Key Insights

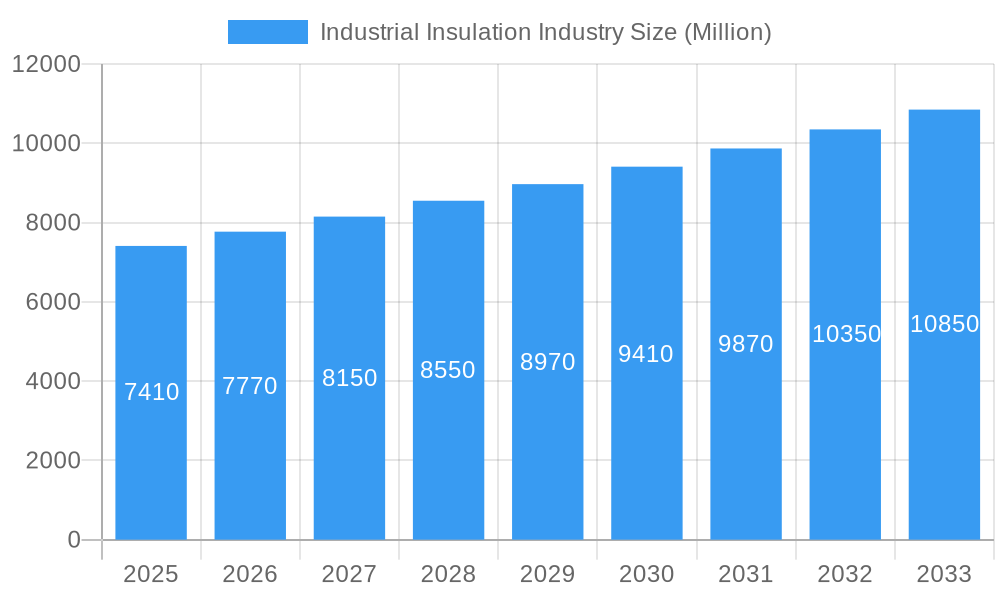

The global industrial insulation market is poised for robust expansion, projected to reach a substantial valuation of $7.41 billion. This growth trajectory is underpinned by a Compound Annual Growth Rate (CAGR) exceeding 5.00%, signaling sustained demand and investment opportunities. A critical driver for this market is the escalating need for energy efficiency across various industrial sectors. As regulatory pressures mount and operational costs continue to rise, industries are increasingly recognizing the indispensable role of effective insulation in minimizing heat loss, reducing energy consumption, and consequently, lowering carbon footprints. Furthermore, the ongoing expansion and modernization of key industries such as chemical and petrochemical, oil and gas, and power generation are directly fueling the demand for advanced insulation solutions. These sectors, characterized by high-temperature processes and the handling of volatile materials, necessitate superior insulation materials for safety, operational integrity, and the prevention of thermal bridging.

Industrial Insulation Industry Market Size (In Billion)

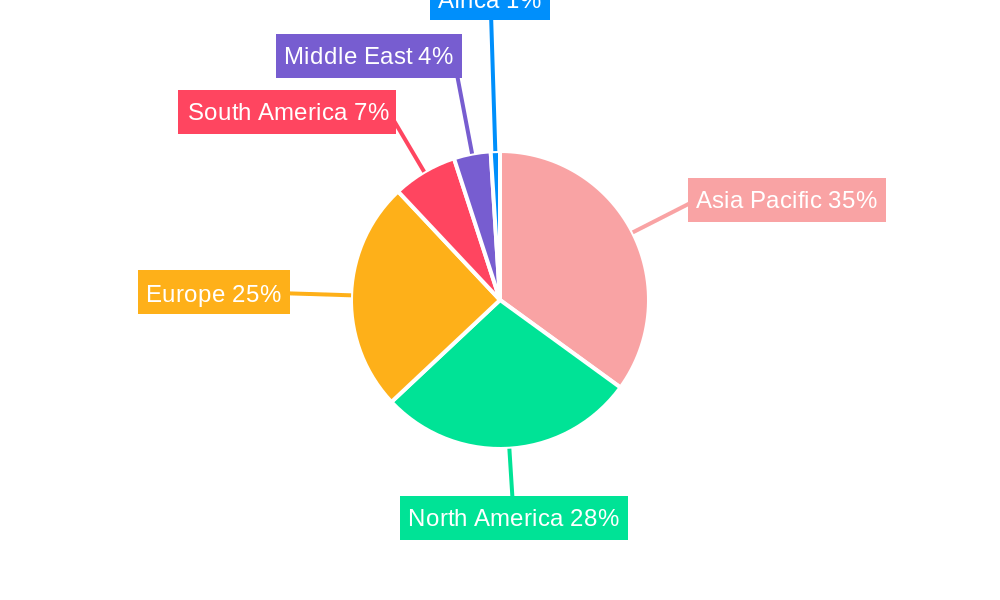

The market is segmented by insulation material, product type, and end-user industry, reflecting diverse application requirements. Within insulation materials, mineral wool and fiberglass are expected to maintain their dominance due to their cost-effectiveness and excellent thermal and acoustic properties, while foamed plastics and calcium silicate are gaining traction for specialized applications requiring high-performance insulation. Blanket and board forms are projected to lead product demand, catering to a wide array of applications from pipework to large surface areas. The construction sector, driven by sustainable building initiatives and stringent energy codes, represents a significant end-user, alongside the ever-growing chemical and petrochemical and oil and gas industries. Geographically, Asia Pacific is anticipated to lead the market growth, propelled by rapid industrialization and infrastructure development in countries like China and India. North America and Europe, with their established industrial bases and focus on retrofitting existing facilities for energy efficiency, will continue to be significant markets.

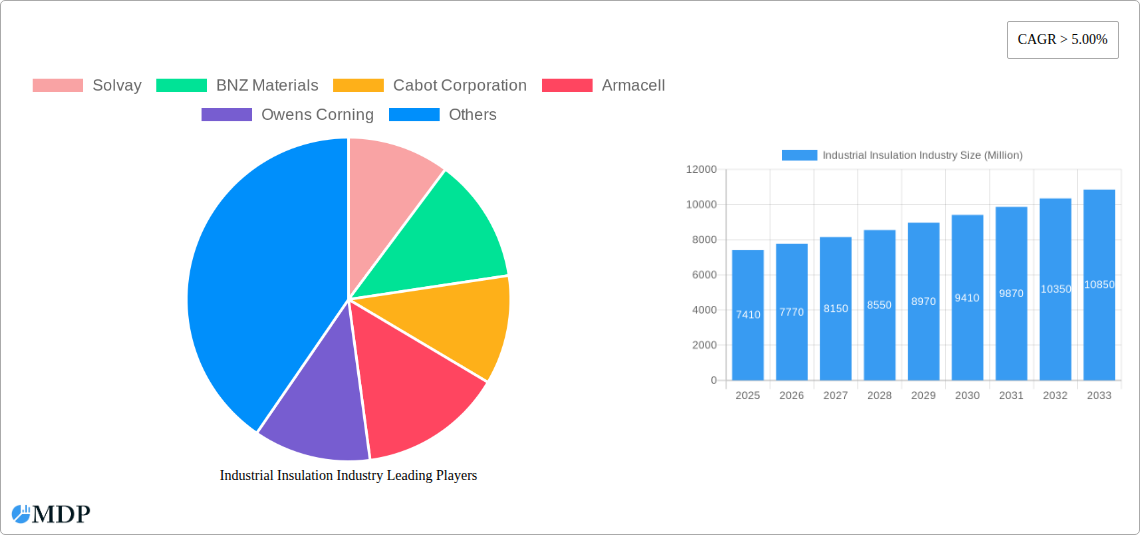

Industrial Insulation Industry Company Market Share

Here's an SEO-optimized and engaging report description for the Industrial Insulation Industry, designed to maximize search visibility and attract industry stakeholders:

Industrial Insulation Industry Market Dynamics & Concentration

The global industrial insulation market is characterized by moderate to high concentration, with key players like Solvay, Owens Corning, and Knauf Insulation holding significant market share. Innovation is a primary driver, fueled by the demand for enhanced thermal performance, fire resistance, and energy efficiency across diverse end-user industries. Regulatory frameworks, particularly those focused on energy conservation and environmental protection, are increasingly shaping market dynamics, mandating stricter insulation standards. Product substitutes, such as advanced composite materials, pose a growing challenge, necessitating continuous product development. End-user trends lean towards sustainable and high-performance insulation solutions, driving adoption in sectors like chemical and petrochemical and power generation. Mergers and acquisitions (M&A) remain a strategic tool for consolidation and market expansion, with recent activity indicating a trend towards acquiring niche players and expanding geographic footprints. The market anticipates a steady increase in M&A deal counts as companies seek to bolster their product portfolios and competitive positions.

- Market Concentration: Moderate to High, driven by established global players.

- Innovation Drivers: Energy efficiency mandates, demand for fire-resistant materials, and improved thermal performance.

- Regulatory Frameworks: Stringent energy conservation codes and environmental regulations worldwide.

- Product Substitutes: Emerging advanced materials and composites.

- End-user Trends: Growing preference for sustainable, durable, and high-performance insulation.

- M&A Activities: Strategic acquisitions for portfolio expansion and geographic reach.

Industrial Insulation Industry Industry Trends & Analysis

The industrial insulation industry is poised for significant growth, driven by a confluence of factors that underscore the critical role of effective insulation in modern industrial operations. The increasing global focus on energy efficiency and decarbonization is a primary market growth driver. As governments and corporations worldwide implement stricter energy conservation policies and sustainability targets, the demand for high-performance industrial insulation solutions to minimize heat loss and energy consumption is escalating. This trend is particularly pronounced in energy-intensive sectors such as oil and gas, chemical and petrochemical, and power generation, where substantial operational cost savings and reduced environmental impact can be achieved through superior insulation. Technological disruptions are also playing a pivotal role. Innovations in insulation materials, including advanced fiber glass, mineral wool, and foamed plastics, are offering improved thermal resistance, greater durability, and enhanced fire safety properties. These advancements enable insulation to perform optimally under extreme temperatures and harsh industrial environments, thereby expanding their applicability and market penetration. Consumer preferences are evolving towards more sustainable and eco-friendly insulation options, prompting manufacturers to invest in research and development of bio-based and recyclable insulation materials. This shift is not only driven by regulatory pressures but also by growing corporate social responsibility initiatives and market demand for green building and manufacturing practices. Competitive dynamics are intensifying, with leading players actively engaged in strategic partnerships, product innovation, and capacity expansions to capture market share. The market penetration of specialized insulation products designed for specific industrial applications, such as cryogenic insulation for LNG facilities or high-temperature insulation for furnaces, is also on the rise. The global industrial insulation market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025–2033, reflecting its robust growth trajectory. This expansion is underpinned by continuous technological advancements, growing environmental consciousness, and the persistent need for energy optimization across industrial landscapes.

Leading Markets & Segments in Industrial Insulation Industry

The industrial insulation market exhibits distinct leadership across various segments, driven by specific end-user demands and regional economic developments.

Dominant Insulation Material:

- Mineral Wool: This material holds a significant market share due to its excellent thermal and acoustic insulation properties, coupled with its inherent fire resistance. It is widely adopted in the construction, chemical and petrochemical, and power generation sectors. The increasing demand for fire safety and energy efficiency in industrial facilities directly fuels the growth of the mineral wool segment. Its ability to withstand high temperatures makes it indispensable for applications in furnaces, boilers, and industrial piping systems.

- Fiber Glass: Another dominant material, fiber glass insulation offers a balance of thermal performance, cost-effectiveness, and ease of installation. Its versatility makes it suitable for a broad range of industrial applications, including HVAC systems in commercial buildings, pipe insulation, and sound dampening. The growing construction sector and the need for efficient thermal management in various industrial processes contribute to its sustained market presence.

- Foamed Plastics: This category, encompassing materials like polyurethane (PU) and expanded polystyrene (EPS), is critical for applications requiring lightweight, moisture-resistant, and high-performance insulation. Its dominance is particularly notable in the construction industry for building envelopes and in the cold chain logistics sector for refrigeration and temperature-controlled transportation. The demand for superior insulation in energy-efficient buildings and specialized industrial cooling applications drives its growth.

Dominant Product Type:

- Blanket Insulation: These flexible insulation forms are highly versatile and widely used for insulating large surface areas, pipes, and vessels. Their ease of application and adaptability to complex shapes make them a preferred choice in sectors like oil and gas and chemical processing. The continuous need for effective thermal management in these industries supports the sustained demand for blanket insulation.

- Board Insulation: Rigid insulation boards are favored for applications requiring structural integrity and precise thermal control, such as in building envelopes, industrial roofing, and specialized equipment housing. Their dimensional stability and high compressive strength are advantageous in demanding industrial environments.

Dominant End-user Industry:

- Construction: This sector remains a cornerstone of the industrial insulation market. Driven by global urbanization, infrastructure development, and a strong emphasis on energy-efficient buildings, the construction industry is a major consumer of all types of industrial insulation. Stringent building codes and a growing awareness of the financial and environmental benefits of proper insulation are key drivers.

- Chemical and Petrochemical: The imperative for maintaining process temperatures, ensuring safety, and minimizing energy losses in chemical plants and refineries makes this sector a significant and consistent market for industrial insulation. High-temperature insulation and cryogenic insulation are critical in this segment, driving demand for specialized products.

- Oil and Gas: From upstream exploration and production to midstream transportation and downstream refining, the oil and gas industry relies heavily on industrial insulation to maintain operational efficiency, prevent energy loss, and ensure the safety of personnel and equipment, particularly in extreme environments.

The dominance of these segments is a direct reflection of economic policies promoting energy efficiency, significant infrastructure development projects, and the intrinsic operational requirements of these core industrial sectors.

Industrial Insulation Industry Product Developments

Product development in the industrial insulation industry is primarily focused on enhancing thermal performance, improving fire safety, and increasing sustainability. Innovations in mineral wool and fiber glass are yielding materials with lower thermal conductivity, enabling thinner insulation layers and greater energy savings. The development of advanced composites and foams is creating insulation solutions that are lighter, more durable, and resistant to moisture and chemical degradation. Furthermore, there is a growing trend towards bio-based and recycled insulation materials, responding to environmental regulations and market demand for green building solutions. These product advancements offer competitive advantages by meeting evolving industry standards and end-user requirements for efficiency, safety, and environmental responsibility.

Key Drivers of Industrial Insulation Industry Growth

Several key factors are propelling the growth of the industrial insulation industry.

- Energy Efficiency Mandates: Increasingly stringent government regulations and corporate sustainability goals are driving demand for insulation that minimizes energy consumption and reduces operational costs.

- Industrial Expansion and Modernization: Growth in key sectors like chemical and petrochemical, oil and gas, and power generation, along with the modernization of existing facilities, necessitates effective insulation for process optimization and safety.

- Technological Advancements: Innovations in insulation materials, such as improved thermal resistance and fire-retardant properties, are expanding application possibilities and enhancing performance.

- Focus on Fire Safety: The inherent risk of fire in industrial settings is increasing the demand for non-combustible and fire-resistant insulation solutions.

Challenges in the Industrial Insulation Industry Market

The industrial insulation industry faces several challenges that could impede its growth.

- Fluctuating Raw Material Prices: The cost of key raw materials, such as mineral fibers and petrochemical derivatives, can be volatile, impacting manufacturers' profitability and product pricing.

- Skilled Labor Shortages: The installation of industrial insulation often requires specialized skills, and a shortage of trained professionals can lead to project delays and increased labor costs.

- Complex Regulatory Landscapes: Navigating diverse and evolving environmental and safety regulations across different regions can be challenging for manufacturers and installers.

- Competition from Substitute Materials: Emerging advanced materials with specialized properties can pose a competitive threat to traditional insulation products.

Emerging Opportunities in Industrial Insulation Industry

The industrial insulation industry is ripe with emerging opportunities. The growing demand for cryogenic insulation in the liquefied natural gas (LNG) sector and for high-temperature insulation in renewable energy applications, such as solar thermal power plants, presents significant growth avenues. Furthermore, the increasing adoption of smart building technologies and the Internet of Things (IoT) is creating opportunities for integrated insulation systems that monitor thermal performance and optimize energy usage. Strategic partnerships between insulation manufacturers and engineering firms to offer comprehensive solutions, along with market expansion into developing economies with burgeoning industrial sectors, are also key catalysts for long-term growth.

Leading Players in the Industrial Insulation Industry Sector

- Solvay

- BNZ Materials

- Cabot Corporation

- Armacell

- Owens Corning

- BASF SE

- Rockwool A/S

- Knauf Insulation

- Temati Group

- INSUL-FAB

- Johns Manville-Berkshire Hathway Company

- Jays Refractory Specialists

Key Milestones in Industrial Insulation Industry Industry

- November 2022: BEWI acquired Aislamientos y Envases SL, a Spanish insulation company that provides EPS-based products for packaging and industrial applications, to expand its geographic footprint and strengthen its insulation solutions product portfolio in Spain.

- October 2022: Knauf Group increased its mineral wool (insulation) production capacity within Central and Eastern Europe by investing close to EUR 135 million (~USD 133.4 million) in Knauf Insulation's facility in Tarnaveni, Romania, along with retrofitting the existing plant, which was acquired earlier this year. The new facility is expected to be completed by 2024.

Strategic Outlook for Industrial Insulation Industry Market

The strategic outlook for the industrial insulation market is overwhelmingly positive, driven by the global imperative for energy efficiency and sustainability. Future market potential lies in the continued development of advanced materials that offer superior thermal performance and reduced environmental impact. Companies will likely focus on expanding their presence in emerging economies, where industrialization is rapidly increasing. Strategic opportunities also include offering integrated insulation solutions that incorporate smart technologies for real-time monitoring and optimization. Furthermore, a commitment to circular economy principles, through the development of recyclable and bio-based insulation, will be crucial for long-term competitive advantage and market leadership in the evolving industrial landscape.

Industrial Insulation Industry Segmentation

-

1. Insulation Material

- 1.1. Mineral Wool

- 1.2. Fiber Glass

- 1.3. Foamed Plastics

- 1.4. Calcium Silicate

- 1.5. Other Insulation Materials

-

2. Product

- 2.1. Blanket

- 2.2. Board

- 2.3. Pipe

- 2.4. Other Products

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Chemical and Petrochemical

- 3.3. Construction

- 3.4. Electrical and Electronics

- 3.5. Oil and Gas

- 3.6. Power Generation

- 3.7. Other End-user Industries

Industrial Insulation Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Industrial Insulation Industry Regional Market Share

Geographic Coverage of Industrial Insulation Industry

Industrial Insulation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Construction and Power Generation Industry; Regulatory Support to Increase Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. Environmental Hazards; Other Restraints

- 3.4. Market Trends

- 3.4.1. Power Generation Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Insulation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insulation Material

- 5.1.1. Mineral Wool

- 5.1.2. Fiber Glass

- 5.1.3. Foamed Plastics

- 5.1.4. Calcium Silicate

- 5.1.5. Other Insulation Materials

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Blanket

- 5.2.2. Board

- 5.2.3. Pipe

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Chemical and Petrochemical

- 5.3.3. Construction

- 5.3.4. Electrical and Electronics

- 5.3.5. Oil and Gas

- 5.3.6. Power Generation

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Insulation Material

- 6. Asia Pacific Industrial Insulation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insulation Material

- 6.1.1. Mineral Wool

- 6.1.2. Fiber Glass

- 6.1.3. Foamed Plastics

- 6.1.4. Calcium Silicate

- 6.1.5. Other Insulation Materials

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Blanket

- 6.2.2. Board

- 6.2.3. Pipe

- 6.2.4. Other Products

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Chemical and Petrochemical

- 6.3.3. Construction

- 6.3.4. Electrical and Electronics

- 6.3.5. Oil and Gas

- 6.3.6. Power Generation

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Insulation Material

- 7. North America Industrial Insulation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insulation Material

- 7.1.1. Mineral Wool

- 7.1.2. Fiber Glass

- 7.1.3. Foamed Plastics

- 7.1.4. Calcium Silicate

- 7.1.5. Other Insulation Materials

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Blanket

- 7.2.2. Board

- 7.2.3. Pipe

- 7.2.4. Other Products

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Chemical and Petrochemical

- 7.3.3. Construction

- 7.3.4. Electrical and Electronics

- 7.3.5. Oil and Gas

- 7.3.6. Power Generation

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Insulation Material

- 8. Europe Industrial Insulation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insulation Material

- 8.1.1. Mineral Wool

- 8.1.2. Fiber Glass

- 8.1.3. Foamed Plastics

- 8.1.4. Calcium Silicate

- 8.1.5. Other Insulation Materials

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Blanket

- 8.2.2. Board

- 8.2.3. Pipe

- 8.2.4. Other Products

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Chemical and Petrochemical

- 8.3.3. Construction

- 8.3.4. Electrical and Electronics

- 8.3.5. Oil and Gas

- 8.3.6. Power Generation

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Insulation Material

- 9. South America Industrial Insulation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insulation Material

- 9.1.1. Mineral Wool

- 9.1.2. Fiber Glass

- 9.1.3. Foamed Plastics

- 9.1.4. Calcium Silicate

- 9.1.5. Other Insulation Materials

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Blanket

- 9.2.2. Board

- 9.2.3. Pipe

- 9.2.4. Other Products

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Chemical and Petrochemical

- 9.3.3. Construction

- 9.3.4. Electrical and Electronics

- 9.3.5. Oil and Gas

- 9.3.6. Power Generation

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Insulation Material

- 10. Middle East Industrial Insulation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insulation Material

- 10.1.1. Mineral Wool

- 10.1.2. Fiber Glass

- 10.1.3. Foamed Plastics

- 10.1.4. Calcium Silicate

- 10.1.5. Other Insulation Materials

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Blanket

- 10.2.2. Board

- 10.2.3. Pipe

- 10.2.4. Other Products

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive

- 10.3.2. Chemical and Petrochemical

- 10.3.3. Construction

- 10.3.4. Electrical and Electronics

- 10.3.5. Oil and Gas

- 10.3.6. Power Generation

- 10.3.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Insulation Material

- 11. Saudi Arabia Industrial Insulation Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Insulation Material

- 11.1.1. Mineral Wool

- 11.1.2. Fiber Glass

- 11.1.3. Foamed Plastics

- 11.1.4. Calcium Silicate

- 11.1.5. Other Insulation Materials

- 11.2. Market Analysis, Insights and Forecast - by Product

- 11.2.1. Blanket

- 11.2.2. Board

- 11.2.3. Pipe

- 11.2.4. Other Products

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Automotive

- 11.3.2. Chemical and Petrochemical

- 11.3.3. Construction

- 11.3.4. Electrical and Electronics

- 11.3.5. Oil and Gas

- 11.3.6. Power Generation

- 11.3.7. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Insulation Material

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Solvay

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 BNZ Materials

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cabot Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Armacell

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Owens Corning

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 BASF SE

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Rockwool A/S

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Knauf Insulation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Temati Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 INSUL-FAB

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Johns Manville-Berkshire Hathway Company

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Jays Refractory Specialists

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Solvay

List of Figures

- Figure 1: Global Industrial Insulation Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Industrial Insulation Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Industrial Insulation Industry Revenue (Million), by Insulation Material 2025 & 2033

- Figure 4: Asia Pacific Industrial Insulation Industry Volume (K Tons), by Insulation Material 2025 & 2033

- Figure 5: Asia Pacific Industrial Insulation Industry Revenue Share (%), by Insulation Material 2025 & 2033

- Figure 6: Asia Pacific Industrial Insulation Industry Volume Share (%), by Insulation Material 2025 & 2033

- Figure 7: Asia Pacific Industrial Insulation Industry Revenue (Million), by Product 2025 & 2033

- Figure 8: Asia Pacific Industrial Insulation Industry Volume (K Tons), by Product 2025 & 2033

- Figure 9: Asia Pacific Industrial Insulation Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: Asia Pacific Industrial Insulation Industry Volume Share (%), by Product 2025 & 2033

- Figure 11: Asia Pacific Industrial Insulation Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Industrial Insulation Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 13: Asia Pacific Industrial Insulation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Asia Pacific Industrial Insulation Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Asia Pacific Industrial Insulation Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: Asia Pacific Industrial Insulation Industry Volume (K Tons), by Country 2025 & 2033

- Figure 17: Asia Pacific Industrial Insulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Industrial Insulation Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: North America Industrial Insulation Industry Revenue (Million), by Insulation Material 2025 & 2033

- Figure 20: North America Industrial Insulation Industry Volume (K Tons), by Insulation Material 2025 & 2033

- Figure 21: North America Industrial Insulation Industry Revenue Share (%), by Insulation Material 2025 & 2033

- Figure 22: North America Industrial Insulation Industry Volume Share (%), by Insulation Material 2025 & 2033

- Figure 23: North America Industrial Insulation Industry Revenue (Million), by Product 2025 & 2033

- Figure 24: North America Industrial Insulation Industry Volume (K Tons), by Product 2025 & 2033

- Figure 25: North America Industrial Insulation Industry Revenue Share (%), by Product 2025 & 2033

- Figure 26: North America Industrial Insulation Industry Volume Share (%), by Product 2025 & 2033

- Figure 27: North America Industrial Insulation Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 28: North America Industrial Insulation Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 29: North America Industrial Insulation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: North America Industrial Insulation Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: North America Industrial Insulation Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: North America Industrial Insulation Industry Volume (K Tons), by Country 2025 & 2033

- Figure 33: North America Industrial Insulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America Industrial Insulation Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Industrial Insulation Industry Revenue (Million), by Insulation Material 2025 & 2033

- Figure 36: Europe Industrial Insulation Industry Volume (K Tons), by Insulation Material 2025 & 2033

- Figure 37: Europe Industrial Insulation Industry Revenue Share (%), by Insulation Material 2025 & 2033

- Figure 38: Europe Industrial Insulation Industry Volume Share (%), by Insulation Material 2025 & 2033

- Figure 39: Europe Industrial Insulation Industry Revenue (Million), by Product 2025 & 2033

- Figure 40: Europe Industrial Insulation Industry Volume (K Tons), by Product 2025 & 2033

- Figure 41: Europe Industrial Insulation Industry Revenue Share (%), by Product 2025 & 2033

- Figure 42: Europe Industrial Insulation Industry Volume Share (%), by Product 2025 & 2033

- Figure 43: Europe Industrial Insulation Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Europe Industrial Insulation Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: Europe Industrial Insulation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Europe Industrial Insulation Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Europe Industrial Insulation Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Industrial Insulation Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: Europe Industrial Insulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Industrial Insulation Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Industrial Insulation Industry Revenue (Million), by Insulation Material 2025 & 2033

- Figure 52: South America Industrial Insulation Industry Volume (K Tons), by Insulation Material 2025 & 2033

- Figure 53: South America Industrial Insulation Industry Revenue Share (%), by Insulation Material 2025 & 2033

- Figure 54: South America Industrial Insulation Industry Volume Share (%), by Insulation Material 2025 & 2033

- Figure 55: South America Industrial Insulation Industry Revenue (Million), by Product 2025 & 2033

- Figure 56: South America Industrial Insulation Industry Volume (K Tons), by Product 2025 & 2033

- Figure 57: South America Industrial Insulation Industry Revenue Share (%), by Product 2025 & 2033

- Figure 58: South America Industrial Insulation Industry Volume Share (%), by Product 2025 & 2033

- Figure 59: South America Industrial Insulation Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 60: South America Industrial Insulation Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 61: South America Industrial Insulation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: South America Industrial Insulation Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: South America Industrial Insulation Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: South America Industrial Insulation Industry Volume (K Tons), by Country 2025 & 2033

- Figure 65: South America Industrial Insulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Industrial Insulation Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East Industrial Insulation Industry Revenue (Million), by Insulation Material 2025 & 2033

- Figure 68: Middle East Industrial Insulation Industry Volume (K Tons), by Insulation Material 2025 & 2033

- Figure 69: Middle East Industrial Insulation Industry Revenue Share (%), by Insulation Material 2025 & 2033

- Figure 70: Middle East Industrial Insulation Industry Volume Share (%), by Insulation Material 2025 & 2033

- Figure 71: Middle East Industrial Insulation Industry Revenue (Million), by Product 2025 & 2033

- Figure 72: Middle East Industrial Insulation Industry Volume (K Tons), by Product 2025 & 2033

- Figure 73: Middle East Industrial Insulation Industry Revenue Share (%), by Product 2025 & 2033

- Figure 74: Middle East Industrial Insulation Industry Volume Share (%), by Product 2025 & 2033

- Figure 75: Middle East Industrial Insulation Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 76: Middle East Industrial Insulation Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 77: Middle East Industrial Insulation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Middle East Industrial Insulation Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Middle East Industrial Insulation Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East Industrial Insulation Industry Volume (K Tons), by Country 2025 & 2033

- Figure 81: Middle East Industrial Insulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East Industrial Insulation Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Saudi Arabia Industrial Insulation Industry Revenue (Million), by Insulation Material 2025 & 2033

- Figure 84: Saudi Arabia Industrial Insulation Industry Volume (K Tons), by Insulation Material 2025 & 2033

- Figure 85: Saudi Arabia Industrial Insulation Industry Revenue Share (%), by Insulation Material 2025 & 2033

- Figure 86: Saudi Arabia Industrial Insulation Industry Volume Share (%), by Insulation Material 2025 & 2033

- Figure 87: Saudi Arabia Industrial Insulation Industry Revenue (Million), by Product 2025 & 2033

- Figure 88: Saudi Arabia Industrial Insulation Industry Volume (K Tons), by Product 2025 & 2033

- Figure 89: Saudi Arabia Industrial Insulation Industry Revenue Share (%), by Product 2025 & 2033

- Figure 90: Saudi Arabia Industrial Insulation Industry Volume Share (%), by Product 2025 & 2033

- Figure 91: Saudi Arabia Industrial Insulation Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 92: Saudi Arabia Industrial Insulation Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 93: Saudi Arabia Industrial Insulation Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 94: Saudi Arabia Industrial Insulation Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 95: Saudi Arabia Industrial Insulation Industry Revenue (Million), by Country 2025 & 2033

- Figure 96: Saudi Arabia Industrial Insulation Industry Volume (K Tons), by Country 2025 & 2033

- Figure 97: Saudi Arabia Industrial Insulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Saudi Arabia Industrial Insulation Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Insulation Industry Revenue Million Forecast, by Insulation Material 2020 & 2033

- Table 2: Global Industrial Insulation Industry Volume K Tons Forecast, by Insulation Material 2020 & 2033

- Table 3: Global Industrial Insulation Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Global Industrial Insulation Industry Volume K Tons Forecast, by Product 2020 & 2033

- Table 5: Global Industrial Insulation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Industrial Insulation Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Industrial Insulation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Industrial Insulation Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global Industrial Insulation Industry Revenue Million Forecast, by Insulation Material 2020 & 2033

- Table 10: Global Industrial Insulation Industry Volume K Tons Forecast, by Insulation Material 2020 & 2033

- Table 11: Global Industrial Insulation Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Global Industrial Insulation Industry Volume K Tons Forecast, by Product 2020 & 2033

- Table 13: Global Industrial Insulation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Industrial Insulation Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Industrial Insulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Industrial Insulation Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: China Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Japan Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: South Korea Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Global Industrial Insulation Industry Revenue Million Forecast, by Insulation Material 2020 & 2033

- Table 28: Global Industrial Insulation Industry Volume K Tons Forecast, by Insulation Material 2020 & 2033

- Table 29: Global Industrial Insulation Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 30: Global Industrial Insulation Industry Volume K Tons Forecast, by Product 2020 & 2033

- Table 31: Global Industrial Insulation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 32: Global Industrial Insulation Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Industrial Insulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Industrial Insulation Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 35: United States Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United States Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Canada Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Canada Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Mexico Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Mexico Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Global Industrial Insulation Industry Revenue Million Forecast, by Insulation Material 2020 & 2033

- Table 42: Global Industrial Insulation Industry Volume K Tons Forecast, by Insulation Material 2020 & 2033

- Table 43: Global Industrial Insulation Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 44: Global Industrial Insulation Industry Volume K Tons Forecast, by Product 2020 & 2033

- Table 45: Global Industrial Insulation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Industrial Insulation Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Industrial Insulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Industrial Insulation Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Germany Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Germany Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: France Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: France Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Italy Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Italy Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 57: Rest of Europe Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Europe Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Global Industrial Insulation Industry Revenue Million Forecast, by Insulation Material 2020 & 2033

- Table 60: Global Industrial Insulation Industry Volume K Tons Forecast, by Insulation Material 2020 & 2033

- Table 61: Global Industrial Insulation Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 62: Global Industrial Insulation Industry Volume K Tons Forecast, by Product 2020 & 2033

- Table 63: Global Industrial Insulation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 64: Global Industrial Insulation Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 65: Global Industrial Insulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global Industrial Insulation Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 67: Brazil Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Brazil Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 69: Argentina Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Argentina Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: Rest of South America Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of South America Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Global Industrial Insulation Industry Revenue Million Forecast, by Insulation Material 2020 & 2033

- Table 74: Global Industrial Insulation Industry Volume K Tons Forecast, by Insulation Material 2020 & 2033

- Table 75: Global Industrial Insulation Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 76: Global Industrial Insulation Industry Volume K Tons Forecast, by Product 2020 & 2033

- Table 77: Global Industrial Insulation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 78: Global Industrial Insulation Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 79: Global Industrial Insulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Industrial Insulation Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 81: Global Industrial Insulation Industry Revenue Million Forecast, by Insulation Material 2020 & 2033

- Table 82: Global Industrial Insulation Industry Volume K Tons Forecast, by Insulation Material 2020 & 2033

- Table 83: Global Industrial Insulation Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 84: Global Industrial Insulation Industry Volume K Tons Forecast, by Product 2020 & 2033

- Table 85: Global Industrial Insulation Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 86: Global Industrial Insulation Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 87: Global Industrial Insulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 88: Global Industrial Insulation Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 89: South Africa Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: South Africa Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 91: Rest of Middle East Industrial Insulation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Middle East Industrial Insulation Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Insulation Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Industrial Insulation Industry?

Key companies in the market include Solvay, BNZ Materials, Cabot Corporation, Armacell, Owens Corning, BASF SE, Rockwool A/S, Knauf Insulation, Temati Group, INSUL-FAB, Johns Manville-Berkshire Hathway Company, Jays Refractory Specialists.

3. What are the main segments of the Industrial Insulation Industry?

The market segments include Insulation Material, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Construction and Power Generation Industry; Regulatory Support to Increase Energy Efficiency.

6. What are the notable trends driving market growth?

Power Generation Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Environmental Hazards; Other Restraints.

8. Can you provide examples of recent developments in the market?

November 2022: BEWI acquired Aislamientos y Envases SL, a Spanish insulation company that provides EPS-based products for packaging and industrial applications, to expand its geographic footprint and strengthen its insulation solutions product portfolio in Spain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Insulation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Insulation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Insulation Industry?

To stay informed about further developments, trends, and reports in the Industrial Insulation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence