Key Insights

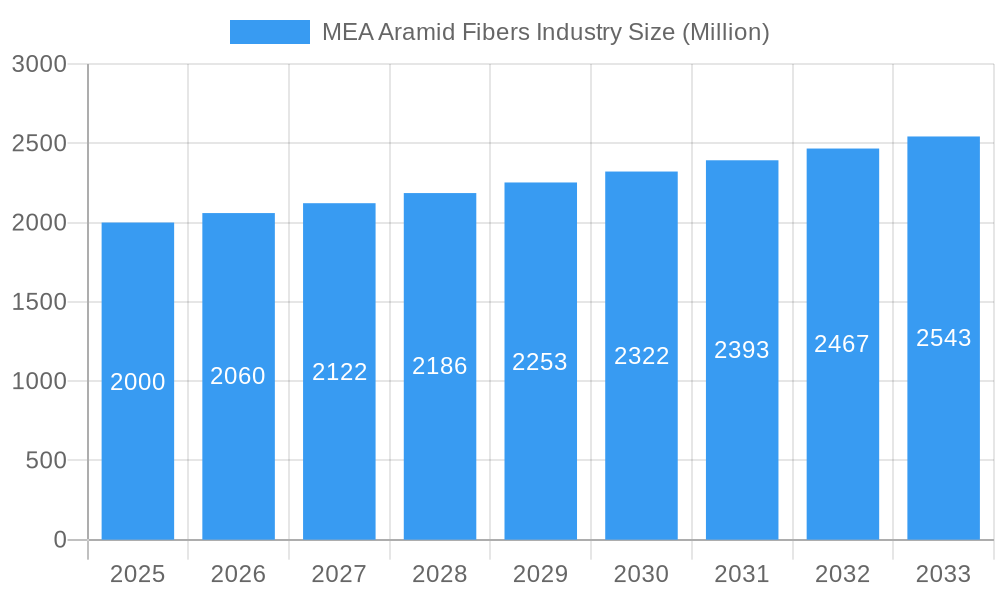

The Middle East and Africa (MEA) aramid fibers market, while smaller than established regions like North America or Asia-Pacific, exhibits promising growth potential driven by increasing demand from key sectors. The market's expansion is fueled by the region's burgeoning automotive industry, particularly in countries like Saudi Arabia and the UAE, which are investing heavily in infrastructure development and vehicle manufacturing. Furthermore, the growth of the aerospace and defense sector, coupled with strategic investments in telecommunications infrastructure across several MEA nations, significantly contributes to the demand for high-performance aramid fibers. While the precise market size for MEA in 2025 is not provided, we can reasonably estimate it based on the global market size of $59.45 billion and applying a proportionate share considering the region's economic growth and industrial development. Considering the global CAGR of over 3%, a conservative estimate for the MEA market size in 2025 could be around $2 billion. This figure will likely increase as the region's industrial sectors continue to mature and adopt advanced materials. Significant constraints could include import reliance, fluctuations in oil prices (impactful on several sectors), and potential regulatory hurdles related to material sourcing and manufacturing.

MEA Aramid Fibers Industry Market Size (In Billion)

The market segmentation in the MEA region largely mirrors global trends, with para-aramid and meta-aramid dominating product types. However, the relative proportion of each segment might vary based on specific industry needs within the region. Aerospace and defense, given its strategic importance in many MEA countries, likely represents a substantial end-user segment, followed by the automotive sector and the burgeoning telecommunications infrastructure projects. Key players in the global aramid fiber market, such as DuPont and Teijin Aramid, are likely to have a significant presence in the MEA market through direct sales, partnerships, or distribution networks. Local players may also emerge, driven by growing domestic demand and government initiatives to foster local manufacturing capabilities. The forecast period of 2025-2033 suggests continued growth, particularly driven by infrastructural investment and diversification of economies within the MEA region. Factors such as technological advancements in aramid fiber production, sustainability considerations, and increasing awareness of the material's high-performance characteristics will further shape the market's trajectory.

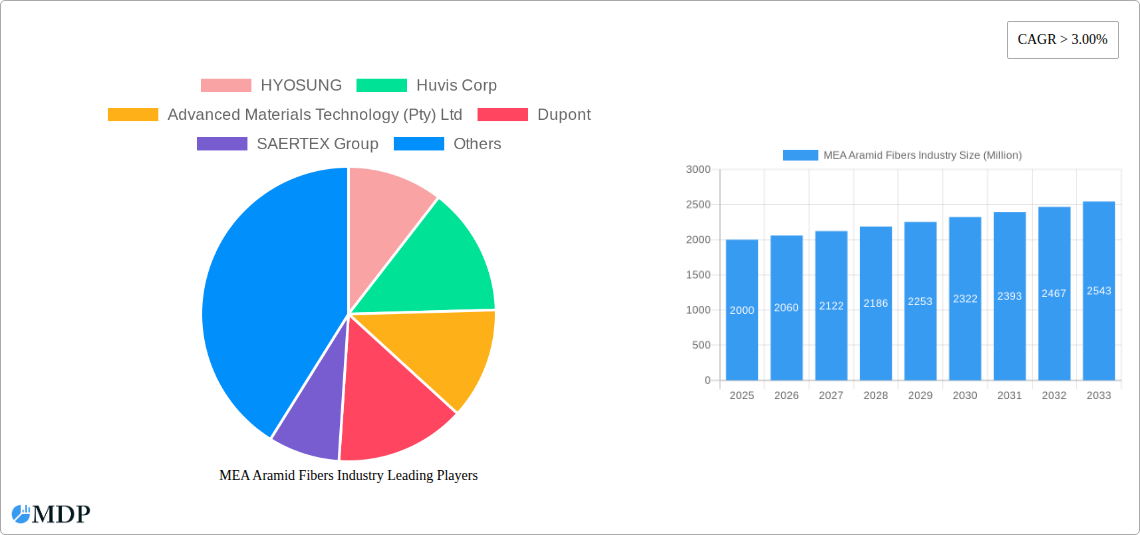

MEA Aramid Fibers Industry Company Market Share

MEA Aramid Fibers Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) Aramid Fibers industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. From market size and segmentation to competitive landscapes and future growth prospects, this report covers all key aspects, empowering informed decision-making. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. The report utilizes data and projections to paint a complete picture of MEA's aramid fiber market, expected to be worth xx Million by 2033.

MEA Aramid Fibers Industry Market Dynamics & Concentration

This section analyzes the MEA aramid fibers market's competitive landscape, identifying key trends influencing its growth and evolution. The market is characterized by a moderate level of concentration, with several key players dominating the scene. Market share data reveals that HYOSUNG and Teijin Aramid B V hold significant portions of the market, while other companies like Huvis Corp, DuPont, and TORAY INDUSTRIES INC. contribute substantially to the overall market volume.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Ongoing research and development in high-performance materials, particularly for lightweight and high-strength applications, are major drivers.

- Regulatory Frameworks: Government regulations regarding safety and environmental standards impact the production and usage of aramid fibers in various end-use industries.

- Product Substitutes: Competition from alternative materials like carbon fiber and other advanced composites influences market dynamics.

- End-User Trends: The increasing demand for lightweight, high-strength materials across sectors like aerospace and automotive drives market growth.

- M&A Activities: The past five years witnessed approximately xx M&A deals within the MEA aramid fibers market, signifying a degree of consolidation amongst leading companies.

MEA Aramid Fibers Industry Industry Trends & Analysis

The MEA aramid fibers market is experiencing robust growth, driven by increasing demand across various end-use sectors. This growth is further fueled by technological advancements leading to improved material properties and expanded application possibilities. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, indicating significant market expansion. Market penetration rates show strong growth across automotive and aerospace segments, while the electrical and electronics sectors also exhibit promising adoption rates. Competitive dynamics are intense, with companies focusing on product differentiation, technological innovation, and strategic partnerships to maintain their market share. The increasing adoption of sustainable manufacturing practices is shaping the market, pushing companies towards environmentally friendly production methods.

Leading Markets & Segments in MEA Aramid Fibers Industry

The automotive sector represents the largest end-use segment within the MEA aramid fibers market, driven by stringent fuel efficiency standards and the need for lightweight vehicles. The aerospace and defense sectors are other significant contributors, fueled by demand for high-performance materials in aircraft and defense systems. Within product types, para-aramid fibers dominate the market due to their superior strength-to-weight ratio. The UAE and Saudi Arabia are the leading markets in MEA, benefiting from substantial investments in infrastructure projects.

- Key Drivers for Leading Markets:

- UAE: Strong economic growth, robust infrastructure development, and government support for advanced materials industries.

- Saudi Arabia: Significant investments in aerospace and defense, as well as the automotive sector, are driving demand.

- Dominance Analysis: The dominance of automotive and para-aramid segments is attributed to their cost-effectiveness, excellent performance, and growing demand across various applications.

MEA Aramid Fibers Industry Product Developments

Recent product developments focus on enhancing the performance and application range of aramid fibers. This includes innovations in fiber processing techniques, leading to improved strength, durability, and heat resistance. The development of new composite materials incorporating aramid fibers expands their applications into emerging sectors. These advancements cater to the growing need for lightweight and high-performance materials, making aramid fibers a competitive choice across various industries.

Key Drivers of MEA Aramid Fibers Industry Growth

Several key factors are propelling the growth of the MEA aramid fibers market. Technological advancements leading to superior material properties play a significant role. The expanding automotive and aerospace sectors contribute significantly to market demand. Furthermore, supportive government policies and investments in infrastructure projects in several MEA countries fuel market expansion.

Challenges in the MEA Aramid Fibers Industry Market

Despite promising growth prospects, the MEA aramid fibers market faces several challenges. Fluctuations in raw material prices and supply chain disruptions pose risks. Intense competition among established players and the entry of new competitors pressure profit margins. Regulatory hurdles and stringent environmental regulations also add to the complexity of market operations. These factors could collectively impact market growth by approximately xx% if not addressed effectively.

Emerging Opportunities in MEA Aramid Fibers Industry

The MEA aramid fibers market presents several exciting opportunities. Technological breakthroughs in fiber production and composite material development will create new applications. Strategic partnerships and collaborations among industry players will drive innovation and market penetration. Expanding into new end-use sectors and regional markets can yield significant growth potential.

Leading Players in the MEA Aramid Fibers Industry Sector

- HYOSUNG

- Huvis Corp

- Advanced Materials Technology (Pty) Ltd

- Dupont

- SAERTEX Group

- YF International bv

- Teijin Aramid B V

- TORAY INDUSTRIES INC

- Tango Engineering

Key Milestones in MEA Aramid Fibers Industry Industry

- 2021: HYOSUNG launched a new generation of high-strength para-aramid fiber, expanding its market share.

- 2022: A significant investment by a major player in a new aramid fiber production facility in the UAE boosted regional capacity.

- 2023: Several strategic partnerships were formed to improve the supply chain efficiency and boost the research and development activities. (Further milestones will be detailed in the full report).

Strategic Outlook for MEA Aramid Fibers Industry Market

The MEA aramid fibers market is poised for continued growth, driven by technological advancements, increasing demand from key sectors, and supportive government policies. Strategic opportunities lie in focusing on innovation, strengthening supply chains, and expanding into new markets. Companies that adapt to evolving industry trends and embrace sustainable practices will be best positioned to capture significant market share and drive long-term growth.

MEA Aramid Fibers Industry Segmentation

-

1. Product Type

- 1.1. Para-aramid

- 1.2. Meta-aramid

-

2. End-user Industry

- 2.1. Aerospace and Defense

- 2.2. Automotive

- 2.3. Electrical and Electronics

- 2.4. Sporting Goods

- 2.5. Other En

-

3. Geography

-

3.1. Middle East and Africa

- 3.1.1. Saudi Arabia

- 3.1.2. South Africa

- 3.1.3. Nigeria

- 3.1.4. Qatar

- 3.1.5. Egypt

- 3.1.6. UAE

- 3.1.7. Rest of Middle East and Africa

-

3.1. Middle East and Africa

MEA Aramid Fibers Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. Saudi Arabia

- 1.2. South Africa

- 1.3. Nigeria

- 1.4. Qatar

- 1.5. Egypt

- 1.6. UAE

- 1.7. Rest of Middle East and Africa

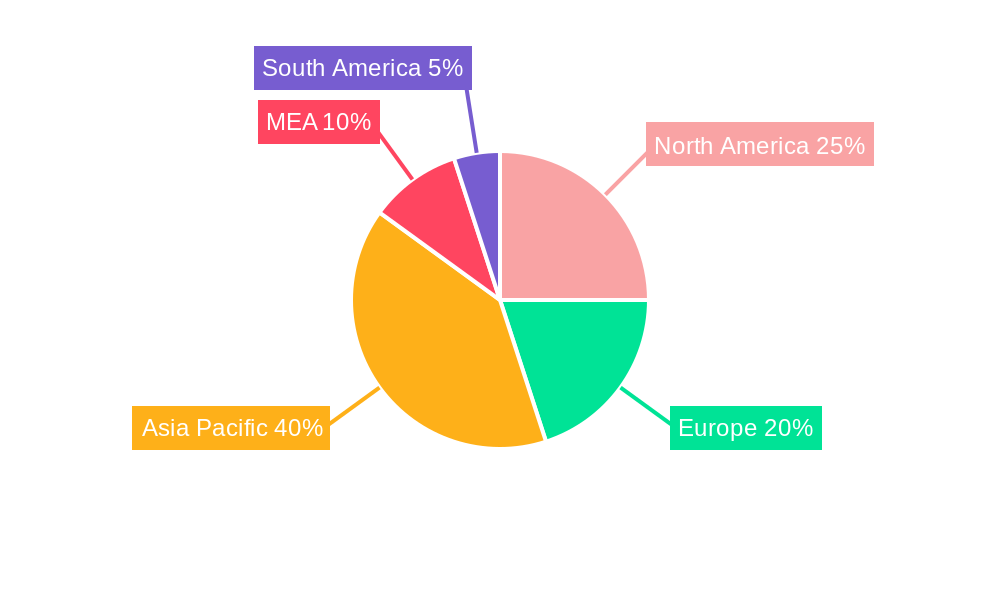

MEA Aramid Fibers Industry Regional Market Share

Geographic Coverage of MEA Aramid Fibers Industry

MEA Aramid Fibers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increase in Demand for Light Weight Materials in Automotive Industry; The Increase in Usage of Aramid Fibers as a Potential Substitute for Steel Materials; Other Drivers

- 3.3. Market Restrains

- 3.3.1. The Availability of Better Alternatives For Aramid Fibers; Other Restraints

- 3.4. Market Trends

- 3.4.1. Aerospace and Defence Sector Dominated the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Aramid Fibers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Para-aramid

- 5.1.2. Meta-aramid

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Aerospace and Defense

- 5.2.2. Automotive

- 5.2.3. Electrical and Electronics

- 5.2.4. Sporting Goods

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle East and Africa

- 5.3.1.1. Saudi Arabia

- 5.3.1.2. South Africa

- 5.3.1.3. Nigeria

- 5.3.1.4. Qatar

- 5.3.1.5. Egypt

- 5.3.1.6. UAE

- 5.3.1.7. Rest of Middle East and Africa

- 5.3.1. Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HYOSUNG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Huvis Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Advanced Materials Technology (Pty) Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dupont

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SAERTEX Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 YF International bv*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Teijin Aramid B V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TORAY INDUSTRIES INC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tango Engineering

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 HYOSUNG

List of Figures

- Figure 1: Global MEA Aramid Fibers Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Middle East and Africa MEA Aramid Fibers Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: Middle East and Africa MEA Aramid Fibers Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Middle East and Africa MEA Aramid Fibers Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Middle East and Africa MEA Aramid Fibers Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Middle East and Africa MEA Aramid Fibers Industry Revenue (Million), by Geography 2025 & 2033

- Figure 7: Middle East and Africa MEA Aramid Fibers Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Middle East and Africa MEA Aramid Fibers Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Middle East and Africa MEA Aramid Fibers Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Aramid Fibers Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global MEA Aramid Fibers Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global MEA Aramid Fibers Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global MEA Aramid Fibers Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global MEA Aramid Fibers Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global MEA Aramid Fibers Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Global MEA Aramid Fibers Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global MEA Aramid Fibers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia MEA Aramid Fibers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Africa MEA Aramid Fibers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Nigeria MEA Aramid Fibers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Qatar MEA Aramid Fibers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Egypt MEA Aramid Fibers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: UAE MEA Aramid Fibers Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Middle East and Africa MEA Aramid Fibers Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Aramid Fibers Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the MEA Aramid Fibers Industry?

Key companies in the market include HYOSUNG, Huvis Corp, Advanced Materials Technology (Pty) Ltd, Dupont, SAERTEX Group, YF International bv*List Not Exhaustive, Teijin Aramid B V, TORAY INDUSTRIES INC, Tango Engineering.

3. What are the main segments of the MEA Aramid Fibers Industry?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.45 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increase in Demand for Light Weight Materials in Automotive Industry; The Increase in Usage of Aramid Fibers as a Potential Substitute for Steel Materials; Other Drivers.

6. What are the notable trends driving market growth?

Aerospace and Defence Sector Dominated the Market.

7. Are there any restraints impacting market growth?

The Availability of Better Alternatives For Aramid Fibers; Other Restraints.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are being covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Aramid Fibers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Aramid Fibers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Aramid Fibers Industry?

To stay informed about further developments, trends, and reports in the MEA Aramid Fibers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence