Key Insights

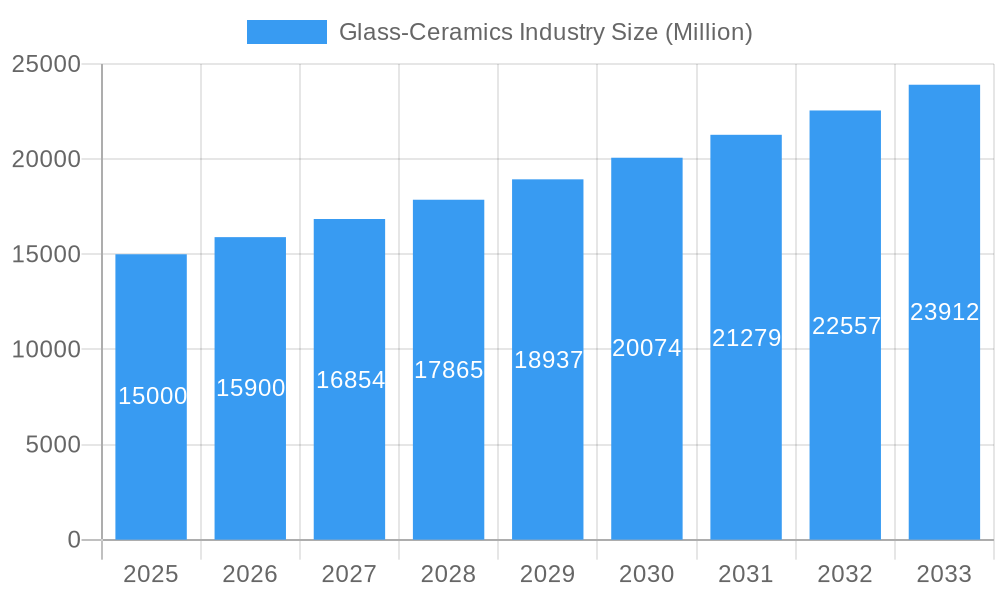

The global glass-ceramics market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for energy-efficient building materials is fueling adoption in the construction sector, while advancements in electronics and the burgeoning healthcare industry are creating new avenues for application. Specifically, the rising need for durable, lightweight, and biocompatible materials in medical devices and implants is a significant driver. Furthermore, the aerospace industry's pursuit of high-performance materials for aircraft and spacecraft components contributes substantially to market growth. Technological advancements in material science, leading to enhanced properties like improved strength, thermal resistance, and chemical durability, further solidify market prospects. However, the market faces constraints such as the relatively high production costs of specialized glass-ceramics and the availability of alternative materials. The segmentation by material (lithium, magnesium, zinc, etc.) and application (building & construction, electronics, healthcare, aerospace, etc.) allows for a granular understanding of market dynamics. Regional analysis reveals significant growth potential in the Asia-Pacific region, particularly in countries like China and India, driven by their rapid infrastructure development and expanding industrial sectors. North America and Europe also maintain substantial market shares, fueled by established technological advancements and consumer demand.

Glass-Ceramics Industry Market Size (In Billion)

The competitive landscape is characterized by a blend of established multinational corporations and regional players. Companies like SCHOTT AG, Saint-Gobain, Corning Incorporated, and others are leading the innovation and market share, leveraging their extensive research and development capabilities and global distribution networks. The future of the glass-ceramics market looks bright, with continued expansion predicted across all major application segments and geographies. Strategic partnerships, technological collaborations, and focus on sustainability will likely play crucial roles in shaping the industry's trajectory over the forecast period. The market's resilience to economic fluctuations stems from its applications in essential sectors, ensuring sustained growth even amidst external uncertainties. Further research into specialized glass-ceramics with enhanced properties and exploring new applications will drive future market expansion.

Glass-Ceramics Industry Company Market Share

Glass-Ceramics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global glass-ceramics industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and future growth potential. The report forecasts a market value exceeding xx Million by 2033, highlighting lucrative opportunities within this dynamic sector. It includes detailed analysis of leading companies like SCHOTT AG, Saint-Gobain, and Corning Incorporated, and covers key segments including Lithium, Magnesium, and Zinc based materials, with applications spanning building and construction, electrical and electronics, healthcare, aerospace, and optical industries.

Glass-Ceramics Industry Market Dynamics & Concentration

The glass-ceramics market is characterized by a moderately consolidated structure, where a select group of major players commands a significant portion of the global market share. Prominent companies like SCHOTT AG, Saint-Gobain, and Corning Incorporated are key influencers, collectively estimated to hold approximately xx% of the global market in 2024. This concentration is shaped by substantial capital investment requirements for advanced production facilities, the necessity for rigorous quality control, and the demand for specialized technical expertise. Continuous innovation is a vital aspect, with companies consistently developing advanced glass-ceramic materials possessing superior and tailored properties. Regulatory landscapes, particularly those concerning environmental sustainability and material safety, exert a considerable influence on market dynamics. While advanced polymers and composites present a competitive challenge as product substitutes, the inherent unique properties of glass-ceramics – including exceptional strength, remarkable thermal resistance, and excellent biocompatibility – provide a distinct and enduring advantage across a multitude of applications. Evolving end-user demands for enhanced energy efficiency, lightweight materials, and advanced functionalities are significant drivers of market growth. Mergers and acquisitions (M&A) are a recurring strategic tool within the industry, with xx significant deals recorded between 2019 and 2024. These M&A activities underscore the industry's strategic imperative to broaden product portfolios, acquire cutting-edge technologies, and expand their global market reach.

- Market Share Snapshot: The top 3 players collectively accounted for approximately xx% of the market in 2024.

- M&A Activity Overview: A total of xx major M&A deals were completed between 2019 and 2024.

- Key Innovation Drivers: Continuous development of enhanced material properties, seamless functional integration, and sophisticated processing techniques are paramount.

- Regulatory Influences: Stringent environmental regulations and evolving material safety standards significantly shape market operations.

Glass-Ceramics Industry Industry Trends & Analysis

The global glass-ceramics market is poised for robust expansion, driven by escalating demand across a diverse array of end-use sectors. The compound annual growth rate (CAGR) is projected to reach an impressive xx% during the forecast period spanning from 2025 to 2033. This upward trajectory is propelled by several key factors, including the increasing adoption of energy-efficient building solutions, the dynamic growth of the electronics industry, and the expanding healthcare sector. Technological advancements are continuously facilitating the creation of novel glass-ceramic materials with precisely engineered properties for specific applications. For instance, the advent of transparent glass-ceramics is revolutionizing architectural design, thereby accelerating market penetration within the building and construction sector. Furthermore, evolving consumer preferences for materials that offer exceptional durability and high performance are contributing significantly to market growth. Despite this positive outlook, the competitive arena remains highly dynamic, with established players prioritizing innovation and market diversification, while new entrants are strategically targeting niche market segments. The increasing penetration into emerging economies, fueled by substantial infrastructure development initiatives and ongoing industrialization, represents another critical growth catalyst.

Leading Markets & Segments in Glass-Ceramics Industry

The Building and Construction segment stands as the dominant force in the glass-ceramics market, contributing an estimated xx% of the total market value in 2024. This segment's preeminence is largely attributed to the booming construction industry, particularly in rapidly developing economies. Within the materials landscape, Lithium-based glass-ceramics command a substantial market share, a testament to their superior and versatile properties.

-

Key Drivers for Building and Construction:

- Substantial growth in infrastructure investments globally.

- Accelerated urbanization and a construction boom in developing nations.

- A surging demand for energy-efficient and sustainable building solutions.

-

Dominant Regions: North America and the Asia-Pacific regions are at the forefront of market share due to their vigorous construction and industrial activities. Europe also maintains a significant market presence, primarily driven by strong demand from the automotive and healthcare sectors.

-

Electrical and Electronics Segment: This segment is experiencing vigorous growth, fueled by the escalating demand for sophisticated and advanced electronic components.

-

Healthcare Segment: The increasing integration of glass-ceramics into medical devices and implants is a primary driver behind this segment's significant growth trajectory.

Glass-Ceramics Industry Product Developments

Recent advancements in product development are heavily focused on imbuing glass-ceramics with enhanced functionalities. This includes significant improvements in thermal shock resistance, increased mechanical strength, and the customization of optical properties. Achieving these enhancements involves the meticulous development of glass-ceramics with unique compositions and precisely controlled microstructures. The strategic integration of nanomaterials and the adoption of advanced processing techniques have further elevated the performance characteristics of glass-ceramics, thereby expanding their range of applicability. These innovations translate into tangible competitive advantages through superior performance, optimized production costs, and a stronger commitment to sustainability.

Key Drivers of Glass-Ceramics Industry Growth

The glass-ceramics market's growth is primarily driven by technological advancements leading to enhanced material properties. Economic factors, such as increasing infrastructure spending and industrialization in developing nations, further stimulate market expansion. Favorable government regulations promoting energy-efficient construction and sustainable materials also contribute to growth. For instance, incentives for green building materials are driving adoption in the construction sector.

Challenges in the Glass-Ceramics Industry Market

Challenges include stringent regulatory compliance for material safety and environmental protection, potentially leading to increased production costs. Fluctuations in raw material prices also impact profitability. Intense competition from alternative materials and the need for continuous technological innovation to maintain a competitive edge represent other significant hurdles. These factors collectively impact market growth by approximately xx% based on market analysis.

Emerging Opportunities in Glass-Ceramics Industry

The long-term growth potential for the glass-ceramics industry is exceptionally promising, driven by groundbreaking technological advancements that are opening doors to novel applications. These include exciting new frontiers such as flexible electronics and advanced biomedical devices. Seizing these opportunities will necessitate strategic collaborations with leading technology providers and aggressive expansion into new and emerging markets. Furthermore, the development and implementation of sustainable manufacturing processes represent another critical avenue for ensuring sustained and responsible growth within the industry.

Leading Players in the Glass-Ceramics Industry Sector

- SCHOTT AG

- Dongguan Hongtai Glass Co Ltd

- Saint-Gobain

- Ohara Corporation

- CoorsTek Inc

- Morgan Advanced Materials PLC

- AGC Inc

- Nippon Electric Glass Co Ltd

- KEDI Glass-ceramic Industrial Co Ltd

- Corning Incorporated

- Jingniu Glass Ceramics Group Co Ltd

- Kanger Glass-ceramic Co Ltd

Key Milestones in Glass-Ceramics Industry Industry

- February 2021: Saint-Gobain acquired Trakya Glass Rus ZAO, expanding its market presence in Russia.

- September 2021: SCHOTT AG acquired Applied Microarrays Inc., strengthening its position in the healthcare sector.

Strategic Outlook for Glass-Ceramics Industry Market

The future of the glass-ceramics industry is promising, with significant growth potential driven by technological innovation, expanding applications, and increasing demand from various sectors. Companies focused on strategic partnerships, research and development, and sustainable manufacturing practices are well-positioned to capitalize on the market's long-term growth prospects. The market is expected to witness further consolidation through M&A activities, resulting in a more concentrated industry landscape.

Glass-Ceramics Industry Segmentation

-

1. Material

- 1.1. Lithium

- 1.2. Mangnesium

- 1.3. Zinc

-

2. Application

- 2.1. Building and Construction

- 2.2. Electrical and Electronics

- 2.3. Healthcare

- 2.4. Aerospace

- 2.5. Optical

- 2.6. Other Applications

Glass-Ceramics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Glass-Ceramics Industry Regional Market Share

Geographic Coverage of Glass-Ceramics Industry

Glass-Ceramics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Usage in Aerospace Applications; Increasing Demand from Building and Construction

- 3.3. Market Restrains

- 3.3.1. Fluctuating Prices of Raw Materials; Government Regulations on Carbon Emission

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Building and Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Glass-Ceramics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Lithium

- 5.1.2. Mangnesium

- 5.1.3. Zinc

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Building and Construction

- 5.2.2. Electrical and Electronics

- 5.2.3. Healthcare

- 5.2.4. Aerospace

- 5.2.5. Optical

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Asia Pacific Glass-Ceramics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Lithium

- 6.1.2. Mangnesium

- 6.1.3. Zinc

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Building and Construction

- 6.2.2. Electrical and Electronics

- 6.2.3. Healthcare

- 6.2.4. Aerospace

- 6.2.5. Optical

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. North America Glass-Ceramics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Lithium

- 7.1.2. Mangnesium

- 7.1.3. Zinc

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Building and Construction

- 7.2.2. Electrical and Electronics

- 7.2.3. Healthcare

- 7.2.4. Aerospace

- 7.2.5. Optical

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Glass-Ceramics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Lithium

- 8.1.2. Mangnesium

- 8.1.3. Zinc

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Building and Construction

- 8.2.2. Electrical and Electronics

- 8.2.3. Healthcare

- 8.2.4. Aerospace

- 8.2.5. Optical

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. South America Glass-Ceramics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Lithium

- 9.1.2. Mangnesium

- 9.1.3. Zinc

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Building and Construction

- 9.2.2. Electrical and Electronics

- 9.2.3. Healthcare

- 9.2.4. Aerospace

- 9.2.5. Optical

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Glass-Ceramics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Lithium

- 10.1.2. Mangnesium

- 10.1.3. Zinc

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Building and Construction

- 10.2.2. Electrical and Electronics

- 10.2.3. Healthcare

- 10.2.4. Aerospace

- 10.2.5. Optical

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SCHOTT AG*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dongguan Hongtai Glass Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Saint-Gobain

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ohara Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CoorsTek Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Morgan Advanced Materials PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AGC Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nippon Electric Glass Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KEDI Glass-ceramic Industrial Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Corning Incorporated

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jingniu Glass Ceramics Group Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kanger Glass-ceramic Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 SCHOTT AG*List Not Exhaustive

List of Figures

- Figure 1: Global Glass-Ceramics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Glass-Ceramics Industry Revenue (Million), by Material 2025 & 2033

- Figure 3: Asia Pacific Glass-Ceramics Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: Asia Pacific Glass-Ceramics Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Glass-Ceramics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Glass-Ceramics Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Glass-Ceramics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Glass-Ceramics Industry Revenue (Million), by Material 2025 & 2033

- Figure 9: North America Glass-Ceramics Industry Revenue Share (%), by Material 2025 & 2033

- Figure 10: North America Glass-Ceramics Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Glass-Ceramics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Glass-Ceramics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Glass-Ceramics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Glass-Ceramics Industry Revenue (Million), by Material 2025 & 2033

- Figure 15: Europe Glass-Ceramics Industry Revenue Share (%), by Material 2025 & 2033

- Figure 16: Europe Glass-Ceramics Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Glass-Ceramics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Glass-Ceramics Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Glass-Ceramics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Glass-Ceramics Industry Revenue (Million), by Material 2025 & 2033

- Figure 21: South America Glass-Ceramics Industry Revenue Share (%), by Material 2025 & 2033

- Figure 22: South America Glass-Ceramics Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Glass-Ceramics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Glass-Ceramics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Glass-Ceramics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Glass-Ceramics Industry Revenue (Million), by Material 2025 & 2033

- Figure 27: Middle East and Africa Glass-Ceramics Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East and Africa Glass-Ceramics Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Glass-Ceramics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Glass-Ceramics Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Glass-Ceramics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Glass-Ceramics Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Glass-Ceramics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Glass-Ceramics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Glass-Ceramics Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 5: Global Glass-Ceramics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Glass-Ceramics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Glass-Ceramics Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global Glass-Ceramics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Glass-Ceramics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Glass-Ceramics Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 19: Global Glass-Ceramics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Glass-Ceramics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Glass-Ceramics Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 27: Global Glass-Ceramics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Glass-Ceramics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Glass-Ceramics Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 33: Global Glass-Ceramics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Glass-Ceramics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: South Africa Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Saudi Arabia Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Glass-Ceramics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Glass-Ceramics Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Glass-Ceramics Industry?

Key companies in the market include SCHOTT AG*List Not Exhaustive, Dongguan Hongtai Glass Co Ltd, Saint-Gobain, Ohara Corporation, CoorsTek Inc, Morgan Advanced Materials PLC, AGC Inc, Nippon Electric Glass Co Ltd, KEDI Glass-ceramic Industrial Co Ltd, Corning Incorporated, Jingniu Glass Ceramics Group Co Ltd, Kanger Glass-ceramic Co Ltd.

3. What are the main segments of the Glass-Ceramics Industry?

The market segments include Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Usage in Aerospace Applications; Increasing Demand from Building and Construction.

6. What are the notable trends driving market growth?

Growing Demand from the Building and Construction Sector.

7. Are there any restraints impacting market growth?

Fluctuating Prices of Raw Materials; Government Regulations on Carbon Emission.

8. Can you provide examples of recent developments in the market?

In February 2021, Saint-Gobain completed the joint acquisition of Trakya Glass Rus ZAO, a glass manufacturing company, to further enhance the sale of glass ceramics, glassware, glass packaging, and chemicals in Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Glass-Ceramics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Glass-Ceramics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Glass-Ceramics Industry?

To stay informed about further developments, trends, and reports in the Glass-Ceramics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence