Key Insights

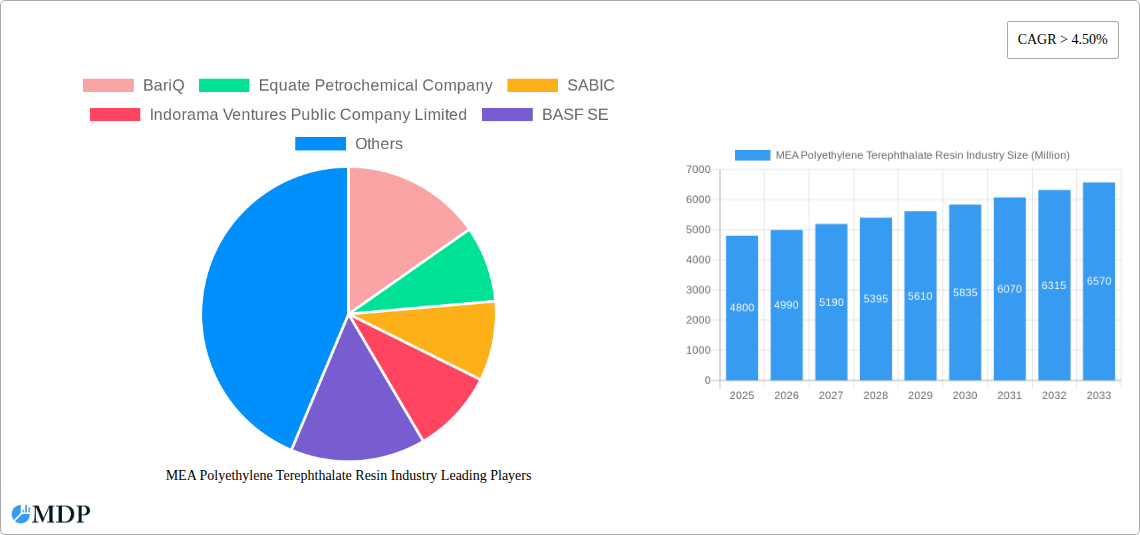

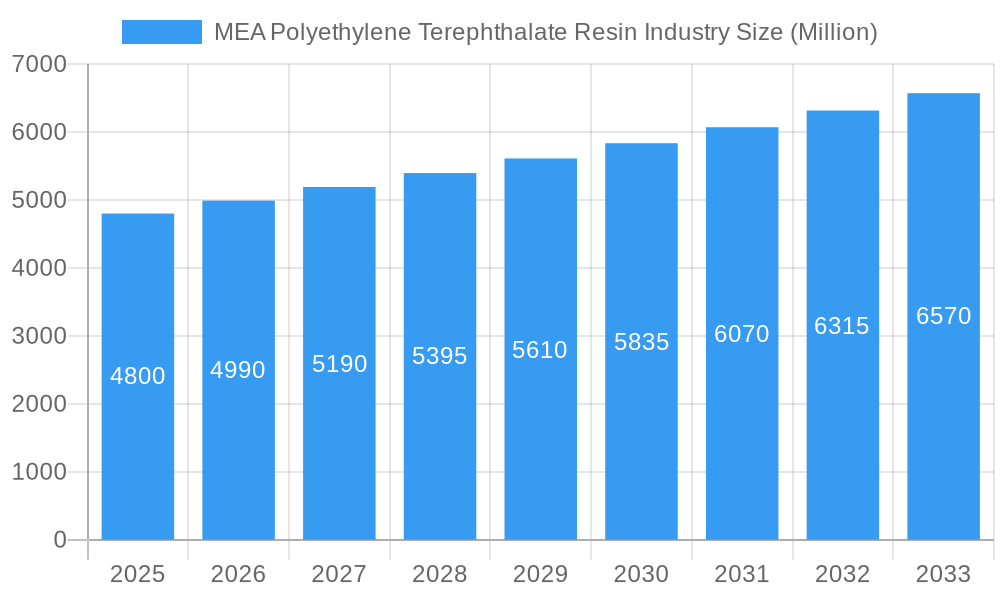

The Middle East and Africa (MEA) Polyethylene Terephthalate (PET) Resin market is projected for significant expansion, anticipating a market size of USD 1.2 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 5.5% through 2033. This growth is largely propelled by the robust demand from the Food and Beverage sector, attributed to a growing regional population and rising disposable incomes. The automotive industry is also a key contributor, utilizing PET resins for their lightweight and durable characteristics in vehicle components. Additionally, the expanding Electrical & Electronics and Healthcare sectors, requiring advanced packaging and materials, are significant drivers of this market's positive trajectory. The increasing adoption of sustainable packaging, including recycled PET (rPET), is a notable trend, encouraging investment in advanced recycling technologies and bio-based materials.

MEA Polyethylene Terephthalate Resin Industry Market Size (In Billion)

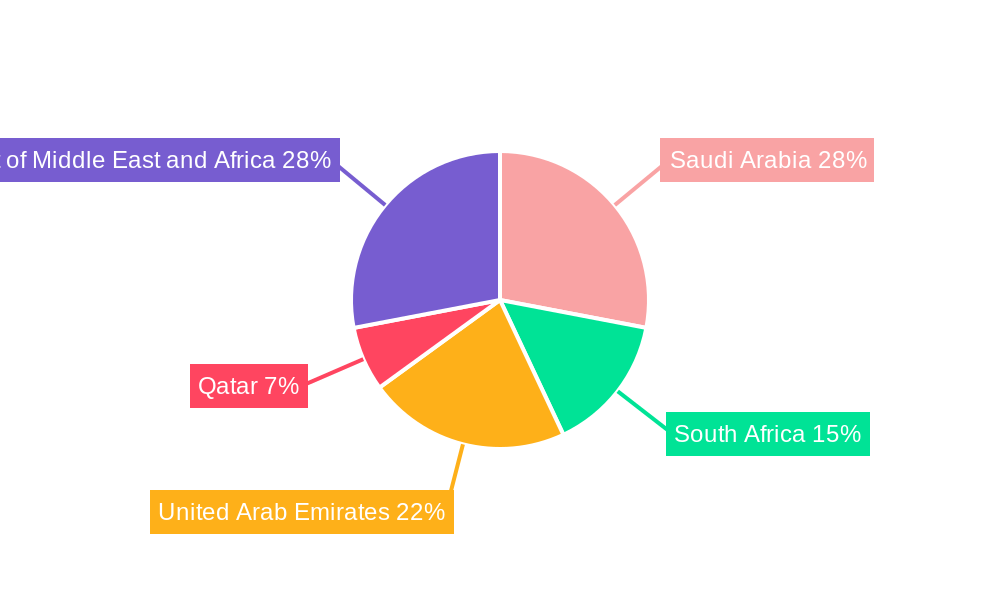

However, the MEA PET Resin market encounters certain challenges. Fluctuations in raw material prices, particularly crude oil derivatives, can affect production costs. Stringent environmental regulations and heightened attention to plastic waste management, while fostering sustainability, may necessitate substantial capital investment for compliance and the adoption of new technologies. The competitive landscape features major global and regional players such as SABIC, Indorama Ventures, and BASF SE, actively pursuing strategic partnerships, mergers, and acquisitions to enhance market presence and product offerings. Key regions like Saudi Arabia and the United Arab Emirates are expected to dominate consumption and production, supported by supportive industrial policies and infrastructure development.

MEA Polyethylene Terephthalate Resin Industry Company Market Share

MEA Polyethylene Terephthalate Resin Industry: Comprehensive Market Analysis and Future Outlook (2019-2033)

Report Description:

Dive into the dynamic MEA Polyethylene Terephthalate (PET) Resin Industry with this in-depth market report. Covering the historical period of 2019-2024 and extending to a detailed forecast from 2025-2033, with a base year of 2025, this report offers unparalleled insights into market size, trends, and growth drivers. Analyze critical segments including Bottles, Films and Sheets, and Other Product Types, and explore their impact across key End-user Industries such as Food and Beverage, Automotive, Electrical and Electronics, Healthcare, and Consumer Goods. Understand the geographical landscape with a focus on Saudi Arabia, South Africa, United Arab Emirates, Qatar, and the Rest of Middle-East and Africa. This report leverages high-traffic keywords to maximize search visibility, making it an essential resource for industry stakeholders seeking to understand the evolving MEA PET resin market.

MEA Polyethylene Terephthalate Resin Industry Market Dynamics & Concentration

The MEA Polyethylene Terephthalate (PET) resin industry exhibits a moderate to high level of market concentration, with a few key players dominating production and supply. Major companies like SABIC, Indorama Ventures Public Company Limited, Equate Petrochemical Company, and Dow command significant market share, influencing pricing and innovation. Innovation drivers are primarily focused on enhancing sustainability through recycled PET (rPET) integration and developing high-performance PET grades for specialized applications. Regulatory frameworks are increasingly emphasizing environmental responsibility, pushing for increased PET recycling rates and the use of sustainable feedstocks. Product substitutes, while present in certain applications (e.g., other polymers for packaging), face challenges in matching PET's cost-effectiveness, recyclability, and performance characteristics. End-user trends are leaning towards lightweighting, durability, and increased recyclability, directly impacting PET resin demand. Merger and acquisition (M&A) activities, though not always frequent, play a crucial role in consolidating market positions and expanding production capacities. For instance, Alpek's acquisition of OCTAL Holding SAOC signals a move towards increased value-added PET sheet production. The overall M&A deal count is projected to remain stable, with strategic acquisitions focused on regional expansion and technological advancements.

MEA Polyethylene Terephthalate Resin Industry Industry Trends & Analysis

The MEA Polyethylene Terephthalate (PET) resin industry is experiencing robust growth, propelled by a confluence of economic, demographic, and environmental factors. The increasing demand from the Food and Beverage sector remains a primary growth driver, fueled by a rising population and expanding middle class across the Middle East and Africa. The shift towards packaged foods and beverages, coupled with a growing preference for convenient and safe packaging solutions, directly translates to higher PET resin consumption for bottles, films, and sheets. The Automotive sector is another significant contributor, with PET resins finding applications in lightweight components and interior trims, contributing to fuel efficiency and design flexibility. The Electrical and Electronics industry is also a growing market, utilizing PET for its insulating properties and durability in components and housings. Furthermore, the Healthcare sector's demand for sterile, safe, and transparent packaging for pharmaceuticals and medical devices further bolsters PET consumption. Consumer goods, ranging from personal care products to household items, also represent a substantial market.

Technological disruptions are largely centered around advancements in recycling technologies and the development of bio-based PET alternatives. The increasing focus on the circular economy is driving innovation in chemical and mechanical recycling, enabling the production of high-quality rPET that can substitute virgin PET in various applications. This trend is further supported by governmental initiatives and consumer pressure for sustainable packaging solutions. Consumer preferences are evolving, with a strong emphasis on environmental impact and product safety. This is leading to a demand for recyclable packaging and products made from recycled materials. Competitive dynamics within the MEA region are shaped by the presence of established global players and the emergence of regional manufacturers. Strategic partnerships and vertical integration are key strategies employed by companies to enhance their market position and ensure a stable supply chain. The projected Compound Annual Growth Rate (CAGR) for the MEA PET resin market is estimated to be around 5.5% during the forecast period (2025-2033), indicating a healthy expansion trajectory. Market penetration of rPET is expected to increase significantly as recycling infrastructure improves and regulatory mandates become more stringent.

Leading Markets & Segments in MEA Polyethylene Terephthalate Resin Industry

The MEA Polyethylene Terephthalate (PET) Resin industry is characterized by the dominance of specific segments and geographies, each driven by unique economic and consumer trends.

Product Type Dominance:

- Bottles: This segment consistently holds the largest market share, driven by the insatiable demand from the Food and Beverage industry. The convenience, clarity, and shatterproof nature of PET bottles make them the preferred choice for beverages, water, and edible oils across the region. Economic growth and a rising disposable income in key MEA nations directly correlate with increased consumption of bottled goods.

- Films and Sheets: This segment is witnessing substantial growth, particularly in applications requiring durability and barrier properties. The increasing adoption of flexible packaging in the Food and Beverage sector, along with the use of PET films in the Consumer Goods and Electrical and Electronics industries for protective layers and insulation, contributes significantly. The growing e-commerce landscape also fuels demand for robust packaging solutions.

- Other Product Types: This encompasses a diverse range of applications, including textiles, automotive components, and industrial films. While smaller in market share individually, these niche applications collectively represent a growing area for PET resin utilization as technological advancements unlock new possibilities.

End-user Industry Dominance:

- Food and Beverage: Unquestionably the leading end-user industry, its demand underpins the majority of PET resin consumption in the MEA region. This is propelled by population growth, urbanization, and evolving dietary habits that favor packaged food and drinks. Saudi Arabia and the United Arab Emirates are major hubs due to their large populations and significant retail infrastructure.

- Consumer Goods: This sector benefits from the increasing disposable incomes and the rising demand for packaged household products, personal care items, and cosmetics. The aesthetic appeal and protective qualities of PET packaging make it a preferred choice for manufacturers.

- Automotive: The MEA region's focus on diversifying its economy beyond oil and gas has led to increased investments in manufacturing, including the automotive sector. PET resins are increasingly used for interior components and lightweighting, contributing to improved fuel efficiency and sustainability. Saudi Arabia and the UAE are key contributors to this segment's growth.

- Electrical and Electronics: Growing urbanization and technological adoption are driving demand for consumer electronics. PET's excellent electrical insulation properties and durability make it suitable for components and housings in this rapidly expanding sector.

- Healthcare: The increasing emphasis on public health and the growing private healthcare sector in the MEA region are driving demand for PET in pharmaceutical packaging, medical devices, and diagnostic equipment, where its inertness and sterilization capabilities are crucial.

Geographical Dominance:

- Saudi Arabia: With its large population, significant economic diversification efforts, and robust manufacturing base, Saudi Arabia stands as a dominant market for PET resin. Its strategic location and investment in industrial infrastructure further enhance its position.

- United Arab Emirates: The UAE's status as a regional trade and logistics hub, coupled with its advanced infrastructure and a growing consumer market, makes it another leading geography for PET resin consumption and application development.

- Rest of Middle-East and Africa: This vast and diverse region presents significant untapped potential. Growing populations, increasing urbanization, and a developing industrial base in countries like Egypt, Nigeria, and South Africa are expected to drive substantial demand growth for PET resins in the coming years. Economic policies aimed at attracting foreign investment and developing local manufacturing capabilities will be crucial in unlocking this potential.

MEA Polyethylene Terephthalate Resin Industry Product Developments

Recent product developments in the MEA PET resin industry highlight a strong focus on sustainability and enhanced performance. SABIC's introduction of LNP ELCRIN WF0061BiQ resin in May 2022, derived from ocean-bound PET bottles, exemplifies the industry's commitment to chemical upcycling and the circular economy. This novel material's application in consumer electronics, such as fan housings and electrical connectors, alongside automotive seating, showcases its versatility and premium attributes. These advancements offer competitive advantages by addressing growing consumer and regulatory demand for eco-friendly materials without compromising on quality or functionality, thereby opening new market opportunities and strengthening brand reputation.

Key Drivers of MEA Polyethylene Terephthalate Resin Industry Growth

The growth of the MEA Polyethylene Terephthalate (PET) Resin industry is primarily driven by several key factors. Economically, rising disposable incomes and growing populations across the Middle East and Africa are significantly boosting demand for packaged goods, particularly beverages and food products, which are key applications for PET. Technologically, advancements in recycling processes are making recycled PET (rPET) a more viable and cost-effective alternative to virgin PET, aligning with global sustainability trends and regulatory pressures. Regulatory frameworks are increasingly favoring the use of recyclable materials and promoting the circular economy, further encouraging the adoption of PET. Furthermore, the expanding infrastructure development and manufacturing capabilities in sectors like automotive and electronics are creating new avenues for PET resin utilization in components and packaging.

Challenges in the MEA Polyethylene Terephthalate Resin Industry Market

Despite its growth potential, the MEA Polyethylene Terephthalate (PET) Resin industry faces several challenges. Regulatory hurdles, particularly concerning waste management and recycling infrastructure, can slow down the widespread adoption of rPET in some countries. Supply chain disruptions, exacerbated by geopolitical instability and fluctuating raw material prices, can impact production costs and availability. Intense competitive pressures from both domestic and international players, coupled with the potential for substitution by other polymers in specific applications, necessitate continuous innovation and cost optimization. Additionally, the initial investment required for advanced recycling technologies can be a significant barrier for smaller manufacturers.

Emerging Opportunities in MEA Polyethylene Terephthalate Resin Industry

Emerging opportunities in the MEA Polyethylene Terephthalate (PET) Resin industry are largely centered around sustainability and the development of niche applications. The increasing global and regional emphasis on the circular economy presents a significant opportunity for companies investing in advanced recycling technologies and the production of high-quality rPET. Strategic partnerships between resin manufacturers, recyclers, and brand owners can create robust supply chains for recycled materials. Furthermore, technological breakthroughs in developing bio-based PET or enhancing the properties of PET for high-performance applications in the automotive and electrical sectors can unlock new market segments. Market expansion into rapidly developing African economies, with their growing populations and increasing demand for packaged goods, offers substantial long-term growth potential.

Leading Players in the MEA Polyethylene Terephthalate Resin Industry Sector

- BariQ

- Equate Petrochemical Company

- SABIC

- Indorama Ventures Public Company Limited

- BASF SE

- Invista

- Dow

- Eastman Chemical Company

- KAP Industrial

- GAP Polymers

- Bamberger Polymers

- Alpek S A B de C V

Key Milestones in MEA Polyethylene Terephthalate Resin Industry Industry

- May 2022: SABIC introduced LNP ELCRIN WF0061BiQ resin, a novel material that uses ocean-bound polyethylene terephthalate (PET) bottles as a feed stream for chemical upcycling into polybutylene terephthalate (PBT) resin. This resin can be used for consumer electronics applications such as fan housings in computers and automotive seating, as well as electrical connectors and enclosures, signifying a major advancement in sustainable material innovation and circular economy initiatives.

- February 2022: Alpek signed an agreement to acquire OCTAL Holding SAOC ('Octal'). This acquisition aimed to expand Alpek's position in the market and increase its value-added production offerings in Polyethylene Terephthalate (PET) sheets, indicating a strategic move towards market consolidation and enhanced product portfolios.

Strategic Outlook for MEA Polyethylene Terephthalate Resin Industry Market

The strategic outlook for the MEA Polyethylene Terephthalate (PET) Resin Industry is highly positive, with growth accelerators focused on sustainability, innovation, and market expansion. The increasing global demand for recycled content and the drive towards a circular economy will continue to propel investments in advanced recycling technologies and the production of rPET. Companies that can effectively integrate sustainable practices into their operations and offer high-quality recycled resins will gain a significant competitive edge. Furthermore, strategic collaborations and partnerships across the value chain, from raw material sourcing to end-product manufacturing, will be crucial for market players to navigate evolving regulatory landscapes and consumer preferences. Exploring untapped opportunities in the rapidly growing African markets, coupled with continuous product innovation to cater to specialized applications in automotive and electronics, will be key to long-term success and market leadership.

MEA Polyethylene Terephthalate Resin Industry Segmentation

-

1. Product Type

- 1.1. Bottles

- 1.2. Films and Sheets

- 1.3. Other Product Types

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Automotive

- 2.3. Electrical and Electronics

- 2.4. Healthcare

- 2.5. Consumer Goods

- 2.6. Other End-user Industries

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. United Arab Emirates

- 3.4. Qatar

- 3.5. Rest of Middle-East and Africa

MEA Polyethylene Terephthalate Resin Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. United Arab Emirates

- 4. Qatar

- 5. Rest of Middle East and Africa

MEA Polyethylene Terephthalate Resin Industry Regional Market Share

Geographic Coverage of MEA Polyethylene Terephthalate Resin Industry

MEA Polyethylene Terephthalate Resin Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Food and Beverage Industry; Increasing Emphasis on Recycling

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Substitute Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Food and Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Polyethylene Terephthalate Resin Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles

- 5.1.2. Films and Sheets

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Automotive

- 5.2.3. Electrical and Electronics

- 5.2.4. Healthcare

- 5.2.5. Consumer Goods

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. United Arab Emirates

- 5.3.4. Qatar

- 5.3.5. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. United Arab Emirates

- 5.4.4. Qatar

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia MEA Polyethylene Terephthalate Resin Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bottles

- 6.1.2. Films and Sheets

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food and Beverage

- 6.2.2. Automotive

- 6.2.3. Electrical and Electronics

- 6.2.4. Healthcare

- 6.2.5. Consumer Goods

- 6.2.6. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. United Arab Emirates

- 6.3.4. Qatar

- 6.3.5. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South Africa MEA Polyethylene Terephthalate Resin Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bottles

- 7.1.2. Films and Sheets

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food and Beverage

- 7.2.2. Automotive

- 7.2.3. Electrical and Electronics

- 7.2.4. Healthcare

- 7.2.5. Consumer Goods

- 7.2.6. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. United Arab Emirates

- 7.3.4. Qatar

- 7.3.5. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. United Arab Emirates MEA Polyethylene Terephthalate Resin Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bottles

- 8.1.2. Films and Sheets

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food and Beverage

- 8.2.2. Automotive

- 8.2.3. Electrical and Electronics

- 8.2.4. Healthcare

- 8.2.5. Consumer Goods

- 8.2.6. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. United Arab Emirates

- 8.3.4. Qatar

- 8.3.5. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Qatar MEA Polyethylene Terephthalate Resin Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bottles

- 9.1.2. Films and Sheets

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food and Beverage

- 9.2.2. Automotive

- 9.2.3. Electrical and Electronics

- 9.2.4. Healthcare

- 9.2.5. Consumer Goods

- 9.2.6. Other End-user Industries

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. South Africa

- 9.3.3. United Arab Emirates

- 9.3.4. Qatar

- 9.3.5. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Middle East and Africa MEA Polyethylene Terephthalate Resin Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Bottles

- 10.1.2. Films and Sheets

- 10.1.3. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food and Beverage

- 10.2.2. Automotive

- 10.2.3. Electrical and Electronics

- 10.2.4. Healthcare

- 10.2.5. Consumer Goods

- 10.2.6. Other End-user Industries

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. South Africa

- 10.3.3. United Arab Emirates

- 10.3.4. Qatar

- 10.3.5. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BariQ

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Equate Petrochemical Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SABIC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Indorama Ventures Public Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Invista

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dow

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eastman Chemical Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KAP Industrial

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GAP Polymers

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bamberger Polymers

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Alpek S A B de C V

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 BariQ

List of Figures

- Figure 1: MEA Polyethylene Terephthalate Resin Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: MEA Polyethylene Terephthalate Resin Industry Share (%) by Company 2025

List of Tables

- Table 1: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 13: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 19: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 21: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 27: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 29: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 35: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 36: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 37: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 42: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 43: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 44: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 45: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: MEA Polyethylene Terephthalate Resin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: MEA Polyethylene Terephthalate Resin Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Polyethylene Terephthalate Resin Industry?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the MEA Polyethylene Terephthalate Resin Industry?

Key companies in the market include BariQ, Equate Petrochemical Company, SABIC, Indorama Ventures Public Company Limited, BASF SE, Invista, Dow, Eastman Chemical Company, KAP Industrial, GAP Polymers, Bamberger Polymers, Alpek S A B de C V.

3. What are the main segments of the MEA Polyethylene Terephthalate Resin Industry?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Food and Beverage Industry; Increasing Emphasis on Recycling.

6. What are the notable trends driving market growth?

Increasing Demand from Food and Beverage Industry.

7. Are there any restraints impacting market growth?

Increasing Usage of Substitute Products.

8. Can you provide examples of recent developments in the market?

In May 2022, SABIC introduced LNP ELCRIN WF0061BiQ resin, a novel material that uses ocean-bound polyethylene terephthalate (PET) bottles as a feed stream for chemical upcycling into polybutylene terephthalate (PBT) resin. This resin can be used for consumer electronics applications such as fan housings in computers and automotive seating, as well as electrical connectors and enclosures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Polyethylene Terephthalate Resin Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Polyethylene Terephthalate Resin Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Polyethylene Terephthalate Resin Industry?

To stay informed about further developments, trends, and reports in the MEA Polyethylene Terephthalate Resin Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence