Key Insights

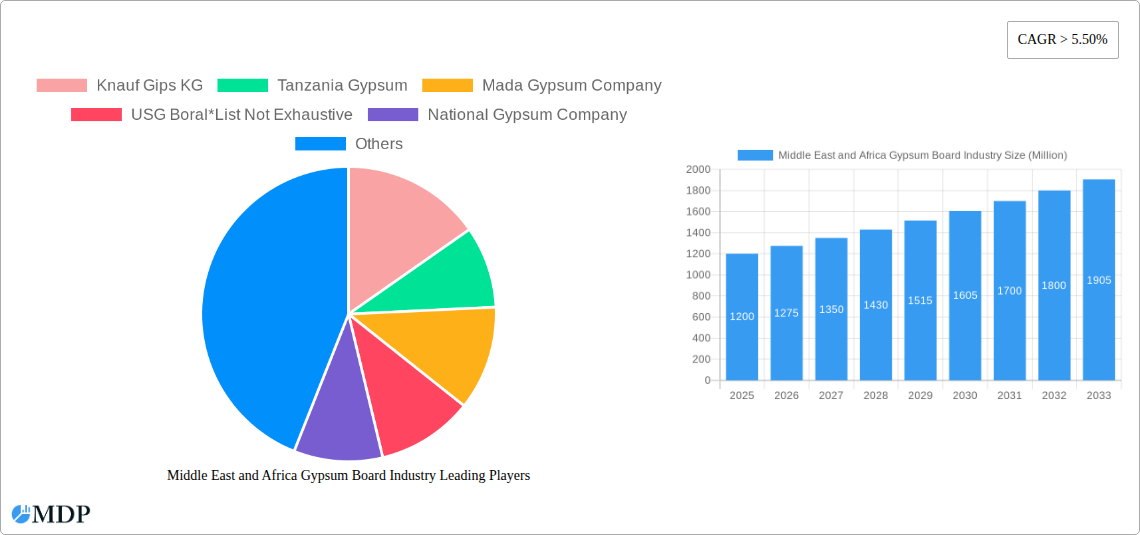

The Middle East and Africa (MEA) Gypsum Board Market is projected for substantial growth, with an estimated market size of 31.07 billion USD. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 5.3% from 2025 to 2033. The region's booming construction sector, fueled by significant infrastructure investments, urbanization, and population growth, is the primary growth engine. Government initiatives promoting construction, including smart city projects, affordable housing, and commercial/industrial hub development, are key accelerators. This construction surge directly increases demand for gypsum boards, essential for modern interior finishing due to their fire resistance, sound insulation, and aesthetic flexibility.

Middle East and Africa Gypsum Board Industry Market Size (In Billion)

Market diversification is underway, influenced by evolving construction methods and consumer preferences. Rapid urbanization and a growing middle class seeking improved living standards are boosting residential construction. Substantial investments in commercial and institutional projects (hospitals, schools, hotels) and industrial facility expansion further sustain demand. Emerging trends like pre-decorated gypsum boards for efficient interior fitting and the increasing demand for sustainable building materials are shaping the market. Potential challenges include fluctuating raw material costs and informal market competition. The competitive environment features established global and regional manufacturers focused on product innovation and strategic expansion.

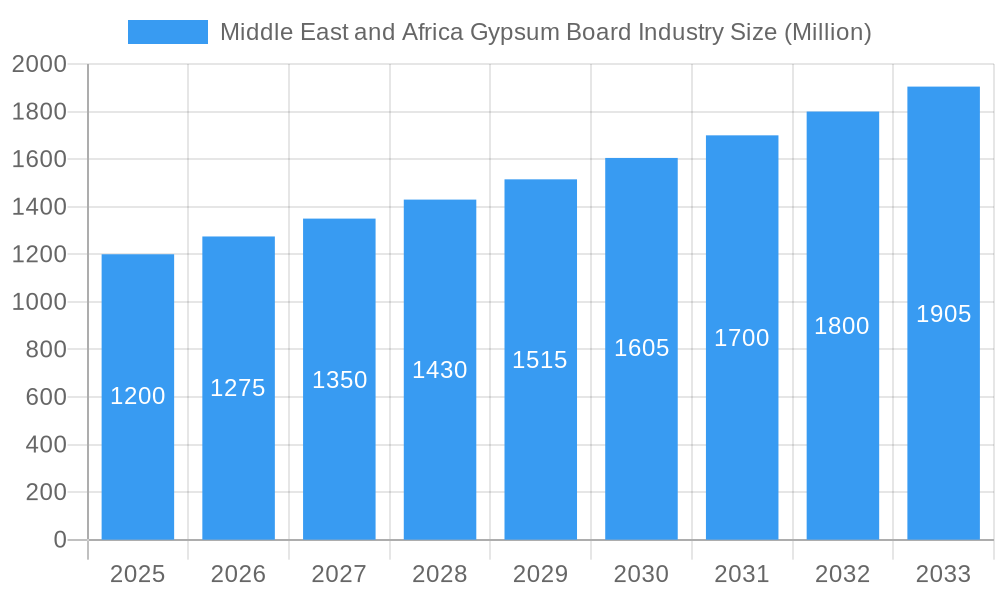

Middle East and Africa Gypsum Board Industry Company Market Share

Unlocking Growth: Middle East and Africa Gypsum Board Industry Market Report (2019-2033)

Dive deep into the dynamic Middle East and Africa gypsum board market with this comprehensive industry report, meticulously analyzed from 2019 to 2033, with 2025 as the base and estimated year. This report is your definitive guide to understanding market dynamics, key players, growth drivers, and future opportunities in this rapidly expanding sector. Featuring high-traffic keywords like "gypsum board market," "Middle East construction," "Africa building materials," "wall board manufacturers," and "ceiling board demand," this analysis is optimized for maximum search visibility and engagement with industry stakeholders. Explore detailed insights into market concentration, innovation, regulatory landscapes, product substitutes, end-user trends, M&A activities, industry trends, leading markets, product developments, growth drivers, challenges, and emerging opportunities.

Middle East and Africa Gypsum Board Industry Market Dynamics & Concentration

The Middle East and Africa gypsum board industry exhibits moderate market concentration, with several key players vying for significant market share. Innovation drivers are primarily focused on enhanced product performance, such as improved fire resistance, moisture resistance, and acoustic insulation, catering to evolving construction standards and end-user preferences. Regulatory frameworks across the region are becoming more stringent, with a growing emphasis on sustainable building practices and product certifications, influencing manufacturing processes and material choices. Product substitutes, while present in traditional construction materials, are being increasingly displaced by the cost-effectiveness, ease of installation, and versatility of gypsum boards. End-user trends indicate a strong demand from the residential sector, driven by population growth and urbanization, alongside a burgeoning demand from the commercial and institutional sectors for modern interior finishes. Mergers and acquisitions (M&A) activities are shaping the competitive landscape, with strategic acquisitions aimed at expanding production capacity, market reach, and product portfolios. For instance, the sale of Boral's stake in USG Boral to Knauf signifies significant consolidation and strategic realignment within the global gypsum board industry. The market share of leading players is estimated to be around 65-70%, with an estimated 5-8 M&A deals anticipated during the forecast period.

Middle East and Africa Gypsum Board Industry Industry Trends & Analysis

The Middle East and Africa gypsum board industry is poised for significant expansion, driven by robust economic growth, increasing urbanization, and substantial investments in infrastructure development across the region. The forecast period (2025–2033) anticipates a Compound Annual Growth Rate (CAGR) of approximately 7.5%, a testament to the burgeoning demand for modern construction materials. Technological disruptions are playing a pivotal role, with manufacturers investing in advanced production techniques to enhance product quality, reduce manufacturing costs, and develop specialized gypsum board solutions. These include the development of lightweight boards, enhanced soundproofing materials, and eco-friendly product lines incorporating recycled content. Consumer preferences are shifting towards aesthetically pleasing, durable, and sustainable interior finishing solutions, directly benefiting the gypsum board market. The industry is witnessing a growing adoption of pre-decorated boards offering ready-to-install finishes, catering to the demand for faster project completion and reduced on-site labor. Competitive dynamics are intensifying, with both established international players and emerging regional manufacturers focusing on product innovation, strategic partnerships, and expanding their distribution networks to capture market share. Market penetration is expected to rise, particularly in developing economies within Africa, as construction activities accelerate and awareness of gypsum board benefits grows. The increasing use of BIM (Building Information Modeling) in construction projects is also driving demand for precise and high-quality gypsum board products.

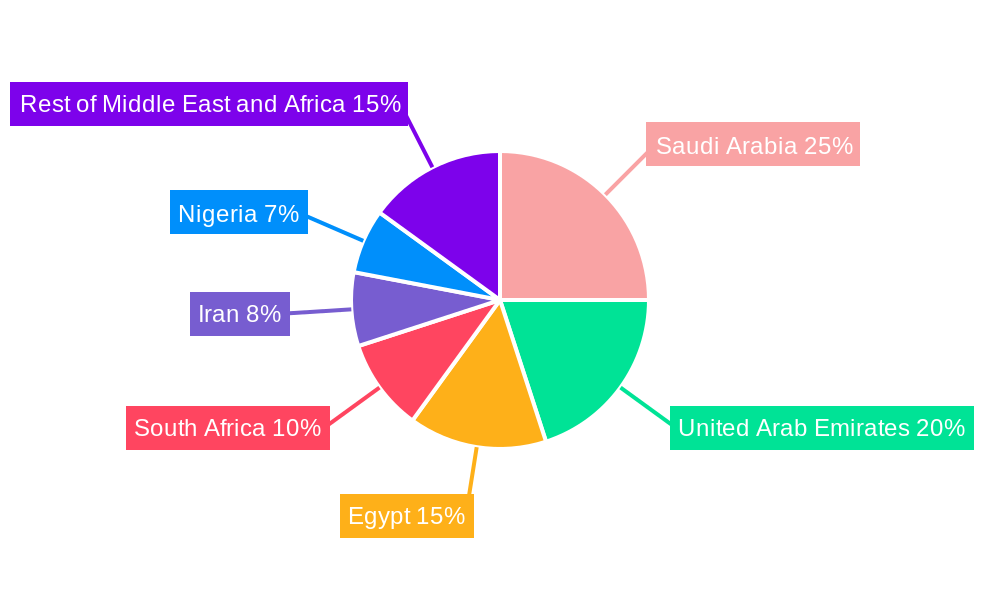

Leading Markets & Segments in Middle East and Africa Gypsum Board Industry

The Middle East and Africa gypsum board industry is characterized by strong performance in key geographical regions and specific product segments.

Dominant Geography:

- Saudi Arabia stands out as a leading market, propelled by ambitious Vision 2030 initiatives that fuel massive infrastructure projects, urban development, and real estate investments. The sheer scale of construction activity, including giga-projects, creates substantial demand for gypsum boards in both residential and commercial applications.

- United Arab Emirates continues to be a significant contributor, with ongoing developments in tourism, hospitality, and commercial real estate driving consistent demand for high-quality construction materials. Dubai and Abu Dhabi remain hubs for major construction endeavors.

- Egypt is emerging as a strong contender, fueled by government-led infrastructure projects, new urban communities, and a growing population, leading to increased demand for residential and commercial construction.

- South Africa demonstrates consistent demand driven by urbanization and a need for affordable housing solutions, alongside commercial and industrial construction.

- Iran presents a substantial market, though influenced by economic conditions, with ongoing construction and renovation activities contributing to gypsum board consumption.

- Nigeria possesses immense growth potential, driven by a large and growing population, rapid urbanization, and a significant housing deficit, indicating a rising demand for construction materials like gypsum boards.

- Rest of Middle-East and Africa encompasses a diverse range of countries with varying growth trajectories, many of which are experiencing increased construction activity due to population growth, infrastructure investment, and economic development.

Dominant Segments:

- Wall Board commands the largest market share, forming the backbone of interior construction for partition walls, false ceilings, and decorative finishes across all sectors. Its versatility and ease of installation make it a preferred choice for a wide array of construction projects.

- Ceiling Board also holds a significant share, driven by the demand for modern, aesthetically pleasing, and functional suspended and integrated ceiling systems in commercial, institutional, and residential spaces.

- Pre-decorated Board is an emerging and rapidly growing segment. As construction timelines shorten and demand for ready-to-install finishes increases, these boards, offering integrated decorative surfaces, are gaining traction, especially in commercial fit-outs and high-end residential projects.

Key drivers for this dominance include government investments in infrastructure, a growing population, rapid urbanization, and the increasing adoption of modern construction techniques. For instance, Saudi Arabia's Vision 2030 explicitly targets significant real estate and infrastructure development, directly impacting gypsum board demand.

Middle East and Africa Gypsum Board Industry Product Developments

Product development in the Middle East and Africa gypsum board industry is actively focused on enhancing performance and sustainability. Innovations include the introduction of specialized gypsum boards with superior fire resistance, enhanced sound insulation properties, and increased moisture resistance, catering to specific application needs in diverse climatic conditions. The trend towards environmentally friendly construction is driving the development of boards with higher recycled content and reduced carbon footprints. Competitive advantages are being achieved through the integration of advanced manufacturing technologies that enable thinner, lighter yet stronger boards, reducing transportation costs and installation time. Furthermore, the market is seeing advancements in pre-decorated gypsum boards offering a wider range of aesthetic finishes, improving on-site efficiency and aesthetic appeal. These developments are crucial for meeting evolving construction standards and consumer expectations for durability, safety, and aesthetics.

Key Drivers of Middle East and Africa Gypsum Board Industry Growth

The growth of the Middle East and Africa gypsum board industry is propelled by a confluence of factors. Foremost is the substantial investment in infrastructure development and real estate projects across both regions, spurred by economic diversification initiatives and population growth. Rapid urbanization is leading to increased demand for housing and commercial spaces, directly benefiting the gypsum board market. Technological advancements in manufacturing processes are enhancing product quality and reducing costs, making gypsum boards more competitive. Furthermore, growing awareness of the environmental benefits and ease of installation associated with gypsum boards is influencing construction choices. Favorable government policies and building codes that promote modern construction materials also play a crucial role in driving market expansion.

Challenges in the Middle East and Africa Gypsum Board Industry Market

Despite robust growth prospects, the Middle East and Africa gypsum board market faces several challenges. Volatile raw material prices, particularly for gypsum rock and paper facing, can impact manufacturing costs and profitability. Supply chain disruptions, coupled with logistical complexities in a vast and diverse region, can lead to increased lead times and shipping costs. Intense competition from both local and international players can put pressure on pricing. Additionally, varying regulatory standards across different countries and the need for skilled labor for proper installation can pose hurdles. The economic sensitivity of the construction sector, which can be affected by global economic downturns or regional political instability, also presents a risk.

Emerging Opportunities in Middle East and Africa Gypsum Board Industry

The Middle East and Africa gypsum board industry is ripe with emerging opportunities. The significant housing deficit in many African nations presents a vast untapped market for affordable and efficient construction solutions. Continued investments in smart city projects and sustainable building initiatives in the Middle East offer avenues for high-performance and eco-friendly gypsum board products. Strategic partnerships between manufacturers and construction companies can streamline distribution and project integration. The growing trend towards prefabricated and modular construction also opens up new possibilities for specialized gypsum board systems. Furthermore, focusing on niche applications such as specialized acoustic or fire-rated boards can unlock premium market segments.

Leading Players in the Middle East and Africa Gypsum Board Industry Sector

- Knauf Gips KG

- Tanzania Gypsum

- Mada Gypsum Company

- USG Boral

- National Gypsum Company

- Saint-Gobain (Gyproc)

- Gypsemna

- AYHACO Gypsum Products Manufacturing

- Global Gypsum Co Ltd

- KCC Corporation

Key Milestones in Middle East and Africa Gypsum Board Industry Industry

- November 2021: Saint-Gobain acquired a gypsum plant in Nairobi, Kenya, marking its first production site in Kenya and signaling an expansion of its regional footprint.

- April 2021: Boral sold its 50% stake in USG Boral to Gebr Knauf KG (Knauf) for USD 1.02 billion. This significant transaction aimed at debt reduction for Boral and likely signifies strategic realignments and potential consolidation within the global gypsum board sector.

Strategic Outlook for Middle East and Africa Gypsum Board Industry Market

The strategic outlook for the Middle East and Africa gypsum board market is overwhelmingly positive, driven by ongoing mega-projects and a growing need for modern, efficient building materials. Manufacturers are poised to capitalize on increasing demand by focusing on product innovation, particularly in areas of sustainability, fire safety, and acoustic performance. Expanding distribution networks into less penetrated African markets and forging strategic alliances with local construction firms will be crucial for market penetration. Investment in advanced manufacturing technologies to enhance production efficiency and product quality will be a key differentiator. The adoption of digital solutions in sales and customer support, along with a focus on providing comprehensive technical expertise, will further strengthen market positioning and drive sustainable long-term growth.

Middle East and Africa Gypsum Board Industry Segmentation

-

1. Type

- 1.1. Wall Board

- 1.2. Ceiling Board

- 1.3. Pre-decorated Board

-

2. Application

- 2.1. Residential Sector

- 2.2. Institutional Sector

- 2.3. Industrial Sector

- 2.4. Commercial Sector

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. Iran

- 3.4. Nigeria

- 3.5. Egypt

- 3.6. United Arab Emirates

- 3.7. Rest of Middle-East and Africa

Middle East and Africa Gypsum Board Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Iran

- 4. Nigeria

- 5. Egypt

- 6. United Arab Emirates

- 7. Rest of Middle East and Africa

Middle East and Africa Gypsum Board Industry Regional Market Share

Geographic Coverage of Middle East and Africa Gypsum Board Industry

Middle East and Africa Gypsum Board Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Construction Activities in Saudi Arabia; Booming Tourism in the Middle Eastern Countries

- 3.3. Market Restrains

- 3.3.1. Prone to Water Damage; Other Restraints

- 3.4. Market Trends

- 3.4.1. Ceiling Boards to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wall Board

- 5.1.2. Ceiling Board

- 5.1.3. Pre-decorated Board

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential Sector

- 5.2.2. Institutional Sector

- 5.2.3. Industrial Sector

- 5.2.4. Commercial Sector

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. Iran

- 5.3.4. Nigeria

- 5.3.5. Egypt

- 5.3.6. United Arab Emirates

- 5.3.7. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Iran

- 5.4.4. Nigeria

- 5.4.5. Egypt

- 5.4.6. United Arab Emirates

- 5.4.7. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wall Board

- 6.1.2. Ceiling Board

- 6.1.3. Pre-decorated Board

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential Sector

- 6.2.2. Institutional Sector

- 6.2.3. Industrial Sector

- 6.2.4. Commercial Sector

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. Iran

- 6.3.4. Nigeria

- 6.3.5. Egypt

- 6.3.6. United Arab Emirates

- 6.3.7. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South Africa Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wall Board

- 7.1.2. Ceiling Board

- 7.1.3. Pre-decorated Board

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential Sector

- 7.2.2. Institutional Sector

- 7.2.3. Industrial Sector

- 7.2.4. Commercial Sector

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. Iran

- 7.3.4. Nigeria

- 7.3.5. Egypt

- 7.3.6. United Arab Emirates

- 7.3.7. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Iran Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wall Board

- 8.1.2. Ceiling Board

- 8.1.3. Pre-decorated Board

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential Sector

- 8.2.2. Institutional Sector

- 8.2.3. Industrial Sector

- 8.2.4. Commercial Sector

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. Iran

- 8.3.4. Nigeria

- 8.3.5. Egypt

- 8.3.6. United Arab Emirates

- 8.3.7. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Nigeria Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wall Board

- 9.1.2. Ceiling Board

- 9.1.3. Pre-decorated Board

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential Sector

- 9.2.2. Institutional Sector

- 9.2.3. Industrial Sector

- 9.2.4. Commercial Sector

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. South Africa

- 9.3.3. Iran

- 9.3.4. Nigeria

- 9.3.5. Egypt

- 9.3.6. United Arab Emirates

- 9.3.7. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Egypt Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wall Board

- 10.1.2. Ceiling Board

- 10.1.3. Pre-decorated Board

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential Sector

- 10.2.2. Institutional Sector

- 10.2.3. Industrial Sector

- 10.2.4. Commercial Sector

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. South Africa

- 10.3.3. Iran

- 10.3.4. Nigeria

- 10.3.5. Egypt

- 10.3.6. United Arab Emirates

- 10.3.7. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Wall Board

- 11.1.2. Ceiling Board

- 11.1.3. Pre-decorated Board

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Residential Sector

- 11.2.2. Institutional Sector

- 11.2.3. Industrial Sector

- 11.2.4. Commercial Sector

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Saudi Arabia

- 11.3.2. South Africa

- 11.3.3. Iran

- 11.3.4. Nigeria

- 11.3.5. Egypt

- 11.3.6. United Arab Emirates

- 11.3.7. Rest of Middle-East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Middle East and Africa Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Wall Board

- 12.1.2. Ceiling Board

- 12.1.3. Pre-decorated Board

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Residential Sector

- 12.2.2. Institutional Sector

- 12.2.3. Industrial Sector

- 12.2.4. Commercial Sector

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Saudi Arabia

- 12.3.2. South Africa

- 12.3.3. Iran

- 12.3.4. Nigeria

- 12.3.5. Egypt

- 12.3.6. United Arab Emirates

- 12.3.7. Rest of Middle-East and Africa

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Knauf Gips KG

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Tanzania Gypsum

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Mada Gypsum Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 USG Boral*List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 National Gypsum Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Saint-Gobain (Gyproc)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Gypsemna

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 AYHACO Gypsum Products Manufacturing

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Global Gypsum Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 KCC Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Knauf Gips KG

List of Figures

- Figure 1: Middle East and Africa Gypsum Board Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Gypsum Board Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 32: Middle East and Africa Gypsum Board Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Gypsum Board Industry?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Middle East and Africa Gypsum Board Industry?

Key companies in the market include Knauf Gips KG, Tanzania Gypsum, Mada Gypsum Company, USG Boral*List Not Exhaustive, National Gypsum Company, Saint-Gobain (Gyproc), Gypsemna, AYHACO Gypsum Products Manufacturing, Global Gypsum Co Ltd, KCC Corporation.

3. What are the main segments of the Middle East and Africa Gypsum Board Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Construction Activities in Saudi Arabia; Booming Tourism in the Middle Eastern Countries.

6. What are the notable trends driving market growth?

Ceiling Boards to Dominate the Market.

7. Are there any restraints impacting market growth?

Prone to Water Damage; Other Restraints.

8. Can you provide examples of recent developments in the market?

In November 2021, Saint-Gobain acquired a gypsum plant in Nairobi, Kenya. This is Saint-Gobain's first production site in Kenya.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Gypsum Board Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Gypsum Board Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Gypsum Board Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Gypsum Board Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence