Key Insights

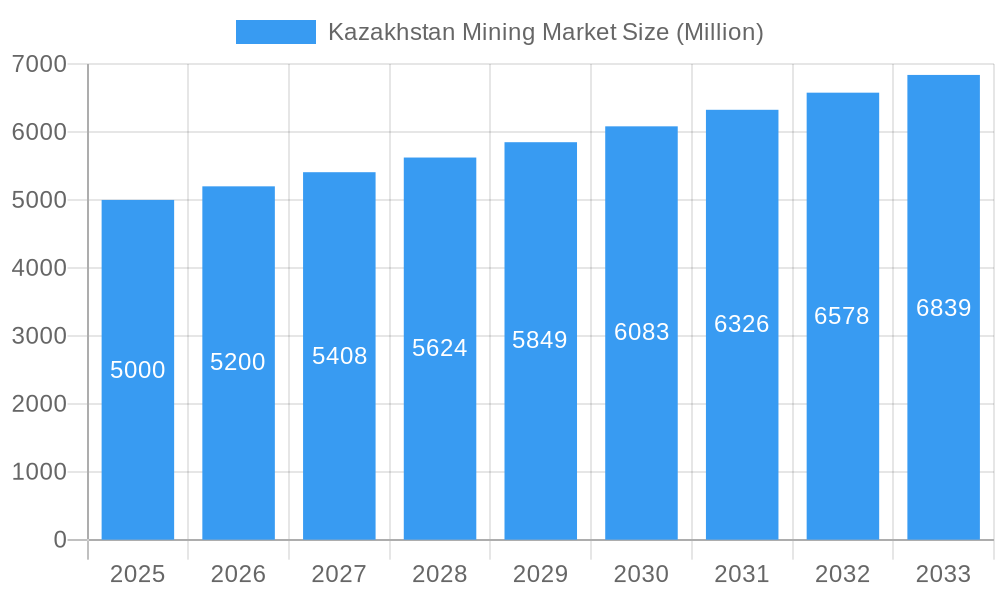

The Kazakhstan mining market is projected for significant expansion, demonstrating a compound annual growth rate (CAGR) of 11.5%. With a current market size of 29.52 billion in the base year 2024, the sector is anticipated to experience sustained growth through 2033. This robust expansion is underpinned by Kazakhstan's vast mineral wealth, including substantial reserves of uranium, copper, zinc, and iron ore, positioning it as a key global supplier. Government-led initiatives aimed at fostering foreign investment and enhancing infrastructure further bolster the favorable operating environment for mining enterprises. Concurrently, escalating global demand for these essential minerals, driven by industrialization and technological advancements in critical sectors such as renewable energy and electronics, is significantly amplifying export opportunities.

Kazakhstan Mining Market Market Size (In Billion)

While the market navigates challenges including commodity price volatility and environmental considerations inherent to mining, the overall outlook remains highly promising. The market segmentation encompasses diverse mineral types and distinct regional areas within Kazakhstan. Leading entities such as National Mining Company Tau-Ken Samruk JSC, Kazatomprom JSC, and Eurasian Resources Group are pivotal players, whose strategic decisions will profoundly shape the market's trajectory. The long-term forecast indicates continued growth, potentially at a tempered pace, influenced by global economic dynamics and evolving demand patterns. Kazakhstan's rich mineral resources and strategic geographic position ensure its enduring significance in the international mining arena. Market success will be contingent on effective environmental stewardship, the adoption of sustainable practices, and ongoing governmental support for responsible mining operations. Advancing into value-added mineral processing will be instrumental in maximizing economic benefits and ensuring long-term sustainability. The competitive landscape is expected to see increased consolidation, strategic alliances among established players, and the emergence of new entrants attracted by the abundant opportunities.

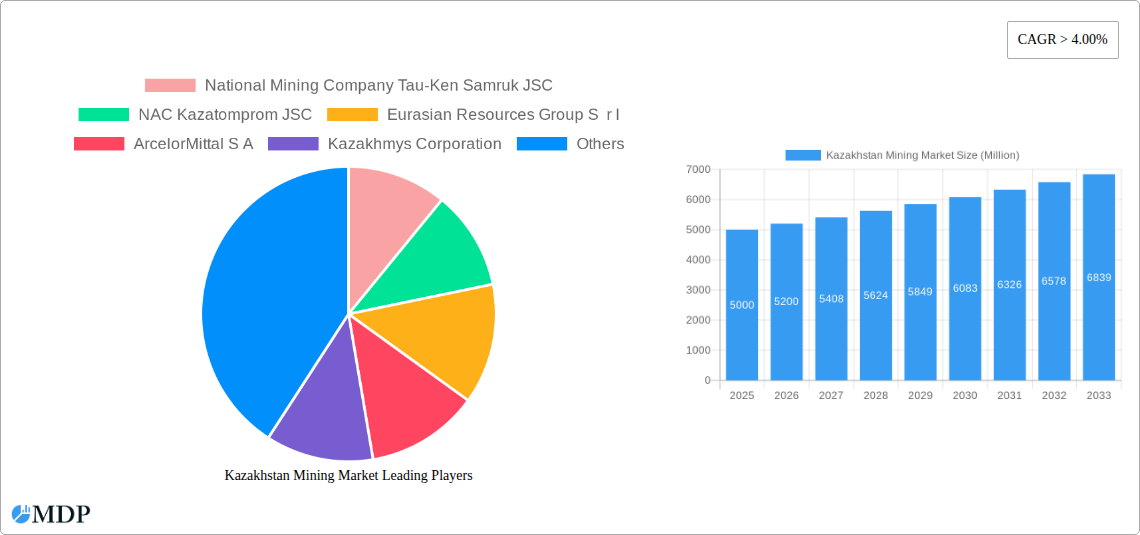

Kazakhstan Mining Market Company Market Share

Unlock the Potential: A Comprehensive Analysis of the Kazakhstan Mining Market (2019-2033)

This in-depth report provides a comprehensive analysis of the Kazakhstan mining market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils the market dynamics, growth drivers, challenges, and lucrative opportunities shaping this dynamic sector. The report leverages extensive research and data analysis to provide actionable intelligence, forecasting market trends until 2033.

Kazakhstan Mining Market Market Dynamics & Concentration

The Kazakhstan mining market, a significant contributor to the nation's GDP, exhibits a concentrated landscape dominated by a handful of major players alongside numerous smaller, specialized companies. Market share analysis reveals that National Mining Company Tau-Ken Samruk JSC, NAC Kazatomprom JSC, Eurasian Resources Group S r l, ArcelorMittal S A, Kazakhmys Corporation, KAZ Minerals PLC, and KAZZINC JSC hold a substantial portion of the market, although the exact figures vary across segments. The market concentration is influenced by factors such as government regulations, resource ownership, and the capital-intensive nature of mining operations.

Innovation drivers, primarily focused on enhancing efficiency and sustainability, include the adoption of advanced technologies like AI, automation, and improved exploration techniques. Stringent environmental regulations and a growing emphasis on responsible sourcing are shaping the industry's trajectory. Product substitutes, though limited in some segments, exist in certain areas, and the market is characterized by continuous evolution of end-user demands, necessitating adaptation and innovation to meet evolving needs. M&A activity has been moderate in recent years, with xx deals recorded between 2019 and 2024, primarily focused on consolidating resources and expanding operational capacity. This activity is expected to increase in the forecast period, driven by the ongoing industry consolidation and search for synergies among companies.

Kazakhstan Mining Market Industry Trends & Analysis

The Kazakhstan mining market demonstrates robust growth, driven by strong global demand for its diverse mineral resources. The historical period (2019-2024) shows an average annual growth rate (CAGR) of xx%, with market penetration reaching xx% in key segments. Technological disruptions, particularly in automation and data analytics, are enhancing operational efficiency and resource management. Consumer preferences, primarily focused on sustainable and ethically sourced materials, are exerting significant influence on industry practices. Competitive dynamics are characterized by intense rivalry among established players, coupled with the emergence of new entrants aiming to capitalize on the market’s growth potential. Further growth is projected to be driven by infrastructure investments, government incentives, and increasing foreign direct investment (FDI). The forecast period (2025-2033) anticipates a CAGR of xx%, fueled by continued demand and technological advancements. Market penetration is expected to reach xx% by 2033.

Leading Markets & Segments in Kazakhstan Mining Market

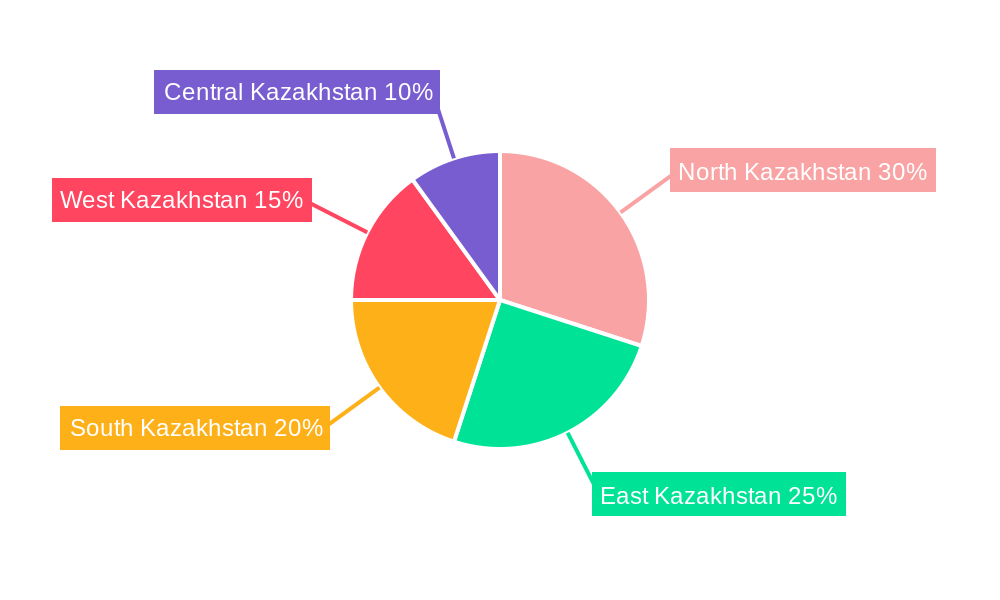

The Kazakhstan mining market showcases regional disparities in terms of resource distribution and mining activity. The dominant segment remains coal, followed by uranium, iron ore, copper, and gold. The Karaganda region stands out as a major coal producing area, while uranium production is concentrated in the north and central regions.

- Key Drivers in Dominant Segments:

- Coal: High global demand, particularly from the EU, coupled with suitable quality and logistical advantages. Government support for infrastructure development facilitating export.

- Uranium: Kazakhstan's established position as a leading uranium producer, underpinned by significant reserves and strategic partnerships.

- Metals: Significant reserves of copper, iron ore, and gold, attracting both domestic and international investment.

The dominance of these segments is underpinned by abundant resource reserves, well-established infrastructure, favorable government policies encouraging foreign investment, and consistent demand for their outputs in the global market.

Kazakhstan Mining Market Product Developments

Recent product developments have focused on improving extraction processes, optimizing resource utilization, and enhancing the sustainability of mining operations. This includes the adoption of advanced technologies for mineral processing and waste management. The emphasis on producing higher-quality products, tailored to specific end-user requirements, is also significant. These developments aim to improve overall efficiency and competitiveness, responding to evolving technological trends and market demands.

Key Drivers of Kazakhstan Mining Market Growth

The Kazakhstan mining market's growth is propelled by several key factors: robust global demand for minerals, significant untapped reserves, supportive government policies promoting investment and infrastructure development, strategic partnerships with international mining companies, and continuous technological advancements aimed at improving efficiency and sustainability.

Challenges in the Kazakhstan Mining Market Market

Challenges facing the Kazakhstan mining market include the volatility of commodity prices, environmental concerns linked to mining operations, logistical constraints in transporting minerals, and infrastructure limitations in certain regions. Furthermore, the sector faces skilled labor shortages and intense competition from other global mining hubs. These factors can significantly impact profitability and sustainability.

Emerging Opportunities in Kazakhstan Mining Market

Emerging opportunities include the exploration and development of new mineral deposits, particularly rare earth elements, advancements in technology such as AI and automation, and increasing demand for sustainable mining practices. Strategic partnerships with international companies, focused on technology transfer and investment, represent considerable potential. The development of downstream processing capabilities to add value to extracted minerals provides further opportunities for growth.

Leading Players in the Kazakhstan Mining Market Sector

- National Mining Company Tau-Ken Samruk JSC

- NAC Kazatomprom JSC

- Eurasian Resources Group S r l

- ArcelorMittal S A

- Kazakhmys Corporation

- KAZ Minerals PLC

- KAZZINC JSC

- List Not Exhaustive

Key Milestones in Kazakhstan Mining Market Industry

- July 2022: Kazakhstan exported 2.85 Million tons of coal and coke to the EU, a significant increase compared to the previous year's average of 0.81 Million tons.

- January-June 2022: Kazakhstan produced 57.4 Million tons of coal, representing a 5.9% increase year-on-year, generating a profit of USD 564 Million. These milestones highlight the sector's growth potential and strong export orientation.

Strategic Outlook for Kazakhstan Mining Market Market

The Kazakhstan mining market holds considerable long-term growth potential, driven by sustained global demand for minerals, ongoing technological advancements, and strategic initiatives to attract investment. Focusing on sustainable mining practices, developing downstream processing capabilities, and forging strategic partnerships will be crucial for maximizing future growth and capturing emerging market opportunities. The sector is poised for continued expansion and diversification in the coming years.

Kazakhstan Mining Market Segmentation

- 1. Coal

- 2. Ferrous Metals

- 3. Non Ferrous Metals

Kazakhstan Mining Market Segmentation By Geography

- 1. Kazakhstan

Kazakhstan Mining Market Regional Market Share

Geographic Coverage of Kazakhstan Mining Market

Kazakhstan Mining Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Coal Mining to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kazakhstan Mining Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coal

- 5.2. Market Analysis, Insights and Forecast - by Ferrous Metals

- 5.3. Market Analysis, Insights and Forecast - by Non Ferrous Metals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kazakhstan

- 5.1. Market Analysis, Insights and Forecast - by Coal

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 National Mining Company Tau-Ken Samruk JSC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NAC Kazatomprom JSC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eurasian Resources Group S r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ArcelorMittal S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kazakhmys Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KAZ Minerals PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KAZZINC JSC*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 National Mining Company Tau-Ken Samruk JSC

List of Figures

- Figure 1: Kazakhstan Mining Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Kazakhstan Mining Market Share (%) by Company 2025

List of Tables

- Table 1: Kazakhstan Mining Market Revenue billion Forecast, by Coal 2020 & 2033

- Table 2: Kazakhstan Mining Market Revenue billion Forecast, by Ferrous Metals 2020 & 2033

- Table 3: Kazakhstan Mining Market Revenue billion Forecast, by Non Ferrous Metals 2020 & 2033

- Table 4: Kazakhstan Mining Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Kazakhstan Mining Market Revenue billion Forecast, by Coal 2020 & 2033

- Table 6: Kazakhstan Mining Market Revenue billion Forecast, by Ferrous Metals 2020 & 2033

- Table 7: Kazakhstan Mining Market Revenue billion Forecast, by Non Ferrous Metals 2020 & 2033

- Table 8: Kazakhstan Mining Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kazakhstan Mining Market?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Kazakhstan Mining Market?

Key companies in the market include National Mining Company Tau-Ken Samruk JSC, NAC Kazatomprom JSC, Eurasian Resources Group S r l, ArcelorMittal S A, Kazakhmys Corporation, KAZ Minerals PLC, KAZZINC JSC*List Not Exhaustive.

3. What are the main segments of the Kazakhstan Mining Market?

The market segments include Coal, Ferrous Metals, Non Ferrous Metals.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.52 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Coal Mining to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In July 2022, Kazakhstan exported 2.85 million tons of coal and coke to the European Union (EU) countries since the beginning of this year, as its coal is suitable for their power plants. Kazakhstan exported an average of 0.81 million tons of coal to EU nations in the previous year. From January to June 2022, Kazakhstan produced 57.4 million tons of coal, 5.9% more than a year earlier, with a profit of 271 billion tenges (USD 564 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kazakhstan Mining Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kazakhstan Mining Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kazakhstan Mining Market?

To stay informed about further developments, trends, and reports in the Kazakhstan Mining Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence