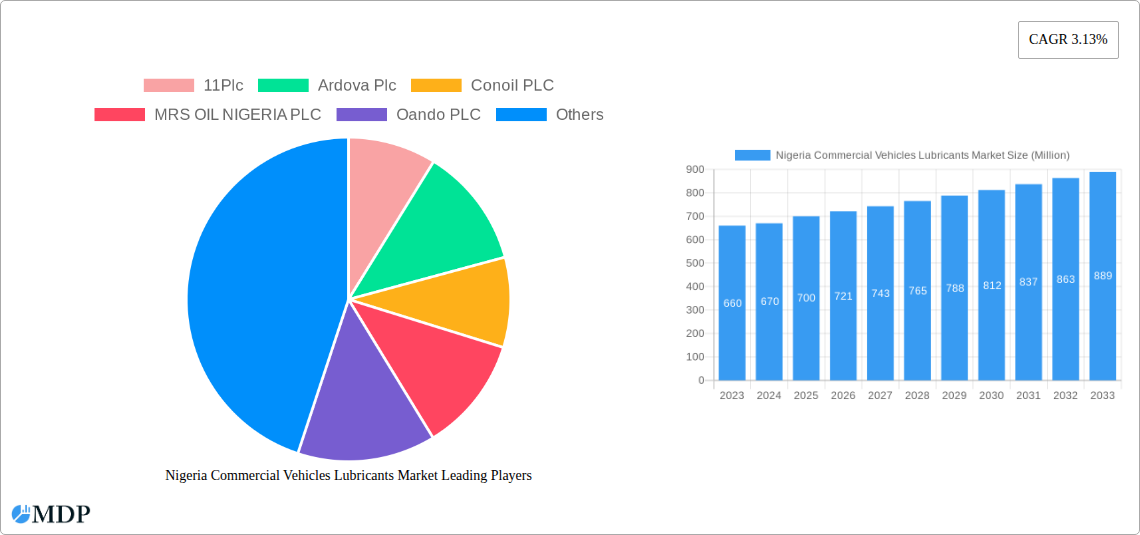

Nigeria Commercial Vehicles Lubricants Market Market Size (In Million)

Market restraints include crude oil price volatility affecting manufacturing costs and a significant unorganized sector offering lower-priced alternatives. However, increasing environmental regulations are expected to drive demand for quality, branded lubricants. Key market players like Royal Dutch Shell Plc, TotalEnergies, Oando PLC, Conoil PLC, Ardova Plc, MRS OIL NIGERIA PLC, and 11Plc are actively competing through product diversification and extensive distribution networks. Economic diversification and trade liberalization policies further support sustained demand for commercial vehicle lubricants.

Nigeria Commercial Vehicles Lubricants Market Company Market Share

This report offers an in-depth analysis of the Nigeria Commercial Vehicles Lubricants Market, providing critical insights for stakeholders. We analyze market trends, growth drivers, and future forecasts for the period 2025–2033, with a base year of 2025. The report covers market concentration, innovation, regulatory landscapes, and industry developments, including M&A activities and partnerships involving major players. This is an essential guide to the Nigerian automotive lubricants sector, commercial transport lubrication solutions, and vehicle maintenance products in Nigeria.

Nigeria Commercial Vehicles Lubricants Market Market Dynamics & Concentration

The Nigeria Commercial Vehicles Lubricants Market is characterized by a moderate to high concentration, with a few key players dominating market share. Innovation drivers are primarily focused on enhanced fuel efficiency, extended drain intervals, and improved engine protection for the demanding Nigerian operating conditions. Regulatory frameworks, managed by bodies such as the Standards Organisation of Nigeria (SON), are crucial in ensuring product quality and safety, influencing market entry and product development. Product substitutes, while present in the form of lower-grade or imported lubricants, are increasingly being differentiated by quality, brand reputation, and performance guarantees offered by established companies. End-user trends reflect a growing demand for premium lubricants driven by fleet modernization, increasing awareness of total cost of ownership, and the need to minimize downtime. Mergers and acquisitions (M&A) activities are significant indicators of market consolidation and strategic expansion. For instance, Ardova PLC's acquisition of Enyo Retail & Supply Limited in 2021, adding 95 retail stations to its existing network, is a prime example of expanding market reach. This move, alongside Ardova's lubricant deal with Shell in November 2020, signifies a strategic shift towards integrated supply chains and broader product distribution. The market is seeing a steady increase in deal counts related to distribution networks and retail expansion, further solidifying the positions of leading entities.

Nigeria Commercial Vehicles Lubricants Market Industry Trends & Analysis

The Nigeria Commercial Vehicles Lubricants Market is poised for robust growth, driven by several interconnected factors. The expansion of the transportation and logistics sector, fueled by an increasing population and growing e-commerce activities, directly translates into higher demand for commercial vehicles, and consequently, for their essential lubrication needs. Economic policies aimed at boosting industrialization and infrastructure development further contribute to the growth of commercial fleet operations. Technological advancements in engine design, demanding more sophisticated and high-performance lubricants, are also a significant trend. These advancements necessitate the development of lubricants that offer superior wear protection, thermal stability, and fuel economy. Consumer preferences are shifting towards brands that offer reliability, extended service intervals, and technical support, moving beyond basic price considerations. The competitive landscape is intense, with both multinational corporations and local players vying for market share. Leading companies are investing in research and development to introduce next-generation lubricants that meet evolving emission standards and performance requirements. The market penetration of synthetic and semi-synthetic lubricants is steadily increasing, reflecting a demand for higher quality products that can optimize fleet performance and reduce maintenance costs. The market CAGR is projected to be significant, reflecting a healthy expansion trajectory over the forecast period.

Leading Markets & Segments in Nigeria Commercial Vehicles Lubricants Market

Within the Nigeria Commercial Vehicles Lubricants Market, Engine Oils represent the dominant segment, accounting for the largest share of market revenue and volume. This is directly attributable to the sheer number of commercial vehicles operating across the nation, each requiring regular engine oil changes for optimal performance and longevity. The economic policies of the Nigerian government, particularly those focused on enhancing domestic manufacturing and trade, indirectly boost the demand for heavy-duty trucks and other commercial vehicles, thus perpetuating the dominance of engine oils. Infrastructure development projects, such as road network expansions and port upgrades, also necessitate increased movement of goods, leading to higher utilization of commercial fleets and a commensurate rise in engine oil consumption.

- Engine Oils: This segment benefits from the continuous operation of trucks, buses, and other commercial vehicles. Factors such as the increasing average age of the fleet and the need for robust engine protection against wear and tear in challenging road conditions contribute to sustained demand. The shift towards more fuel-efficient and emission-compliant engines also drives innovation and demand for specialized engine oils.

- Transmission & Gear Oils: With the increasing complexity of commercial vehicle transmissions and differentials, the demand for specialized transmission and gear oils is steadily growing. These fluids are critical for ensuring smooth gear changes, reducing friction, and protecting vital components from extreme pressure.

- Hydraulic Fluids: The expansion of construction and material handling equipment, often categorized under commercial vehicles for operational purposes, fuels the demand for hydraulic fluids. These are essential for the operation of hydraulic systems in dump trucks, cranes, and other specialized machinery.

- Greases: While a smaller segment, greases are indispensable for lubricating chassis components, bearings, and other moving parts in commercial vehicles, requiring regular replenishment to ensure operational efficiency and prevent premature wear.

Nigeria Commercial Vehicles Lubricants Market Product Developments

Product development in the Nigeria Commercial Vehicles Lubricants Market is increasingly focused on creating high-performance, long-lasting lubricants tailored for the unique operating conditions in Nigeria. Innovations include the formulation of synthetic and semi-synthetic engine oils offering superior thermal stability, exceptional wear protection, and extended drain intervals, thereby reducing operational costs for fleet owners. Advanced transmission & gear oils are being developed to enhance fuel efficiency and provide robust protection against extreme pressure and shock loads encountered in heavy-duty applications. Hydraulic fluids are seeing advancements in terms of improved viscosity stability across a wide temperature range and enhanced anti-wear properties. The competitive advantage of these new products lies in their ability to meet stringent OEM specifications and deliver measurable improvements in vehicle performance and maintenance schedules.

Key Drivers of Nigeria Commercial Vehicles Lubricants Market Growth

The Nigeria Commercial Vehicles Lubricants Market is propelled by several key drivers. The ongoing expansion of the country's logistics and transportation infrastructure, including road networks and ports, directly stimulates the demand for commercial vehicles and their associated lubricant needs. Economic diversification efforts aimed at boosting industrial output and agricultural productivity further contribute to the increased movement of goods, necessitating a larger fleet of commercial vehicles. Technological advancements in commercial vehicle manufacturing, leading to more sophisticated engines and transmissions, require specialized, high-performance lubricants. Furthermore, growing awareness among fleet operators regarding the benefits of using premium lubricants, such as extended engine life, improved fuel efficiency, and reduced maintenance downtime, is a significant growth catalyst.

Challenges in the Nigeria Commercial Vehicles Lubricants Market Market

Despite the promising growth trajectory, the Nigeria Commercial Vehicles Lubricants Market faces several challenges. The prevalence of substandard and counterfeit lubricants poses a significant threat to brand reputation and can lead to premature vehicle damage, impacting end-user trust. Fluctuations in global crude oil prices can lead to price volatility of base oils, impacting the overall cost of lubricants and potentially affecting profit margins for manufacturers and distributors. The existing infrastructure for collecting and recycling used lubricants is still developing, posing environmental concerns and limiting sustainable practices. Additionally, intense competition from both established international brands and local manufacturers, coupled with price sensitivity among some segments of fleet operators, creates constant pressure on pricing and market share. Supply chain disruptions, often exacerbated by import-related complexities, can also impact product availability and lead times.

Emerging Opportunities in Nigeria Commercial Vehicles Lubricants Market

Emerging opportunities in the Nigeria Commercial Vehicles Lubricants Market are largely driven by technological breakthroughs and strategic market expansion. The increasing adoption of advanced engine technologies in commercial vehicles, such as those requiring specialized synthetic lubricants and those designed for emission control, presents a significant avenue for growth. The continuous development and upgrading of Nigeria's road and logistics infrastructure will lead to an increased number of commercial vehicles on the road, thereby expanding the addressable market for lubricants. Strategic partnerships between lubricant manufacturers, vehicle OEMs, and fleet management companies can unlock new distribution channels and create value-added service offerings. Furthermore, the growing demand for environmentally friendly and fuel-efficient lubricants provides an opportunity for companies to innovate and cater to a niche but growing segment of the market.

Leading Players in the Nigeria Commercial Vehicles Lubricants Market Sector

- 11Plc

- Ardova Plc

- Conoil PLC

- MRS OIL NIGERIA PLC

- Oando PLC

- Royal Dutch Shell Plc

- TotalEnergie

Key Milestones in Nigeria Commercial Vehicles Lubricants Market Industry

- November 2021: Ardova PLC acquired Enyo Retail & Supply Limited. This significant acquisition integrated Enyo's 95 retail stations with Ardova's existing 450 stations, expanding its nationwide footprint to 545 stations and strengthening its distribution network for lubricants and other petroleum products.

- March 2021: Hyundai Motor Company and Royal Dutch Shell PLC announced a five-year global business cooperation agreement. This partnership, with a renewed focus on clean energy and carbon reduction, aims to support Hyundai's transformation into a Smart Mobility Solution Provider, potentially influencing future lubricant specifications and collaborations for commercial vehicles.

- November 2020: Ardova PLC signed a strategic lubricants deal with Shell in Nigeria. Under this agreement, Ardova PLC (AP) became the official distributor of Shell lubricants in the country, significantly expanding Shell's market reach through Ardova's established network and enhancing its product availability across Nigeria.

Strategic Outlook for Nigeria Commercial Vehicles Lubricants Market Market

The strategic outlook for the Nigeria Commercial Vehicles Lubricants Market is one of sustained growth and evolving product demand. Future market potential is amplified by the continuous growth in trade, e-commerce, and infrastructure development, all of which necessitate a robust commercial transportation sector. Companies are advised to focus on innovation in high-performance lubricants that offer extended drain intervals and improved fuel efficiency, catering to the increasing cost-consciousness and operational efficiency demands of fleet operators. Strategic partnerships with vehicle manufacturers (OEMs) and a stronger emphasis on after-sales service and technical support will be crucial for building brand loyalty and securing long-term market share. Embracing digital channels for sales and customer engagement will also be a key growth accelerator, allowing for more targeted marketing and efficient distribution of commercial vehicle lubrication solutions.

Nigeria Commercial Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Nigeria Commercial Vehicles Lubricants Market Segmentation By Geography

- 1. Niger

Nigeria Commercial Vehicles Lubricants Market Regional Market Share

Geographic Coverage of Nigeria Commercial Vehicles Lubricants Market

Nigeria Commercial Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Commercial Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 11Plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ardova Plc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Conoil PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MRS OIL NIGERIA PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oando PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TotalEnergie

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 11Plc

List of Figures

- Figure 1: Nigeria Commercial Vehicles Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Nigeria Commercial Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Commercial Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Nigeria Commercial Vehicles Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Nigeria Commercial Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 4: Nigeria Commercial Vehicles Lubricants Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Commercial Vehicles Lubricants Market?

The projected CAGR is approximately 3.89%.

2. Which companies are prominent players in the Nigeria Commercial Vehicles Lubricants Market?

Key companies in the market include 11Plc, Ardova Plc, Conoil PLC, MRS OIL NIGERIA PLC, Oando PLC, Royal Dutch Shell Plc, TotalEnergie.

3. What are the main segments of the Nigeria Commercial Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 574.93 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Product Type : Engine Oils.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2021: Ardova PLC acquired Enyo Retail & Supply Limited in 2021. This acquisition adds Enyo's 95 retail stations to Ardova's existing 450 stations, growing its portfolio to 545 stations nationwide.March 2021: Hyundai Motor Company and Royal Dutch Shell PLC announced a five-year global business cooperation agreement, with a new focus on clean energy and carbon reduction, to help Hyundai continue its transformation as a Smart Mobility Solution Provider.November 2020: Ardova signed a lubricants deal with Shell in Nigeria, and Ardova PLC (AP) will be the distributor of Shell lubricants in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Commercial Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Commercial Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Commercial Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the Nigeria Commercial Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence