Key Insights

The European water treatment chemicals market is poised for significant expansion, driven by escalating industrial activity, stringent environmental mandates, and a heightened emphasis on water conservation across diverse sectors. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.11%, indicating sustained demand for advanced water purification solutions. Key growth accelerators include the increasing requirement for sophisticated water purification technologies in industries such as power generation, manufacturing, and pharmaceuticals, coupled with the wider adoption of sustainable water management practices by municipalities. Moreover, the escalating issue of water scarcity in specific European regions is spurring investments in water treatment infrastructure and chemical solutions. Despite potential headwinds from volatile raw material costs and economic fluctuations, the long-term market outlook remains robust, supported by continuous technological innovation and unwavering governmental backing for water infrastructure enhancement.

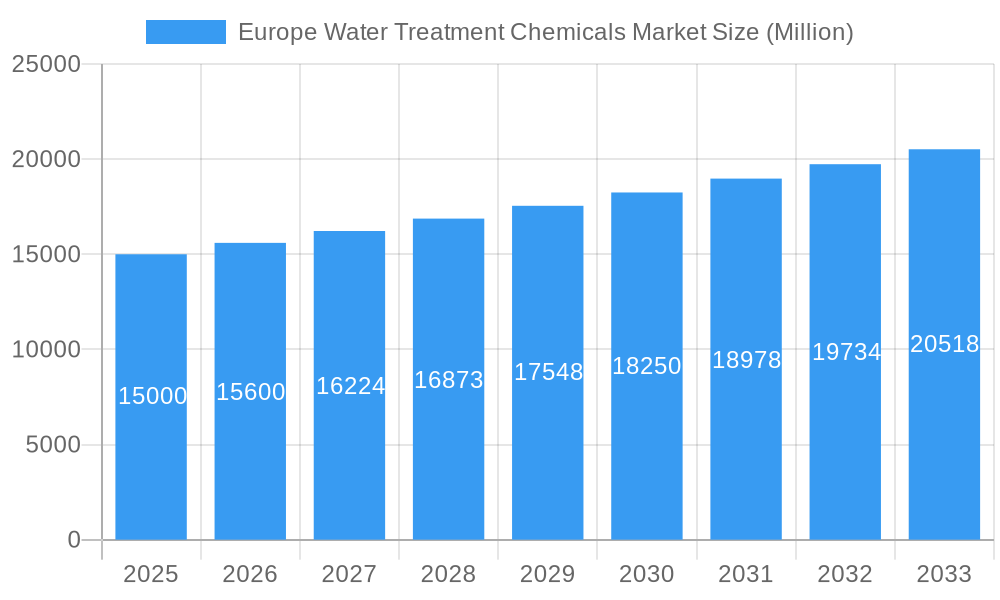

Europe Water Treatment Chemicals Market Market Size (In Billion)

The market exhibits considerable segmentation, with a wide array of chemical types addressing specific treatment requirements. Leading companies, including Dow, Ecolab, Kemira, Kurita Water Industries, Lonza, SNF, Solenis, Solvay, Suez Group, and Veolia, are actively engaged in competitive strategies, introducing novel solutions and broadening their market reach through strategic acquisitions and partnerships. The market is anticipated to experience substantial growth from the base year 2025 through 2033, with notable advancements expected in sectors demanding high-purity water and those prioritizing eco-friendly treatment methodologies. The ongoing evolution of sustainable and efficient water treatment chemicals will be instrumental in defining the market's future trajectory. Regional growth disparities are expected to mirror variations in economic development, regulatory frameworks, and industrial output across Europe. The global market size for water treatment chemicals is estimated at 7.64 billion by 2025.

Europe Water Treatment Chemicals Market Company Market Share

Europe Water Treatment Chemicals Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Water Treatment Chemicals Market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. From market dynamics and leading players to emerging opportunities and future trends, this report delivers actionable intelligence for informed decision-making. The study period spans 2019-2033, with a focus on the forecast period 2025-2033, and utilizes 2025 as the base year. The report’s findings are based on rigorous research and analysis, providing a clear picture of the current market landscape and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Water Treatment Chemicals Market Market Dynamics & Concentration

The European Water Treatment Chemicals market is characterized by a moderate level of concentration, with several major players holding significant market share. Dow, Ecolab, Kemira, Kurita Water Industries Ltd, Lonza, SNF, Solenis, Solvay, Suez Group, and Veolia are key participants, although the market includes numerous smaller, specialized companies. The market share of the top five players is estimated at xx%, indicating a competitive landscape with opportunities for both established players and emerging entrants.

Several factors drive innovation within this market. Stringent environmental regulations across Europe are pushing the development of sustainable and environmentally friendly water treatment solutions. Growing awareness of water scarcity and the need for efficient water management further fuels innovation. Technological advancements, such as the application of nanotechnology and advanced oxidation processes, are also contributing to the development of new and improved water treatment chemicals.

Mergers and acquisitions (M&A) play a significant role in shaping the market landscape. The number of M&A deals in the European water treatment chemicals market has seen a steady increase in recent years, driven by companies seeking to expand their product portfolios, geographic reach, and technological capabilities. In 2024, xx M&A deals were recorded, indicating a robust level of consolidation in the sector. This trend is expected to continue during the forecast period, further shaping the competitive dynamics of the market. The existence of substitute products, such as physical water treatment methods, presents a challenge to chemical-based solutions, forcing companies to innovate and differentiate their offerings.

- Market Concentration: xx% held by top 5 players.

- M&A Deal Count (2024): xx

- Key Innovation Drivers: Stringent environmental regulations, water scarcity concerns, technological advancements.

- Substitute Products: Physical water treatment methods.

Europe Water Treatment Chemicals Market Industry Trends & Analysis

The European Water Treatment Chemicals market is experiencing robust and dynamic growth, propelled by a confluence of escalating industrialization, rapid urbanization, and a heightened global consciousness regarding water resource management. The increasing demand for clean water in both domestic and industrial spheres, coupled with a surge in wastewater generation, is fundamentally driving the need for sophisticated and effective water treatment solutions. Furthermore, the persistent global concern over waterborne diseases is a significant catalyst, compelling a faster adoption of advanced and reliable water purification technologies. A pivotal trend shaping the market is the intensified focus on water reuse and recycling initiatives. This shift, underpinned by stringent European regulations mandating sustainability and promoting a circular economy for water, is not merely an environmental imperative but a substantial economic driver for market expansion.

Technological innovations are profoundly reshaping the landscape of water treatment. The widespread integration of cutting-edge technologies, including advanced membrane filtration systems (such as ultrafiltration and nanofiltration), highly efficient reverse osmosis processes, and germicidal ultraviolet (UV) disinfection methods, is significantly augmenting the efficacy and efficiency of water treatment operations. Concurrently, there's a discernible and accelerating development of more sustainable and environmentally benign water treatment chemicals. Consumer preferences are demonstrably evolving, leaning towards eco-conscious products, which in turn is directly influencing the demand for biodegradable and sustainably sourced water treatment chemicals. The market is thus characterized by a transition towards greener chemistries and processes.

The competitive arena is marked by an intense and multifaceted rivalry between established global leaders and agile, innovative emerging companies. To secure and expand market share, companies are actively pursuing strategic alliances, collaborative ventures, and relentless technological innovation. Price competitiveness remains a significant factor, influencing the pricing strategies and profitability of various market participants. The market is projected to witness substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of [Insert specific CAGR]% during the forecast period. Furthermore, the penetration of advanced water treatment technologies is anticipated to escalate by approximately [Insert specific percentage]% by 2033, indicating a significant upgrade in treatment capabilities across the region.

Leading Markets & Segments in Europe Water Treatment Chemicals Market

The Western European region currently dominates the European Water Treatment Chemicals market, driven by factors such as strong industrial development, advanced infrastructure, and stringent environmental regulations. Germany, France, and the UK are particularly significant markets within this region.

- Key Drivers in Western Europe:

- High level of industrialization and urbanization.

- Stringent environmental regulations.

- Well-developed water infrastructure.

- Significant investments in water treatment projects.

The dominance of Western Europe is primarily attributed to the higher concentration of industrial activities and the comparatively advanced water treatment infrastructure compared to other regions within Europe. Stringent environmental regulations in these countries, aimed at minimizing the environmental impact of industrial wastewater, necessitate the adoption of advanced water treatment technologies and subsequently drives demand for high-quality chemicals. This coupled with high disposable income and increased awareness about water conservation contributes to the higher market share of Western Europe. However, Eastern European countries are experiencing rapid growth and are expected to show strong expansion in the forecast period.

Europe Water Treatment Chemicals Market Product Developments

Recent product developments within the Europe Water Treatment Chemicals market are characterized by an innovative drive towards enhanced sustainability and superior performance. A significant focus has been placed on formulating chemicals that are not only highly effective but also biodegradable and derived from renewable resources, minimizing their environmental footprint. Innovations in nanotechnology are yielding novel solutions that offer unprecedented levels of contaminant removal and water purification. Advanced Oxidation Processes (AOPs) are also gaining traction, providing powerful methods for degrading recalcitrant organic pollutants and improving overall water quality. These advancements are meticulously designed to address the specific and evolving needs of diverse industrial sectors and cater to the growing consumer demand for environmentally responsible solutions. The market is increasingly witnessing a trend towards highly customized chemical formulations, precisely tailored to meet the unique treatment challenges and regulatory requirements of different industrial applications, thereby offering bespoke and optimized water management strategies.

Key Drivers of Europe Water Treatment Chemicals Market Growth

The expansion of the Europe Water Treatment Chemicals market is underpinned by a robust set of driving forces. Paramount among these are the increasingly stringent environmental regulations enforced across the European Union, which are meticulously designed to curb water pollution and guarantee the highest standards of water quality, thereby necessitating the widespread adoption of effective treatment chemicals. The escalating global awareness of water scarcity, coupled with the imperative for efficient and judicious water resource management, serves as another significant impetus for market growth. Technological advancements, particularly the continuous development of more efficient, cost-effective, and sustainable water treatment chemicals and processes, are actively fueling market expansion. Moreover, the relentless pace of industrialization and ongoing urbanization across Europe are leading to a substantial increase in water consumption and a corresponding rise in wastewater generation, which in turn generates a heightened and sustained demand for a diverse range of water treatment chemicals.

Challenges in the Europe Water Treatment Chemicals Market Market

The European Water Treatment Chemicals market faces several challenges. Fluctuations in raw material prices and supply chain disruptions can impact production costs and market stability. Stringent environmental regulations, while driving demand, can also increase compliance costs for manufacturers. Intense competition among established and emerging players creates pressure on pricing and profitability. Moreover, the economic climate and fluctuating exchange rates may impact market growth. These factors are expected to collectively impact the growth by approximately xx% during the forecast period.

Emerging Opportunities in Europe Water Treatment Chemicals Market

The European Water Treatment Chemicals market is ripe with burgeoning opportunities for stakeholders. The accelerating adoption of sophisticated water treatment technologies, such as advanced membrane filtration systems and novel advanced oxidation processes, presents significant avenues for growth and innovation. Strategic collaborations and synergistic partnerships between chemical manufacturers, technology providers, and end-users are poised to unlock the development of groundbreaking, cost-effective, and highly efficient water treatment solutions. Geographic expansion, particularly into the rapidly developing markets of Eastern Europe, offers promising prospects for market penetration and revenue generation. Furthermore, substantial investments in research and development focused on pioneering sustainable chemistries and bio-based alternatives to conventional treatment chemicals can unlock entirely new market segments and competitive advantages. The market is anticipated to experience a period of accelerated growth through the strategic pursuit and implementation of these emerging opportunities.

Leading Players in the Europe Water Treatment Chemicals Market Sector

- Dow (Dow)

- Ecolab (Ecolab)

- Kemira (Kemira)

- Kurita Water Industries Ltd (Kurita Water Industries Ltd)

- Lonza (Lonza)

- SNF

- Solenis (Solenis)

- Solvay (Solvay)

- Suez Group (Suez Group)

- Veolia (Veolia)

- List Not Exhaustive

Key Milestones in Europe Water Treatment Chemicals Market Industry

- January 2022: Solenis announced the 100% acquisition of SCL GmbH, strengthening its polyacrylamide production capabilities for various industries including water treatment.

- May 2022: Solenis acquired Neu Kimya, expanding its reach into Turkey, Southeast Europe, and the Middle East.

- September 2022: Solenis completed the acquisition of Clearon Corp., enhancing its offerings for recreational water treatment.

Strategic Outlook for Europe Water Treatment Chemicals Market Market

The strategic outlook for the Europe Water Treatment Chemicals market is exceptionally positive, buoyed by a convergence of increasing environmental consciousness, progressively stringent regulatory frameworks, and relentless technological innovation. Companies that proactively prioritize sustainability, foster a culture of continuous innovation, and forge robust strategic partnerships are exceptionally well-positioned for enduring success and market leadership. A critical element for sustained long-term growth will involve strategic investments in research and development, specifically targeting the creation of eco-friendly chemicals and high-performance treatment solutions. Furthermore, the strategic expansion into underserved or emerging geographical markets, coupled with the adept leveraging of digital technologies to enhance customer engagement, service delivery, and operational efficiency, will undoubtedly create significant and valuable growth opportunities. The market is poised for substantial and sustained expansion driven by these forward-looking strategies, painting a very promising picture for the foreseeable future.

Europe Water Treatment Chemicals Market Segmentation

-

1. Product Type

- 1.1. Flocculants and Coagulants

- 1.2. Biocide and Disinfectant

- 1.3. Defoamers and Defoaming Agents

- 1.4. pH and Adjuster and Softener

- 1.5. Corrosion and Scale Inhibitor

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power

- 2.2. Oil and Gas

- 2.3. Chemical Manufcaturing

- 2.4. Mining and Mineral Processing

- 2.5. Municipal

- 2.6. Food and Beverage

- 2.7. Pulp and Paper

- 2.8. Other End-user Industries

Europe Water Treatment Chemicals Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Russia

- 6. Rest of Europe

Europe Water Treatment Chemicals Market Regional Market Share

Geographic Coverage of Europe Water Treatment Chemicals Market

Europe Water Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Regulations to Produce and Dispose Wastewater; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations to Produce and Dispose Wastewater; Other Drivers

- 3.4. Market Trends

- 3.4.1. Power Generation Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Flocculants and Coagulants

- 5.1.2. Biocide and Disinfectant

- 5.1.3. Defoamers and Defoaming Agents

- 5.1.4. pH and Adjuster and Softener

- 5.1.5. Corrosion and Scale Inhibitor

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power

- 5.2.2. Oil and Gas

- 5.2.3. Chemical Manufcaturing

- 5.2.4. Mining and Mineral Processing

- 5.2.5. Municipal

- 5.2.6. Food and Beverage

- 5.2.7. Pulp and Paper

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Russia

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Flocculants and Coagulants

- 6.1.2. Biocide and Disinfectant

- 6.1.3. Defoamers and Defoaming Agents

- 6.1.4. pH and Adjuster and Softener

- 6.1.5. Corrosion and Scale Inhibitor

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Power

- 6.2.2. Oil and Gas

- 6.2.3. Chemical Manufcaturing

- 6.2.4. Mining and Mineral Processing

- 6.2.5. Municipal

- 6.2.6. Food and Beverage

- 6.2.7. Pulp and Paper

- 6.2.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Flocculants and Coagulants

- 7.1.2. Biocide and Disinfectant

- 7.1.3. Defoamers and Defoaming Agents

- 7.1.4. pH and Adjuster and Softener

- 7.1.5. Corrosion and Scale Inhibitor

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Power

- 7.2.2. Oil and Gas

- 7.2.3. Chemical Manufcaturing

- 7.2.4. Mining and Mineral Processing

- 7.2.5. Municipal

- 7.2.6. Food and Beverage

- 7.2.7. Pulp and Paper

- 7.2.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Flocculants and Coagulants

- 8.1.2. Biocide and Disinfectant

- 8.1.3. Defoamers and Defoaming Agents

- 8.1.4. pH and Adjuster and Softener

- 8.1.5. Corrosion and Scale Inhibitor

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Power

- 8.2.2. Oil and Gas

- 8.2.3. Chemical Manufcaturing

- 8.2.4. Mining and Mineral Processing

- 8.2.5. Municipal

- 8.2.6. Food and Beverage

- 8.2.7. Pulp and Paper

- 8.2.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Flocculants and Coagulants

- 9.1.2. Biocide and Disinfectant

- 9.1.3. Defoamers and Defoaming Agents

- 9.1.4. pH and Adjuster and Softener

- 9.1.5. Corrosion and Scale Inhibitor

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Power

- 9.2.2. Oil and Gas

- 9.2.3. Chemical Manufcaturing

- 9.2.4. Mining and Mineral Processing

- 9.2.5. Municipal

- 9.2.6. Food and Beverage

- 9.2.7. Pulp and Paper

- 9.2.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Flocculants and Coagulants

- 10.1.2. Biocide and Disinfectant

- 10.1.3. Defoamers and Defoaming Agents

- 10.1.4. pH and Adjuster and Softener

- 10.1.5. Corrosion and Scale Inhibitor

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Power

- 10.2.2. Oil and Gas

- 10.2.3. Chemical Manufcaturing

- 10.2.4. Mining and Mineral Processing

- 10.2.5. Municipal

- 10.2.6. Food and Beverage

- 10.2.7. Pulp and Paper

- 10.2.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Europe Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Flocculants and Coagulants

- 11.1.2. Biocide and Disinfectant

- 11.1.3. Defoamers and Defoaming Agents

- 11.1.4. pH and Adjuster and Softener

- 11.1.5. Corrosion and Scale Inhibitor

- 11.1.6. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Power

- 11.2.2. Oil and Gas

- 11.2.3. Chemical Manufcaturing

- 11.2.4. Mining and Mineral Processing

- 11.2.5. Municipal

- 11.2.6. Food and Beverage

- 11.2.7. Pulp and Paper

- 11.2.8. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dow

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ecolab

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kemira

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kurita Water Industries Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Lonza

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 SNF

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Solenis

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Solvay

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Suez Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Veolia*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Dow

List of Figures

- Figure 1: Global Europe Water Treatment Chemicals Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Germany Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Germany Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Germany Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Germany Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Germany Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: United Kingdom Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: United Kingdom Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: United Kingdom Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: United Kingdom Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: United Kingdom Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 13: United Kingdom Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: France Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: France Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: France Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: France Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: France Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 19: France Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Italy Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Italy Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Italy Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Italy Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Italy Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Italy Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Russia Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Russia Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Russia Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Russia Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Russia Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Russia Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of Europe Europe Water Treatment Chemicals Market Revenue (billion), by Product Type 2025 & 2033

- Figure 33: Rest of Europe Europe Water Treatment Chemicals Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Rest of Europe Europe Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 35: Rest of Europe Europe Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Rest of Europe Europe Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Rest of Europe Europe Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Europe Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Water Treatment Chemicals Market?

The projected CAGR is approximately 3.11%.

2. Which companies are prominent players in the Europe Water Treatment Chemicals Market?

Key companies in the market include Dow, Ecolab, Kemira, Kurita Water Industries Ltd, Lonza, SNF, Solenis, Solvay, Suez Group, Veolia*List Not Exhaustive.

3. What are the main segments of the Europe Water Treatment Chemicals Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.64 billion as of 2022.

5. What are some drivers contributing to market growth?

Stringent Regulations to Produce and Dispose Wastewater; Other Drivers.

6. What are the notable trends driving market growth?

Power Generation Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Regulations to Produce and Dispose Wastewater; Other Drivers.

8. Can you provide examples of recent developments in the market?

September 2022: Solenis announced the acquisition completion of Clearon Corp., which will help Solenis expand its product offering. It will also strengthen its ability to supply cost-effective, sustainable solutions for recreational pool and spa customers, providing clean, clear, safer water.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Water Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Water Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Water Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the Europe Water Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence