Key Insights

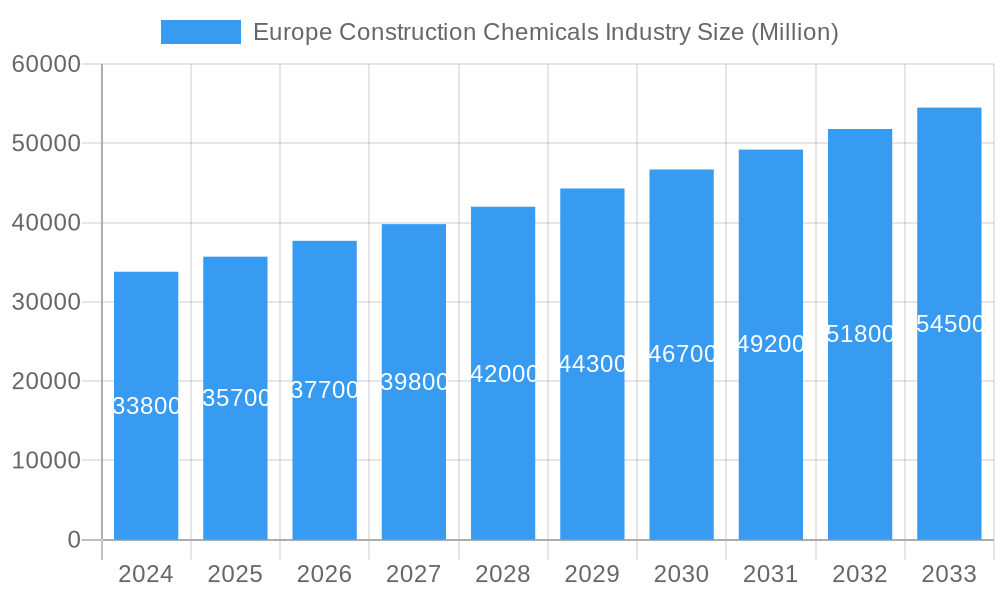

The European construction chemicals market is projected for significant expansion, reaching an estimated USD 14.05 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.91% from 2025 to 2033. This growth is driven by sustained infrastructure development across Germany, France, and the UK, coupled with a revitalized residential construction sector. The increasing adoption of sustainable building practices and renovation projects further supports market growth. Key drivers include product innovation, such as low-VOC adhesives and coatings, and the rising demand for advanced waterproofing and repair solutions. Industrial and commercial construction also contribute significantly, necessitating specialized chemical solutions.

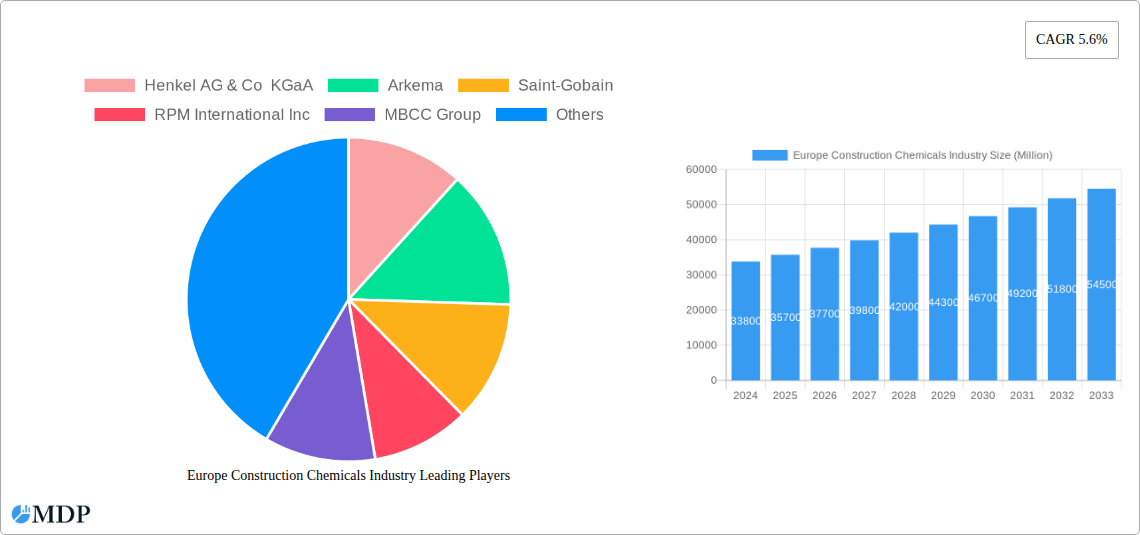

Europe Construction Chemicals Industry Market Size (In Billion)

The market encompasses a diverse product portfolio, including Adhesives, Anchors and Grouts, Concrete Admixtures, Concrete Protective Coatings, Flooring Resins, Repair and Rehabilitation Chemicals, Sealants, Surface Treatment Chemicals, and Waterproofing Solutions. The growing need for enhanced building durability, performance, and energy efficiency is fueling demand for these specialized products. Emerging trends like smart materials and circular economy principles are expected to influence future market dynamics. While robust demand is a positive factor, potential challenges include fluctuating raw material prices and stringent environmental regulations, though proactive sustainability initiatives are likely to mitigate these concerns. Leading players such as Sika AG, Henkel AG & Co KGaA, and Arkema are instrumental in driving innovation and market expansion within this dynamic sector.

Europe Construction Chemicals Industry Company Market Share

Europe Construction Chemicals Industry: Market Dynamics, Trends, and Strategic Outlook (2019-2033)

This comprehensive report delivers an in-depth analysis of the Europe construction chemicals industry, a critical sector underpinning modern infrastructure development and building renovations. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study provides unparalleled insights into market dynamics, key trends, leading players, and future strategic opportunities. Discover the forces shaping this multi-billion Euro market, driven by sustainable construction practices, technological advancements, and evolving end-user demands.

Europe Construction Chemicals Industry Market Dynamics & Concentration

The Europe construction chemicals industry is characterized by a moderate to high level of market concentration, with several global giants holding significant market share. Key players like Sika AG, Henkel AG & Co KGaA, and Arkema are at the forefront, driving innovation and influencing market trends. The market's dynamism is fueled by relentless innovation, with companies investing heavily in R&D for eco-friendly and high-performance products. Regulatory frameworks, particularly those focused on sustainability and environmental impact, play a crucial role in shaping product development and market entry. The availability of product substitutes, while present, often comes with trade-offs in terms of performance or lifespan, limiting their disruptive potential. End-user trends lean towards durable, energy-efficient, and aesthetically pleasing construction materials, directly impacting demand for specialized chemical solutions. Mergers and acquisitions (M&A) are a significant feature, with recent high-profile deals indicating a consolidation trend aimed at expanding product portfolios and geographical reach. For instance, the acquisition of MBCC Group by Sika AG represents a substantial shift in market concentration. The M&A deal count has seen consistent activity, reflecting strategic moves to gain competitive advantages and capture larger market shares. Understanding these dynamics is crucial for stakeholders navigating this evolving landscape.

Europe Construction Chemicals Industry Industry Trends & Analysis

The Europe construction chemicals industry is on a robust growth trajectory, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is primarily driven by a burgeoning demand for sustainable building materials and energy-efficient construction practices across the continent. Technological disruptions, such as advancements in nanotechnology for enhanced material performance and the increasing adoption of digital solutions in construction, are reshaping product development and application. Consumer preferences are increasingly skewed towards solutions that offer long-term durability, reduced environmental impact, and improved occupant comfort. The widespread implementation of green building standards and mandates for reduced carbon emissions are further propelling the adoption of advanced construction chemicals. Competitive dynamics within the industry are intense, with a focus on product differentiation through specialized formulations and superior performance characteristics. Market penetration for innovative solutions like advanced concrete admixtures and high-performance waterproofing membranes is on the rise, supported by government initiatives promoting infrastructure upgrades and residential building modernization. The ongoing shift towards prefabricated construction and modular building techniques also presents significant opportunities for specialized chemical suppliers who can offer integrated solutions. The increasing urbanization across Europe, coupled with a continuous need for infrastructure development and renovation projects, will continue to be a primary catalyst for market growth. The industry is actively responding to these trends by developing products that enhance structural integrity, improve energy efficiency, and minimize environmental footprints throughout the building lifecycle.

Leading Markets & Segments in Europe Construction Chemicals Industry

The Infrastructure end-use sector stands as a dominant force in the Europe construction chemicals industry, driven by substantial public and private investments in transportation networks, utilities, and energy projects. Countries like Germany, France, and the United Kingdom are at the forefront of this demand, fueled by aging infrastructure requiring extensive repair and rehabilitation, alongside new development projects.

Within product segments, Concrete Admixtures are experiencing significant growth, particularly High Range Water Reducers (Super Plasticizers) and Shrinkage Reducing Admixtures. These products are crucial for improving concrete workability, durability, and reducing cracking in large-scale infrastructure projects and high-rise buildings. The demand for these admixtures is directly linked to stringent performance requirements in modern construction.

Waterproofing Solutions, specifically Membranes, are also critical, especially in regions with challenging climatic conditions. Their importance spans all end-use sectors, from residential basements to commercial roofing and large-scale infrastructure like bridges and tunnels. The growing emphasis on preventing water damage and extending the lifespan of structures directly boosts the market for these solutions.

The Residential sector, while showing steady growth, is increasingly influenced by the demand for energy-efficient and sustainable building materials. This translates into higher demand for Sealants (especially Silicone for its durability and weather resistance) and Concrete Protective Coatings (like Epoxy and Polyurethane for enhanced durability and aesthetic appeal).

Adhesives, particularly Water-borne and Reactive types, are seeing increased adoption across Commercial, Industrial and Institutional, and Residential segments due to their lower VOC emissions and enhanced bonding capabilities.

The dominance of these segments is supported by:

- Economic Policies: Government stimulus packages for infrastructure development and renovation projects.

- Infrastructure Investments: Significant capital expenditure on roads, railways, airports, and utilities.

- Environmental Regulations: Stringent building codes mandating energy efficiency and sustainable material use.

- Technological Advancements: Development of high-performance, low-VOC, and durable chemical formulations.

- Urbanization: Continued population growth in urban centers driving demand for new construction and renovation.

Europe Construction Chemicals Industry Product Developments

Innovation in the Europe construction chemicals industry is keenly focused on sustainability, performance enhancement, and ease of application. Leading companies are developing advanced Concrete Admixtures that significantly improve concrete strength and durability while reducing water and cement content, thereby lowering the carbon footprint. Novel Waterproofing Solutions, including self-healing membranes and advanced sealant technologies, are emerging to offer superior protection against moisture ingress in diverse construction environments. The development of low-VOC and solvent-free Adhesives and Flooring Resins aligns with stringent environmental regulations and growing consumer preference for healthier indoor air quality. Furthermore, smart materials with self-monitoring capabilities are being explored to provide real-time structural health insights. These product developments are driven by the need to meet evolving building codes, enhance construction efficiency, and contribute to more resilient and sustainable built environments.

Key Drivers of Europe Construction Chemicals Industry Growth

The Europe construction chemicals industry is propelled by a confluence of powerful growth drivers. A primary catalyst is the sustained investment in infrastructure development and modernization across the continent, driven by government initiatives and the need to upgrade aging facilities. The growing emphasis on sustainable construction and stringent environmental regulations, such as those promoting energy efficiency and reduced carbon emissions, is fostering demand for eco-friendly and high-performance chemical solutions. Technological advancements in material science are leading to the development of innovative products with enhanced durability, strength, and functionality. Furthermore, the increasing trend of urbanization and the subsequent need for new residential and commercial buildings, coupled with extensive renovation activities, continue to fuel market expansion. The adoption of advanced building techniques also necessitates specialized chemical products, further bolstering growth.

Challenges in the Europe Construction Chemicals Industry Market

Despite robust growth prospects, the Europe construction chemicals industry faces several significant challenges. Stringent and often evolving environmental regulations can pose compliance hurdles and increase R&D costs for manufacturers. Supply chain disruptions, amplified by geopolitical events and raw material price volatility, can impact production costs and delivery timelines. Intense price competition among established players and emerging low-cost alternatives can compress profit margins. Furthermore, the long service life of many construction chemicals means that demand is tied to new construction and renovation cycles, making the market susceptible to economic downturns and fluctuating construction activity. Skilled labor shortages within the construction sector can also indirectly affect the adoption of advanced chemical solutions that require specialized application knowledge.

Emerging Opportunities in Europe Construction Chemicals Industry

The Europe construction chemicals industry is ripe with emerging opportunities, primarily driven by the accelerating transition towards a circular economy and digitalization. The demand for advanced repair and rehabilitation chemicals, including fiber wrapping systems and injection grouting materials, is set to surge as the continent focuses on extending the lifespan of existing infrastructure and buildings. Technological breakthroughs in bio-based and recycled materials for construction chemicals offer significant potential for market differentiation and meeting sustainability targets. Strategic partnerships between chemical manufacturers and construction technology firms can unlock new avenues for integrated solutions and smart building applications. The ongoing renovation wave across Europe, particularly for energy efficiency upgrades, presents a consistent demand for high-performance insulation chemicals, sealants, and coatings. Expansion into emerging markets within Europe with significant development needs, and a focus on specialized niche products, also represent key growth catalysts.

Leading Players in the Europe Construction Chemicals Industry Sector

- Sika AG

- Henkel AG & Co KGaA

- Arkema

- Saint-Gobain

- RPM International Inc

- MBCC Group

- Atlas

- Kingspan Group

- Fosroc Inc

- CEMEX S A B de C V

- Ardex Group

- MAPEI S p A

- Selena Group

- Schomburg

- MC-Bauchemie

Key Milestones in Europe Construction Chemicals Industry Industry

- May 2023: Kingspan Group has expanded its waterproofing solutions business in the DACH region by acquiring CaPlast and its subsidiaries AerO Coated Fabrics and Now Contec from KAP AG. This strategic acquisition enhances Kingspan's market presence and product offering in a key European market.

- May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand. This monumental acquisition significantly reshapes the competitive landscape and consolidates Sika's market leadership.

- March 2023: Sika AG announced its plan to divest its MBCC admixture assets to Cinven, a global private equity firm, as part of its strategy to secure full ownership of MBCC Group. This divestment is a key step in Sika's regulatory approval process for the MBCC acquisition, streamlining its portfolio.

Strategic Outlook for Europe Construction Chemicals Industry Market

The strategic outlook for the Europe construction chemicals industry remains exceptionally positive, driven by a sustained commitment to sustainability, digitalization, and infrastructure resilience. Future growth will be significantly accelerated by the ongoing decarbonization efforts across the construction sector, leading to increased demand for low-carbon footprint materials and energy-efficient solutions. Companies that can effectively leverage digital technologies for product development, supply chain optimization, and customer engagement will gain a competitive edge. The increasing focus on circular economy principles will also open avenues for the development and adoption of chemical products derived from recycled or bio-based feedstocks. Strategic expansion through targeted acquisitions or joint ventures to enhance product portfolios and geographical reach will be a key differentiator. Furthermore, a proactive approach to adapting to evolving regulatory landscapes and investing in innovation for smart and resilient building materials will position stakeholders for long-term success in this dynamic market.

Europe Construction Chemicals Industry Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

-

2.1. Adhesives

-

2.1.1. By Sub Product

- 2.1.1.1. Hot Melt

- 2.1.1.2. Reactive

- 2.1.1.3. Solvent-borne

- 2.1.1.4. Water-borne

-

2.1.1. By Sub Product

-

2.2. Anchors and Grouts

- 2.2.1. Cementitious Fixing

- 2.2.2. Resin Fixing

- 2.2.3. Other Types

-

2.3. Concrete Admixtures

- 2.3.1. Accelerator

- 2.3.2. Air Entraining Admixture

- 2.3.3. High Range Water Reducer (Super Plasticizer)

- 2.3.4. Retarder

- 2.3.5. Shrinkage Reducing Admixture

- 2.3.6. Viscosity Modifier

- 2.3.7. Water Reducer (Plasticizer)

-

2.4. Concrete Protective Coatings

- 2.4.1. Acrylic

- 2.4.2. Alkyd

- 2.4.3. Epoxy

- 2.4.4. Polyurethane

- 2.4.5. Other Resin Types

-

2.5. Flooring Resins

- 2.5.1. Polyaspartic

-

2.6. Repair and Rehabilitation Chemicals

- 2.6.1. Fiber Wrapping Systems

- 2.6.2. Injection Grouting Materials

- 2.6.3. Micro-concrete Mortars

- 2.6.4. Modified Mortars

- 2.6.5. Rebar Protectors

-

2.7. Sealants

- 2.7.1. Silicone

-

2.8. Surface Treatment Chemicals

- 2.8.1. Curing Compounds

- 2.8.2. Mold Release Agents

- 2.8.3. Other Product Types

-

2.9. Waterproofing Solutions

- 2.9.1. Membranes

-

2.1. Adhesives

Europe Construction Chemicals Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Construction Chemicals Industry Regional Market Share

Geographic Coverage of Europe Construction Chemicals Industry

Europe Construction Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Banning/ Limiting Use of Plastics used in packaging applications

- 3.3. Market Restrains

- 3.3.1. ; Harmful Amines in Dyes; Paperless Green Initiatives

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Construction Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Adhesives

- 5.2.1.1. By Sub Product

- 5.2.1.1.1. Hot Melt

- 5.2.1.1.2. Reactive

- 5.2.1.1.3. Solvent-borne

- 5.2.1.1.4. Water-borne

- 5.2.1.1. By Sub Product

- 5.2.2. Anchors and Grouts

- 5.2.2.1. Cementitious Fixing

- 5.2.2.2. Resin Fixing

- 5.2.2.3. Other Types

- 5.2.3. Concrete Admixtures

- 5.2.3.1. Accelerator

- 5.2.3.2. Air Entraining Admixture

- 5.2.3.3. High Range Water Reducer (Super Plasticizer)

- 5.2.3.4. Retarder

- 5.2.3.5. Shrinkage Reducing Admixture

- 5.2.3.6. Viscosity Modifier

- 5.2.3.7. Water Reducer (Plasticizer)

- 5.2.4. Concrete Protective Coatings

- 5.2.4.1. Acrylic

- 5.2.4.2. Alkyd

- 5.2.4.3. Epoxy

- 5.2.4.4. Polyurethane

- 5.2.4.5. Other Resin Types

- 5.2.5. Flooring Resins

- 5.2.5.1. Polyaspartic

- 5.2.6. Repair and Rehabilitation Chemicals

- 5.2.6.1. Fiber Wrapping Systems

- 5.2.6.2. Injection Grouting Materials

- 5.2.6.3. Micro-concrete Mortars

- 5.2.6.4. Modified Mortars

- 5.2.6.5. Rebar Protectors

- 5.2.7. Sealants

- 5.2.7.1. Silicone

- 5.2.8. Surface Treatment Chemicals

- 5.2.8.1. Curing Compounds

- 5.2.8.2. Mold Release Agents

- 5.2.8.3. Other Product Types

- 5.2.9. Waterproofing Solutions

- 5.2.9.1. Membranes

- 5.2.1. Adhesives

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arkema

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saint-Gobain

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RPM International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MBCC Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Atlas

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kingspan Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fosroc Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CEMEX S A B de C V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ardex Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sika AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 MAPEI S p A

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Selena Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Schomburg

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 MC-Bauchemie

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Europe Construction Chemicals Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Construction Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Construction Chemicals Industry Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 2: Europe Construction Chemicals Industry Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: Europe Construction Chemicals Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Europe Construction Chemicals Industry Volume K Tons Forecast, by Product 2020 & 2033

- Table 5: Europe Construction Chemicals Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Construction Chemicals Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Construction Chemicals Industry Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 8: Europe Construction Chemicals Industry Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: Europe Construction Chemicals Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Europe Construction Chemicals Industry Volume K Tons Forecast, by Product 2020 & 2033

- Table 11: Europe Construction Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Construction Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Construction Chemicals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Construction Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Construction Chemicals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Construction Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: France Europe Construction Chemicals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Europe Construction Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Construction Chemicals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Construction Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Construction Chemicals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Construction Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Construction Chemicals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Construction Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Construction Chemicals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Construction Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Construction Chemicals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Construction Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Construction Chemicals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Construction Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Construction Chemicals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Construction Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Construction Chemicals Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Construction Chemicals Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Construction Chemicals Industry?

The projected CAGR is approximately 4.91%.

2. Which companies are prominent players in the Europe Construction Chemicals Industry?

Key companies in the market include Henkel AG & Co KGaA, Arkema, Saint-Gobain, RPM International Inc, MBCC Group, Atlas, Kingspan Group, Fosroc Inc, CEMEX S A B de C V, Ardex Group, Sika AG, MAPEI S p A, Selena Group, Schomburg, MC-Bauchemie.

3. What are the main segments of the Europe Construction Chemicals Industry?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.05 billion as of 2022.

5. What are some drivers contributing to market growth?

; Banning/ Limiting Use of Plastics used in packaging applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Harmful Amines in Dyes; Paperless Green Initiatives.

8. Can you provide examples of recent developments in the market?

May 2023: Kingspan Group has expanded its waterproofing solutions business in the DACH region by acquiring CaPlast and its subsidiaries AerO Coated Fabrics and Now Contec from KAP AG.May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.March 2023: Sika AG announced its plan to divest its MBCC admixture assets to Cinven, a global private equity firm, as part of its strategy to secure full ownership of MBCC Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Construction Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Construction Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Construction Chemicals Industry?

To stay informed about further developments, trends, and reports in the Europe Construction Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence