Key Insights

The global industrial absorbent market, valued at approximately 4762.68 million in 2025, is projected to experience robust growth, exceeding a 4.1% CAGR through 2033. This expansion is fueled by several key drivers, including increasing industrial activity across diverse sectors such as oil and gas, chemical processing, and food manufacturing, which necessitates effective spill control and cleanup solutions. Stringent environmental regulations globally are also driving adoption as industries strive to minimize environmental impact and comply with safety standards. Further growth is anticipated from the rising demand for specialized absorbents, particularly in hazardous material handling (Hazmat) and applications requiring unique material properties like high absorbency or chemical resistance. Market segmentation reveals a diverse landscape, with universal absorbents maintaining significant market share, alongside specialized oil-only and Hazmat solutions. Material types, encompassing both natural and synthetic options, cater to varying application needs and budget considerations. Geographically, the Asia-Pacific region, particularly China and India, represents a substantial market due to rapid industrialization and infrastructure development. North America and Europe also maintain significant market presence, driven by established industrial bases and stringent environmental regulations. However, challenges such as fluctuating raw material prices and the potential for substitute technologies present some restraints on market growth.

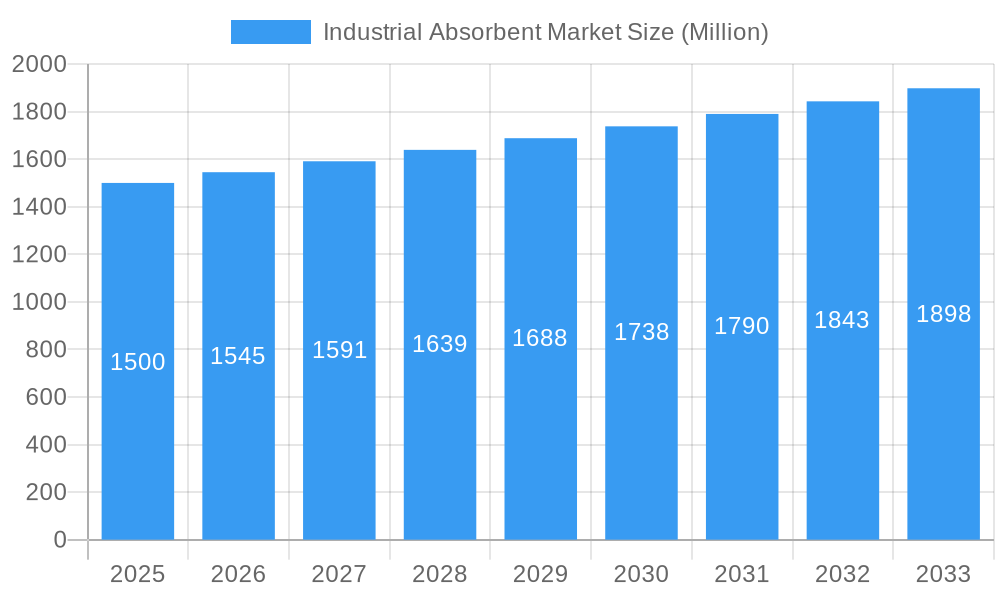

Industrial Absorbent Market Market Size (In Billion)

The competitive landscape is characterized by a mix of established multinational corporations and specialized manufacturers. Key players like 3M, Kimberly-Clark, and ANSELL LTD leverage brand recognition and diverse product portfolios to capture substantial market share. Smaller, specialized players focus on niche applications or innovative absorbent technologies, offering unique value propositions. Future growth will likely be shaped by technological advancements in absorbent materials, a focus on sustainability and environmentally friendly solutions, and continued emphasis on regulatory compliance. The market is poised for continued expansion, driven by the unrelenting need for efficient and effective industrial spill control and waste management across various sectors and regions globally.

Industrial Absorbent Market Company Market Share

Industrial Absorbent Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Industrial Absorbent Market, covering market dynamics, industry trends, leading players, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry stakeholders, investors, and anyone seeking to understand this dynamic market. We project a xx Million market value in 2025, with a CAGR of xx% from 2025 to 2033.

Industrial Absorbent Market Market Dynamics & Concentration

The Industrial Absorbent Market is characterized by a moderately concentrated landscape, with key players such as UES Promura, TOLSA, Monarch Green Inc, Kimberly-Clark Worldwide Inc, 3M, Decorus Europe, Johnson Matthey, ANSELL LTD, Meltblown Technologies Inc, and Brady Worldwide Inc. The market share distribution is currently dynamic, with leading companies strategically acquiring smaller players and investing in R&D to bolster their positions. Innovation is a significant growth engine, particularly the development of advanced, eco-friendly, and high-performance absorbent materials designed for specialized industrial applications. Stringent environmental regulations worldwide, especially concerning hazardous material containment and remediation, are a primary catalyst for product development and market adoption. While alternative spill control methods exist, their effectiveness and scalability often fall short of comprehensive absorbent solutions, presenting a moderate competitive threat. End-user trends are strongly leaning towards sustainable practices, enhanced workplace safety protocols, and efficient waste management, which collectively fuel the demand for sophisticated and environmentally conscious absorbent solutions.

- Market Concentration: Leading players are actively consolidating their positions through strategic initiatives, with the top 5 entities projected to command a substantial, albeit evolving, market share by 2025.

- M&A Activity: Significant mergers and acquisitions activity has been observed between 2019 and 2024, indicating a trend towards consolidation and market expansion among key stakeholders.

- Innovation Drivers: Robust demand for sustainable, biodegradable, and highly efficient absorbent materials is propelling R&D efforts.

- Regulatory Framework: Evolving and increasingly stringent environmental compliance mandates are a powerful force shaping product innovation and market penetration.

- Product Substitutes: While alternative spill control technologies are present, their comprehensive effectiveness for diverse industrial needs remains a key differentiator for absorbents.

- End-User Trends: A pronounced shift towards adopting environmentally responsible practices and prioritizing worker safety is a major impetus for advanced absorbent solutions.

Industrial Absorbent Market Industry Trends & Analysis

The Industrial Absorbent Market is experiencing robust growth, driven primarily by increasing industrial activity across various sectors. The rising demand for effective spill control solutions in industries like oil and gas, chemicals, and healthcare is a significant factor. Technological advancements, such as the development of novel absorbent materials with improved performance characteristics, are further fueling market expansion. Consumer preference for sustainable and environmentally friendly products is shaping the market, leading to increased adoption of biodegradable and recyclable absorbents. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of innovative startups. The market penetration rate for eco-friendly absorbents is projected to reach xx% by 2033.

Leading Markets & Segments in Industrial Absorbent Market

North America currently leads the Industrial Absorbent Market, propelled by its mature industrial base and rigorous environmental protection policies, with the United States being the primary contributor within this region. However, the Asia-Pacific region is emerging as a high-growth frontier, driven by rapid industrial expansion, increasing awareness of environmental stewardship, and significant investments in infrastructure. This region presents substantial opportunities for market players.

- Dominant Region: North America, with the United States as its leading market.

- Key Drivers (North America): Strict environmental enforcement and a highly active industrial sector.

- Key Drivers (Asia-Pacific): Accelerating industrialization and a growing emphasis on ecological preservation.

- Leading Segment (Type): Universal absorbents continue to dominate due to their versatility and broad applicability across various industrial scenarios.

- Leading Segment (End-user Industry): The Oil and Gas sector remains a pivotal market segment due to the inherent risks of spills and the paramount importance of stringent safety and containment measures.

- Leading Segment (Material Type): Synthetic absorbents currently hold a greater market share owing to their superior performance characteristics, including higher absorption capacity and durability, compared to natural alternatives.

Industrial Absorbent Market Product Developments

Recent years have witnessed significant product innovations in the Industrial Absorbent Market. The focus is on developing eco-friendly, high-performance absorbents with enhanced oil absorption capacity, quicker response times, and improved reusability. Companies are investing in advanced materials and technologies to cater to specific industry needs, such as creating bio-based absorbents for the oil and gas industry. These advancements are leading to improved efficiency and reduced environmental impact.

Key Drivers of Industrial Absorbent Market Growth

The Industrial Absorbent Market is experiencing robust growth, underpinned by a confluence of critical factors. Increasingly stringent environmental regulations globally necessitate effective and compliant spill containment and cleanup solutions, particularly within industries handling hazardous substances. A heightened global consciousness regarding environmental protection, coupled with a strong push for sustainable operational practices, is significantly boosting the demand for eco-friendly and biodegradable absorbent materials. Continuous technological advancements in absorbent material science are yielding products with enhanced performance capabilities, improved cost-effectiveness, and specialized functionalities, thereby expanding their utility. Furthermore, sustained industrial expansion across diverse sectors and the escalating emphasis on maintaining high safety standards in workplaces ensure a consistent and growing demand for reliable industrial absorbents.

Challenges in the Industrial Absorbent Market Market

The Industrial Absorbent Market encounters several significant challenges that influence its trajectory. Volatility in raw material prices, often influenced by global commodity markets, can directly impact production costs and affect profit margins for manufacturers. The continuous emergence and refinement of alternative spill control technologies and substitute products pose an ongoing competitive threat, requiring constant innovation and differentiation. Navigating complex and evolving regulatory landscapes, along with meeting stringent compliance requirements for product efficacy and disposal, can escalate operational costs and prolong product development cycles. Additionally, global supply chain disruptions and intricate logistics can impede the efficient and timely delivery of absorbent products to end-users, potentially affecting customer satisfaction and market reach.

Emerging Opportunities in Industrial Absorbent Market

The Industrial Absorbent Market presents significant opportunities for growth. The increasing demand for sustainable and eco-friendly solutions creates a niche for biodegradable and recyclable absorbent products. Strategic partnerships and collaborations between absorbent manufacturers and end-user industries can unlock new market avenues. Technological advancements in material science and manufacturing processes can lead to the development of even more efficient and cost-effective absorbents.

Leading Players in the Industrial Absorbent Market Sector

- UES Promura

- TOLSA

- Monarch Green Inc

- Kimberly-Clark Worldwide Inc

- 3M

- Decorus Europe

- Johnson Matthey

- ANSELL LTD

- Meltblown Technologies Inc

- Brady Worldwide Inc

Key Milestones in Industrial Absorbent Market Industry

- June 2022: Green Boom announces MoUs with IPA Qatar, expanding into the Middle East market with its biodegradable oil-only absorbents. This marks a significant step towards market expansion and adoption of eco-friendly solutions in the region.

Strategic Outlook for Industrial Absorbent Market Market

The Industrial Absorbent Market is strategically positioned for sustained and significant growth. This expansion will be fueled by a synergistic interplay of groundbreaking technological innovations, the enforcement of rigorous environmental regulations, and the persistent rise in industrial activities worldwide. Key strategic imperatives for market participants include a focused commitment to developing and marketing novel, sustainable, and high-performance absorbent solutions. Building strategic alliances, exploring mergers and acquisitions for market consolidation, and actively expanding into rapidly developing emerging economies will be crucial for capturing substantial market share and ensuring enduring success in this dynamic sector.

Industrial Absorbent Market Segmentation

-

1. Material Type

- 1.1. Natural

- 1.2. Synthetic

-

2. Type

- 2.1. Universal

- 2.2. Oil-only

- 2.3. Hazmat

- 2.4. Other Types

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Chemical

- 3.3. Food Processing

- 3.4. Healthcare

- 3.5. Other End-user Industries

Industrial Absorbent Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Industrial Absorbent Market Regional Market Share

Geographic Coverage of Industrial Absorbent Market

Industrial Absorbent Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Oil and Gas Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Health Hazards related to the Manufacturing of the Absorbents; Other Restraints

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to Dominate the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Absorbent Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Universal

- 5.2.2. Oil-only

- 5.2.3. Hazmat

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Chemical

- 5.3.3. Food Processing

- 5.3.4. Healthcare

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Asia Pacific Industrial Absorbent Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Natural

- 6.1.2. Synthetic

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Universal

- 6.2.2. Oil-only

- 6.2.3. Hazmat

- 6.2.4. Other Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Oil and Gas

- 6.3.2. Chemical

- 6.3.3. Food Processing

- 6.3.4. Healthcare

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. North America Industrial Absorbent Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Natural

- 7.1.2. Synthetic

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Universal

- 7.2.2. Oil-only

- 7.2.3. Hazmat

- 7.2.4. Other Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Oil and Gas

- 7.3.2. Chemical

- 7.3.3. Food Processing

- 7.3.4. Healthcare

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe Industrial Absorbent Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Natural

- 8.1.2. Synthetic

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Universal

- 8.2.2. Oil-only

- 8.2.3. Hazmat

- 8.2.4. Other Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Oil and Gas

- 8.3.2. Chemical

- 8.3.3. Food Processing

- 8.3.4. Healthcare

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. South America Industrial Absorbent Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Natural

- 9.1.2. Synthetic

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Universal

- 9.2.2. Oil-only

- 9.2.3. Hazmat

- 9.2.4. Other Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Oil and Gas

- 9.3.2. Chemical

- 9.3.3. Food Processing

- 9.3.4. Healthcare

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Industrial Absorbent Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Natural

- 10.1.2. Synthetic

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Universal

- 10.2.2. Oil-only

- 10.2.3. Hazmat

- 10.2.4. Other Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Oil and Gas

- 10.3.2. Chemical

- 10.3.3. Food Processing

- 10.3.4. Healthcare

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UES Promura*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TOLSA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Monarch Green Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kimberly-Clark Worldwide Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Decorus Europe

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson Matthey

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ANSELL LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Meltblown Technologies Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Brady Worldwide Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 UES Promura*List Not Exhaustive

List of Figures

- Figure 1: Global Industrial Absorbent Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Industrial Absorbent Market Revenue (million), by Material Type 2025 & 2033

- Figure 3: Asia Pacific Industrial Absorbent Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: Asia Pacific Industrial Absorbent Market Revenue (million), by Type 2025 & 2033

- Figure 5: Asia Pacific Industrial Absorbent Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Industrial Absorbent Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Industrial Absorbent Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Industrial Absorbent Market Revenue (million), by Country 2025 & 2033

- Figure 9: Asia Pacific Industrial Absorbent Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Industrial Absorbent Market Revenue (million), by Material Type 2025 & 2033

- Figure 11: North America Industrial Absorbent Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: North America Industrial Absorbent Market Revenue (million), by Type 2025 & 2033

- Figure 13: North America Industrial Absorbent Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Industrial Absorbent Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 15: North America Industrial Absorbent Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Industrial Absorbent Market Revenue (million), by Country 2025 & 2033

- Figure 17: North America Industrial Absorbent Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Industrial Absorbent Market Revenue (million), by Material Type 2025 & 2033

- Figure 19: Europe Industrial Absorbent Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Europe Industrial Absorbent Market Revenue (million), by Type 2025 & 2033

- Figure 21: Europe Industrial Absorbent Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Industrial Absorbent Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 23: Europe Industrial Absorbent Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Industrial Absorbent Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Industrial Absorbent Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Industrial Absorbent Market Revenue (million), by Material Type 2025 & 2033

- Figure 27: South America Industrial Absorbent Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: South America Industrial Absorbent Market Revenue (million), by Type 2025 & 2033

- Figure 29: South America Industrial Absorbent Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Industrial Absorbent Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 31: South America Industrial Absorbent Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: South America Industrial Absorbent Market Revenue (million), by Country 2025 & 2033

- Figure 33: South America Industrial Absorbent Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Industrial Absorbent Market Revenue (million), by Material Type 2025 & 2033

- Figure 35: Middle East and Africa Industrial Absorbent Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: Middle East and Africa Industrial Absorbent Market Revenue (million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Industrial Absorbent Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Industrial Absorbent Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Industrial Absorbent Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Industrial Absorbent Market Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Industrial Absorbent Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Absorbent Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 2: Global Industrial Absorbent Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Global Industrial Absorbent Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Industrial Absorbent Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Industrial Absorbent Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 6: Global Industrial Absorbent Market Revenue million Forecast, by Type 2020 & 2033

- Table 7: Global Industrial Absorbent Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Industrial Absorbent Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Japan Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Global Industrial Absorbent Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 15: Global Industrial Absorbent Market Revenue million Forecast, by Type 2020 & 2033

- Table 16: Global Industrial Absorbent Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Industrial Absorbent Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: United States Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Canada Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Industrial Absorbent Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 22: Global Industrial Absorbent Market Revenue million Forecast, by Type 2020 & 2033

- Table 23: Global Industrial Absorbent Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Industrial Absorbent Market Revenue million Forecast, by Country 2020 & 2033

- Table 25: Germany Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Italy Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: France Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Global Industrial Absorbent Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 31: Global Industrial Absorbent Market Revenue million Forecast, by Type 2020 & 2033

- Table 32: Global Industrial Absorbent Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Industrial Absorbent Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: Brazil Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Industrial Absorbent Market Revenue million Forecast, by Material Type 2020 & 2033

- Table 38: Global Industrial Absorbent Market Revenue million Forecast, by Type 2020 & 2033

- Table 39: Global Industrial Absorbent Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Industrial Absorbent Market Revenue million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Industrial Absorbent Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Absorbent Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Industrial Absorbent Market?

Key companies in the market include UES Promura*List Not Exhaustive, TOLSA, Monarch Green Inc, Kimberly-Clark Worldwide Inc, 3M, Decorus Europe, Johnson Matthey, ANSELL LTD, Meltblown Technologies Inc, Brady Worldwide Inc.

3. What are the main segments of the Industrial Absorbent Market?

The market segments include Material Type, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4762.68 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Oil and Gas Industry; Other Drivers.

6. What are the notable trends driving market growth?

Oil and Gas Industry to Dominate the Demand.

7. Are there any restraints impacting market growth?

Health Hazards related to the Manufacturing of the Absorbents; Other Restraints.

8. Can you provide examples of recent developments in the market?

June 2022: Green Boom, a revolutionary line of eco-friendly oil absorbent products, announced a Memorandums of Understanding (MoUs) with Investment Promotion Agency Qatar (IPA Qatar) during the second annual Qatar Economic Forum. With this announcement, the company created its presence in the Middle East region to cater biodegradable line of oil-only absorbents suitable for large spill response, industrial and transportation applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Absorbent Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Absorbent Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Absorbent Market?

To stay informed about further developments, trends, and reports in the Industrial Absorbent Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence