Key Insights

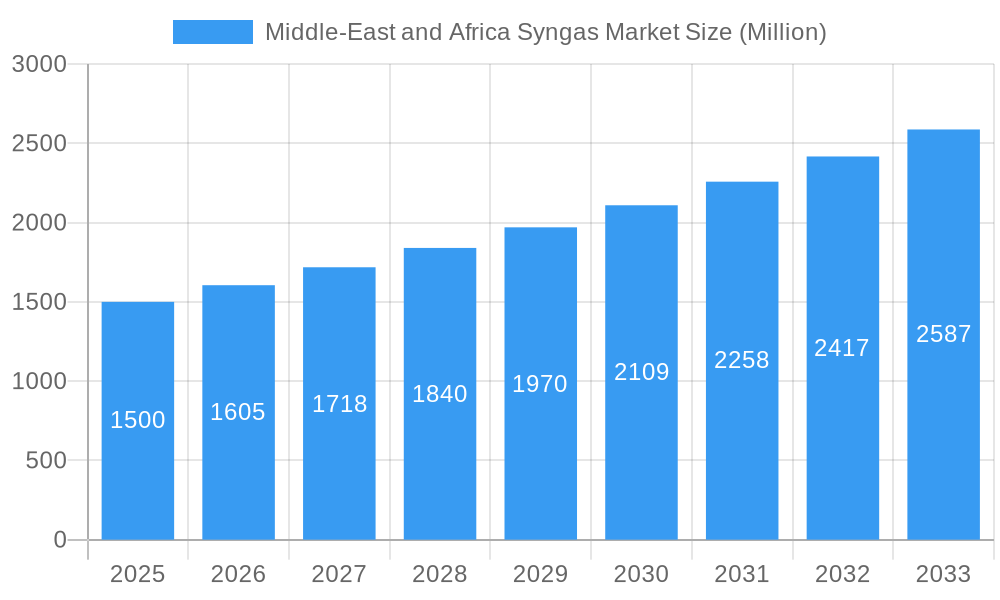

The Middle East and Africa syngas market is poised for substantial growth, driven by escalating energy demands and the region's rich natural resources, including coal, natural gas, and biomass. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 8%, reaching an estimated market size of $258.1 billion by 2025. Key growth catalysts include the increasing need for power generation fuels in rapidly developing economies, the chemical industry's growing reliance on syngas as a primary feedstock, and the diversification of energy sources through biomass gasification initiatives. Challenges such as high initial capital investments and potential environmental concerns are being addressed by advancements in gasification technologies like auto-thermal and combined reforming. The market is segmented by gasifier type (fixed bed, entrained flow, fluidized bed) and application, with power generation, chemical production, and dimethyl ether (DME) synthesis being prominent segments. Leading players, including TechnipFMC, General Electric, and Air Products, are strategically positioned to leverage this expansion. Regions with substantial coal, natural gas, and biomass reserves, such as South Africa and rapidly developing East African economies, are expected to be significant market contributors.

Middle-East and Africa Syngas Market Market Size (In Billion)

The competitive environment features a mix of multinational corporations and specialized engineering firms focused on developing innovative and efficient gasification solutions for diverse feedstock and application needs. Market consolidation and expansion are anticipated through increased mergers and acquisitions. The adoption of advanced technologies, supported by favorable government policies promoting energy security and industrial development, will shape the future of the Middle East and Africa syngas market, particularly in resource-rich countries and with a growing emphasis on cleaner energy solutions.

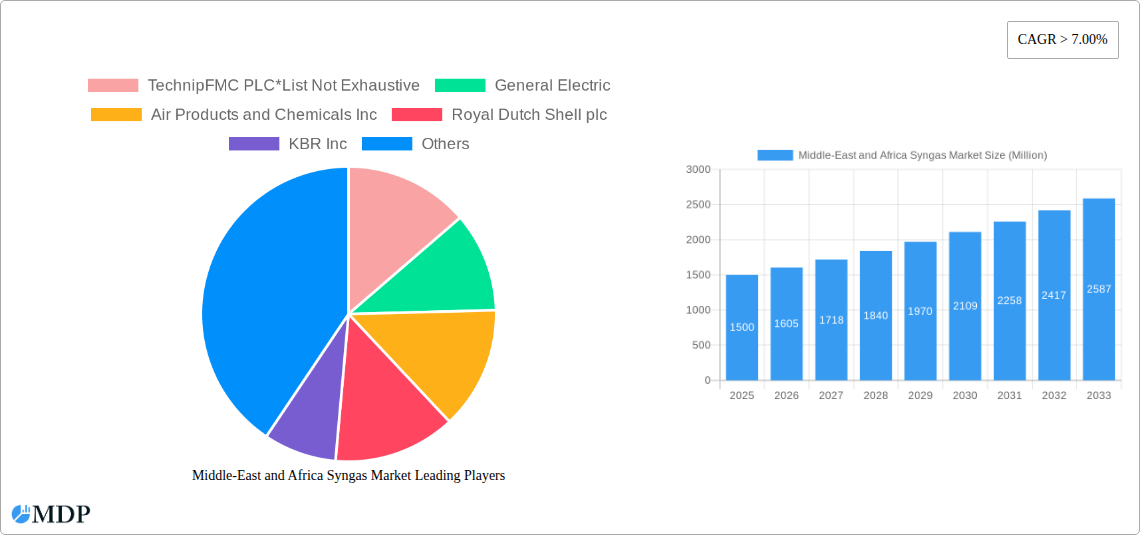

Middle-East and Africa Syngas Market Company Market Share

Unlock Growth Opportunities in the Thriving Middle East & Africa Syngas Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa Syngas market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and future prospects. The analysis incorporates key segments including Gasifier Type (Fixed Bed, Entrained Flow, Fluidized Bed), Application (Power Generation, Chemicals, Dimethyl Ether, Liquid Fuels, Gaseous Fuels), Feedstock (Coal, Natural Gas, Petroleum, Petcoke, Biomass), and Technology (Steam Reforming, Partial Oxidation, Auto-thermal Reforming, Combined/Two-step Reforming, Biomass Gasification). Leading players like TechnipFMC PLC, General Electric, Air Products and Chemicals Inc, Royal Dutch Shell plc, KBR Inc, BASF SE, Linde plc, Air Liquide, BP plc, and SABIC are profiled, providing a granular view of the competitive landscape. The report's data-driven insights will help you navigate the complexities of this rapidly evolving market and capitalize on emerging opportunities.

Middle-East and Africa Syngas Market Market Dynamics & Concentration

The Middle East and Africa syngas market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the market is witnessing increased competition from smaller, specialized companies. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory frameworks. The market share of the top 5 players is estimated at approximately 60% in 2025, with TechnipFMC PLC and General Electric holding the largest shares. Innovation is a key driver, with companies continuously investing in R&D to improve efficiency, reduce costs, and develop new applications for syngas. Stringent environmental regulations are pushing the adoption of cleaner syngas production technologies, while the availability of suitable feedstock and robust infrastructure plays a crucial role in market growth. M&A activity has been moderate, with approximately xx deals recorded between 2019 and 2024. These deals primarily involved acquisitions of smaller companies by larger players to expand their market reach and technological capabilities. The emergence of alternative technologies and fuels poses a threat, but the increasing demand for cleaner energy sources is expected to drive market growth.

Middle-East and Africa Syngas Market Industry Trends & Analysis

The Middle East and Africa syngas market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This robust growth is primarily driven by the increasing demand for power generation and chemical production, coupled with supportive government initiatives promoting clean energy sources. Technological advancements, particularly in carbon capture and utilization, are enhancing the efficiency and sustainability of syngas production. Market penetration of syngas in power generation is expected to reach xx% by 2033, driven by the need for diversification away from fossil fuels. Consumer preferences are shifting towards cleaner and more sustainable energy sources, creating further demand for syngas. Competitive dynamics are characterized by strategic partnerships, R&D investments, and the development of innovative technologies. However, challenges remain, including volatile feedstock prices and the need for significant infrastructure investments.

Leading Markets & Segments in Middle-East and Africa Syngas Market

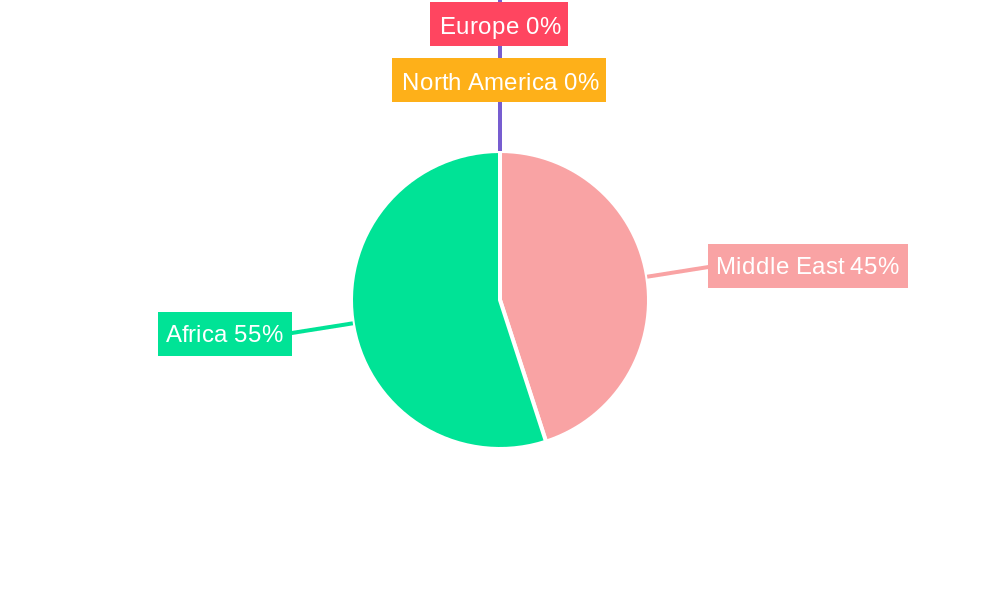

The Middle East region is expected to dominate the syngas market in the Middle East and Africa, driven by substantial natural gas reserves and increasing investments in power generation and petrochemical industries. Within the Middle East, Saudi Arabia and the UAE are anticipated to be leading countries.

- Key Drivers for the Middle East: Abundant natural gas reserves, government support for energy diversification, and significant investments in infrastructure development.

- Key Drivers for Africa: Growing industrialization, increasing demand for power generation, and the potential for biomass gasification.

Segment Analysis:

- Gasifier Type: Entrained flow gasifiers are projected to hold the largest market share due to their higher efficiency and suitability for various feedstocks.

- Application: Power generation is the dominant application segment, followed by the chemicals sector. The Dimethyl Ether (DME) market is expected to grow significantly driven by its potential as a cleaner fuel.

- Feedstock: Natural gas is the primary feedstock, owing to its widespread availability and cost-effectiveness. However, the use of biomass is expected to increase in the long term due to growing environmental concerns.

- Technology: Steam reforming is the most prevalent technology currently, but auto-thermal reforming and biomass gasification are gaining traction due to their improved efficiency and environmental benefits.

The dominance of specific segments stems from factors such as existing infrastructure, regulatory support, and technological maturity. However, evolving trends towards cleaner technologies and diverse feedstock utilization are expected to reshape segmental market shares over time.

Middle-East and Africa Syngas Market Product Developments

Recent product innovations focus on improving gasifier efficiency, enhancing carbon capture and utilization technologies, and developing new syngas applications. Advancements in gasification technologies, such as the integration of advanced catalysts and process optimization techniques, are leading to significant cost reductions and improved performance. This, coupled with the development of new downstream applications, is driving market expansion. The increasing focus on sustainable and environmentally friendly production processes is further enhancing the competitiveness of syngas in various applications.

Key Drivers of Middle-East and Africa Syngas Market Growth

Several factors contribute to the growth of the Middle East and Africa syngas market. These include:

- Abundant Natural Gas Reserves: The region possesses substantial natural gas reserves, providing a cost-effective feedstock for syngas production.

- Government Initiatives: Governments in several countries are actively promoting syngas as a cleaner energy source, offering incentives and subsidies to encourage its adoption.

- Growing Demand for Power: The increasing demand for electricity across the region is driving the need for efficient and cost-effective power generation solutions, which syngas can effectively provide.

- Technological Advancements: Continuous improvement in syngas production technologies is enhancing efficiency, reducing costs, and increasing overall market appeal.

Challenges in the Middle-East and Africa Syngas Market Market

Despite the positive outlook, the market faces several challenges:

- High Capital Costs: Establishing syngas production facilities requires significant capital investment, posing a barrier to entry for smaller players.

- Feedstock Price Volatility: Fluctuations in natural gas prices can significantly impact syngas production costs and profitability.

- Environmental Regulations: Stricter environmental regulations related to greenhouse gas emissions might increase production costs.

- Infrastructure Limitations: In some regions, limited infrastructure for syngas transportation and distribution can hinder market expansion.

Emerging Opportunities in Middle-East and Africa Syngas Market

The long-term growth of the Middle East and Africa syngas market is expected to be fueled by several factors. Technological breakthroughs in carbon capture and utilization will further enhance syngas's environmental profile, attracting more investments. Strategic partnerships between syngas producers, power generation companies, and chemical manufacturers will unlock new market opportunities, and expanding the application of syngas into new sectors, such as transportation fuels, will drive significant growth.

Leading Players in the Middle-East and Africa Syngas Market Sector

- TechnipFMC PLC

- General Electric

- Air Products and Chemicals Inc

- Royal Dutch Shell plc

- KBR Inc

- BASF SE

- Linde plc

- Air Liquide

- BP plc

- SABIC

Key Milestones in Middle-East and Africa Syngas Market Industry

- 2020: Government of Saudi Arabia announces a significant investment in syngas-based power generation projects.

- 2021: TechnipFMC PLC and General Electric form a strategic partnership to develop advanced syngas technologies.

- 2022: Air Products and Chemicals Inc acquires a smaller syngas producer in the UAE, expanding its market presence.

- 2023: Several companies announce investments in R&D for carbon capture and utilization technologies for syngas production.

- 2024: Several African countries announce government initiatives to promote syngas as a cleaner energy source.

Strategic Outlook for Middle-East and Africa Syngas Market Market

The future of the Middle East and Africa syngas market is promising, with significant growth opportunities driven by technological advancements, supportive government policies, and the growing need for cleaner energy. Strategic investments in R&D, strategic partnerships, and expansion into new markets will shape future market dynamics. Focusing on sustainable and cost-effective syngas production, along with exploring new applications and markets, will be critical for maximizing market potential and achieving sustainable growth in the long term.

Middle-East and Africa Syngas Market Segmentation

-

1. Feedstock

- 1.1. Coal

- 1.2. Natural Gas

- 1.3. Petroleum

- 1.4. Pet-coke

- 1.5. Biomass

-

2. Technology

- 2.1. Steam Reforming

- 2.2. Partial Oxidation

- 2.3. Auto-thermal Reforming

- 2.4. Combined or Two-step Reforming

- 2.5. Biomass Gasification

-

3. Gasifier Type

- 3.1. Fixed Bed

- 3.2. Entrained Flow

- 3.3. Fluidized Bed

-

4. Application

- 4.1. Power Generation

-

4.2. Chemicals

- 4.2.1. Methanol

- 4.2.2. Ammonia

- 4.2.3. Oxo Chemicals

- 4.2.4. n-Butanol

- 4.2.5. Hydrogen

- 4.2.6. Dimethyl Ether

- 4.3. Liquid Fuels

- 4.4. Gaseous Fuels

-

5. Geography

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle-East and Africa

Middle-East and Africa Syngas Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of Middle East and Africa

Middle-East and Africa Syngas Market Regional Market Share

Geographic Coverage of Middle-East and Africa Syngas Market

Middle-East and Africa Syngas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Electricity; Growing Chemical Industry

- 3.3. Market Restrains

- 3.3.1. ; High Capital Investment and Funding

- 3.4. Market Trends

- 3.4.1. Increasing Usage in Power Generation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 5.1.1. Coal

- 5.1.2. Natural Gas

- 5.1.3. Petroleum

- 5.1.4. Pet-coke

- 5.1.5. Biomass

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Steam Reforming

- 5.2.2. Partial Oxidation

- 5.2.3. Auto-thermal Reforming

- 5.2.4. Combined or Two-step Reforming

- 5.2.5. Biomass Gasification

- 5.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 5.3.1. Fixed Bed

- 5.3.2. Entrained Flow

- 5.3.3. Fluidized Bed

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Power Generation

- 5.4.2. Chemicals

- 5.4.2.1. Methanol

- 5.4.2.2. Ammonia

- 5.4.2.3. Oxo Chemicals

- 5.4.2.4. n-Butanol

- 5.4.2.5. Hydrogen

- 5.4.2.6. Dimethyl Ether

- 5.4.3. Liquid Fuels

- 5.4.4. Gaseous Fuels

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Saudi Arabia

- 5.5.2. South Africa

- 5.5.3. Rest of Middle-East and Africa

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.6.2. South Africa

- 5.6.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 6. Saudi Arabia Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 6.1.1. Coal

- 6.1.2. Natural Gas

- 6.1.3. Petroleum

- 6.1.4. Pet-coke

- 6.1.5. Biomass

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Steam Reforming

- 6.2.2. Partial Oxidation

- 6.2.3. Auto-thermal Reforming

- 6.2.4. Combined or Two-step Reforming

- 6.2.5. Biomass Gasification

- 6.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 6.3.1. Fixed Bed

- 6.3.2. Entrained Flow

- 6.3.3. Fluidized Bed

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Power Generation

- 6.4.2. Chemicals

- 6.4.2.1. Methanol

- 6.4.2.2. Ammonia

- 6.4.2.3. Oxo Chemicals

- 6.4.2.4. n-Butanol

- 6.4.2.5. Hydrogen

- 6.4.2.6. Dimethyl Ether

- 6.4.3. Liquid Fuels

- 6.4.4. Gaseous Fuels

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Saudi Arabia

- 6.5.2. South Africa

- 6.5.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 7. South Africa Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 7.1.1. Coal

- 7.1.2. Natural Gas

- 7.1.3. Petroleum

- 7.1.4. Pet-coke

- 7.1.5. Biomass

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Steam Reforming

- 7.2.2. Partial Oxidation

- 7.2.3. Auto-thermal Reforming

- 7.2.4. Combined or Two-step Reforming

- 7.2.5. Biomass Gasification

- 7.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 7.3.1. Fixed Bed

- 7.3.2. Entrained Flow

- 7.3.3. Fluidized Bed

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Power Generation

- 7.4.2. Chemicals

- 7.4.2.1. Methanol

- 7.4.2.2. Ammonia

- 7.4.2.3. Oxo Chemicals

- 7.4.2.4. n-Butanol

- 7.4.2.5. Hydrogen

- 7.4.2.6. Dimethyl Ether

- 7.4.3. Liquid Fuels

- 7.4.4. Gaseous Fuels

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Saudi Arabia

- 7.5.2. South Africa

- 7.5.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 8. Rest of Middle East and Africa Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 8.1.1. Coal

- 8.1.2. Natural Gas

- 8.1.3. Petroleum

- 8.1.4. Pet-coke

- 8.1.5. Biomass

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Steam Reforming

- 8.2.2. Partial Oxidation

- 8.2.3. Auto-thermal Reforming

- 8.2.4. Combined or Two-step Reforming

- 8.2.5. Biomass Gasification

- 8.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 8.3.1. Fixed Bed

- 8.3.2. Entrained Flow

- 8.3.3. Fluidized Bed

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Power Generation

- 8.4.2. Chemicals

- 8.4.2.1. Methanol

- 8.4.2.2. Ammonia

- 8.4.2.3. Oxo Chemicals

- 8.4.2.4. n-Butanol

- 8.4.2.5. Hydrogen

- 8.4.2.6. Dimethyl Ether

- 8.4.3. Liquid Fuels

- 8.4.4. Gaseous Fuels

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Saudi Arabia

- 8.5.2. South Africa

- 8.5.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 TechnipFMC PLC*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 General Electric

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Air Products and Chemicals Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Royal Dutch Shell plc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 KBR Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 BASF SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Linde plc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Air Liquide

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 BP p l c

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 SABIC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 TechnipFMC PLC*List Not Exhaustive

List of Figures

- Figure 1: Middle-East and Africa Syngas Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Syngas Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 2: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 3: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 6: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 7: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 11: Middle-East and Africa Syngas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 13: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 14: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 15: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 16: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 17: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 18: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 19: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 26: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 27: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 28: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 29: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 30: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 31: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 33: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 34: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 35: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 38: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 39: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 40: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 41: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 42: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 43: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Syngas Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Middle-East and Africa Syngas Market?

Key companies in the market include TechnipFMC PLC*List Not Exhaustive, General Electric, Air Products and Chemicals Inc, Royal Dutch Shell plc, KBR Inc, BASF SE, Linde plc, Air Liquide, BP p l c, SABIC.

3. What are the main segments of the Middle-East and Africa Syngas Market?

The market segments include Feedstock, Technology, Gasifier Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 258.1 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Electricity; Growing Chemical Industry.

6. What are the notable trends driving market growth?

Increasing Usage in Power Generation Industry.

7. Are there any restraints impacting market growth?

; High Capital Investment and Funding.

8. Can you provide examples of recent developments in the market?

Partnerships between companies for syngas technology development

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Syngas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Syngas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Syngas Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Syngas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence