Key Insights

The Japanese automotive engine oil market is poised for steady growth, projected to reach 45.56 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 4.8% through 2033. This expansion is fueled by the enduring demand for reliable engine lubrication across Japan's extensive automotive fleet, including commercial vehicles, motorcycles, and passenger cars. An aging vehicle population necessitates consistent maintenance and fluid replacement, providing a stable market base. Concurrently, advancements in engine technology, while potentially extending oil change intervals, are driving demand for higher-performance synthetic and semi-synthetic formulations, contributing to value growth. A competitive landscape featuring major domestic and international players like ExxonMobil Corporation, Royal Dutch Shell Plc, BP PLC (Castrol), ENEOS Corporation, FUCHS, and Motul fosters innovation and product differentiation, encouraging consumer interest in premium offerings.

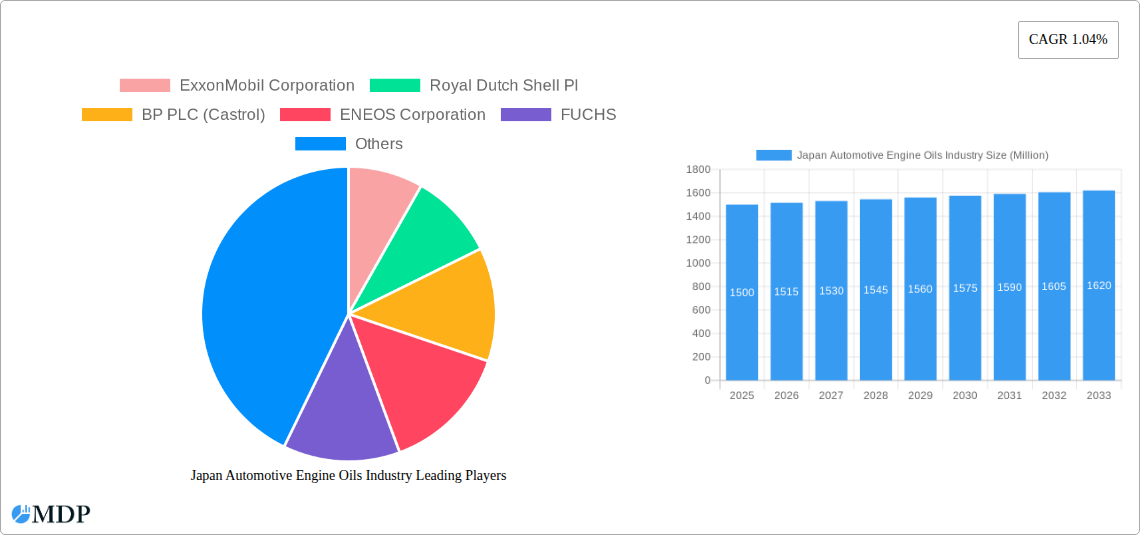

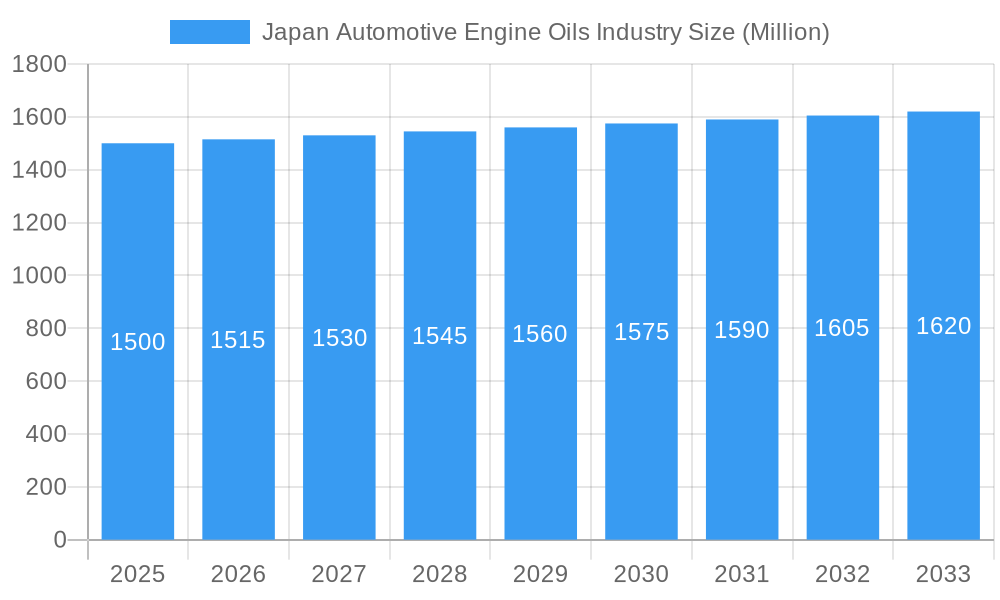

Japan Automotive Engine Oils Industry Market Size (In Billion)

However, the market navigates several restraining factors. Extended oil drain intervals and the growing adoption of electric vehicles (EVs), which do not require traditional engine oil, pose significant long-term challenges. While EVs are not yet dominant, their increasing market share will influence demand for conventional engine oils. Additionally, stringent environmental regulations and a societal focus on sustainability are promoting eco-friendlier lubricants. Japan's mature automotive market, characterized by a stable vehicle fleet and slower new vehicle adoption rates compared to emerging economies, also contributes to a moderate CAGR. Nevertheless, the substantial volume of existing internal combustion engine vehicles, coupled with the ongoing need for high-quality lubrication solutions, ensures the continued relevance and stable expansion of the Japanese automotive engine oil industry.

Japan Automotive Engine Oils Industry Company Market Share

Report Title: Japan Automotive Engine Oils Industry Market Size, Share, Trends, Growth & Forecast 2019-2033 - Comprehensive Analysis & Strategic Insights

Report Description: Gain critical insights into the dynamic Japan automotive engine oils industry. This definitive report offers an in-depth analysis of market size, Japan engine oil market share, evolving automotive lubricant trends, and future growth trajectories from 2019 to 2033. Explore the intricate landscape of Japan's automotive aftermarket, focusing on passenger vehicle engine oil, commercial vehicle engine oil, and motorcycle engine oil segments. Understand the impact of leading players such as ExxonMobil Corporation, Royal Dutch Shell Plc, BP PLC (Castrol), ENEOS Corporation, FUCHS, Cosmo Energy Holdings Co Ltd, Motul, Japan Sun Oil Company Ltd (SUNOCO Inc ), Idemitsu Kosan Co Ltd, and AKT Japan Co Ltd (TAKUMI Motor Oil).

This comprehensive study provides actionable intelligence for industry stakeholders, investors, and strategists, covering market dynamics, innovation drivers, regulatory frameworks, product developments, and emerging opportunities. With a base year of 2025 and a forecast period extending to 2033, this report is essential for understanding the competitive forces and strategic imperatives shaping the Japanese lubricant market. Achieve a competitive edge with data-driven insights into engine oil product grades, market concentration, and the influence of technological advancements and consumer preferences on the automotive sector in Japan.

Japan Automotive Engine Oils Industry Market Dynamics & Concentration

The Japan automotive engine oils industry is characterized by a moderately concentrated market, with a few key global and domestic players holding significant market share. Innovation drivers are primarily focused on the development of high-performance, fuel-efficient, and environmentally friendly lubricants. Stringent regulatory frameworks, particularly concerning emissions standards and environmental impact, significantly influence product development and market entry. Product substitutes, such as alternative fuels and electric vehicles, present a long-term challenge, but for the foreseeable future, conventional engine oils remain dominant. End-user trends indicate a growing preference for synthetic and semi-synthetic oils, driven by demands for extended drain intervals and enhanced engine protection. Merger and acquisition (M&A) activities are strategic, aimed at consolidating market position, acquiring new technologies, or expanding distribution networks. While specific M&A deal counts are not publicly disclosed for this niche, the industry witnesses strategic alliances and partnerships to navigate market complexities. Market share is influenced by brand reputation, product quality, distribution reach, and technological innovation, with established brands like ENEOS, Shell, and ExxonMobil commanding considerable segments.

Japan Automotive Engine Oils Industry Industry Trends & Analysis

The Japan automotive engine oils industry is experiencing robust growth, propelled by a combination of evolving automotive technologies, increasing vehicle parc, and a growing demand for high-performance lubricants. The market is projected to expand at a compound annual growth rate (CAGR) of approximately 3.5% from the base year 2025 through 2033. This expansion is fueled by several key trends, including the increasing complexity of modern engines, which necessitate advanced lubricant formulations to ensure optimal performance and longevity. The rising penetration of higher-viscosity grade oils, such as 0W-20 and 5W-30, is a significant trend, driven by the automotive industry's push for improved fuel economy and reduced emissions. Furthermore, the aftermarket segment continues to be a strong contributor, with consumers increasingly opting for premium and synthetic engine oils to maintain their vehicles.

Technological disruptions are also playing a crucial role. The development of advanced additive technologies that offer superior wear protection, thermal stability, and deposit control is a key focus for manufacturers. Furthermore, the automotive industry's gradual shift towards hybrid and electric vehicles, while posing a long-term challenge to traditional engine oil demand, also presents opportunities for specialized lubricants catering to hybrid powertrains and associated components. Consumer preferences are shifting towards brands that emphasize sustainability, reduced environmental impact, and enhanced engine protection. This is leading to increased demand for eco-friendly lubricant formulations.

The competitive dynamics within the Japan automotive engine oil market are characterized by intense competition between established global lubricant giants and strong domestic players. Companies are investing heavily in research and development to introduce next-generation engine oils that meet evolving OEM specifications and consumer expectations. The market penetration of synthetic engine oils continues to rise, reflecting a growing consumer awareness of the benefits these products offer. As the vehicle parc matures, the demand for high-quality engine oils for maintenance and repair remains consistently strong.

Leading Markets & Segments in Japan Automotive Engine Oils Industry

Within the Japan automotive engine oils industry, Passenger Vehicles represent the dominant segment, driven by the sheer volume of passenger cars on Japanese roads and a high rate of vehicle ownership. The economic policies promoting domestic automotive manufacturing and a mature aftermarket ecosystem further bolster this segment. The demand for engine oils in passenger vehicles is closely tied to the performance requirements of a diverse range of engine technologies, from highly efficient compact engines to more powerful performance-oriented powertrains.

The Product Grade segmentation is also critical. While conventional mineral oils still hold a share, the trend is strongly leaning towards Synthetic and Semi-Synthetic engine oils. This shift is powered by:

- Enhanced Engine Protection: Synthetic oils offer superior lubrication across a wider temperature range, reducing wear and tear on critical engine components.

- Improved Fuel Efficiency: Lower viscosity synthetic oils contribute to reduced friction, leading to better fuel economy, a key consideration for Japanese consumers.

- Extended Drain Intervals: Synthetic formulations allow for longer periods between oil changes, offering convenience and cost savings for vehicle owners.

- Environmental Compliance: The development of advanced synthetic lubricants often aligns with stricter emission standards and the automotive industry's sustainability goals.

The Commercial Vehicles segment, while smaller in volume compared to passenger cars, is significant due to the higher oil capacities and demanding operating conditions, leading to a consistent demand for high-performance and durable engine oils. The Motorcycles segment also contributes, with a dedicated market for specialized motorcycle engine oils that cater to the unique lubrication needs of two-wheeled vehicles. The dominance of passenger vehicles and the increasing preference for synthetic product grades underscore the market's evolution towards premiumization and performance.

Japan Automotive Engine Oils Industry Product Developments

Product developments in the Japan automotive engine oils industry are characterized by a relentless pursuit of enhanced performance, efficiency, and environmental compatibility. Manufacturers are heavily investing in advanced additive technologies to create lubricants that offer superior wear protection, extended drain intervals, and improved fuel economy. The trend towards lower viscosity grades, such as 0W-20 and 5W-30, is a direct result of these innovations, catering to the evolving demands of modern, fuel-efficient engines. For instance, Motul's launch of CLASSIC EIGHTIES 10W-40 and CLASSIC NINETIES 10W-30 engine oils for classic cars highlights a niche but growing segment focused on specialized formulations. The collaboration between lubricant manufacturers and automotive OEMs, such as Motul's engagement with Honda's HRC factory racing team, underscores the drive for high-tech synthetic lubricants that push the boundaries of engine performance and protection. These developments are crucial for maintaining competitive advantage and meeting stringent OEM specifications.

Key Drivers of Japan Automotive Engine Oils Industry Growth

The growth of the Japan automotive engine oils industry is propelled by several interconnected factors. A primary driver is the continuous evolution of engine technology, with manufacturers developing more sophisticated and fuel-efficient powertrains that demand advanced lubricant formulations. The substantial and aging vehicle parc in Japan ensures a consistent demand for maintenance and replacement engine oils, especially within the aftermarket. Technological advancements in lubricant formulation, including the widespread adoption of synthetic and semi-synthetic oils, offer enhanced engine protection, improved fuel economy, and extended drain intervals, aligning with consumer preferences for performance and cost-effectiveness. Furthermore, increasingly stringent environmental regulations and a growing consumer awareness regarding sustainability are driving the development and adoption of eco-friendly and lower-emission lubricant solutions.

Challenges in the Japan Automotive Engine Oils Industry Market

Despite its growth, the Japan automotive engine oils industry faces several significant challenges. The long-term shift towards electric vehicles (EVs) poses a fundamental threat to the demand for traditional internal combustion engine oils. While the transition is gradual, it necessitates a strategic pivot for lubricant manufacturers towards specialized fluids for EVs and hybrid powertrains. Fluctuations in crude oil prices and the cost of base oils and additives can impact profit margins and pricing strategies. Intense competition, both from global majors and strong domestic players, creates pressure on pricing and requires continuous investment in product innovation and marketing to maintain market share. Furthermore, navigating evolving and increasingly stringent environmental regulations, while also a driver for innovation, can incur significant R&D and compliance costs. Supply chain disruptions, as experienced globally, can also affect the availability and cost of raw materials.

Emerging Opportunities in Japan Automotive Engine Oils Industry

Emerging opportunities in the Japan automotive engine oils industry lie in embracing the evolving automotive landscape and leveraging technological advancements. The burgeoning hybrid vehicle market presents a significant opportunity for specialized hybrid engine oils and transmission fluids that cater to the unique lubrication needs of these powertrains. The increasing demand for high-performance lubricants for aging vehicle fleets, particularly in the aftermarket, offers a stable revenue stream. Furthermore, the development and promotion of sustainable and bio-based engine oils align with growing environmental consciousness among consumers and can create a competitive differentiator. Strategic partnerships with automotive OEMs to co-develop lubricants for next-generation engines and electric vehicle components represent another avenue for growth. The focus on advanced additive technologies that enhance fuel efficiency and reduce emissions will continue to drive innovation and market penetration.

Leading Players in the Japan Automotive Engine Oils Industry Sector

- ExxonMobil Corporation

- Royal Dutch Shell Plc

- BP PLC (Castrol)

- ENEOS Corporation

- FUCHS

- Cosmo Energy Holdings Co Ltd

- Motul

- Japan Sun Oil Company Ltd (SUNOCO Inc )

- Idemitsu Kosan Co Ltd

- AKT Japan Co Ltd (TAKUMI Motor Oil)

Key Milestones in Japan Automotive Engine Oils Industry Industry

- January 2022: ExxonMobil Corporation reorganized along three business lines – ExxonMobil Upstream Company, ExxonMobil Product Solutions, and ExxonMobil Low Carbon Solutions, indicating a strategic focus on evolving energy landscapes and product diversification.

- April 2021: Motul launched two engine oils, CLASSIC EIGHTIES 10W-40 and CLASSIC NINETIES 10W-30, specifically for classic cars manufactured between the 1970s and 2000s, demonstrating a commitment to niche market segments and heritage vehicles.

- March 2021: Engineers of Motul engaged with Honda's HRC factory racing team's engine development department on various projects, including the development of high-tech synthetic lubricants at the company's R&D facility in Japan, highlighting a strong focus on innovation and collaborative product development for high-performance applications.

Strategic Outlook for Japan Automotive Engine Oils Industry Market

The strategic outlook for the Japan automotive engine oils industry is one of adaptation and innovation. While the long-term transition to electric vehicles presents a challenge, opportunities abound in catering to the evolving needs of hybrid powertrains and maintaining the vast existing internal combustion engine fleet. Manufacturers will need to focus on developing high-performance, fuel-efficient, and environmentally sustainable lubricant solutions. Strategic partnerships with automotive manufacturers for the co-development of next-generation fluids will be crucial. Emphasis on advanced additive technologies, increased penetration of synthetic and semi-synthetic oils, and exploration of bio-based lubricants will define the competitive landscape. The aftermarket segment will remain a strong pillar, while continuous R&D investment is essential to meet increasingly stringent OEM specifications and evolving consumer demands for superior engine protection and performance.

Japan Automotive Engine Oils Industry Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

- 1.2. Motorcycles

- 1.3. Passenger Vehicles

- 2. Product Grade

Japan Automotive Engine Oils Industry Segmentation By Geography

- 1. Japan

Japan Automotive Engine Oils Industry Regional Market Share

Geographic Coverage of Japan Automotive Engine Oils Industry

Japan Automotive Engine Oils Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for the Paper and Plastics Packaging Industry; Increasing Demand from the Building and Construction Industry

- 3.3. Market Restrains

- 3.3.1. Cyclic Nature of Mining Industry; Other Restraints

- 3.4. Market Trends

- 3.4.1. Largest Segment By Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Automotive Engine Oils Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Motorcycles

- 5.1.3. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Grade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ExxonMobil Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Royal Dutch Shell Pl

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BP PLC (Castrol)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ENEOS Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FUCHS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cosmo Energy Holdings Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Motul

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Japan Sun Oil Company Ltd (SUNOCO Inc )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Idemitsu Kosan Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AKT Japan Co Ltd (TAKUMI Motor Oil)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ExxonMobil Corporation

List of Figures

- Figure 1: Japan Automotive Engine Oils Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Automotive Engine Oils Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Automotive Engine Oils Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Japan Automotive Engine Oils Industry Volume Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Japan Automotive Engine Oils Industry Revenue billion Forecast, by Product Grade 2020 & 2033

- Table 4: Japan Automotive Engine Oils Industry Volume Million Forecast, by Product Grade 2020 & 2033

- Table 5: Japan Automotive Engine Oils Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Japan Automotive Engine Oils Industry Volume Million Forecast, by Region 2020 & 2033

- Table 7: Japan Automotive Engine Oils Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Japan Automotive Engine Oils Industry Volume Million Forecast, by Vehicle Type 2020 & 2033

- Table 9: Japan Automotive Engine Oils Industry Revenue billion Forecast, by Product Grade 2020 & 2033

- Table 10: Japan Automotive Engine Oils Industry Volume Million Forecast, by Product Grade 2020 & 2033

- Table 11: Japan Automotive Engine Oils Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Japan Automotive Engine Oils Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Automotive Engine Oils Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Japan Automotive Engine Oils Industry?

Key companies in the market include ExxonMobil Corporation, Royal Dutch Shell Pl, BP PLC (Castrol), ENEOS Corporation, FUCHS, Cosmo Energy Holdings Co Ltd, Motul, Japan Sun Oil Company Ltd (SUNOCO Inc ), Idemitsu Kosan Co Ltd, AKT Japan Co Ltd (TAKUMI Motor Oil).

3. What are the main segments of the Japan Automotive Engine Oils Industry?

The market segments include Vehicle Type, Product Grade.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for the Paper and Plastics Packaging Industry; Increasing Demand from the Building and Construction Industry.

6. What are the notable trends driving market growth?

Largest Segment By Vehicle Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Passenger Vehicles</span>.

7. Are there any restraints impacting market growth?

Cyclic Nature of Mining Industry; Other Restraints.

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.April 2021: Motul launched two engine oils, namely CLASSIC EIGHTIES 10W-40 and CLASSIC NINETIES 10W-30, for classic cars manufactured between the 1970s and 2000s.March 2021: Engineers of Motul engage with Honda's HRC factory racing team's engine development department on various projects, including the development of high-tech synthetic lubricants, at the company's R&D facility in Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Automotive Engine Oils Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Automotive Engine Oils Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Automotive Engine Oils Industry?

To stay informed about further developments, trends, and reports in the Japan Automotive Engine Oils Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence