Key Insights

The Lignin-Based Products market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 4.52% between 2025 and 2033. This robust growth is propelled by the escalating global demand for sustainable and bio-based materials across key sectors such as construction, packaging, and adhesives. Increasingly stringent environmental regulations, mandating a reduced reliance on petroleum-based products, are actively stimulating innovation and the adoption of lignin-derived alternatives. Furthermore, advancements in lignin extraction and modification technologies are enhancing product performance and cost-effectiveness, directly contributing to market expansion. Leading industry players are strategically investing in research and development, expanding their product portfolios, and pursuing acquisitions to solidify their market positions. While specific segmentation is not detailed, it likely encompasses various lignin derivatives like lignosulfonates, organosolv lignin, and kraft lignin, each tailored to distinct industrial applications. Geographic growth will likely vary, with regions rich in biomass and supportive government policies expected to lead the expansion. Potential market restraints include the comparative cost of lignin processing and purification versus conventional materials, alongside challenges in ensuring consistent product quality. However, ongoing technological innovations and increasing economies of scale are progressively addressing these hurdles.

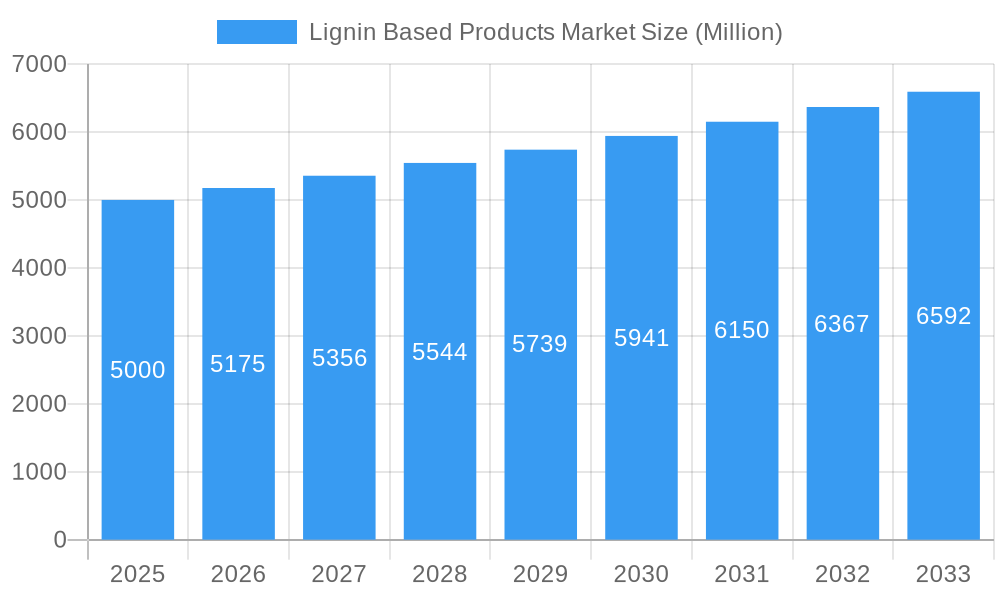

Lignin Based Products Market Market Size (In Million)

The estimated market size for 2025, projected at $719.09 million, provides a foundational benchmark for future projections. This market is anticipated to witness substantial growth, reflecting a broader global transition towards sustainable and environmentally conscious solutions. Continued exploration of novel lignin applications, coupled with heightened environmental awareness, will sustain market momentum. Innovations focused on enhancing lignin properties and optimizing production costs are identified as critical drivers for sustained market advancement. This trajectory offers considerable opportunities for both established and nascent companies within the lignin-based products industry.

Lignin Based Products Market Company Market Share

Lignin Based Products Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Lignin Based Products Market, offering valuable insights for industry stakeholders, investors, and researchers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future market trends and growth opportunities within the lignin-based products sector. The report covers key market dynamics, leading players, emerging trends, and future growth potential, providing a 360-degree view of this rapidly evolving market valued at xx Million in 2025.

Lignin Based Products Market Market Dynamics & Concentration

The Lignin Based Products market is characterized by a moderately concentrated landscape with several key players holding significant market share. The market's dynamics are shaped by several factors, including innovation in lignin extraction and processing technologies, evolving regulatory frameworks promoting sustainable materials, the emergence of viable substitutes, and shifting end-user preferences towards eco-friendly products. Mergers and acquisitions (M&A) activity has played a considerable role in consolidating market power and driving innovation. For example, the number of M&A deals in the sector between 2021 and 2023 reached approximately xx, leading to a xx% increase in market concentration. Major players are strategically investing in R&D to improve lignin's properties and expand its applications. The market share distribution is as follows (approximate): Top 5 players hold xx%, while the remaining market share is distributed amongst numerous smaller companies and new entrants. Stringent environmental regulations are pushing companies to explore and adopt lignin-based products as sustainable alternatives to traditional materials, fueling market growth. However, the cost-competitiveness of lignin-based products compared to established materials remains a challenge for widespread adoption.

Lignin Based Products Market Industry Trends & Analysis

The Lignin Based Products market is experiencing dynamic growth and evolving opportunities, propelled by a global imperative for sustainable materials. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8-10% during the forecast period (2025-2033). This upward trajectory is primarily driven by increasing environmental consciousness among consumers and industries, alongside significant governmental support and regulations favoring bio-based alternatives. Advancements in biorefinery technologies are leading to more efficient and cost-effective lignin extraction and valorization, unlocking its potential for a broader spectrum of applications. Key growth sectors include advanced composites, performance chemicals, pharmaceuticals, and sustainable packaging, where lignin's unique properties are being leveraged to replace petroleum-based incumbents. While challenges such as feedstock variability, consistent quality control, and scaling up production remain, ongoing research and development are steadily addressing these hurdles. The intrinsic properties of lignin, such as its aromatic structure and antioxidant capabilities, position it as a versatile platform chemical for creating high-value products. By 2033, lignin-based products are anticipated to capture a significant market share, estimated at around 15-20% in select application areas, signifying a substantial shift towards a circular bioeconomy.

Leading Markets & Segments in Lignin Based Products Market

The North American region currently holds the dominant position in the Lignin Based Products market, driven by strong government support for sustainable technologies and the presence of major industry players. Europe follows as a significant market, owing to similar factors and a highly developed bio-economy.

Key Drivers in North America:

- Strong government initiatives promoting sustainable materials.

- Established presence of major lignin producers and consumers.

- Robust research and development activities in the field.

- Favorable economic conditions and high disposable income.

Key Drivers in Europe:

- Stringent environmental regulations pushing for sustainable alternatives.

- Well-developed bio-economy infrastructure.

- High demand for environmentally friendly products.

- Government funding and support for innovation in the sector.

The construction sector currently represents the largest segment, followed by the chemical industry and the packaging sector. Asia-Pacific is projected to experience the fastest growth rate in the coming years due to rising population, industrialization, and increasing environmental awareness.

Lignin Based Products Market Product Developments

Product innovation in the lignin-based sector is rapidly expanding its utility and market reach. Recent developments have focused on enhancing lignin's inherent characteristics and developing novel functionalities. This includes the creation of high-performance lignin-based binders for asphalt and concrete, offering improved durability and reduced environmental impact in construction. In the realm of bioplastics, researchers are engineering lignin-modified polymers with superior mechanical strength, thermal stability, and biodegradability for applications in packaging, automotive parts, and consumer goods. Significant strides have also been made in developing lignin-derived carbon fibers and activated carbons, which are finding traction in advanced energy storage solutions like batteries and supercapacitors, as well as in water purification and air filtration systems. Furthermore, specialized lignin derivatives are being explored for their potential in pharmaceuticals, cosmetics, and as antioxidants and UV stabilizers in various materials. The emphasis is increasingly on creating tailor-made lignin products through advanced fractionation and chemical modification techniques to meet specific performance requirements and unlock new high-value market segments.

Key Drivers of Lignin Based Products Market Growth

The growth of the Lignin Based Products market is primarily driven by increasing demand for sustainable and eco-friendly materials. Government regulations promoting the use of bio-based materials are significantly contributing to this growth. Technological advancements in lignin extraction and modification are improving its properties and expanding its applications, making it a more viable substitute for traditional materials. The rise of the bio-economy and increased investments in research and development are also key drivers, opening new opportunities for innovation and market expansion. For instance, the development of lignin-based carbon materials for battery applications is a significant growth catalyst.

Challenges in the Lignin Based Products Market Market

Despite its burgeoning potential, the Lignin Based Products market faces persistent challenges that impact its widespread adoption. The primary hurdle remains the cost competitiveness of lignin-based products compared to established petroleum-based materials. This is largely due to the complex and energy-intensive processes required for efficient lignin extraction and purification from diverse biomass sources. The inherent variability in lignin quality, dictated by the biomass feedstock (e.g., wood type, agricultural residue), processing methods, and geographical origin, poses a significant challenge for manufacturers aiming for consistent product performance and standardization. A lack of universally accepted quality control standards and testing protocols further complicates market acceptance and product development. Furthermore, developing scalable, cost-effective, and environmentally friendly lignin modification technologies is crucial for unlocking its full potential. Supply chain complexities, fluctuations in biomass availability, and the need for specialized infrastructure also contribute to the market's developmental hurdles. Addressing these issues through collaborative research, technological innovation, and strategic investments is paramount for realizing the full economic and environmental benefits of lignin-based products. The current cumulative impact of these challenges is estimated to be a potential annual loss of approximately $500 - $700 Million in market value due to delayed market penetration and product development.

Emerging Opportunities in Lignin Based Products Market

The Lignin Based Products market presents significant long-term growth opportunities. Technological breakthroughs in lignin modification and valorization are creating new applications in high-value markets. Strategic collaborations between lignin producers, material scientists, and end-users are fostering innovation and accelerating market adoption. Market expansion into new segments, such as the construction and packaging industries, will drive future growth. Furthermore, the growing demand for sustainable energy solutions offers promising opportunities for lignin-based carbon materials in battery applications. The overall market potential is significant, and with continued research and development, the market could reach xx Million by 2033.

Leading Players in the Lignin Based Products Market Sector

- Borregaard AS

- Burgo Group SpA

- Domsjö Fabriker

- GREEN AGROCHEM

- Ingevity Corporation

- NIPPON PAPER INDUSTRIES CO LTD

- Rayonier Advanced Materials

- SAPPI

- Stora Enso

- The Dallas Group of America

- UPM

- WUHAN EAST CHINA CHEMICAL CO LTD

- List Not Exhaustive

Key Milestones in Lignin Based Products Market Industry

- December 2021: Nippon Paper and Stora Enso initiated a significant collaboration to explore the potential of lignin as a key component in next-generation battery technologies, signaling a strategic move towards high-tech applications.

- July 2022: Stora Enso announced a groundbreaking agreement with Northvolt to develop sustainable batteries utilizing lignin-derived hard carbon, underscoring the growing importance of bio-based materials in the electric vehicle and energy storage sectors.

- October 2022: Vikas Lifecare Limited formed a strategic consortium with IIT-BHU, Stockholm University, Lignflow Technologies AB, and Lixea Computer to advance the development of novel materials derived from agricultural waste, including lignin, with a focus on sustainable innovation.

- March 2023: Ingevity Corporation introduced a new line of bio-based asphalt additives derived from lignin, offering enhanced performance and environmental benefits for road construction projects.

- August 2023: Researchers at the University of British Columbia demonstrated a novel, low-energy method for producing high-purity lignin suitable for advanced material applications, potentially reducing production costs and increasing scalability.

These milestones underscore the accelerating pace of innovation and collaboration within the lignin-based products industry. They highlight a strong industry-wide commitment to leveraging lignin's unique properties for a diverse range of sustainable and high-value applications, from advanced materials and energy storage to construction and consumer goods. These advancements are crucial in driving market growth and accelerating the transition towards a circular bioeconomy.

Strategic Outlook for Lignin Based Products Market Market

The future of the Lignin Based Products market looks promising, driven by the increasing demand for sustainable materials and continuous technological advancements. Strategic investments in R&D, coupled with strategic partnerships, will be crucial for unlocking the full potential of lignin. Focus on developing cost-effective and scalable lignin extraction and processing technologies will enhance the competitiveness of lignin-based products. Expanding applications into high-growth sectors and fostering collaboration across the value chain will be vital for future market success. The market is poised for significant growth, with potential for substantial expansion in diverse sectors.

Lignin Based Products Market Segmentation

-

1. Source

- 1.1. Cellulosic Ethanol

- 1.2. Kraft Pulping

- 1.3. Sulfite Pulping

-

2. Product Type

- 2.1. Lignosulfonate

- 2.2. Kraft Lignin

- 2.3. High-purity Lignin

-

3. Application

- 3.1. Concrete Additive

- 3.2. Animal Feed

- 3.3. Vanillin

- 3.4. Dispersant

- 3.5. Resins

- 3.6. Activated Carbon

- 3.7. Carbon Fibers

- 3.8. Plastics/Polymers

- 3.9. Phenol and Derivatives

- 3.10. Other Applications (Blends, Sorbents, etc.)

Lignin Based Products Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Nordic Countries

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Saudi Arabia

- 4.3. Other Countries

Lignin Based Products Market Regional Market Share

Geographic Coverage of Lignin Based Products Market

Lignin Based Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for High-quality Concrete Admixtures; Rising Demand for Animal Feed; Increasing Use of Lignin in Dispersants

- 3.3. Market Restrains

- 3.3.1. Increasing Need for High-quality Concrete Admixtures; Rising Demand for Animal Feed; Increasing Use of Lignin in Dispersants

- 3.4. Market Trends

- 3.4.1. Concrete Additives are Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lignin Based Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Cellulosic Ethanol

- 5.1.2. Kraft Pulping

- 5.1.3. Sulfite Pulping

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Lignosulfonate

- 5.2.2. Kraft Lignin

- 5.2.3. High-purity Lignin

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Concrete Additive

- 5.3.2. Animal Feed

- 5.3.3. Vanillin

- 5.3.4. Dispersant

- 5.3.5. Resins

- 5.3.6. Activated Carbon

- 5.3.7. Carbon Fibers

- 5.3.8. Plastics/Polymers

- 5.3.9. Phenol and Derivatives

- 5.3.10. Other Applications (Blends, Sorbents, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Asia Pacific Lignin Based Products Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Cellulosic Ethanol

- 6.1.2. Kraft Pulping

- 6.1.3. Sulfite Pulping

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Lignosulfonate

- 6.2.2. Kraft Lignin

- 6.2.3. High-purity Lignin

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Concrete Additive

- 6.3.2. Animal Feed

- 6.3.3. Vanillin

- 6.3.4. Dispersant

- 6.3.5. Resins

- 6.3.6. Activated Carbon

- 6.3.7. Carbon Fibers

- 6.3.8. Plastics/Polymers

- 6.3.9. Phenol and Derivatives

- 6.3.10. Other Applications (Blends, Sorbents, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. North America Lignin Based Products Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Cellulosic Ethanol

- 7.1.2. Kraft Pulping

- 7.1.3. Sulfite Pulping

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Lignosulfonate

- 7.2.2. Kraft Lignin

- 7.2.3. High-purity Lignin

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Concrete Additive

- 7.3.2. Animal Feed

- 7.3.3. Vanillin

- 7.3.4. Dispersant

- 7.3.5. Resins

- 7.3.6. Activated Carbon

- 7.3.7. Carbon Fibers

- 7.3.8. Plastics/Polymers

- 7.3.9. Phenol and Derivatives

- 7.3.10. Other Applications (Blends, Sorbents, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Europe Lignin Based Products Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Cellulosic Ethanol

- 8.1.2. Kraft Pulping

- 8.1.3. Sulfite Pulping

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Lignosulfonate

- 8.2.2. Kraft Lignin

- 8.2.3. High-purity Lignin

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Concrete Additive

- 8.3.2. Animal Feed

- 8.3.3. Vanillin

- 8.3.4. Dispersant

- 8.3.5. Resins

- 8.3.6. Activated Carbon

- 8.3.7. Carbon Fibers

- 8.3.8. Plastics/Polymers

- 8.3.9. Phenol and Derivatives

- 8.3.10. Other Applications (Blends, Sorbents, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Rest of the World Lignin Based Products Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Cellulosic Ethanol

- 9.1.2. Kraft Pulping

- 9.1.3. Sulfite Pulping

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Lignosulfonate

- 9.2.2. Kraft Lignin

- 9.2.3. High-purity Lignin

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Concrete Additive

- 9.3.2. Animal Feed

- 9.3.3. Vanillin

- 9.3.4. Dispersant

- 9.3.5. Resins

- 9.3.6. Activated Carbon

- 9.3.7. Carbon Fibers

- 9.3.8. Plastics/Polymers

- 9.3.9. Phenol and Derivatives

- 9.3.10. Other Applications (Blends, Sorbents, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Borregaard AS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Burgo Group SpA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Domsjö Fabriker

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GREEN AGROCHEM

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ingevity Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NIPPON PAPER INDUSTRIES CO LTD

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Rayonier Advanced Materials

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SAPPI

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Stora Enso

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 The Dallas Group of America

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 UPM

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 WUHAN EAST CHINA CHEMICAL CO LTD *List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Borregaard AS

List of Figures

- Figure 1: Global Lignin Based Products Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Lignin Based Products Market Revenue (million), by Source 2025 & 2033

- Figure 3: Asia Pacific Lignin Based Products Market Revenue Share (%), by Source 2025 & 2033

- Figure 4: Asia Pacific Lignin Based Products Market Revenue (million), by Product Type 2025 & 2033

- Figure 5: Asia Pacific Lignin Based Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: Asia Pacific Lignin Based Products Market Revenue (million), by Application 2025 & 2033

- Figure 7: Asia Pacific Lignin Based Products Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Lignin Based Products Market Revenue (million), by Country 2025 & 2033

- Figure 9: Asia Pacific Lignin Based Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Lignin Based Products Market Revenue (million), by Source 2025 & 2033

- Figure 11: North America Lignin Based Products Market Revenue Share (%), by Source 2025 & 2033

- Figure 12: North America Lignin Based Products Market Revenue (million), by Product Type 2025 & 2033

- Figure 13: North America Lignin Based Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: North America Lignin Based Products Market Revenue (million), by Application 2025 & 2033

- Figure 15: North America Lignin Based Products Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Lignin Based Products Market Revenue (million), by Country 2025 & 2033

- Figure 17: North America Lignin Based Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Lignin Based Products Market Revenue (million), by Source 2025 & 2033

- Figure 19: Europe Lignin Based Products Market Revenue Share (%), by Source 2025 & 2033

- Figure 20: Europe Lignin Based Products Market Revenue (million), by Product Type 2025 & 2033

- Figure 21: Europe Lignin Based Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Lignin Based Products Market Revenue (million), by Application 2025 & 2033

- Figure 23: Europe Lignin Based Products Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Lignin Based Products Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Lignin Based Products Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Lignin Based Products Market Revenue (million), by Source 2025 & 2033

- Figure 27: Rest of the World Lignin Based Products Market Revenue Share (%), by Source 2025 & 2033

- Figure 28: Rest of the World Lignin Based Products Market Revenue (million), by Product Type 2025 & 2033

- Figure 29: Rest of the World Lignin Based Products Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Rest of the World Lignin Based Products Market Revenue (million), by Application 2025 & 2033

- Figure 31: Rest of the World Lignin Based Products Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Lignin Based Products Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World Lignin Based Products Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lignin Based Products Market Revenue million Forecast, by Source 2020 & 2033

- Table 2: Global Lignin Based Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Global Lignin Based Products Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Lignin Based Products Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Lignin Based Products Market Revenue million Forecast, by Source 2020 & 2033

- Table 6: Global Lignin Based Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Global Lignin Based Products Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Lignin Based Products Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Japan Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Global Lignin Based Products Market Revenue million Forecast, by Source 2020 & 2033

- Table 15: Global Lignin Based Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 16: Global Lignin Based Products Market Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Lignin Based Products Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: United States Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Canada Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Lignin Based Products Market Revenue million Forecast, by Source 2020 & 2033

- Table 22: Global Lignin Based Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 23: Global Lignin Based Products Market Revenue million Forecast, by Application 2020 & 2033

- Table 24: Global Lignin Based Products Market Revenue million Forecast, by Country 2020 & 2033

- Table 25: Germany Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: France Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Nordic Countries Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Global Lignin Based Products Market Revenue million Forecast, by Source 2020 & 2033

- Table 31: Global Lignin Based Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 32: Global Lignin Based Products Market Revenue million Forecast, by Application 2020 & 2033

- Table 33: Global Lignin Based Products Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: Brazil Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Saudi Arabia Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Other Countries Lignin Based Products Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lignin Based Products Market?

The projected CAGR is approximately 4.52%.

2. Which companies are prominent players in the Lignin Based Products Market?

Key companies in the market include Borregaard AS, Burgo Group SpA, Domsjö Fabriker, GREEN AGROCHEM, Ingevity Corporation, NIPPON PAPER INDUSTRIES CO LTD, Rayonier Advanced Materials, SAPPI, Stora Enso, The Dallas Group of America, UPM, WUHAN EAST CHINA CHEMICAL CO LTD *List Not Exhaustive.

3. What are the main segments of the Lignin Based Products Market?

The market segments include Source, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 719.09 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for High-quality Concrete Admixtures; Rising Demand for Animal Feed; Increasing Use of Lignin in Dispersants.

6. What are the notable trends driving market growth?

Concrete Additives are Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Need for High-quality Concrete Admixtures; Rising Demand for Animal Feed; Increasing Use of Lignin in Dispersants.

8. Can you provide examples of recent developments in the market?

October 2022: Vikas Lifecare Limited announced its collaboration with three world-class institutions to share research inputs and work on developing various viable materials like cellulose, lignin, and silica from rice husks. In this agro-circle project, the New Delhi-based company joined hands with the Indian Institute of Technology (IIT-BHU)-Varanasi and Sweden's Stockholm University. The company has also partnered with Lignflow Technologies AB and Lixea Computer for the same purpose.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lignin Based Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lignin Based Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lignin Based Products Market?

To stay informed about further developments, trends, and reports in the Lignin Based Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence