Key Insights

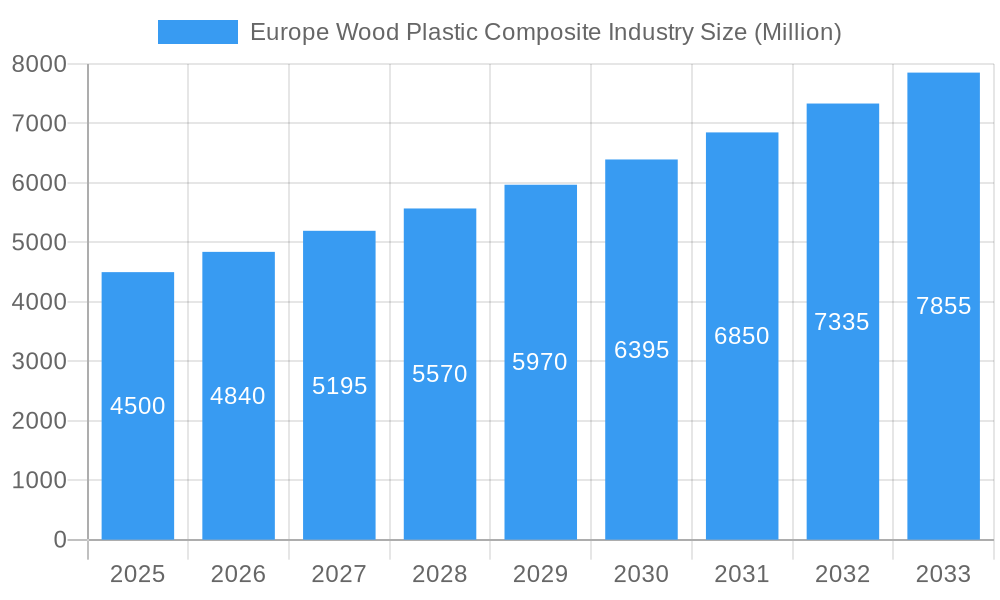

The European Wood Plastic Composite (WPC) market is projected for substantial growth, propelled by heightened environmental awareness, stringent building codes promoting sustainable materials, and increasing demand for durable, low-maintenance alternatives. With an estimated current market size of $4.5 billion and a robust Compound Annual Growth Rate (CAGR) of 11.7%, the industry is forecasted to exceed $8.89 billion by 2025. Key growth drivers include the rising adoption of WPC in outdoor applications like decking and fencing, where its inherent resistance to rot, insects, and weathering provides a distinct advantage. The automotive sector's increasing use of WPC for interior components, driven by lightweighting objectives and improved fuel efficiency, alongside demand from the furniture and consumer goods industries for aesthetically pleasing and eco-friendly products, are significant contributors. The emphasis on circular economy principles and the utilization of recycled wood fibers and plastics further enhances the WPC market's appeal and sustainability credentials, aligning with European Union green initiatives.

Europe Wood Plastic Composite Industry Market Size (In Billion)

Despite a positive outlook, the market confronts certain challenges. Fluctuations in raw material prices, including wood fibers and virgin plastics, can impact profit margins, necessitating strategic sourcing and pricing adjustments. High initial manufacturing costs and the requirement for specialized processing equipment may pose barriers to entry for new participants. However, continuous technological advancements are optimizing production processes, leading to cost efficiencies and enhanced product performance. Emerging trends, such as the development of advanced WPC formulations with superior fire resistance and structural integrity, coupled with growing demand for customized WPC solutions, are expected to shape the market's future. Innovations in design, aesthetics, and surface treatments will further expand WPC's applicability across diverse sectors, solidifying its role as a critical sustainable material in European construction, automotive, and consumer goods industries.

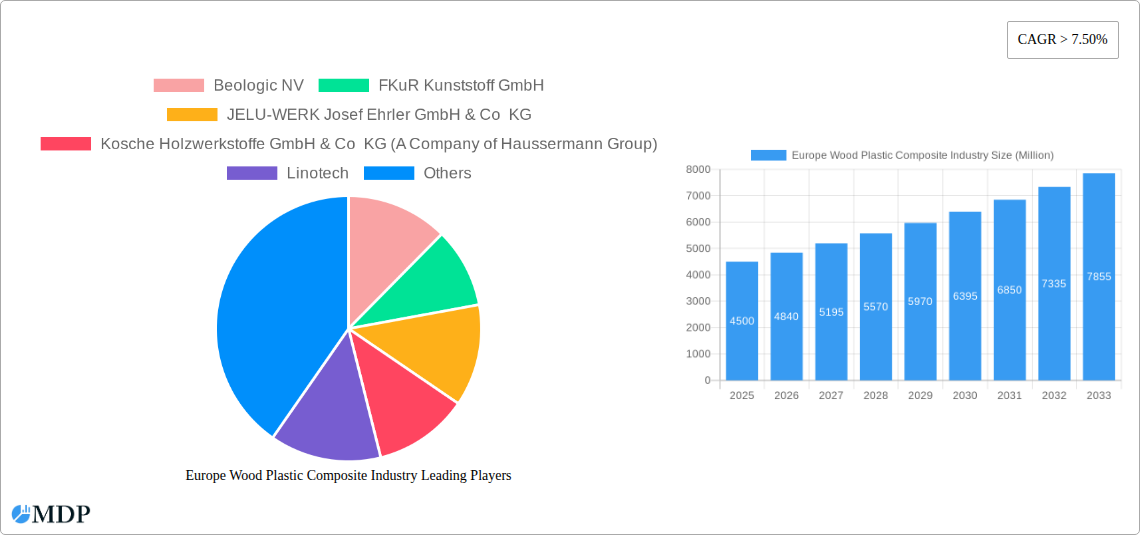

Europe Wood Plastic Composite Industry Company Market Share

This comprehensive report analyzes the expanding European Wood Plastic Composite (WPC) industry, a dynamic sector positioned for significant growth driven by sustainability mandates, material science innovations, and escalating demand for eco-friendly alternatives. Covering a detailed analysis from 2019 to 2033, with a base year of 2025 and a market size of $8.89 billion, this report offers actionable insights for stakeholders. The historical period of 2019–2024 provides context for current trends and future potential. Explore market dynamics, leading applications including decking, automotive interior parts, siding and fencing, technical applications, furniture, and consumer goods, and competitive strategies shaping the European WPC market.

Europe Wood Plastic Composite Industry Market Dynamics & Concentration

The Europe Wood Plastic Composite industry exhibits a moderately concentrated market structure, with several key players holding significant market share. Innovation remains a primary driver, fueled by advancements in polymer science and the increasing integration of recycled materials. Regulatory frameworks, particularly those promoting circular economy principles and sustainable construction, are playing a pivotal role in shaping market growth. Product substitutes, such as traditional wood and metal composites, continue to pose competition, but the superior durability, low maintenance, and aesthetic appeal of WPCs are increasingly appealing to end-users. End-user trends highlight a strong preference for sustainable and long-lasting materials across various applications. Mergers and acquisitions (M&A) activities, while not at extreme levels, indicate strategic consolidation and expansion efforts. For instance, in June 2022, Biofibre's acquisition of an 80% stake in Naftex signifies a notable M&A event. Anticipated M&A deal counts are projected to increase as larger entities seek to bolster their sustainable product portfolios.

Europe Wood Plastic Composite Industry Industry Trends & Analysis

The Europe Wood Plastic Composite industry is experiencing robust growth, driven by a confluence of favorable market trends and technological advancements. The rising global consciousness towards environmental sustainability and the increasing implementation of stringent government regulations mandating the use of eco-friendly materials are significant growth drivers. The compound annual growth rate (CAGR) for the European WPC market is projected to be robust, attracting substantial investment. Technological disruptions are continuously enhancing the performance and versatility of WPCs. Innovations in extrusion techniques, the development of novel bio-based plasticizers, and advancements in fiber processing are leading to WPC products with improved strength, UV resistance, and aesthetic finishes. Consumer preferences are increasingly leaning towards durable, low-maintenance, and aesthetically pleasing building materials that align with sustainable living principles. This shift is particularly evident in the decking, siding, and fencing segments, where WPC offers a compelling alternative to traditional wood. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on cost-competitiveness. The market penetration of WPCs is steadily increasing across various applications, displacing conventional materials and capturing market share. The integration of recycled content, as highlighted by Novowood's ReMade in Italy certification with 81.5% recycled material, further strengthens the market position of WPC products within the circular economy framework, allowing them to benefit from incentives like the 110% Ecobonus. The ongoing development of high-performance WPC formulations is expanding their applicability into more demanding sectors like automotive interiors and technical applications.

Leading Markets & Segments in Europe Wood Plastic Composite Industry

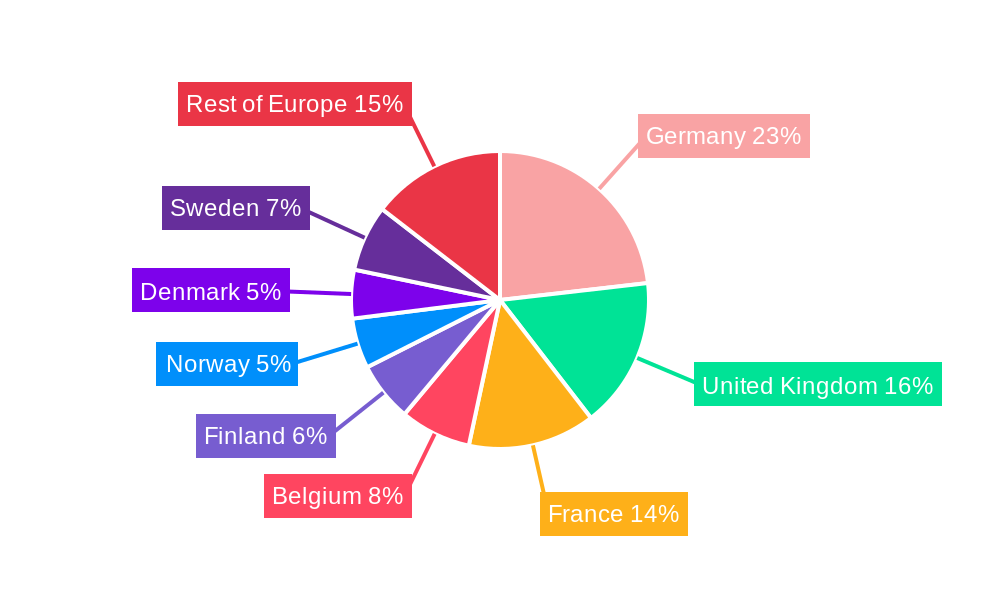

The Europe Wood Plastic Composite Industry is dominated by Western European markets, with Germany, the United Kingdom, France, and Scandinavia being the key consumption hubs. Economic policies supporting green building initiatives, coupled with substantial investments in infrastructure and renovation projects, are significant drivers of growth in these regions.

- Decking: This segment leads the market due to its high demand for durable, weather-resistant, and low-maintenance outdoor flooring solutions for residential and commercial spaces. Economic growth and increased disposable income fuel consumer spending on home improvement and outdoor living spaces, directly benefiting WPC decking.

- Siding and Fencing: The demand for WPC in siding and fencing applications is driven by its aesthetic appeal, durability against environmental factors, and minimal maintenance requirements, offering a superior alternative to traditional wood products. Urbanization and the construction of new residential complexes contribute to the expansion of this segment.

- Auto-interior Parts: The automotive industry's increasing focus on lightweight, sustainable, and aesthetically pleasing interior components is a key growth driver for WPC. Stringent emission regulations and a consumer preference for eco-friendly vehicle interiors are pushing automakers to adopt WPC materials.

- Furniture: The furniture sector is witnessing a growing adoption of WPC for its durability, resistance to moisture and pests, and its ability to be molded into various designs, appealing to both indoor and outdoor furniture markets.

- Technical Applications: This segment, though smaller, is exhibiting significant growth potential driven by the development of specialized WPC formulations for industrial components, construction elements, and other niche applications requiring specific performance characteristics.

- Consumer Goods: The versatility of WPC is leading to its increasing use in various consumer goods, including garden accessories, playground equipment, and decorative items, capitalizing on its durability and eco-friendly attributes.

Europe Wood Plastic Composite Industry Product Developments

Continuous product innovation is a hallmark of the Europe Wood Plastic Composite industry. Manufacturers are actively developing WPC formulations with enhanced properties such as improved fire resistance, superior UV stability, and increased mechanical strength. Key developments include the integration of advanced reinforcing fibers and novel polymer blends to achieve specific performance characteristics for diverse applications. The focus on bio-based and recycled content further enhances the market appeal and sustainability credentials of these products, creating a competitive advantage for companies that can offer differentiated and eco-conscious solutions.

Key Drivers of Europe Wood Plastic Composite Industry Growth

The growth of the Europe Wood Plastic Composite industry is propelled by several key factors. Technological advancements in material science are leading to WPC products with superior performance and wider applicability. Economic drivers, including government incentives for sustainable construction and the increasing demand for durable and low-maintenance building materials, are significantly boosting adoption rates. Regulatory frameworks that promote the use of recycled content and environmentally friendly materials are creating a favorable market environment. Furthermore, the growing consumer awareness and preference for sustainable products are playing a crucial role in driving market expansion.

Challenges in the Europe Wood Plastic Composite Industry Market

Despite its promising outlook, the Europe Wood Plastic Composite Industry faces certain challenges. Regulatory hurdles related to product standardization and certification can sometimes slow down market penetration. Supply chain complexities, particularly concerning the consistent availability and quality of recycled feedstocks, can pose operational challenges for manufacturers. Competitive pressures from established materials like traditional wood and other composite alternatives necessitate continuous innovation and cost optimization. The initial higher price point compared to some conventional materials can also be a barrier in price-sensitive markets, impacting broader market adoption.

Emerging Opportunities in Europe Wood Plastic Composite Industry

The Europe Wood Plastic Composite Industry is ripe with emerging opportunities. The increasing focus on the circular economy presents significant potential for businesses to leverage recycled materials and develop end-of-life solutions. Technological breakthroughs in bio-based composites and advanced manufacturing techniques are opening doors for new product development and market expansion into high-value applications. Strategic partnerships between WPC manufacturers, raw material suppliers, and end-users are crucial for driving innovation and market adoption. Furthermore, the growing demand for sustainable materials in emerging economies and developing regions presents significant market expansion strategies.

Leading Players in the Europe Wood Plastic Composite Industry Sector

- Beologic NV

- FKuR Kunststoff GmbH

- JELU-WERK Josef Ehrler GmbH & Co KG

- Kosche Holzwerkstoffe GmbH & Co KG (A Company of Haussermann Group)

- Linotech

- Moller GmbH & Co KG

- Naftex GmbH

- NATURinFORM GmbH

- NOVO-TECH GmbH & Co KG

- Novowood

- Polyplank AB

- Renolit SE

- Silvadec

- Technamation Technical Europe GmbH

- Tecnaro GmbH

- UPM

- Vannplastic Ltd

Key Milestones in Europe Wood Plastic Composite Industry Industry

- June 2022: Natural fiber and bioplastics compounder Biofibre, a subsidiary of machinery manufacturer LWB-Steinl, acquired 80% of wood plastic composite (WPC) producer Naftex, indicating market consolidation and strategic investment.

- January 2021: Novowood obtained the ReMade in Italy certification, certifying an 81.5% percentage of recycled material inside its product. This certification allows the company to be classified in class "A" among producers with the highest value in the Circular Economy chain and entitles its products to receive the 110% Ecobonus for building interventions, highlighting the growing importance of sustainability certifications and government incentives.

Strategic Outlook for Europe Wood Plastic Composite Industry Market

The strategic outlook for the Europe Wood Plastic Composite Industry is exceptionally positive, driven by the accelerating global shift towards sustainable and circular economy principles. Growth accelerators include continued innovation in bio-based and recycled WPC formulations, catering to the increasing demand for eco-friendly building materials. Strategic opportunities lie in expanding into new application areas, such as advanced composite structures and interior design elements, and in forging deeper collaborations across the value chain to optimize material sourcing and product development. The persistent focus on durability, low maintenance, and aesthetic appeal will continue to drive market penetration, making WPC a cornerstone of sustainable construction and manufacturing in the years to come.

Europe Wood Plastic Composite Industry Segmentation

-

1. Application

- 1.1. Decking

- 1.2. Auto-interior Parts

- 1.3. Siding and Fencing

- 1.4. Technical Applications

- 1.5. Furniture

- 1.6. Consumer Goods

Europe Wood Plastic Composite Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Belgium

- 5. Finland

- 6. Norway

- 7. Denmark

- 8. Sweden

- 9. Rest of Europe

Europe Wood Plastic Composite Industry Regional Market Share

Geographic Coverage of Europe Wood Plastic Composite Industry

Europe Wood Plastic Composite Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sustainable Characteristics of Wood-plastic Composites; Growing Demand from Construction Industry

- 3.3. Market Restrains

- 3.3.1. Sustainable Characteristics of Wood-plastic Composites; Growing Demand from Construction Industry

- 3.4. Market Trends

- 3.4.1. Decking Application is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Wood Plastic Composite Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Decking

- 5.1.2. Auto-interior Parts

- 5.1.3. Siding and Fencing

- 5.1.4. Technical Applications

- 5.1.5. Furniture

- 5.1.6. Consumer Goods

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Belgium

- 5.2.5. Finland

- 5.2.6. Norway

- 5.2.7. Denmark

- 5.2.8. Sweden

- 5.2.9. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Europe Wood Plastic Composite Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Decking

- 6.1.2. Auto-interior Parts

- 6.1.3. Siding and Fencing

- 6.1.4. Technical Applications

- 6.1.5. Furniture

- 6.1.6. Consumer Goods

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. United Kingdom Europe Wood Plastic Composite Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Decking

- 7.1.2. Auto-interior Parts

- 7.1.3. Siding and Fencing

- 7.1.4. Technical Applications

- 7.1.5. Furniture

- 7.1.6. Consumer Goods

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. France Europe Wood Plastic Composite Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Decking

- 8.1.2. Auto-interior Parts

- 8.1.3. Siding and Fencing

- 8.1.4. Technical Applications

- 8.1.5. Furniture

- 8.1.6. Consumer Goods

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Belgium Europe Wood Plastic Composite Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Decking

- 9.1.2. Auto-interior Parts

- 9.1.3. Siding and Fencing

- 9.1.4. Technical Applications

- 9.1.5. Furniture

- 9.1.6. Consumer Goods

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Finland Europe Wood Plastic Composite Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Decking

- 10.1.2. Auto-interior Parts

- 10.1.3. Siding and Fencing

- 10.1.4. Technical Applications

- 10.1.5. Furniture

- 10.1.6. Consumer Goods

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Norway Europe Wood Plastic Composite Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Decking

- 11.1.2. Auto-interior Parts

- 11.1.3. Siding and Fencing

- 11.1.4. Technical Applications

- 11.1.5. Furniture

- 11.1.6. Consumer Goods

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Denmark Europe Wood Plastic Composite Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Application

- 12.1.1. Decking

- 12.1.2. Auto-interior Parts

- 12.1.3. Siding and Fencing

- 12.1.4. Technical Applications

- 12.1.5. Furniture

- 12.1.6. Consumer Goods

- 12.1. Market Analysis, Insights and Forecast - by Application

- 13. Sweden Europe Wood Plastic Composite Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Application

- 13.1.1. Decking

- 13.1.2. Auto-interior Parts

- 13.1.3. Siding and Fencing

- 13.1.4. Technical Applications

- 13.1.5. Furniture

- 13.1.6. Consumer Goods

- 13.1. Market Analysis, Insights and Forecast - by Application

- 14. Rest of Europe Europe Wood Plastic Composite Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Application

- 14.1.1. Decking

- 14.1.2. Auto-interior Parts

- 14.1.3. Siding and Fencing

- 14.1.4. Technical Applications

- 14.1.5. Furniture

- 14.1.6. Consumer Goods

- 14.1. Market Analysis, Insights and Forecast - by Application

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 Beologic NV

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 FKuR Kunststoff GmbH

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 JELU-WERK Josef Ehrler GmbH & Co KG

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Kosche Holzwerkstoffe GmbH & Co KG (A Company of Haussermann Group)

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Linotech

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Moller GmbH & Co KG

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Naftex GmbH

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 NATURinFORM GmbH

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 NOVO-TECH GmbH & Co KG

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Novowood

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Polyplank AB

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Renolit SE

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 Silvadec

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 Technamation Technical Europe GmbH

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.15 Tecnaro GmbH

- 15.2.15.1. Overview

- 15.2.15.2. Products

- 15.2.15.3. SWOT Analysis

- 15.2.15.4. Recent Developments

- 15.2.15.5. Financials (Based on Availability)

- 15.2.16 UPM

- 15.2.16.1. Overview

- 15.2.16.2. Products

- 15.2.16.3. SWOT Analysis

- 15.2.16.4. Recent Developments

- 15.2.16.5. Financials (Based on Availability)

- 15.2.17 Vannplastic Ltd*List Not Exhaustive

- 15.2.17.1. Overview

- 15.2.17.2. Products

- 15.2.17.3. SWOT Analysis

- 15.2.17.4. Recent Developments

- 15.2.17.5. Financials (Based on Availability)

- 15.2.1 Beologic NV

List of Figures

- Figure 1: Global Europe Wood Plastic Composite Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Wood Plastic Composite Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: Germany Europe Wood Plastic Composite Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Germany Europe Wood Plastic Composite Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: Germany Europe Wood Plastic Composite Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: United Kingdom Europe Wood Plastic Composite Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: United Kingdom Europe Wood Plastic Composite Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: United Kingdom Europe Wood Plastic Composite Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: United Kingdom Europe Wood Plastic Composite Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: France Europe Wood Plastic Composite Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: France Europe Wood Plastic Composite Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: France Europe Wood Plastic Composite Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: France Europe Wood Plastic Composite Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Belgium Europe Wood Plastic Composite Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Belgium Europe Wood Plastic Composite Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Belgium Europe Wood Plastic Composite Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Belgium Europe Wood Plastic Composite Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Finland Europe Wood Plastic Composite Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Finland Europe Wood Plastic Composite Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Finland Europe Wood Plastic Composite Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Finland Europe Wood Plastic Composite Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Norway Europe Wood Plastic Composite Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Norway Europe Wood Plastic Composite Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Norway Europe Wood Plastic Composite Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Norway Europe Wood Plastic Composite Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Denmark Europe Wood Plastic Composite Industry Revenue (billion), by Application 2025 & 2033

- Figure 27: Denmark Europe Wood Plastic Composite Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Denmark Europe Wood Plastic Composite Industry Revenue (billion), by Country 2025 & 2033

- Figure 29: Denmark Europe Wood Plastic Composite Industry Revenue Share (%), by Country 2025 & 2033

- Figure 30: Sweden Europe Wood Plastic Composite Industry Revenue (billion), by Application 2025 & 2033

- Figure 31: Sweden Europe Wood Plastic Composite Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Sweden Europe Wood Plastic Composite Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Sweden Europe Wood Plastic Composite Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Europe Europe Wood Plastic Composite Industry Revenue (billion), by Application 2025 & 2033

- Figure 35: Rest of Europe Europe Wood Plastic Composite Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Rest of Europe Europe Wood Plastic Composite Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Rest of Europe Europe Wood Plastic Composite Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Europe Wood Plastic Composite Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Wood Plastic Composite Industry?

The projected CAGR is approximately 11.7%.

2. Which companies are prominent players in the Europe Wood Plastic Composite Industry?

Key companies in the market include Beologic NV, FKuR Kunststoff GmbH, JELU-WERK Josef Ehrler GmbH & Co KG, Kosche Holzwerkstoffe GmbH & Co KG (A Company of Haussermann Group), Linotech, Moller GmbH & Co KG, Naftex GmbH, NATURinFORM GmbH, NOVO-TECH GmbH & Co KG, Novowood, Polyplank AB, Renolit SE, Silvadec, Technamation Technical Europe GmbH, Tecnaro GmbH, UPM, Vannplastic Ltd*List Not Exhaustive.

3. What are the main segments of the Europe Wood Plastic Composite Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.89 billion as of 2022.

5. What are some drivers contributing to market growth?

Sustainable Characteristics of Wood-plastic Composites; Growing Demand from Construction Industry.

6. What are the notable trends driving market growth?

Decking Application is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Sustainable Characteristics of Wood-plastic Composites; Growing Demand from Construction Industry.

8. Can you provide examples of recent developments in the market?

In June 2022, Natural fiber and bioplastics compounder Biofibre, a subsidiary of machinery manufacturer LWB-Steinl, acquired 80% of wood plastic composite (WPC) producer Naftex.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Wood Plastic Composite Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Wood Plastic Composite Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Wood Plastic Composite Industry?

To stay informed about further developments, trends, and reports in the Europe Wood Plastic Composite Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence