Key Insights

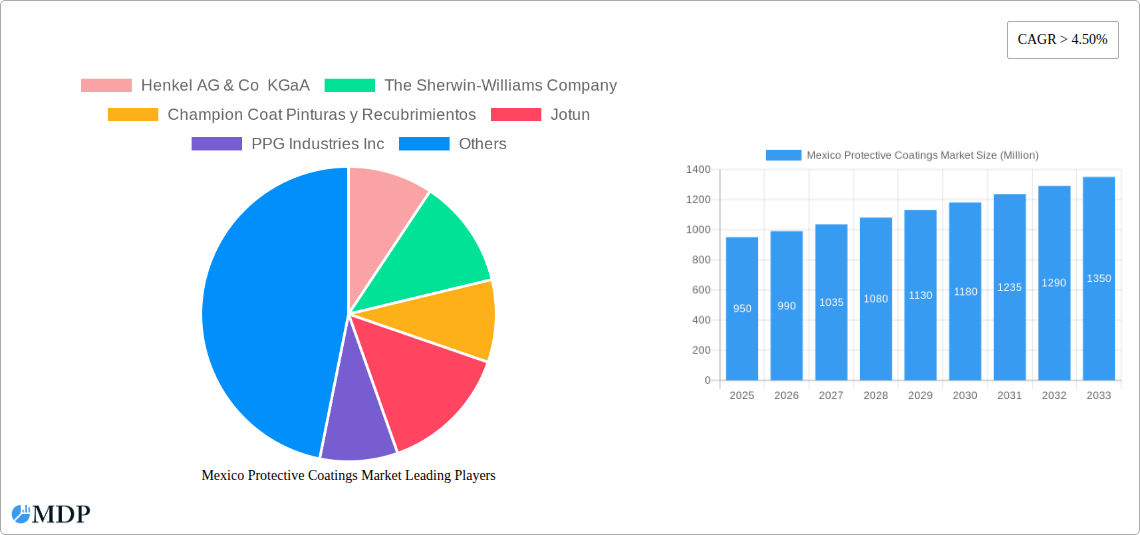

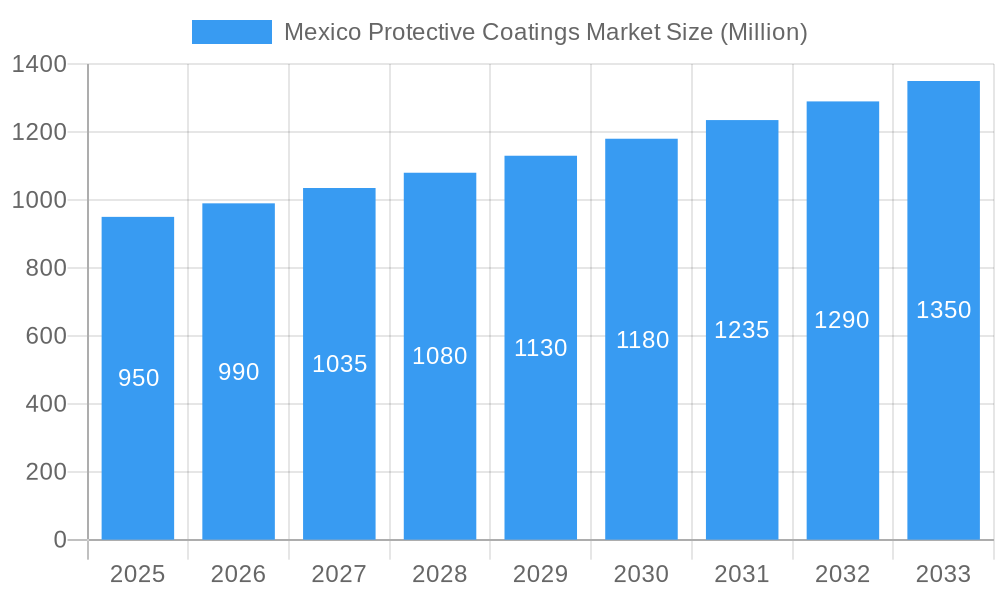

The protective coatings market in Mexico is poised for robust expansion, driven by significant investments in key industrial sectors and an increasing emphasis on asset longevity. With a market size estimated to be in the range of $800 million to $1.2 billion in 2025, and a Compound Annual Growth Rate (CAGR) exceeding 4.50% through 2033, the sector is demonstrating substantial momentum. Major growth drivers include the thriving oil and gas industry, which demands high-performance coatings for exploration, production, and refining infrastructure, and the booming mining sector, necessitating durable solutions for extraction and processing equipment. Furthermore, ongoing infrastructure development, including roads, bridges, and utilities, alongside expansion in the power generation sector, creates a consistent demand for protective coatings that can withstand harsh environmental conditions and corrosive elements. The trend towards advanced coating technologies, such as UV-cured and waterborne formulations, reflects a growing environmental consciousness and a push for more sustainable and efficient application methods. This shift is supported by various resin types, with acrylic and epoxy coatings leading the way due to their superior adhesion, chemical resistance, and durability.

Mexico Protective Coatings Market Market Size (In Million)

Despite the positive outlook, certain restraints could influence the market's trajectory. Fluctuations in raw material prices, particularly for resins and pigments, can impact profitability and pricing strategies for manufacturers. Additionally, stringent environmental regulations and the need for specialized application equipment may present challenges for smaller players. However, the overarching trend of increasing infrastructure modernization, coupled with a growing awareness of the long-term cost benefits of using high-quality protective coatings for asset maintenance and protection, is expected to outweigh these limitations. Key companies like Henkel AG & Co KGaA, The Sherwin-Williams Company, Akzo Nobel N.V., and PPG Industries Inc. are actively investing in research and development and expanding their presence in Mexico to capitalize on these opportunities. The market segments, spanning various end-user industries and coating technologies, are well-defined and offer diverse avenues for growth, with a particular focus on high-performance solutions that enhance operational efficiency and asset lifespan across Mexico's industrial landscape.

Mexico Protective Coatings Market Company Market Share

Unlocking the Potential: A Comprehensive Analysis of the Mexico Protective Coatings Market (2019-2033)

Dive deep into the dynamic Mexico Protective Coatings Market with this in-depth report, meticulously crafted to provide actionable insights for industry leaders, investors, and stakeholders. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this report offers unparalleled visibility into market dynamics, growth drivers, emerging trends, and competitive landscapes. Leverage high-traffic keywords such as "Mexico protective coatings," "industrial coatings Mexico," "corrosion protection Mexico," "construction coatings Mexico," and "oil and gas coatings Mexico" to maximize your search visibility. This report is designed for immediate use without any further modification, offering a complete and actionable overview.

Mexico Protective Coatings Market Market Dynamics & Concentration

The Mexico Protective Coatings Market is characterized by a moderate to high level of concentration, with a few key players holding significant market share. Innovation is a critical driver, fueled by advancements in resin technologies and a growing demand for sustainable and high-performance coatings. Regulatory frameworks, particularly those concerning environmental impact and VOC emissions, are increasingly shaping product development and market entry strategies. The presence of viable product substitutes, such as alternative materials and more basic coating solutions, presents a challenge that manufacturers are addressing through enhanced product differentiation and value-added services. End-user trends are significantly influenced by the performance requirements of sectors like Oil and Gas and Infrastructure, driving demand for specialized, durable, and weather-resistant coatings. Mergers and acquisitions (M&A) activities are sporadic but play a role in market consolidation and portfolio expansion, with an estimated XX M&A deal counts observed during the historical period. Key companies like Henkel AG & Co KGaA, The Sherwin-Williams Company, and PPG Industries Inc. are instrumental in shaping the competitive landscape.

Mexico Protective Coatings Market Industry Trends & Analysis

The Mexico Protective Coatings Market is poised for robust growth, driven by several interconnected trends and influencing factors. A significant market penetration is observed, with an anticipated Compound Annual Growth Rate (CAGR) of XX% projected over the forecast period (2025-2033). The burgeoning infrastructure development across Mexico, including transportation networks, public buildings, and industrial facilities, is a primary growth engine, necessitating extensive application of protective coatings for asset longevity and aesthetic appeal. The Oil and Gas sector continues to be a major consumer, demanding high-performance coatings that can withstand harsh environments, chemical exposure, and extreme temperatures, thereby preventing corrosion and ensuring operational safety.

Technological disruptions are playing a pivotal role. The shift towards waterborne and UV-cured technologies is accelerating, driven by increasing environmental regulations and a growing preference for sustainable solutions. These technologies offer reduced VOC emissions, faster curing times, and improved performance characteristics compared to traditional solventborne coatings. Consumer preferences are evolving, with a greater emphasis on durability, ease of application, and long-term cost-effectiveness. This is pushing manufacturers to invest in research and development for advanced formulations.

The competitive dynamics within the market are intense, with both global giants and established local players vying for market share. Companies are focusing on product innovation, strategic partnerships, and expanding their distribution networks to reach a wider customer base. The mining industry, while subject to commodity price fluctuations, also represents a significant demand for robust protective coatings that can endure abrasive conditions and chemical exposure. The power generation sector, encompassing both renewable and traditional energy sources, requires specialized coatings for power plants, transmission towers, and renewable energy infrastructure, further contributing to market expansion. The "Other End-user Industries" segment, which includes automotive, marine, and general industrial applications, also exhibits consistent demand for protective coatings, adding to the overall market vitality.

Leading Markets & Segments in Mexico Protective Coatings Market

The Oil and Gas end-user industry stands out as a dominant force within the Mexico Protective Coatings Market, driven by substantial investments in exploration, production, and refining infrastructure. The inherent corrosive nature of the oil and gas extraction and processing environments necessitates the application of high-performance coatings for pipelines, storage tanks, offshore platforms, and drilling equipment to ensure asset integrity and prevent costly downtime. Economic policies supporting the energy sector and continued global demand for hydrocarbons fuel this segment's growth.

In terms of Technology, the Waterborne segment is rapidly gaining traction and is projected to witness significant expansion. This is primarily attributed to stringent environmental regulations in Mexico and globally, pushing manufacturers and end-users towards low-VOC (Volatile Organic Compound) solutions. Waterborne coatings offer a more sustainable alternative without compromising on protective qualities, making them increasingly attractive for a wide range of applications.

Analyzing Resin Type, Epoxy resins continue to hold a leading position. Their exceptional adhesion, chemical resistance, and mechanical strength make them indispensable for demanding applications in infrastructure, industrial maintenance, and the Oil and Gas sector. The versatility of epoxy formulations allows them to be tailored for specific performance requirements, further solidifying their market dominance.

Infrastructure as an end-user industry is another significant contributor, with ongoing government initiatives focused on modernizing transportation networks, urban development, and public utilities. These projects, including bridges, highways, airports, and water treatment facilities, require substantial volumes of protective coatings to shield structures from environmental degradation, corrosion, and wear. Government spending and infrastructure development plans are key drivers for this segment.

Among the Technology options, while solventborne coatings have historically been dominant, the market is witnessing a discernible shift. Powder coatings are also carving out a notable niche, particularly in applications where superior durability and a seamless finish are required, such as in architectural metalwork and automotive components.

Regarding Resin Types, Polyurethane coatings are also crucial, offering excellent flexibility, UV resistance, and abrasion resistance, making them ideal for exterior applications and surfaces subjected to mechanical stress.

Mexico Protective Coatings Market Product Developments

Product innovation in the Mexico Protective Coatings Market is characterized by a strong emphasis on enhanced performance, sustainability, and ease of application. Manufacturers are actively developing advanced formulations that offer superior corrosion resistance, chemical inertness, and extended service life for demanding industrial environments. A key trend is the development of eco-friendly coatings, including low-VOC waterborne systems and solvent-free options, aligning with global sustainability initiatives and regulatory pressures. Furthermore, R&D efforts are focused on coatings with specialized properties such as anti-graffiti, fire retardant, and antimicrobial functionalities, catering to niche market demands and providing competitive advantages.

Key Drivers of Mexico Protective Coatings Market Growth

Several key factors are propelling the growth of the Mexico Protective Coatings Market. Foremost is the substantial investment in infrastructure development, including transportation, energy, and urban renewal projects, which necessitates robust protective coatings for longevity and durability. The significant presence and continued expansion of the Oil and Gas sector, with its stringent requirements for corrosion prevention in harsh environments, remains a primary growth accelerator. Growing environmental consciousness and stricter regulations regarding VOC emissions are driving the adoption of advanced, eco-friendly coating technologies such as waterborne and powder coatings. Finally, the mining industry's demand for coatings that can withstand extreme abrasive conditions and chemical exposure contributes to market expansion.

Challenges in the Mexico Protective Coatings Market Market

Despite its growth potential, the Mexico Protective Coatings Market faces several challenges. Intense price competition among numerous players can impact profit margins and necessitate cost-optimization strategies. Stringent and evolving environmental regulations, while driving innovation, also pose compliance challenges and can increase R&D and production costs. Fluctuations in raw material prices, particularly for key resins and pigments, can affect manufacturing expenses and pricing stability. Furthermore, the skilled labor shortage for specialized coating application can lead to project delays and impact the quality of finished projects.

Emerging Opportunities in Mexico Protective Coatings Market

The Mexico Protective Coatings Market presents several promising opportunities for growth and expansion. The increasing demand for high-performance, durable coatings in renewable energy infrastructure, such as wind turbines and solar farms, represents a significant untapped market. The growing trend towards smart coatings, incorporating functionalities like self-healing or monitoring capabilities, offers a pathway for technological differentiation and premium pricing. Strategic partnerships and collaborations between coating manufacturers and end-users can lead to the development of tailor-made solutions, fostering customer loyalty and market penetration. Expansion into niche applications within the automotive, marine, and aerospace sectors, where specialized protective properties are paramount, also offers considerable potential.

Leading Players in the Mexico Protective Coatings Market Sector

- Henkel AG & Co KGaA

- The Sherwin-Williams Company

- Champion Coat Pinturas y Recubrimientos

- Jotun

- PPG Industries Inc

- Pinturas Berel SA de CV

- BASF SE

- Akzo Noble N V

- Axalta Coating Systems

- PRISA

- Osel Paintings

- HEMPEL A/S

- Sika AG

Key Milestones in Mexico Protective Coatings Market Industry

- 2023: Major players like PPG Industries Inc. and The Sherwin-Williams Company launched new lines of low-VOC, waterborne protective coatings to meet increasing environmental demands.

- 2022: Henkel AG & Co KGaA expanded its adhesive and surface treatment portfolio, including advanced protective coatings for the automotive sector, in response to industry growth.

- 2021: Axalta Coating Systems invested in expanding its manufacturing capabilities in Mexico to meet the growing demand from industrial and infrastructure sectors.

- 2020: Jotun introduced innovative anti-corrosion coatings designed for extended durability in extreme marine and offshore environments.

- 2019: Pinturas Berel SA de CV focused on expanding its distribution network to reach more remote infrastructure projects across Mexico.

Strategic Outlook for Mexico Protective Coatings Market Market

The strategic outlook for the Mexico Protective Coatings Market is one of sustained growth, driven by ongoing infrastructure development and the robust performance of the Oil and Gas sector. The increasing adoption of sustainable coating technologies presents a significant opportunity for companies that invest in eco-friendly R&D and production. Expanding product portfolios to include specialized coatings for niche applications, such as renewable energy and high-durability industrial uses, will be crucial for competitive advantage. Strategic alliances and a focus on customer-centric solutions will enable players to navigate market complexities and capitalize on emerging trends. Continuous innovation in product performance and application efficiency will be paramount for long-term success.

Mexico Protective Coatings Market Segmentation

-

1. End-user Industry

- 1.1. Oil and Gas

- 1.2. Mining

- 1.3. Power

- 1.4. Infrastructure

- 1.5. Other End-user Industries

-

2. Technology

- 2.1. Waterborne

- 2.2. Solventborne

- 2.3. Powder

- 2.4. UV-Cured

-

3. Resin Type

- 3.1. Acrylic

- 3.2. Epoxy

- 3.3. Alkyd

- 3.4. Polyurethane

- 3.5. Polyester

- 3.6. Other Resin Types

Mexico Protective Coatings Market Segmentation By Geography

- 1. Mexico

Mexico Protective Coatings Market Regional Market Share

Geographic Coverage of Mexico Protective Coatings Market

Mexico Protective Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Infrastructure and Industrialization in Mexico; Increasing demand from Mexico's Oil and gas industry

- 3.3. Market Restrains

- 3.3.1. High prices of Raw materials

- 3.4. Market Trends

- 3.4.1. Increasing demand from Mexico’s Oil and Gas industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Protective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Oil and Gas

- 5.1.2. Mining

- 5.1.3. Power

- 5.1.4. Infrastructure

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Waterborne

- 5.2.2. Solventborne

- 5.2.3. Powder

- 5.2.4. UV-Cured

- 5.3. Market Analysis, Insights and Forecast - by Resin Type

- 5.3.1. Acrylic

- 5.3.2. Epoxy

- 5.3.3. Alkyd

- 5.3.4. Polyurethane

- 5.3.5. Polyester

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Sherwin-Williams Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Champion Coat Pinturas y Recubrimientos

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PPG Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pinturas Berel SA de CV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Akzo Noble N V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Axalta Coating Systems

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PRISA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Osel Paintings

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 HEMPEL A/S

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sika AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Mexico Protective Coatings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Protective Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Protective Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Mexico Protective Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 3: Mexico Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Mexico Protective Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: Mexico Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 6: Mexico Protective Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 7: Mexico Protective Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Mexico Protective Coatings Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Mexico Protective Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Mexico Protective Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Mexico Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Mexico Protective Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 13: Mexico Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 14: Mexico Protective Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 15: Mexico Protective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Mexico Protective Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Protective Coatings Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Mexico Protective Coatings Market?

Key companies in the market include Henkel AG & Co KGaA, The Sherwin-Williams Company, Champion Coat Pinturas y Recubrimientos, Jotun, PPG Industries Inc, Pinturas Berel SA de CV, BASF SE, Akzo Noble N V, Axalta Coating Systems, PRISA, Osel Paintings, HEMPEL A/S, Sika AG.

3. What are the main segments of the Mexico Protective Coatings Market?

The market segments include End-user Industry, Technology, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Infrastructure and Industrialization in Mexico; Increasing demand from Mexico's Oil and gas industry.

6. What are the notable trends driving market growth?

Increasing demand from Mexico’s Oil and Gas industry.

7. Are there any restraints impacting market growth?

High prices of Raw materials.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are being covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Protective Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Protective Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Protective Coatings Market?

To stay informed about further developments, trends, and reports in the Mexico Protective Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence