Key Insights

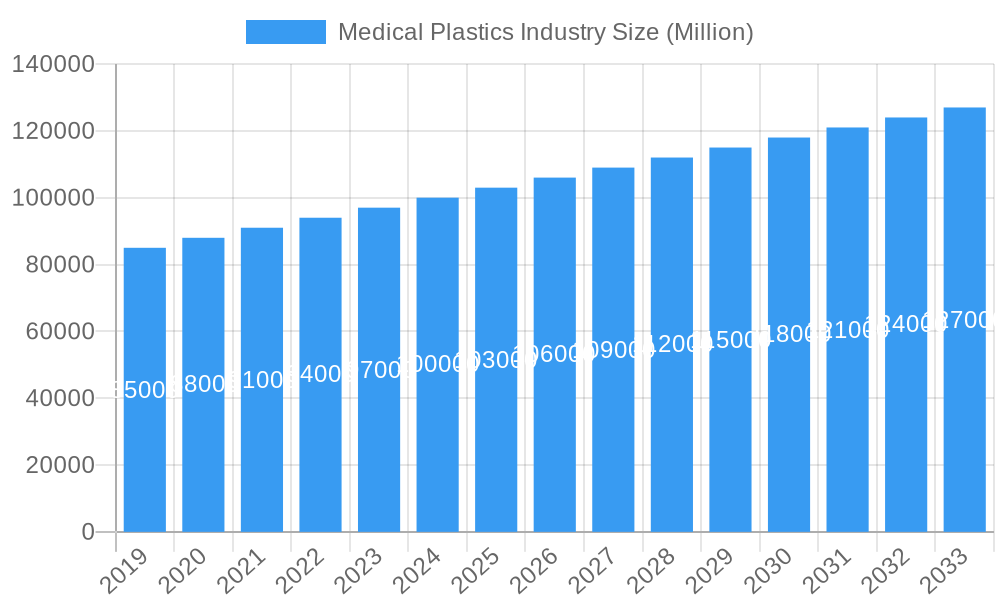

The global medical plastics market is projected to reach a market size of $27.46 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.56% through 2033. This growth is driven by increasing global healthcare spending, rising demand for advanced medical devices, and the inherent benefits of plastics including cost-effectiveness, lightweight design, and excellent biocompatibility. The growing incidence of chronic diseases and an aging population further propel the need for sophisticated medical equipment and single-use products, sustaining demand for high-performance medical plastics. Key growth factors include material science innovation, such as the development of novel bioplastics and antimicrobial polymers, and the trend towards minimally invasive surgery requiring specialized plastic components.

Medical Plastics Industry Market Size (In Billion)

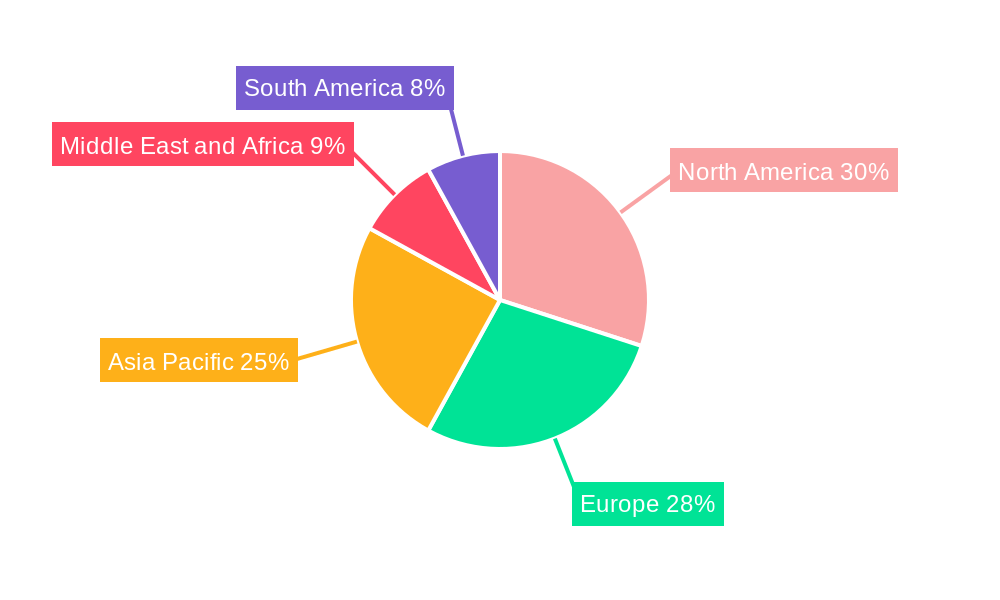

The market is segmented into Traditional Plastics (e.g., Polyethylene, Polypropylene) and Engineering Plastics (e.g., ABS, Polycarbonate). Engineering plastics are experiencing higher adoption due to their superior mechanical and thermal properties, essential for complex medical devices. Applications are extensive, covering surgical instruments, disposable supplies, diagnostic equipment, and anesthetic and imaging devices. North America and Europe currently lead the market, supported by robust healthcare infrastructure and R&D investments. The Asia Pacific region is a rapidly growing market, driven by improved healthcare access, rising disposable incomes, and a flourishing medical device manufacturing sector. Market restraints, including stringent regulatory approvals and environmental concerns, are being mitigated by advancements in recyclable and biodegradable medical-grade polymers and a focus on sustainable manufacturing.

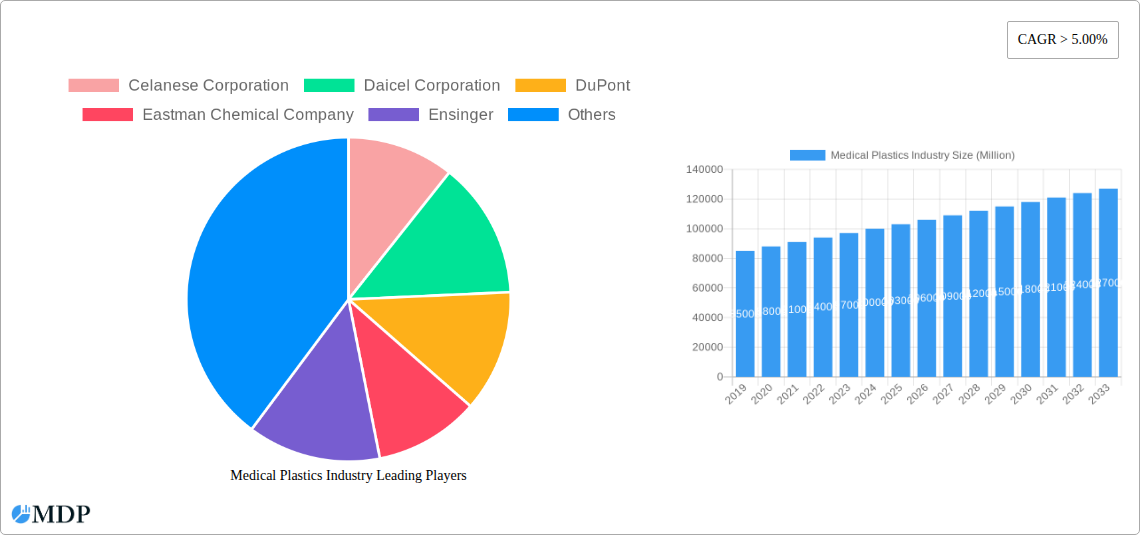

Medical Plastics Industry Company Market Share

Medical Plastics Industry: Market Dynamics, Trends, and Strategic Outlook (2019-2033)

This comprehensive report delivers an in-depth analysis of the global Medical Plastics Industry, a critical and rapidly evolving sector vital to modern healthcare. Spanning the historical period of 2019-2024, the base year of 2025, and a robust forecast period extending to 2033, this report provides unparalleled insights into market dynamics, technological advancements, and strategic opportunities. With an estimated market size projected to reach over $50 Million by 2025 and a Compound Annual Growth Rate (CAGR) of XX%, this study is indispensable for industry stakeholders seeking to navigate and capitalize on this burgeoning market. The report leverages high-traffic keywords such as "medical-grade polymers," "healthcare plastics," "biocompatible materials," "medical device manufacturing," and "ISO 13485 compliant plastics" to ensure maximum search visibility.

Medical Plastics Industry Market Dynamics & Concentration

The Medical Plastics Industry exhibits a moderate to high level of market concentration, driven by a select group of major players and specialized material manufacturers. Innovation is a paramount driver, fueled by the constant demand for advanced materials with enhanced biocompatibility, sterilizability, and durability for a wide range of medical applications. Regulatory frameworks, including stringent FDA, EMA, and ISO 13485 standards, significantly shape market entry and product development, necessitating rigorous testing and compliance. Product substitutes, though present, often fall short in meeting the specific performance requirements of medical applications, reinforcing the dominance of specialized polymers. End-user trends highlight a growing preference for single-use devices to mitigate infection risks and an increasing demand for minimally invasive surgical tools, which in turn drive the need for intricate and high-performance plastic components. Mergers and acquisitions (M&A) activities, while not at an extremely high volume, are strategic, focusing on acquiring specialized technologies, expanding geographical reach, or consolidating market share. For instance, an estimated XX M&A deals were observed during the historical period, with average deal values ranging from $XX Million to $XX Million. Key companies like DuPont and SABIC are actively involved in strategic collaborations and acquisitions to enhance their portfolio in high-growth medical segments.

- Market Concentration: Moderate to High.

- Innovation Drivers: Biocompatibility, Sterilization Resistance, Durability, Miniaturization.

- Regulatory Frameworks: FDA, EMA, ISO 13485.

- Product Substitutes: Limited effectiveness in critical medical applications.

- End-User Trends: Rise of single-use devices, demand for minimally invasive tools.

- M&A Activities: Strategic acquisitions focusing on technology and market expansion.

Medical Plastics Industry Industry Trends & Analysis

The Medical Plastics Industry is poised for substantial growth, driven by an aging global population, increasing prevalence of chronic diseases, and advancements in medical technology. The Market Size is projected to ascend significantly, exceeding $XX Million by 2033. A key growth driver is the escalating demand for disposable medical products, ranging from syringes and catheters to diagnostic kits, fueled by hygiene concerns and cost-effectiveness in healthcare settings. The expanding use of advanced medical devices, including sophisticated diagnostic imaging equipment and implantable devices, necessitates the use of high-performance engineering plastics such as PEEK and advanced polycarbonates. Technological disruptions, including the development of novel biocompatible polymers and antimicrobial plastics, are transforming material capabilities and expanding application horizons. Consumer preferences are increasingly geared towards safer, more effective, and less invasive medical procedures, which directly translates to a higher demand for precision-engineered medical plastic components. The competitive dynamics are characterized by intense R&D efforts, strategic partnerships between material suppliers and device manufacturers, and a focus on sustainable and recyclable medical plastic solutions. The market penetration of advanced medical plastics is expected to rise as cost efficiencies are realized and regulatory approvals become more streamlined for innovative materials. The Compound Annual Growth Rate (CAGR) for the Medical Plastics Industry is estimated at XX% during the forecast period. XX% of the market is driven by the demand for disposables, while XX% is attributed to surgical instruments.

Leading Markets & Segments in Medical Plastics Industry

North America currently dominates the Medical Plastics Industry market due to its advanced healthcare infrastructure, high per capita healthcare spending, and significant research and development investments. The United States, in particular, is a leading consumer and innovator in medical plastics. Within the broader market, Engineer Plastics are experiencing robust growth, driven by their superior mechanical properties, chemical resistance, and ability to withstand sterilization processes. Specifically, Polyetheretherketone (PEEK) is witnessing a surge in demand for implantable devices and high-stress surgical instruments due to its exceptional strength and biocompatibility. Polycarbonate (PC) remains a staple for diagnostic and imaging equipment due to its clarity and impact resistance.

In terms of applications, Surgical instruments and Disposables represent the largest and fastest-growing segments. The increasing volume of surgical procedures, coupled with the shift towards single-use instruments for infection control, fuels demand for durable and sterilizable medical plastics in this segment. The Diagnosis instruments segment is also expanding rapidly, driven by the development of point-of-care testing devices and sophisticated laboratory equipment.

- Dominant Region: North America (led by the United States).

- Key Drivers for Regional Dominance:

- Advanced healthcare infrastructure.

- High per capita healthcare expenditure.

- Strong R&D ecosystem.

- Favorable regulatory environment for innovation.

- Leading Segment (Type): Engineer Plastics.

- PEEK: For implantable devices, high-stress surgical tools.

- PC: For diagnostic and imaging equipment.

- Leading Segments (Application):

- Surgical Instruments: Driven by procedure volume and infection control.

- Disposables: Fueled by hygiene concerns and cost-effectiveness.

- Diagnosis Instruments: Benefiting from point-of-care testing and lab equipment advancements.

Medical Plastics Industry Product Developments

Recent product developments in the Medical Plastics Industry are characterized by a strong focus on enhancing biocompatibility, improving antimicrobial properties, and achieving greater sustainability. Innovations in PEEK for spinal implants and complex orthopedic devices are gaining traction. Advancements in antimicrobial Polypropylene (PP) and Polyethylene (PE) are being introduced for high-contact surfaces in medical devices and sterile packaging. The development of bio-based and biodegradable medical plastics is also a significant trend, offering a more environmentally responsible alternative for certain applications, especially disposables. These innovations are driven by the need for materials that can reduce infection rates, improve patient outcomes, and meet evolving environmental regulations, providing a competitive edge for manufacturers who can offer enhanced performance and sustainability.

Key Drivers of Medical Plastics Industry Growth

The growth of the Medical Plastics Industry is propelled by several interconnected factors. The continuously aging global population leads to an increased demand for healthcare services and medical devices. A parallel trend is the rising prevalence of chronic diseases, necessitating long-term treatment and the use of advanced medical equipment. Technological advancements in minimally invasive surgery and drug delivery systems are creating new applications for specialized polymers. Furthermore, increasing healthcare spending globally, particularly in emerging economies, expands market access and demand. The persistent focus on infection control fuels the demand for single-use medical plastics, while regulatory support for medical innovation encourages the development and adoption of new materials and devices.

- Demographic Shifts: Aging population and rising chronic disease rates.

- Technological Advancements: Minimally invasive surgery, advanced drug delivery.

- Economic Factors: Increasing global healthcare expenditure.

- Public Health Imperatives: Emphasis on infection control and single-use devices.

- Regulatory Environment: Support for medical device innovation.

Challenges in the Medical Plastics Industry Market

Despite its growth trajectory, the Medical Plastics Industry faces several challenges. Stringent and evolving regulatory requirements from bodies like the FDA and EMA can lead to extended product development cycles and increased compliance costs. Volatile raw material prices, often linked to petrochemical markets, can impact manufacturing costs and profitability. The inherent complexities of sterilization processes for certain plastics require specialized materials and validation, posing a technical challenge. Concerns regarding the environmental impact of plastic waste, particularly from single-use devices, are driving a demand for sustainable alternatives, which are still in early stages of widespread adoption. Moreover, the intense competition from both established players and emerging niche manufacturers necessitates continuous innovation and cost optimization.

- Regulatory Hurdles: Strict compliance and lengthy approval processes.

- Supply Chain Volatility: Fluctuating raw material costs.

- Sterilization Challenges: Material compatibility and validation.

- Environmental Concerns: Plastic waste and demand for sustainability.

- Competitive Pressures: Need for innovation and cost efficiency.

Emerging Opportunities in Medical Plastics Industry

The Medical Plastics Industry is ripe with emerging opportunities driven by continuous innovation and evolving healthcare needs. The growing field of regenerative medicine and tissue engineering presents a significant opportunity for advanced biocompatible and resorbable polymers. The expansion of telemedicine and remote patient monitoring will drive demand for sophisticated, lightweight, and durable plastic components for connected medical devices. Further advancements in 3D printing (additive manufacturing) for personalized medical devices and implants are opening new avenues for specialized medical plastics. Strategic partnerships between material suppliers, device manufacturers, and research institutions can accelerate the development and commercialization of novel solutions. The increasing focus on circular economy principles within the healthcare sector also presents an opportunity for companies developing advanced recycling technologies for medical plastics.

Leading Players in the Medical Plastics Industry Sector

- Celanese Corporation

- Daicel Corporation

- DuPont

- Eastman Chemical Company

- Ensinger

- GW Plastics

- Mitsubishi Chemical Corporation

- Nolato AB (publ)

- NUSIL

- Orthoplastics Ltd

- Röchling SE & Co KG

- SABIC

- Saint-Gobain Performance Plastics

- Solvay

- Sylvin Technologies

- Teknor Apex

- Westlake Plastics

Key Milestones in Medical Plastics Industry Industry

- 2019: Launch of new antimicrobial polymers for medical devices by leading chemical companies, addressing infection control.

- 2020: Increased demand for single-use plastics driven by the COVID-19 pandemic, impacting supply chains and production.

- 2021: Significant investment in R&D for biodegradable and bio-based medical plastics by major corporations.

- 2022: Advancements in PEEK material processing for complex implantable devices, expanding its application range.

- 2023: Growing adoption of 3D printing technologies for personalized medical devices, leading to demand for specialized printing filaments.

- 2024 (Estimated): Further integration of AI and machine learning in material design and quality control for medical plastics.

Strategic Outlook for Medical Plastics Industry Market

The strategic outlook for the Medical Plastics Industry is exceptionally promising, fueled by ongoing global healthcare advancements and a sustained demand for innovative material solutions. Growth accelerators will include the continued development of high-performance engineering plastics for sophisticated medical devices, the expansion of applications for biocompatible and resorbable polymers, and the increasing adoption of sustainable and eco-friendly plastic alternatives. Strategic partnerships aimed at co-developing next-generation materials and manufacturing processes will be crucial. Companies that can effectively navigate the complex regulatory landscape while demonstrating a commitment to product safety, efficacy, and environmental responsibility will be best positioned for long-term success. The future market potential lies in addressing unmet clinical needs through advanced material science and intelligent manufacturing.

Medical Plastics Industry Segmentation

-

1. Type

-

1.1. Traditional Plastics

- 1.1.1. Polyethylene (PE)

- 1.1.2. Polypropylene (PP)

- 1.1.3. Polystyrene(PS)

- 1.1.4. Polyvinylchloride(PVC)

-

1.2. Engineer Plastics

- 1.2.1. Acrylonitrile butadiene styrene (ABS)

- 1.2.2. Polycarbonate (PC)

- 1.2.3. Polymethylmethacrylate (PMMA)

- 1.2.4. Polyetheretherketone (PEEK)

- 1.2.5. Polyoxymethylene (POM)

- 1.2.6. Polyphenylene Oxide (PPO)

- 1.2.7. Others

-

1.1. Traditional Plastics

-

2. Application

- 2.1. Surgical instruments

- 2.2. Disposables

- 2.3. Diagnosis instruments

- 2.4. Sterilization trays

- 2.5. Anesthetic and imaging equipment

- 2.6. Others

Medical Plastics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. MiddleEast and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Medical Plastics Industry Regional Market Share

Geographic Coverage of Medical Plastics Industry

Medical Plastics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Medical Devices from the Asia-Pacific Region; Expanding Prosthetics Market

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand for Medical Devices from the Asia-Pacific Region; Expanding Prosthetics Market

- 3.4. Market Trends

- 3.4.1. Surgical Instruments Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Traditional Plastics

- 5.1.1.1. Polyethylene (PE)

- 5.1.1.2. Polypropylene (PP)

- 5.1.1.3. Polystyrene(PS)

- 5.1.1.4. Polyvinylchloride(PVC)

- 5.1.2. Engineer Plastics

- 5.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 5.1.2.2. Polycarbonate (PC)

- 5.1.2.3. Polymethylmethacrylate (PMMA)

- 5.1.2.4. Polyetheretherketone (PEEK)

- 5.1.2.5. Polyoxymethylene (POM)

- 5.1.2.6. Polyphenylene Oxide (PPO)

- 5.1.2.7. Others

- 5.1.1. Traditional Plastics

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Surgical instruments

- 5.2.2. Disposables

- 5.2.3. Diagnosis instruments

- 5.2.4. Sterilization trays

- 5.2.5. Anesthetic and imaging equipment

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. MiddleEast and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Traditional Plastics

- 6.1.1.1. Polyethylene (PE)

- 6.1.1.2. Polypropylene (PP)

- 6.1.1.3. Polystyrene(PS)

- 6.1.1.4. Polyvinylchloride(PVC)

- 6.1.2. Engineer Plastics

- 6.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 6.1.2.2. Polycarbonate (PC)

- 6.1.2.3. Polymethylmethacrylate (PMMA)

- 6.1.2.4. Polyetheretherketone (PEEK)

- 6.1.2.5. Polyoxymethylene (POM)

- 6.1.2.6. Polyphenylene Oxide (PPO)

- 6.1.2.7. Others

- 6.1.1. Traditional Plastics

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Surgical instruments

- 6.2.2. Disposables

- 6.2.3. Diagnosis instruments

- 6.2.4. Sterilization trays

- 6.2.5. Anesthetic and imaging equipment

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Traditional Plastics

- 7.1.1.1. Polyethylene (PE)

- 7.1.1.2. Polypropylene (PP)

- 7.1.1.3. Polystyrene(PS)

- 7.1.1.4. Polyvinylchloride(PVC)

- 7.1.2. Engineer Plastics

- 7.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 7.1.2.2. Polycarbonate (PC)

- 7.1.2.3. Polymethylmethacrylate (PMMA)

- 7.1.2.4. Polyetheretherketone (PEEK)

- 7.1.2.5. Polyoxymethylene (POM)

- 7.1.2.6. Polyphenylene Oxide (PPO)

- 7.1.2.7. Others

- 7.1.1. Traditional Plastics

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Surgical instruments

- 7.2.2. Disposables

- 7.2.3. Diagnosis instruments

- 7.2.4. Sterilization trays

- 7.2.5. Anesthetic and imaging equipment

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Traditional Plastics

- 8.1.1.1. Polyethylene (PE)

- 8.1.1.2. Polypropylene (PP)

- 8.1.1.3. Polystyrene(PS)

- 8.1.1.4. Polyvinylchloride(PVC)

- 8.1.2. Engineer Plastics

- 8.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 8.1.2.2. Polycarbonate (PC)

- 8.1.2.3. Polymethylmethacrylate (PMMA)

- 8.1.2.4. Polyetheretherketone (PEEK)

- 8.1.2.5. Polyoxymethylene (POM)

- 8.1.2.6. Polyphenylene Oxide (PPO)

- 8.1.2.7. Others

- 8.1.1. Traditional Plastics

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Surgical instruments

- 8.2.2. Disposables

- 8.2.3. Diagnosis instruments

- 8.2.4. Sterilization trays

- 8.2.5. Anesthetic and imaging equipment

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Traditional Plastics

- 9.1.1.1. Polyethylene (PE)

- 9.1.1.2. Polypropylene (PP)

- 9.1.1.3. Polystyrene(PS)

- 9.1.1.4. Polyvinylchloride(PVC)

- 9.1.2. Engineer Plastics

- 9.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 9.1.2.2. Polycarbonate (PC)

- 9.1.2.3. Polymethylmethacrylate (PMMA)

- 9.1.2.4. Polyetheretherketone (PEEK)

- 9.1.2.5. Polyoxymethylene (POM)

- 9.1.2.6. Polyphenylene Oxide (PPO)

- 9.1.2.7. Others

- 9.1.1. Traditional Plastics

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Surgical instruments

- 9.2.2. Disposables

- 9.2.3. Diagnosis instruments

- 9.2.4. Sterilization trays

- 9.2.5. Anesthetic and imaging equipment

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. MiddleEast and Africa Medical Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Traditional Plastics

- 10.1.1.1. Polyethylene (PE)

- 10.1.1.2. Polypropylene (PP)

- 10.1.1.3. Polystyrene(PS)

- 10.1.1.4. Polyvinylchloride(PVC)

- 10.1.2. Engineer Plastics

- 10.1.2.1. Acrylonitrile butadiene styrene (ABS)

- 10.1.2.2. Polycarbonate (PC)

- 10.1.2.3. Polymethylmethacrylate (PMMA)

- 10.1.2.4. Polyetheretherketone (PEEK)

- 10.1.2.5. Polyoxymethylene (POM)

- 10.1.2.6. Polyphenylene Oxide (PPO)

- 10.1.2.7. Others

- 10.1.1. Traditional Plastics

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Surgical instruments

- 10.2.2. Disposables

- 10.2.3. Diagnosis instruments

- 10.2.4. Sterilization trays

- 10.2.5. Anesthetic and imaging equipment

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Celanese Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daicel Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DuPont

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eastman Chemical Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ensinger

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GW Plastics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Chemical Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nolato AB (publ)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NUSIL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Orthoplastics Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Röchling SE & Co KG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SABIC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Saint-Gobain Performance Plastics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Solvay

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sylvin Technologies

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Teknor Apex

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Westlake Plastics*List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Celanese Corporation

List of Figures

- Figure 1: Global Medical Plastics Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Medical Plastics Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: Asia Pacific Medical Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Medical Plastics Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Medical Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Medical Plastics Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Medical Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Medical Plastics Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: North America Medical Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Medical Plastics Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: North America Medical Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Medical Plastics Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Medical Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Medical Plastics Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Medical Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Medical Plastics Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Medical Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Medical Plastics Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Medical Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Medical Plastics Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Medical Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Medical Plastics Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Medical Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Medical Plastics Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Medical Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: MiddleEast and Africa Medical Plastics Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: MiddleEast and Africa Medical Plastics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: MiddleEast and Africa Medical Plastics Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: MiddleEast and Africa Medical Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: MiddleEast and Africa Medical Plastics Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: MiddleEast and Africa Medical Plastics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Medical Plastics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Medical Plastics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Medical Plastics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Medical Plastics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Medical Plastics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Medical Plastics Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Medical Plastics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Medical Plastics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Medical Plastics Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Plastics Industry?

The projected CAGR is approximately 5.56%.

2. Which companies are prominent players in the Medical Plastics Industry?

Key companies in the market include Celanese Corporation, Daicel Corporation, DuPont, Eastman Chemical Company, Ensinger, GW Plastics, Mitsubishi Chemical Corporation, Nolato AB (publ), NUSIL, Orthoplastics Ltd, Röchling SE & Co KG, SABIC, Saint-Gobain Performance Plastics, Solvay, Sylvin Technologies, Teknor Apex, Westlake Plastics*List Not Exhaustive.

3. What are the main segments of the Medical Plastics Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.46 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Medical Devices from the Asia-Pacific Region; Expanding Prosthetics Market.

6. What are the notable trends driving market growth?

Surgical Instruments Application to Dominate the Market.

7. Are there any restraints impacting market growth?

; Increasing Demand for Medical Devices from the Asia-Pacific Region; Expanding Prosthetics Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Plastics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Plastics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Plastics Industry?

To stay informed about further developments, trends, and reports in the Medical Plastics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence