Key Insights

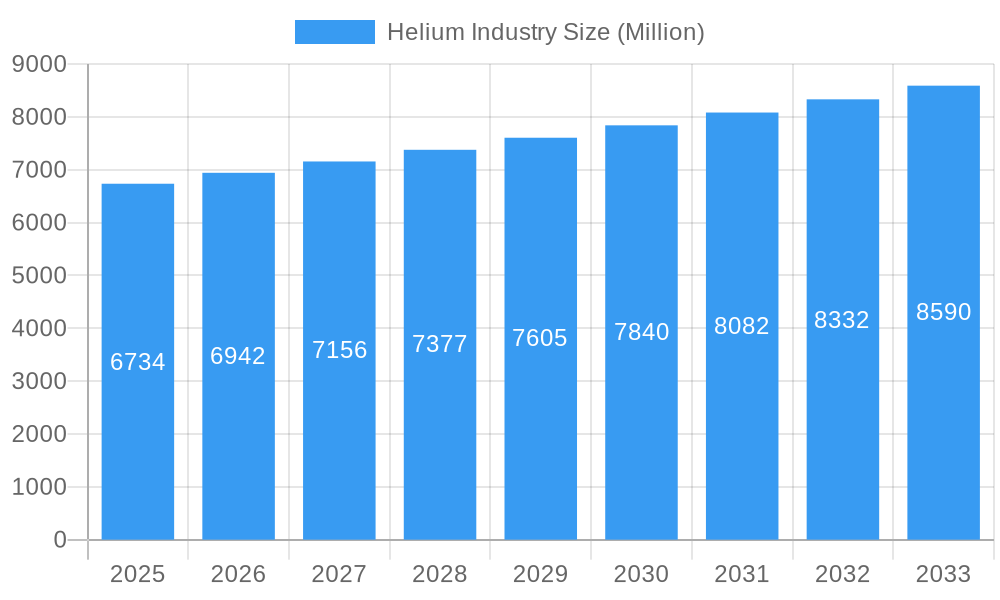

The global helium market, valued at 3.36 billion in the 2025 base year, is projected for robust growth with a Compound Annual Growth Rate (CAGR) of 3.05% from 2025 to 2033. This expansion is propelled by escalating demand across key industries. The electronics and semiconductor sectors, crucial for leak detection and fabrication, are significant growth drivers. The healthcare industry's reliance on helium for MRI and medical applications further bolsters demand. Aerospace and aircraft industries leverage helium for purging and pressurization. While welding and metal fabrication remain important, advancements in cryogenics and controlled atmosphere applications are increasingly contributing to market growth. Geographically, North America, Europe, and Asia-Pacific are prominent markets, with the United States, China, and Japan as leading consumers. Potential restraints include supply chain complexities and price volatility due to helium's finite natural occurrence. Innovations in efficient helium recovery and recycling are anticipated to address these challenges and foster future expansion.

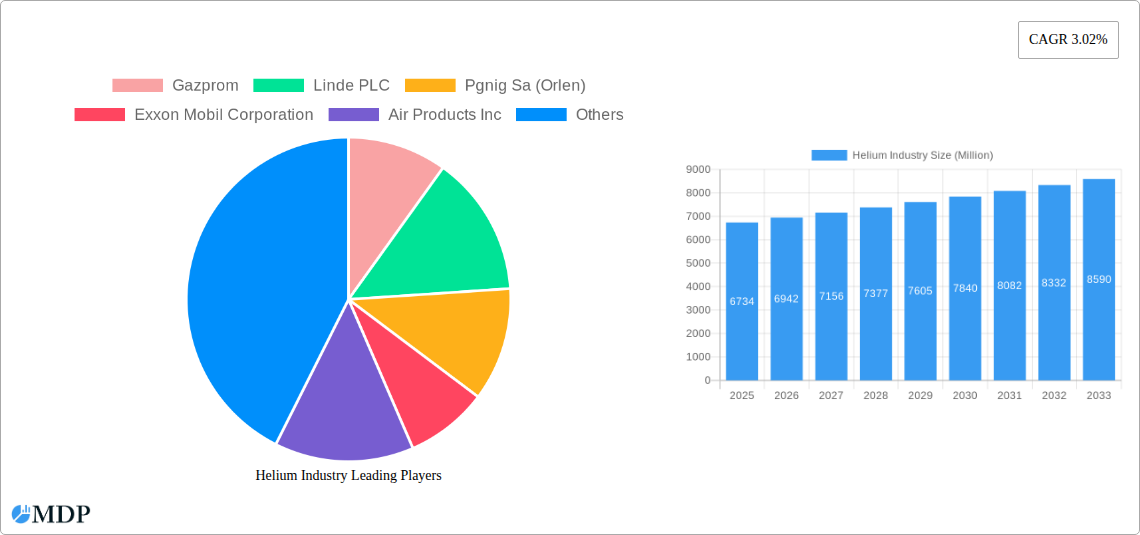

Helium Industry Market Size (In Billion)

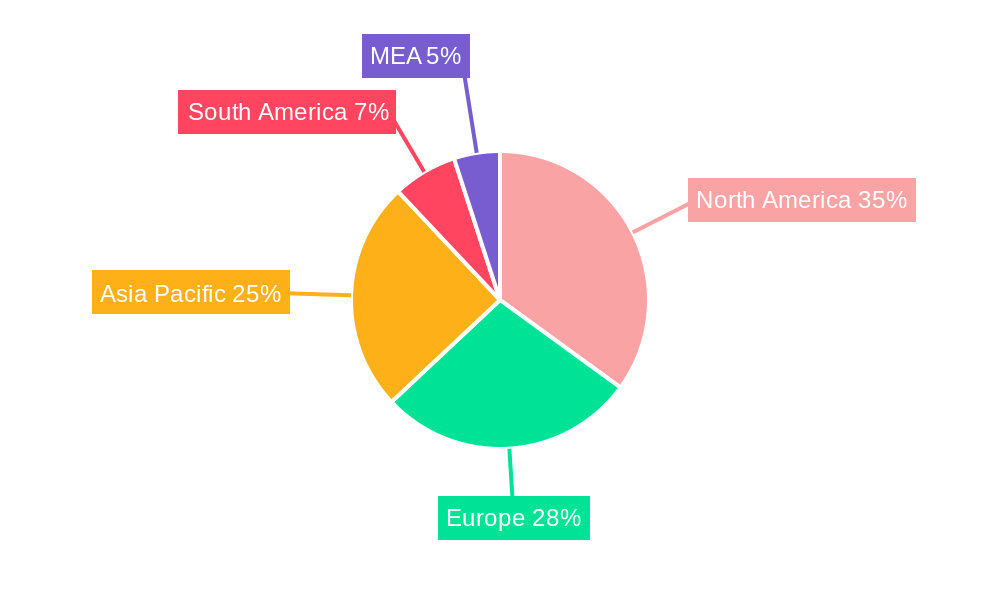

Market segmentation highlights substantial opportunities in applications such as breathing mixes, cryogenics, and leak detection. Breathing mixes are primarily driven by medical requirements for controlled atmospheric gases, while cryogenics cater to expanding scientific research and industrial needs. North America is expected to retain market leadership due to its strong industrial infrastructure and technological prowess. Europe and Asia-Pacific are poised for significant growth, fueled by increasing industrialization and economic development. The competitive environment comprises major global suppliers including Air Products, Linde PLC, and Air Liquide, alongside regional producers. These entities are likely investing in capacity enhancement and technological innovation to secure market share amidst rising demand and supply pressures.

Helium Industry Company Market Share

Helium Industry Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global helium industry, covering market dynamics, leading players, emerging trends, and future growth prospects from 2019 to 2033. With a focus on actionable insights and key performance indicators (KPIs), this report is essential for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period is 2019-2024. Expect detailed analysis of over $XX Million market.

Helium Industry Market Dynamics & Concentration

The global helium market, valued at $XX Million in 2024, exhibits a moderately concentrated structure, with a handful of major players controlling a significant market share. Gazprom, Linde PLC, Air Liquide, and Air Products Inc. are among the key industry leaders, each holding a substantial portion of the overall market. However, smaller players, including regional distributors and specialized helium suppliers, also contribute significantly to the market's overall volume. Innovation within the industry is driven by advancements in helium extraction techniques, purification processes, and the development of novel applications, particularly in high-growth sectors like electronics and semiconductors. Stringent regulatory frameworks governing helium production, distribution, and usage vary across different geographical regions, influencing market dynamics. While there are limited direct substitutes for helium in many applications, some industries explore alternative gases or technologies, impacting demand depending on cost-effectiveness and performance. End-user trends towards increased usage of helium in medical, scientific, and technological sectors drive market growth, while mergers and acquisitions (M&A) activities among major players further shape the competitive landscape.

- Market Share: Top 5 players hold approximately XX% of the global market share.

- M&A Activity: An average of XX M&A deals per year were recorded during the historical period (2019-2024).

- Innovation Focus: Improved extraction methods, advanced purification technologies, and exploring new applications for helium are key areas of focus.

Helium Industry Trends & Analysis

The helium market demonstrates a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033), primarily fueled by growing demand across diverse end-user industries. Technological advancements in helium liquefaction and transportation are enhancing efficiency and reducing costs, contributing to broader adoption and wider market penetration. Consumer preferences for helium-based products and services are influenced by factors like product quality, price competitiveness, and environmental sustainability. Intense competition within the industry compels companies to differentiate themselves through product innovation, superior supply chain management, and customized solutions to specific client needs. Market penetration in emerging economies, driven by rising industrialization and technological development, adds significantly to overall market growth. The increasing prevalence of technological applications that utilize helium, particularly in the electronics and healthcare sectors, further expands the market.

Leading Markets & Segments in Helium Industry

The North American region currently holds the leading position in the global helium market, driven by robust industrial activity, high levels of technological advancement, and a large installed base of helium-dependent industries. Within the market segments, the liquid helium phase commands a higher value than the gaseous phase due to its concentrated form and suitability for specialized applications.

Key Drivers by Segment:

- Liquid Helium: High demand from cryogenics and MRI applications drives substantial growth, with notable presence in advanced research institutions and medical facilities.

- Gaseous Helium: Dominant use in leak detection, welding, and other industrial processes maintains its market share.

- Cryogenics: Expansion in scientific research, medical imaging, and industrial processes fuels consistent demand.

- Aerospace and Aircraft: Increasing aerospace activity, and development of high-end technologies results in a significant demand.

- Electronics and Semiconductors: The surge in demand for advanced semiconductor manufacturing processes drives considerable growth in this sector.

Regional Dominance Analysis: North America's dominance stems from factors like established helium extraction infrastructure, a strong presence of key helium producers, and high consumption across various end-user industries. However, Asia-Pacific is projected to witness rapid growth in helium demand over the forecast period, owing to rising industrialization and technological advancements in this region.

Helium Industry Product Developments

Recent advancements in helium purification and liquefaction technologies have enabled producers to extract and process helium more efficiently and cost-effectively. This has resulted in better quality products and increased overall supply. Further, innovation in packaging and transportation methods has improved the safety and reliability of helium delivery. New applications, especially in semiconductor manufacturing and emerging technologies, are constantly driving the development of specialized helium grades with precise properties to meet specific industrial needs. The competitive landscape compels players to offer innovative solutions that optimize performance and reduce costs for the end-users.

Key Drivers of Helium Industry Growth

Growth in the helium industry is driven by several key factors: the increasing demand for helium across various applications (e.g., MRI machines, semiconductor manufacturing), technological advancements that improve efficiency and reduce costs, government support for research and development in helium-related technologies, and expansion into new geographic markets. The growing adoption of helium in emerging industries like quantum computing presents further growth opportunities.

Challenges in the Helium Industry Market

The helium industry faces challenges including limited global reserves of helium, fluctuating prices due to supply chain vulnerabilities, and increased competition in the market. Environmental concerns related to helium extraction and processing are emerging as regulatory hurdles and are pushing the industry to implement more sustainable practices. Supply chain disruptions and geopolitical uncertainties can also greatly impact helium availability and pricing.

Emerging Opportunities in Helium Industry

Emerging opportunities in the helium industry include the development of new applications in areas such as advanced manufacturing, medical technologies, and aerospace. Strategic partnerships between helium producers and end-users are creating new avenues for growth and market expansion. Technological breakthroughs in helium recovery and purification methods, alongside research into helium recycling, present substantial growth opportunities.

Leading Players in the Helium Industry Sector

- Gazprom

- Linde PLC

- Pgnig Sa (Orlen)

- Exxon Mobil Corporation

- Air Products Inc

- NexAir LLC

- Gulf Cryo

- Matheson Tri-Gas Inc

- Iwatani Corporation

- Messer Group GmbH

- Qatarenergy Lng

- Air Liquide

- Weil Group

- Renergen

Key Milestones in Helium Industry Industry

- July 2022: Helios Specialty Gases and Iwatani Corporation signed an agreement for Iwatani to supply liquid helium to Helios’s transfer facilities in Gujarat, Telangana, and Rajasthan, expanding Iwatani's market reach in India.

- April 2022: Linde signed a long-term helium off-take agreement with Freeport LNG, planning a new helium processing plant in Texas to add nearly 200 million cubic feet of helium to its portfolio by 2024. This significantly strengthens Linde's helium supply capabilities.

Strategic Outlook for Helium Industry Market

The helium industry is poised for continued growth, driven by technological advancements, increasing demand from key end-user sectors, and the emergence of new applications. Strategic partnerships and investments in innovative technologies will play a crucial role in shaping the industry's future, emphasizing the significance of sustainable and efficient helium production and utilization. The ongoing exploration of helium reserves and the development of advanced extraction methods present significant opportunities for long-term market expansion and the securing of a more stable helium supply chain.

Helium Industry Segmentation

-

1. Phase

- 1.1. Liquid

- 1.2. Gas

-

2. Application

- 2.1. Breathing Mixes

- 2.2. Cryogenics

- 2.3. Leak Detection

- 2.4. Pressurizing and Purging

- 2.5. Welding

- 2.6. Controlled Atmosphere

- 2.7. Other Applications

-

3. End-user Industry

- 3.1. Aerospace and Aircraft

- 3.2. Electronics and Semiconductors

- 3.3. Nuclear Power

- 3.4. Healthcare

- 3.5. Welding and Metal Fabrication

- 3.6. Other End-user Industries

Helium Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Australia and New Zealand

-

6. Rest of Asia Pacific

- 6.1. North America

- 7. United States

- 8. Canada

-

9. Mexico

- 9.1. Europe

- 10. Germany

- 11. France

- 12. Italy

- 13. United Kingdom

- 14. Russia

-

15. Rest of Europe

- 15.1. Rest of the World

- 16. South America

- 17. Middle East and Africa

Helium Industry Regional Market Share

Geographic Coverage of Helium Industry

Helium Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Helium Across the Semiconductor Industry; Growing Utilization of Helium Across Aviation Industry

- 3.3. Market Restrains

- 3.3.1. Expensive Extraction Process; Inconsistent Supply of Helium

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Healthcare Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Helium Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 5.1.1. Liquid

- 5.1.2. Gas

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Breathing Mixes

- 5.2.2. Cryogenics

- 5.2.3. Leak Detection

- 5.2.4. Pressurizing and Purging

- 5.2.5. Welding

- 5.2.6. Controlled Atmosphere

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Aerospace and Aircraft

- 5.3.2. Electronics and Semiconductors

- 5.3.3. Nuclear Power

- 5.3.4. Healthcare

- 5.3.5. Welding and Metal Fabrication

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Australia and New Zealand

- 5.4.6. Rest of Asia Pacific

- 5.4.7. United States

- 5.4.8. Canada

- 5.4.9. Mexico

- 5.4.10. Germany

- 5.4.11. France

- 5.4.12. Italy

- 5.4.13. United Kingdom

- 5.4.14. Russia

- 5.4.15. Rest of Europe

- 5.4.16. South America

- 5.4.17. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 6. China Helium Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 6.1.1. Liquid

- 6.1.2. Gas

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Breathing Mixes

- 6.2.2. Cryogenics

- 6.2.3. Leak Detection

- 6.2.4. Pressurizing and Purging

- 6.2.5. Welding

- 6.2.6. Controlled Atmosphere

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Aerospace and Aircraft

- 6.3.2. Electronics and Semiconductors

- 6.3.3. Nuclear Power

- 6.3.4. Healthcare

- 6.3.5. Welding and Metal Fabrication

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 7. India Helium Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 7.1.1. Liquid

- 7.1.2. Gas

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Breathing Mixes

- 7.2.2. Cryogenics

- 7.2.3. Leak Detection

- 7.2.4. Pressurizing and Purging

- 7.2.5. Welding

- 7.2.6. Controlled Atmosphere

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Aerospace and Aircraft

- 7.3.2. Electronics and Semiconductors

- 7.3.3. Nuclear Power

- 7.3.4. Healthcare

- 7.3.5. Welding and Metal Fabrication

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 8. Japan Helium Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 8.1.1. Liquid

- 8.1.2. Gas

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Breathing Mixes

- 8.2.2. Cryogenics

- 8.2.3. Leak Detection

- 8.2.4. Pressurizing and Purging

- 8.2.5. Welding

- 8.2.6. Controlled Atmosphere

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Aerospace and Aircraft

- 8.3.2. Electronics and Semiconductors

- 8.3.3. Nuclear Power

- 8.3.4. Healthcare

- 8.3.5. Welding and Metal Fabrication

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 9. South Korea Helium Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Phase

- 9.1.1. Liquid

- 9.1.2. Gas

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Breathing Mixes

- 9.2.2. Cryogenics

- 9.2.3. Leak Detection

- 9.2.4. Pressurizing and Purging

- 9.2.5. Welding

- 9.2.6. Controlled Atmosphere

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Aerospace and Aircraft

- 9.3.2. Electronics and Semiconductors

- 9.3.3. Nuclear Power

- 9.3.4. Healthcare

- 9.3.5. Welding and Metal Fabrication

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Phase

- 10. Australia and New Zealand Helium Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Phase

- 10.1.1. Liquid

- 10.1.2. Gas

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Breathing Mixes

- 10.2.2. Cryogenics

- 10.2.3. Leak Detection

- 10.2.4. Pressurizing and Purging

- 10.2.5. Welding

- 10.2.6. Controlled Atmosphere

- 10.2.7. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Aerospace and Aircraft

- 10.3.2. Electronics and Semiconductors

- 10.3.3. Nuclear Power

- 10.3.4. Healthcare

- 10.3.5. Welding and Metal Fabrication

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Phase

- 11. Rest of Asia Pacific Helium Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Phase

- 11.1.1. Liquid

- 11.1.2. Gas

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Breathing Mixes

- 11.2.2. Cryogenics

- 11.2.3. Leak Detection

- 11.2.4. Pressurizing and Purging

- 11.2.5. Welding

- 11.2.6. Controlled Atmosphere

- 11.2.7. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Aerospace and Aircraft

- 11.3.2. Electronics and Semiconductors

- 11.3.3. Nuclear Power

- 11.3.4. Healthcare

- 11.3.5. Welding and Metal Fabrication

- 11.3.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Phase

- 12. United States Helium Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Phase

- 12.1.1. Liquid

- 12.1.2. Gas

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Breathing Mixes

- 12.2.2. Cryogenics

- 12.2.3. Leak Detection

- 12.2.4. Pressurizing and Purging

- 12.2.5. Welding

- 12.2.6. Controlled Atmosphere

- 12.2.7. Other Applications

- 12.3. Market Analysis, Insights and Forecast - by End-user Industry

- 12.3.1. Aerospace and Aircraft

- 12.3.2. Electronics and Semiconductors

- 12.3.3. Nuclear Power

- 12.3.4. Healthcare

- 12.3.5. Welding and Metal Fabrication

- 12.3.6. Other End-user Industries

- 12.1. Market Analysis, Insights and Forecast - by Phase

- 13. Canada Helium Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Phase

- 13.1.1. Liquid

- 13.1.2. Gas

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Breathing Mixes

- 13.2.2. Cryogenics

- 13.2.3. Leak Detection

- 13.2.4. Pressurizing and Purging

- 13.2.5. Welding

- 13.2.6. Controlled Atmosphere

- 13.2.7. Other Applications

- 13.3. Market Analysis, Insights and Forecast - by End-user Industry

- 13.3.1. Aerospace and Aircraft

- 13.3.2. Electronics and Semiconductors

- 13.3.3. Nuclear Power

- 13.3.4. Healthcare

- 13.3.5. Welding and Metal Fabrication

- 13.3.6. Other End-user Industries

- 13.1. Market Analysis, Insights and Forecast - by Phase

- 14. Mexico Helium Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Phase

- 14.1.1. Liquid

- 14.1.2. Gas

- 14.2. Market Analysis, Insights and Forecast - by Application

- 14.2.1. Breathing Mixes

- 14.2.2. Cryogenics

- 14.2.3. Leak Detection

- 14.2.4. Pressurizing and Purging

- 14.2.5. Welding

- 14.2.6. Controlled Atmosphere

- 14.2.7. Other Applications

- 14.3. Market Analysis, Insights and Forecast - by End-user Industry

- 14.3.1. Aerospace and Aircraft

- 14.3.2. Electronics and Semiconductors

- 14.3.3. Nuclear Power

- 14.3.4. Healthcare

- 14.3.5. Welding and Metal Fabrication

- 14.3.6. Other End-user Industries

- 14.1. Market Analysis, Insights and Forecast - by Phase

- 15. Germany Helium Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Phase

- 15.1.1. Liquid

- 15.1.2. Gas

- 15.2. Market Analysis, Insights and Forecast - by Application

- 15.2.1. Breathing Mixes

- 15.2.2. Cryogenics

- 15.2.3. Leak Detection

- 15.2.4. Pressurizing and Purging

- 15.2.5. Welding

- 15.2.6. Controlled Atmosphere

- 15.2.7. Other Applications

- 15.3. Market Analysis, Insights and Forecast - by End-user Industry

- 15.3.1. Aerospace and Aircraft

- 15.3.2. Electronics and Semiconductors

- 15.3.3. Nuclear Power

- 15.3.4. Healthcare

- 15.3.5. Welding and Metal Fabrication

- 15.3.6. Other End-user Industries

- 15.1. Market Analysis, Insights and Forecast - by Phase

- 16. France Helium Industry Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - by Phase

- 16.1.1. Liquid

- 16.1.2. Gas

- 16.2. Market Analysis, Insights and Forecast - by Application

- 16.2.1. Breathing Mixes

- 16.2.2. Cryogenics

- 16.2.3. Leak Detection

- 16.2.4. Pressurizing and Purging

- 16.2.5. Welding

- 16.2.6. Controlled Atmosphere

- 16.2.7. Other Applications

- 16.3. Market Analysis, Insights and Forecast - by End-user Industry

- 16.3.1. Aerospace and Aircraft

- 16.3.2. Electronics and Semiconductors

- 16.3.3. Nuclear Power

- 16.3.4. Healthcare

- 16.3.5. Welding and Metal Fabrication

- 16.3.6. Other End-user Industries

- 16.1. Market Analysis, Insights and Forecast - by Phase

- 17. Italy Helium Industry Analysis, Insights and Forecast, 2020-2032

- 17.1. Market Analysis, Insights and Forecast - by Phase

- 17.1.1. Liquid

- 17.1.2. Gas

- 17.2. Market Analysis, Insights and Forecast - by Application

- 17.2.1. Breathing Mixes

- 17.2.2. Cryogenics

- 17.2.3. Leak Detection

- 17.2.4. Pressurizing and Purging

- 17.2.5. Welding

- 17.2.6. Controlled Atmosphere

- 17.2.7. Other Applications

- 17.3. Market Analysis, Insights and Forecast - by End-user Industry

- 17.3.1. Aerospace and Aircraft

- 17.3.2. Electronics and Semiconductors

- 17.3.3. Nuclear Power

- 17.3.4. Healthcare

- 17.3.5. Welding and Metal Fabrication

- 17.3.6. Other End-user Industries

- 17.1. Market Analysis, Insights and Forecast - by Phase

- 18. United Kingdom Helium Industry Analysis, Insights and Forecast, 2020-2032

- 18.1. Market Analysis, Insights and Forecast - by Phase

- 18.1.1. Liquid

- 18.1.2. Gas

- 18.2. Market Analysis, Insights and Forecast - by Application

- 18.2.1. Breathing Mixes

- 18.2.2. Cryogenics

- 18.2.3. Leak Detection

- 18.2.4. Pressurizing and Purging

- 18.2.5. Welding

- 18.2.6. Controlled Atmosphere

- 18.2.7. Other Applications

- 18.3. Market Analysis, Insights and Forecast - by End-user Industry

- 18.3.1. Aerospace and Aircraft

- 18.3.2. Electronics and Semiconductors

- 18.3.3. Nuclear Power

- 18.3.4. Healthcare

- 18.3.5. Welding and Metal Fabrication

- 18.3.6. Other End-user Industries

- 18.1. Market Analysis, Insights and Forecast - by Phase

- 19. Russia Helium Industry Analysis, Insights and Forecast, 2020-2032

- 19.1. Market Analysis, Insights and Forecast - by Phase

- 19.1.1. Liquid

- 19.1.2. Gas

- 19.2. Market Analysis, Insights and Forecast - by Application

- 19.2.1. Breathing Mixes

- 19.2.2. Cryogenics

- 19.2.3. Leak Detection

- 19.2.4. Pressurizing and Purging

- 19.2.5. Welding

- 19.2.6. Controlled Atmosphere

- 19.2.7. Other Applications

- 19.3. Market Analysis, Insights and Forecast - by End-user Industry

- 19.3.1. Aerospace and Aircraft

- 19.3.2. Electronics and Semiconductors

- 19.3.3. Nuclear Power

- 19.3.4. Healthcare

- 19.3.5. Welding and Metal Fabrication

- 19.3.6. Other End-user Industries

- 19.1. Market Analysis, Insights and Forecast - by Phase

- 20. Rest of Europe Helium Industry Analysis, Insights and Forecast, 2020-2032

- 20.1. Market Analysis, Insights and Forecast - by Phase

- 20.1.1. Liquid

- 20.1.2. Gas

- 20.2. Market Analysis, Insights and Forecast - by Application

- 20.2.1. Breathing Mixes

- 20.2.2. Cryogenics

- 20.2.3. Leak Detection

- 20.2.4. Pressurizing and Purging

- 20.2.5. Welding

- 20.2.6. Controlled Atmosphere

- 20.2.7. Other Applications

- 20.3. Market Analysis, Insights and Forecast - by End-user Industry

- 20.3.1. Aerospace and Aircraft

- 20.3.2. Electronics and Semiconductors

- 20.3.3. Nuclear Power

- 20.3.4. Healthcare

- 20.3.5. Welding and Metal Fabrication

- 20.3.6. Other End-user Industries

- 20.1. Market Analysis, Insights and Forecast - by Phase

- 21. South America Helium Industry Analysis, Insights and Forecast, 2020-2032

- 21.1. Market Analysis, Insights and Forecast - by Phase

- 21.1.1. Liquid

- 21.1.2. Gas

- 21.2. Market Analysis, Insights and Forecast - by Application

- 21.2.1. Breathing Mixes

- 21.2.2. Cryogenics

- 21.2.3. Leak Detection

- 21.2.4. Pressurizing and Purging

- 21.2.5. Welding

- 21.2.6. Controlled Atmosphere

- 21.2.7. Other Applications

- 21.3. Market Analysis, Insights and Forecast - by End-user Industry

- 21.3.1. Aerospace and Aircraft

- 21.3.2. Electronics and Semiconductors

- 21.3.3. Nuclear Power

- 21.3.4. Healthcare

- 21.3.5. Welding and Metal Fabrication

- 21.3.6. Other End-user Industries

- 21.1. Market Analysis, Insights and Forecast - by Phase

- 22. Middle East and Africa Helium Industry Analysis, Insights and Forecast, 2020-2032

- 22.1. Market Analysis, Insights and Forecast - by Phase

- 22.1.1. Liquid

- 22.1.2. Gas

- 22.2. Market Analysis, Insights and Forecast - by Application

- 22.2.1. Breathing Mixes

- 22.2.2. Cryogenics

- 22.2.3. Leak Detection

- 22.2.4. Pressurizing and Purging

- 22.2.5. Welding

- 22.2.6. Controlled Atmosphere

- 22.2.7. Other Applications

- 22.3. Market Analysis, Insights and Forecast - by End-user Industry

- 22.3.1. Aerospace and Aircraft

- 22.3.2. Electronics and Semiconductors

- 22.3.3. Nuclear Power

- 22.3.4. Healthcare

- 22.3.5. Welding and Metal Fabrication

- 22.3.6. Other End-user Industries

- 22.1. Market Analysis, Insights and Forecast - by Phase

- 23. Competitive Analysis

- 23.1. Global Market Share Analysis 2025

- 23.2. Company Profiles

- 23.2.1 Gazprom

- 23.2.1.1. Overview

- 23.2.1.2. Products

- 23.2.1.3. SWOT Analysis

- 23.2.1.4. Recent Developments

- 23.2.1.5. Financials (Based on Availability)

- 23.2.2 Linde PLC

- 23.2.2.1. Overview

- 23.2.2.2. Products

- 23.2.2.3. SWOT Analysis

- 23.2.2.4. Recent Developments

- 23.2.2.5. Financials (Based on Availability)

- 23.2.3 Pgnig Sa (Orlen)

- 23.2.3.1. Overview

- 23.2.3.2. Products

- 23.2.3.3. SWOT Analysis

- 23.2.3.4. Recent Developments

- 23.2.3.5. Financials (Based on Availability)

- 23.2.4 Exxon Mobil Corporation

- 23.2.4.1. Overview

- 23.2.4.2. Products

- 23.2.4.3. SWOT Analysis

- 23.2.4.4. Recent Developments

- 23.2.4.5. Financials (Based on Availability)

- 23.2.5 Air Products Inc

- 23.2.5.1. Overview

- 23.2.5.2. Products

- 23.2.5.3. SWOT Analysis

- 23.2.5.4. Recent Developments

- 23.2.5.5. Financials (Based on Availability)

- 23.2.6 NexAir LLC

- 23.2.6.1. Overview

- 23.2.6.2. Products

- 23.2.6.3. SWOT Analysis

- 23.2.6.4. Recent Developments

- 23.2.6.5. Financials (Based on Availability)

- 23.2.7 Gulf Cryo

- 23.2.7.1. Overview

- 23.2.7.2. Products

- 23.2.7.3. SWOT Analysis

- 23.2.7.4. Recent Developments

- 23.2.7.5. Financials (Based on Availability)

- 23.2.8 Matheson Tri-Gas Inc

- 23.2.8.1. Overview

- 23.2.8.2. Products

- 23.2.8.3. SWOT Analysis

- 23.2.8.4. Recent Developments

- 23.2.8.5. Financials (Based on Availability)

- 23.2.9 Iwatani Corporation

- 23.2.9.1. Overview

- 23.2.9.2. Products

- 23.2.9.3. SWOT Analysis

- 23.2.9.4. Recent Developments

- 23.2.9.5. Financials (Based on Availability)

- 23.2.10 Messer Group GmbH

- 23.2.10.1. Overview

- 23.2.10.2. Products

- 23.2.10.3. SWOT Analysis

- 23.2.10.4. Recent Developments

- 23.2.10.5. Financials (Based on Availability)

- 23.2.11 Qatarenergy Lng

- 23.2.11.1. Overview

- 23.2.11.2. Products

- 23.2.11.3. SWOT Analysis

- 23.2.11.4. Recent Developments

- 23.2.11.5. Financials (Based on Availability)

- 23.2.12 Air Liquide

- 23.2.12.1. Overview

- 23.2.12.2. Products

- 23.2.12.3. SWOT Analysis

- 23.2.12.4. Recent Developments

- 23.2.12.5. Financials (Based on Availability)

- 23.2.13 Weil Group*List Not Exhaustive

- 23.2.13.1. Overview

- 23.2.13.2. Products

- 23.2.13.3. SWOT Analysis

- 23.2.13.4. Recent Developments

- 23.2.13.5. Financials (Based on Availability)

- 23.2.14 Renergen

- 23.2.14.1. Overview

- 23.2.14.2. Products

- 23.2.14.3. SWOT Analysis

- 23.2.14.4. Recent Developments

- 23.2.14.5. Financials (Based on Availability)

- 23.2.1 Gazprom

List of Figures

- Figure 1: Global Helium Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Helium Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: China Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 4: China Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 5: China Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 6: China Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 7: China Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 8: China Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 9: China Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: China Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: China Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 12: China Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 13: China Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: China Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: China Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: China Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 17: China Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: China Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: India Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 20: India Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 21: India Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 22: India Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 23: India Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 24: India Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 25: India Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: India Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 27: India Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 28: India Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 29: India Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: India Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: India Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: India Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 33: India Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: India Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Japan Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 36: Japan Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 37: Japan Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 38: Japan Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 39: Japan Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 40: Japan Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 41: Japan Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 42: Japan Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 43: Japan Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 44: Japan Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: Japan Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Japan Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Japan Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Japan Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: Japan Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Japan Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South Korea Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 52: South Korea Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 53: South Korea Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 54: South Korea Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 55: South Korea Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 56: South Korea Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 57: South Korea Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: South Korea Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: South Korea Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 60: South Korea Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 61: South Korea Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: South Korea Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: South Korea Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: South Korea Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 65: South Korea Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South Korea Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Australia and New Zealand Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 68: Australia and New Zealand Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 69: Australia and New Zealand Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 70: Australia and New Zealand Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 71: Australia and New Zealand Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 72: Australia and New Zealand Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 73: Australia and New Zealand Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 74: Australia and New Zealand Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 75: Australia and New Zealand Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 76: Australia and New Zealand Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 77: Australia and New Zealand Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Australia and New Zealand Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Australia and New Zealand Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Australia and New Zealand Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 81: Australia and New Zealand Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Australia and New Zealand Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Rest of Asia Pacific Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 84: Rest of Asia Pacific Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 85: Rest of Asia Pacific Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 86: Rest of Asia Pacific Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 87: Rest of Asia Pacific Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 88: Rest of Asia Pacific Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 89: Rest of Asia Pacific Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 90: Rest of Asia Pacific Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 91: Rest of Asia Pacific Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 92: Rest of Asia Pacific Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 93: Rest of Asia Pacific Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 94: Rest of Asia Pacific Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 95: Rest of Asia Pacific Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 96: Rest of Asia Pacific Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 97: Rest of Asia Pacific Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Rest of Asia Pacific Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 99: United States Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 100: United States Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 101: United States Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 102: United States Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 103: United States Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 104: United States Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 105: United States Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 106: United States Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 107: United States Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 108: United States Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 109: United States Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 110: United States Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 111: United States Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 112: United States Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 113: United States Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 114: United States Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 115: Canada Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 116: Canada Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 117: Canada Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 118: Canada Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 119: Canada Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 120: Canada Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 121: Canada Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 122: Canada Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 123: Canada Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 124: Canada Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 125: Canada Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 126: Canada Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 127: Canada Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 128: Canada Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 129: Canada Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 130: Canada Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 131: Mexico Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 132: Mexico Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 133: Mexico Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 134: Mexico Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 135: Mexico Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 136: Mexico Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 137: Mexico Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 138: Mexico Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 139: Mexico Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 140: Mexico Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 141: Mexico Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 142: Mexico Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 143: Mexico Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 144: Mexico Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 145: Mexico Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 146: Mexico Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 147: Germany Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 148: Germany Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 149: Germany Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 150: Germany Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 151: Germany Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 152: Germany Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 153: Germany Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 154: Germany Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 155: Germany Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 156: Germany Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 157: Germany Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 158: Germany Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 159: Germany Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 160: Germany Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 161: Germany Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 162: Germany Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 163: France Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 164: France Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 165: France Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 166: France Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 167: France Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 168: France Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 169: France Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 170: France Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 171: France Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 172: France Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 173: France Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 174: France Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 175: France Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 176: France Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 177: France Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 178: France Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 179: Italy Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 180: Italy Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 181: Italy Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 182: Italy Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 183: Italy Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 184: Italy Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 185: Italy Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 186: Italy Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 187: Italy Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 188: Italy Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 189: Italy Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 190: Italy Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 191: Italy Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 192: Italy Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 193: Italy Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 194: Italy Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 195: United Kingdom Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 196: United Kingdom Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 197: United Kingdom Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 198: United Kingdom Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 199: United Kingdom Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 200: United Kingdom Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 201: United Kingdom Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 202: United Kingdom Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 203: United Kingdom Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 204: United Kingdom Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 205: United Kingdom Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 206: United Kingdom Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 207: United Kingdom Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 208: United Kingdom Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 209: United Kingdom Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 210: United Kingdom Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 211: Russia Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 212: Russia Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 213: Russia Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 214: Russia Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 215: Russia Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 216: Russia Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 217: Russia Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 218: Russia Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 219: Russia Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 220: Russia Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 221: Russia Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 222: Russia Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 223: Russia Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 224: Russia Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 225: Russia Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 226: Russia Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 227: Rest of Europe Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 228: Rest of Europe Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 229: Rest of Europe Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 230: Rest of Europe Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 231: Rest of Europe Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 232: Rest of Europe Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 233: Rest of Europe Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 234: Rest of Europe Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 235: Rest of Europe Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 236: Rest of Europe Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 237: Rest of Europe Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 238: Rest of Europe Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 239: Rest of Europe Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 240: Rest of Europe Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 241: Rest of Europe Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 242: Rest of Europe Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 243: South America Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 244: South America Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 245: South America Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 246: South America Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 247: South America Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 248: South America Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 249: South America Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 250: South America Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 251: South America Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 252: South America Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 253: South America Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 254: South America Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 255: South America Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 256: South America Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 257: South America Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 258: South America Helium Industry Volume Share (%), by Country 2025 & 2033

- Figure 259: Middle East and Africa Helium Industry Revenue (billion), by Phase 2025 & 2033

- Figure 260: Middle East and Africa Helium Industry Volume (K Tons), by Phase 2025 & 2033

- Figure 261: Middle East and Africa Helium Industry Revenue Share (%), by Phase 2025 & 2033

- Figure 262: Middle East and Africa Helium Industry Volume Share (%), by Phase 2025 & 2033

- Figure 263: Middle East and Africa Helium Industry Revenue (billion), by Application 2025 & 2033

- Figure 264: Middle East and Africa Helium Industry Volume (K Tons), by Application 2025 & 2033

- Figure 265: Middle East and Africa Helium Industry Revenue Share (%), by Application 2025 & 2033

- Figure 266: Middle East and Africa Helium Industry Volume Share (%), by Application 2025 & 2033

- Figure 267: Middle East and Africa Helium Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 268: Middle East and Africa Helium Industry Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 269: Middle East and Africa Helium Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 270: Middle East and Africa Helium Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 271: Middle East and Africa Helium Industry Revenue (billion), by Country 2025 & 2033

- Figure 272: Middle East and Africa Helium Industry Volume (K Tons), by Country 2025 & 2033

- Figure 273: Middle East and Africa Helium Industry Revenue Share (%), by Country 2025 & 2033

- Figure 274: Middle East and Africa Helium Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 2: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 3: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Helium Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Helium Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 10: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 11: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 18: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 19: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 26: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 27: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 34: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 35: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 37: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 42: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 43: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 50: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 51: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 52: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 53: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 55: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: North America Helium Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: North America Helium Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 60: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 61: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 62: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 63: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 64: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 65: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 66: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 67: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 68: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 69: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 70: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 71: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 72: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 73: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 74: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 75: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 76: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 77: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 78: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 79: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 80: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 81: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 82: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 83: Europe Helium Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Europe Helium Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 85: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 86: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 87: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 88: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 89: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 90: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 91: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 92: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 93: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 94: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 95: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 96: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 97: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 98: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 99: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 100: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 101: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 102: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 103: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 104: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 105: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 106: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 107: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 108: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 109: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 110: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 111: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 112: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 113: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 114: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 115: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 116: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 117: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 118: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 119: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 120: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 121: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 122: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 123: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 124: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 125: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 126: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 127: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 128: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 129: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 130: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 131: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 132: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 133: Rest of the World Helium Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 134: Rest of the World Helium Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 135: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 136: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 137: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 138: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 139: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 140: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 141: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 142: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 143: Global Helium Industry Revenue billion Forecast, by Phase 2020 & 2033

- Table 144: Global Helium Industry Volume K Tons Forecast, by Phase 2020 & 2033

- Table 145: Global Helium Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 146: Global Helium Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 147: Global Helium Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 148: Global Helium Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 149: Global Helium Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 150: Global Helium Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Helium Industry?

The projected CAGR is approximately 3.05%.

2. Which companies are prominent players in the Helium Industry?

Key companies in the market include Gazprom, Linde PLC, Pgnig Sa (Orlen), Exxon Mobil Corporation, Air Products Inc, NexAir LLC, Gulf Cryo, Matheson Tri-Gas Inc, Iwatani Corporation, Messer Group GmbH, Qatarenergy Lng, Air Liquide, Weil Group*List Not Exhaustive, Renergen.

3. What are the main segments of the Helium Industry?

The market segments include Phase, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.36 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Helium Across the Semiconductor Industry; Growing Utilization of Helium Across Aviation Industry.

6. What are the notable trends driving market growth?

Increasing Demand from the Healthcare Industry.

7. Are there any restraints impacting market growth?

Expensive Extraction Process; Inconsistent Supply of Helium.

8. Can you provide examples of recent developments in the market?

July 2022: Helios Specialty Gases and Iwatani Corporation signed an agreement involving Iwatani, supplying liquid helium to Helious’s transfer facilities in Gujarat, Telangana, and Rajasthan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Helium Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Helium Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Helium Industry?

To stay informed about further developments, trends, and reports in the Helium Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence